Missouri

Housing Development

Commission

First Place Loan Program

Operations Manual

TABLE OF CONTENTS

SECTION 1 -CERTIFIED LENDER ELIGIBILITY REQUIREMENTS ........................................................................................ 1-1

All financial institutions must meet the following requirements: ................................................................................................ 1-1

Constant Funding ........................................................................................................................................................................ 1-2

Third Party Originations .............................................................................................................................................................. 1-2

Loan Officer Certification Requirements ..................................................................................................................................... 1-3

LENDERPARTICIPATIONAPPLICATION ......................................................................................................................................... 1-4

SECTION 2 - RESERVATION OF FUNDS .......................................................................................................................... 2-1

Requirements .............................................................................................................................................................................. 2-1

Reservation Procedure ................................................................................................................................................................ 2-1

Reservation Expiration Dates ...................................................................................................................................................... 2-1

Reservation Extensions ............................................................................................................................................................... 2-2

Reservation Change Requests ..................................................................................................................................................... 2-2

Approved Reservations ............................................................................................................................................................... 2-2

SECTION 3 - BORROWER ELIGIBILITY REQUIREMENTS.................................................................................................. 3-1

Definition of a First-Time Home Buyer ........................................................................................................................................ 3-1

Exceptions to First-Time Homebuyer Requirements: ................................................................................................................... 3-1

Definition of Present and Non-Present Ownership Interest ......................................................................................................... 3-1

Present Ownership Interest ......................................................................................................................................................... 3-2

Non-Present Ownership Interest ................................................................................................................................................. 3-2

Existing Mortgages ..................................................................................................................................................................... 3-2

Persons Who Are Separated or Legally Separated - Waivers of Marital Rights .................................................................... 3-3

Married Persons – Non Borrowing Spouses................................................................................................................................. 3-3

Applicants Who Own/Owned Rental Property ............................................................................................................................ 3-4

Applicants Whose Ex-Spouse Solely Owned Real Estate Prior to the Marriage ............................................................. 3-4

Applicants Who Own or Owned a Mobile Home within Past Three Years ................................................................................... 3-4

Applicants Who Are Licensed Real Estate Agents ....................................................................................................................... 3-5

Total Household Number ............................................................................................................................................................ 3-5

Total Family Household Income .................................................................................................................................................. 3-6

Lenders Options for Verifying Income: ......................................................................................................................................... 3-7

Option One - Alternative Documentation Method ....................................................................................................................... 3-7

Option Two - “The Work Number for Everyone” ......................................................................................................................... 3-8

Option Three -Third Party Verification of Income ........................................................................................................................ 3-9

Miscellaneous Criteria –applicable regardless of calculation method used Layoffs Due to Illness or Injury ................................ 3-12

Quitting a Job after Application ................................................................................................................................................ 3-12

Applicants Close to the MHDC Maximum Income Limits ........................................................................................................... 3-12

Treatment of Assets .................................................................................................................................................................. 3-12

Underwriting Income vs Program Projected Household Income ............................................................................................... 3-13

Prior Approvals on Calculating Total Household Income ........................................................................................................... 3-13

Example of Calculation Method................................................................................................................................................. 3-14

Example of Calculation Method................................................................................................................................................. 3-15

..................................................................................................................................................................................................3-15

Example of Calculation Method................................................................................................................................................. 3-16

..................................................................................................................................................................................................3-17

Example of Calculation Method................................................................................................................................................. 3-18

Owner-Occupancy Requirements ............................................................................................................................................. 3-19

Non-U.S. Citizens ....................................................................................................................................................................... 3-19

SECTION 4 - RESIDENCE ELIGIBILITY REQUIREMENTS ................................................................................................... 4-1

Location/Program Area .............................................................................................................................................................. 4-1

Occupancy Requirements ........................................................................................................................................................... 4-1

Residence Type ........................................................................................................................................................................... 4-1

Non-Eligible Properties: .............................................................................................................................................................. 4-2

Flood Plains ................................................................................................................................................................................. 4-2

Flood plain zones: ....................................................................................................................................................................... 4-2

3..................................................................................................................................................................................................4-3

Flood Certification ...................................................................................................................................................................... 4-4

HUD-Owned Properties .............................................................................................................................................................. 4-4

Properties That Have Been Inherited ........................................................................................................................................... 4-4

Acquisition Cost Limitations ........................................................................................................................................................ 4-4

Non-Realty Items ........................................................................................................................................................................ 4-6

Sweat Equity ............................................................................................................................................................................... 4-6

Buyers Paying for Repairs ........................................................................................................................................................... 4-7

Excess Land Included in the Sale of Property ............................................................................................................................... 4-7

SECTION 5 - MORTGAGE LOAN REQUIREMENTS .......................................................................................................... 5-1

FICO Score ................................................................................................................................................................................... 5-1

CAL Funds ................................................................................................................................................................................... 5-1

Lenders’ Fees and Charges .......................................................................................................................................................... 5-1

Loan Closing Requirements ......................................................................................................................................................... 5-3

Timely Delivery ............................................................................................................................................................................ 5-4

Eligible Loan Programs ................................................................................................................................................................ 5-4

Underwriting .............................................................................................................................................................................. 5-5

Escrowing for Repairs ................................................................................................................................................................. 5-5

Mortgage Loan Insurance or Guaranty ....................................................................................................................................... 5-5

FHA 203(k) Loans ........................................................................................................................................................................ 5-5

Relocation Companies ................................................................................................................................................................. 5-5

Borrowers to Receive a Rent Credit ............................................................................................................................................. 5-6

Sellers to Remain in Property after Closing ................................................................................................................................. 5-6

Co-Signers vs Co-Borrowers ........................................................................................................................................................ 5-6

Use of Power of Attorney (POA) For the Execution of MHDC Documents: ................................................................................... 5-7

Borrowers under the Age of 18 ................................................................................................................................................... 5-7

Prepays ....................................................................................................................................................................................... 5-7

SECTION 6 - LOAN CLOSING DOCUMENTS .................................................................................................................... 6-1

Electronic Documents (EDocs) .................................................................................................................................................... 6-1

MHDC Required Compliance Package Documentation ............................................................................................................... 6-1

Verifications of Employment ....................................................................................................................................................... 6-2

Lender’s Certificate (Form #520) ................................................................................................................................................. 6-2

Seller’s Affidavit (Form #525) ...................................................................................................................................................... 6-2

Federal Income Tax Returns ........................................................................................................................................................ 6-3

Real Estate Sales Contracts ......................................................................................................................................................... 6-3

Closing Disclosure Statement - CD .............................................................................................................................................. 6-3

Federal Recapture Tax ................................................................................................................................................................ 6-3

Information for Home Buyers Regarding Recapture Tax ............................................................................................................. 6-4

SECTION 7 - USE OF FIRST PLACE PROGRAM WITH OTHER PROGRAMS ....................................................................... 7-1

Secondary Financing ................................................................................................................................................................... 7-1

SECTION 8 - SALE OF MORTGAGE LOANS ..................................................................................................................... 8-1

Amounts Paid to Originating Lenders ......................................................................................................................................... 8-1

Master Servicer ........................................................................................................................................................................... 8-2

SALE OF LOANS TO MASTER SERVICER ........................................................................................................................................ 8-2

MHDC GEOGRAPHICAL AREAS .................................................................................................................................................... 8-3

SECTION 9 - GROSS ANNUAL HOUSEHOLD INCOME LIMITS ......................................................................................... 9-1

SECTION 10 - STAFF NAMES AND TELEPHONE NUMBERS ............................................................................................10-1

SECTION 11 - FEDERALLY TARGETED CENSUS TRACT AREAS .............................................................................................2

1

-

1

0B

Section 1 - Certified Lender Eligibility Requirements

11B

All financial institutions must meet the following requirements:

1. If the lender is a GSE seller/servicer it must provide lender number. It must also provide

information per the TPO section of the FNMA selling guide:

a. Resumes of principal officers and underwriting personnel

b. Lenders quality control procedures

c. Results of background check of principal officers

d. Lender’s hiring procedures for checking employees, including management, in the

origination of mortgage loans against GSA excluded parties list, HUD LPD List and FHFA

SCP list.

2. If the lender is a bank or savings and loan association, FDIC must insure the bank or

savings and loan association depository accounts.

3. The Financial institution must have a three-year history of continuous operation in the

State of Missouri. Lender shall provide proof of date of incorporation in the State of

Missouri, or License to Operate in the State of Missouri.

4. The Financial institution must have a minimum net worth of $1,000,000. Lender shall

provide most current audited Financial Statement.

5. The Financial institution must have a history of combined production of not less than

one million dollars per year in FHA/HUD, VA, and Fannie Mae or USDA Rural

Development loans. MHDC must be provided evidence of the sale into the Secondary

Market of at least this volume of loans.

6. Any single GNMA or Fannie Mae securities-backed bond issue will identify lenders as

follows: Originating Lenders - A financial institution which agrees to originate home

mortgages and assigns such home mortgages and the servicing in connection therewith

to a Master Servicer.

7. Lender must furnish and maintain evidence of $500,000 in Error and Omissions

coverage.

8. Lender must furnish and maintain evidence of Fidelity Bond coverage.

9. Lenders must be approved as an FHA mortgage originator if originating FHA loans, as

a VA mortgage originator if originating VA loans, and as a USDA Rural Development

originator if originating rural development loans.

10. Lenders must originate, process, underwrite, close and fund originated loans in their

own name, and using their own funds.

11. Must originate mortgages as a primary component of the company’s overall business

operations.

12. Must originate and close at least ten MHDC First Place Loan Program loans per year.

13. Financial institutions that have previously participated in MHDC programs must have a

satisfactory production and problem resolution record.

14. Must annually meet MHDC’s financial requirements.

15. Lenders must also meet all of US Bank’s requirements.

16. Must attend Lender Training.

Lenders must submit documentation supporting the above requirements. MHDC reserves the

right to require current participating lenders to demonstrate that they satisfy these

requirements. The master servicer will charge a $175 application fee to review each

application.

1

-

2

MHDC, at its sole discretion, may waive one or more of the requirements in order to originate

loans in some rural or Federally Targeted areas.

Annually, all lenders must submit current financial information for review to ensure continued

compliance with these requirements.

1

-

3

12B

Constant Funding

MHDC has constant funding for the First Place Loan Program.

When a lender has been approved by MHDC to participate in the First Place Loan Program,

MHDC will forward the Lender Origination Agreement, which must be executed by the lender

before they can participate in the program. This document includes, but is not limited to:

1. Three signature pages of the Acceptance of Agreement

These documents must be returned to MHDC before the lender will be provided access to

Lender Online.

13B

Third Party Originations

Certified Lenders may enter into correspondent arrangements with Third Party Originators, but

the following restrictions apply:

1.

There can be no increase in any fees. The allowed fees to the borrower must be split

between the Certified Lender and the correspondent.

2.

All loans close in the name of the Certified Lender. Loans cannot close in the name of

the correspondent and then be sold to the Certified Lender.

3.

The Certified Lender must make all reservations in the Lender Online system. The

Certified Lender cannot provide a password and access to the Lender Online system to

anyone other than their own employees.

4.

The Certified Lender is responsible for ensuring that all underwriting is in compliance

with Secondary Market standards and guidelines for FHA, VA, USDA Rural Development

or Fannie Mae loans. In the event that the correspondent incorrectly underwrites a

loan, and repurchase of the loan is necessary, it will be the Certified Lender, not the

correspondent that will be required to buy the loan back.

5.

Correspondents are not a Certified MHDC lender, and they may not advertise or

represent themselves as such. Correspondents will not be listed on the MHDC website

as Certified Lenders.

It will be the responsibility of the Certified Lender to perform any training needed by

the correspondent’s staff.

Allowing access to the Lender Online system, to the correspondent, or

violating any of the above stated provisions, may subject the Certified Lender

to possible termination of certified status; and immediate cancellation of all

outstanding reservations.

1

-

4

14B

Loan Officer Certification Requirements

Loan Officer Certification is optional. Loan officers are still eligible to participate in the First

Place Loan Program as long as they are employed with a Certified Lender.

All loan officers who wish to be certified must meet the following requirements:

1.

Loan officer’s current employer must be an approved certified lender and must meet

lender eligibility requirements. (See Section 1 page 1-6.)

2.

Loan officers who have less than five years’ experience in the First Place Loan Program,

must take the Lender/Loan Officer Certification Training and pass the test with a

percentage of 70 percent or higher.

3.

Loan officers who have five or more years’ experience in the First Place Loan Program

can opt out of taking the Lender/Loan Officer Certification Training but must pass the

test with a percentage of 70 percent or higher.

4.

A Loan officer certification will never expire as long as the loan officer shows active

participation and/or the lender in which you are employed is a participating certified

lender.

5.

Loan officer may achieve four levels of excellence over their life time:

Bronze Reach 25 approved bond loans

Silver Reach 75 approved bond loans

Gold Reach 125 approved bond loans

Platinum Reach 250 approved bond loans

6.

Loan officers will not be recognized by MHDC on website until they reach a level of

excellence. All loans will accrue toward the next level of excellence.

7.

Loan officer’s level of excellence will carry to any certified lender in which employed.

Top lenders and loan officers will be recognized every year on the MHDC website. The

recognition will be based solely on production of loans for that particular year. MHDC will

award the top loan officer in production with “Loan Officer of the Year Award.” MHDC will also

award the “Lender of the Year Award.” The “Lender of the Year Award” will be based not only

on production but also on the quality and timeliness of the loans that are purchased.

1

-

5

15B

LENDER

PARTICIPATION

APPLICATION

Name of

Institution

Address

City State Zip Code

Contact

Name

Contact Email

Address

Contact Phone/Fax

Number

CHECKLIST

FDIC (if applicable)

Corporation Date (if applicable)

Number of years in the state of Missouri

Current Audited Financial

o

Assets $_

Approval Letters FHA, VA, USDA, etc.

Fidelity Bond

o

Amount $_

o

Expiration

Errors and Omission

o

Amount $_

o

Expiration

Training Attended by_

o Training Date

o Training Location Attended

2

-

1

1B

Section 2 - Reservation of Funds

16B

Requirements

1.

Prior to making a reservation, the lender must have:

a.

A signed application from an applicant who has entered into a fully executed real estate

sales contract with the seller of the residence (contracts must contain the acceptance

signatures of both the buyer and seller, prior to requesting a reservation of funds);

Real estate sales contracts may be written and dated prior to the sale of the “bonds” or

the date reservations will be accepted.

b.

Made a preliminary determination that the applicant qualifies per the financial

institution's guidelines for the mortgage loan; and

c.

Made a preliminary determination that the applicant is eligible to participate in the

MHDC program, including but not limited to the first-time home buyer qualifications,

maximum income limits and maximum purchase price limits in effect at that time.

NOTE: MHDC encourages pre-qualification of potential borrowers.

Lenders may use the pre-qualification credit report and verifications of employment

provided they are dated within four months of the loan closing date.

2.

To reserve funds, the lender must have access to MHDC’s On-Line Reservation system,

Lender Online (LOL). For a detailed explanation of this system, contact the MHDC

homeownership department.

3.

Funds will be reserved on an individual first-come, first-served basis.

4.

There is no cost to the lender to participate in the program, nor to make reservations in

Lender Online (LOL).

17B

Reservation Procedure

1.

MHDC will announce changes and activate the reservation system so that reservations

may be made.

2.

Once the lender receives confirmation of reservation, the loan may close.

3.

Loans may not be canceled to re-reserve for a lower interest rate.

4.

Funds in Federally Targeted Tracts will be the lowest-available rate offered by MHDC in

the preceding 12 months.

18B

Reservation Expiration Dates

All reservations will expire 45 days from the date of reservation approval

Prior to the expiration date, the loan must be closed and a complete compliance package must

be received by MHDC for approval.

NOTE: If a lender determines that a reserved loan will be denied, the reservation must be

canceled by the lender on Lender Online (LOL).

3

-

1

19B

Reservation Extensions

If the lender cannot complete the closing and submission to MHDC within this period, an

extension of the expiration date may be requested. This may be accomplished by an email

describing the reason for the extension request and the estimated date or period of time

needed. Send this, along with the original approved reservation number, to any staff member

in the homeownership department at MHDC.

A valid reason for the extension request is required. MHDC reserves the right to refuse any

request. Any request for an extension must be accompanied by a statement that a

commitment letter has been issued to the borrower. Loans that have not been

approved by the end of the reservation period will not be extended.

NOTES: If a reservation has expired and MHDC has not received a request for an extension,

the reservation will automatically be canceled.

Reservations do not need to be extended after the package has been received at MHDC.

However, all deficiencies must be corrected within 30 days from notice to prevent file

rejection.

20B

Reservation Change Requests

Lenders are required to notify MHDC immediately of any changes.

1.

A written explanation describing the reason for the change must include the

reservation number and borrower name.

2.

Increases in loan amounts in excess of $3,000 must be approved prior to loan

closing.

These changes are to be emailed to MHDC in accordance with the extension instructions.

21B

Approved Reservations

Loans may close as soon as the lender has received a confirmed reservation.

All loans must be closed and shipped to MHDC by the expiration date specified on the

reservation form.

NOTE: Reservations may not have a change in the property address. If the applicant(s)

choose another property, their original approved reservation must be canceled and

a new reservation made on Lender Online (LOL).

Reservations cannot be transferred to another certified lender. If the applicant

chooses to apply with another lender, the original approved reservation must be

canceled and a new reservation made on Lender Online (LOL).

Once reserved, a reservation may not be transferred to a new issue in order to

obtain a different rate.

3

-

1

2B

Section 3 - Borrower Eligibility Requirements

22B

Definition of a First-Time Home Buyer

To qualify for a FIRST PLACE LOAN, the borrower(s) and spouses of the borrower(s) expected

to reside in the home to be purchased must meet the definition of a first-time homebuyer.

A first-time homebuyer is defined as a person:

1.

Who has not had a present ownership interest (see definition) in his or her principal

residence within the past three years; and

2.

Who has not taken a real estate tax deduction (on IRS Schedule A) for any residence

within the past three years; and

3.

Who has not taken a mortgage interest deduction (on IRS Schedule A) for any

residence within the past three years.

EXAMPLE 1: Two single persons are living together and only one is taking title and obtaining

the loan. Only the borrower must meet the first-time homebuyer requirements

and the maximum income limits. The other person will not be counted in the

house.

EXAMPLE 2: Two married persons are purchasing a home, but one person will not take title

due to credit issues. Both must meet the first-time homebuyer requirements and

the maximum income limits.

23B

Exceptions to First-Time Homebuyer Requirements:

1.

Applicants purchasing within Federally Targeted Census Tract Areas are not required to

be first-time homebuyers. For more information on Federally Targeted Census Tract

Areas, see Section 11-1.

2.

Qualified veterans are not required to be first-time homebuyers. Qualified veterans

means any veteran who:

a.

Served on active duty, and;

Applied for financing within 25 years after the date on which the veteran left

active service.

b.

Veteran’s status must be documented by a DD Form 214, Certificate of Release

or Discharge from Active Duty. Active duty veterans must obtain a statement of

service signed by, or by direction of, the adjutant, personnel officer, or unit

commander or higher headquarters showing date of entry on current active

duty.

24B

Definition of Present and Non-Present Ownership Interest

Federal regulations define present ownership interest and non-present ownership interest as

follows:

Applicants who hold or have held one of the following forms of present ownership interest in

his or her principal residence within the past three years would not be considered a first-time

homebuyer.

3

-

2

25B

Present Ownership Interest

A fee simple interest;

A joint tenancy, tenancy-in-common, tenancy by the entirety, or community

property interest;

The interest of a tenant-shareholder in a cooperative; however, this excludes the

interest held by an applicant who lives/lived in a HUD-sponsored or regulated

cooperative housing project provided that:

1.

Such project is owned by a non-profit corporation;

2.

There is no stock issued by the corporation;

3.

Such persons possess only a membership in the corporation, and;

4.

Such persons occupy a specific unit in the project by virtue of an occupancy

agreement or similar agreement which creates a landlord-tenant relationship

pursuant to which the landlord may pursue remedies for breach in

accordance with applicable landlord-tenant law.

A life estate;

A land contract or contract for deed (i.e., a contract pursuant to which possession

and the benefits and burdens of ownership are transferred even though legal title is

not transferred until some later time), whether legally filed or not.

An interest held in trust for the mortgagor (whether or not created by the

mortgagor) that would constitute a present ownership interest if held directly by the

mortgagor.

26B

Non-Present Ownership Interest

Applicants who hold or have held one of the following forms of non-present ownership

interest may qualify as a first-time home buyer. A remainder interest:

A lease with or without an option to purchase;

A mere expectancy to inherit an interest in a principal residence;

The interest that a purchaser of a residence acquires on the execution of a purchase

contract, or

An interest held in property that was not the principal residence during the prior three

years.

27B

Existing Mortgages

A mortgagor shall not have had a mortgage (whether or not paid in full) on the subject

residence at any time prior to the execution of the First Place Loan, and the proceeds of

the First Place Loan will not be used to purchase or replace an existing mortgage.

For purposes of the preceding sentence, the replacement of construction period loans,

3

-

3

bridge loans or similar temporary initial financing (i.e., financing which has a term of

twenty-four months or less) will not be treated as an acquisition or replacement of an

existing mortgage.

28B

Persons Who Are Separated or Legally Separated - Waivers of Marital

Rights

Any applicant who is separated is still considered a married person; however, he or she

may qualify for a First Place Program loan.

The estranged, non-borrowing spouse who does not currently live with the potential

borrower nor plans to live with the potential borrower, will not be required to meet the

First Place Program requirements. The following will be required:

1.

The estranged spouse cannot sign a legal waiver of their marital rights.

He/she must sign the First Deed of Trust and the Tax Exempt Financing

Rider - Form #580.

2.

The applicant and their estranged spouse will be required to sign the MHDC

Waiver of Marital Rights Affidavit, Forms #550-1 and #550-2 attesting they are

separated and do not plan to live together in the property. The estranged

spouse must note the new location where he/she currently resides.

3.

The lender must verify that the separation has been for a period of at least 12

months. (This verification is not submitted to MHDC.)

4.

The income of the estranged spouse will not be included.

29B

Married Persons – Non Borrowing Spouses

An occupying spouse may be omitted from the mortgage for credit or other reasons.

Lenders are required to utilize standard, customary underwriting procedures when

underwriting any loan where only one spouse will act as the borrower due to poor

credit, or other reasons, of the non- borrowing spouse.

If the applicant and their spouse currently reside, or plan to reside, in the subject property

together after closing, use of Forms 550-1 and 550-2 affidavits are not required.

The non-borrowing spouse:

1.

Will not sign the First Note.

2.

The non-borrowing spouse can NOT take title to the property. (The Warranty

Deed must mirror the Note for this program.)

3.

They will sign only the Tax-Exempt Financing Rider – Form #580 and the Deed

of Trust.

4.

Non-borrowing spouse must still meet income and first-time homebuyer

requirements. Proper income verification must be included in the file. If non-

borrowing spouse does not work the spouse will have to sign form #522. Also,

in order to prove first-time homebuyer status, the non-borrowing spouse will

have to sign form #516 certifying that the spouse has not owned any property

as their primary residence within the last 3 years.

3

-

4

30B

Applicants Who Own/Owned Rental Property

Applicants who own or have owned rental property may be considered eligible as a first-

time homebuyer as long as they can prove the following:

1.

They did not live in any of the rental property for which they held ownership

interest at any time within the past three years;

2.

A mortgage interest deduction was not taken as a personal deduction on

Schedule A of their federal tax returns; or

3.

A real estate tax deduction was not taken as a personal deduction on Schedule

A of their federal tax returns. (The person would probably have a rental

schedule showing rental income on the tax return. This would be on the

Schedule E, not on Schedule A.)

4.

Rental income must be counted when calculating for income guidelines.

31B

Applicants Whose Ex-Spouse Solely Owned Real Estate Prior to the

Marriage

If an applicant/occupant was married within the past three years, but is now divorced, and

their ex-spouse owned the property prior to the marriage, the applicant/occupant would

not be considered a first-time homebuyer.

In the state of Missouri, anyone who is or was married to someone that owned property

would be considered an owner of that property as well due to marital rights;

The applicant/occupant would only be considered a first-time homebuyer if:

A.

Three years from the date they stopped occupying the property as their principal

residence, and;

B.

There is no mortgage interest or real estate tax deductions on any of their last three

years of federal income tax returns.

32B

Applicants Who Own or Owned a Mobile Home within Past Three Years

An applicant may be considered a first-time homebuyer in the following circumstance:

A.

If the applicant owns a mobile home, and it is on leased land and still has the

running gear on it (meaning it is NOT permanently fixed to a foundation), and the

potential applicant has not taken a personal tax deduction for home mortgage

interest or real estate taxes on their federal tax returns within the past three years.

B.

If the applicant owns/owned the land on which the mobile home is/was located, the

following must apply:

1.

The mobile home must NOT be on a permanent foundation, and

2.

The applicant must not have taken a home mortgage interest deduction on

Schedule A of the federal return at any time during the past three years, and

3

-

5

3.

If the applicant took a real estate tax deduction on IRS Schedule “A” at any time

during the past three years, he or she must prove or produce the tax receipt

indicating that the real estate tax deduction was for unimproved (vacant) land,

and

4.

The lender must certify that the mobile home is indeed mobile. (A

representative from the mortgage company must verify the mobility of the

mobile home. This may be accomplished by completing MHDC Form #585-

Mobile Home Certification.)

5.

If the mobile home is not sold, rental income must be calculated per income

guidelines.

C.

An applicant would not be considered a first-time homebuyer under the following

circumstances:

1.

If the applicant owns/owned the land and the mobile home is/was permanently

affixed, applicant is NOT eligible (regardless if a tax deduction was taken).

2.

If any home mortgage interest or real estate tax deduction is taken on IRS

Schedule “A” for the mobile home, the applicant does not qualify as a first-time

homebuyer.

Lenders are responsible for maintaining in their files all documentation regarding ownership or

prior ownership of a mobile home. If you have a situation that is not addressed here, please

call us or send us your letter outlining the circumstances in full detail, prior to loan closing, for

approval.

33B

Applicants Who Are Licensed Real Estate Agents

Applicants who are licensed Real Estate Agents and representing themselves on the purchase

of a home using the First Place Program cannot earn any commission on the transaction.

Total Household Number

Total household number will equal the total number of persons who will be on the loan or

married to the person on the loan. Also included in the household number will be any

biological or adopted children of the borrower(s), or non-borrowing spouse that will

occupy the property as their full-time principal residence. Generally, this includes, but

may not be limited to the following:

Biological or adopted children over the age of 18 of the borrower(s), or non-borrowing

spouse, may be counted in the household number if they occupy the property as

their principal residence.

A parent (or biological relative) of the borrower(s), or of the non-borrowing spouse,

may be counted if they occupy the residence as their full-time principal residence.

Foster children are NOT counted as members of the household.

3

-

6

NOTE: For persons who make their living as foster care providers, an exception may be

made when foster care income is included for underwriting purposes.

An unborn child may not be included into the household number.

NOTE: For persons who make their living as foster care providers, an exception may be

made when foster care income is included for underwriting purposes.

An unborn child may not be included into the household number.

35B

Total Family Household Income

To qualify for a First Place Loan, the combined total projected annual household income for all

borrower(s), spouse of borrower(s), working adult children (those not attending school full

time) and any other adult relative living in the house as their principal residence must be

less than the maximum income limit as calculated in accordance with the guidelines set

forth by MHDC.

For full-time students, who are 18 years of age or older *and* are

dependents, a small amount of their earned income will be

counted. Count only earned income up to a maximum of $480 per

year for full-time students, age 18 or older, who are not the head

of the family; spouse or co-head.*If the earned income is less than

$480 annually, count all of the income. If the earned income

exceeds $480 annually,* count $480 and exclude the amount that

exceeds $480.

Total Projected Annual Household Income includes, but is not limited to, the following types of

income:

1. Gross pay 13. Welfare payments

2. Overtime 14. Social Security benefits

3. Bonuses 15. Disability payments

4. Part-time employment 16. Alimony

5. Dividends 17. Child Support payments

6. Interest 18. Public assistance

7. Annuities 19. Sick pay

8. Pensions 20. Unemployment compensation

9. Veterans Administration (VA)

Compensation

21. Income received from trust or

from

business and investments

10.

Gross rental or lease income

11.

Commissions

22. Any regularly occurring additional income

from all sources (both taxable and non-

taxable) including but not limited to

earnings

12.

Deferred

income

3

-

7

Income exclusions include income from the following sources:

A.

Foster Children: Income received for the care of foster children is not considered in

determining eligibility under the Maximum Income Guidelines unless included for

underwriting purposes.

B.

Food Stamps: Food stamps received are not to be considered in determining eligibility

under the Maximum Income Guidelines.

C.

One-Time Occurrences: Life insurance settlements, sign on bonuses etc. These

would not have to be counted into the household income due to them being a

one-time payment or occurrence.

D.

Earned income of minors: (family members under 18) is not counted.

NOTE: Any income included for underwriting purposes must be included in

the household income calculations as well.

36B

Lenders Options for Verifying Income:

1.

Alternative Documentation Method

2.

Work-Number-For-Everyone

3.

Third Party Verification of Income

37B

Option One - Alternative Documentation Method

These guidelines are used to verify W2-reported income only. These guidelines are similar

to the Alternative Documentation requirements in place for use with FHA, VA, USDA Rural

Development or Fannie Mae loans. Lenders must also comply with any alternative

documentation requirements of VA, FHA, USDA Rural Development or Fannie Mae if using

alternative documentation for underwriting purposes.

Documentation to be obtained and submitted:

1.

Recent year’s W2 for that job and,

2.

Thirty days of detailed year-to-date paycheck stubs dated within 30 days of loan

closing. Pay check stubs must reflect overtime, commission, rate of pay, etc. as

separate entries, and be either computer generated or typed and,

3.

Borrower’s start date for that job.

If the borrower started in the middle of the previous year, provide a verbal

verification of employment to reflect the borrower’s start date. This certification

may be no more than 30 days old at time of closing. It must note the names of the

borrower, employer, lender, and processor/contact; addresses; applicable business

3

-

8

telephone numbers; show the date of contact; and state the employment dates.

If the applicant started their job the current year and a W2 is not available,

Alternative Documentation may not be used.

If detailed check stubs containing year-to-date income are not available, this method may

not be used.

Calculation Method for Alternative Documentation:

To utilize this method, the lender shall annualize the borrowers most recent check stub.

Lender shall:

Determine the rate of pay, and the pay period type: hourly, bi-weekly, twice-per-month;

or monthly.

This rate shall be multiplied by the number of annual units for that type: 2,080 hours

(units) for hourly, 52 units for weekly, 26 units for bi-weekly, 24 units for twice-per-

month; 12 for monthly, etc. This shall be the base rate. For example:

$10 hourly = 2,080x10=$20,800 annually

$600 weekly= 52x600=$31,200 annually

$1400 bi-weekly= 26x1, 400=$36,400

$1800 semi-monthly= 24x$1,800=$43,200

When using this method to determine first place program eligibility, income shall be the

greater of the previous years’ W2 income or the current years’ annualized income from

current paycheck stubs.

Overtime, Bonuses, Commissions, etc.:

If overtime, commissions, bonuses or any type of additional pay is disclosed on the paycheck

stub, the lender shall annualize this income as well.

Calculation Example:

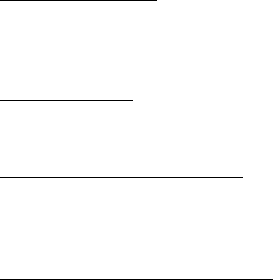

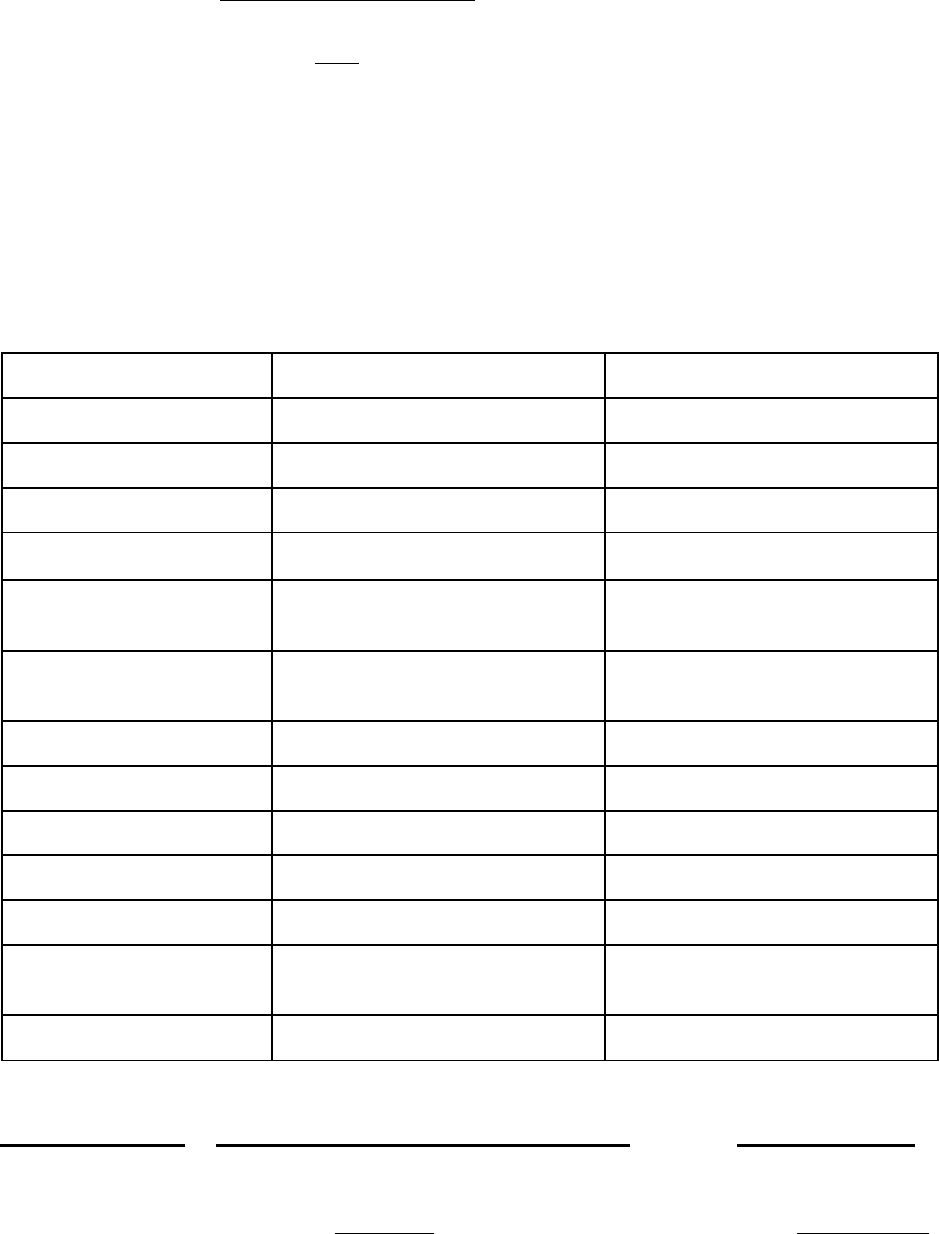

Three Person Household. Qualifying Non-Targeted income: $68,655

Date of paycheck stubs: June 30, 2013

Applicant Borrower Co-Borrower

Full Time Job Yes Yes

Start of

Employment

6/30/2004 2/18/2004

Salary $450 weekly $15 hourly

Date of Next

Increase

Not provided Not provided

Date of Last

Increase

Not Provided Not Provided

YTD Base $11,700 $15,600

3

-

9

YTD Comm./OT 0 $125

2012 Income $22,750 $35,360

All other forms of income (SSI, disability, child support, etc.) would be added to

this figure on the Income Calculation Worksheet.

38B

Option Two - “The Work Number for Everyone”

MHDC will accept TALX Corporation’s verification providing the following is forwarded to MHDC

in lieu of the verification of employment when this service is used:

1.

The form must be a computer-generated or fax form indicating that it came directly

from TALX, “The Work Number for Everyone” program.

2.

MHDC must receive the full version, indicating salary and YTD and prior year

earnings.

3.

The form must carry a certification added to it by the lender, as follows:

4.

The maximum fee charged to the buyer or seller by the lender cannot exceed $15.00, which is

the maximum allowed by HUD for this service. Other verification companies may be used, but

the forms submitted must contain at least the information contained on a standard Fannie Mae

Verification of Employment form.

39B

Option Three -Third Party Verification of Income

Calculating Total Gross Annual Household Income

A.

SALARIED EMPLOYEES - Use the current base earnings, whether hourly, weekly, or

monthly, etc. and project forward for a full 12-month period.

If an applicant receives a pay increase prior to closing, the pay increase must be

included in the base earnings.

If an applicant receives a pay increase and the mortgage lender closes the loan prior to

the increase taking effect, then the increase would not be counted for income eligibility.

B.

IRREGULAR INCOME Such as overtime, bonuses, commissions, part-time pay and

unemployment compensation will be projected using the exact amount of all such pay

received in the most recent 12-month period. (This does not mean a calendar year.)

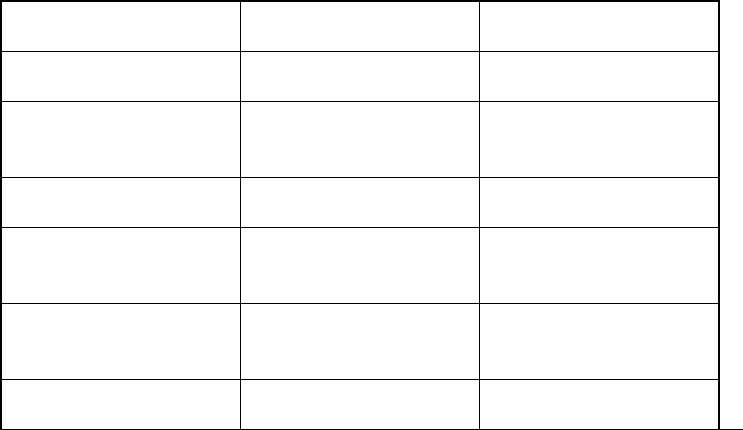

We hereby certify that this form was generated by the Work Number for Everyone program

and is being submitted as we received it:

(Name of Lender)

Date:

By:

(Typed Name of Person executing form)

3

-

10

This income must be counted, even if the employer states it is not likely to

continue.

If the loan closes prior to April 15, it is acceptable to use the overtime, bonuses,

commissions, part-time and unemployment pay earned for the previous calendar year.

If the loan closes on or after April 15, employers must provide the most recent 12-

month period.

If an applicant has not been on the job for a full twelve months, determine the amount

of overtime, bonuses, commissions, part-time and unemployment income earned

within the period of time indicated. Divide the earnings received by the actual period

of time worked. Multiply the result by 12 months or 52 weeks, depending upon the

period used in the division.

NOTE: If an applicant is far below the MHDC Maximum Income Limit and it is easily

determined that under no circumstance would it be possible to exceed

the MHDC Maximum Limit, an exact 12-month breakdown is not required.

However, the irregular income must be included in the calculation

for MHDC purposes.

CAUTION: It has been brought to the attention of MHDC that, in some cases, the

employer’s records do not reflect the full amount of overtime received.

The employer, when paying the applicant for overtime, may report part of

the overtime in the base pay.

EXAMPLE: An applicant receives base pay of $10.00 per hour and worked forty-four

hours. The employer paid the employee:

Pay Type # of Hours Rate Amount

Regular Hours 44.00 $10.00 $440.00

Overtime 4.00 $ 5.00 $20.00

In this example, the actual amount of overtime the applicant received is $60.00. The

employer reported $20.00.

C.

SEASONAL TYPE WORKERS - (i.e., construction workers) - Use the exact income

received in the most recent 12-month period (this does not mean a calendar year),

then project anticipated income.

If an applicant has not been on the job for a full 12 months, determine the amount of

income earned within the period of employment. Divide the earnings received by the

actual period of time worked. Multiply the result by 12 months or 52 weeks, depending

upon the period used in the division.

EXAMPLE: Total earnings are $17,653 for a period of 8 months, paid monthly.

$17,653 / 8 = $2,206.62

$2,206.62 x 12 = $26,479.50

$26,479.50 is the projected annual income for qualifying purposes.

D. SELF-EMPLOYED APPLICANTS - Use net earnings from the most recently filed tax

return. Deductions in connection with the business are allowable; however, all

depreciation must be straight line depreciation. If net income is a loss, the amount of

income would be -0-.

E.

A loss may not be deducted from their total household income calculations.

3

-

11

NOTE: If the loan closes after April 15, the previous year’s federal income tax

return must be used.

Example: Loan closes April 16, 2020, the 2019 return will be required.

If an applicant has not been self-employed for a full twelve months, determine the

amount of earnings within the period of self-employment. This would be done by a P&L

statement from a third party accountant. Divide the earnings received by the actual

period of time worked. Multiply the result by 12 months or 52 weeks, depending upon

the period used in the division. Use the projected income for qualifying. Verify income

per standard underwriting procedures for this situation, interim financial statements,

etc.

F.

BUSINESS INCOME FROM PARTNERSHIPS, S-CORPORATIONS - In addition to

income received from the business, make certain to include the income being retained

in the business from the most recently filed corporate tax return. If the applicant owns

the business 100 percent, include 100 percent of the business profit being retained in

the company. If there are four equal partners, count 25 percent of the business profit

being retained in the company for this applicant’s qualifying income.

NOTE: If the loan file closes after the fiscal year ends for the corporation, the new

return will be required.

If an applicant has not been in business for a full twelve months, determine the amount

of earnings for the appropriate number of months. Divide the earnings received by the

actual period of time in business. Multiply the result by 12 months or 52 weeks,

depending upon the period used in the division. Use projected income for qualifying.

G.

MILITARY PERSONNEL - You must include any housing allowance, food allowance,

etc. that is paid to the applicant that is not paid as a reimbursement.

H. PASTORS, MINISTERS - You must include any housing allowance, food allowance,

etc. that is paid to an applicant that is not paid as a reimbursement.

I. CHILD SUPPORT - Use total amount of child support received within past 12 months.

A printout from the court is sufficient to show exact amounts of support received

within past 12 months. In lieu of the printout, a copy of the divorce decree is

acceptable.

If it is not paid through the courts, but the divorce decree states an amount, or if the

applicant receives less than the amount stated in the divorce decree, a notarized

statement from the applicant stating exact earnings will be acceptable.

If an applicant has not received child support for a full 12 months, determine the

amount of child support earned for the appropriate number of months. Divide the

earnings received by the actual period of time child support has been received.

Multiply the result by 12 months or 52 weeks, depending upon the period used in the

division. Use projected income for qualifying.

If the applicant receives no support for a minor child, The Certification of Zero Support

for Children - MHDC Form #523 must be signed and notarized, stating that the child

receives no child support, SSI or SSA, disability, etc.

J.

CAR ALLOWANCE - If the car allowance is a reimbursement, the amount received

would not be counted for MHDC purposes. However, if an applicant/occupant receives a

car allowance without expenses to offset the allowance, it must be counted as

income.

3

-

12

K.

UNEMPLOYMENT COMPENSATION - If an applicant has a job where he and she is

consistently laid off due to weather conditions, model changes, etc., the unemployment

compensation earned within the past 12 month period must be included in the

calculation of income.

If an applicant has not been on the job for a full 12 months, determine the amount of

unemployment compensation earned within the period of time of employment. Divide

the regular earnings received by the actual period of time on the job. Multiply the

result by 12 months or 52 weeks, depending upon the period used in the division. Add

unemployment compensation to regular income. Use projected income for qualifying.

L.

TEACHERS - The contract in effect at the time of loan closing will be utilized. In

addition, any supplemental contracts or extra duty pay must also be counted. Any

summer employment must be counted as well.

40B

Miscellaneous Criteria -applicable regardless of calculation method used

Layoffs Due to Illness or Injury

The period of time that an applicant was not at work due to an illness or injury may NOT be

counted to achieve a 12 month history for the purpose of overtime, bonuses, commissions,

part-time employment, unemployment, seasonal work, etc.

To properly calculate income in this situation, determine the actual period of time worked

within the 12 month period. Divide the earnings by actual period of time worked. Multiply the

result by 12 months or 52 weeks, depending upon the period used in the division. Use

projected income to qualify

.

41B

Quitting a Job after Application

If an applicant quits a job after the application has been taken, the income from that job must

be used for MHDC purposes. An applicant may not quit a job for purposes of qualifying

for an MHDC loan. The exception is:

1.

Applicant quits a full time position to accept a new full time position, or

2.

Applicant quits one or more part-time positions to accept a full-time position.

42B

Applicants Close to the MHDC Maximum Income Limits

When the applicant is close to the maximum income limit and the employer will not provide

the exact 12 month breakdown, the lender may NOT:

1.

Use an average of more than twelve months, or

2.

Attempt to project the income by taking previous year(s) earnings,

dividing by twelve and multiplying by the number of months needed to

achieve twelve months’ earnings.

The lender may count all of the income earned in a period of time (if more than twelve

months) and treat it as if it was earned within the twelve month period and if the applicant is

still below the maximum an exact twelve months would not be required. However, if the

above cannot be accomplished and the employer cannot or will not break out the information,

the mortgage loan will be denied.

3

-

13

43B

Treatment of Assets

Any liquid asset of $5,000 or greater will need to be multiplied by 2 percent of the annual

interest (which includes checking, savings, etc.) unless the funds are being applied toward the

purchase of the property.

Exception: 401K, stock, etc. are excluded as long as consistent withdrawal transactions are

not taking place.

Example: Checking account balance: $10,500 x 2%= $210 (this amount would be added to

the borrowers annual income).

44B

Underwriting Income vs Program Projected Household Income

If the income figure for credit underwriting is higher than the projected income for MHDC, the

income used for credit underwriting must be used. Total income calculations may not exceed

the current Maximum Income Limits. Limits are subject to change from time to time. Make

certain you are using a current chart.

The exception is if you are using the income of a co-signor for qualification purposes. Income

from non-occupying co-signors is excluded from the total household income.

Another exception would be when a borrower purchases both units of a two unit property

(duplex or two story flat). In this case only, the income anticipated to come from the rental of

the second unit to be purchased may be used for underwriting purposes, which may exceed

the income used for MHDC qualifying purposes by the amount of such rent. In addition,

income from the second unit would not be included in the determination of compliance with

the Maximum Income limits.

Please note: The calculation method for purposes of determining program eligibility is a

different process than income used for credit underwriting. The calculations are used for two

entirely different purposes.

45B

Prior Approvals on Calculating Total Household Income

If an applicant is close to the Maximum Income Guidelines, the lender may request a prior

approval from MHDC.

To request prior approval, lenders should submit The Request for Prior Approval - Form #521,

and the applicable documentation detailed on this form for the type of prior approval

requested, including:

Copy of applicants loan application

The number of persons intending to occupy the residence

The reservation address and maximum income limits for that area

Completed Calculation Worksheet

Qualified documentation of income from all those intending to reside in the property

Child Support, Assets, and documentation for other non-W2 income

If overtime, commissions or bonuses are being used, the lender must set out details

of exactly what was used and a schedule of income from pay stubs or other

documentation used for arriving at the figures

3

-

14

Please note: It can be very difficult for MHDC staff to review a few pieces of paper and

understand the entire situation. Income documentation should be treated the same as if in a

file submission.

MHDC will either APROVE or DISAPROVE the file based on the information submitted to

MHDC.

Requests will be accepted only if Form #521 and certifications are executed by a person

who the lender has authorized to sign, and such authorization has previously been sent to

MHDC.

MHDC requests that all prior approvals allow at least a 48-hour review time.

MHDC will not prior approve each loan for underwriting purposes. Only those

close to the maximum limits should be submitted for review.

46B

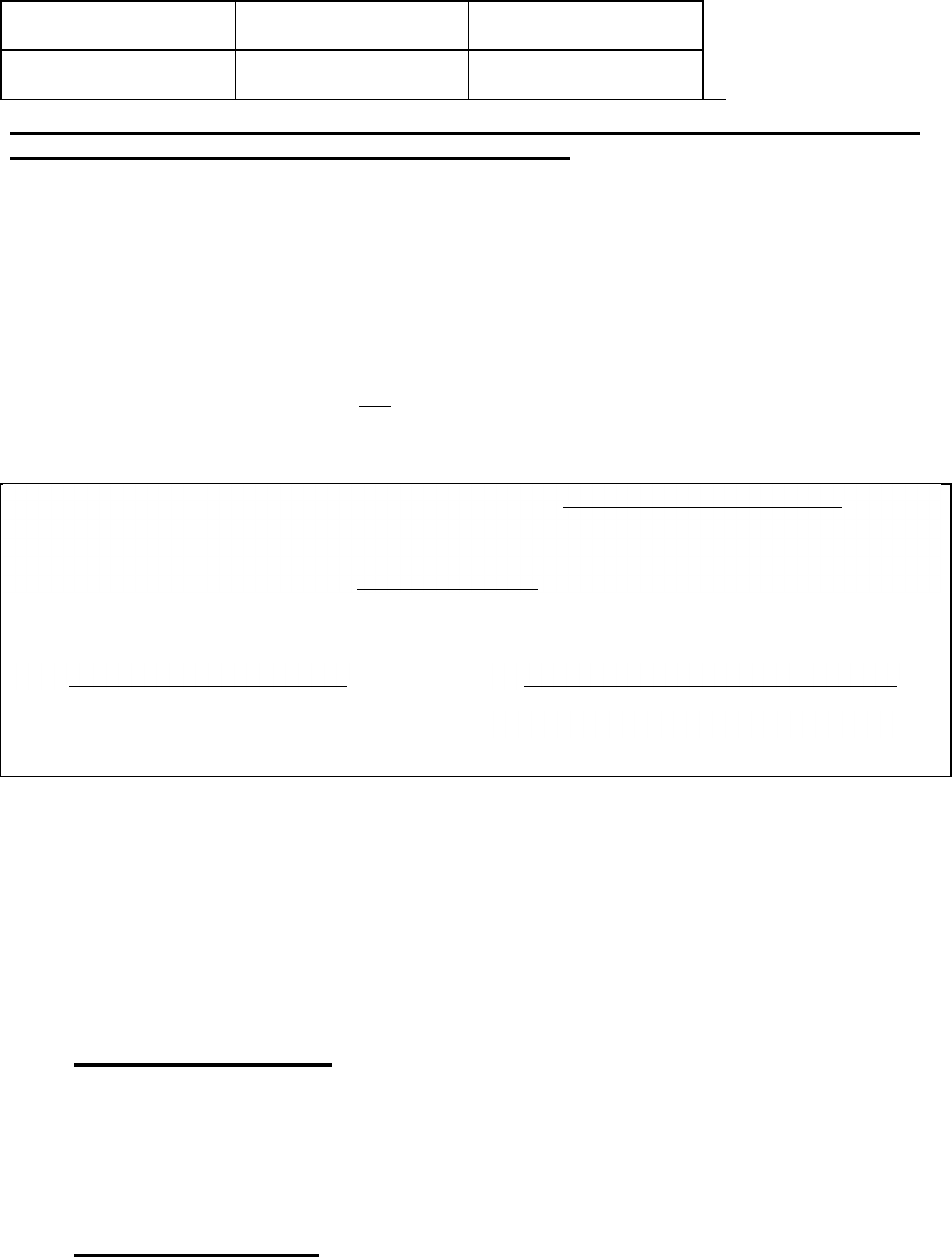

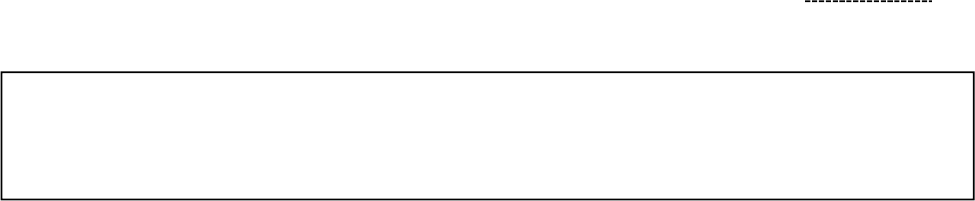

Example of Calculation Method

Information Found on the VOE

Applicant Mr. Davis Mrs. Davis

Job Description Sales & Service Rep Medical Sec. Receptionist

Full-Time Job Yes Yes

Start of Employment 04/15/11 12/05/12

Salary

$660 bi-weekly $14,560 yearly

Date of Next

Increase

not provided not provided

Date of Last

Increase

not provided not provided

Info. Verified as of 08/04/15 07/10/15

Y-T-D Base $8,500.00 $7,400.00

Y-T-D Commission $6,234.73 0.00 (OT)

20014 Base $8,510.00 $780.00

2014 Commission $10,889.21 0.00 (OT)

Additional

Information

On leave from 5/13/15 to

8/4/15, received base only

None

Anticipated Closing: 10/22/15

MHDC would calculate the income as follows:

Applicant Name Description and calculation method Annual Amount

Mr. Davis Base: $660 / bi-weeklyX 26 weeks =

$17,160.00

Commissions: 2015* $6,234.73

2014 + $_ = ÷ 9 mos x 12 mos =

+

3

-

15

Mrs. Davis Base: $14,560.00

TOTAL PROJECTED ANNUAL HOUSEHOLD INCOME: $

*Earnings as of 5/13/15

MHDC would need to know the amount of commissions earned from 8/9/14 to 12/31/14.

The employer verified the information as of 8/4/15; however, Mr. Davis did not work from

5/13/15 to 8/4/15; therefore, the actual period of time worked was determined and projected

for 12 months.

3

-

16

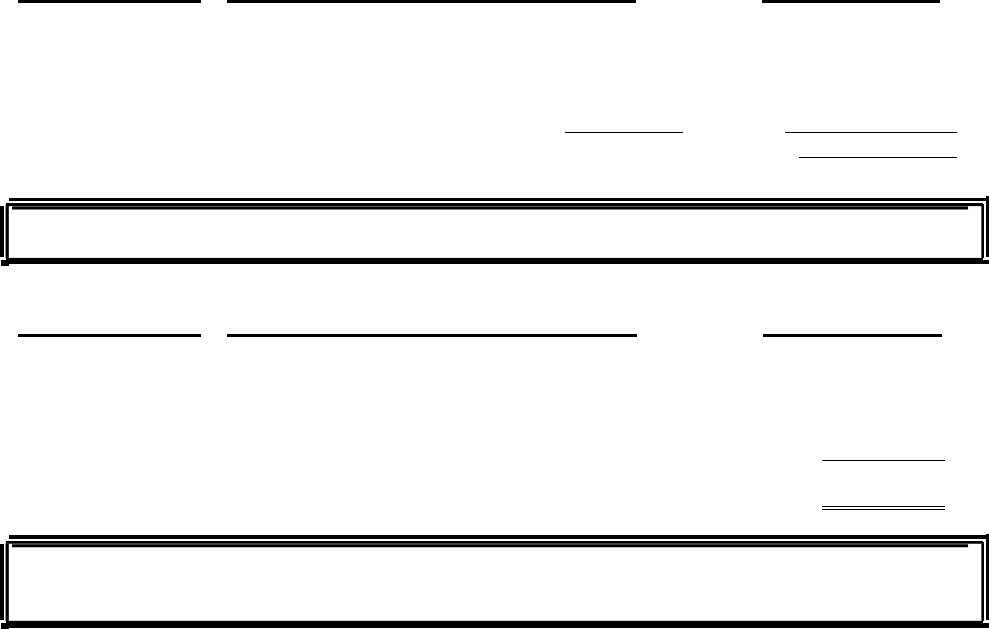

46B

Example of Calculation Method

Information Found on the VOE

Applicant Mr. X

Job Description

Full-Time Job yes

Start of Employment 10/07/01

Salary $18.46 hourly

Date

of

Next

Increase

not provided

Date

of

Last

Increase

not provided

Info. Verified as of 08/14/16

Y-T-D Base $23,016.55

Y-T-D Overtime $5,511.37

2005 Base $30,578.26

Anticipated

Closing

Date:

2005 Commission $6,614.39

9/15/16

Additional

Information

Provided

by

the

Work

Number

for Everyone (TALZ Corp.)

MHDC would calculate the income as follows:

Applicant Name Description and calculation method Annual Amount

Mr. X Base: $18.46/hour X 40 hours X 52

weeks =

$38,396.80

Overtime: 2006 Y-T-D $5,511.37

2015 (8/15/15 to 12/31/15) + =

TOTAL PROJECTED ANNUAL HOUSEHOLD INCOME: $

Looking at worst case:

Applicant Name

Description and calculation method Annual Amount

Mr. X Base: $18.46/hour X 40 hours X

52

weeks =

$38,396.80

Overtime: 2016 Y-T-D $12,125.76

TOTAL PROJECTED ANNUAL HOUSEHOLD INCOME: $50,522.56

48B

NOTE: MHDC is unable to complete the projection, as the specific breakdown of

overtime earned during the period of 8/15/15 to 12/31/15 was not provided.

If the applicant is under the maximum after you count all of the overtime earned in

2015+2016 as a full 12 month period, you would not need to obtain an exact 12-month

breakdown.

3

-

17

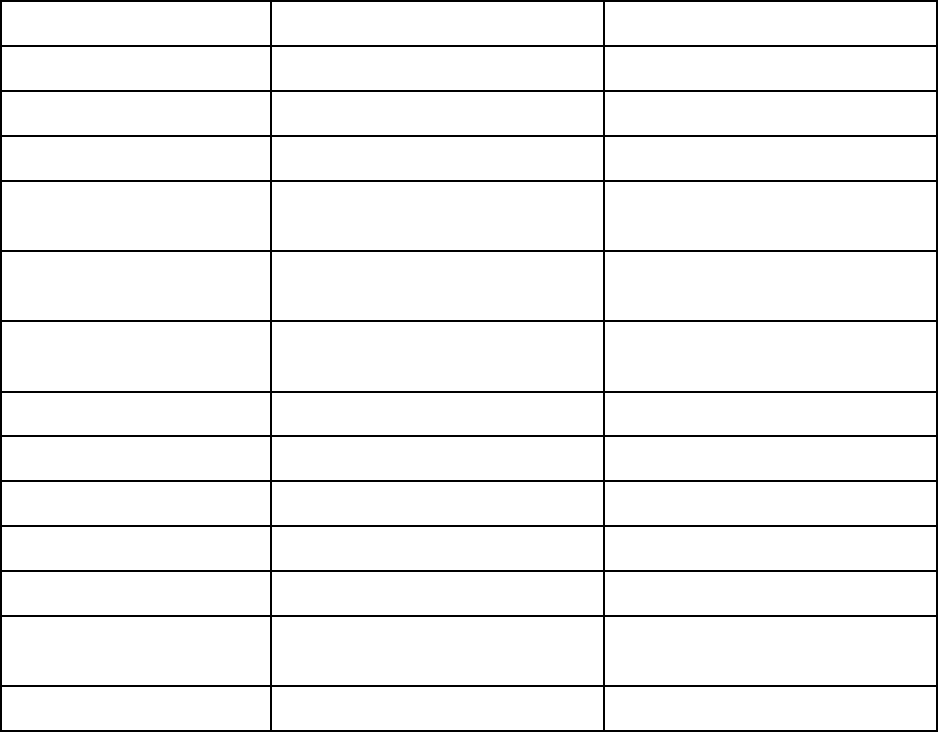

Example of Calculation Method

Information found on the VOE

Applicant Mr. Klein Mrs. Klein

Job Description Technician Technician

Full-Time Job Yes Yes

Start of Employment 05/07/02 07/21/04

Salary

$10.10 hourly

plus .50¢ shift difference

Date of Next

Increase

6/17 = 3% 6/17 = 3%

Date of Last

Increase

6/23/16 = 4% 6/23/16 = 4%

Info. Verified as of 07/11/16 07/11/16

Y-T-D Base $11,706.79 11,794.67

Y-T-D Bonus $409.20 $409.37

1996 Base $19,635.05 $20,366.54

1996 Bonus $838.77 $865.22

Additional

Information

OT Hrs included in base OT Hrs included in base

Anticipated Closing 10/5/16

Additional information provided to MHDC: (Note that both applicants work for same

employer.)

B. Letter from employer stating that there is a vacation shutdown in summer

coinciding with a major auto maker’s production schedule.

MHDC requested additional information verified by the employer in writing:

(Answers)

1. During the period 7/1/15 to 6/30/16:

What

has

Mrs.

Klein

earned

in

overtime

pay?

$1,318.20

What

has

Mrs.

Klein

earned

in

bonus

pay?

$1,026.00

What

has

Mr.

Klein

earned

in

overtime

pay?

$1,084.92

What

has

Mr.

Klein

earned

in

bonus

pay?

$1,002.60

What amount has Mrs. Klein earned in unemployment compensation? $39.00

What amount has Mr. Klein earned in unemployment compensation? $78.00 How

many weeks/days was Mrs. Klein laid off? 8 days

How many weeks/days was Mr. Klein laid off? 8 days

Continued on next page.

3

-

18

Continuation of Mr. & Mrs. Klein’s projected income example.

With the information on the previous page, MHDC projected Mr. & Mrs. Klein’s total household

income as follows:

Applicant

Name

Description

and

calculation

method

Annual

Amount

Mr.

Klein

Base:

$10.10

+

.50

=

$10.60

x

40

x

52

=

$22,048.00

Overtime:

(12

month

earnings)

$1,084.9

Bonus:

(12

month

earnings)

$1,002.6

Unemployment

Comp.

(12

month

earnings)

$78.00

Mrs.

Klein

Base:

$10.10

+

.50

=

$10.60

x

40

x

52

=

$22,048.0

Overtime:

(12

month

earnings)

$1,318.2

Bonus:

(12

month

earnings)

$1,026.0

Unemployment compensation $39.00

$48,644.72

MHDC counted both applicants as working a full 40 hours per week,

52 weeks per year, in their base. In addition, MHDC also counted

unemployment compensation against these applicants. The

employer verified within the past 12 months that these applicants were

laid off a total of 8 days. Therefore, MHDC deducted 8 days of pay

for both applicants:

$10.60 hourly X 8 hours X 8 days =

$678.40 X two applicants = <1,356.80>

TOTAL PROJECTED ANNUAL HOUSEHOLD INCOME: $ 47,287.92

49B

3

-

19

Example of Calculation Method

General information from the applicants’ VOEs for a projected closing date of July 18,

2016.

Mr. Smith

Full Time Job

Start of Employment: 5/15/06

Salary:

$34,800

annually

Date

of

Last

Increase:

8/18/05=

$1,800

Date of Next Increase:

8/15/16=

undetermined

Date

signed

by

employer:

6/7/16

Y

-

T

-

D

earnings

as

of

5/21/16

$12,046.23

2015

earnings:

$21,183.61

Bonus

received

within

last

12

months:

$225.00

Part

-

Time

Job

-

Start

Date:

2015

as

needed

Salary:

None

noted

Date

signed

by

employer:

6/6/16

Total earnings within last 12

mos:

$1,077.50

Mrs. Smith

Substitute Teacher obtained VOE’s

from all schools

Part

-

Time

summer

job

Start

Date

(Not

employed

after

9/30/16)

6/12/16

Earnings as of 7/13/16 $700

MHDC would calculate the income as follows:

Applicant Name Description and calculation method

Annual

Amount

Mr.

Smith

Full

Time

Job

-

Regular

wages

$34,800.00

Bonus

(from

most

recent

12

-

mos)

$225.00

Part

-

time

Job

-

Total

earnings

(from

most

$1,077.50

recent

12

-

mos)

Mrs.

Smith

Substitute

Teacher

-

Total

earnings

(from

most

$4,236.33

recent

12

-

mos)

Part

-

time

Summer

Job

$2,450.00

$700 ÷ 1 month x 3.5 months work

time (to project the income)

TOTAL PROJECTED ANNUAL HOUSEHOLD

INCOME

$42,788.83

3

-

20

50B

Owner-Occupancy Requirements

Mortgagors must occupy the residence within 60 days of loan closing, and continue to occupy,

as long as the bond loan exists, as his or her principal residence.

Mortgagors may not rent or transfer the residence as long as the bond loan exists on the

property. Any assumption must be to an income qualified buyer and be approved by MHDC.

The following properties are not allowed with the First Place Loan Program:

1.

A residence that has more than 15 percent (with the exception of child day care) of

the total area reasonably expected or otherwise primarily intended to be used in a

trade or business. (i.e., Qualifying deduction as an expense for business use of the

home under the Code);

NOTE: When there is a business in the home, a deduction for any cost of the home

may not be taken as a business expense. (i.e., prorating the mortgage payment,

taxes, insurance) and

2.

A residence utilized as an investment property; or

3.

A residence utilized as a recreational home.

51B

Non-U.S. Citizens

Each applicant and their spouse must be a U.S. citizen or a lawful permanent resident alien to

be eligible for MHDC financing. In addition, the subject property must be the borrower’s

principal residence and located within the state of Missouri. The borrower and their spouse

must also have their own valid Social Security number.

MHDC will also provide financing to non-permanent resident aliens, provided:

1.

Borrower occupies the property as the principal residence, and

2.

Borrower has a valid Social Security number, and

3.

Borrower is eligible to work in the United States.

4

-

1

3B

Section 4 - Residence Eligibility Requirements

To qualify for the First Place Program, the residence to be purchased must meet the following

definitions:

Location/Program Area

– The property must be located within the state of Missouri.

Occupancy Requirements

- The borrower must occupy the property within 60 days of

closing. The property must be their full time principle residence.

Residence Type

– any existing or new real property and improvements thereon

including:

1.

A single-family detached building

2.

Manufactured house (see definition below)

2.

Row House

3.

Townhouse

4.

One-half Duplex

5.

Two-Unit Duplex*

6.

Condominium

Duplexes and Income -

Effective 2004 both sides of an existing duplex or, both floors of a pair of flats may be

purchased using the First Place Program as long as the unit is five years or older.

Rental income is not included in household income for the purposes of First Place Loan

Program qualification. Two-Family underwriting guidelines must be followed at all

times. The borrower must occupy one side of the unit.