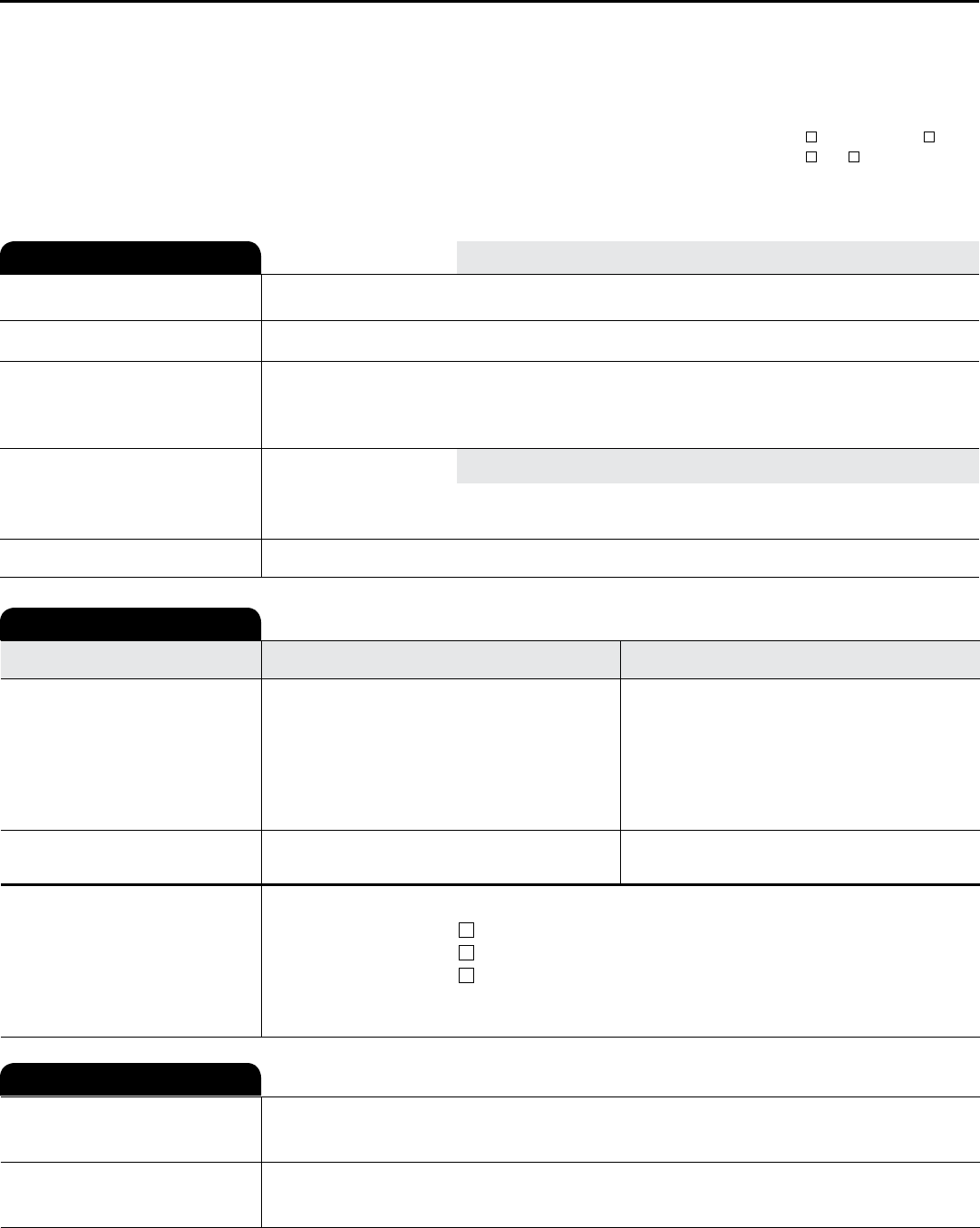

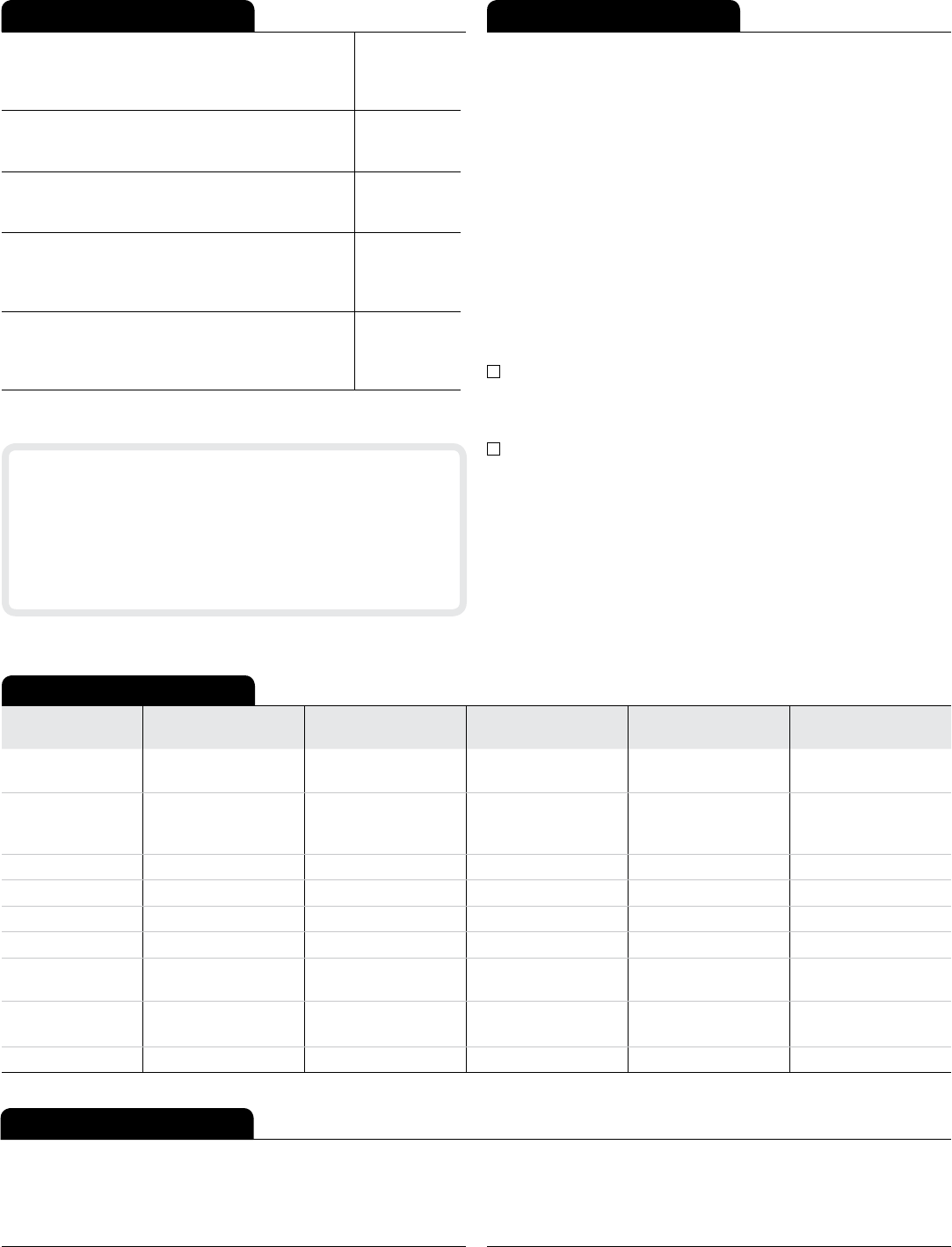

Projected Payments

Loan Terms

Can this amount increase after closing?

Loan Amount

$162,000

NO

Interest Rate 3.875%

NO

Monthly Principal & Interest

See Projected Payments below for your

Estimated Total Monthly Payment

$761.78

NO

Does the loan have these features?

Prepayment Penalty

YES

• As high as $3,240 if you pay o the loan during the

rst 2 years

Balloon Payment

NO

Costs at Closing

CLOSING DISCLOSURE PAGE 1 OF 5 • LOAN ID # 123456789

Payment Calculation Years 1-7 Years 8-30

Principal & Interest

Mortgage Insurance

Estimated Escrow

Amount can increase over time

$761.78

+ 82.35

+ 206.13

$761.78

+ —

+ 206.13

Estimated Total

Monthly Payment

$1,050.26 $967.91

Estimated Taxes, Insurance

& Assessments

Amount can increase over time

See page 4 for details

$356.13

a month

See Escrow Account on page 4 for details. You must pay for other property

costs separately.

This estimate includes In escrow?

x

Property Taxes

YES

x

Homeowner’s Insurance

YES

x

Other: Homeowner’s Association Dues

NO

Closing Costs $9,712.10 Includes $4,694.05 in Loan Costs + $5,018.05 in Other Costs – $0

in Lender Credits. See page 2 for details.

Cash to Close $14,147.26 Includes Closing Costs. See Calculating Cash to Close on page 3 for details.

Transaction Information

Borrower Michael Jones and Mary Stone

123 Anywhere Street

Anytown, ST 12345

Seller Steve Cole and Amy Doe

321 Somewhere Drive

Anytown, ST 12345

Lender Ficus Bank

Loan Information

Loan Term 30 years

Purpose Purchase

Product Fixed Rate

Loan Type

x

Conventional FHA

VA _____________

Loan ID # 123456789

MIC # 000654321

Closing Information

Date Issued 4/15/2013

Closing Date 4/15/2013

Disbursement Date 4/15/2013

Settlement Agent Epsilon Title Co.

File # 12-3456

Property 456 Somewhere Ave

Anytown, ST 12345

Sale Price $180,000

This form is a statement of nal loan terms and closing costs. Compare this

document with your Loan Estimate.

Closing Disclosure

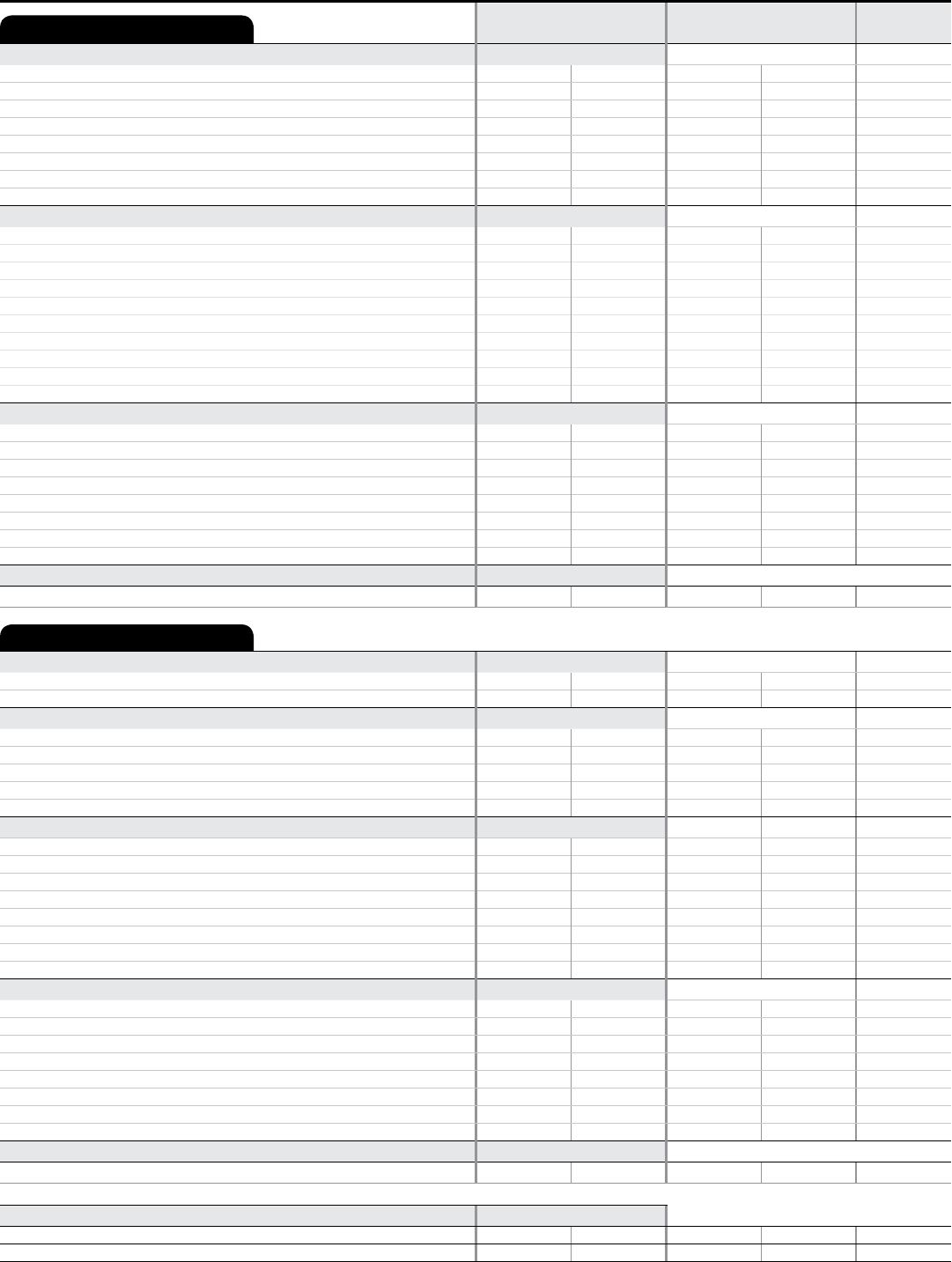

Borrower-Paid Seller-Paid

Paid by

Others

At Closing Before Closing At Closing Before Closing

A. Origination Charges $1,802.00

01 0.25 % of Loan Amount (Points) $405.00

02 Application Fee $300.00

03 Underwriting Fee $1,097.00

04

05

06

07

08

B. Services Borrower Did Not Shop For $236.55

01 Appraisal Fee to John Smith Appraisers Inc. $405.00

02 Credit Report Fee to Information Inc.

$29.80

03 Flood Determination Fee to Info Co. $20.00

04 Flood Monitoring Fee to Info Co. $31.75

05 Tax Monitoring Fee to Info Co. $75.00

06 Tax Status Research Fee to Info Co. $80.00

07

08

09

10

C. Services Borrower Did Shop For $2,655.50

01 Pest Inspection Fee to Pests Co. $120.50

02 Survey Fee to Surveys Co. $85.00

03 Title – Insurance Binder to Epsilon Title Co. $650.00

04 Title – Lender’s Title Insurance to Epsilon Title Co. $500.00

05 Title – Settlement Agent Fee to Epsilon Title Co. $500.00

06 Title – Title Search to Epsilon Title Co. $800.00

07

08

D. TOTAL LOAN COSTS Borrower-Paid $4,694.05

Loan Costs Subtotals (A + B + C) $4,664.25 $29.80

Loan Costs

CLOSING DISCLOSURE PAGE 2 OF 5 • LOAN ID # 123456789

J. TOTAL CLOSING COSTS Borrower-Paid $9,712.10

Closing Costs Subtotals D + I $9,682.30 $29.80 $12,800.00 $750.00 $405.00

Lender Credits

Closing Cost Details

Other Costs

E. Taxes and Other Government Fees $85.00

01 Recording Fees Deed: $40.00 Mortgage: $45.00

$85.00

02 Transfer Tax to Any State $950.00

F. Prepaids $2,120.80

01 Homeowner’s Insurance Premium ( 12 mo.) to Insurance Co.

$1,209.96

02 Mortgage Insurance Premium ( mo.)

03 Prepaid Interest ( $17.44 per day from 4/15/13 to 5/1/13 )

$279.04

04 Property Taxes ( 6 mo.) to Any County USA

$631.80

05

G. Initial Escrow Payment at Closing $412.25

01 Homeowner’s Insurance $100.83 per month for 2 mo. $201.66

02 Mortgage Insurance per month for mo.

03 Property Taxes $105.30 per month for 2 mo. $210.60

04

05

06

07

08 Aggregate Adjustment – 0.01

H. Other $2,400.00

01 HOA Capital Contribution to HOA Acre Inc. $500.00

02 HOA Processing Fee to HOA Acre Inc. $150.00

03 Home Inspection Fee to Engineers Inc. $750.00 $750.00

04 Home Warranty Fee to XYZ Warranty Inc. $450.00

05 Real Estate Commission to Alpha Real Estate Broker $5,700.00

06 Real Estate Commission to Omega Real Estate Broker $5,700.00

07 Title – Owner’s Title Insurance (optional) to Epsilon Title Co. $1,000.00

08

I. TOTAL OTHER COSTS Borrower-Paid $5,018.05

Other Costs Subtotals (E + F + G + H) $5,018.05

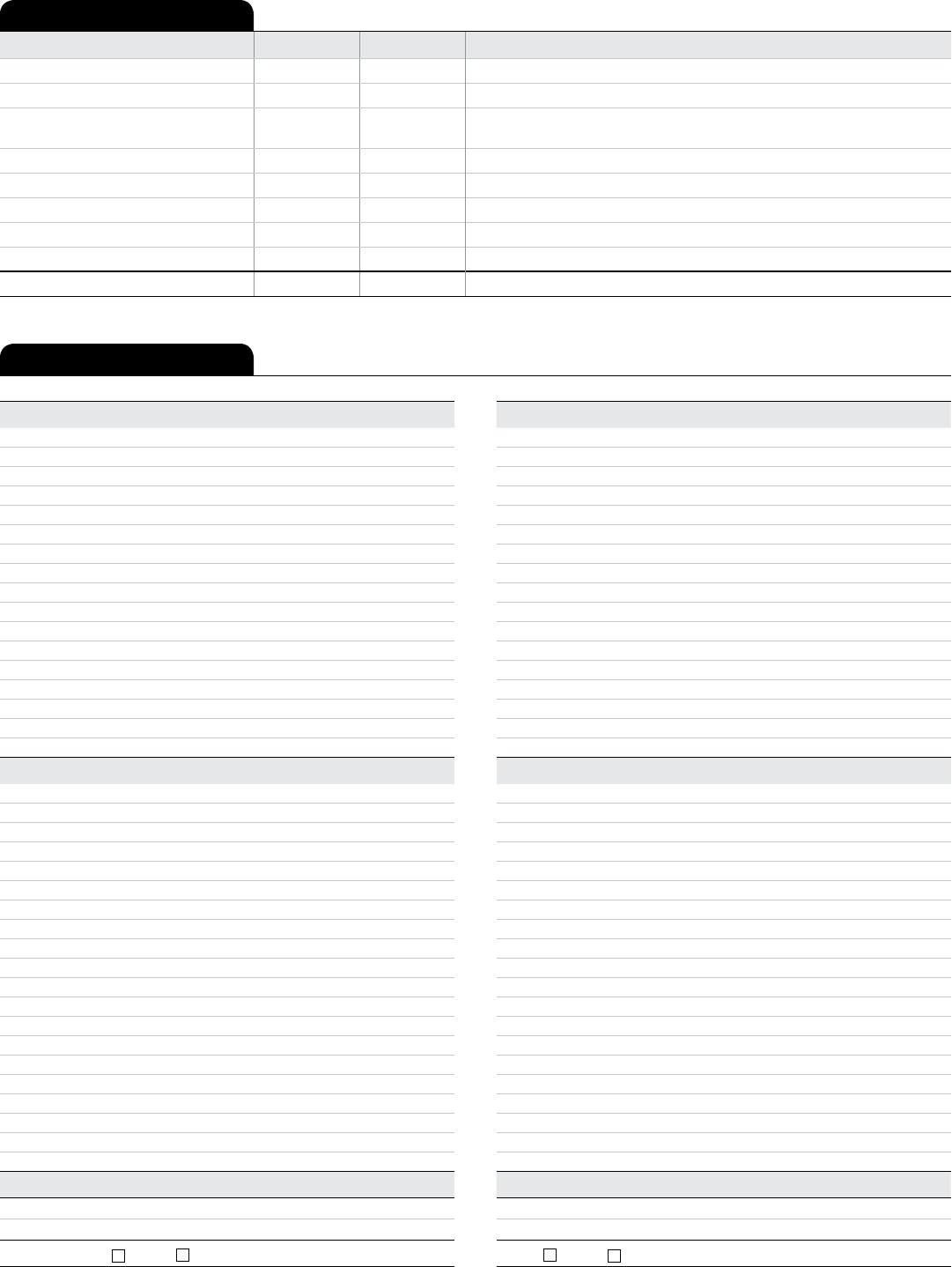

Calculating Cash to Close

BORROWER’S TRANSACTION

K. Due from Borrower at Closing $189,762.30

01 Sale Price of Property $180,000.00

02 Sale Price of Any Personal Property Included in Sale

03 Closing Costs Paid at Closing (J) $9,682.30

04

Adjustments

05

06

07

Adjustments for Items Paid by Seller in Advance

08 City/Town Taxes to

09 County Taxes to

10 Assessments to

11 HOA Dues 4/15/13 to 4/30/13 $80.00

12

13

14

15

L. Paid Already by or on Behalf of Borrower at Closing $175,615.04

01 Deposit $10,000.00

02 Loan Amount $162,000.00

03 Existing Loan(s) Assumed or Taken Subject to

04

05 Seller Credit $2,500.00

Other Credits

06 Rebate from Epsilon Title Co. $750.00

07

Adjustments

08

09

10

11

Adjustments for Items Unpaid by Seller

12 City/Town Taxes 1/1/13 to 4/14/13 $365.04

13 County Taxes to

14 Assessments to

15

16

17

CALCULATION

Total Due from Borrower at Closing (K) $189,762.30

Total Paid Already by or on Behalf of Borrower at Closing (L) – $175,615.04

Cash to Close

x

From

To Borrower $14,147.26

SELLER’S TRANSACTION

M. Due to Seller at Closing $180,080.00

01 Sale Price of Property $180,000.00

02 Sale Price of Any Personal Property Included in Sale

03

04

05

06

07

08

Adjustments for Items Paid by Seller in Advance

09 City/Town Taxes to

10 County Taxes to

11 Assessments to

12 HOA Dues 4/15/13 to 4/30/13 $80.00

13

14

15

16

N. Due from Seller at Closing $115,665.04

01 Excess Deposit

02 Closing Costs Paid at Closing (J) $12,800.00

03 Existing Loan(s) Assumed or Taken Subject to

04 Payo of First Mortgage Loan $100,000.00

05 Payo of Second Mortgage Loan

06

07

08 Seller Credit $2,500.00

09

10

11

12

13

Adjustments for Items Unpaid by Seller

14 City/Town Taxes 1/1/13 to 4/14/13 $365.04

15 County Taxes to

16 Assessments to

17

18

19

CALCULATION

Total Due to Seller at Closing (M) $180,080.00

Total Due from Seller at Closing (N) – $115,665.04

Cash From

x

To Seller $64,414.96

Summaries of Transactions

CLOSING DISCLOSURE PAGE 3 OF 5 • LOAN ID # 123456789

Loan Estimate Final Did this change?

Total Closing Costs (J) $8,054.00 $9,712.10 YES • See Total Loan Costs (D) and Total Other Costs (I)

Closing Costs Paid Before Closing $0 $29.80 YES • You paid these Closing Costs before closing

Closing Costs Financed

(Paid from your Loan Amount) $0 $0 NO

Down Payment/Funds from Borrower $18,000.00 $18,000.00 NO

Deposit – $10,000.00 – $10,000.00 NO

Funds for Borrower $0 $0 NO

Seller Credits $0 $2,500.00 YES • See Seller Credits in Section L

Adjustments and Other Credits $0 $1,035.04 YES • See details in Sections K and L

Cash to Close $16,054.00 $14,147.26

Use this table to see a summary of your transaction.

Use this table to see what has changed from your Loan Estimate.

Assumption

If you sell or transfer this property to another person, your lender

will allow, under certain conditions, this person to assume this

loan on the original terms.

will not allow assumption of this loan on the original terms.

Demand Feature

Your loan

has a demand feature, which permits your lender to require early

repayment of the loan. You should review your note for details.

does not have a demand feature.

Late Payment

If your payment is more than 15 days late, your lender will charge a

late fee of 5% of the monthly principal and interest payment.

Negative Amortization (Increase in Loan Amount)

Under your loan terms, you

are scheduled to make monthly payments that do not pay all of

the interest due that month. As a result, your loan amount will

increase (negatively amortize), and your loan amount will likely

become larger than your original loan amount. Increases in your

loan amount lower the equity you have in this property.

may have monthly payments that do not pay all of the interest

due that month. If you do, your loan amount will increase

(negatively amortize), and, as a result, your loan amount may

become larger than your original loan amount. Increases in your

loan amount lower the equity you have in this property.

do not have a negative amortization feature.

Partial Payments

Your lender

may accept payments that are less than the full amount due

(partial payments) and apply them to your loan.

may hold them in a separate account until you pay the rest of the

payment, and then apply the full payment to your loan.

does not accept any partial payments.

If this loan is sold, your new lender may have a dierent policy.

Security Interest

You are granting a security interest in

456 Somewhere Ave., Anytown, ST 12345

You may lose this property if you do not make your payments or

satisfy other obligations for this loan.

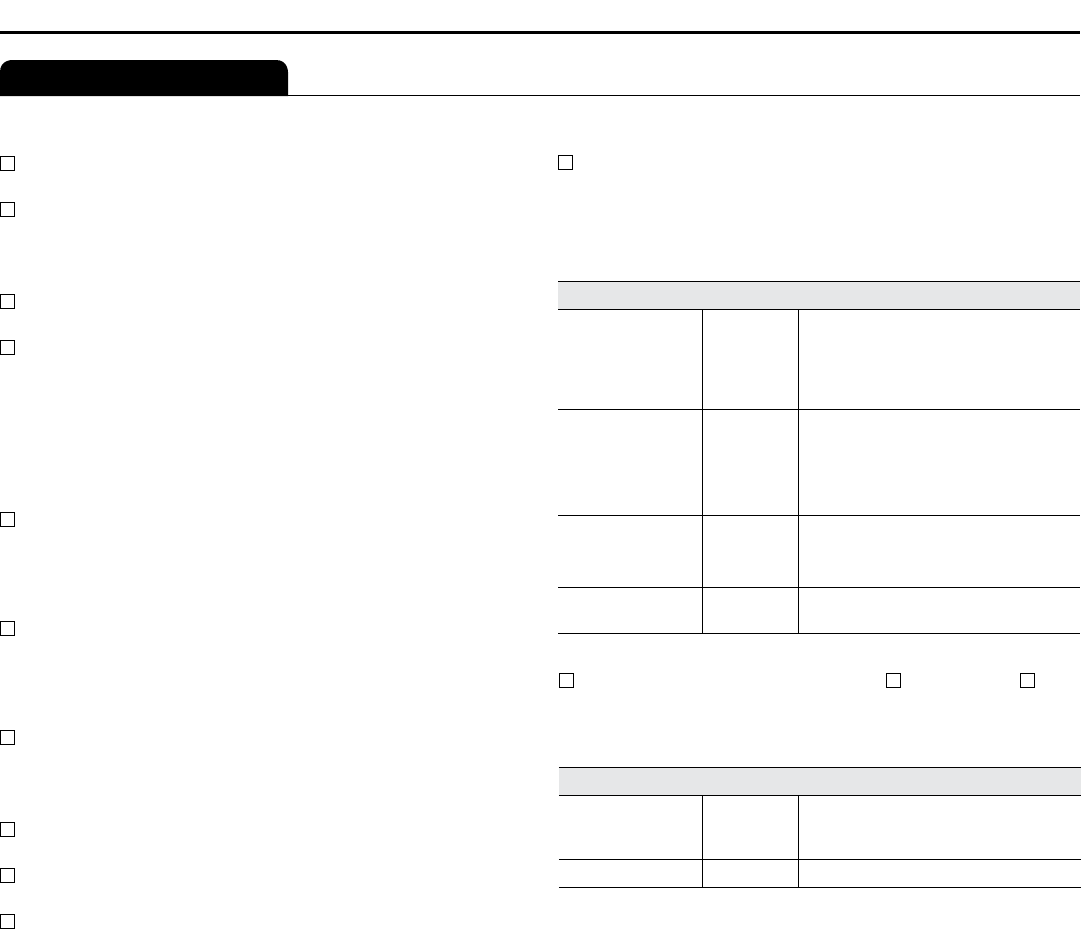

CLOSING DISCLOSURE PAGE 4 OF 5 • LOAN ID # 1234567890

Loan Disclosures

Escrow Account

For now, your loan

will have an escrow account (also called an “impound” or “trust”

account) to pay the property costs listed below. Without an escrow

account, you would pay them directly, possibly in one or two large

payments a year. Your lender may be liable for penalties and interest

for failing to make a payment.

Escrow

Escrowed

Property Costs

over Year 1

$2,473.56 Estimated total amount over year 1 for

your escrowed property costs:

Homeowner’s Insurance

Property Taxes

Non-Escrowed

Property Costs

over Year 1

$1,800.00 Estimated total amount over year 1 for

your non-escrowed property costs:

Homeowner’s Association Dues

You may have other property costs.

Initial Escrow

Payment

$412.25 A cushion for the escrow account you

pay at closing. See Section G on page 2.

Monthly Escrow

Payment

$206.13 The amount included in your total

monthly payment.

No Escrow

Estimated

Property Costs

over Year 1

Estimated total amount over year 1. You

must pay these costs directly, possibly

in one or two large payments a year.

Escrow Waiver Fee

will not have an escrow account because you declined it your

lender does not oer one. You must directly pay your property

costs, such as taxes and homeowner’s insurance. Contact your

lender to ask if your loan can have an escrow account.

In the future,

Your property costs may change and, as a result, your escrow pay-

ment may change. You may be able to cancel your escrow account,

but if you do, you must pay your property costs directly. If you fail

to pay your property taxes, your state or local government may (1)

impose nes and penalties or (2) place a tax lien on this property. If

you fail to pay any of your property costs, your lender may (1) add

the amounts to your loan balance, (2) add an escrow account to your

loan, or (3) require you to pay for property insurance that the lender

buys on your behalf, which likely would cost more and provide fewer

benets than what you could buy on your own.

Additional Information About This Loan

x

x

x

x

x

Contact Information

Conrm Receipt

Other Disclosures

Appraisal

If the property was appraised for your loan, your lender is required to

give you a copy at no additional cost at least 3 days before closing.

If you have not yet received it, please contact your lender at the

information listed below.

Contract Details

See your note and security instrument for information about

• what happens if you fail to make your payments,

• what is a default on the loan,

• situations in which your lender can require early repayment of the

loan, and

• the rules for making payments before they are due.

Liability after Foreclosure

If your lender forecloses on this property and the foreclosure does not

cover the amount of unpaid balance on this loan,

state law may protect you from liability for the unpaid balance. If you

renance or take on any additional debt on this property, you may

lose this protection and have to pay any debt remaining even after

foreclosure. You may want to consult a lawyer for more information.

state law does not protect you from liability for the unpaid balance.

Renance

Renancing this loan will depend on your future nancial situation,

the property value, and market conditions. You may not be able to

renance this loan.

Tax Deductions

If you borrow more than this property is worth, the interest on the

loan amount above this property’s fair market value is not deductible

from your federal income taxes. You should consult a tax advisor for

more information.

By signing, you are only conrming that you have received this form. You do not have to accept this loan because you have signed or received

this form.

Applicant Signature Date Co-Applicant Signature Date

CLOSING DISCLOSURE PAGE 5 OF 5 • LOAN ID # 123456789

Total of Payments. Total you will have paid after

you make all payments of principal, interest,

mortgage insurance, and loan costs, as scheduled.

$285,803.36

Finance Charge. The dollar amount the loan will

cost you.

$118,830.27

Amount Financed. The loan amount available after

paying your upfront nance charge.

$162,000.00

Annual Percentage Rate (APR). Your costs over

the loan term expressed as a rate. This is not your

interest rate.

4.174%

Total Interest Percentage (TIP). The total amount

of interest that you will pay over the loan term as a

percentage of your loan amount.

69.46%

Loan Calculations

x

Lender Mortgage Broker Real Estate Broker

(B)

Real Estate Broker

(S)

Settlement Agent

Name Ficus Bank

FRIENDLY MORTGAGE

BROKER INC.

Omega Real Estate

Broker Inc.

Alpha Real Estate

Broker Co.

Epsilon Title Co.

Address 4321 Random Blvd.

Somecity, ST 12340

1234 Terrapin Dr.

Somecity, MD 54321

789 Local Lane

Sometown, ST 12345

45

987 Suburb Ct.

Someplace, ST 12340

123 Commerce Pl.

Somecity, ST 12344

NMLS ID

222222

ST License ID Z765416 Z61456 Z61616

Contact Joe Smith

JIM TAYLOR

Samuel Green Joseph Cain Sarah Arnold

Contact NMLS ID 12345

394784

Contact

ST License ID

P16415 P51461 PT1234

Email joesmith@

cusbank.com

JTAYLOR

FRNDLYMTGBRKR.CM

epsilontitle.com

Phone 123-456-7890

3334445555

123-555-1717 321-555-7171 987-555-4321

Questions? If you have questions about the

loan terms or costs on this form, use the contact

information below. To get more information

or make a complaint, contact the Consumer

Financial Protection Bureau at

www.consumernance.gov/mortgage-closing

?