RETALIATION GUIDE

December 2023

Enclosed is the 2023 update to the Retaliation Guide, incorporating the changes that have occurred in

state laws during the past year, as reported by each state. All the pages in your book should be

replaced. An arrow in the left margin indicates a change.

In February 2024, the NAIC plans to release an updated second volume of the Retaliation Guide to help

you identify the state tax forms used for collecting premium and retaliatory taxes.

If you have questions about the content, you should request clarification from the state contacts listed. If

you have questions about the printing or distribution of copies, please contact an NAIC Customer Service

Representative at (816) 783-8300 or pr[email protected].

Olivea A. Myers

Editor

Legal Counsel

Patricia E. Cook

Assistant Editor

Senior Paralegal

T

he Retaliation Guide is intended to provide helpful information about retaliatory and other taxes and assessments. The Guide is not intended to be cited as

binding legal authority and does not constitute a formal legal opinion by the NAIC staff on the provisions of state law and should not be relied upon as such.

Every effort has been made to provide correct and accurate summaries to assist the reader in targeting useful information. For further details, including any

additional adoptions, the statutes and regulations cited should be consulted.

Retaliation: A Guide to State

Retaliatory Taxes, Fees, Deposits

and Other Requirements

Volume I

December 2023

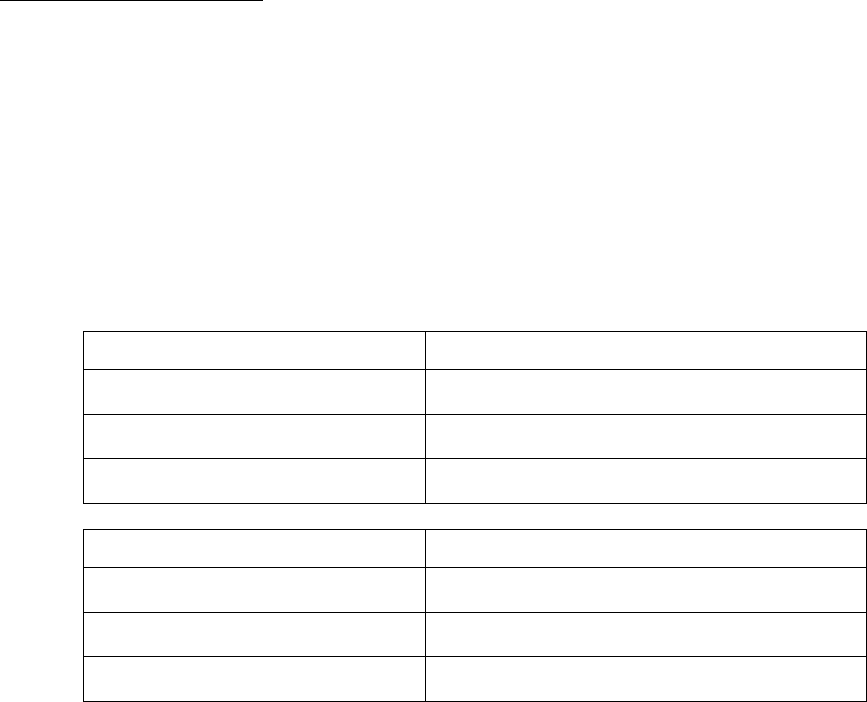

Accounng & Reporng

Informaon about statutory accounng principles and the

procedures necessary for ling nancial annual statements

and conducng risk-based capital calculaons.

Consumer Informaon

Important answers to common quesons about auto, home,

health and life insurance — as well as buyer’s guides on annu-

ies, long-term care insurance and

Medicare supplement plans.

Financial Regulaon

Useful handbooks, compliance guides and reports on nancial

analysis, company licensing, state audit

requirements and receiverships.

Legal

Comprehensive collecon of NAIC model laws, regulaons

and guidelines; state laws on insurance topics; and other reg-

ulatory guidance on taxation and consumer privacy.

Market Regulaon

Regulatory and industry guidance on market-related issues,

including anfraud, product ling requirements, producer

licensing and market analysis.

NAIC Acvies

NAIC member directories, in-depth reporng of state

regulatory acvies and ocial historical records of NAIC na-

onal meengs and other acvies.

Special Studies

Studies, reports, handbooks and regulatory research

conducted by NAIC members on a variety of insurance-

related topics.

Stascal Reports

Valuable and in-demand insurance industry-wide stascal

data for various lines of business, including auto, home,

health and life insurance.

Supplementary Products

Guidance manuals, handbooks, surveys and research

on a wide variety of issues.

Capital Markets & Investment Analysis

Informaon regarding porolio values and procedures for

complying with NAIC reporng requirements.

White Papers

Relevant studies, guidance and NAIC policy posions on

a variety of insurance topics.

© 1999-2023 National Association of Insurance Commissioners. All rights reserved.

ISBN: 978-1-64179-365-0

Printed in the United States of America

No part of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any means,

electronic or mechanical, including photocopying, recording, or any storage or retrieval system, without written permission

from the NAIC.

NAIC Execuve Oce

444 North Capitol Street, NW

Suite 700

Washington, DC 20001

202.471.3990

NAIC Central Oce

1100 Walnut Street

Suite 1500

Kansas City, MO 64106

816.842.3600

NAIC Capital Markets

& Investment Analysis Oce

One New York Plaza, Suite 4210

New York, NY 10004

212.398.9000

The NAIC is the authoritave source for insurance industry informaon. Our expert soluons support the eorts of

regulators, insurers and researchers by providing detailed and comprehensive insurance informaon. The NAIC oers

a wide range of publicaons in the following categories:

For more information about NAIC

publications, visit us at: https://

content.naic.org/prod_serv_home.htm

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AL-1

ALABAMA

→ Arrow indicates an update for 2023

PREMIUM TAX

Premium Tax Base:

Ala. Code § 27-4A-2

All amounts received as consideration for insurance contracts less returned premiums,

reinsurance premiums from companies subject to premium tax, and dividends paid. Annuity

considerations are not included.

Tax Rate:

§ 27-4A-3

Life insurers 2.3%

Health and accident and health 1.6%

Individual life policies of $5,001 up to $25,000 will be taxed at 1%.

Individual life policies of $5,000 or less, will be taxed at 0.50%.

Hospital, medical, surgical, or other health benefits provided to groups with less than 50 insured

participants will be taxed at 0.50%.

Hospital, medical, surgical, or other health benefits supplementary to Medicare and Medicaid or

governmental employee plans are exempt from premium tax.

Premium tax on insurance other than life, health and accident and health at 3.6%.

All property and multi-peril insurance written in fire protection classes 9 & 10 at 1%.

Mobile homes, low value dwelling policies at 1%.

Medical liability insurance at 1.6%.

§ 27-31A-4

Risk retention groups 3.6%, same as foreign admitted insurer

Other Taxes and Assessments:

§§ 40-14a-21 to 40-14a-29 Privilege Tax

The tax rate is determined by the company’s total income allocated to Alabama. The amount of

tax is determined by multiplying the taxpayer’s net worth in Alabama by that rate.

Retaliation—December 2023

AL-2 © 1991-2023 National Association of Insurance Commissioners

Other Taxes and Assessments (cont.)

§§ 11-51-120 to 11-51-122 Municipal Corporations Tax

Municipal corporations may impose a privilege tax of up to 4% on each $100 of gross premiums,

less return premiums, on fire and marine policies on property in the municipality issued during

the previous year; actual amount based on size of municipality. There is no credit for the cost of

reinsurance in a company not authorized in Alabama. The tax on other than fire and marine

insurers varies by size of city or town. The tax is due Mar. 1.

§ 25-5-316 Workers’ Compensation Administration Trust Fund

The state has established a trust fund for administrative expenses. Insurers shall be assessed $250,

plus a proportional amount based on total compensation and medical payments made, to provide

a total assessment of $5,000,000 per year. Insurers and self-insured plans must file a report by

Mar. 1 showing claims for prior year.

§§ 27-42-8; 27-42-8.1 Property and Casualty Guaranty Association

The property and casualty guaranty association may assess an amount up to 1% of net direct

premiums for the year preceding the insolvency on the kinds of insurance in the account with the

deficiency. Effective May 19, 2008, an assessment of up to 2% of net direct premiums for the

year preceding the insolvency for the workers’ compensation account only.

§ 27-44-9 Life and Health Guaranty Association

The life and health guaranty association may assess an amount up to 1% of net direct premiums

on the kinds of insurance in the account with the deficiency plus no more than $300 per year as a

non-pro rata assessment for administrative expenses.

§ 27-31B-16 Captive Insurers

Direct written premiums:

0.4% on first $20 million of direct premiums;

0.3% on next $20 million;

0.2% on next $20 million;

0.075% on each dollar thereafter.

Reinsurance:

0.225% on first $20 million of assumed reinsurance premiums;

0.150% on next $20 million;

0.050% on next $20 million;

0.025% on each dollar thereafter.

No reinsurance tax applies to premiums for risks or portions of risks which are subject to taxation

on a direct basis.

(cont.)

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AL-3

Other Taxes and Assessments (cont.)

§ 27-31B-16 Captive Insurers (cont.)

Captive insurers pay annual minimum tax of $5,000 if the aggregate taxes to be paid by a captive

insurance company calculated under subsections (a) and (b) of §27-31B-16 amount to less than

$5,000 in any year.

Effective July 1, 2016, any business privilege taxes paid, or any examination expenses paid may

be deducted in the calendar year in which they are paid. Aggregate taxes paid by a captive is

capped as $100,000 in any one year.

If a captive insurance company has been licensed for less than a full calendar year and has written

premiums the tax for which is less than the minimum set forth in this section, the tax due shall be

prorated as follows:

(1) If licensed on or before Mar. 31, 100%.

(2) If licensed April 1 to June 30, 75%.

(3) If licensed July 1 to Sept. 30, 50%.

(4) If licensed Oct. 1 to Dec. 31, 25%.

If a captive insurance company surrenders its license and the calculated tax on premiums written

during the calendar year is less than the minimum set forth in this section, the tax due shall be

prorated as follows:

(1) If surrendered on or before Mar. 31, 25%.

(2) If surrendered April 1 to June 30, 50%.

(3) If surrendered July 1 to Sept. 30, 75%.

(4) If surrendered Oct. 1 to Dec. 31, 100%.

The $5,000 minimum is not applicable if the captive has not written any premiums during the

calendar year.

Exclusions and Deductions:

§ 27-34-42 Fraternals

Fraternal benefit societies are exempt from the premium tax.

§ 27-4-8 Life Insurers to Nonprofit Organizations

Life insurers organized and operated without profit for the purpose of providing life insurance

and annuities to nonprofit education and scientific institutions and their employees are exempt

from premium tax. They shall pay an annual license fee of $5,000.

Retaliation—December 2023

AL-4 © 1991-2023 National Association of Insurance Commissioners

Credits:

§ 27-4A-3

The following may be deducted in full:

Ad valorem taxes paid by the insurer upon any real estate and the improvements therein in

Alabama owned and at least 50% occupied by the insurer all year or occupied in whole or part as

its principal office all year.

All licenses and fees paid to any county in Alabama for the privilege of engaging in the business

of insurance.

Ad valorem taxes paid directly or in the form of rent to a third-party landlord on the insurer’s

offices in Alabama, apportioned by the square footage occupied by the insurer.

60% of the privilege tax is deductible.

All expenses of examination of the insurer by the commissioner.

All credits for assessments as provided under §§ 27-42-16 and 27-44-13, or assessments for any

insurance guaranty fund or pool now or hereafter created by statute paid during the calendar year.

§ 40-14B-16 Certified Capital Company (CAPCO)

Insurance companies that have invested in certified capital companies and have been allocated a

premium tax credit by the Alabama Development Office may take up to 12.5% of the vested

premium tax credit each tax year beginning on or after Jan. 1, 2006. Any unused credits may be

carried forward indefinitely until the premium tax credits are used.

§ 40-14B-22 Certified Capital Company (CAPCO II)

Insurance companies that have invested in CAPCO II and have been allocated a premium tax

credit by the Alabama Development Office may take up to 5% of the vested premium tax credit

each tax year beginning Jan. 1, 2011. Beginning Jan. 1, 2014, the insurer may take up to 17.5% of

the credit. Any unused credit may be carried forward indefinitely until the credits are used.

§ 40-18-376 Investment Credit

The incentivized company is allowed an investment credit in an annual amount equal to 1.5

percent of the capital investment incurred as of the beginning of the incentive period to offset the

insurance premium tax levied by Section 27-4A-3(a), or as an estimated payment of insurance

premium tax.

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AL-5

Credits (cont.)

§ 27-4A-3

Insurance Offices Facilities Credit:

For each office owned or leased by an insurer in Alabama and used for insurance operations,

the insurer shall be entitled to tax credits of:

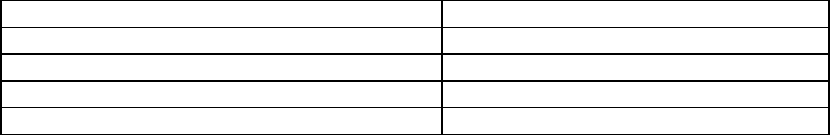

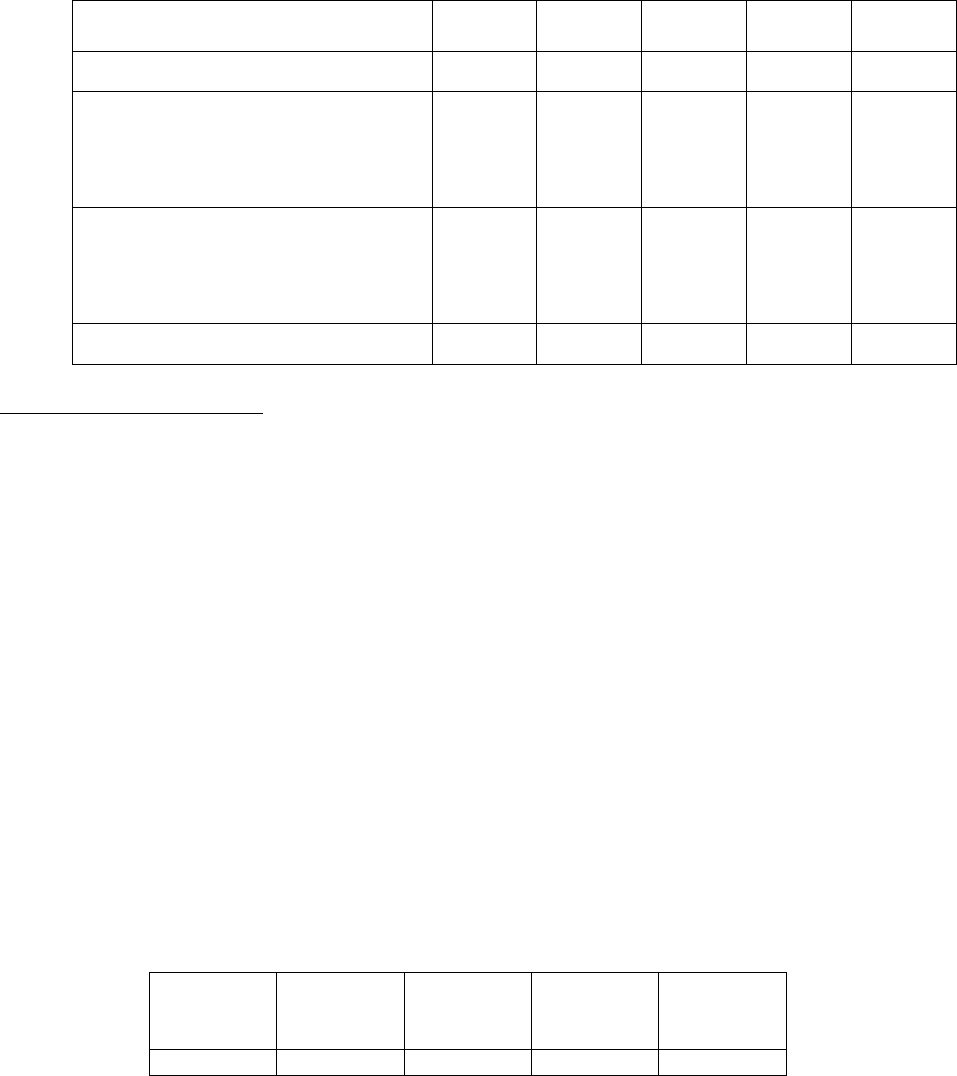

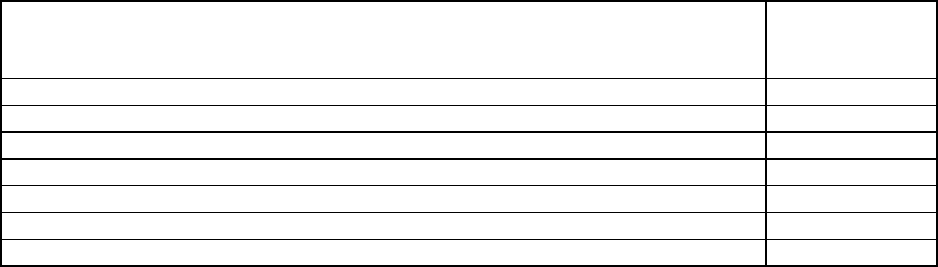

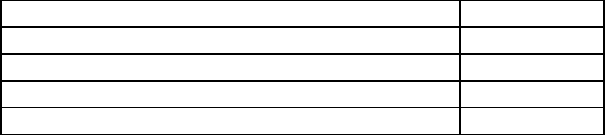

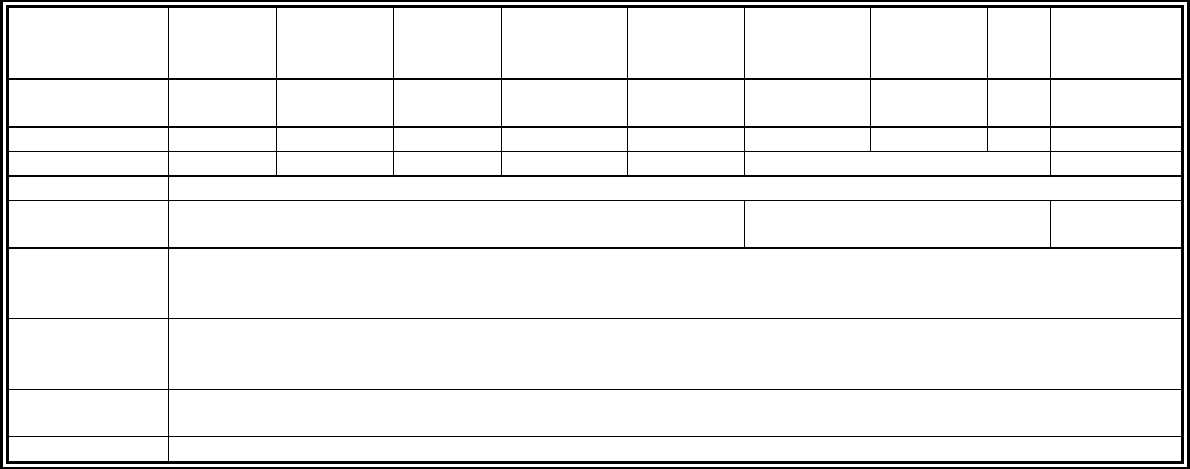

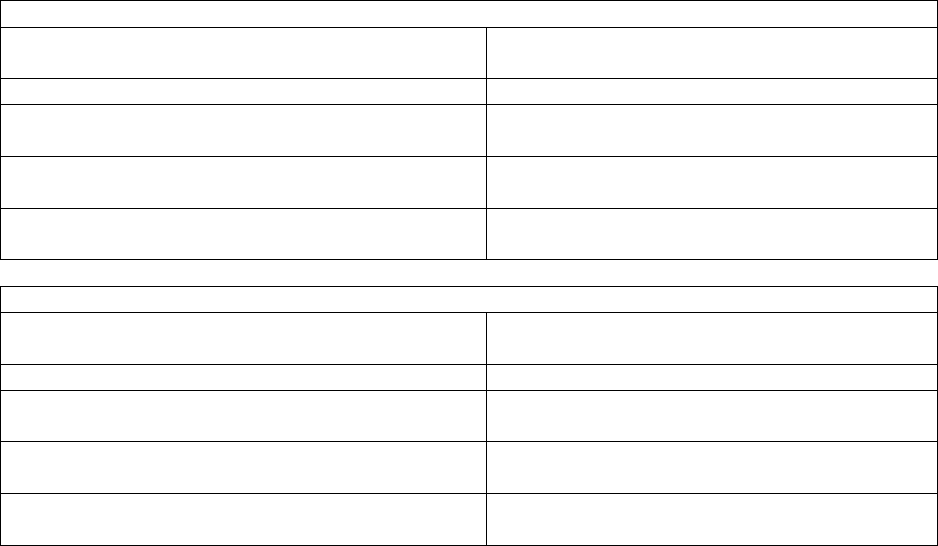

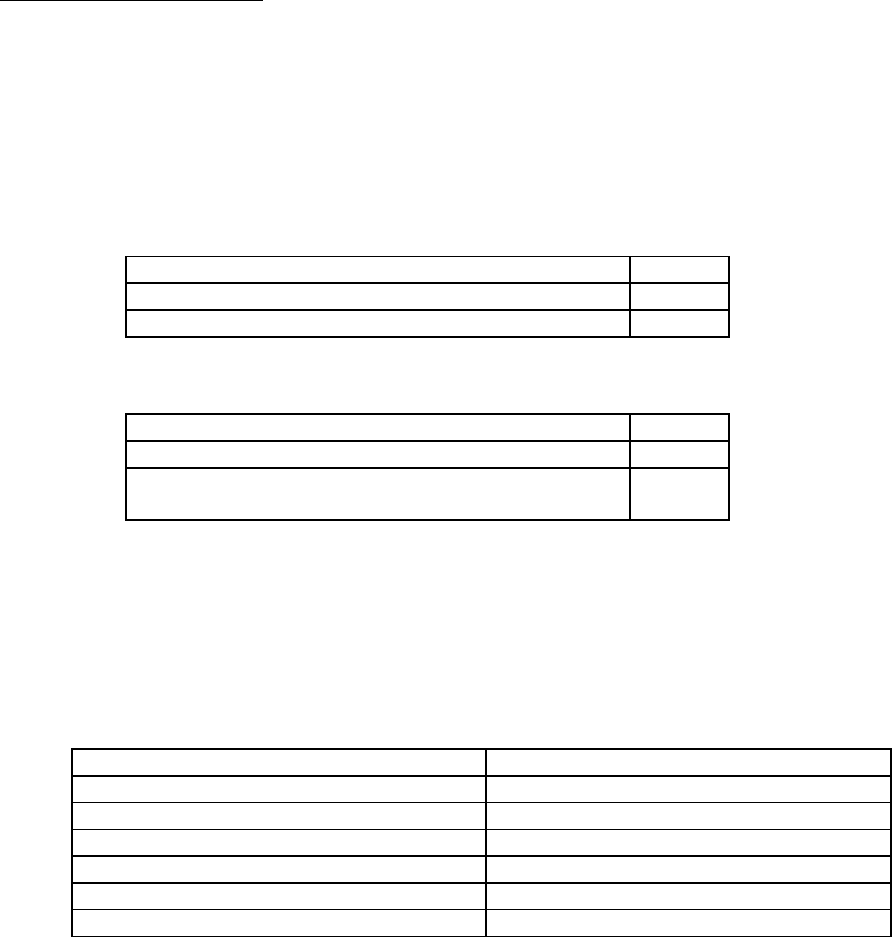

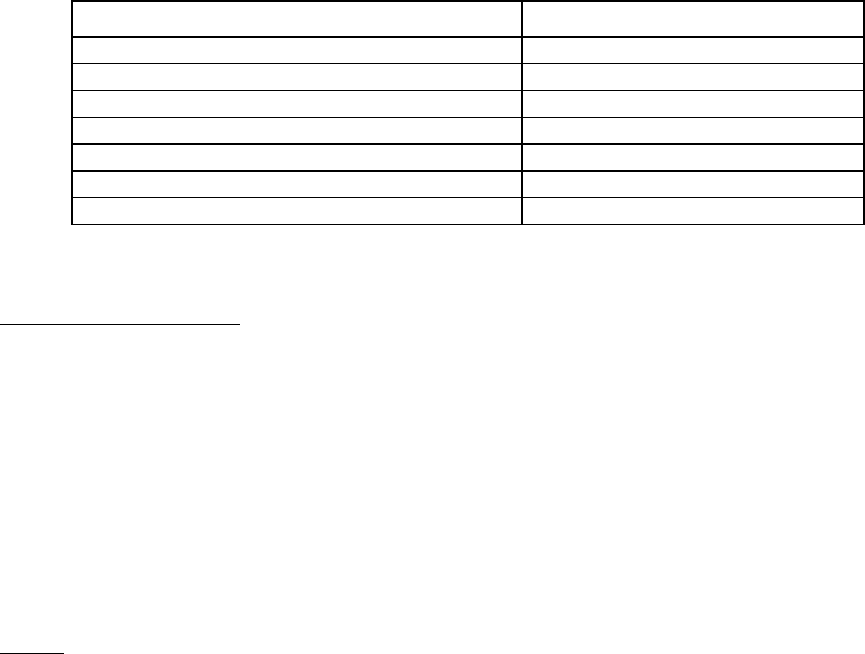

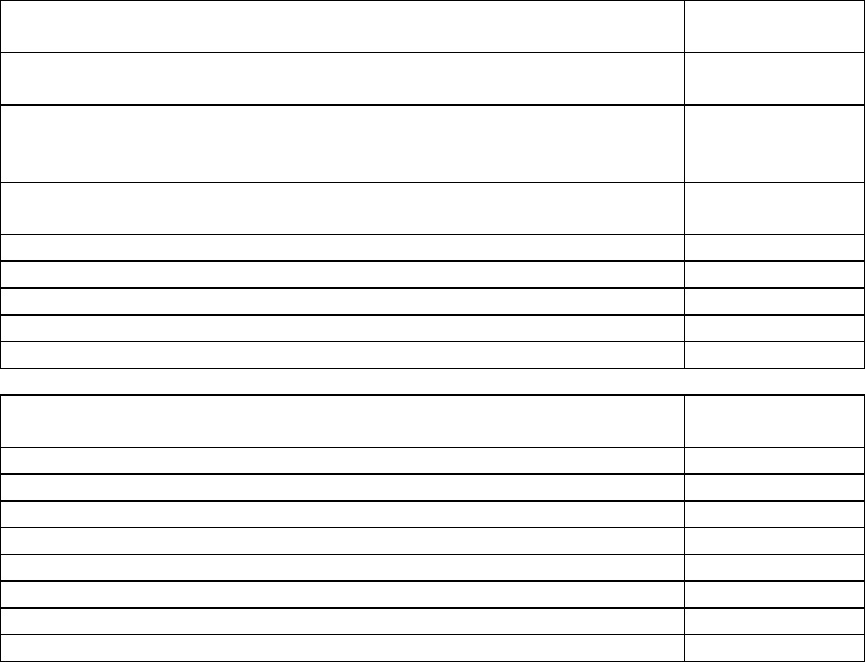

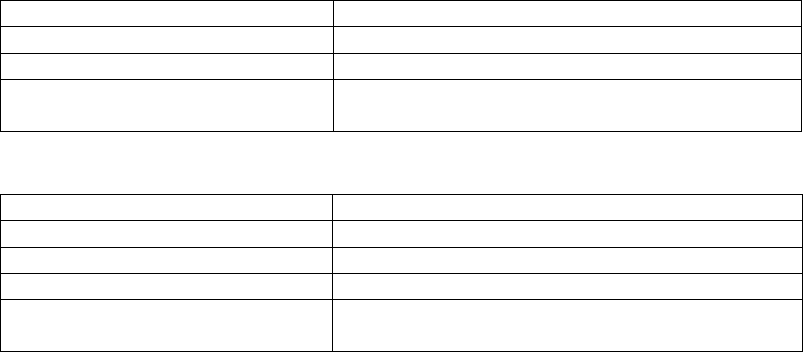

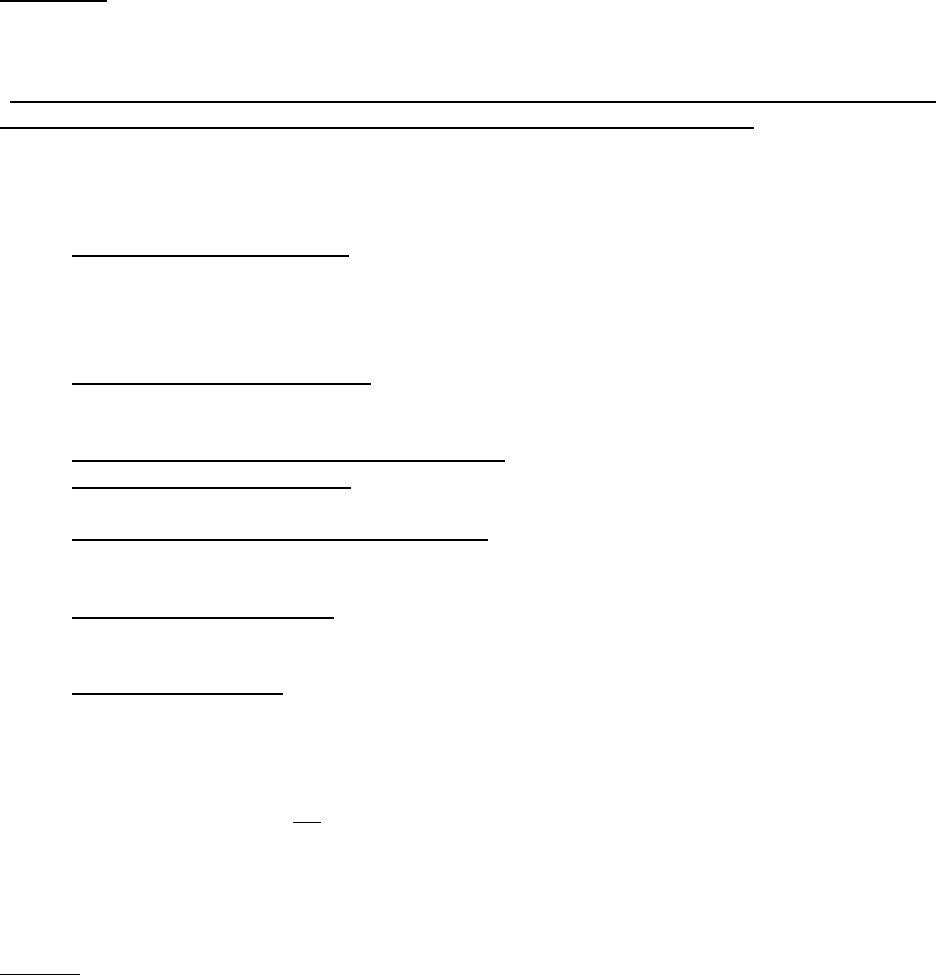

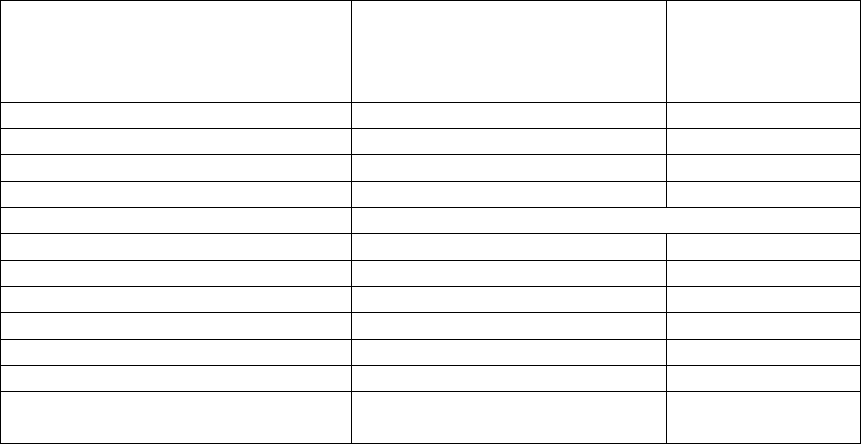

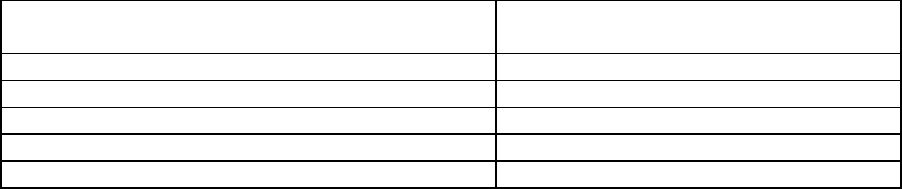

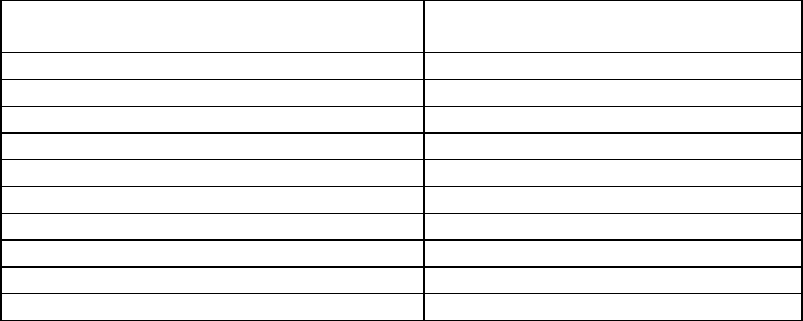

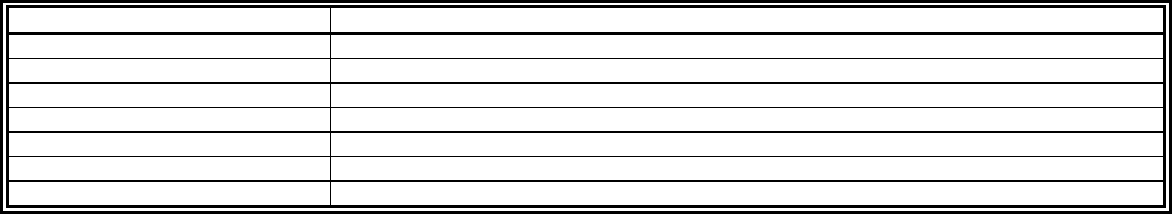

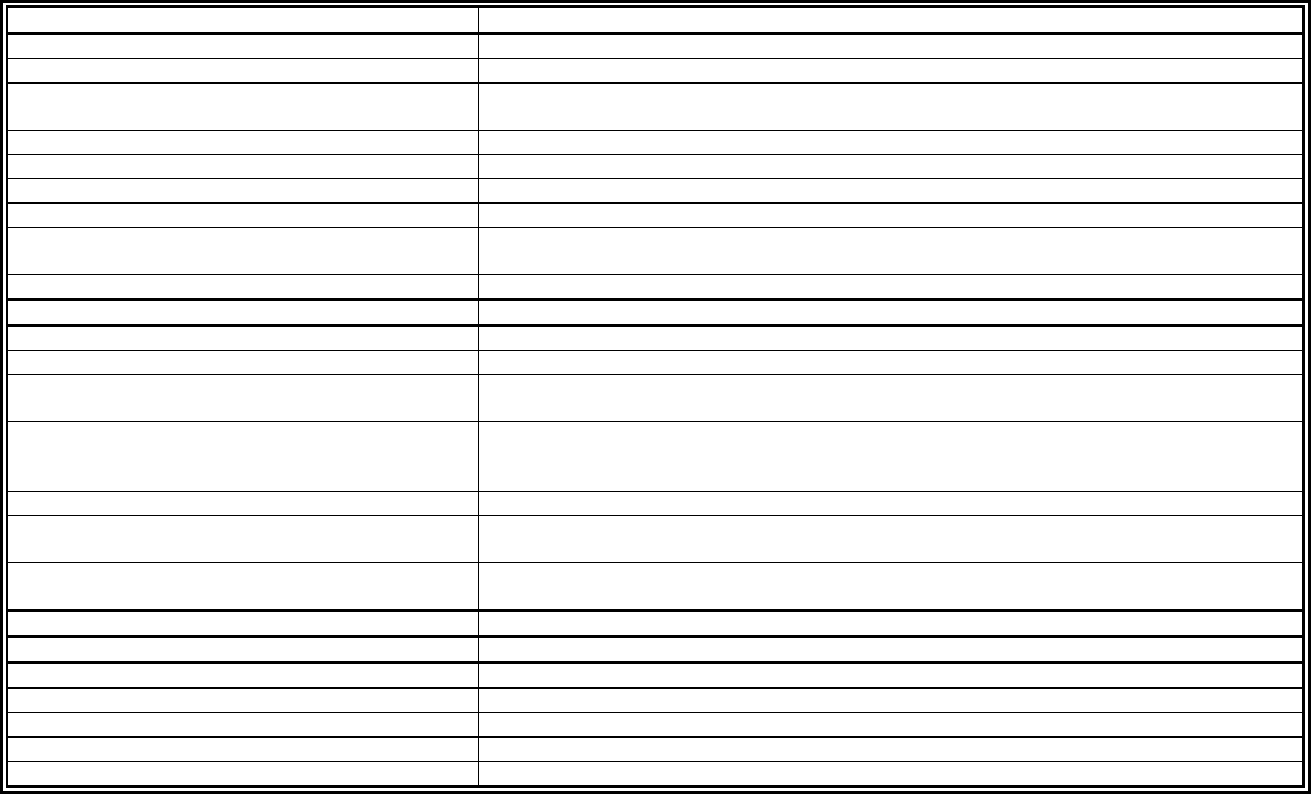

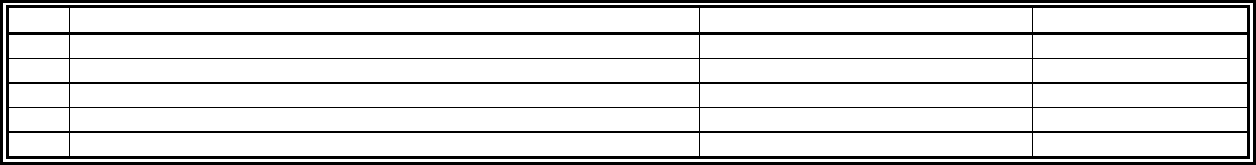

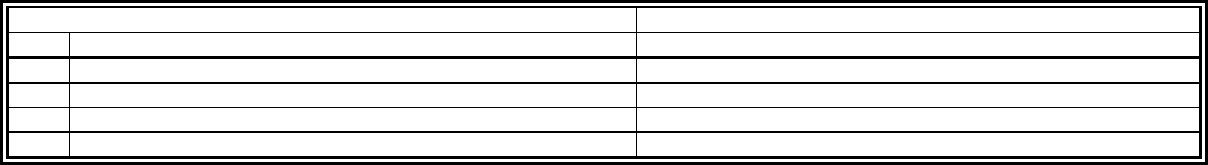

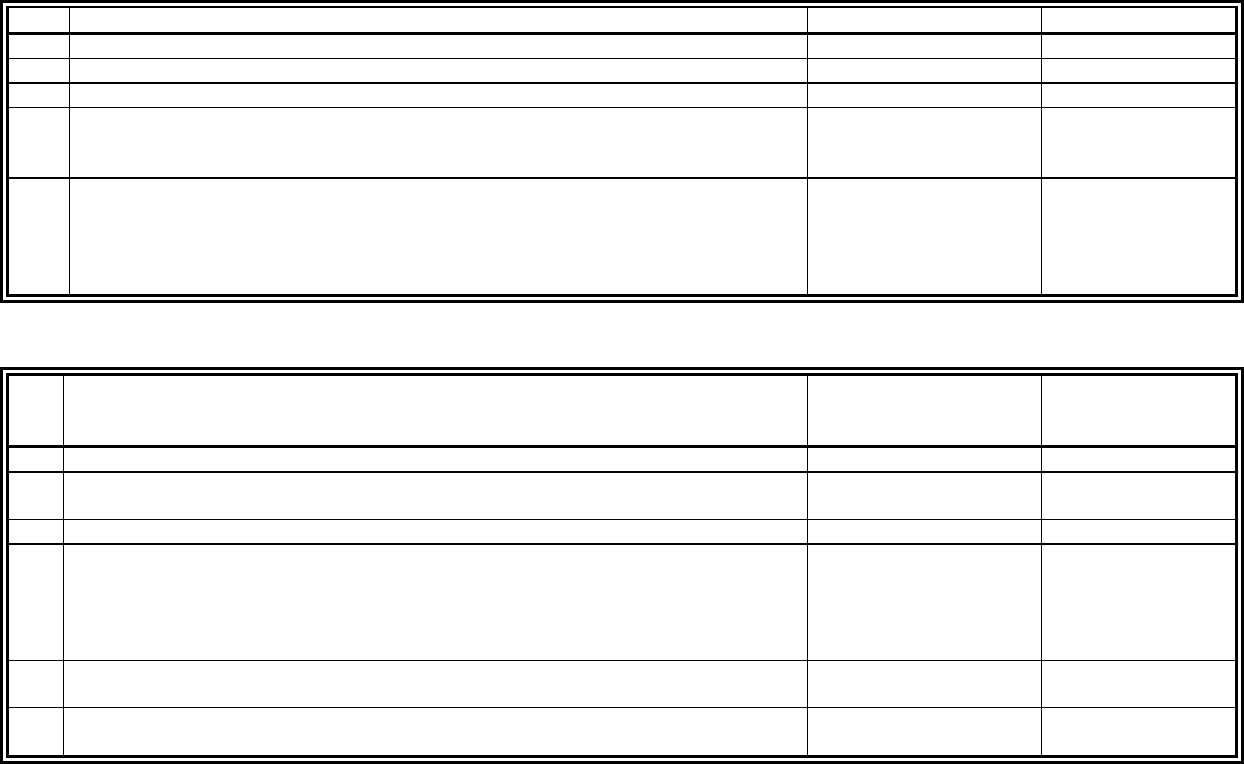

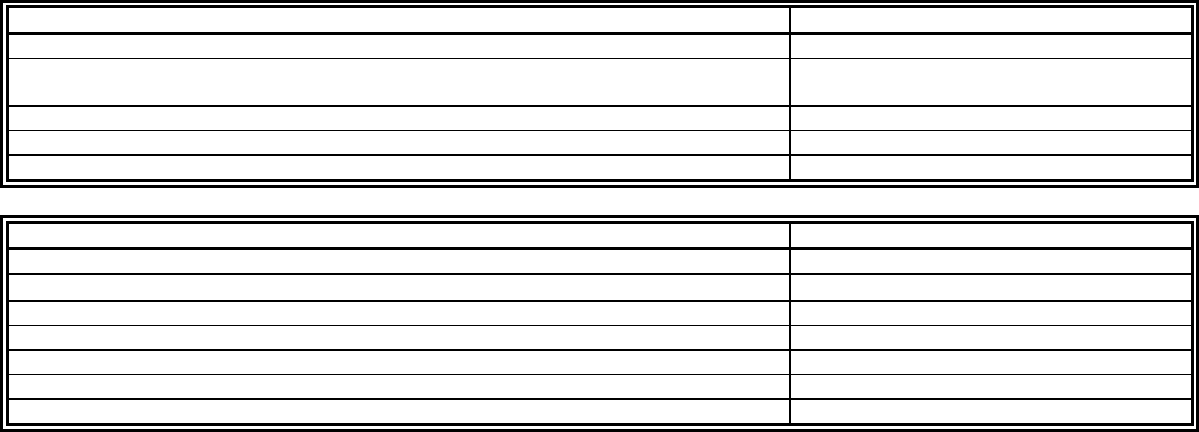

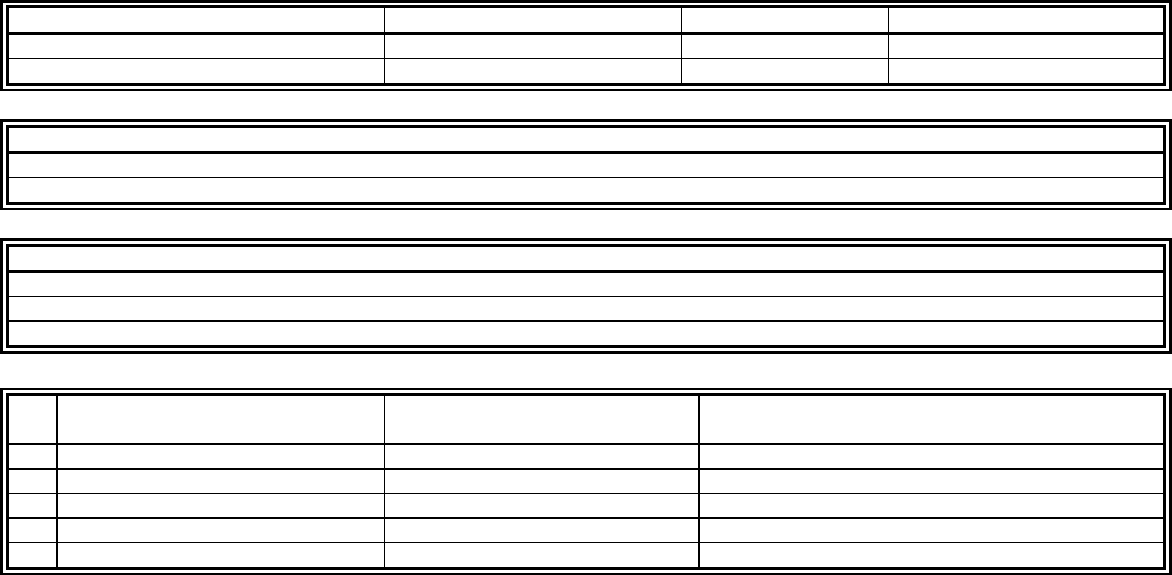

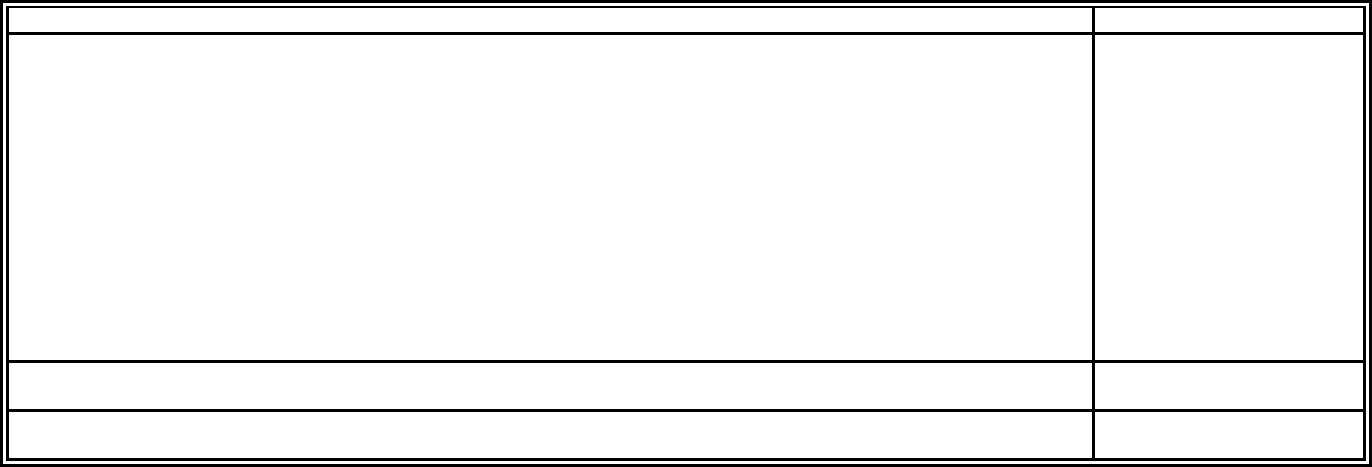

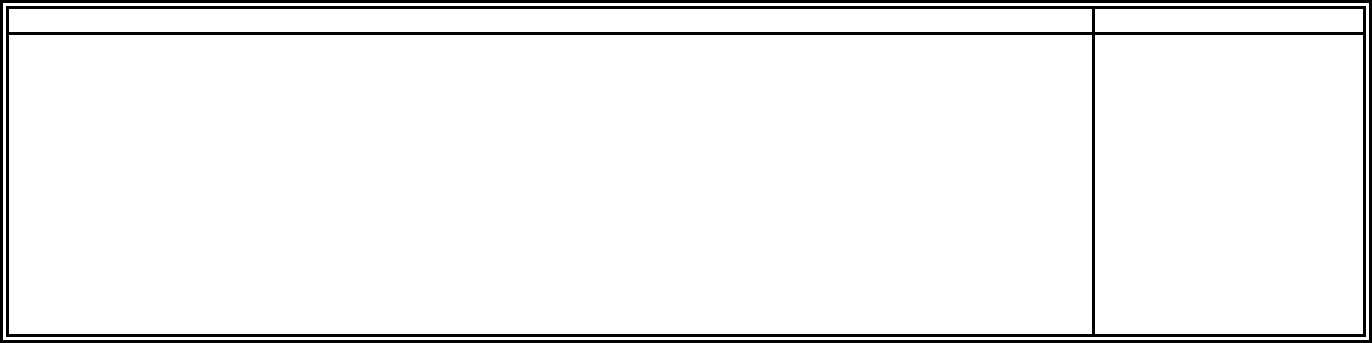

Number of Full-Time Employees in Office

Credit as a % of Taxable Premiums

1–3

0.0025%

4–10

0.0050%

11–50

0.0075%

51 or more

0.0100%

Total allowable credit for office facilities shall not exceed 1% of the insurer’s Alabama taxable

premiums.

Real Property Investment Credit:

For each $1 million in value of real property investments in Alabama, an insurer shall be

entitled to a credit of 0.10% of its Alabama taxable premiums. The total credit allowed for real

property investments shall not exceed 1% of an insurer’s Alabama taxable premiums.

§ 27-44-13 Life and Health Guaranty Association

Life and health guaranty association assessments may be offset against the premium tax at a rate

of 20% per year for five years beginning the year after the assessment is paid.

§ 27-42-16 Property and Casualty Guaranty Association

Property and casualty guaranty association assessments may be taken as a credit against taxes at

the rate of 20% per year for 5 years beginning year after assessment is paid.

§ 27-1-24.1 Coastal Incentive Credit

Insurance carriers must make application and be issued an award certificate in order to receive a

nonrefundable credit against insurance premium tax for new policies written after the date this

Code was amended, July 1, 2014, on properties insured by the Alabama Insurance Underwriting

Association at the time of writing by the private insurer for wind and hail coverage in specified

coastal areas. The amount of the credit is equal to 20% for premiums written in zones B4, B5,

M4, M5 or successor zones and 35% for premiums written in zones B1, B2, B3, M1, M2, M3,

Gulf Front or successor zones. The total credit to be awarded each year is $50,000.

§§ 41-9-216 to 41-9-219.7 Alabama New Markets Credit

Tax credits for investments in impoverished and low-income communities. Alabama Commerce

Department allocates the credits. Zero percent for the first year and 8.33% for years 2 through 7.

Retaliation—December 2023

AL-6 © 1991-2023 National Association of Insurance Commissioners

Credits (cont.)

→ §§ 40-18-370 to 40-18-383 Job Act Investment Credit

The incentivized company is allowed an Investment Credit in an annual amount equal to 1.5

percent of the capital investment incurred as of the beginning of the incentive period of 10 years,

to be used to offset the insurance premium tax levied by Section 27-4A-3(a). If the credit exceeds

the amount of taxes that are allowed to be offset by the project agreement, the unused credit can

be carried forward for up to five years. The credit is available for qualifying projects for which

project agreements are executed on or prior to July 31, 2028. At no time prior to December 31,

2021, shall the annualized balance of the outstanding jobs act incentives exceed $350 million.

This amount will increase to $375 million for 2023; $400 million for 2024; $425 million for

2025; $450 million for 2026; and $475 million for 2027. Of that amount, $20 million must go to

qualifying projects located in targeted or jumpstart counties. Only taxpayers that have been

approved by the Alabama Department of Commerce for qualifying projects are eligible to claim

the credit as provided in the executed State Project Agreement.

→ §§ 40-18-417.4 to 40-18-417.7 Growing Alabama Tax Credit

Alabama taxpayers who make cash contributions to local economic development organizations

for approved qualifying projects receive a Growing Alabama tax credit that can offset up to 50%

of the insurance premium tax levied by Section 27-4A-3(a). All Growing Alabama Credit funding

allocations must be approved on or prior to July 31, 2023, by the Renewal of Alabama

Commission, which is available for online applications. Taxpayers donating to economic

development organizations receive a credit equal to their donation and may carry the credit

forward for up to five years. Cumulative amount of funding approved shall not exceed $20

million prior to January 1, 2024. Amount shall increase to $23 million for the calendar year

ending December 31, 2024; $26 million for 2025; $29 million for 2026; $32 million for 2027;

and $35 million for 2028.

→ §§ 41-10-840 to 41-10-847 Innovating Alabama Tax Credits

A taxpayer is allowed an Innovating Alabama tax credit to be applied to offset the insurance

premium tax by making cash contributions to certain economic development organizations using

an online system created by the Alabama Department of Revenue. In no event shall the tax credit

cause a taxpayer’s tax liability to be reduced by more than 50%. Unused credits may be carried

forward for no more than 5 years.

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AL-7

Payment Due Dates:

→ § 27-4A-3

Each insurer shall pay its premium taxes on a quarterly basis, as follows: on or before May 15, a

payment estimated on the basis of 25% of its business done during the preceding calendar year or

actual business done from January 1 through March 31; on or before August 15, a payment

estimated on the basis of 45% of its business done during the preceding calendar year or at the

option of the insurer, on the basis of 180% of its actual business done from April 1 through June

30; on or before November 15, a payment estimated on the basis of 25% of its business done

during the preceding calendar year, or at the option of the insurer, on the basis of its actual

business done from July 1 through September 30 of the same calendar year; on or before March 1,

a payment is the amount of the remainder of the actual premium taxes due on its business done

during the preceding calendar year. Any taxes paid on an estimated quarterly basis during the

calendar year shall be reconciled to actual premiums received on risks for such calendar year on

the March 1 payment date in the succeeding calendar year.

Penalties:

§ 27-4A-4

Failure to comply with all of provisions subjects the companies to a penalty of not less than $1,000

or more than $10,000.

§ 27-9A-7

Failure for an independent adjuster to inform the commissioner within 30 days of a change in legal

name or address shall result in a penalty of $50. If the penalty is not paid within 30 days after

notice of the penalty assessment, the license shall be suspended until the penalty is paid.

Extensions:

No specific provision for extension.

Retaliatory Law:

§ 27-3-29

When taxes, licenses and other fees, in the aggregate, and any fines, penalties, deposit

requirements, etc. charged Alabama insurers would exceed those imposed by Alabama on similar

insurers, a retaliatory tax will be imposed. Taxes imposed by political subdivisions are considered

imposed by the state. All fees and taxes are aggregated on a separate retaliatory tax form, PG.

Retaliation—December 2023

AL-8 © 1991-2023 National Association of Insurance Commissioners

FEES

All fees and taxes are aggregated on a separate retaliatory tax form.

→ Insurers’ Fees:

§§ 27-4-2; 27-31B-4; 27-21A-21; 8-8-15; 27-12A-41; 27-22A-7; 482-1-160-.04; Bulletin 2021-8

(July 29, 2021); Department website

[Fees in brackets were in effect prior to 1/1/2023. Fees in italics in effect 1/1/2023.]

Certificate of authority:

Initial application for original certificate of authority, including the filing with

the commissioner of all documents incidental thereto .................................................. $500

Initial application for original certificate of authority HMO, including the filing with

the commissioner of all documents incidental thereto ...................................................... 50

Captive insurers, initial application for original certificate of authority ................................ 240

Audit and examination fee for a company application ....................................................... 2,000

Audit and examination fee for an HMO application .......................................................... 2,000

Issuance of original certificate of authority ........................................................................... 500

Annual continuation or renewal fee ....................................................................................... 500

Annual continuation or renewal fee HMO ............................................................................. 200

Reinstatement fee ................................................................................................................... 500

Charter documents:

Filing with the commissioner amendments to articles of incorporation

or of association, or of other charter documents or to bylaws ........................................... 25

Solicitation permit:

Solicitation’s permit, filing application and issuance ............................................................ 250

Annual statement:

For insurer, except when filed as part of application for original certificate

of authority, filing.............................................................................................................. 25

Audit and examination fee for annual statement ................................................................ 1,200

Audit and examination fee for annual statement,

mutual aid societies and fraternals .................................................................................. 400

Audit and examination fee for annual statement HMOs ........................................................ 500

Mi

scellaneous services:

For copies of documents, records on file in insurance department, per page ............................ 1

For each certificate of the commissioner under his seal, other than agent licenses ................... 5

Service of process .................................................................................................................... 50

Returned check fee ................................................................................................................... 30

Fraud Unit:

Assessment ................................................................................................................... [200] 240

Producer appointments:

Filing notice of appointment .................................................................................................... 40

Annual continuation of appointment ....................................................................................... 25

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AL-9

Insurers’ Fees (cont.)

§§ 27-4-2; 27-31B-4; 27-21A-21; 8-8-15; 27-12A-41; 27-22A-7; 482-1-160-.04; Bulletin 2021-8

(July 29, 2021); Department website (cont.)

[Fees in brackets were in effect prior to 1/1/2023. Fees in italics in effect 1/1/2023.]

Service representative appointments:

Initial license/appointment fee (per insurer) .......................................................................... $70

Biennial license renewal fee .................................................................................................... 70

Late fee .................................................................................................................................... 50

Appointment renewal fee ......................................................................................................... 40

Captive insurers:

Filing application for license ................................................................................................. 240

License fee (for original license and each annual renewal) ................................................... 360

Producer Licensing Fees:

§§ 27-4-2; 27-9A-7; 27-8A-9; 27-22A-7; 27-25-4.7; 27-25-4.2; Bulletin 2021-8 (July 29, 2021);

Department website

Producer licenses:

Individuals (resident or nonresident):

License fee (for original license + application) ................................................................. 80

Late fee (only if paid month after birth-month) ................................................................ 50

Biennial license renewal fee .............................................................................................. 70

Reissue fee (within 365 days).......................................................................................... 140

Filing notice of appointment ............................................................................................. 40

Annual continuation of appointment fee ........................................................................... 25

Business entities:

License fee (for original license + application) ............................................................... 130

Biennial license renewal fee ............................................................................................ 100

Late fee .............................................................................................................................. 50

Notice of appointment fee ................................................................................................. 40

Annual continuation of appointment fee ........................................................................... 25

Late fee, for appointment continuation invoice ............................................................... 250

plus an additional 250 for each additional month late

Temporary:

License fee per insurer ...................................................................................................... 80

Notice of appointment fee per insurer ............................................................................... 40

Total initial fees ............................................................................................................... 120

Examination fees (for producer examination or reexamination of resident agent or broker):

Each classification of examination .......................................................................................... 50

Producer Combined Life and Health exam .............................................................................. 75

Producer Combined Property and Casualty exam ................................................................... 75

Retaliation—December 2023

AL-10 © 1991-2023 National Association of Insurance Commissioners

Producer Licensing Fees (cont.)

§§ 27-4-2; 27-9A-7; 27-8A-9; 27-22A-7; 27-25-4.7; 27-25-4.2; Bulletin 2021-8 (July 29, 2021);

Department website (cont.)

Reinsurance intermediary license:

Filing application for license ................................................................................................. $30

Issuance of original license .................................................................................................... 140

Annual continuation of license .............................................................................................. 100

Managing general agent’s license (§ 27-4-2; Bulletin 2021-08):

Application fee for initial application, each insurer ................................................................. 30

License fee ............................................................................................................................. 125

Annual continuation of license, each insurer ........................................................................... 75

Examination fee ..................................................................................................................... 250

Service representative license (§§ 27-4-2; 27-8A-9):

Biennial continuation of license, property and casualty, each insurer ..................................... 70

Late fee .................................................................................................................................... 50

Surplus lines broker:

Individuals:

License fee for original license + application .................................................................. 230

Renewal ........................................................................................................................... 200

Business entities:

Initial license fee + application fee .................................................................................. 530

Annual license renewal fee .............................................................................................. 500

Adjusters (§§ 27-4-2; 27-9A-7; Ala. Admin. Code (AAC) 482-1-151-.06; 482-1-151-.07;

482-1-151-.08):

Individuals:

Individual license fee for original license + application.................................................. 110

Biennial continuation of licenses ...................................................................................... 80

Reissue (within 365 days) ............................................................................................... 160

Late fee (only if paid month after birth month) ................................................................. 40

Apprentice adjuster .......................................................................................................... 110

Business entities:

License fee + application fee ........................................................................................... 230

Biennial license renewal fee ............................................................................................ 200

Reinstated within 30 days of expiration .......................................................................... 300

Reissue fee (within 365 days)............................................................................................ 80

Examination fee ....................................................................................................................... 75

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AL-11

Producer Licensing Fees (cont.)

§§ 27-4-2; 27-9A-7; 27-8A-9; 27-22A-7; 27-25-4.7; 27-25-4.2; Bulletin 2021-8 (July 29, 2021);

Department website (cont.)

Portable electronics (§ 27-22A-7):

Individuals:

Initial license fee (small) ............................................................................................... $100

Initial license fee (large) ............................................................................................... 1,000

Renewal fee (small) ......................................................................................................... 100

Renewal fee (large) ......................................................................................................... 500

Late fee .............................................................................................................................. 50

Appointment fee (small) .................................................................................................... 40

Appointment fee (large) .................................................................................................... 40

Business entities:

Initial license fee (small) ................................................................................................. 100

Initial license fee (large) ............................................................................................... 1,000

Renewal fee (small) ......................................................................................................... 100

Renewal fee (large) ......................................................................................................... 500

Late fee .............................................................................................................................. 50

Appointment fee (small) .................................................................................................... 40

Appointment fee (large) .................................................................................................... 40

Title insurance (§§ 27-25-4.7; 27-25-4.2; AAC 482-1-148-.06):

Individuals:

Initial license + application fee ......................................................................................... 60

Biennial license renewal fee .............................................................................................. 40

Late fee .............................................................................................................................. 50

Reinstatement fee .............................................................................................................. 80

Notice of appointment fee ................................................................................................. 30

Appointment renewal fee .................................................................................................. 10

Examination fee ................................................................................................................. 75

Business entities:

Initial license + application fee ....................................................................................... 120

Biennial license renewal fee ............................................................................................ 100

Late fee .............................................................................................................................. 50

Notice of appointment fee ................................................................................................. 30

Appointment renewal fee .................................................................................................. 10

Producers’ appointment fees are paid by the company. Producer’s license renewal fees are the

responsibility of the producer.

Retaliation—December 2023

AL-12 © 1991-2023 National Association of Insurance Commissioners

DEPOSITS

§ 27-3-11

A value at all times not less than $100,000 or the minimum paid-in capital stock if a stock insurer,

or surplus if a mutual or reciprocal insurer, required to be maintained by the insurer under this

title for authority to transact the kinds of insurance to be transacted, whichever is the smaller

amount. Foreign insurers may provide certification of like deposit in another state.

§ 27-3-12

Surety insurers shall deposit an additional $50,000, unless the company’s deposit in its state of

domicile is at least $200,000.

§ 27-3-13

Domestic title insurers may deposit $50,000; foreign insurers must deposit $50,000.

CONTACT PERSON

Premium Tax

LaKisha Hardy: (334) 241-4114; lakisha.hardy@insurance.alabama.gov

Premium Tax

Andrea Brown: (334) 241-4183; andrea.brown@insurance.alabama.gov

Premium Tax

Caitlin Walker: (334) 240-7574; caitlin.walker@insurance.alabama.gov

Producers’ Licensing

Antwionne Dunklin: (334) 241-4126; antwionne.dunklin@insurance.alabama.gov

Deposits

Ken Smithson: (334) 241-4156; john.smithson@insurance.alabama.gov

Reinsurance Intermediaries and MGAs

Jill Gregory: (334) 241-4161; jill.gregor[email protected].gov

Every effort has been made to make this information as correct and complete as possible, but for

specific issues the reader should check the statutes cited. This summary has been prepared by the

NAIC and reviewed by the state’s insurance department and/or tax department for accuracy. All

decisions on legal interpretation are made by state officials, so the reader should contact the above

for further information.

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AK-1

ALASKA

→ Arrow indicates an update for 2023

PREMIUM TAX

Premium Tax Base:

Alaska Stat. § 21.09.210

Total direct premium written minus cancellations, returned premiums, dividends, refunds and other

similar returns. Considerations on annuities are not taxed; premiums for wet marine and

transportation insurance are covered under another section.

Tax Rate:

§§ 21.09.210; 21.59.070

2.7% for domestic and foreign insurers, except hospital and medical service corporations and title

insurers.

Individual life insurance premiums 2.7% for a policy of individual life insurance with a policy year

premium up to $100,000 and 0.08% for a policy of individual life insurance with a policy year

premium exceeding $100,000. Premiums taxed at the 0.08% rate are not subject to retaliation.

2.7% for risk retention groups

2.7% for automobile service corporations

6% of gross premiums less claims paid for hospital and medical service corporations.

0.75% gross underwriting profit for wet marine and transportation contracts

§ 21.66.110

1% of gross title insurance premiums

§ 21.85.100

2.7% for multiple employer welfare arrangement, except on premiums already reported by

domestic and foreign insurers.

Retaliation—December 2023

AK-2 © 1991-2023 National Association of Insurance Commissioners

Other Taxes and Assessments:

→ § 23.30.040 Second Injury Fund

Employer or insurer contributes an amount based upon a rate set by commissioner and limited by

the amount paid out in workers’ compensation benefits. The maximum rate for 2023 is 2%.

The workers’ compensation reforms passed by the State of Alaska Legislature on May 11, 2018,

(SCS CSHB 79(FIN)) provided for the closure of the Second Injury Fund. The fund will not accept

claims for second injury fund reimbursement after September 30, 2020.

→ § 21.55.220 Health Pool

Comprehensive Health Insurance Association (ACHIA) may assess insurers to cover

administrative operating and losses of the association. 50% of ACHIA assessments paid in 2022

may be offset against 2023 premium taxes.

§ 21.80.060 Property and Casualty Guaranty Association

Initial assessments made by the guaranty association may not be more than 2% of net direct written

premiums in an account with a deficiency.

§ 21.79.070 Life and Health Guaranty Association

The total of all assessments on a member insurer for each subaccount of the life and annuity account

and for the health account may not in any one calendar year exceed 2% of the insurer's average

annual premiums received in this state on policies or contracts covered by the account or

subaccount during the three calendar years preceding the year in which the insurer became an

impaired or insolvent insurer.

§ 21.09.210 Preemption

The state government preempts the field of imposing excise, privilege, franchise, income, license,

permit, registration, and similar taxes, licenses, and fees upon insurers and their general agents,

agents, and representatives; and on the intangible property of insurers or agents; and all political

subdivisions of agencies in the state are prohibited from imposing or levying upon insurers, their

agents and representatives, any tax, license, or fee. This subsection shall not be construed as

prohibiting the imposition by political subdivisions of taxes upon real and tangible personal

property of insurers and their general agents, agents, and representatives.

Exclusions and Deductions:

§ 21.84.400 Fraternals

Fraternal benefit societies are exempt from the payment of premium tax.

§ 21.09.210(i) Public Officers and Employees

Premiums paid by the State of Alaska for insurance policies and contracts purchased for public

officers and employees are exempt from taxation.

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AK-3

Exclusions and Deductions (cont.)

5 U.S.C. § 8909; Social Security Act § 1853

Federal law preempts taxing the following:

• Group health benefits insurance purchased under the Federal Employees Health Benefits Act

Program; and

• Payment to Medicare+ Choice organizations under § 1853.

Credits:

§ 21.96.070 Cash Contributions to Educational Institutions

(a) A taxpayer is allowed a credit against premium tax for cash contributions or equipment accepted

1) for direct instruction, research, and educational support purposes, including library

and museum acquisitions, and contributions to endowment, by an Alaska university

foundation or by a nonprofit, public or private, Alaska two-year or four-year college

accredited by a national or regional accreditation association;

2) for secondary school level vocational education courses, programs and facilities by

a school district in the state;

3) for vocational education courses, programs, and facilities by a state-operated

vocation technical education and training school;

4) for a facility by a nonprofit, public or private, Alaska two-year or four-year college

accredited by a national or regional accreditation association;

5) for Alaska Native cultural or heritage programs and educational support including

mentoring and tutoring, provided by a nonprofit agency for public school staff and

for students who are in grades kindergarten through grade 12 in the state; and

6) for education, research, rehabilitation, and facilities by an institution that is located

in the state and that qualifies as a coastal ecosystem learning center under the Coastal

America Partnership.

(b) The credit is 50% of contributions.

(cont.)

Retaliation—December 2023

AK-4 © 1991-2023 National Association of Insurance Commissioners

Credits (cont.)

§ 21.96.070 Cash Contributions to Educational Institutions (cont.)

(d) A contribution claimed as a credit may not

1) be the basis for a credit claimed under another provision of this title and

2) when combined with contributions that are the basis for credits taken during the

taxpayer’s tax year under AS 43.20.014, AS 43.55.019, AS 43.56.018, AS

43.65.018, AS 43.75.018, or AS 43.77.045, result in a total amount of credits

exceeding $1,000,000; if the taxpayer is a member of an affiliated group, then the

total amount of credits may not exceed $1,000,000 for the affiliated group.

(e) The credit may not reduce a person’s tax liability under AS 21.09.210 or AS 21.66.110 to below

zero for any tax year. An unused credit or portion of a credit not used for a tax year may not be

sold, traded, transferred, or applied in a subsequent tax year.

§ 21.55.220 Comprehensive Health Insurance Association (CHIA) Assessments

A qualified insurer is entitled to offset 50% of the amount of CHIA assessments against premium

taxes the insurer owes on premiums written in the year following the date of the assessment. The

offset may not reduce the premium tax payable to less than zero or create a premium tax credit. An

unused offset may be carried over to the immediately following calendar year. 50% of ACHIA

assessments paid in 2022 may be offset against 2023 premium taxes. This credit is not subject to

retaliation.

Payment Due Dates:

§ 21.09.210; 3 Alaska Admin. Code 21.550 to 21.570

The annual tax report and payment of tax is due on or before Mar. 1. An authorized insurer that

pays $10,000 or more in one tax year shall pay tax the following year in four payments. On or

before May 31, Aug. 31, and Nov. 30, pay 25% of annual premium tax it paid the previous tax year.

On or before Mar. 1 of the following year, calculate total tax due and pay balance or request a

refund or overpayment towards subsequent year tax. Requirement to pay quarterly does not apply

to ocean marine tax or retaliatory fees. The taxes must be paid by the automated clearing house

debit or credit payment system through OPTins.

§ 21.09.200; 3 Alaska Admin. Code 31.050

The annual statement filing fee of $100 is due on or before Mar. 1 and must be paid by the

automated clearing house debit or credit payment system through OPTins. This fee is reported on

the annual premium tax report.

§ 21.09.130; 3 Alaska Admin. Code 31.050

The continuation of certificate of authority fee is due on or before June 30 and must be paid by the

automated clearing house debit or credit payment system through OPTins. This fee is reported on

the annual premium tax report.

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AK-5

Penalties:

§§ 21.09.210; 21.66.110

The late payment fee is $50 per month or part of a month plus 5% of the tax due each calendar

month or part of a month with a maximum late fee of $250 plus 25% of the tax due, and interest at

the rate of 1% per month or part of a month for the period the insurer fails to pay the premium tax.

If payment is not received by the automated clearing house payment method through OPTins, a

penalty of 25% of the tax due will be assessed, with a minimum of $100 and maximum of $2,000.

Suspension or revocation of certificate of authority if insurer fails to pay taxes, penalty or late

payment fee as required.

§ 21.09.200

The late filing of a statement or report in the form and location required by the director is subject

to a penalty of $100 for each day the filing is late.

Extensions:

No provision for extension.

Retaliatory Law:

§ 21.09.270

If taxes, licenses and fees in the aggregate and fines, penalties, deposit requirements, etc. imposed

on Alaska insurers or representatives is in excess of charges Alaska makes on similar insurers or

representatives, a retaliatory fee will be imposed. Does not apply to personal income taxes or to

ad valorem taxes on property or to special purpose assessments imposed in connection with other

than property insurance, except that deductions from premium taxes or other taxes otherwise

payable allowed on accounts of real estate or personal property taxes paid shall be taken into

consideration. A health care insurer may not include taxes, assessments, or other similar obligations

on health care insurance premiums received from the state, a municipality, a city or borough school

district, a regional educational attendance area, the University of Alaska or a community college

operated by the University of Alaska.

Retaliation—December 2023

AK-6 © 1991-2023 National Association of Insurance Commissioners

FEES

The annual statement filing fee and the certificate of authority continuation fee are retaliated in the

aggregate with the other recurring fees and taxes on the premium tax report as well as filing fees for rate

and form filings paid to other states.

Insurers’ Fees:

3 Alaska Admin. Code 31.040 to 31.060

Certificate of authority:

Certificate of authority application, including a solicitation permit and issuance of

the certificate, if issued, a one-time fee of ........................................................................ $2,250

Annual continuation of certificate of authority ......................................................................... 2,250

Amendment to a certificate of authority ...................................................................................... 100

Amendment to the articles of incorporation ................................................................................ 100

Revised bylaws or amendments to bylaws .................................................................................. 100

Reinstatement of a certificate of authority ................................................................................... 500

Replacement of a lost certificate of authority ................................................................................ 25

Certificate of authority:

Application from a multiple employer welfare arrangement,

including the issuance of the certificate, if issued, a one-time fee of ................................. 2,000

Annual continuation of certificate of authority ......................................................................... 2,000

Annual statement:

Annual statement filing fee .......................................................................................................... 100

Solicitation permit:

Subsequent financing for domestic insurers ................................................................................ 100

Registration:

As an accredited reinsurance company ........................................................................................ 500

Review:

Of assuming reinsurance company for compliance with law ...................................................... 100

Holding company:

Form A filing acquisition of control of a merger with a domestic insurer................................ 2,000

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AK-7

Miscellaneous Fees:

3 Alaska Admin. Code 31.040 to 31.060

Rating bureau:

Three-year license ................................................................................................................... $6,000

Surplus lines (applies only to alien insurers not on NAIC Quarterly IID Listing):

Filing of a certified annual financial statement by surplus lines insurer ...................................... 100

Application for registration of a surplus lines insurer on the division’s “white list” ................ 1,000

Annual renewal of “white list” registration ................................................................................. 500

Reinstatement late fee of a surplus lines insurer’s registration .................................................... 250

Risk retention and purchasing groups:

Initial registration of a risk retention group .............................................................................. 1,000

Annual continuation of a risk retention group ............................................................................. 200

Initial registration of a purchasing group ..................................................................................... 500

Annual continuation of a purchasing group ................................................................................. 200

Attorney-in-fact:

Initial application and annual renewal of a resident attorney-in-fact license ............................... 200

Initial application and annual renewal of a nonresident attorney-in-fact license ......................... 500

Joint title plant:

Initial application, including issuance of the certificate, if issued ............................................ 1,000

Annual continuation of certificate of authority ............................................................................ 600

Air Ambulance service provider:

Air ambulance service provider application fee ....................................................................... 1,000

Air ambulance service provider biennial renewal fee .................................................................. 200

Independent review organization:

Initial registration fee and biennial renewal few ....................................................................... 1,000

Miscellaneous services:

For issuing a certification ............................................................................................................... 25

For accepting service of process .................................................................................................... 25

For photocopies ....................... $0.25 per page if copied by division staff, otherwise $0.15 per page

Computer listings ........................................................................................................................... 25

Cassette tape or a computer disk ...................................................................................................... 5

Computer disk formatted for data submission ............................................................................... 25

Returned check fee ......................................................................................................................... 25

For any printed material not otherwise described in this section, director may charge the actual cost

of printing plus handling and postage.

Retaliation—December 2023

AK-8 © 1991-2023 National Association of Insurance Commissioners

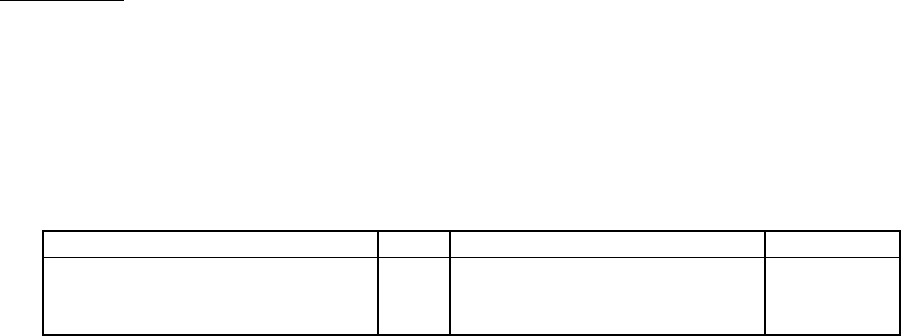

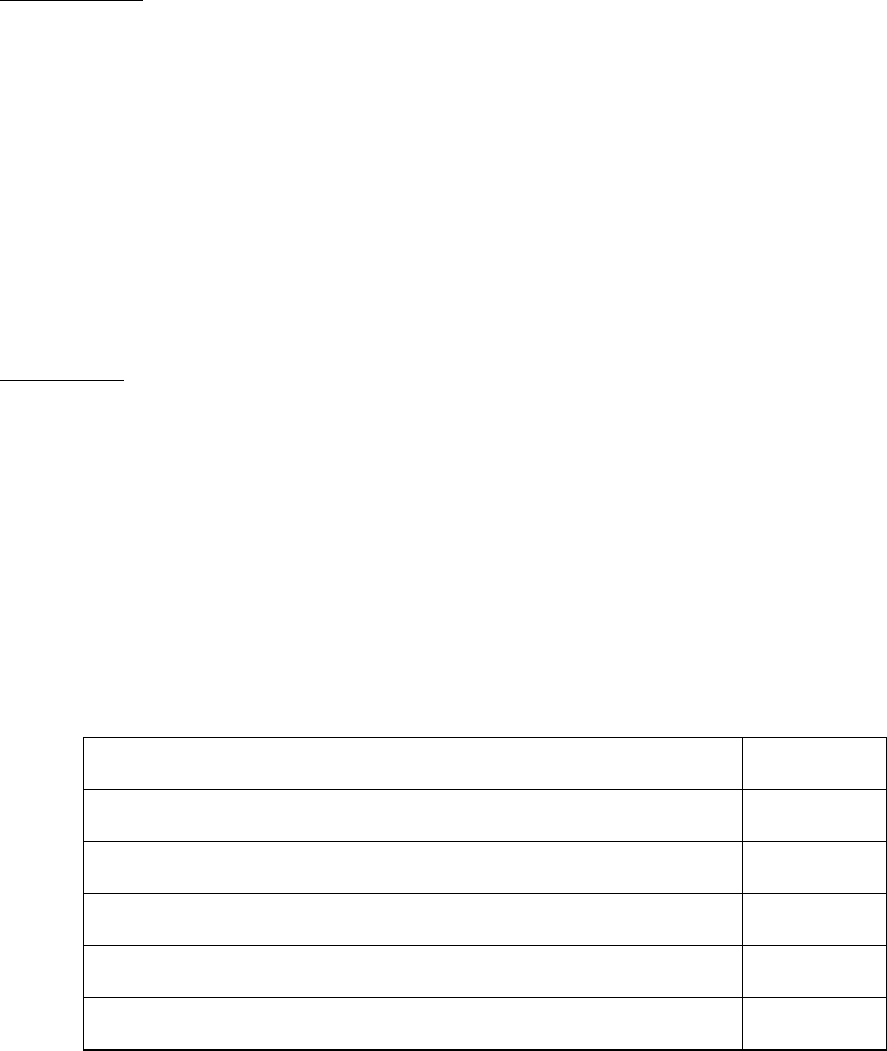

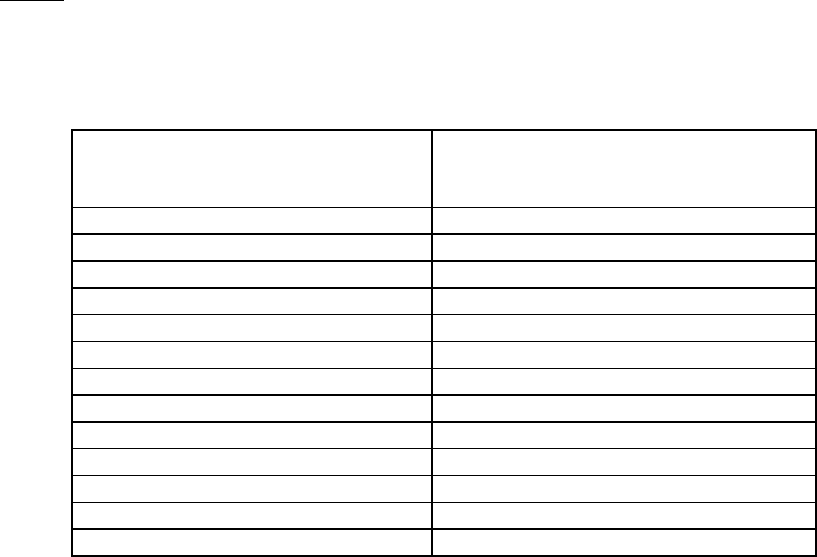

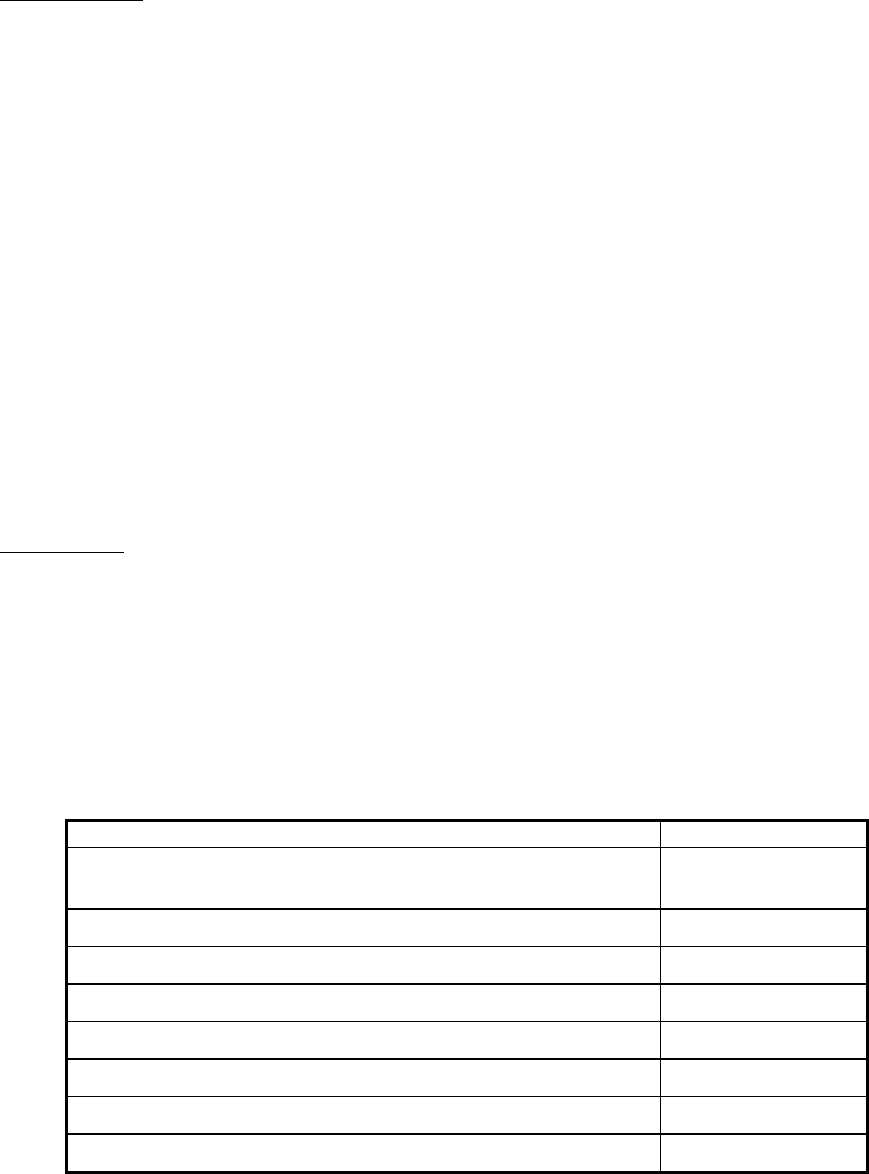

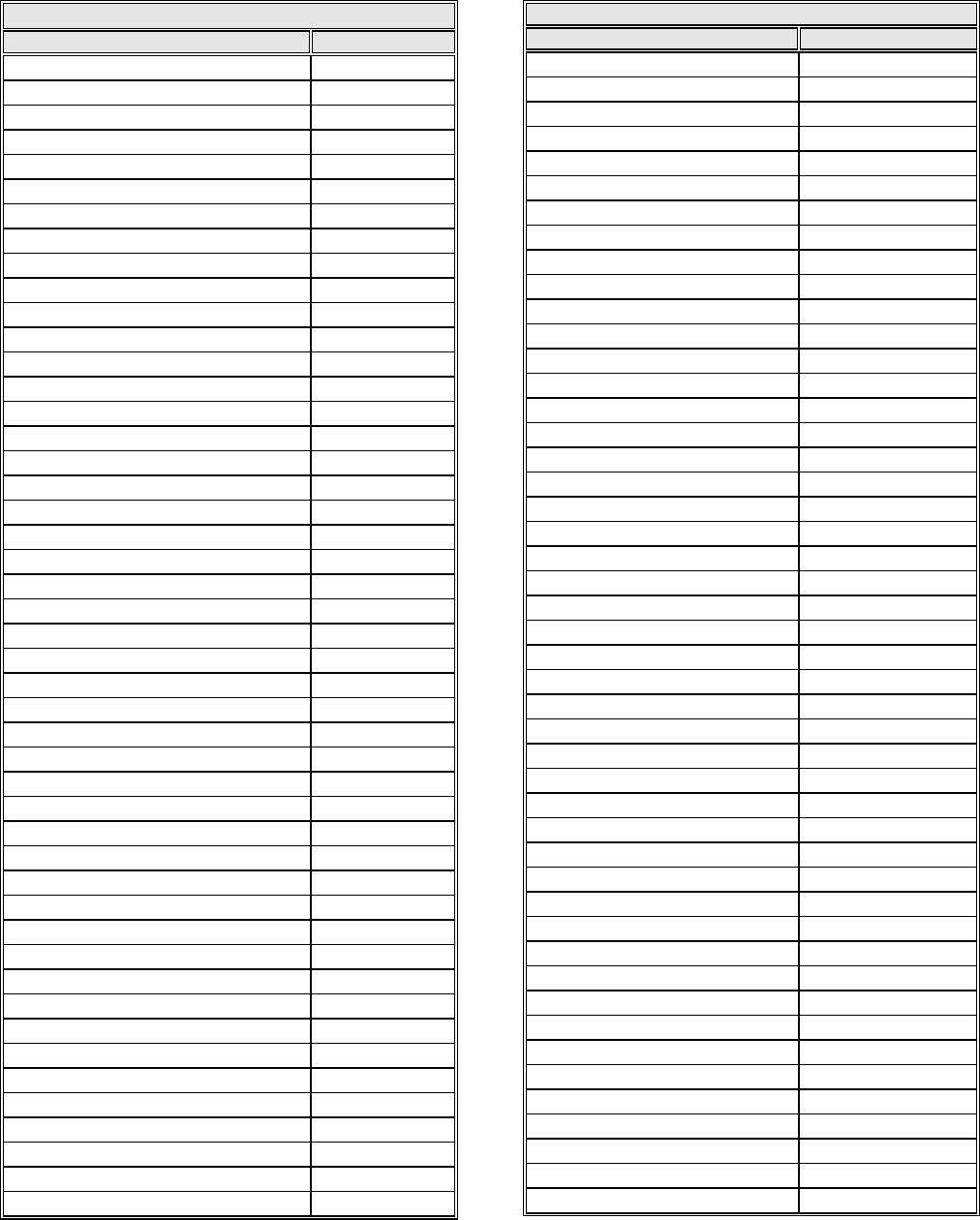

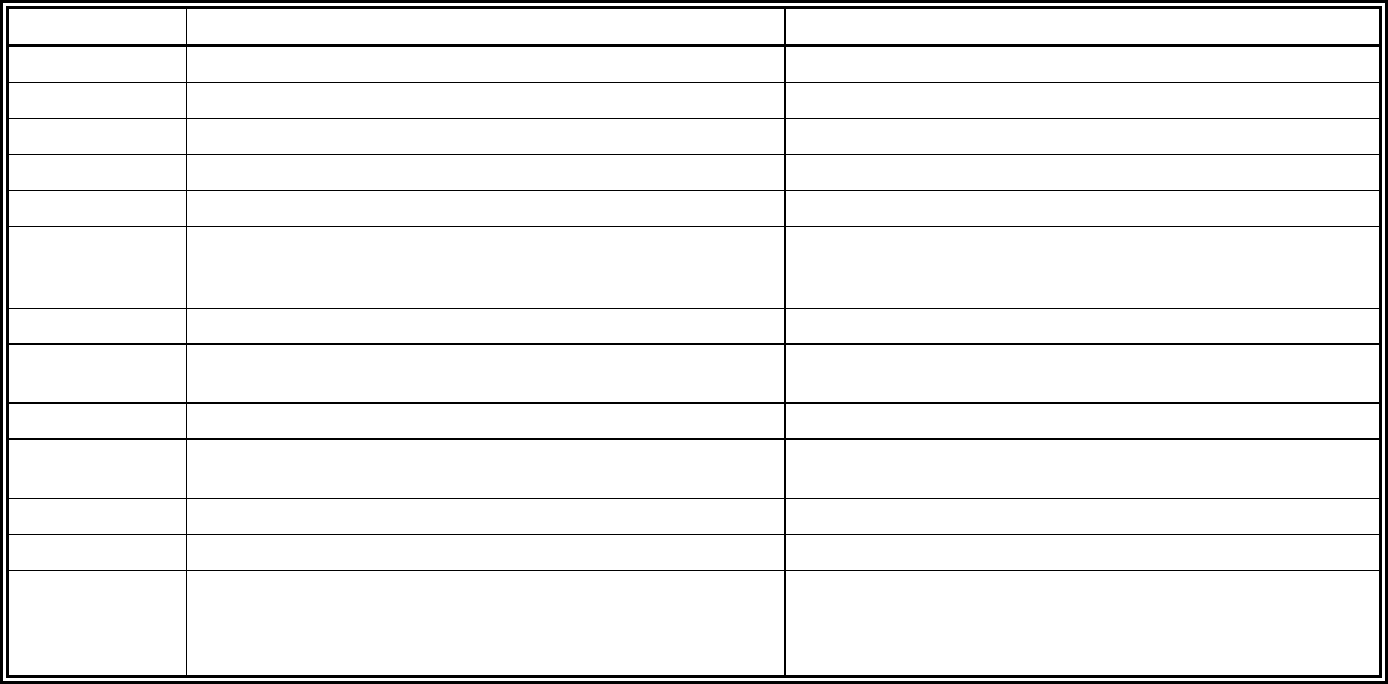

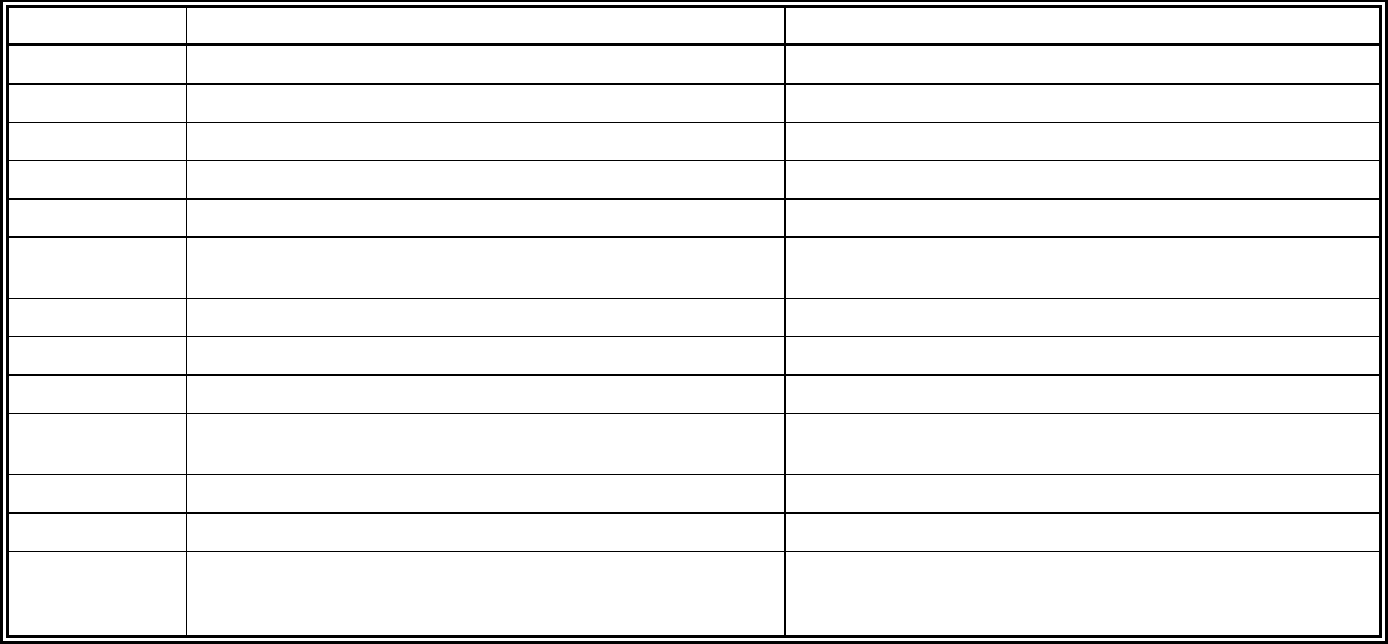

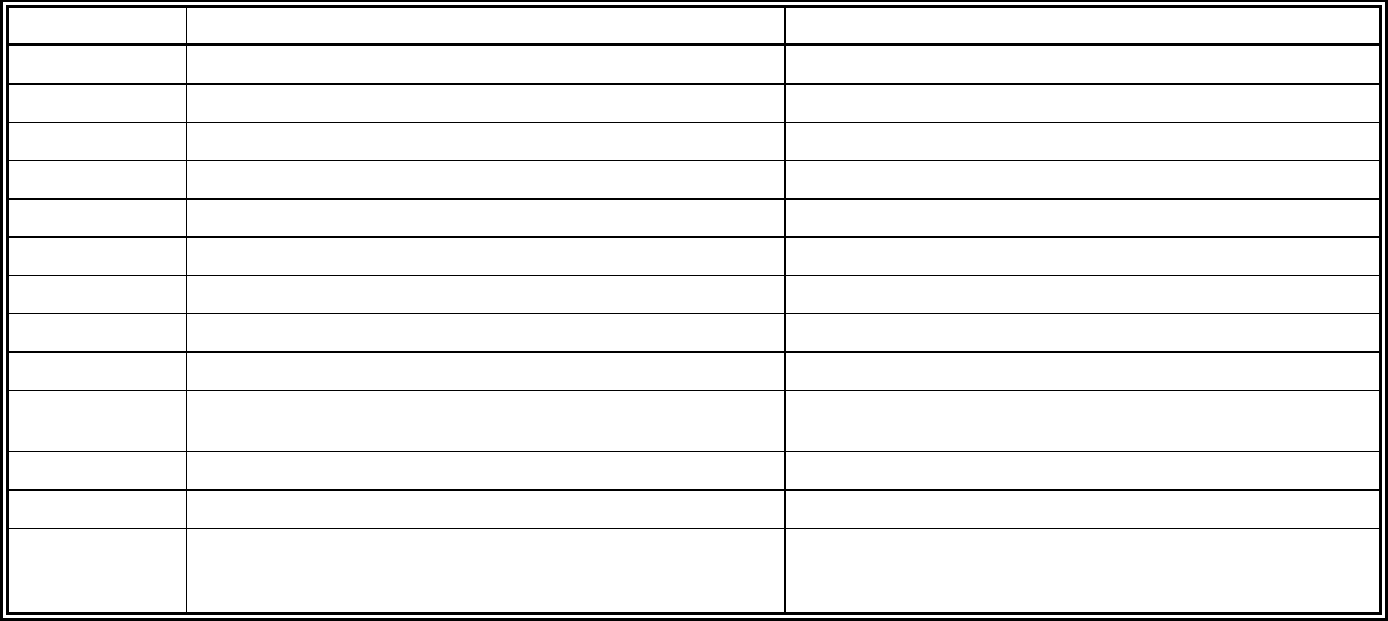

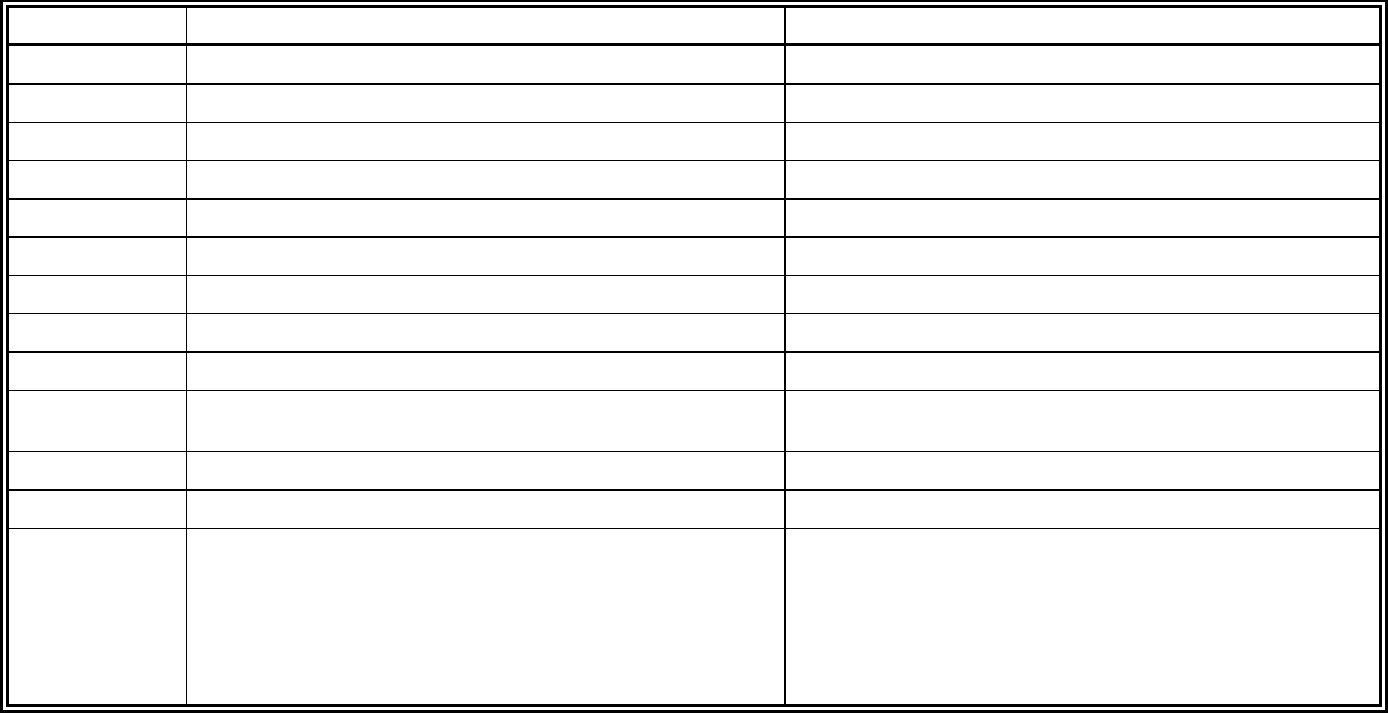

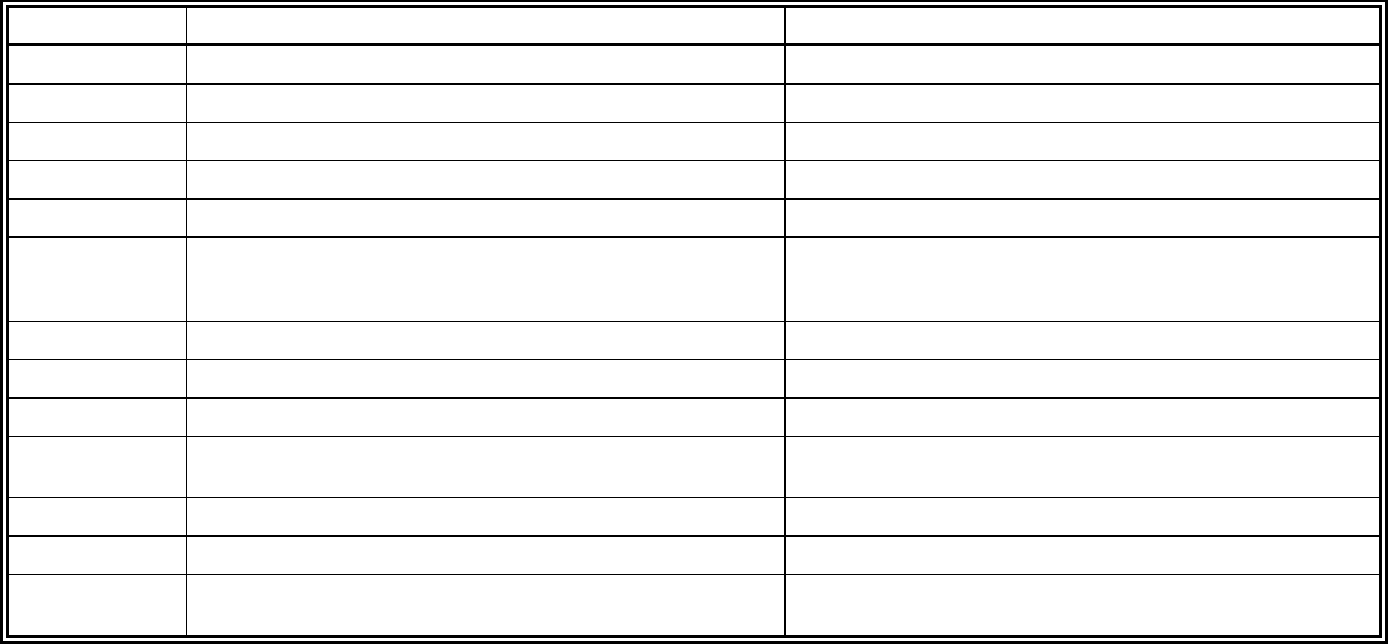

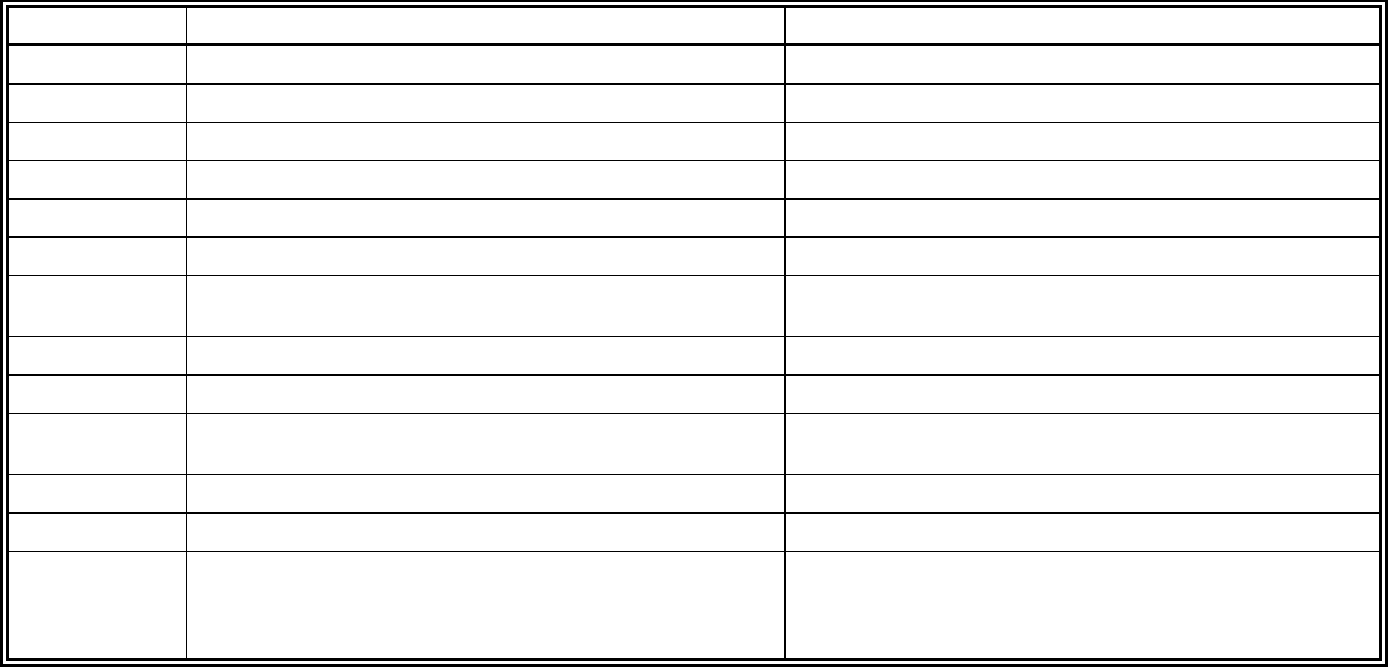

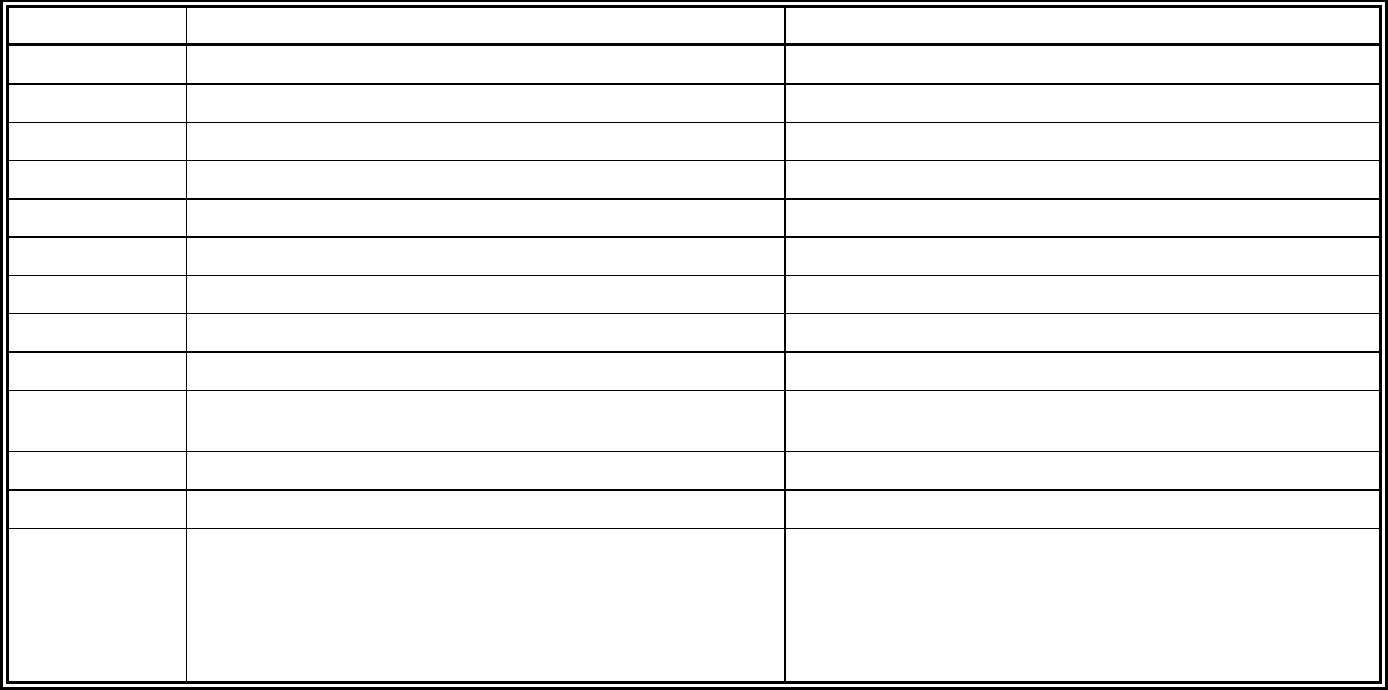

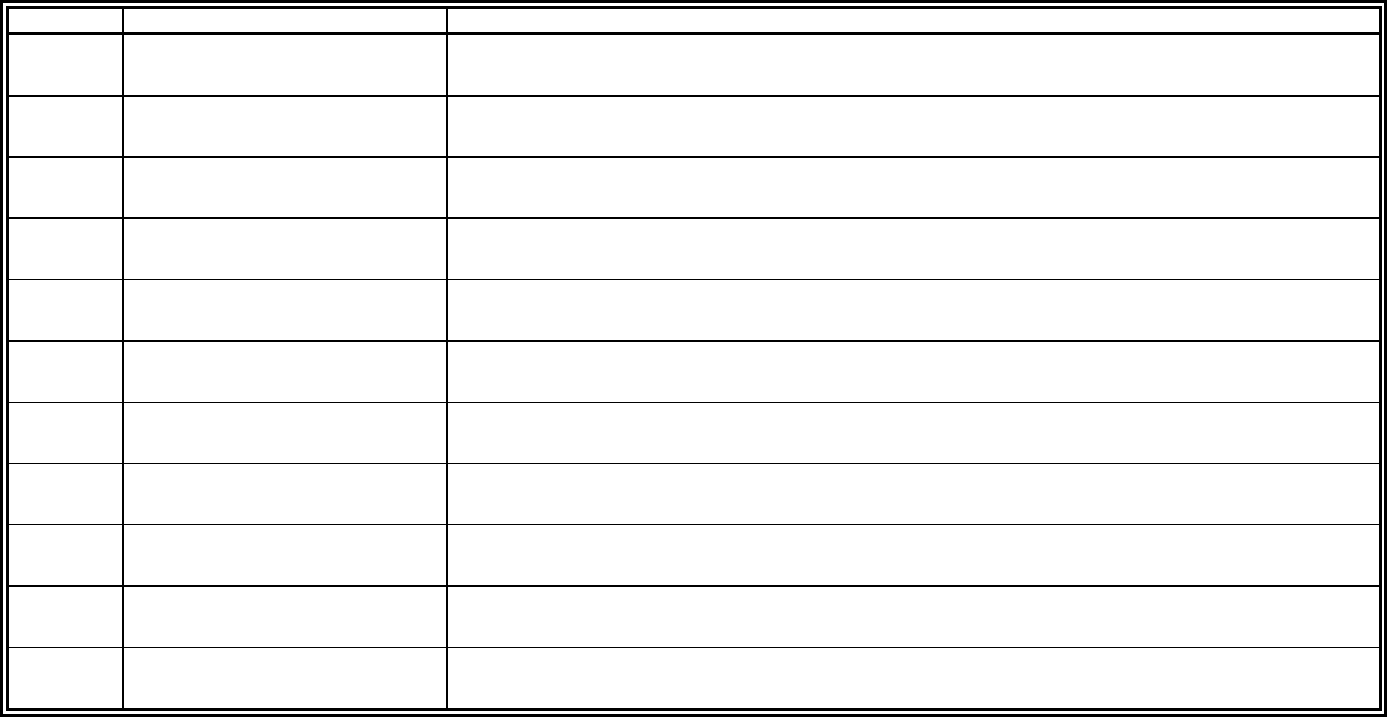

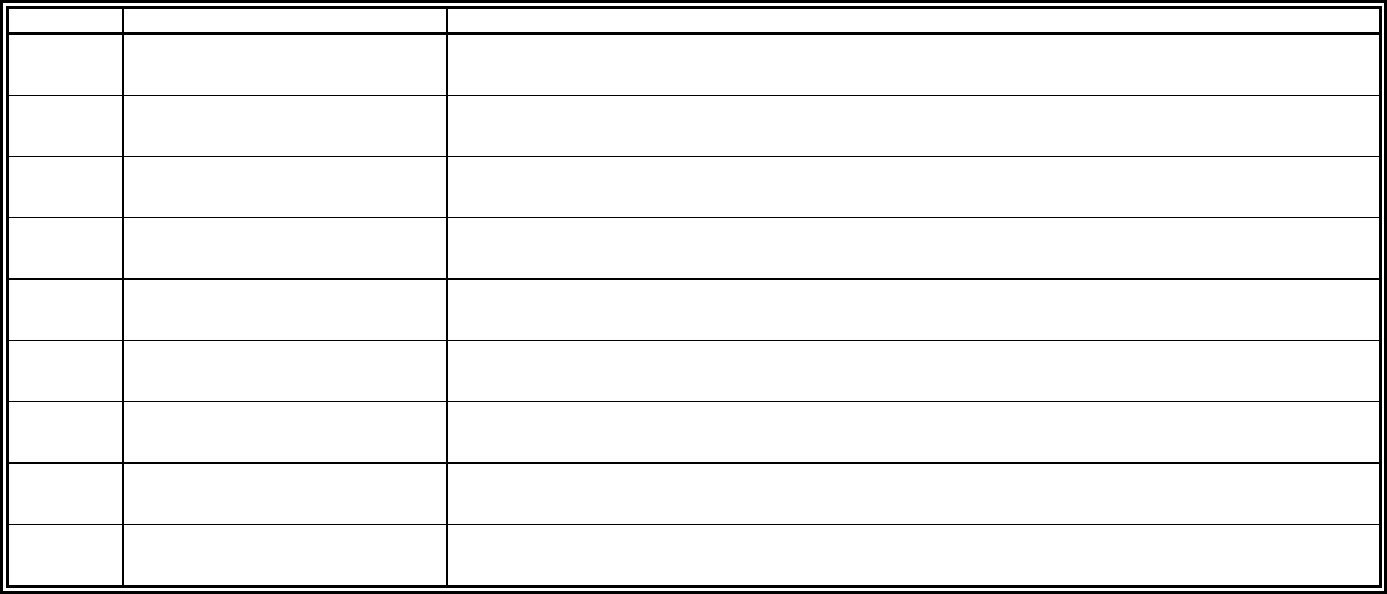

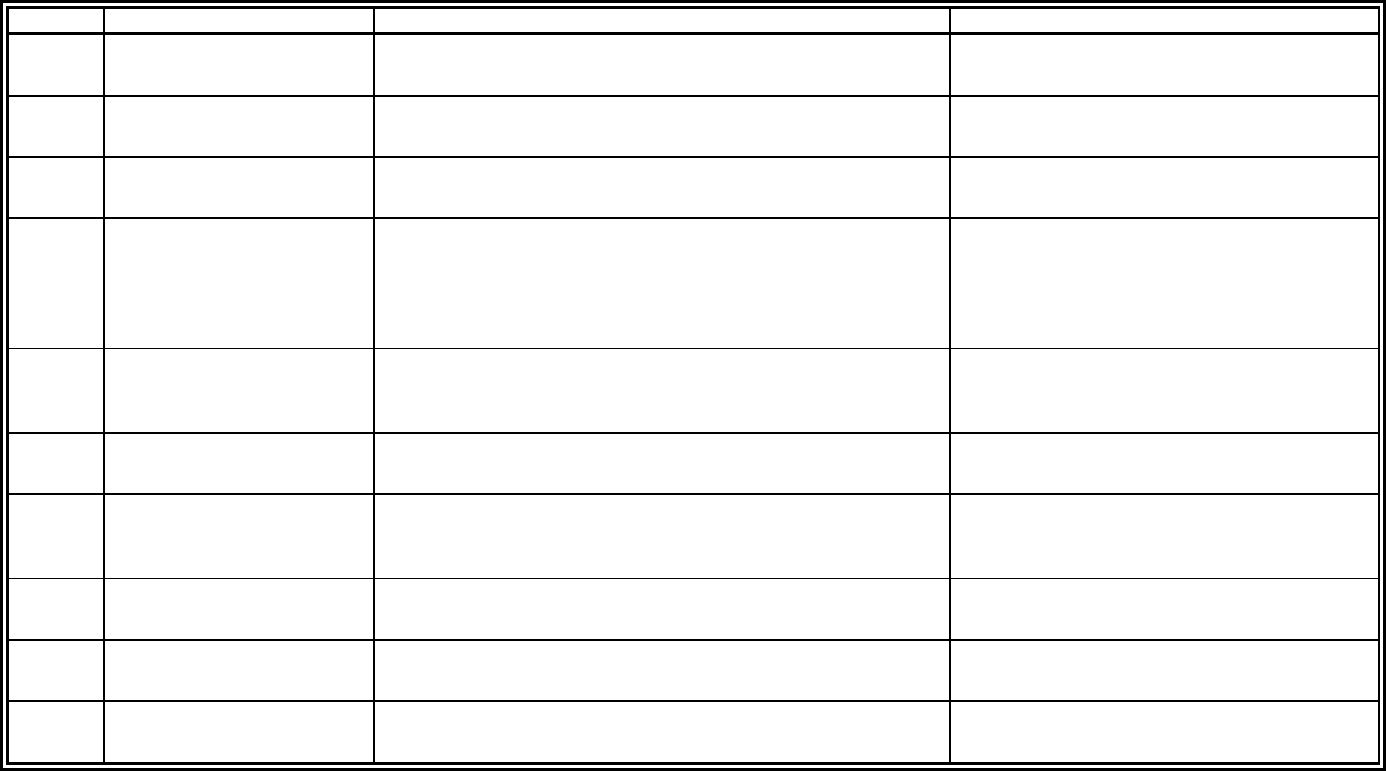

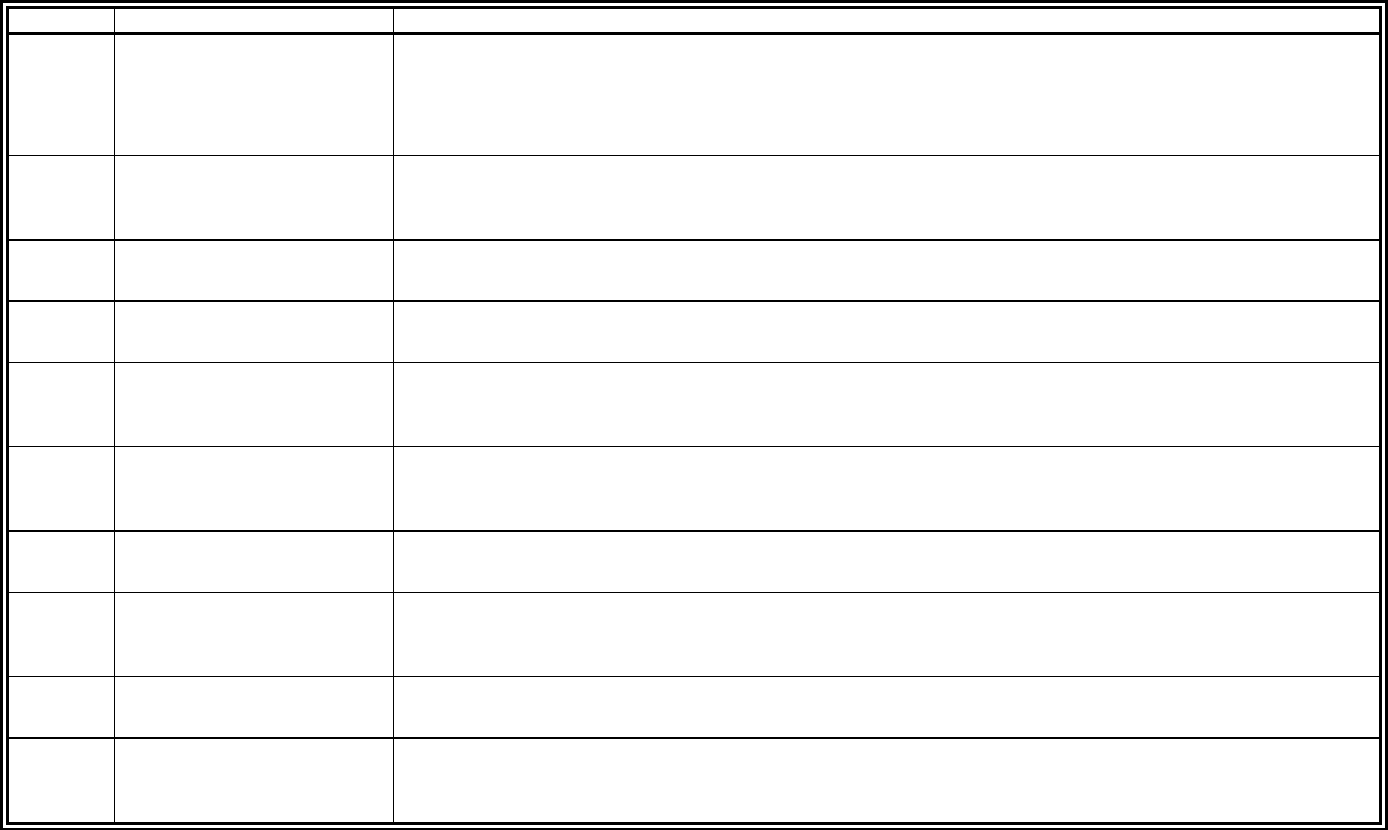

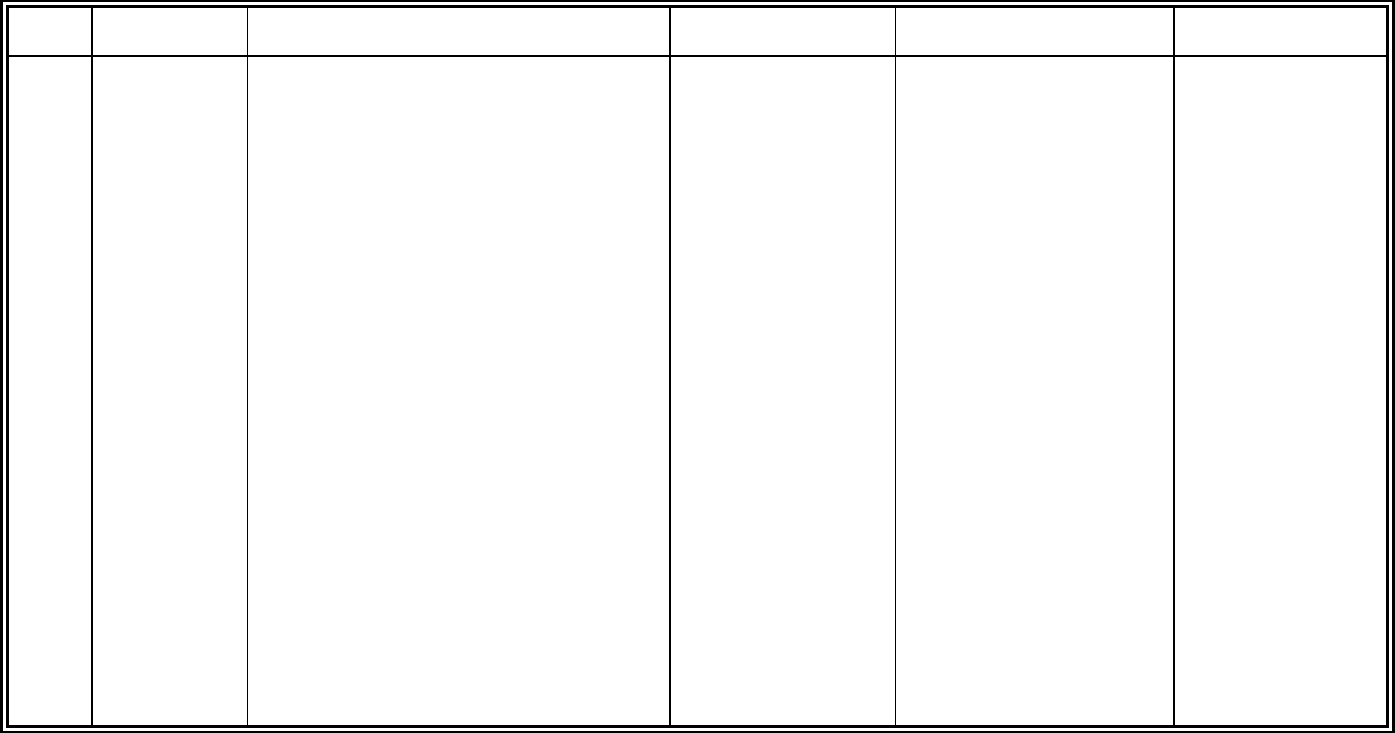

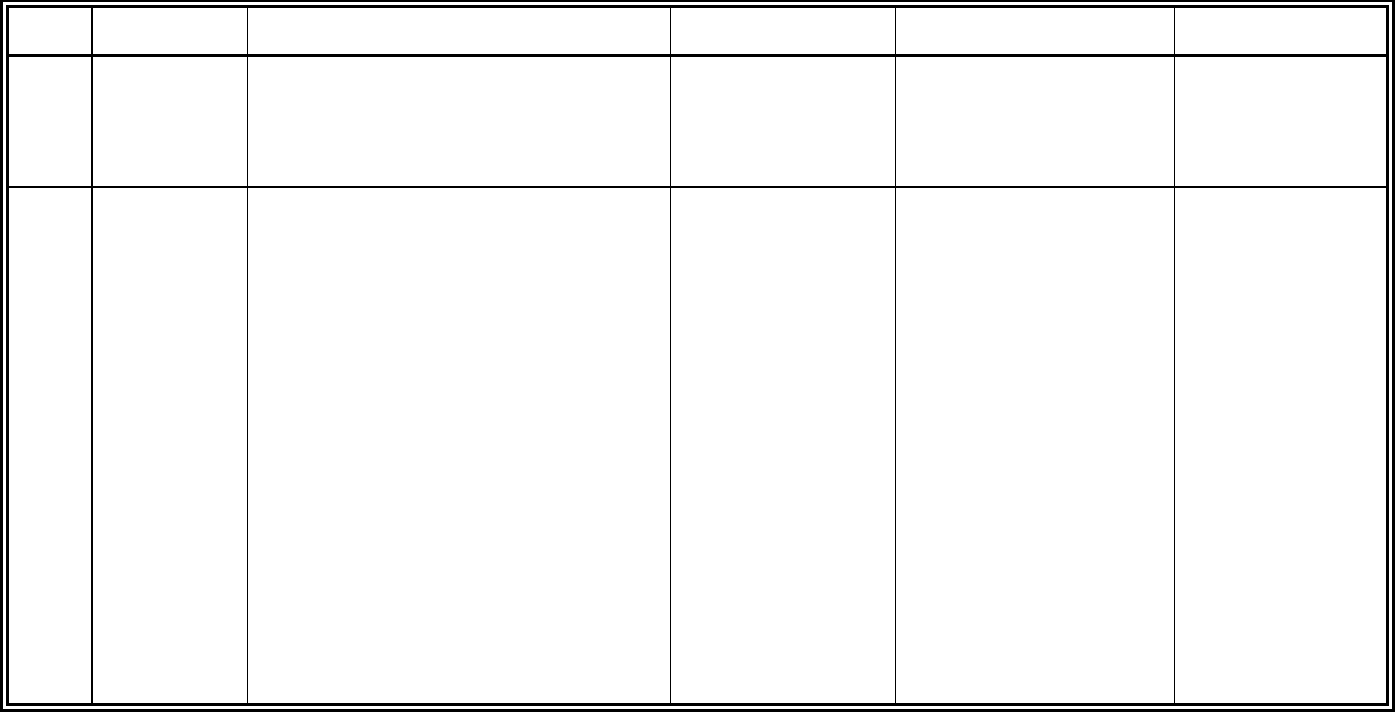

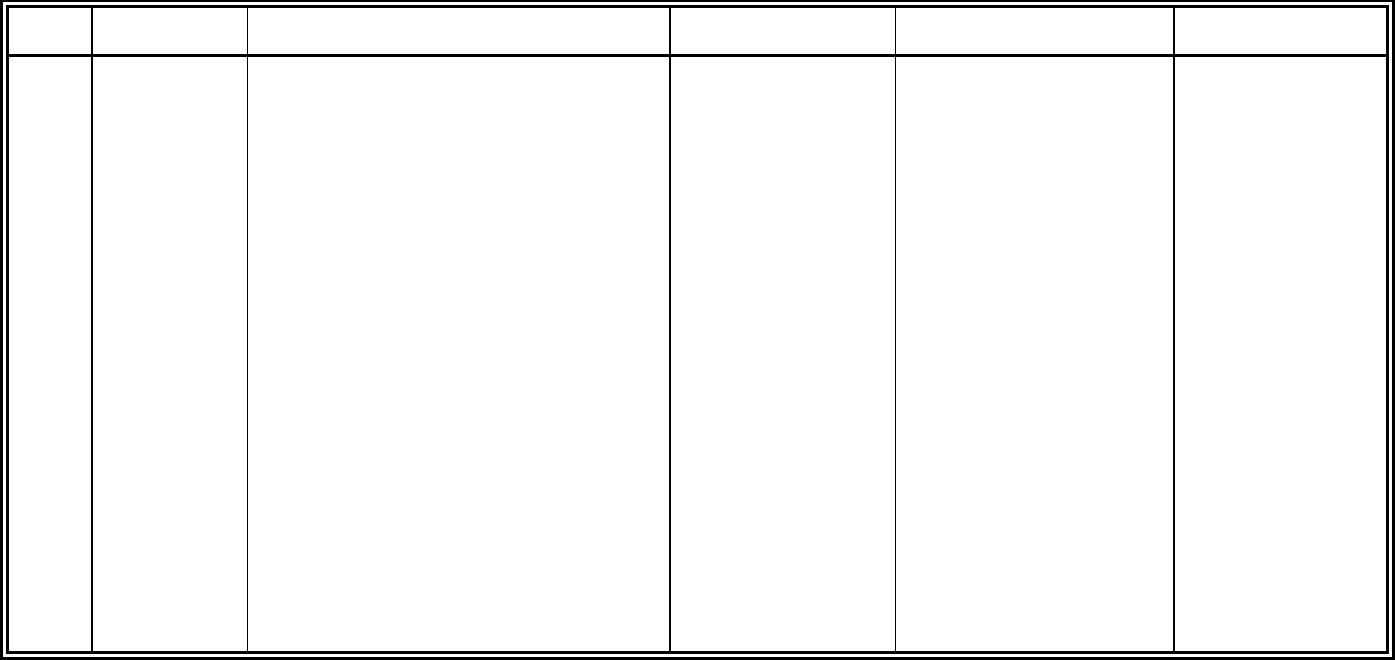

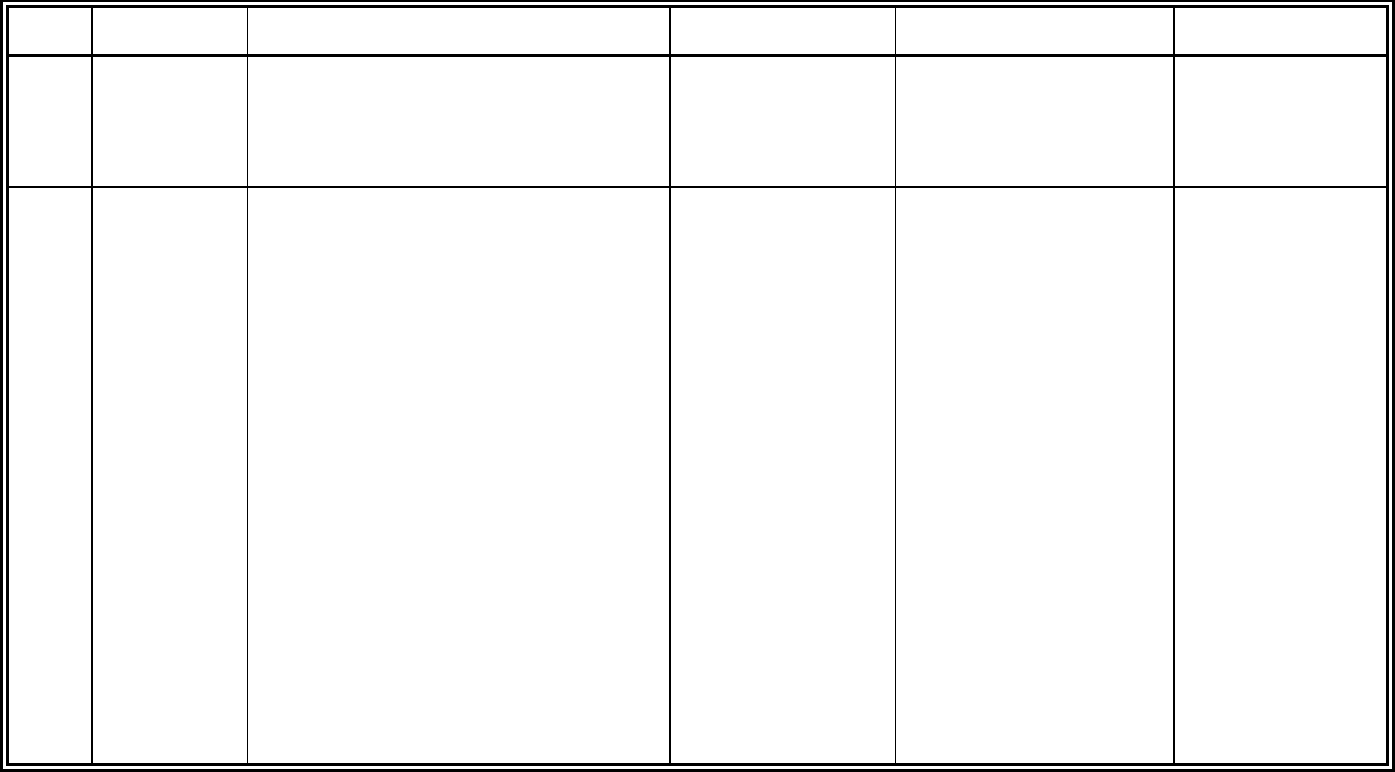

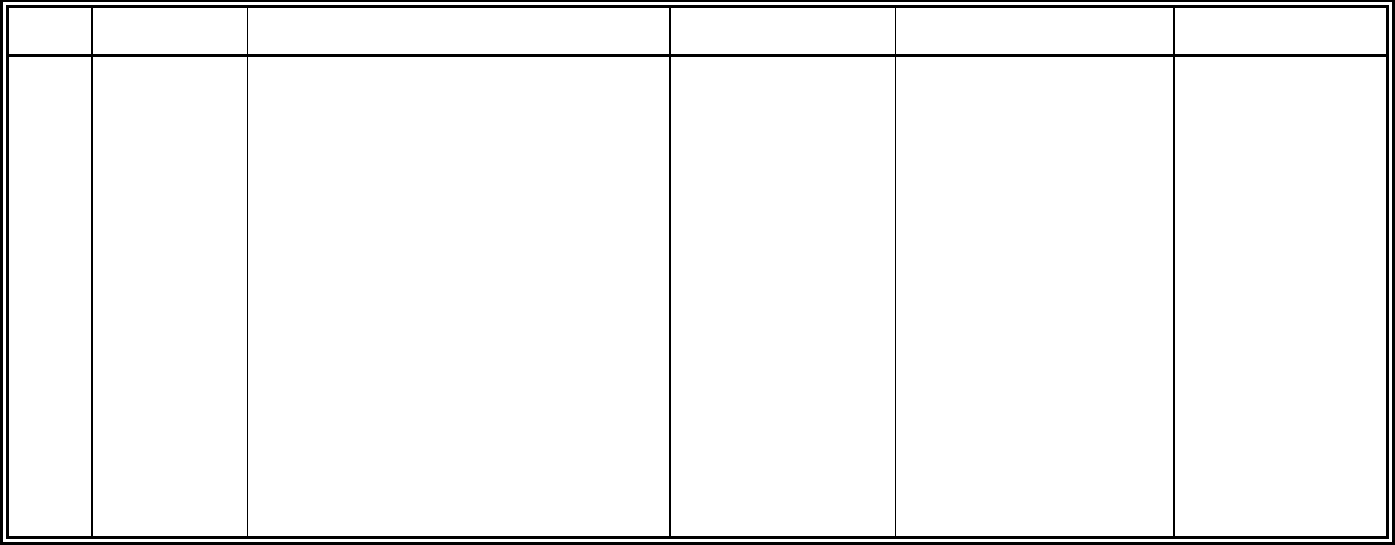

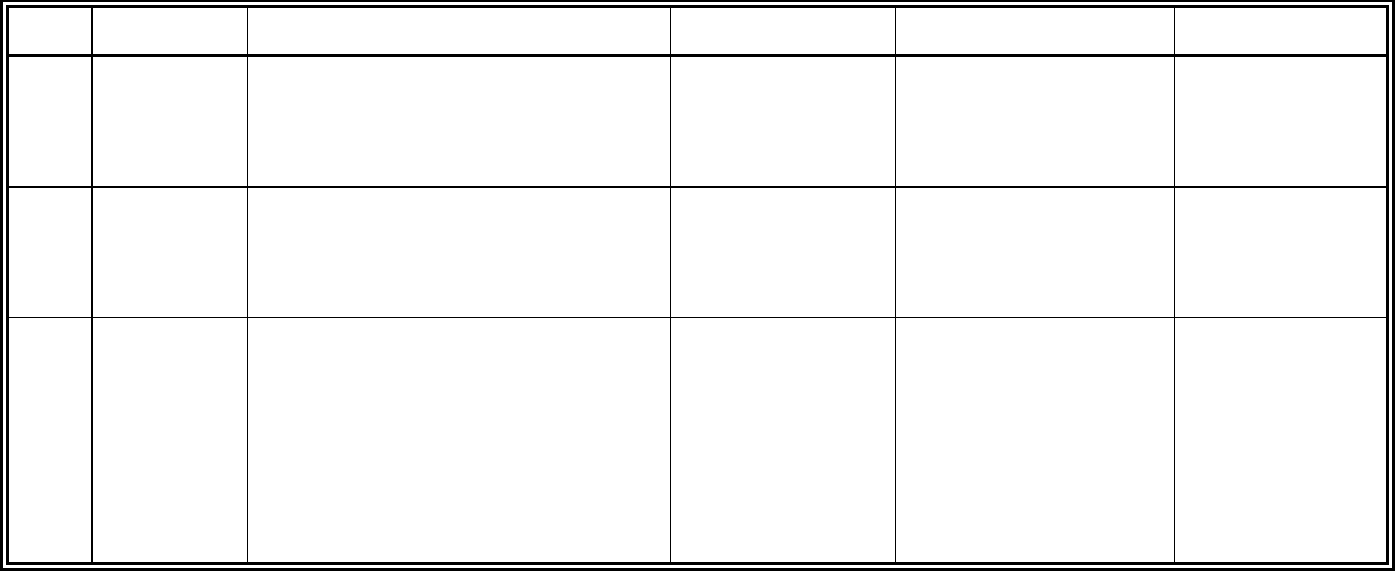

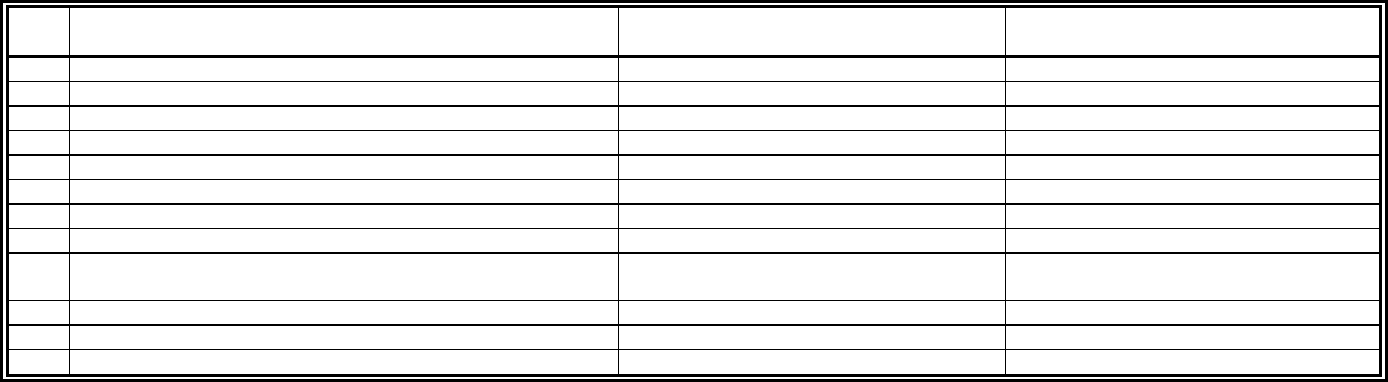

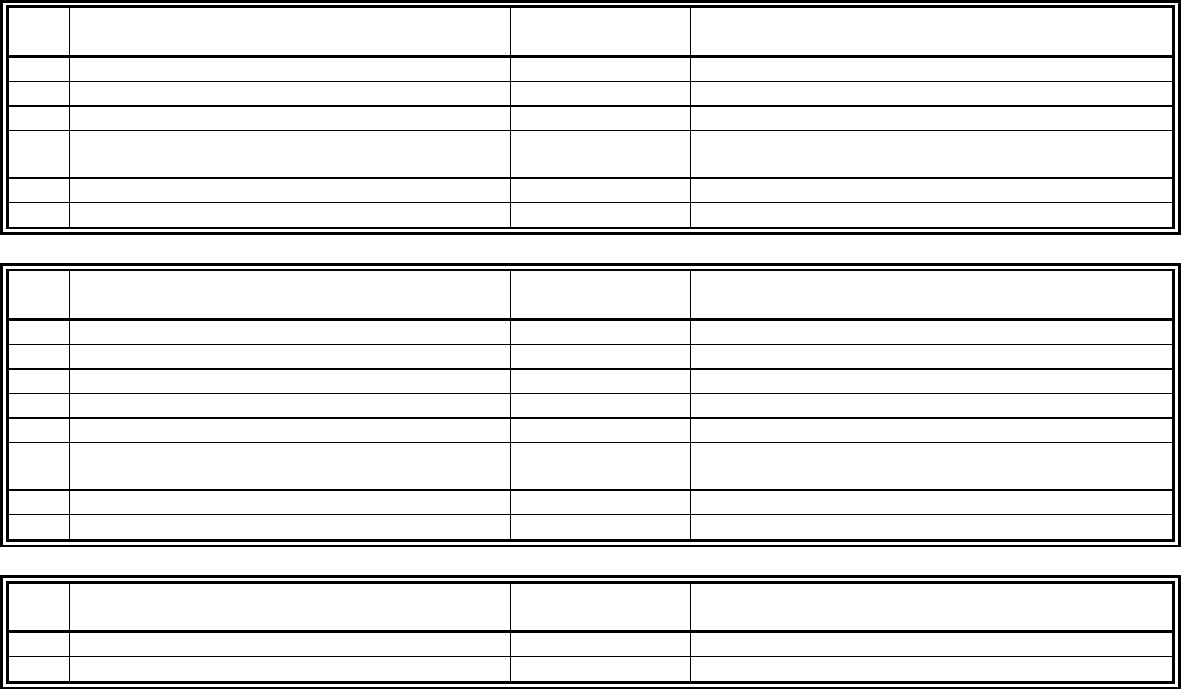

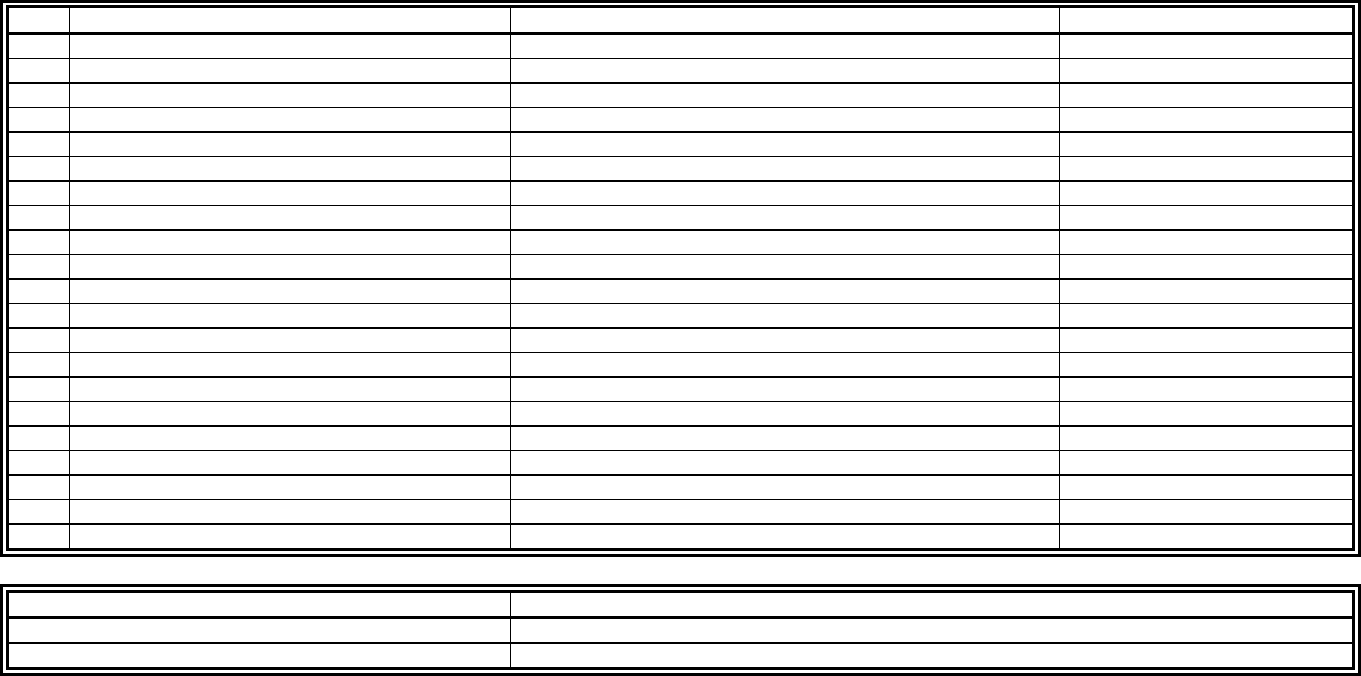

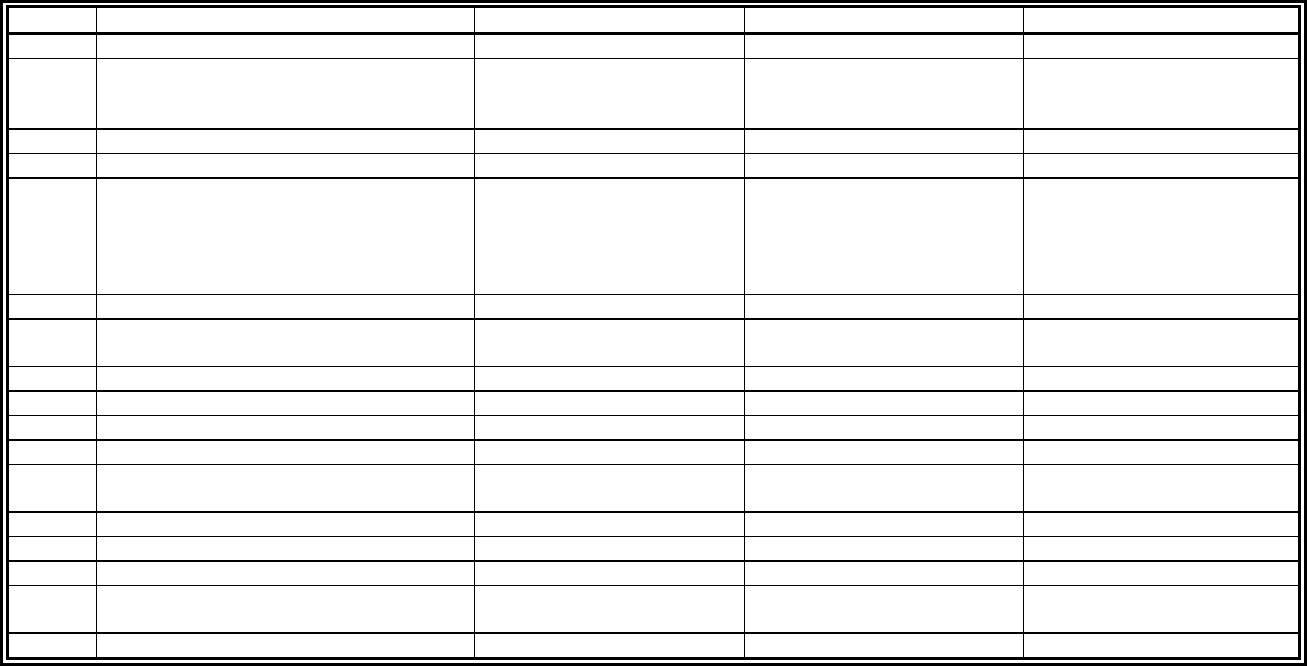

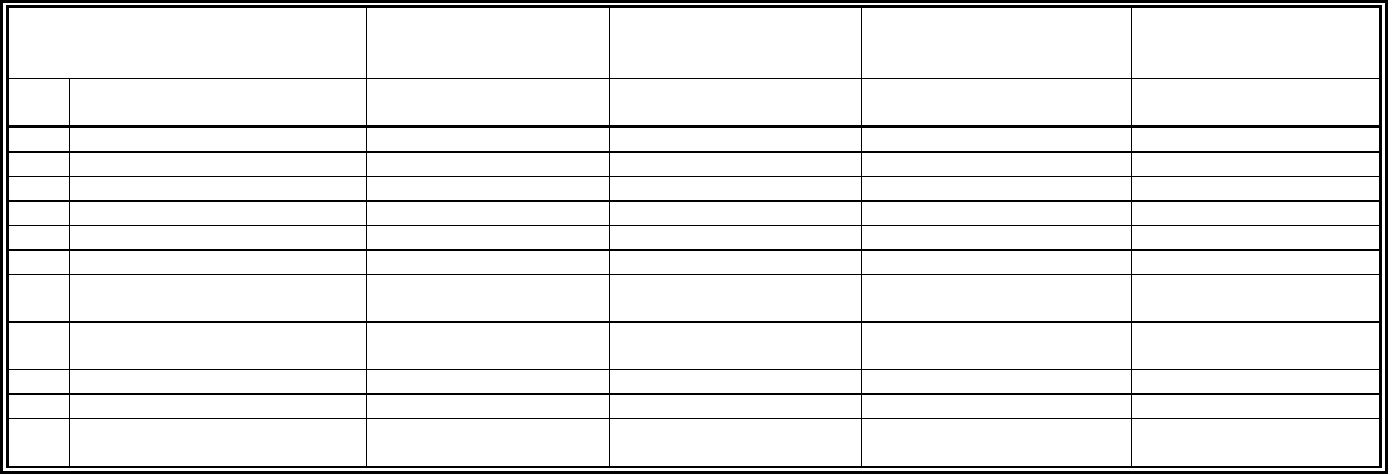

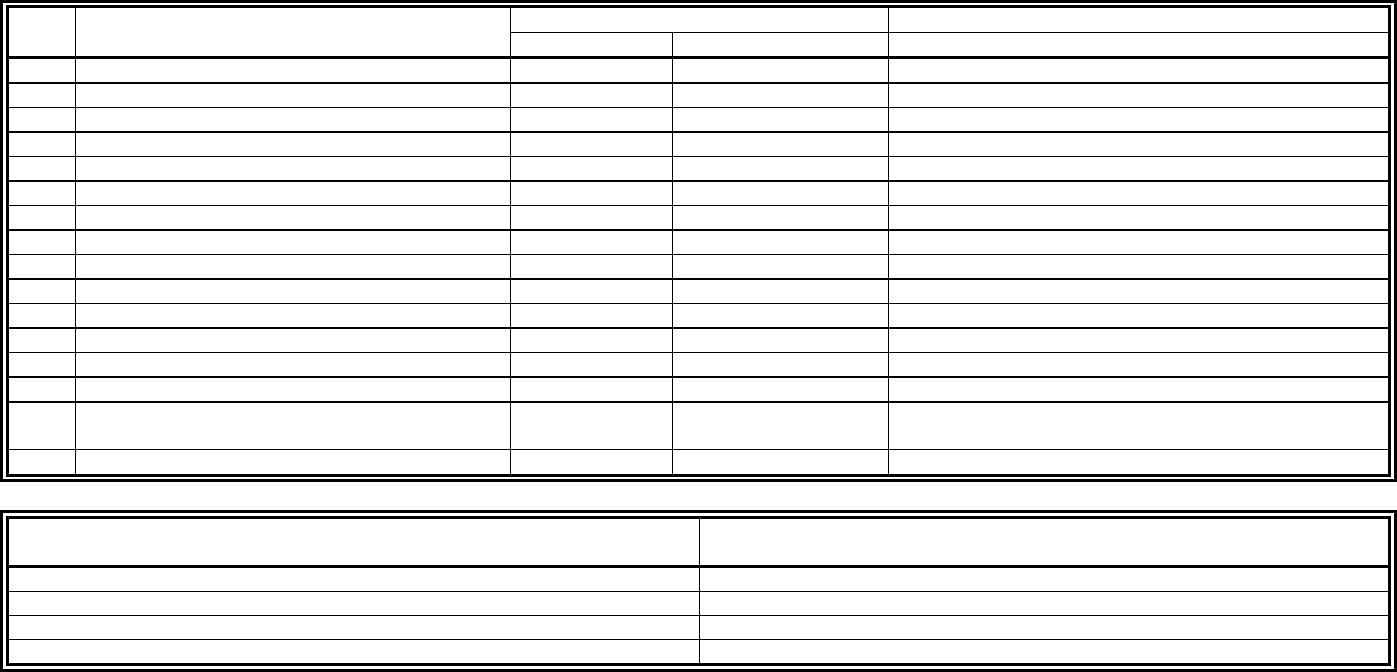

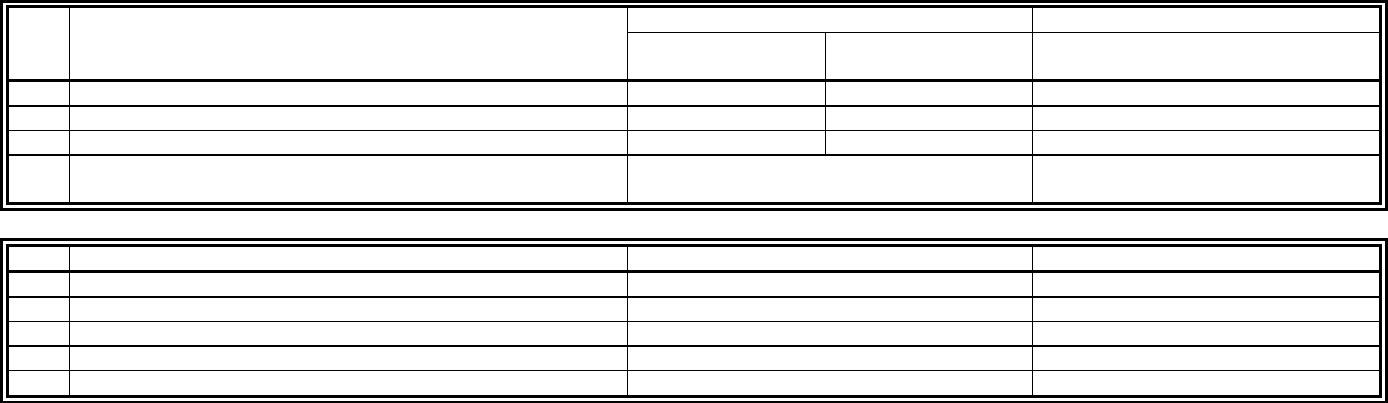

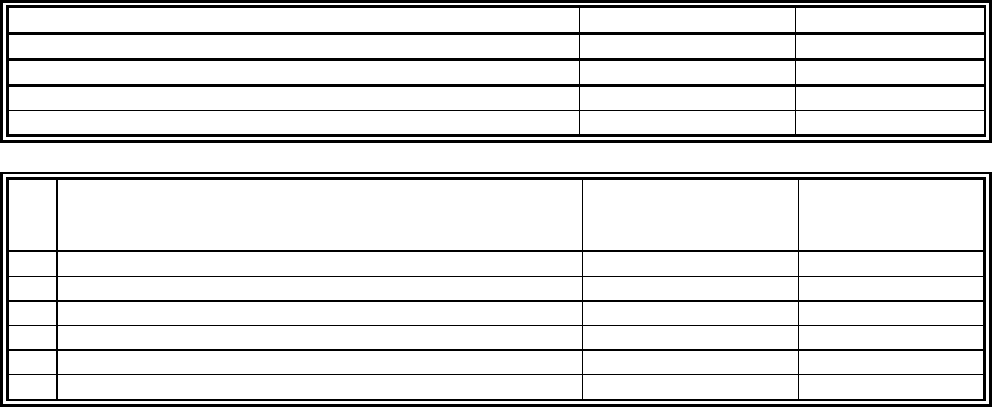

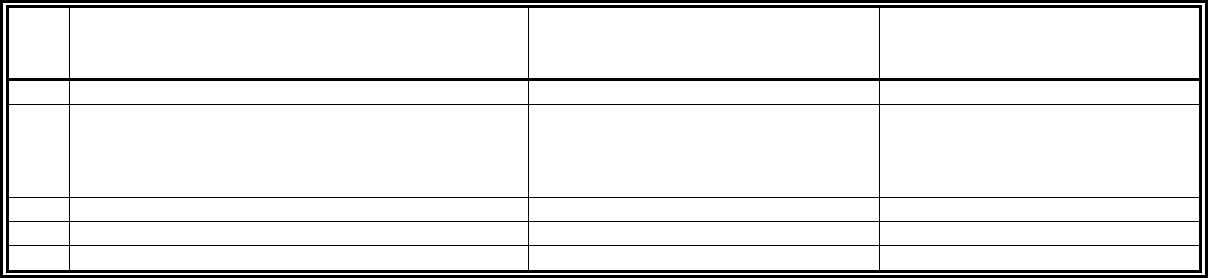

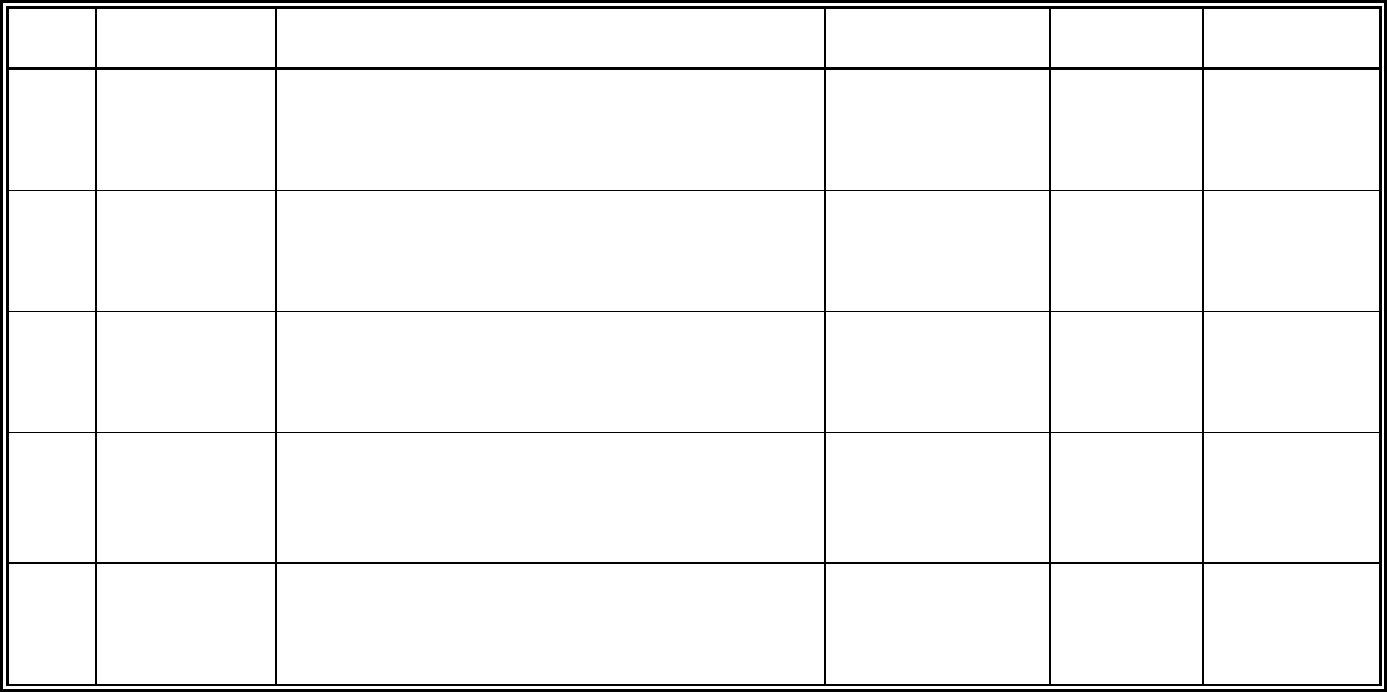

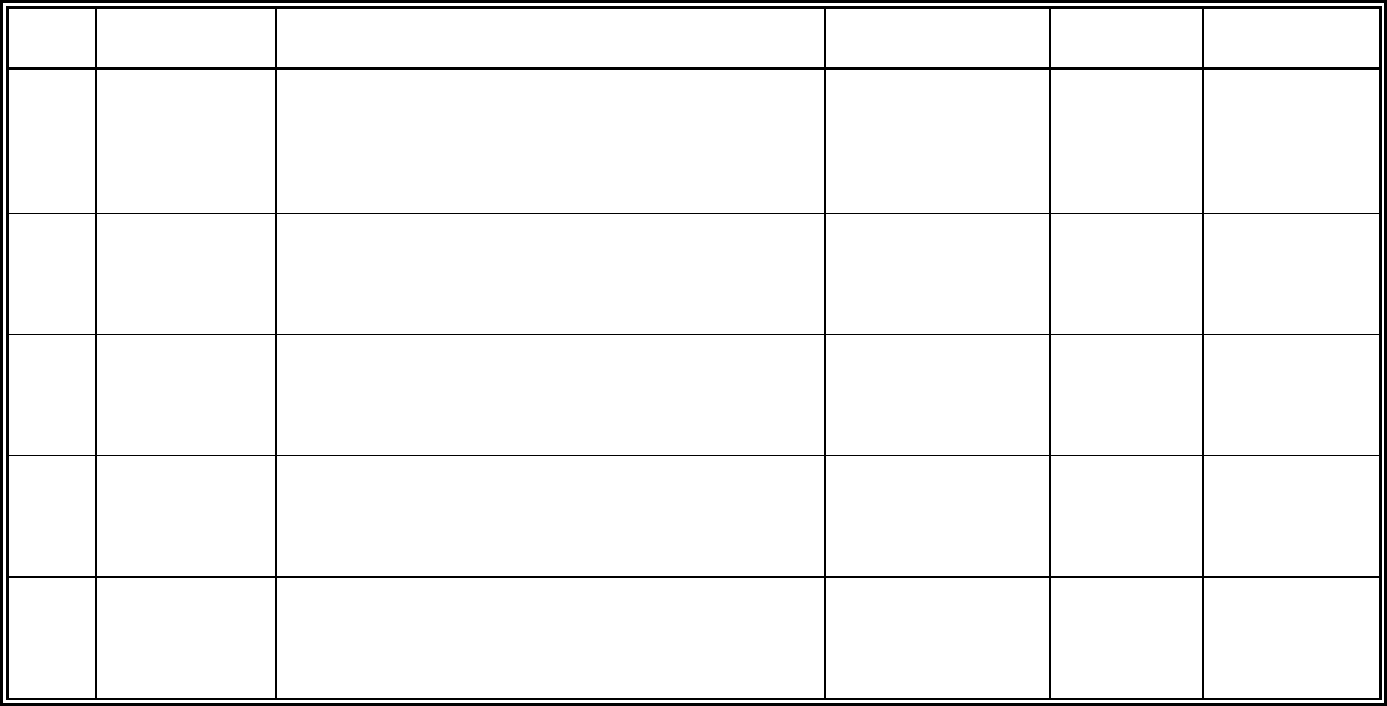

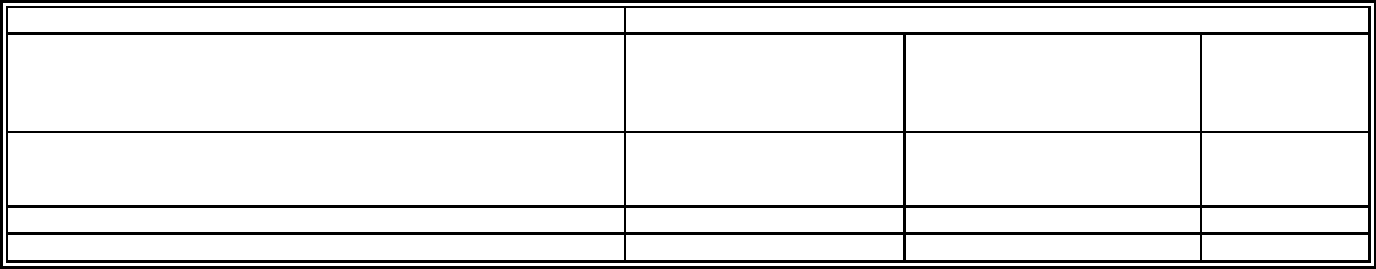

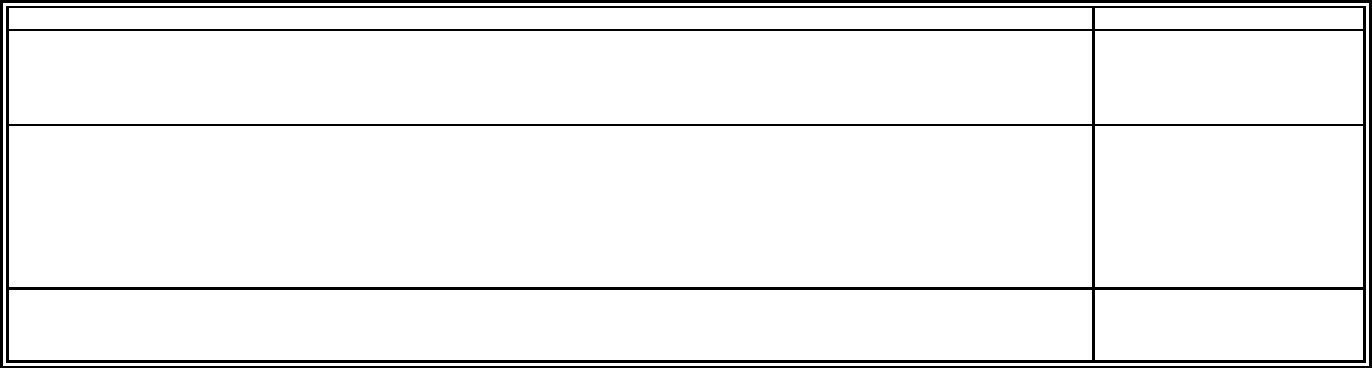

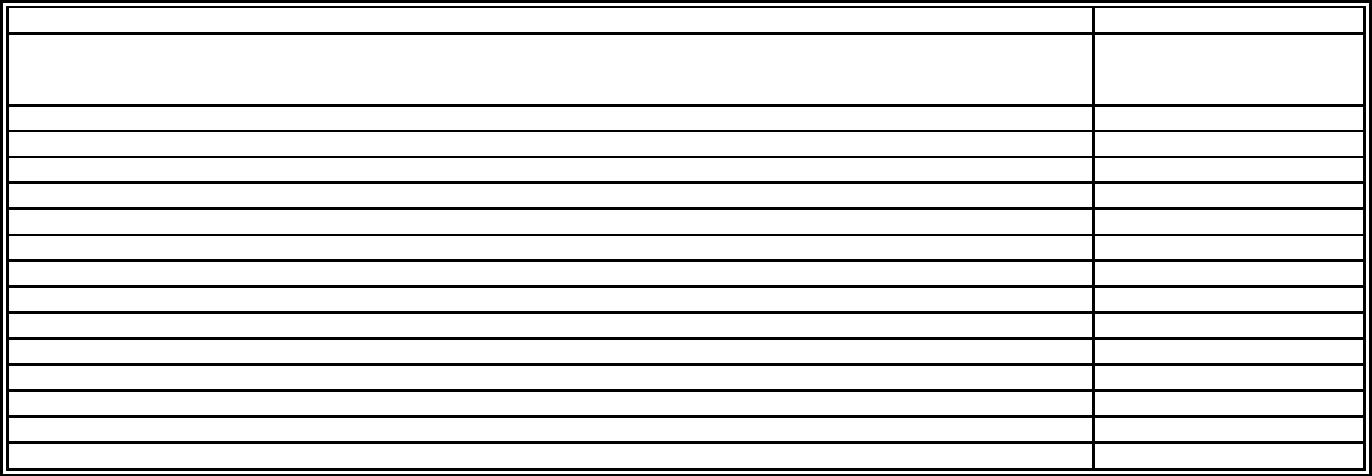

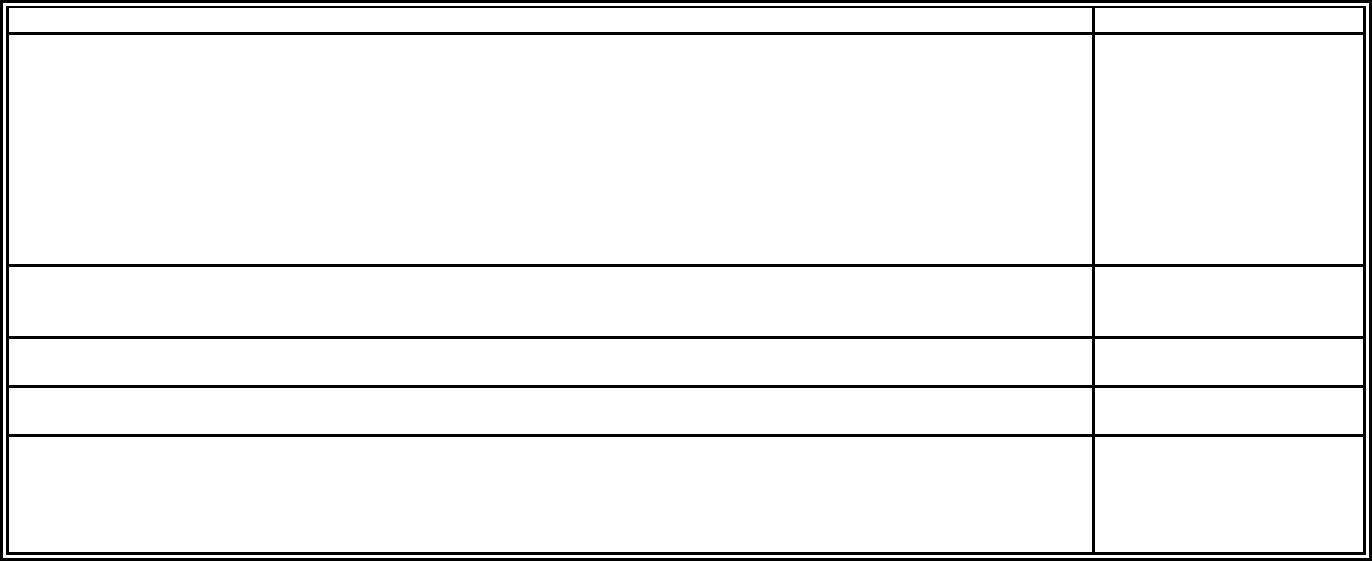

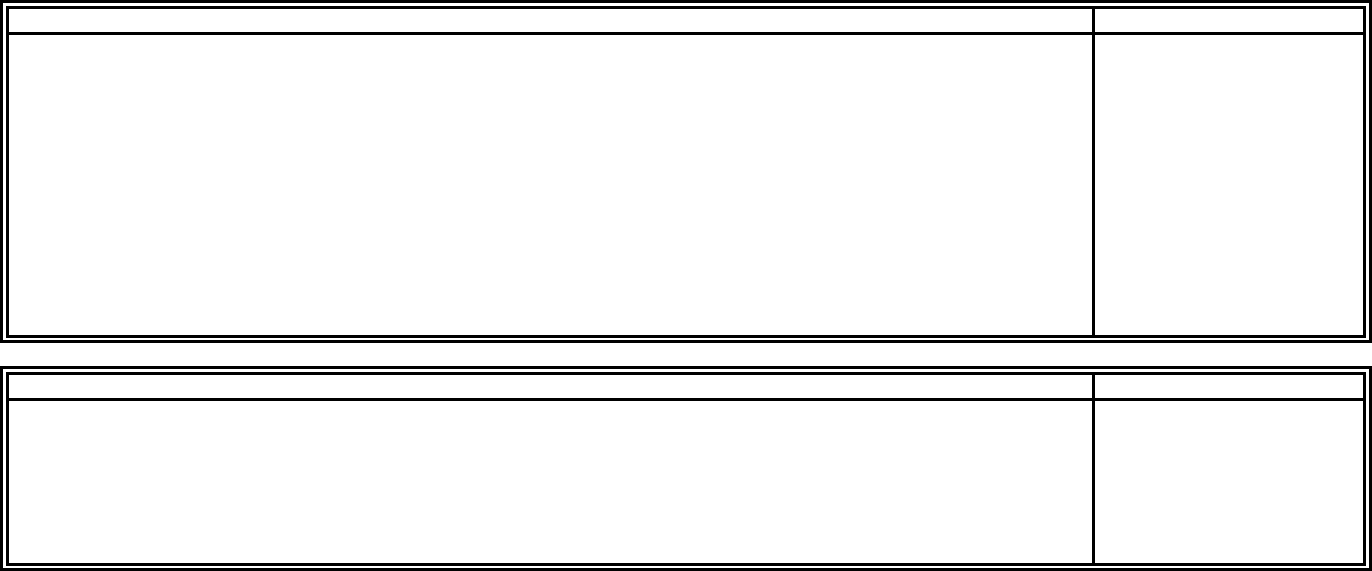

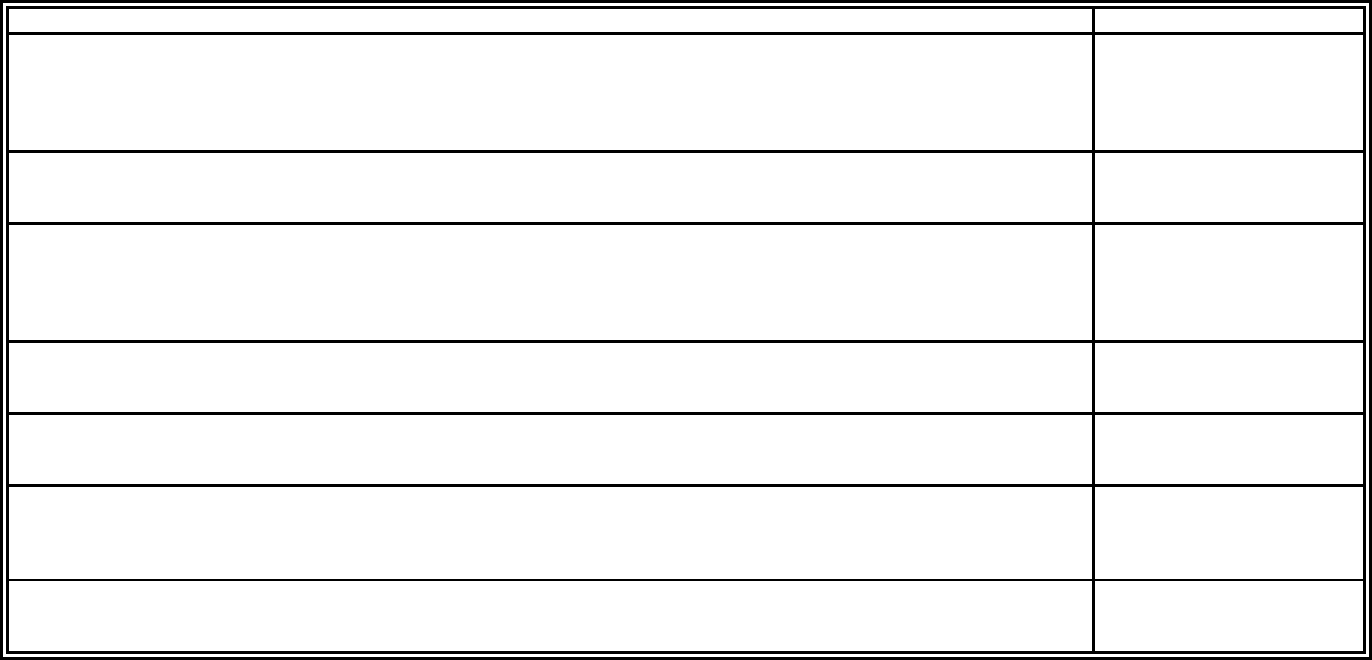

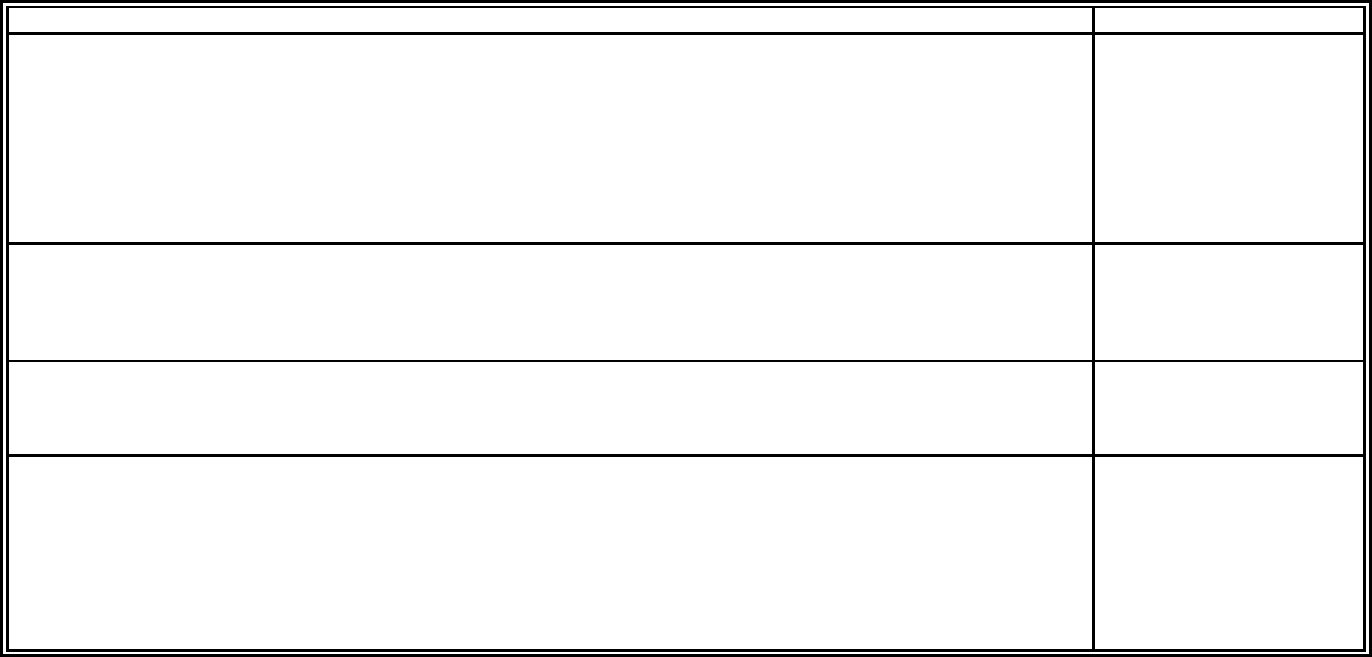

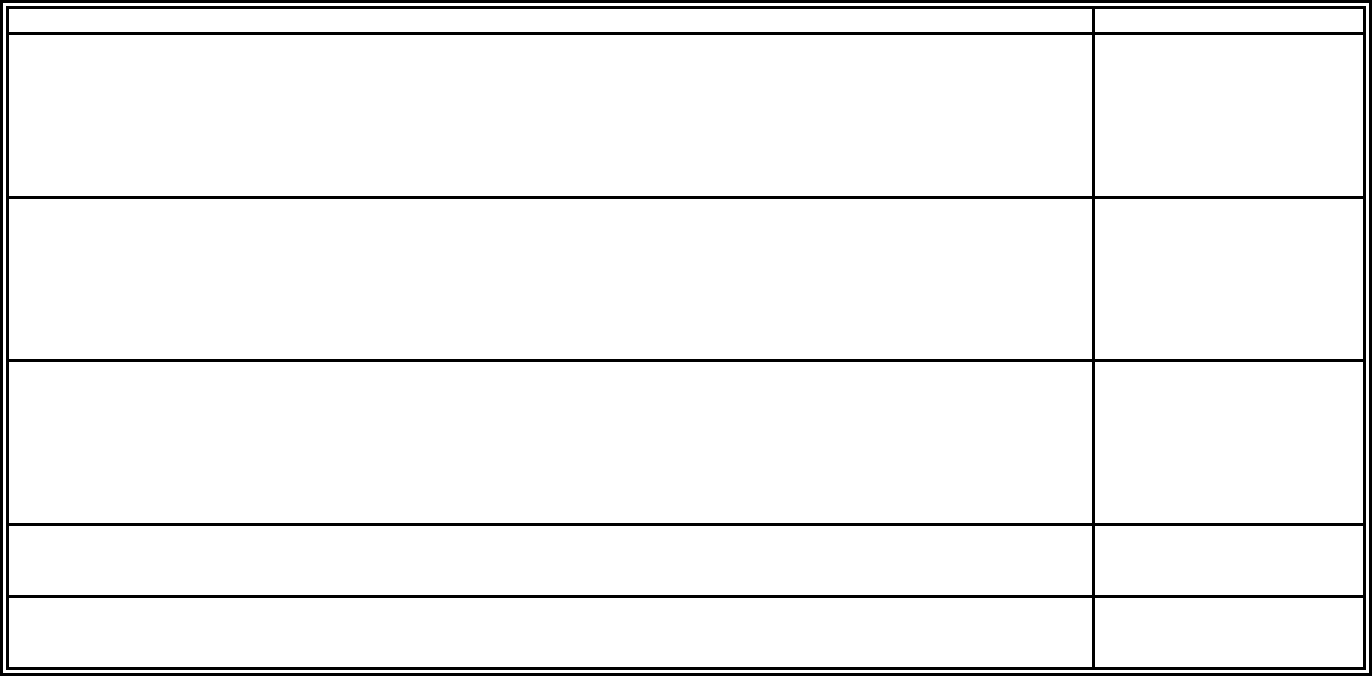

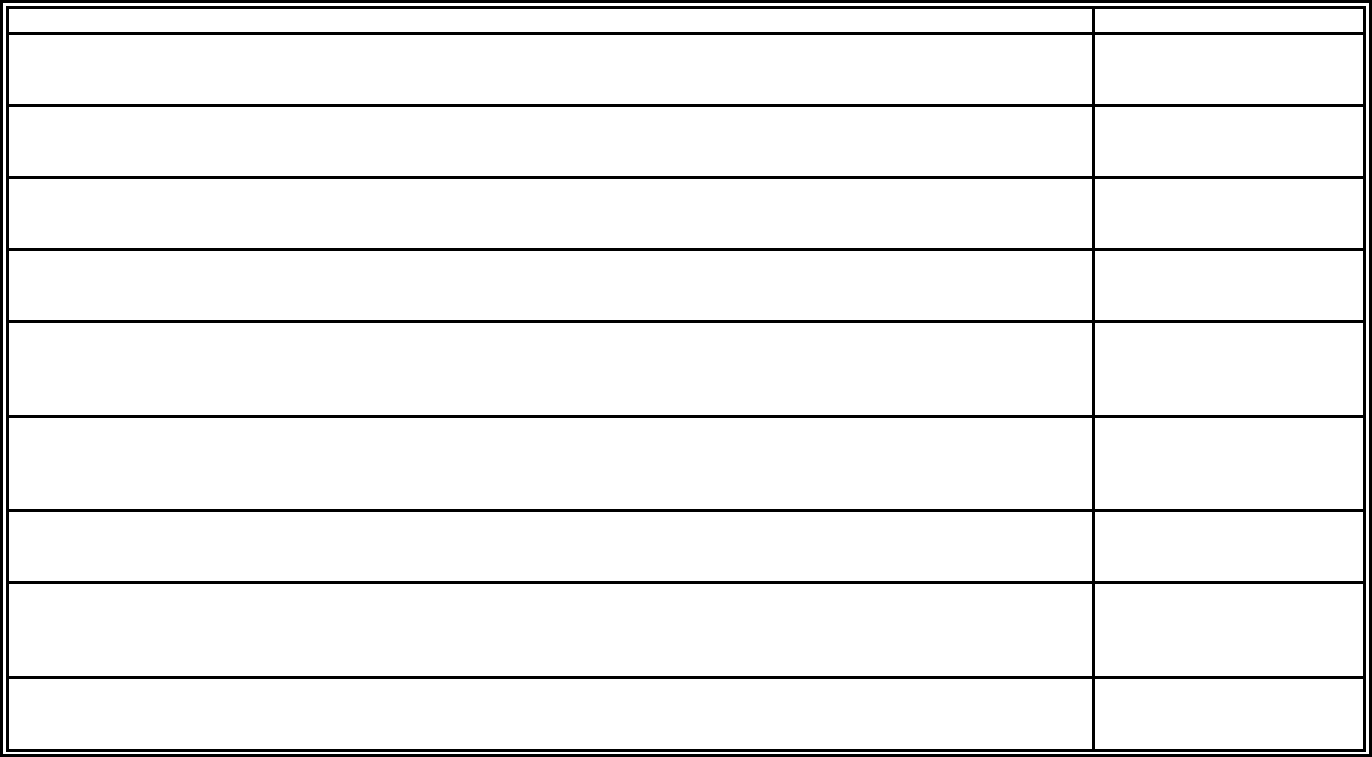

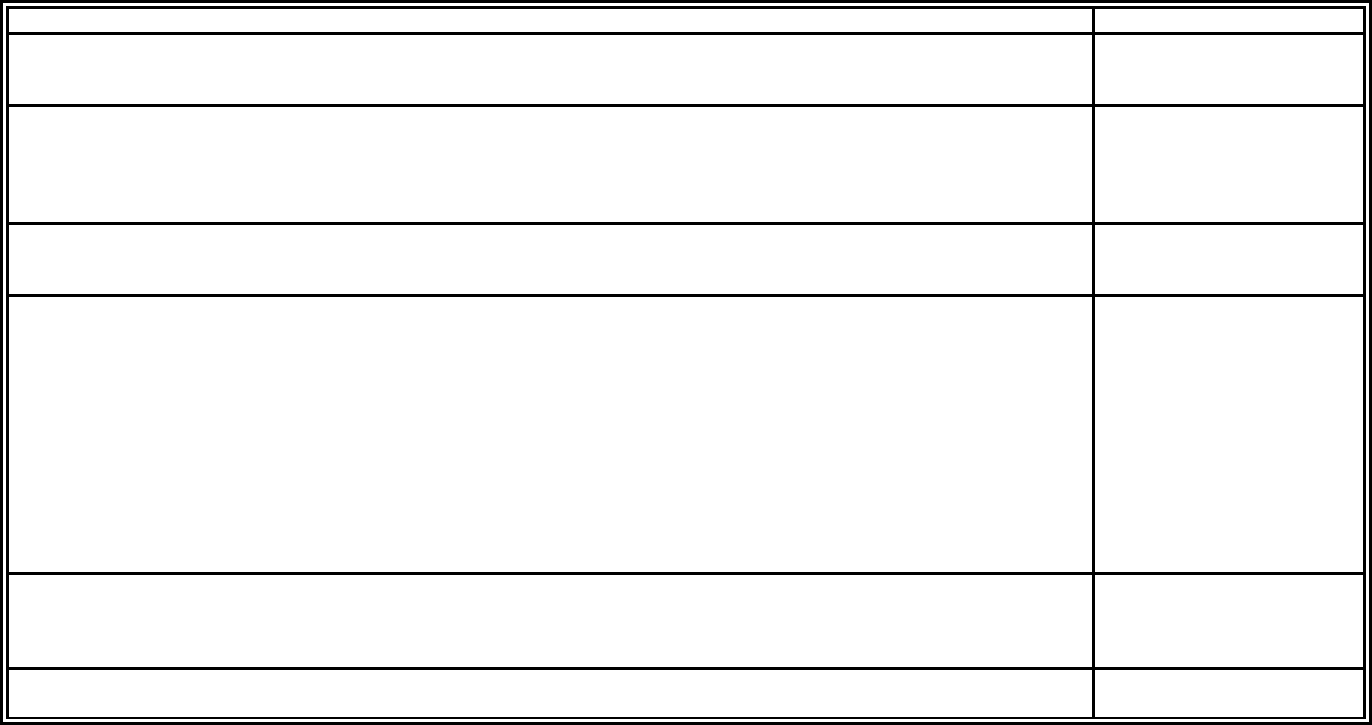

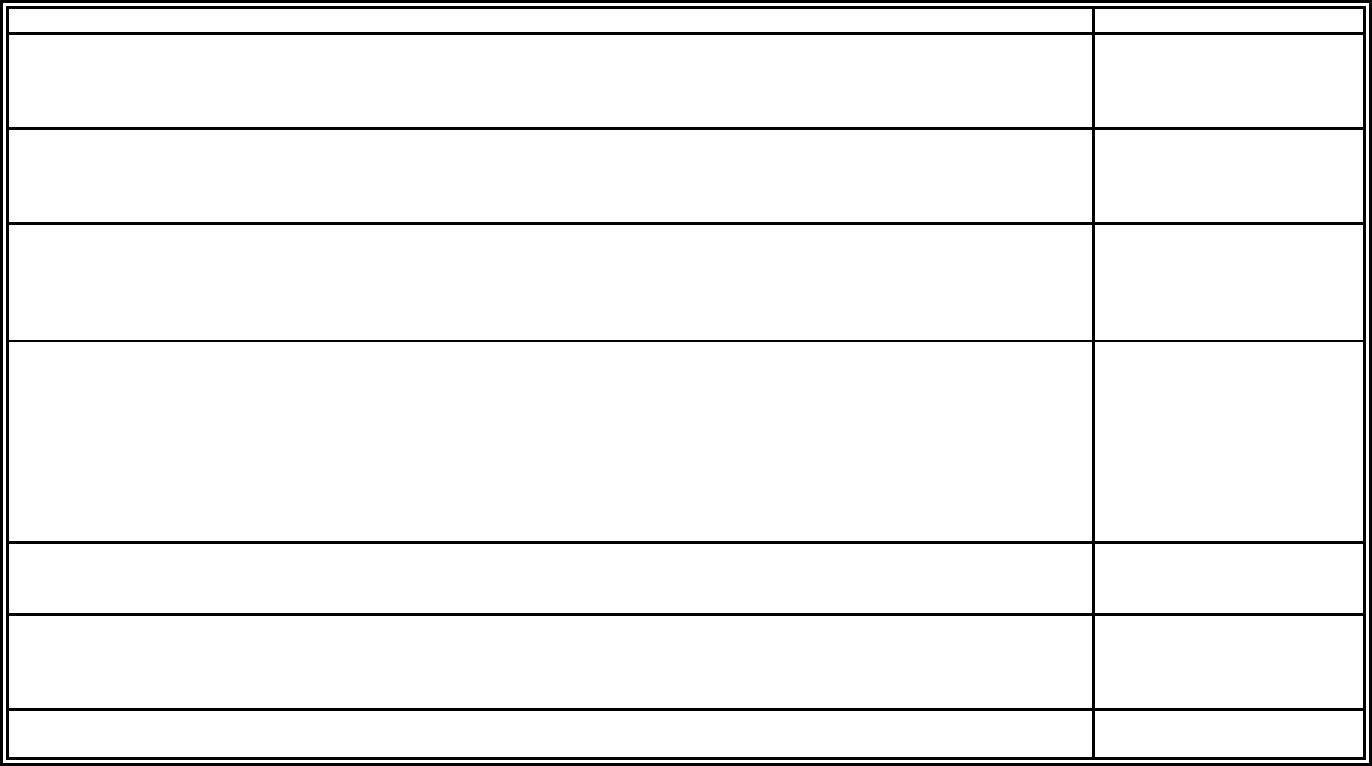

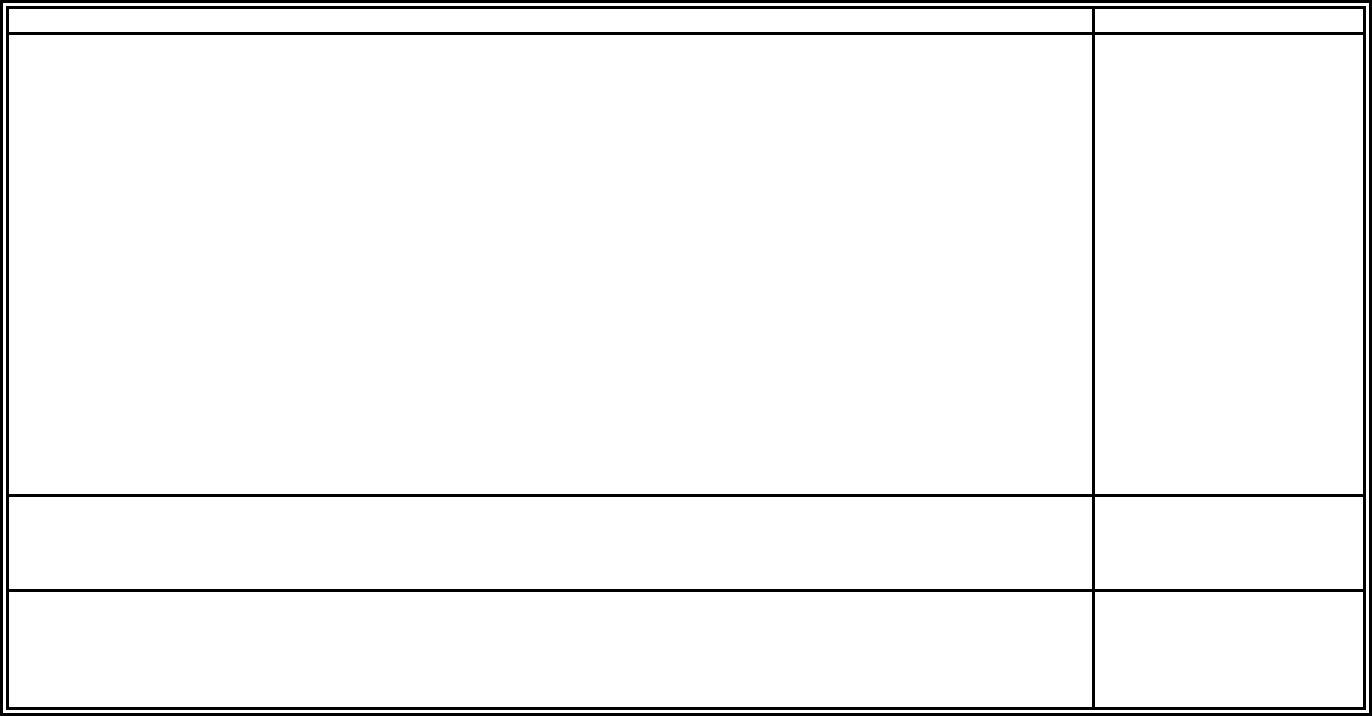

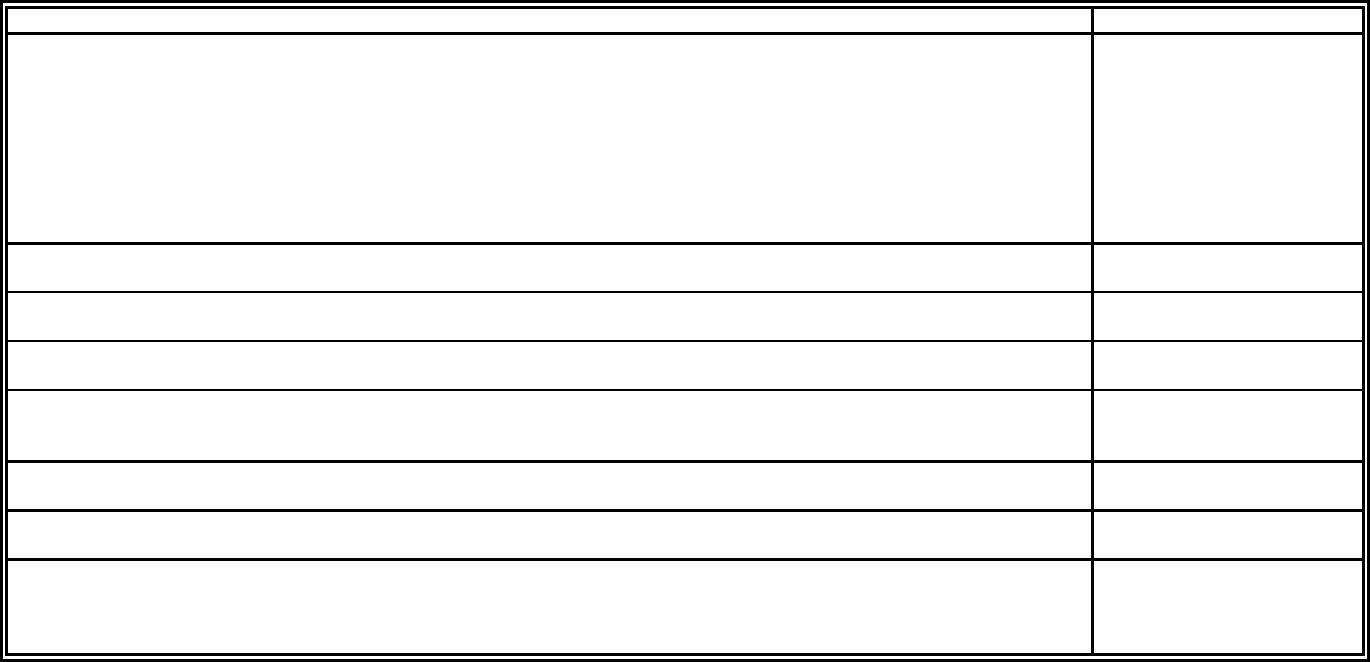

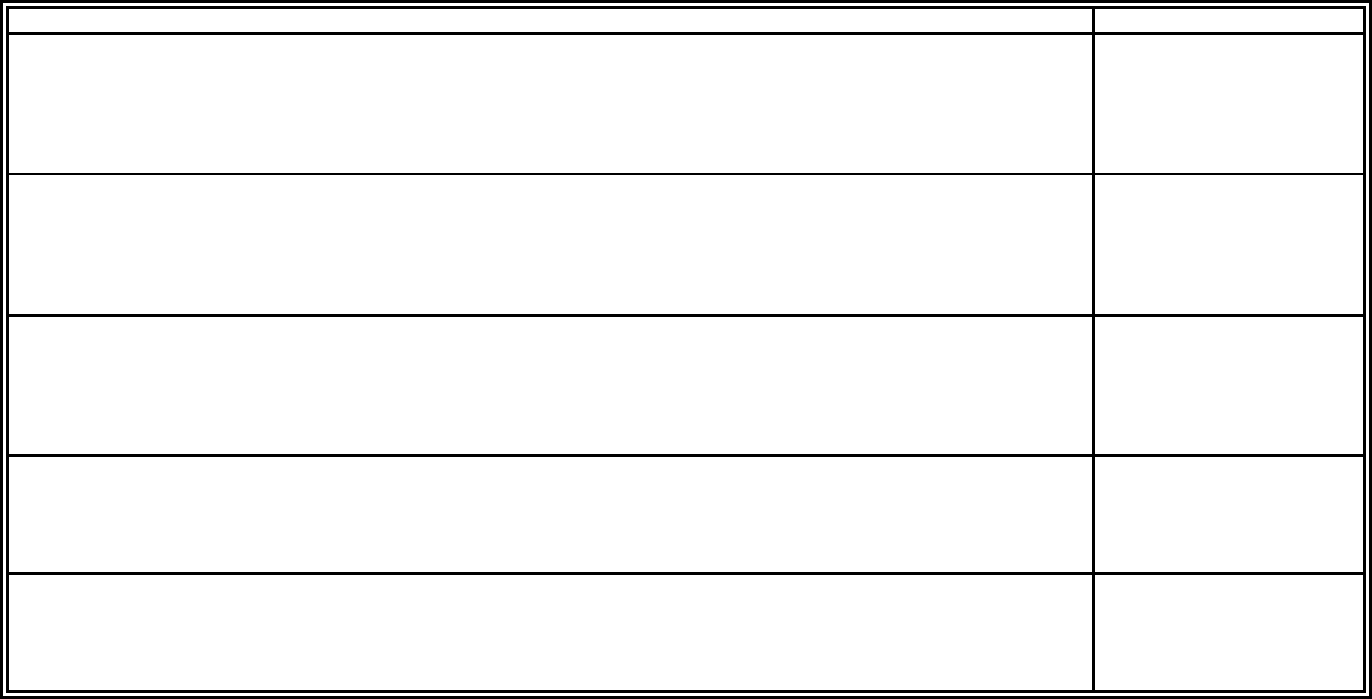

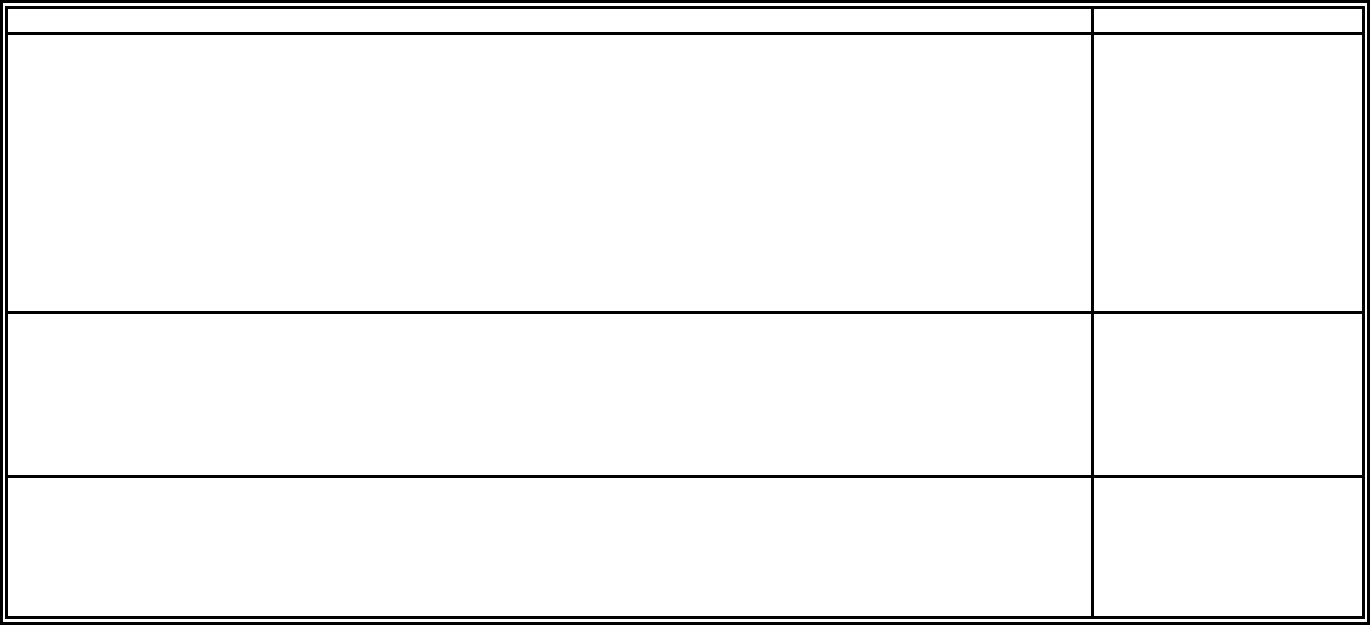

Producer Licensing Fees:

§§ 21.27.010; 21.27.025; 21.27.040; 21.59.140; 21.59.160; 3 Alaska Admin. Code 31.020 to 31.060

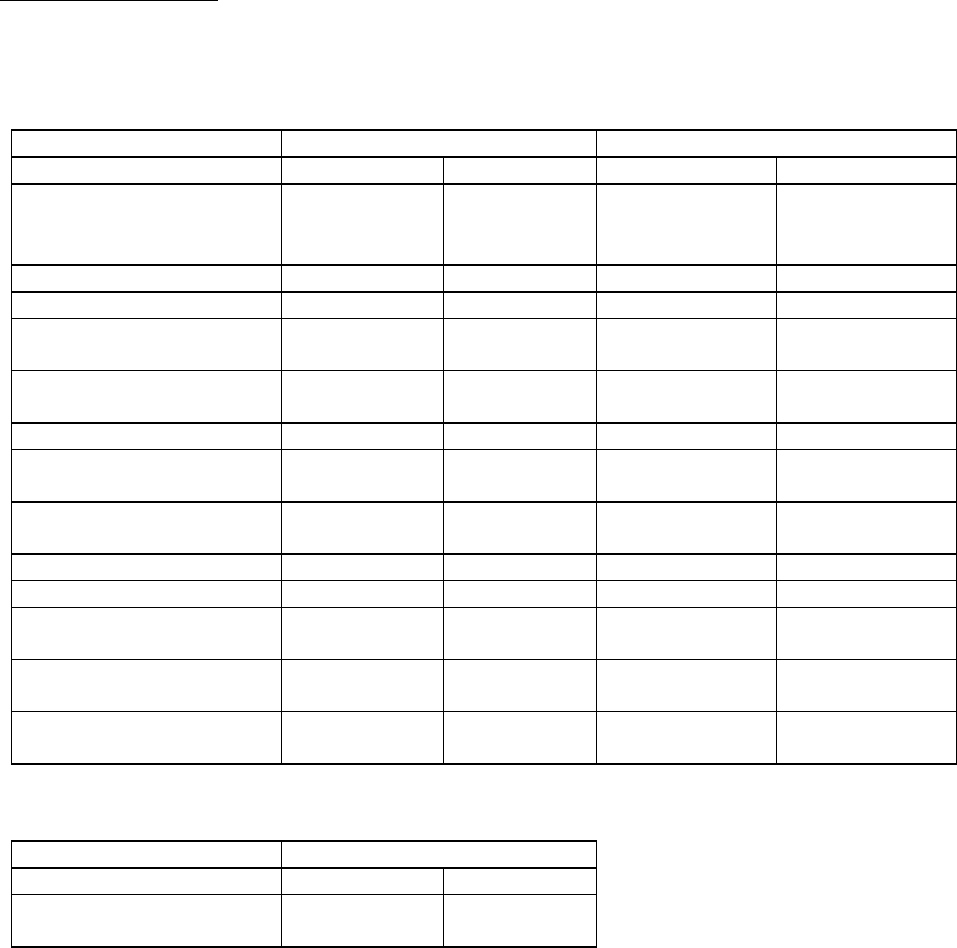

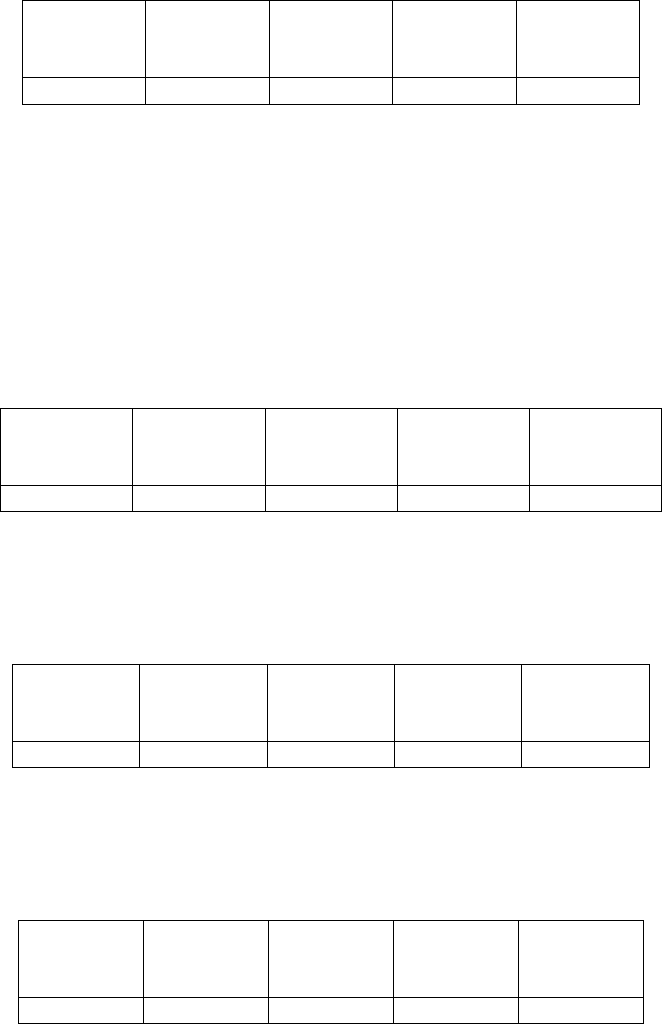

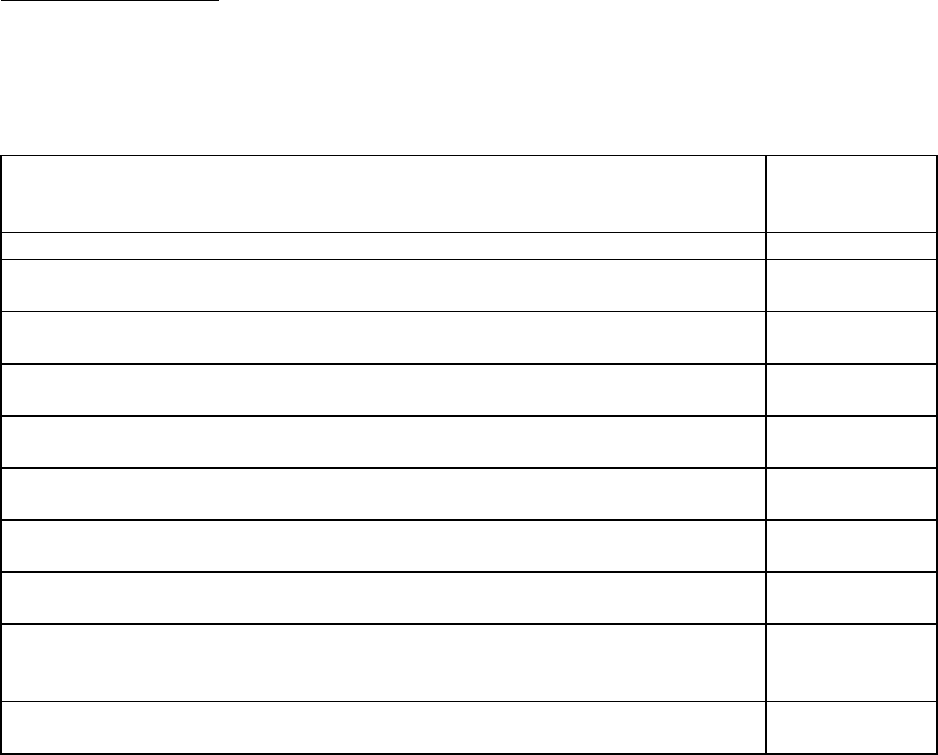

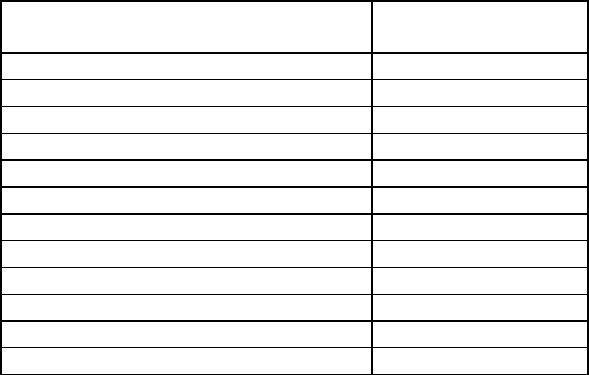

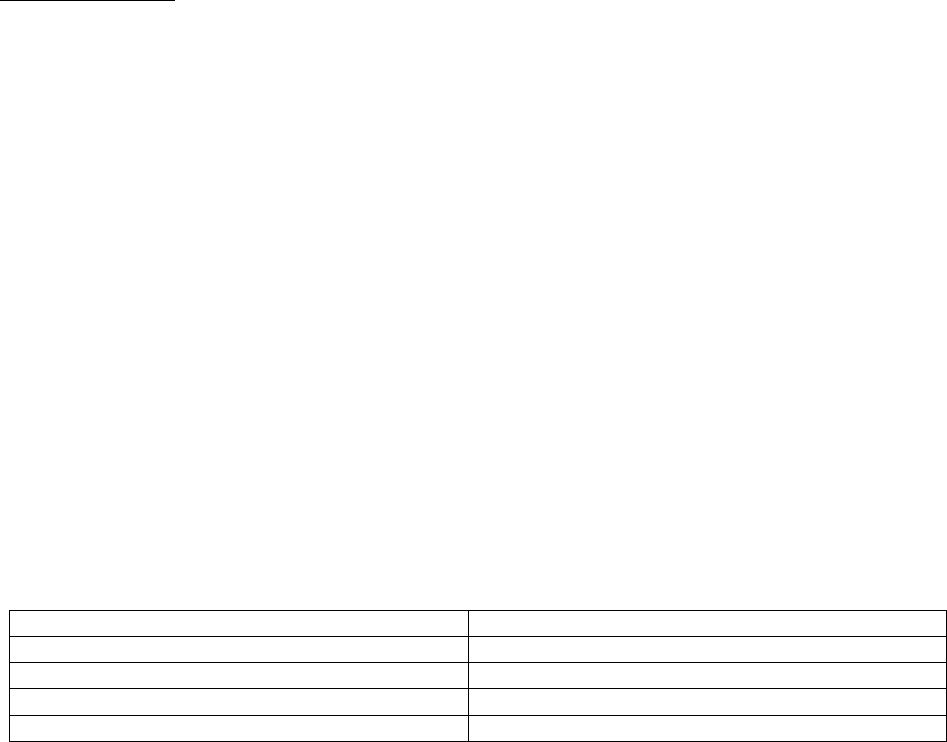

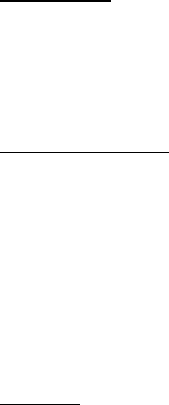

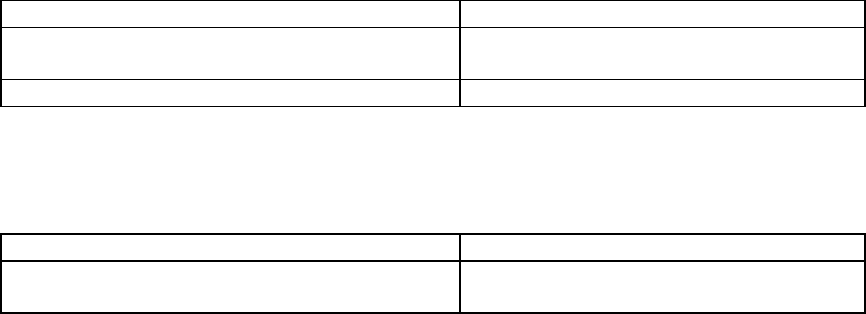

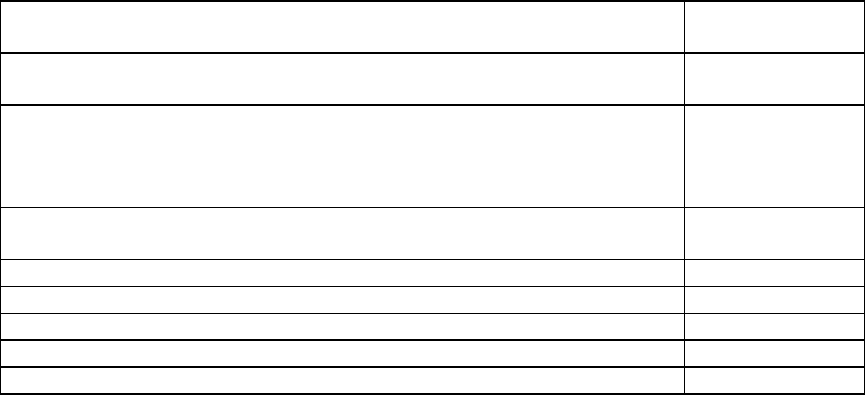

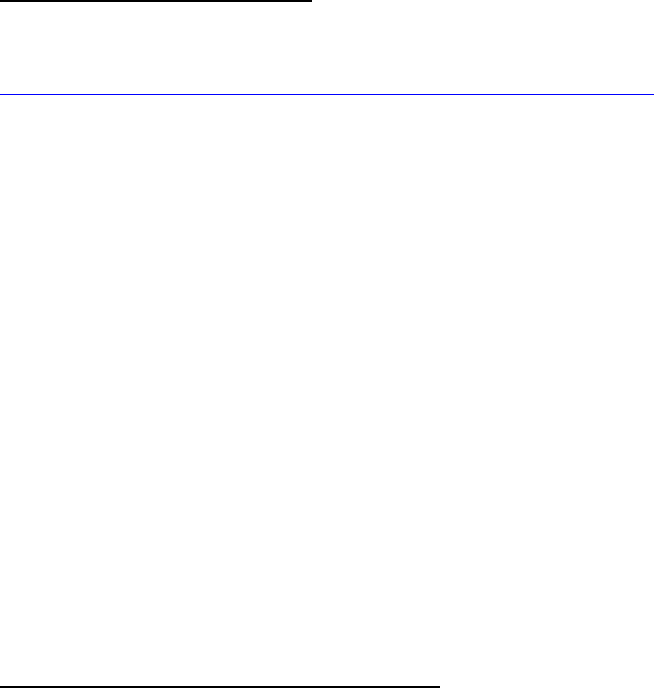

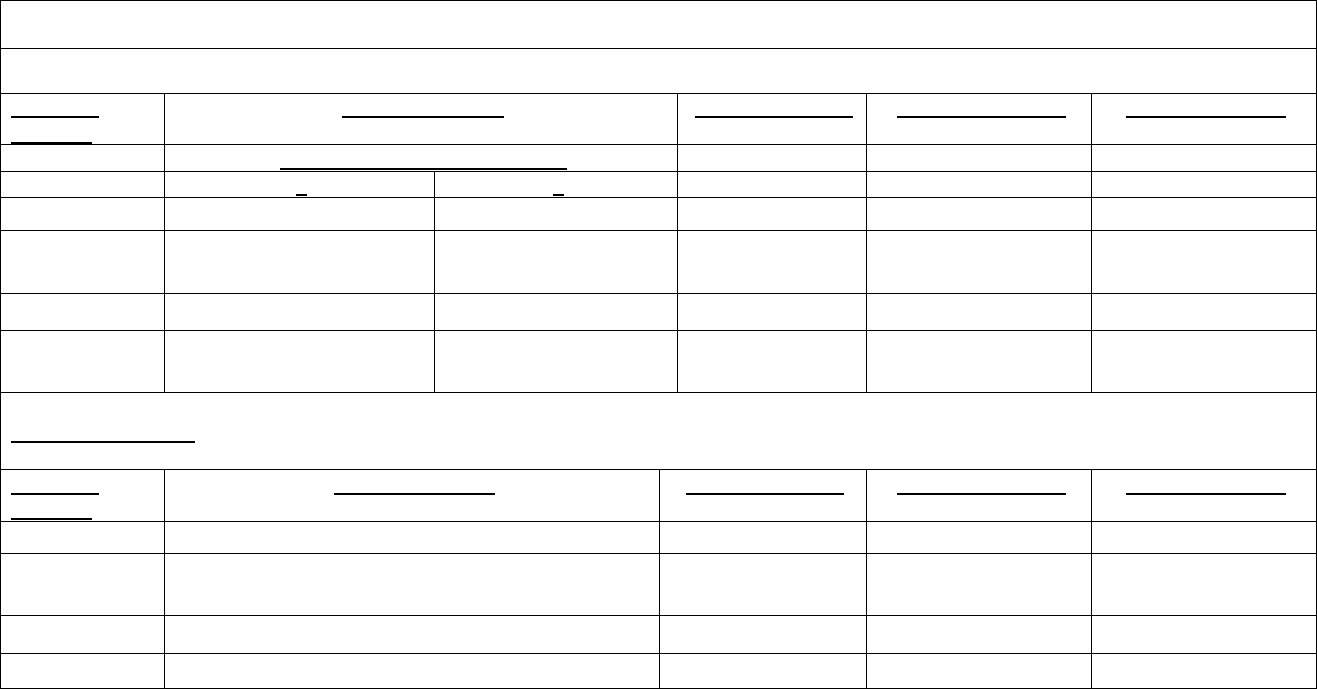

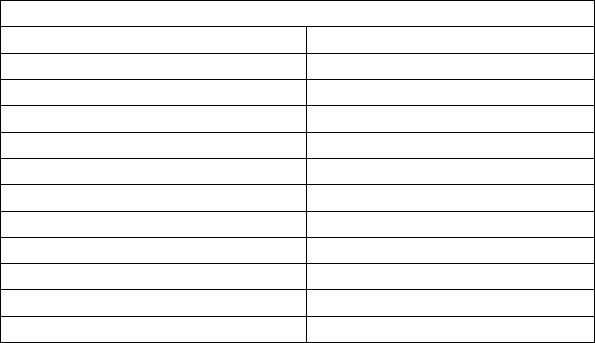

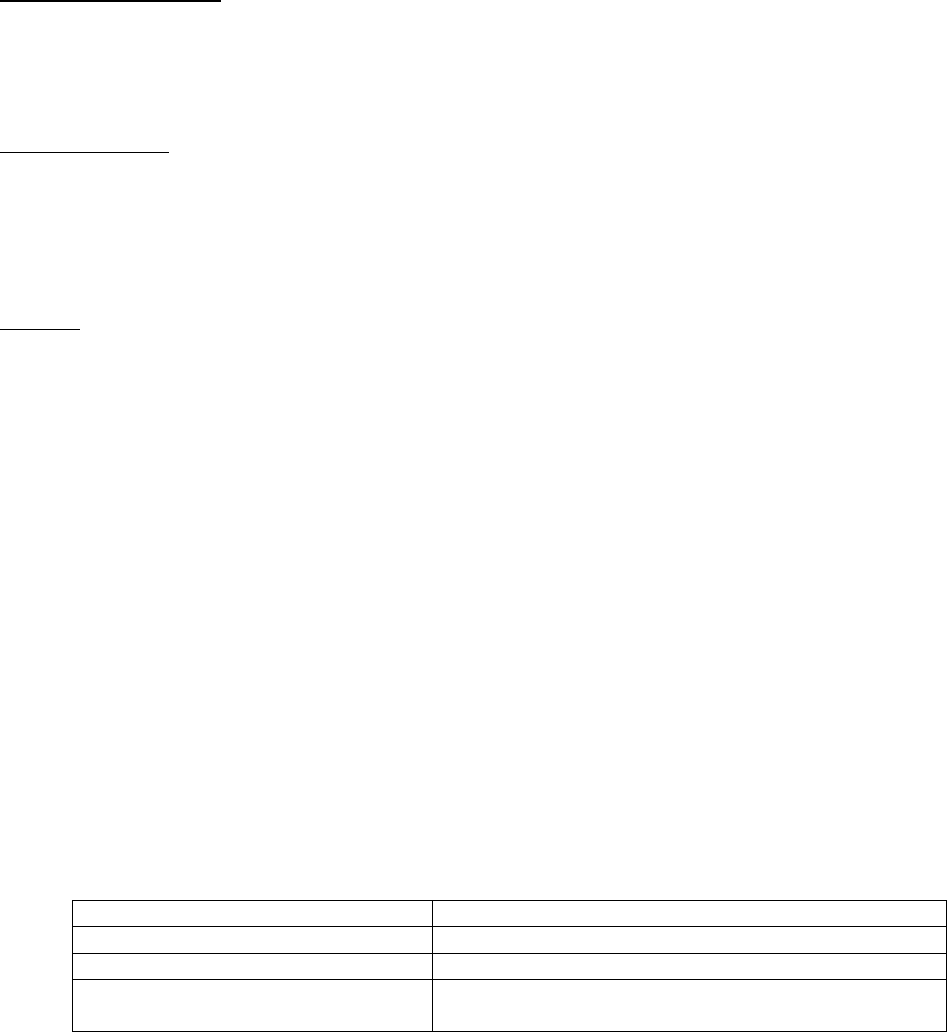

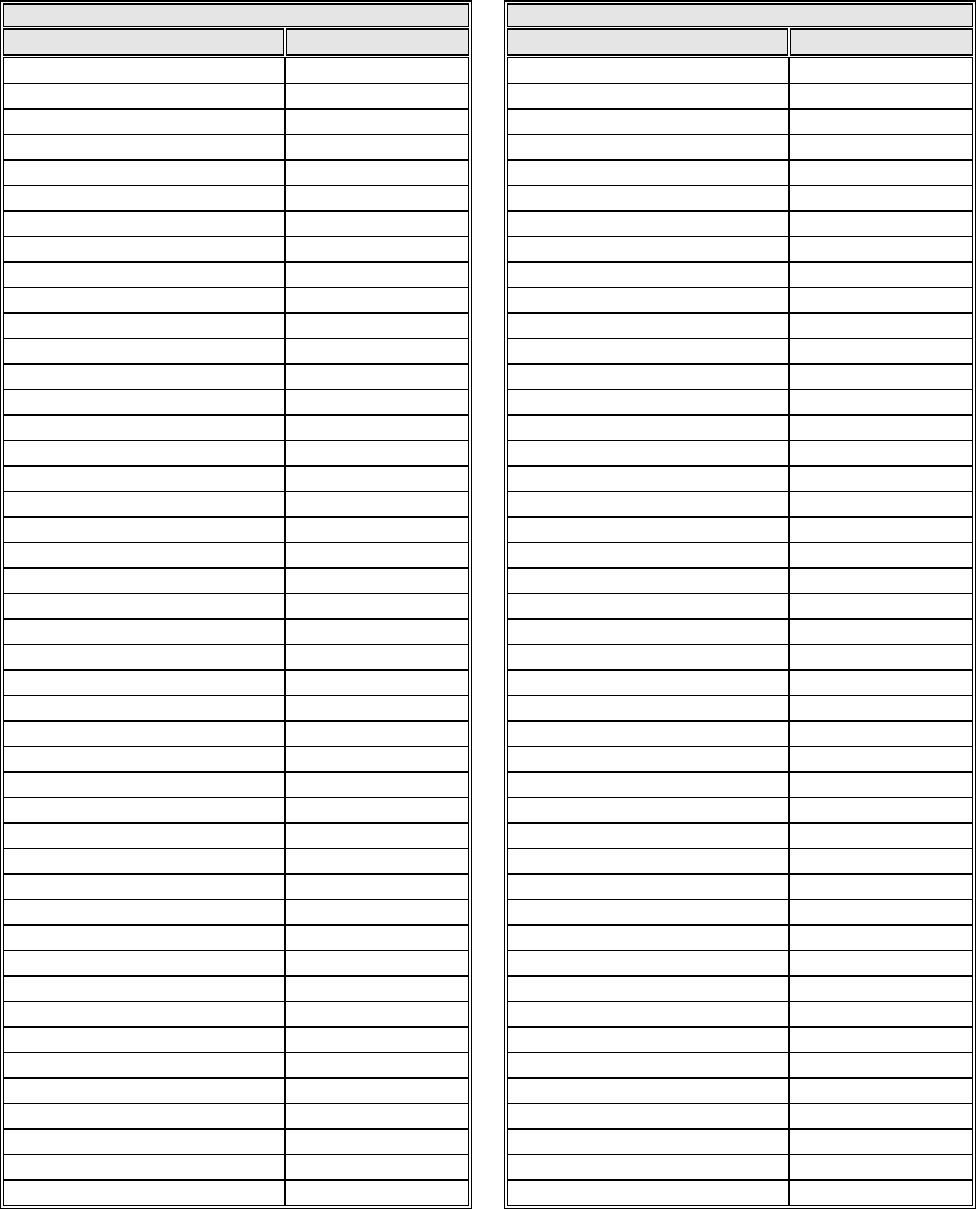

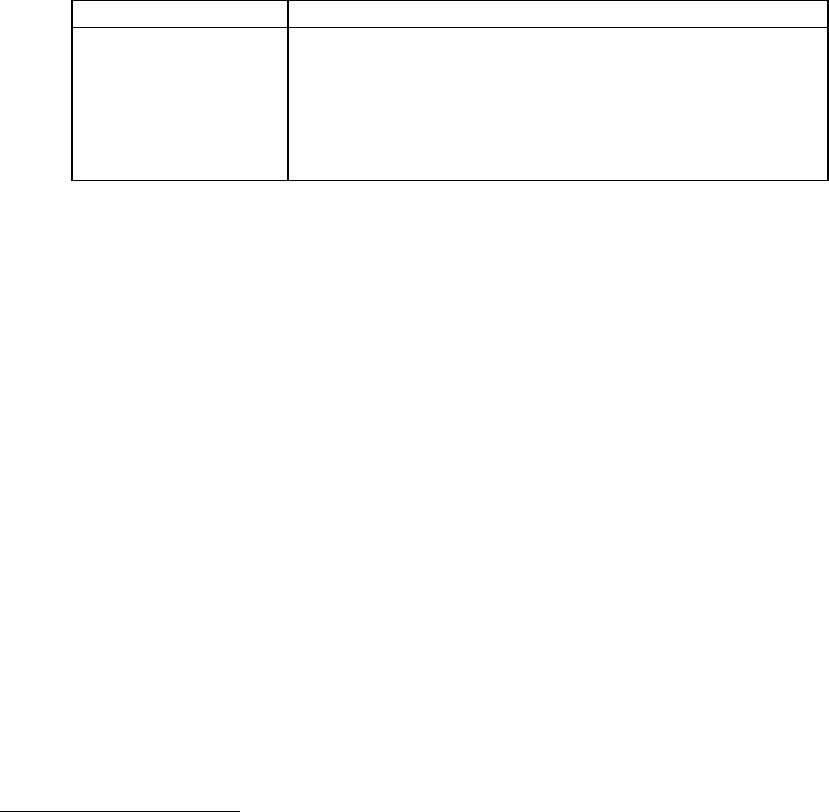

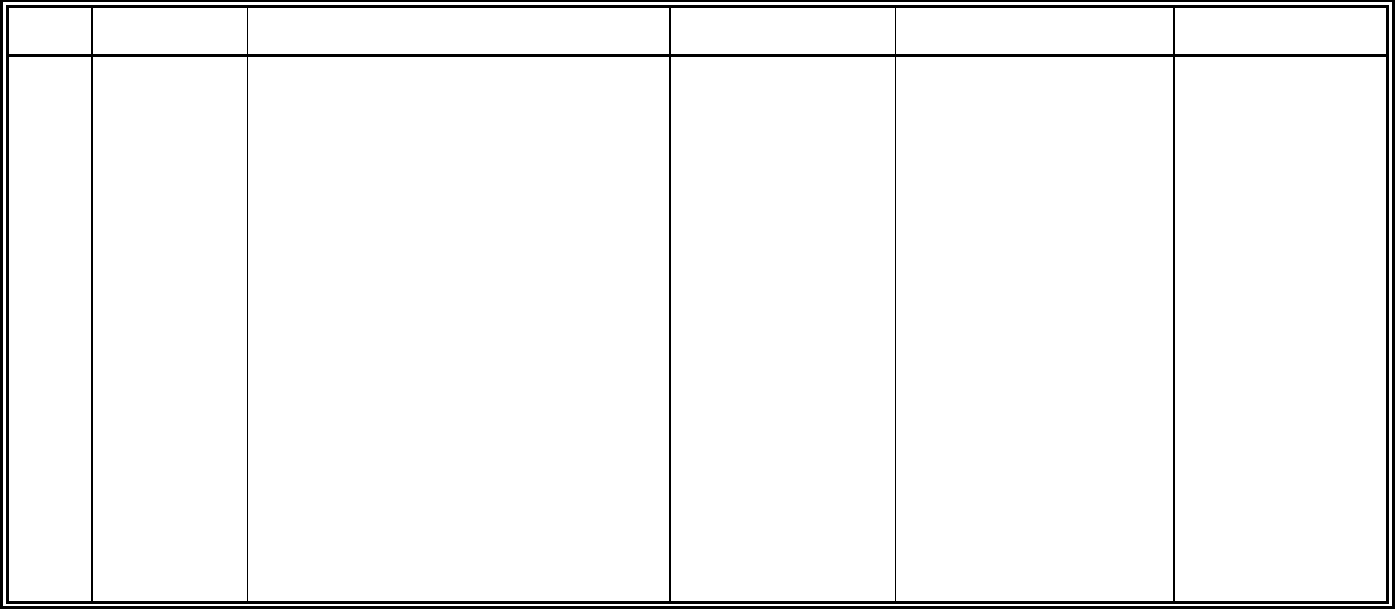

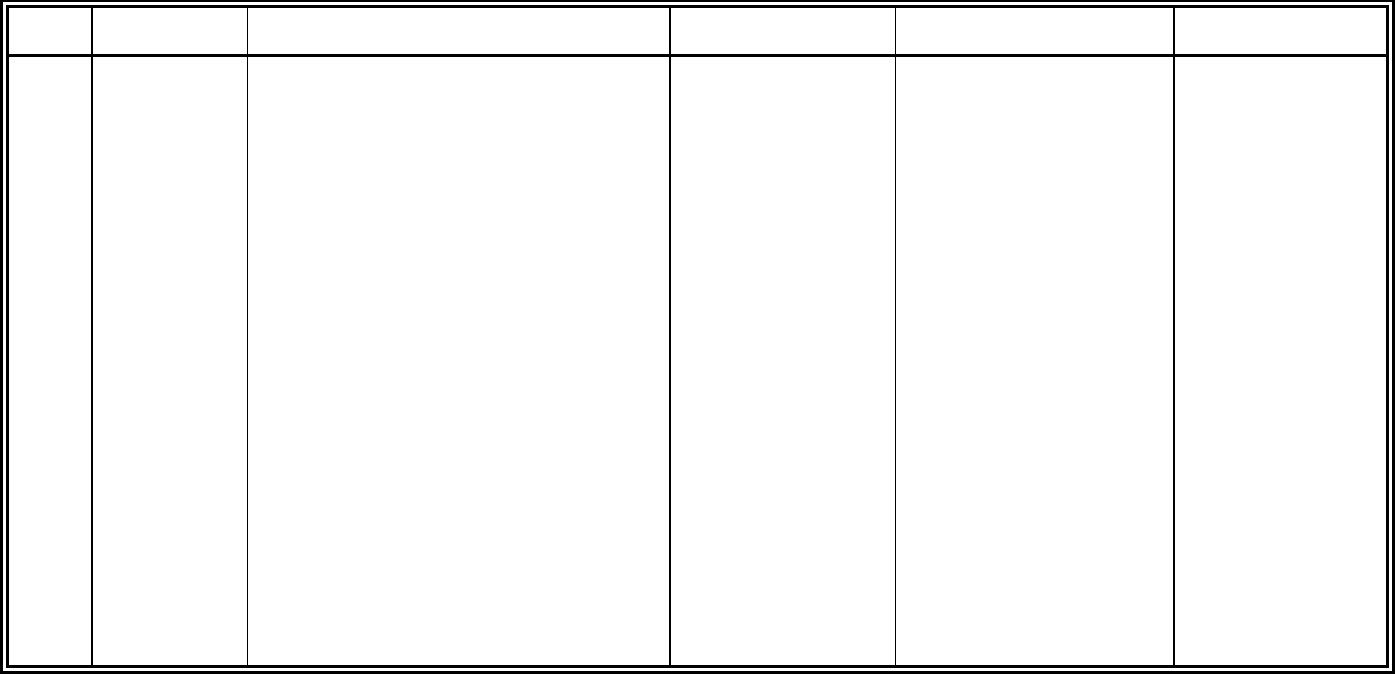

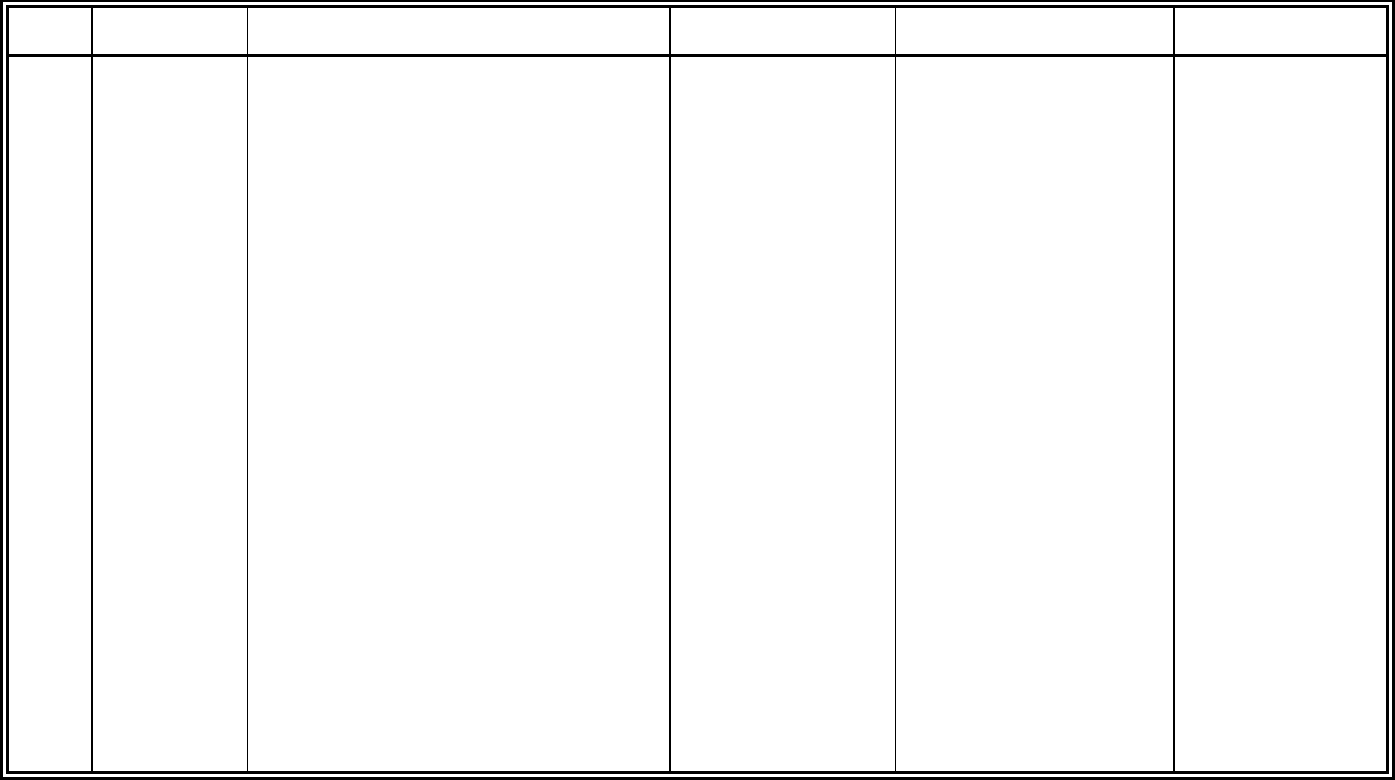

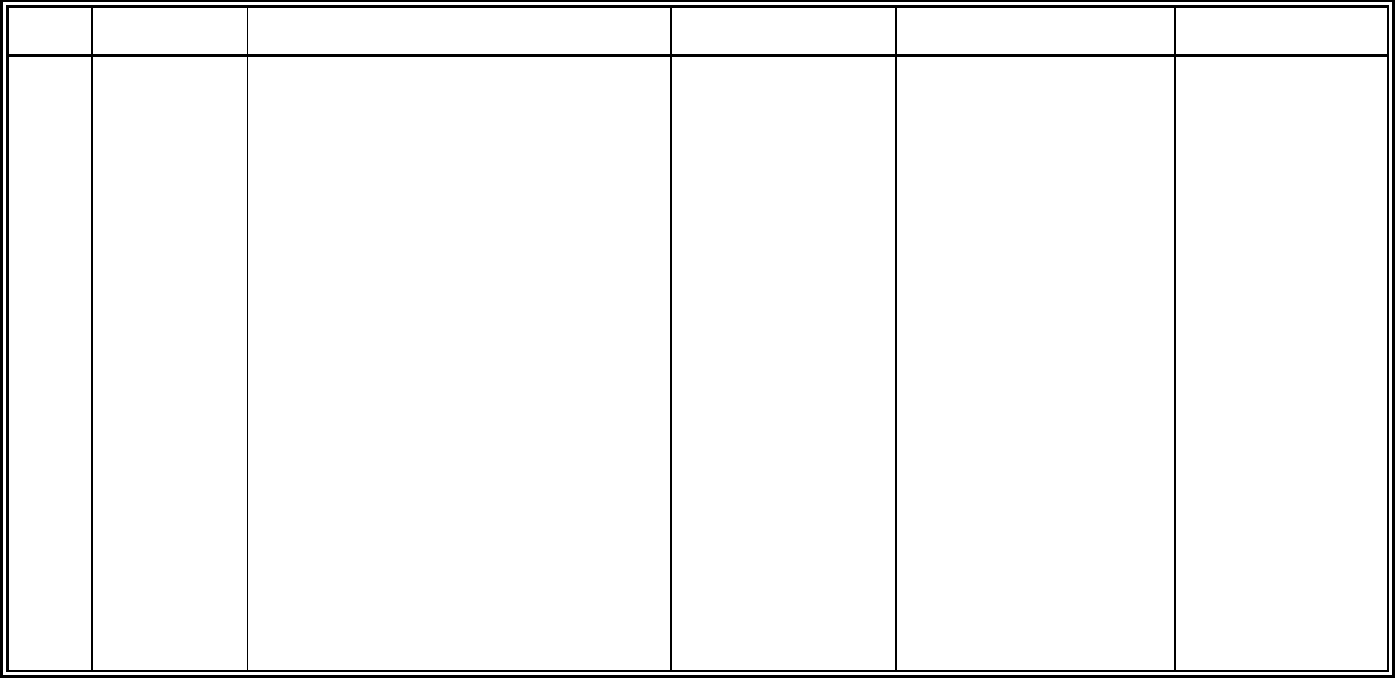

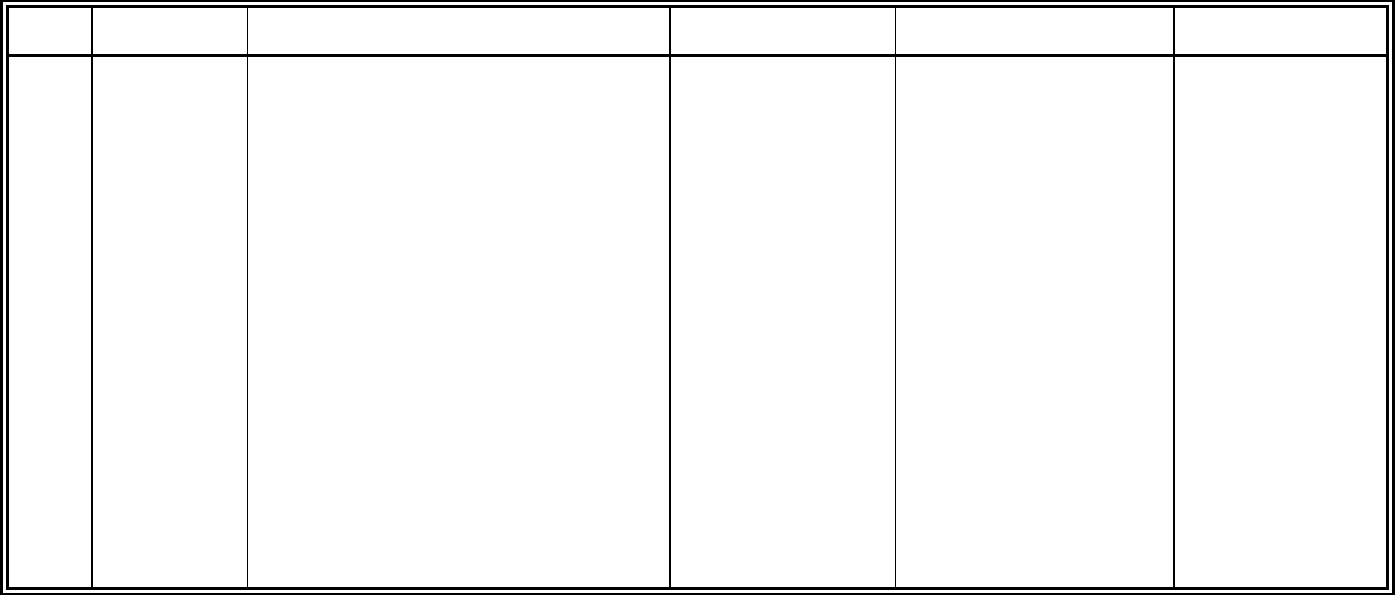

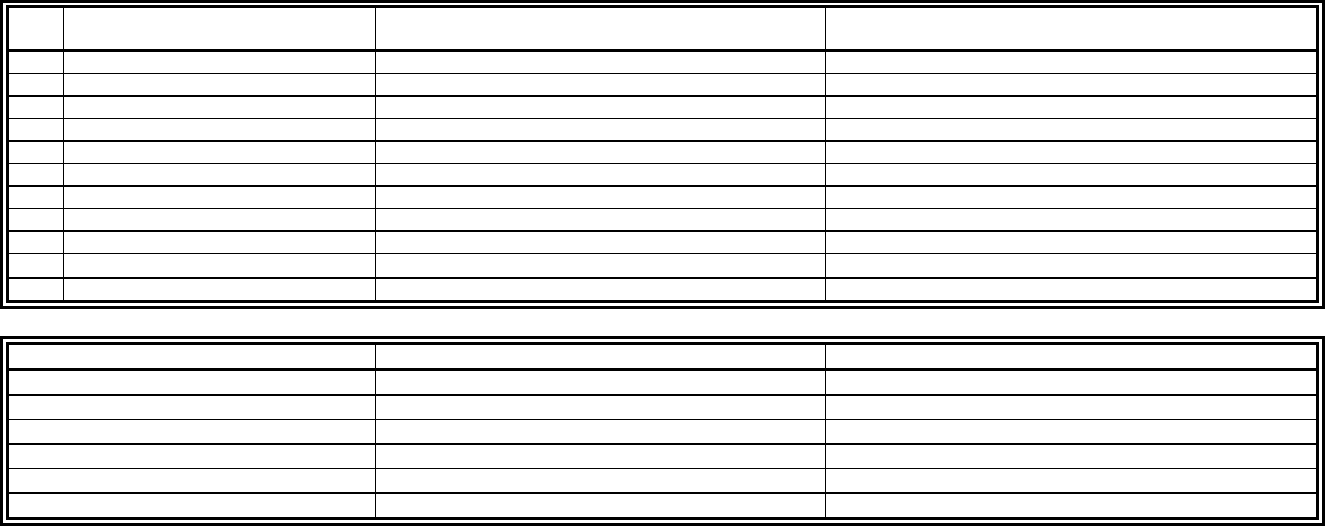

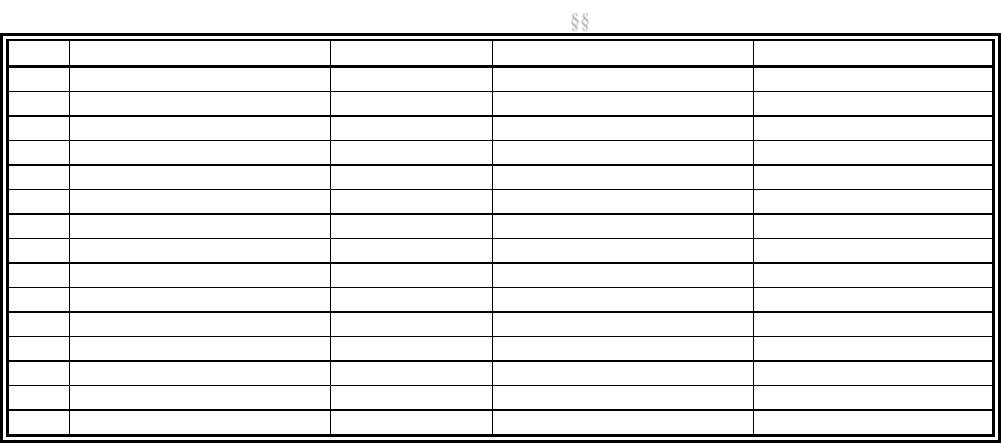

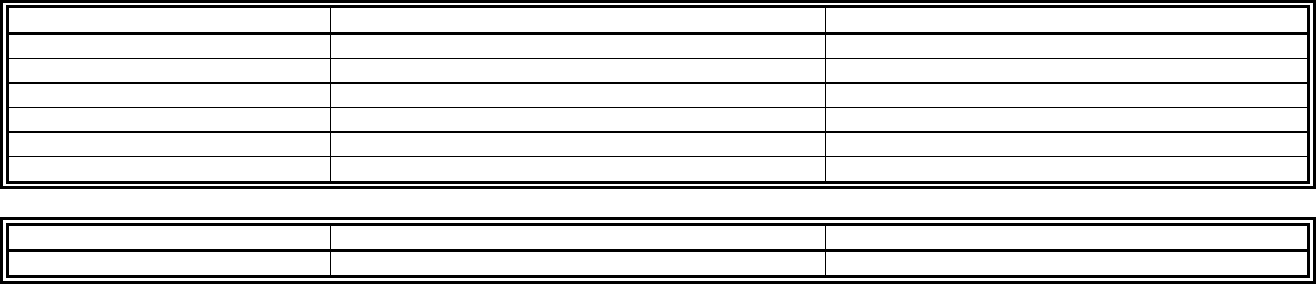

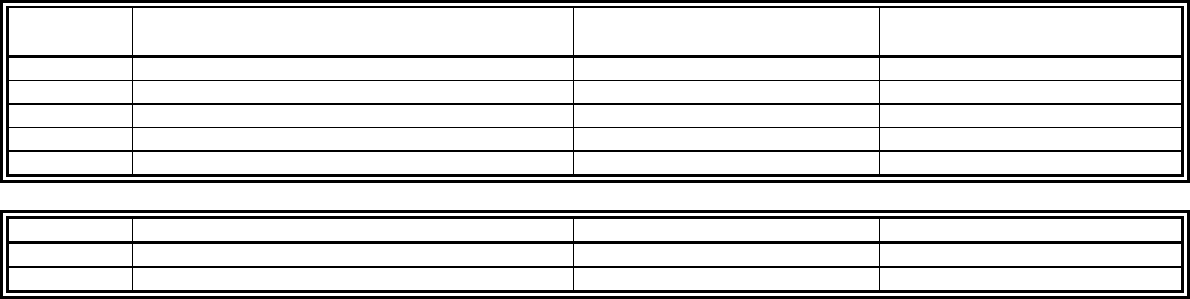

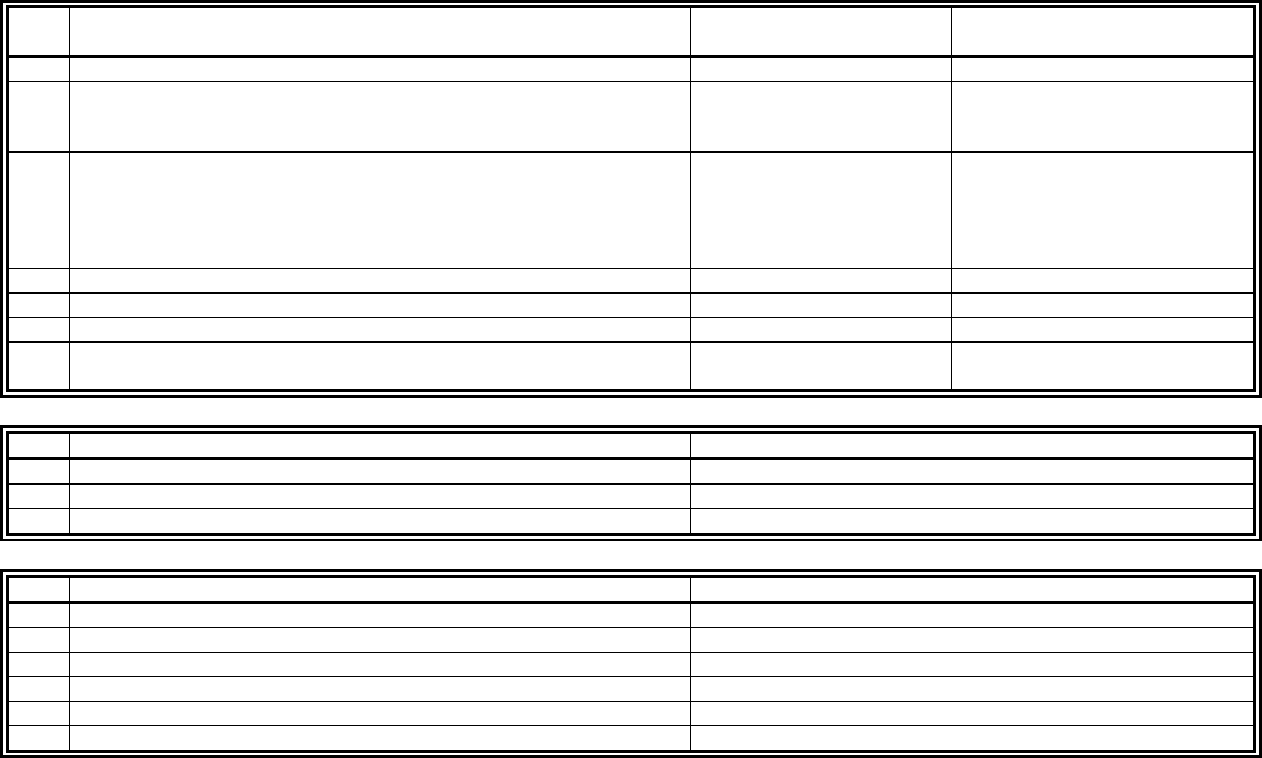

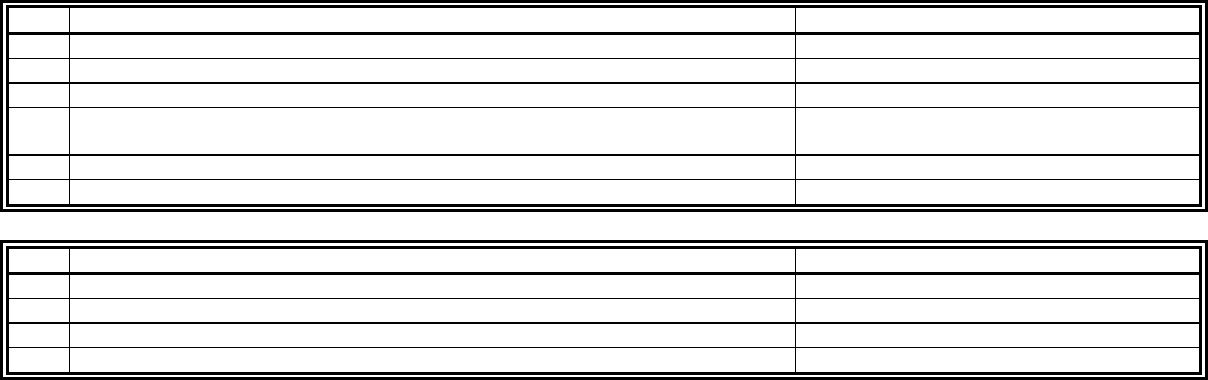

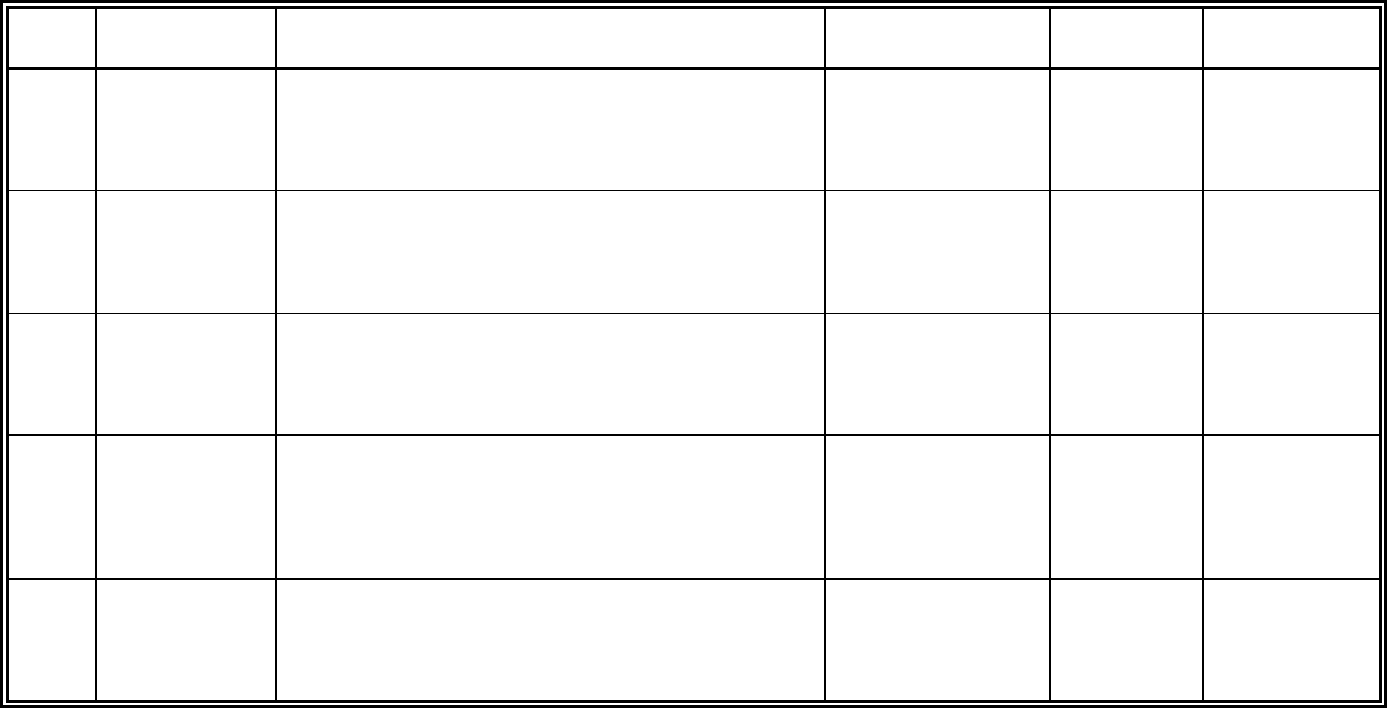

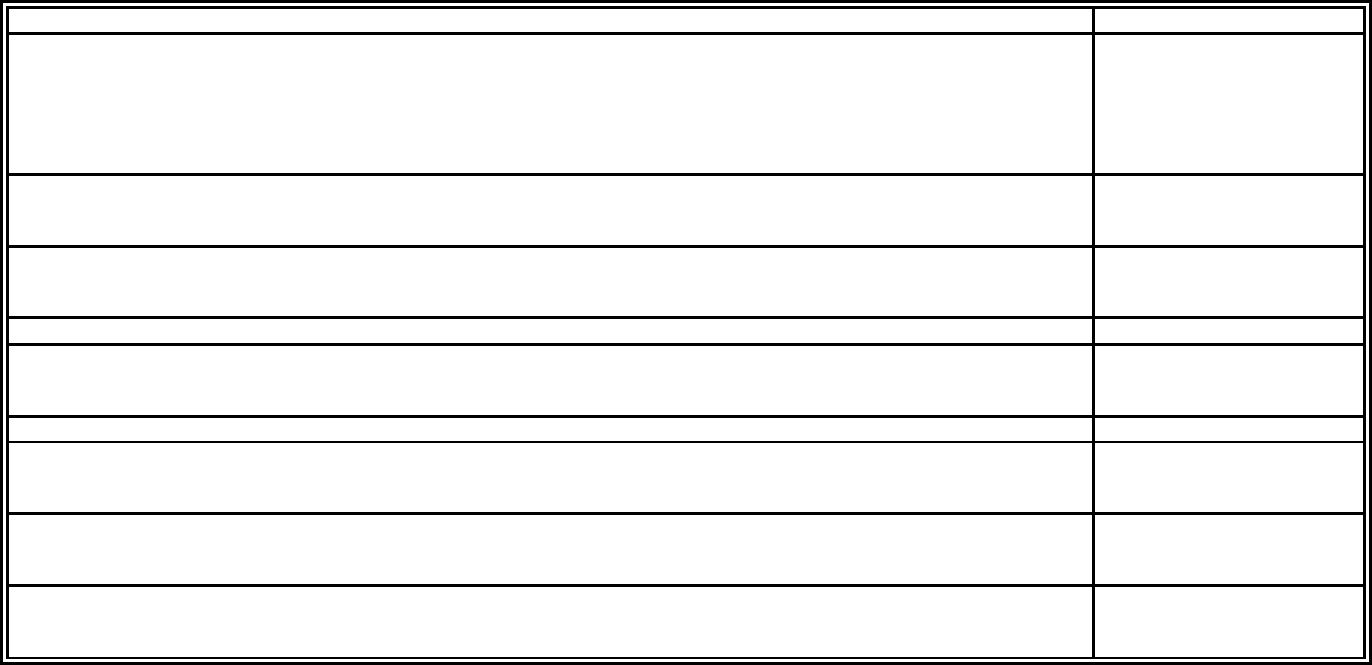

Producer Licenses (Biennial fee)

Individual

Firm

Resident

Nonresident

Resident

Nonresident

Insurance Producer or

Managing General Agent,

any line(s)

$75

$75

$75

$75

Independent Adjuster

75

75

75

75

Surplus Lines Broker

300

300

300

300

Reinsurance

Intermediary Manager

75

75

75

75

Reinsurance

Intermediary Broker

75

75

75

75

Viatical Settlement Broker

100

100

100

100

Viatical Settlement

Representative

100

100

100

100

Viatical Settlement

Provider

300

300

300

300

1033 License Application

300

300

N/A

N/A

Third Party Administrator

300

300

300

300

Independent Portable

Electronics Adjuster

75

75

75

75

Motor Vehicle Service

Contract Provider

300

300

300

300

Motor Vehicle Service

Contract Administrator

75

75

75

75

Trainee Licenses

Individual

Resident

Nonresident

Trainee Independent

Adjusters

$75

N/A

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AK-9

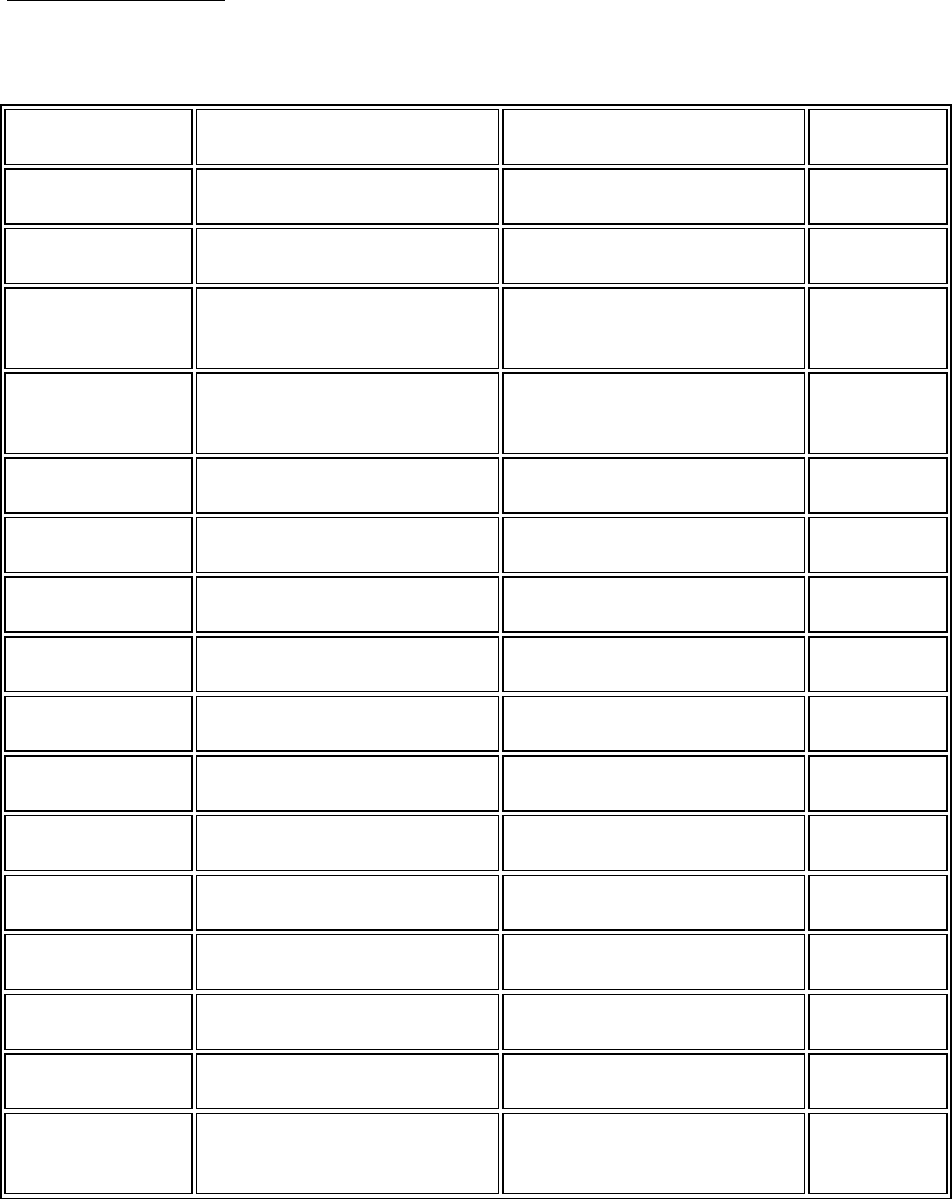

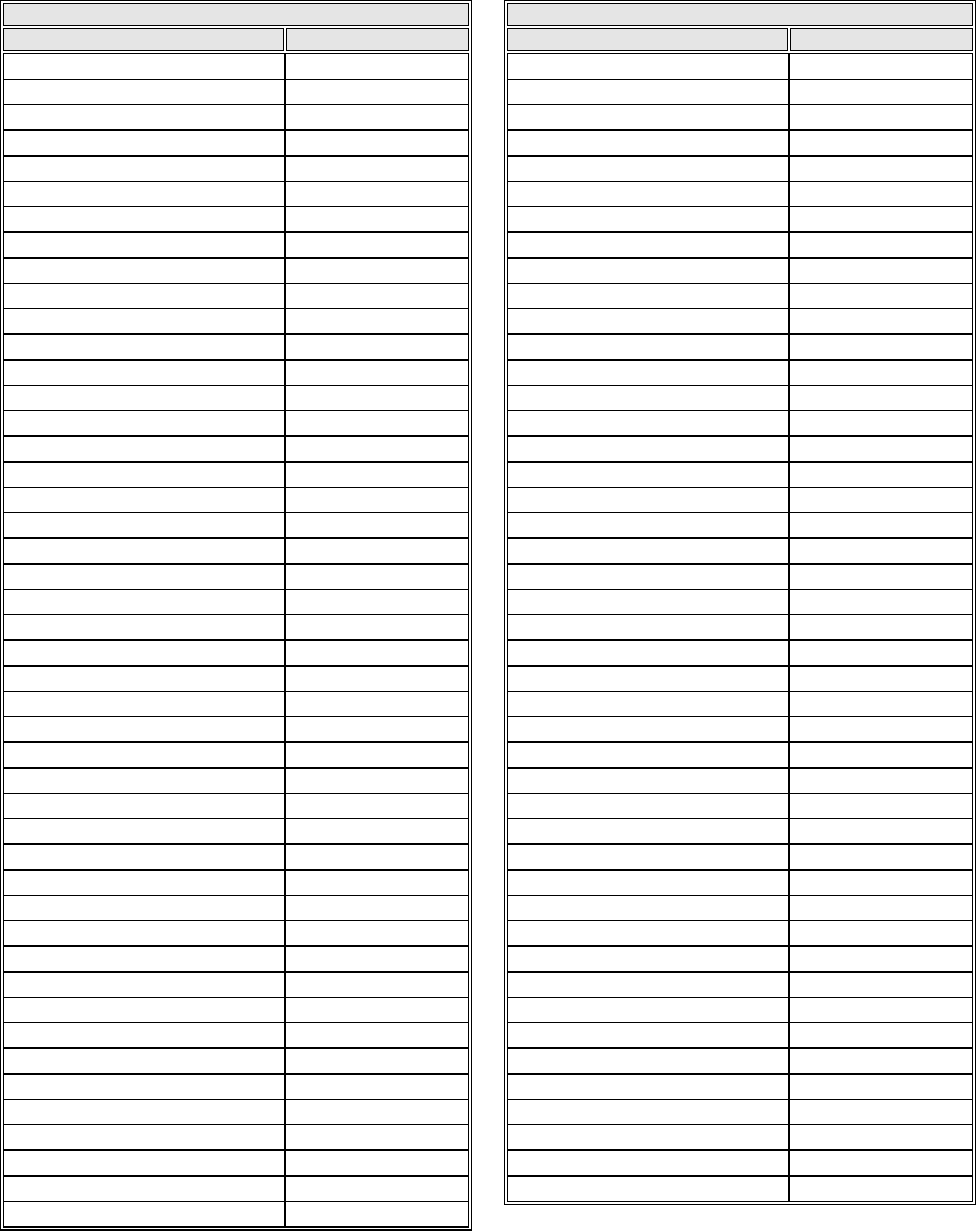

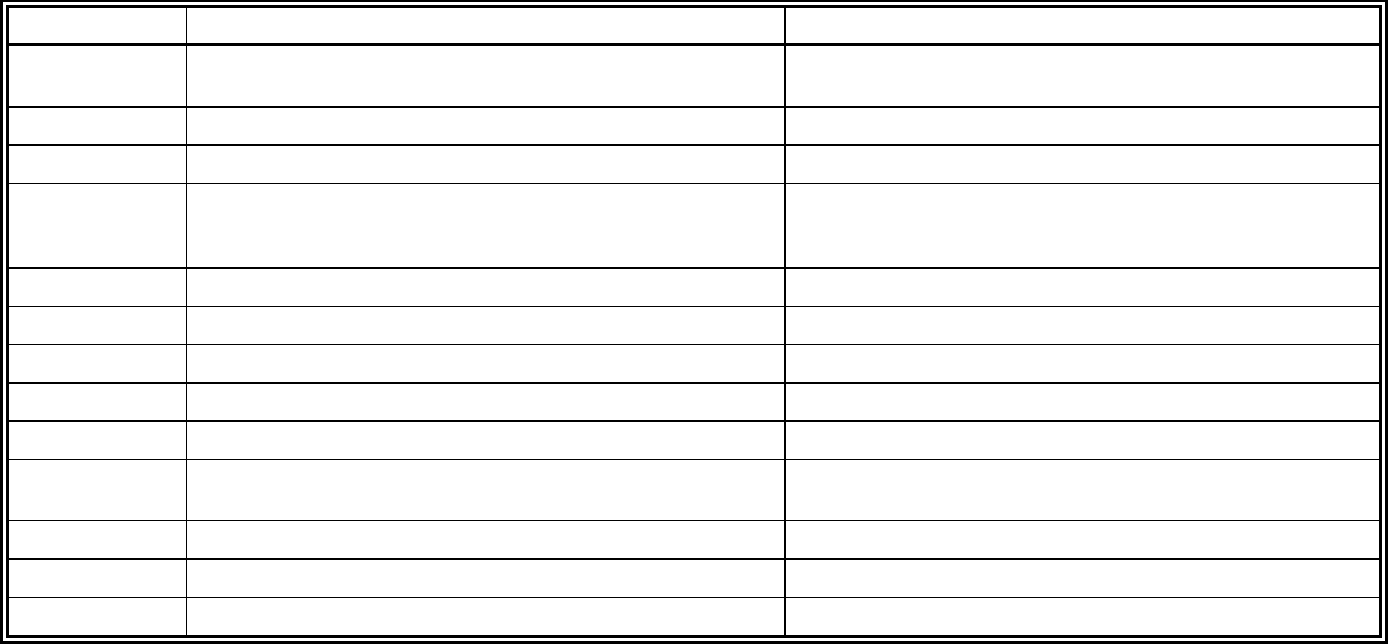

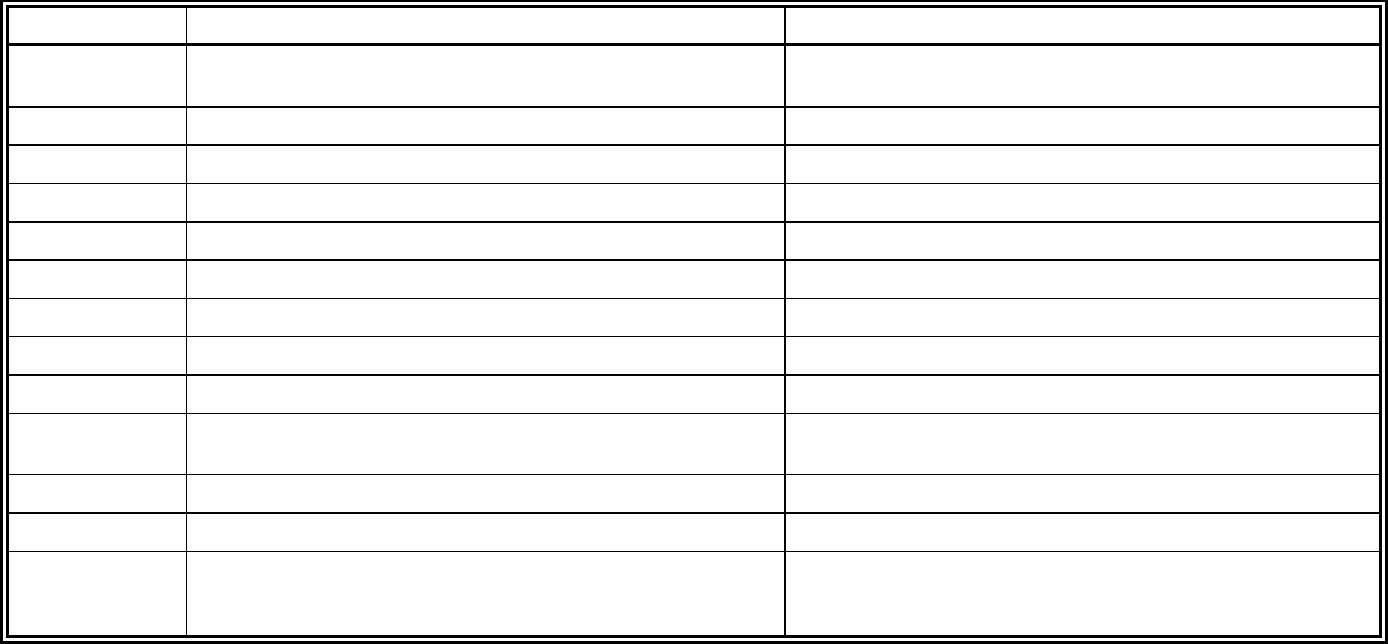

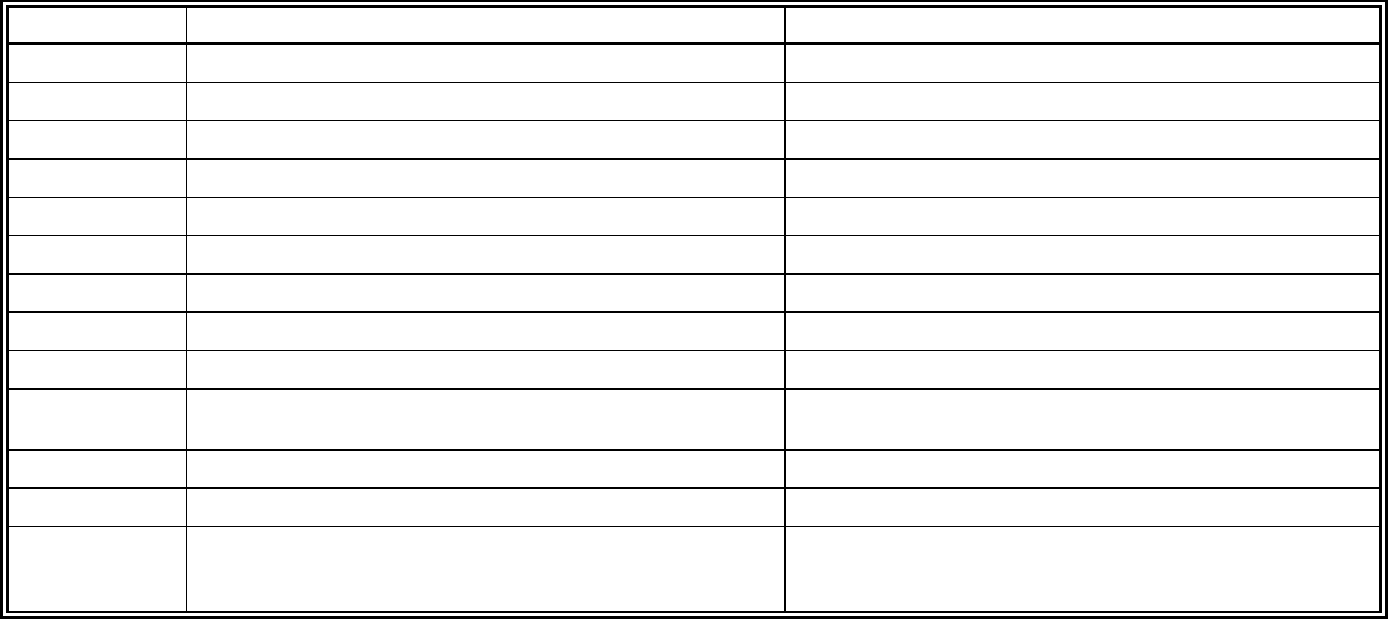

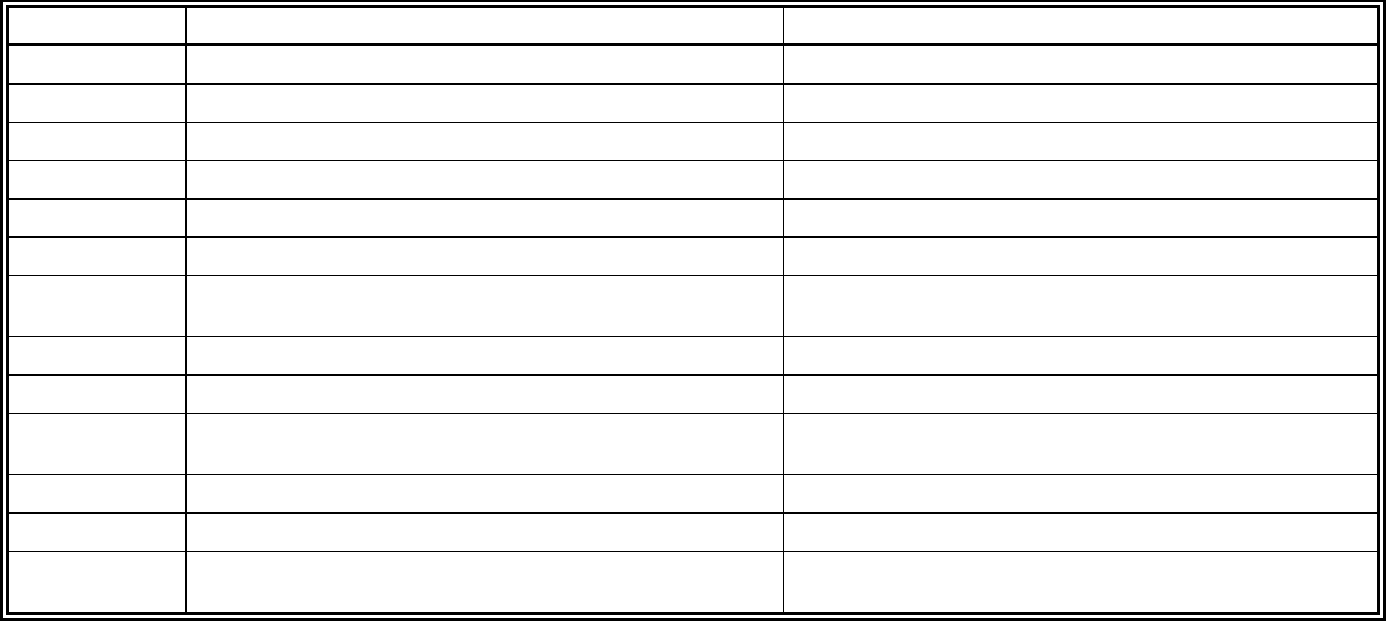

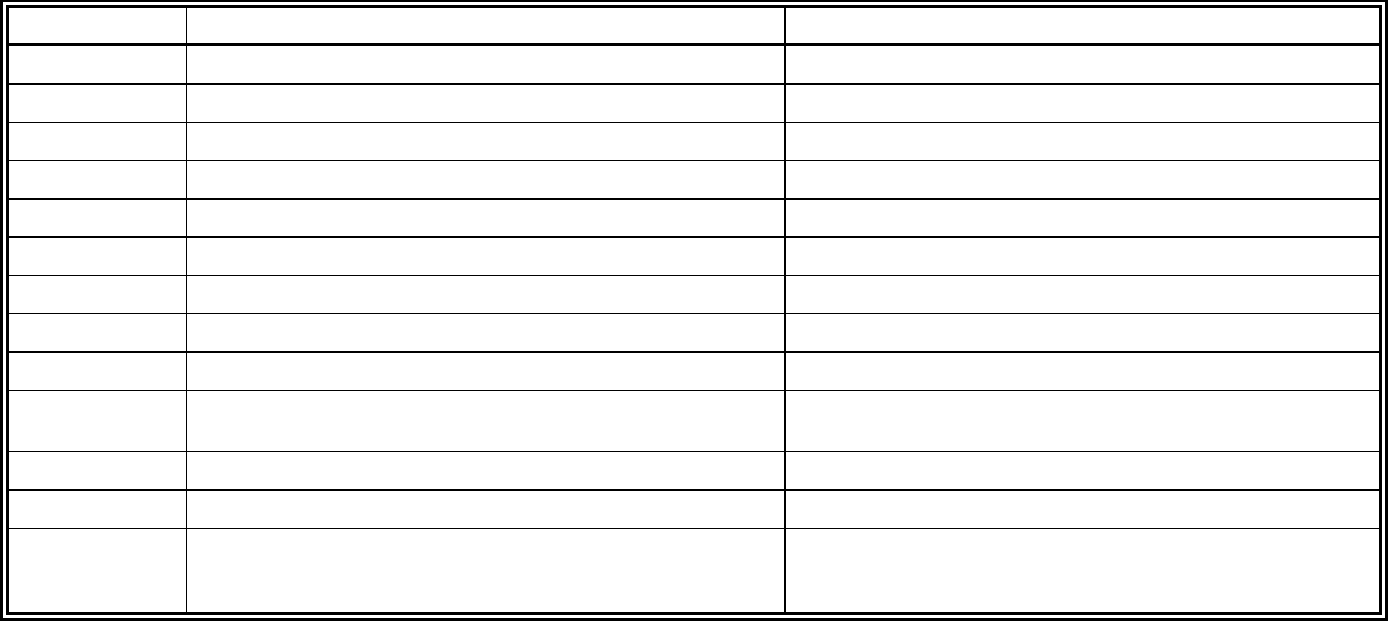

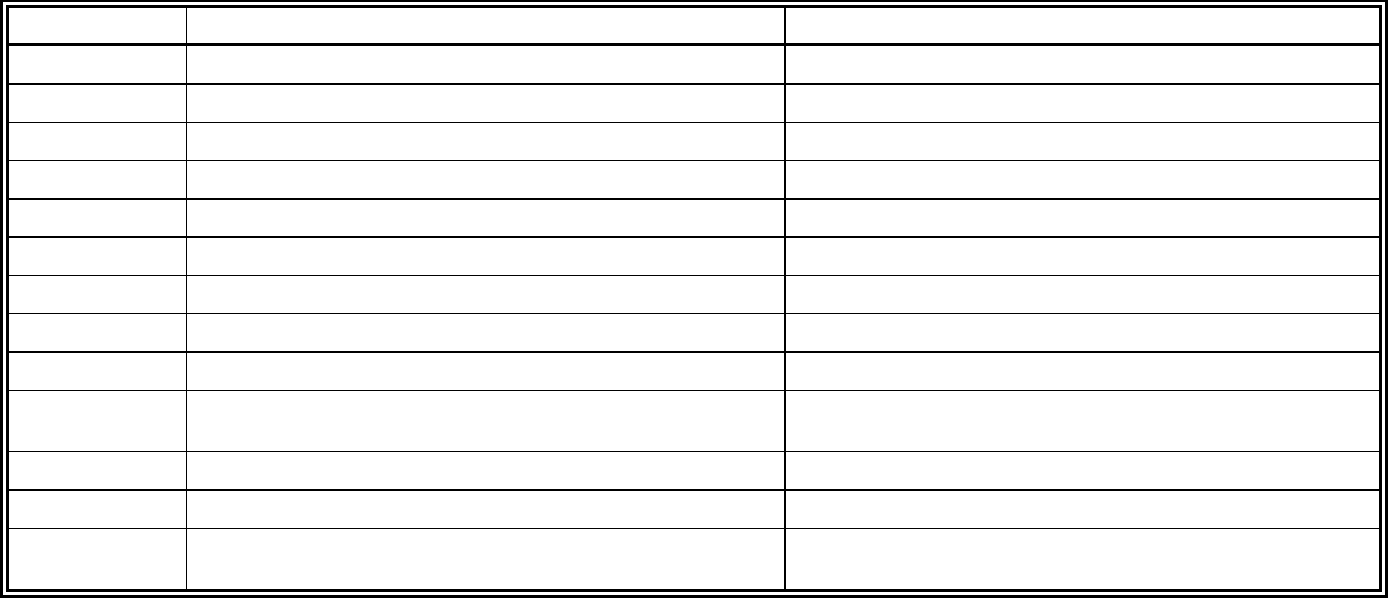

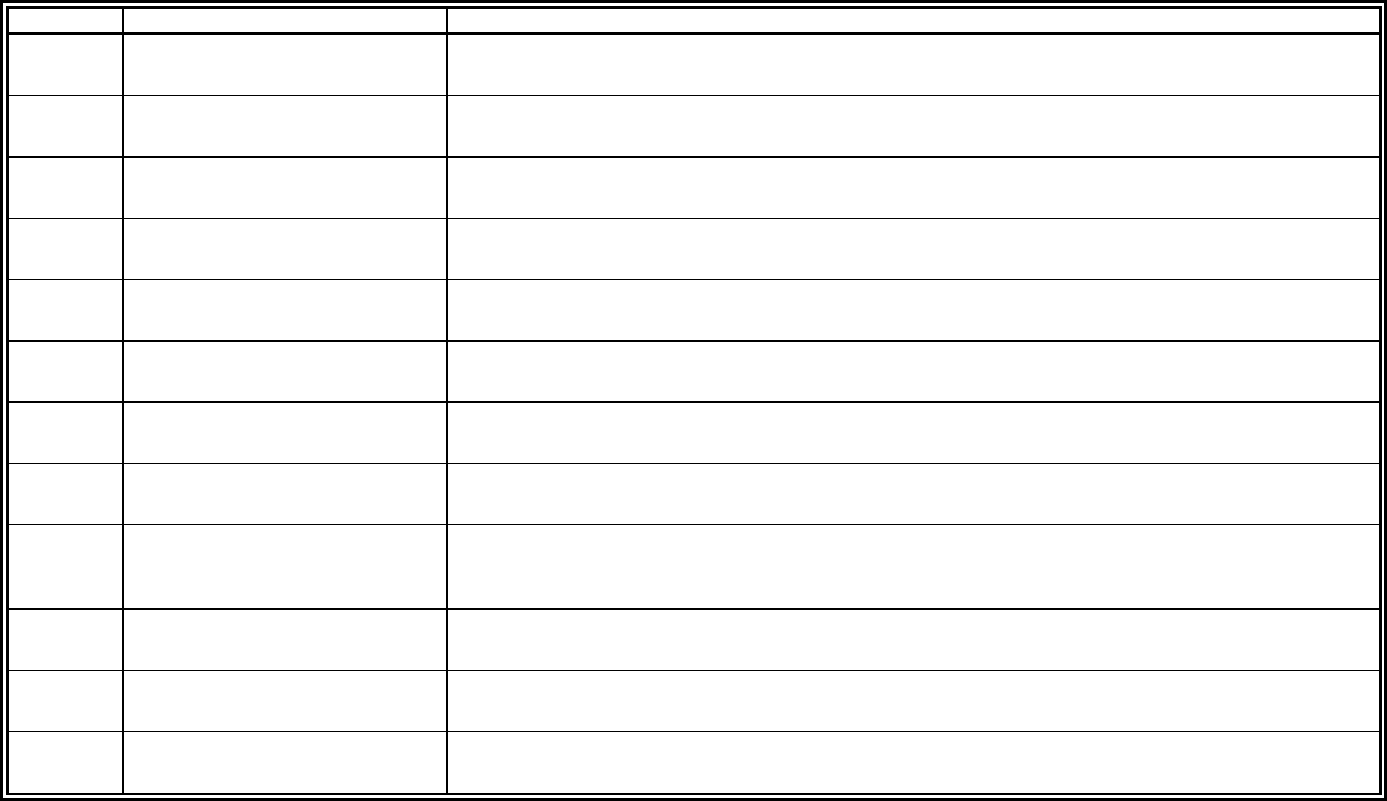

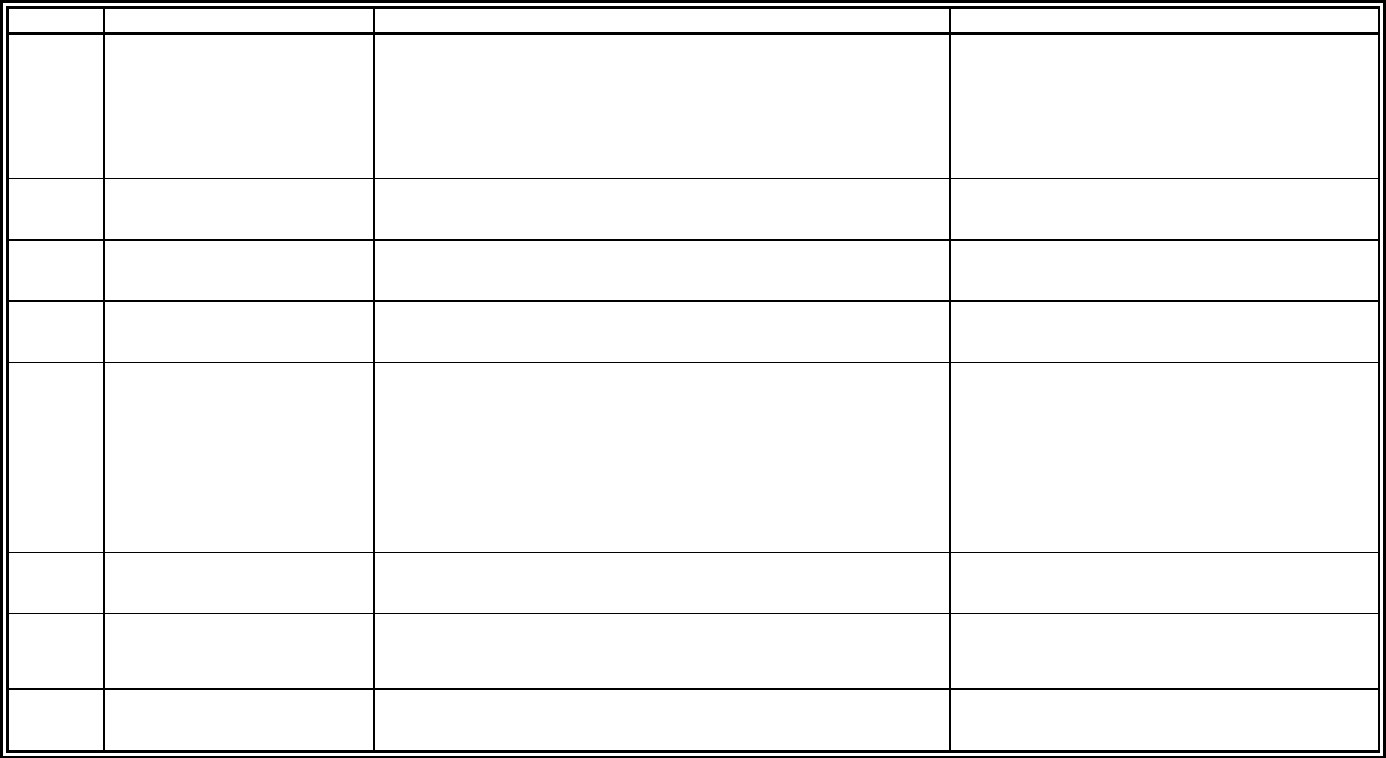

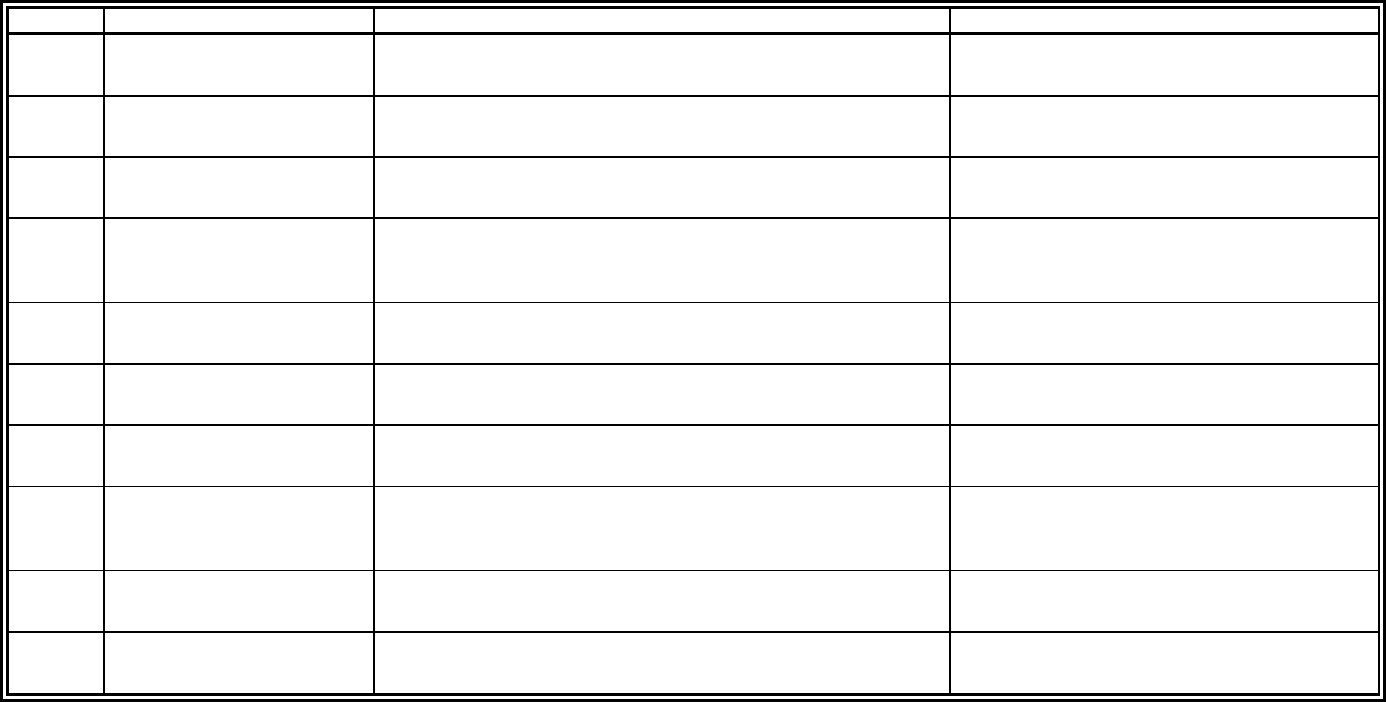

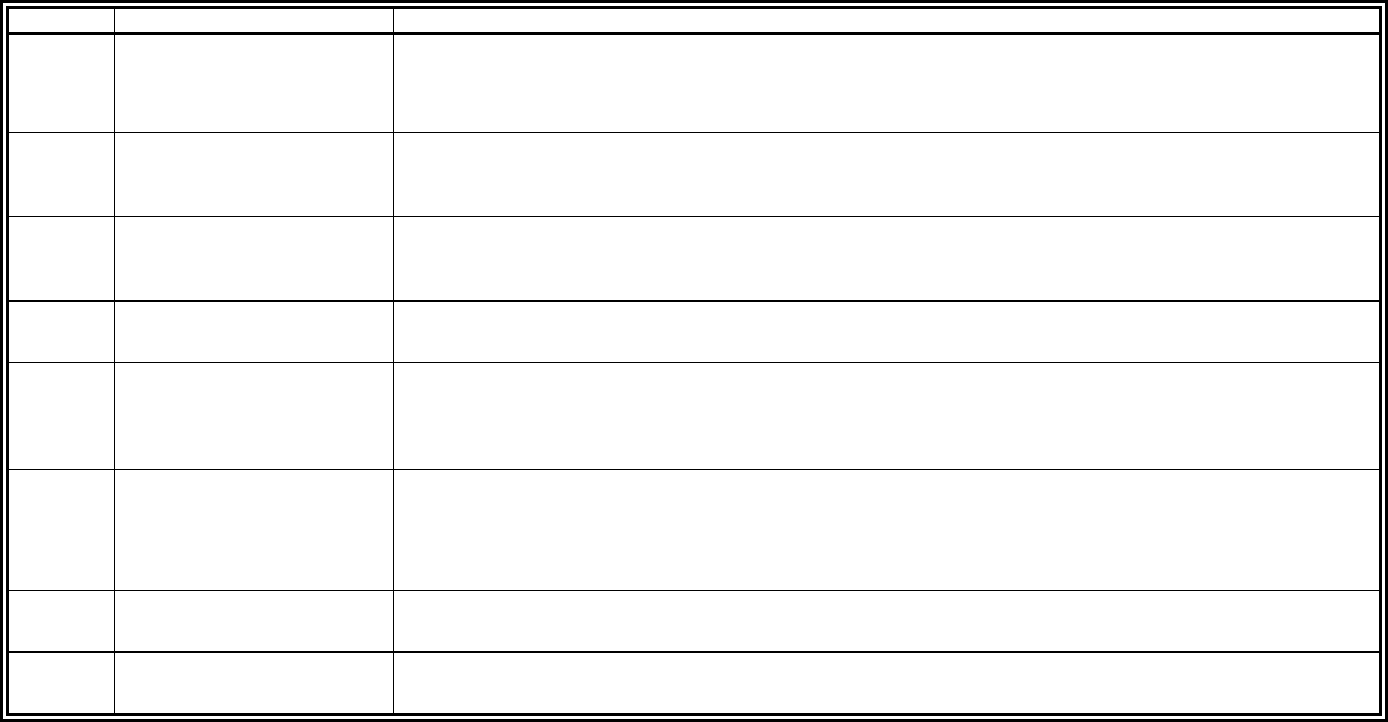

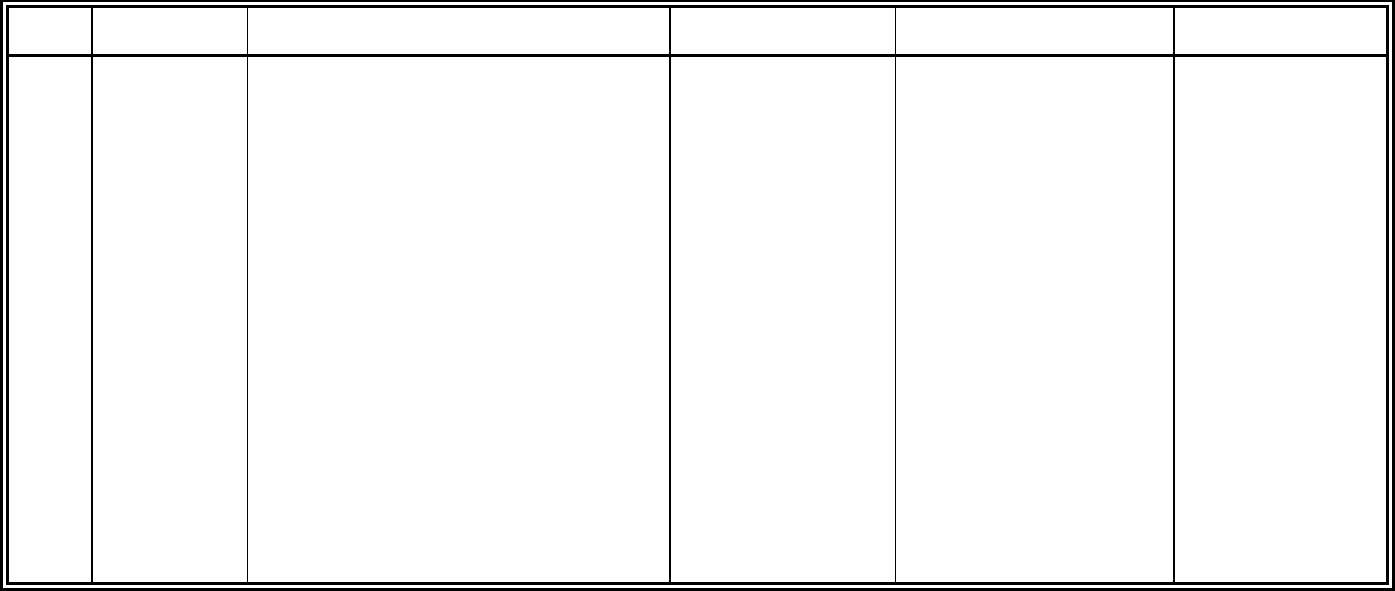

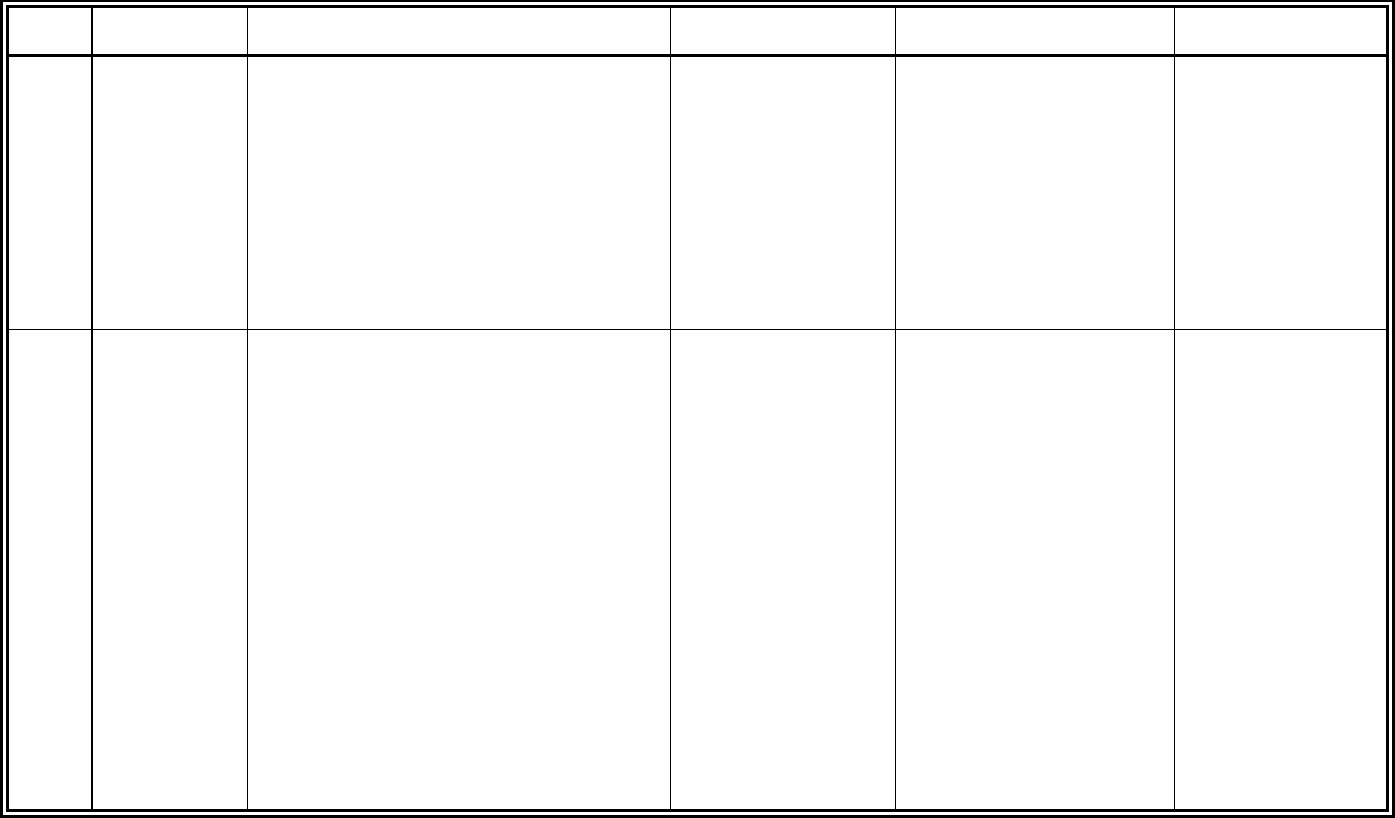

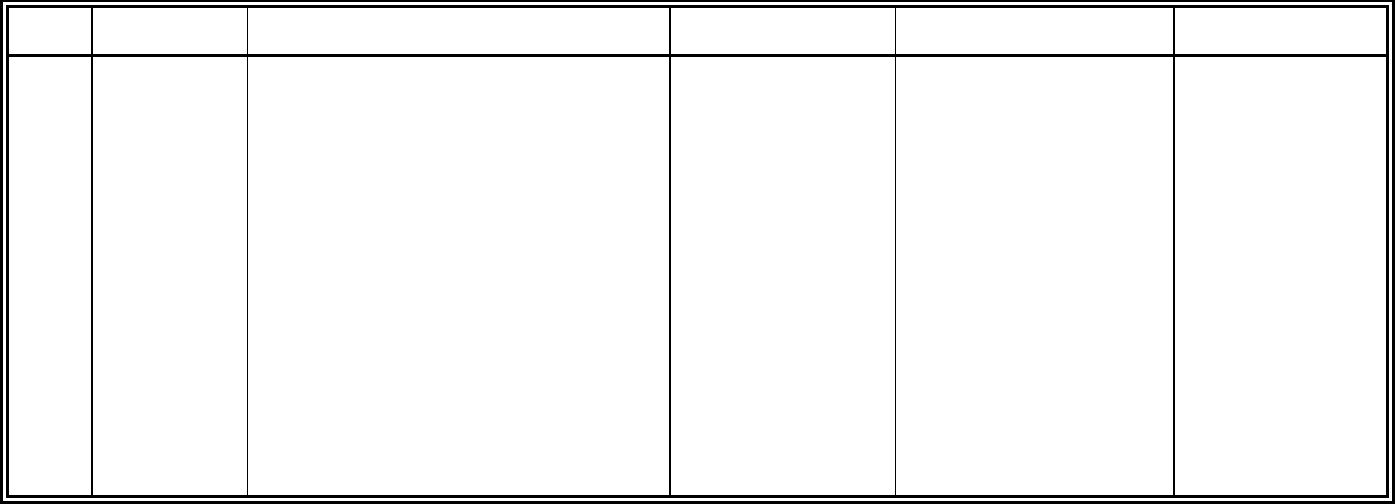

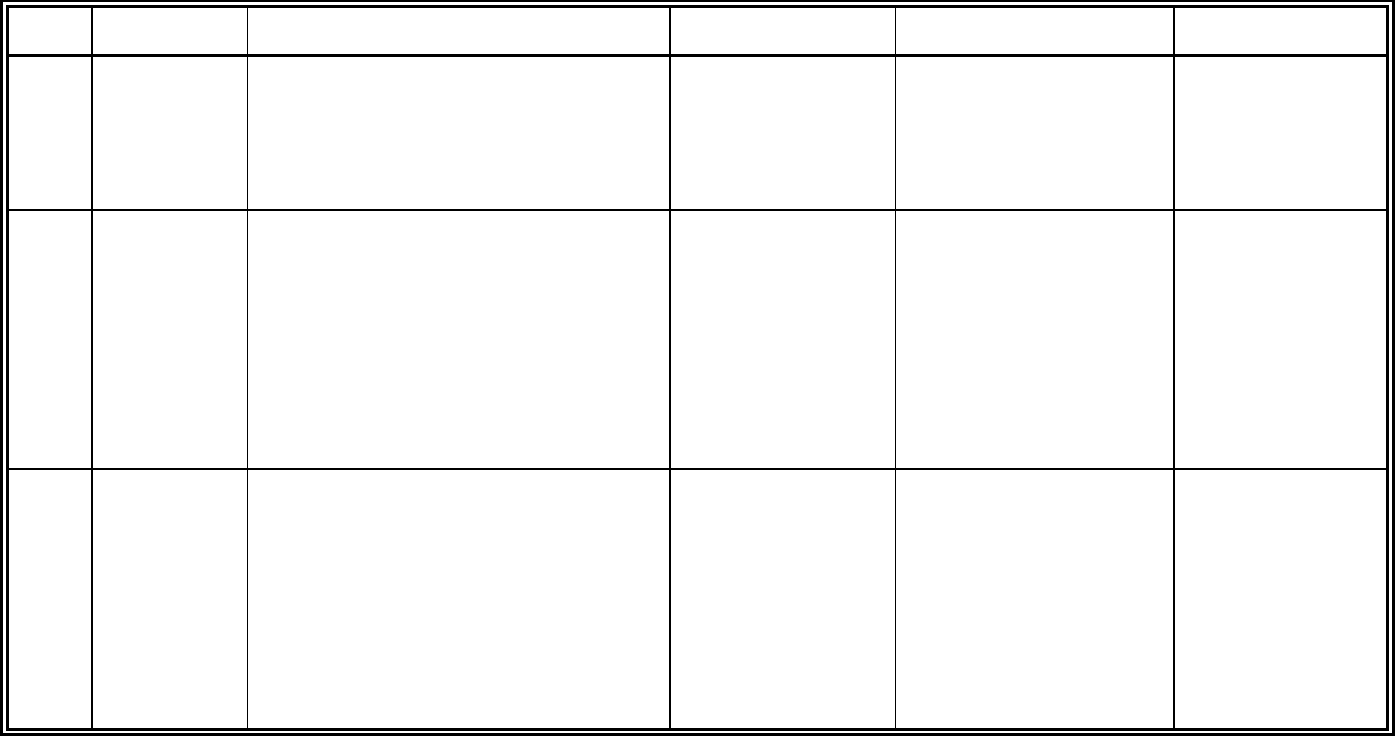

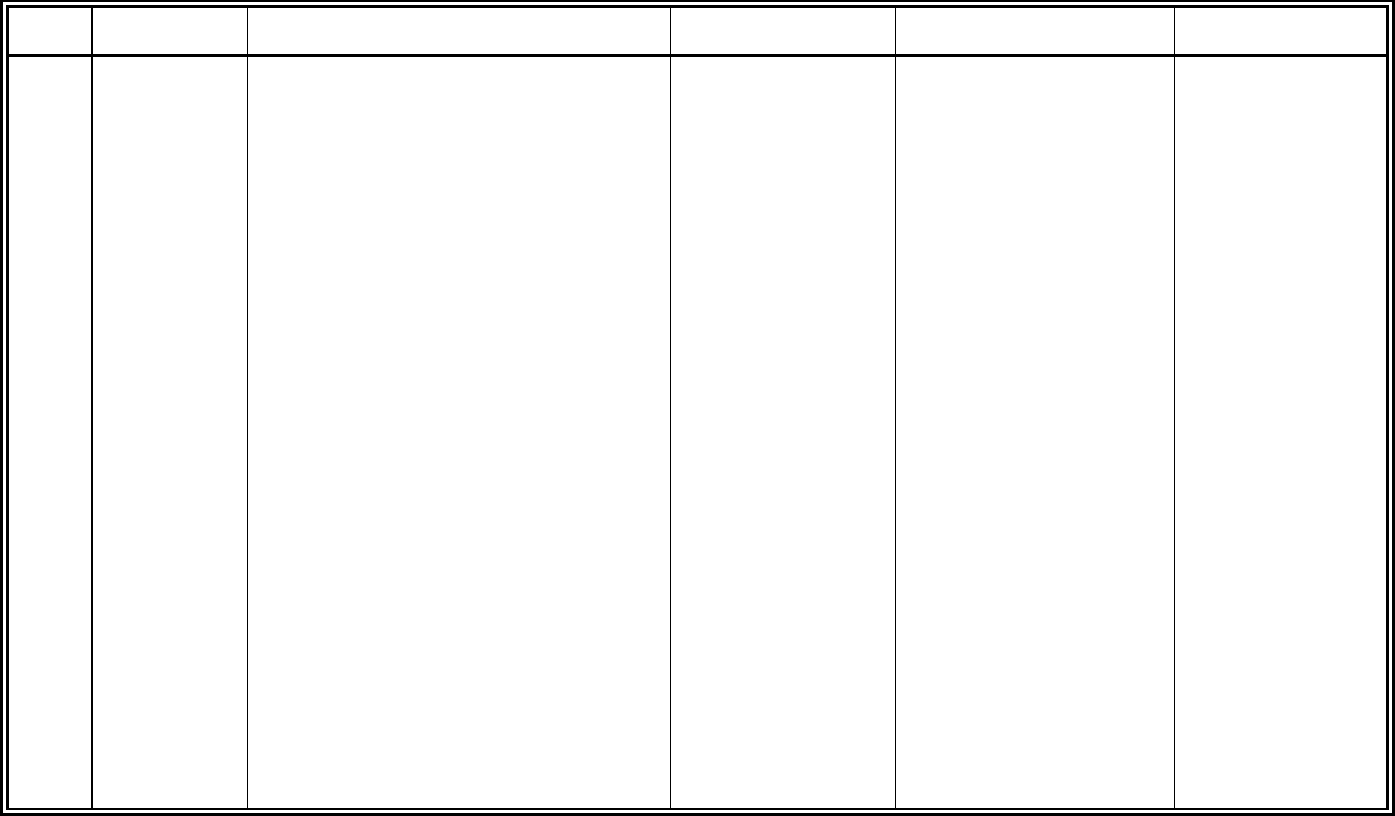

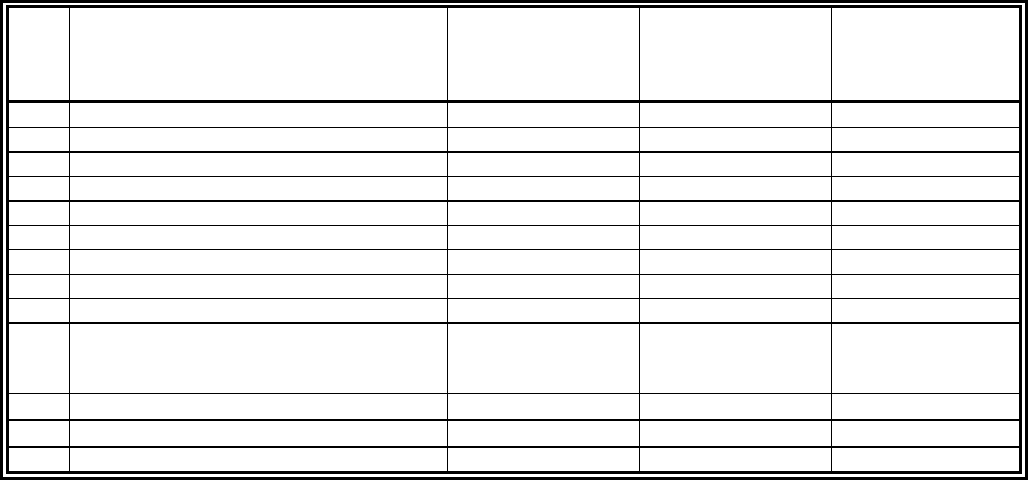

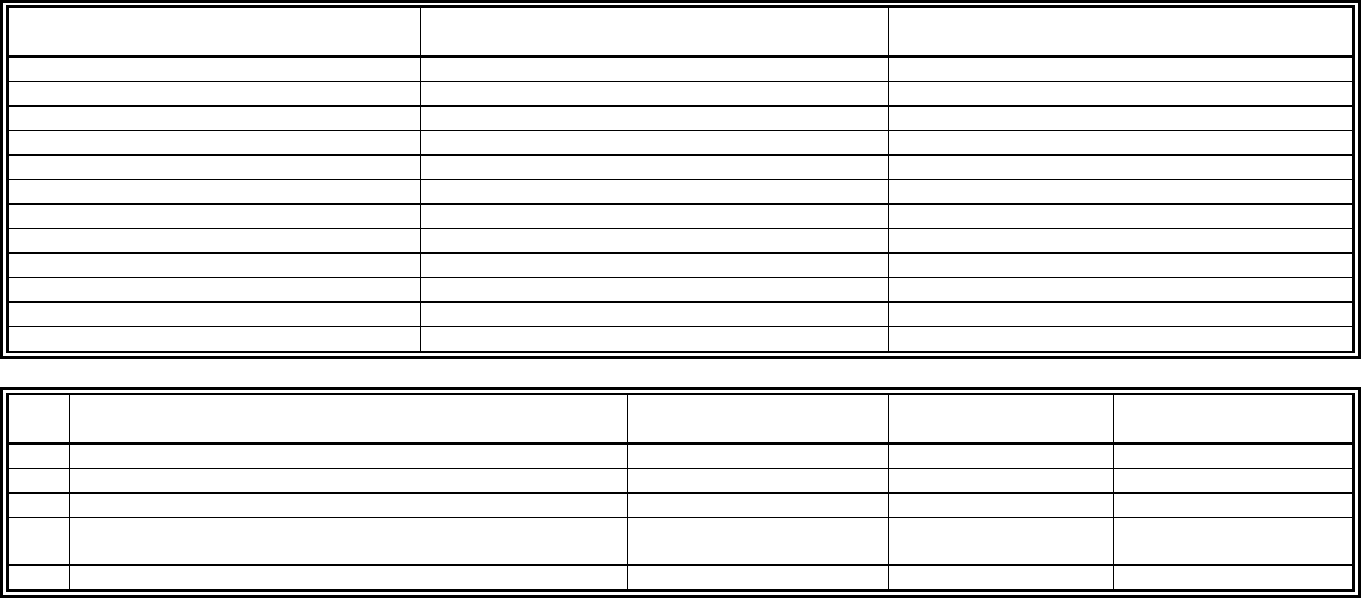

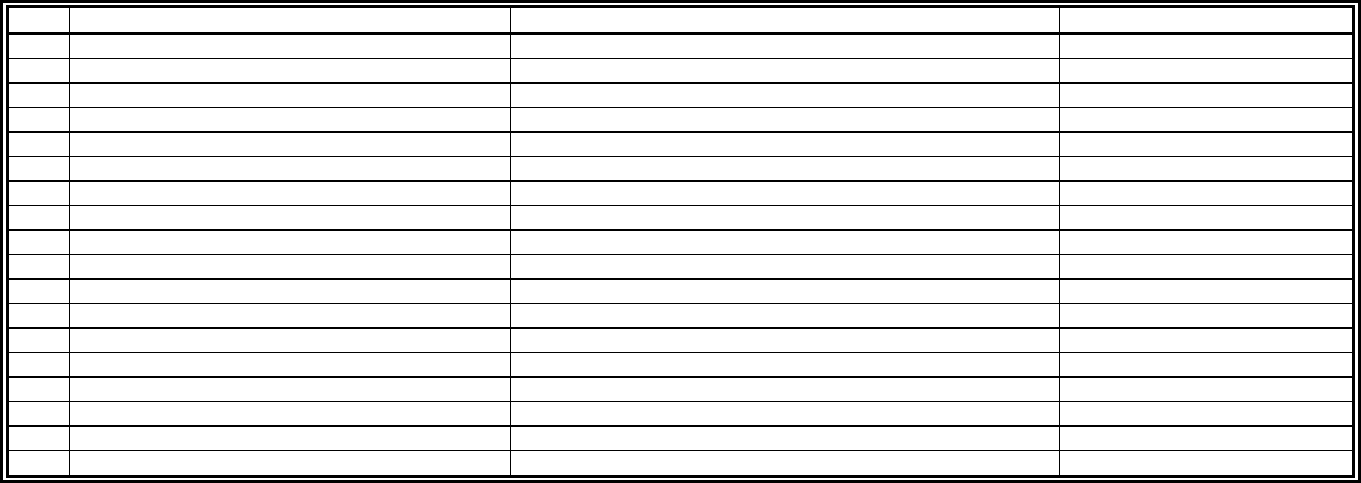

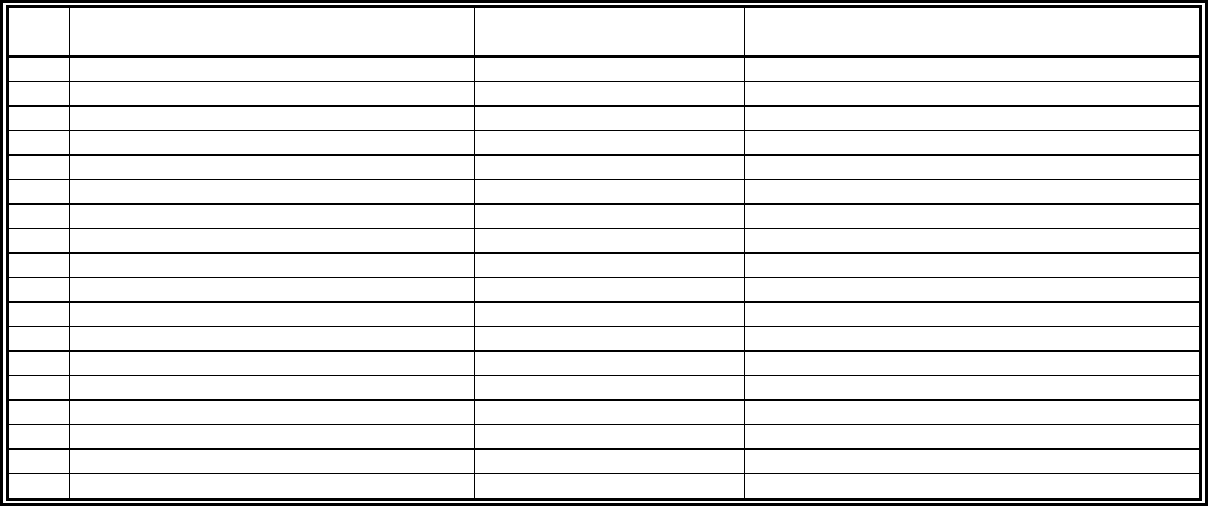

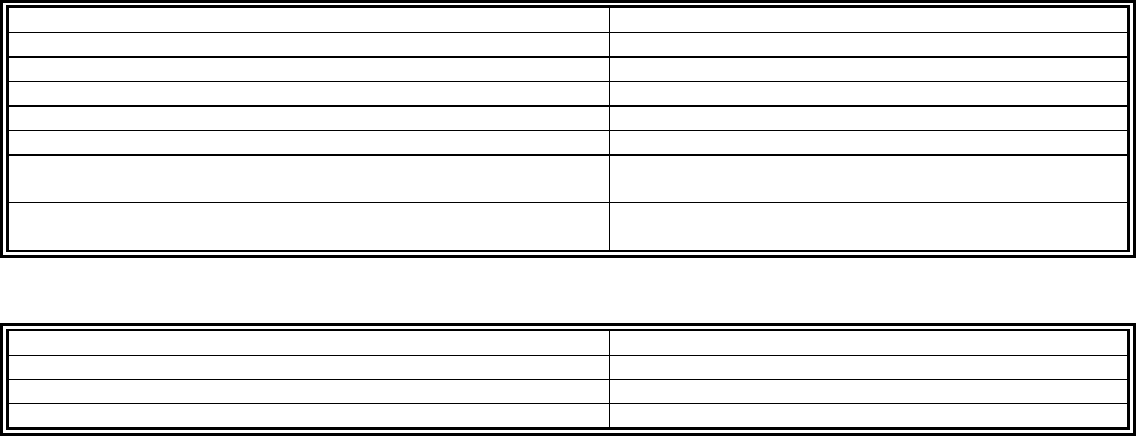

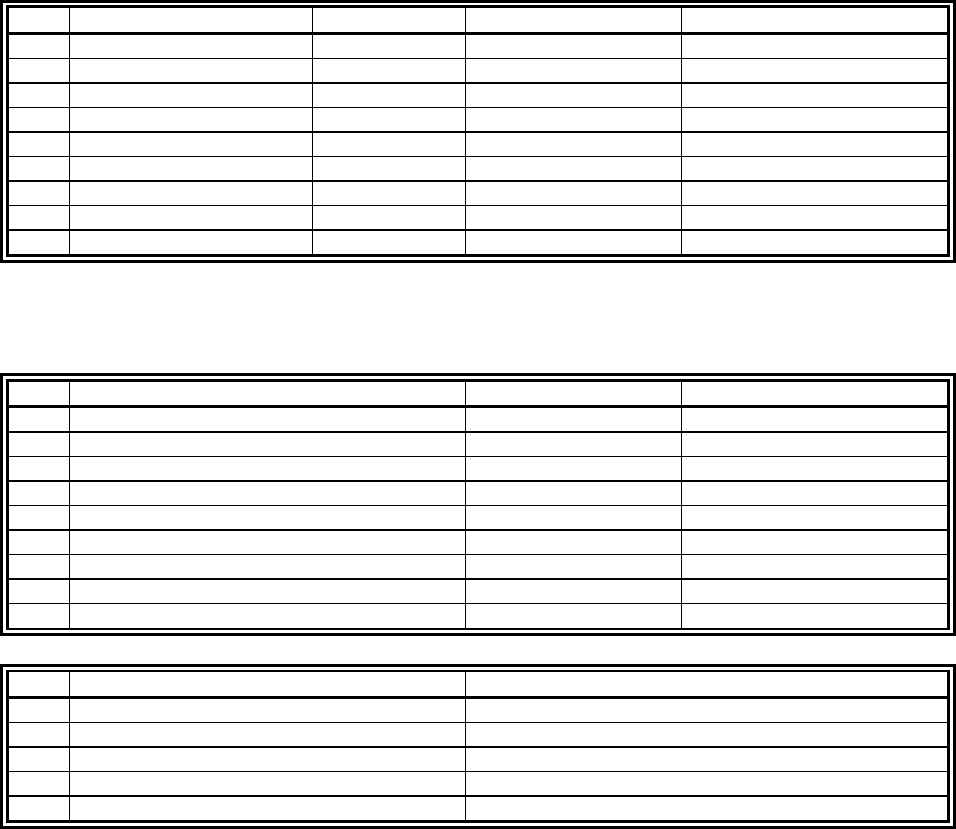

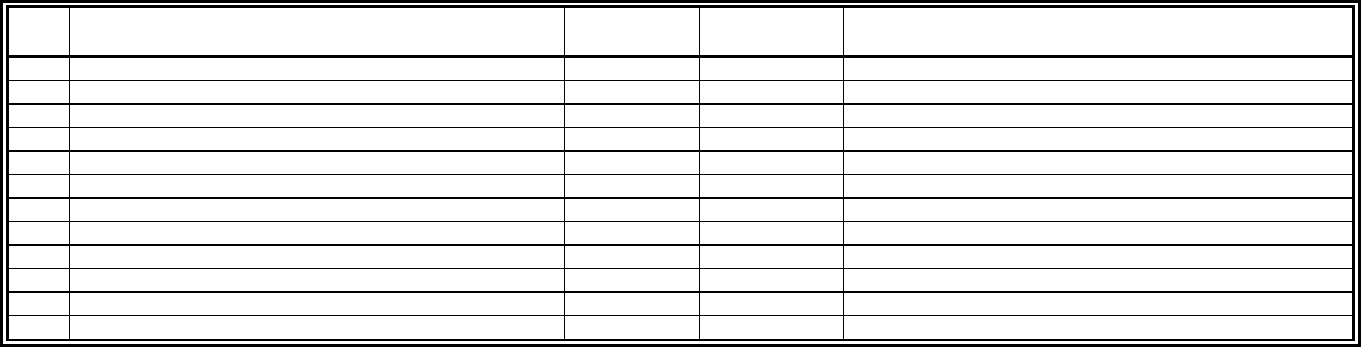

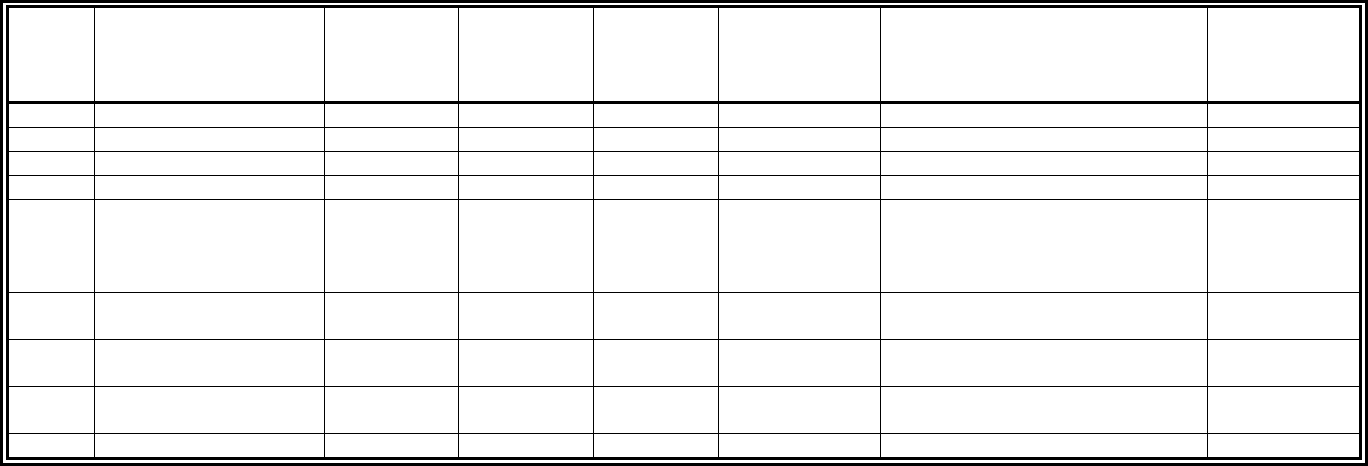

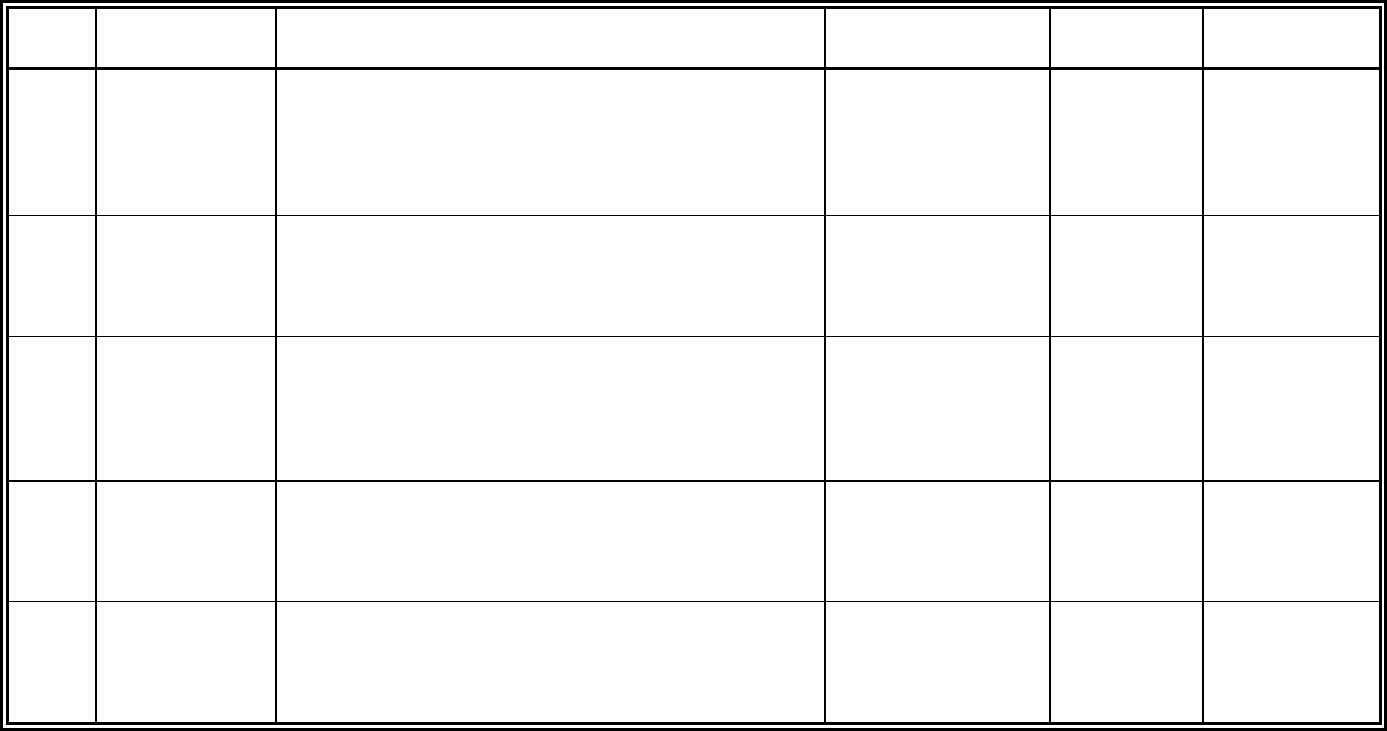

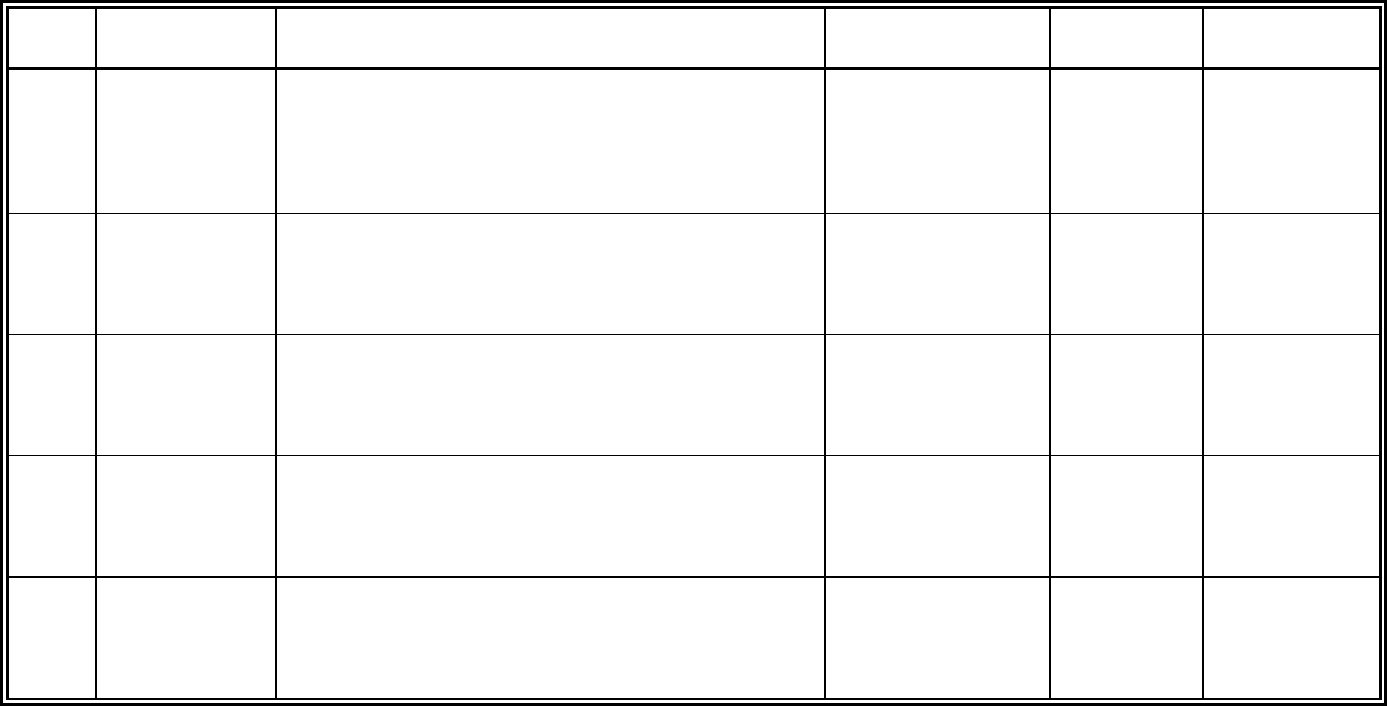

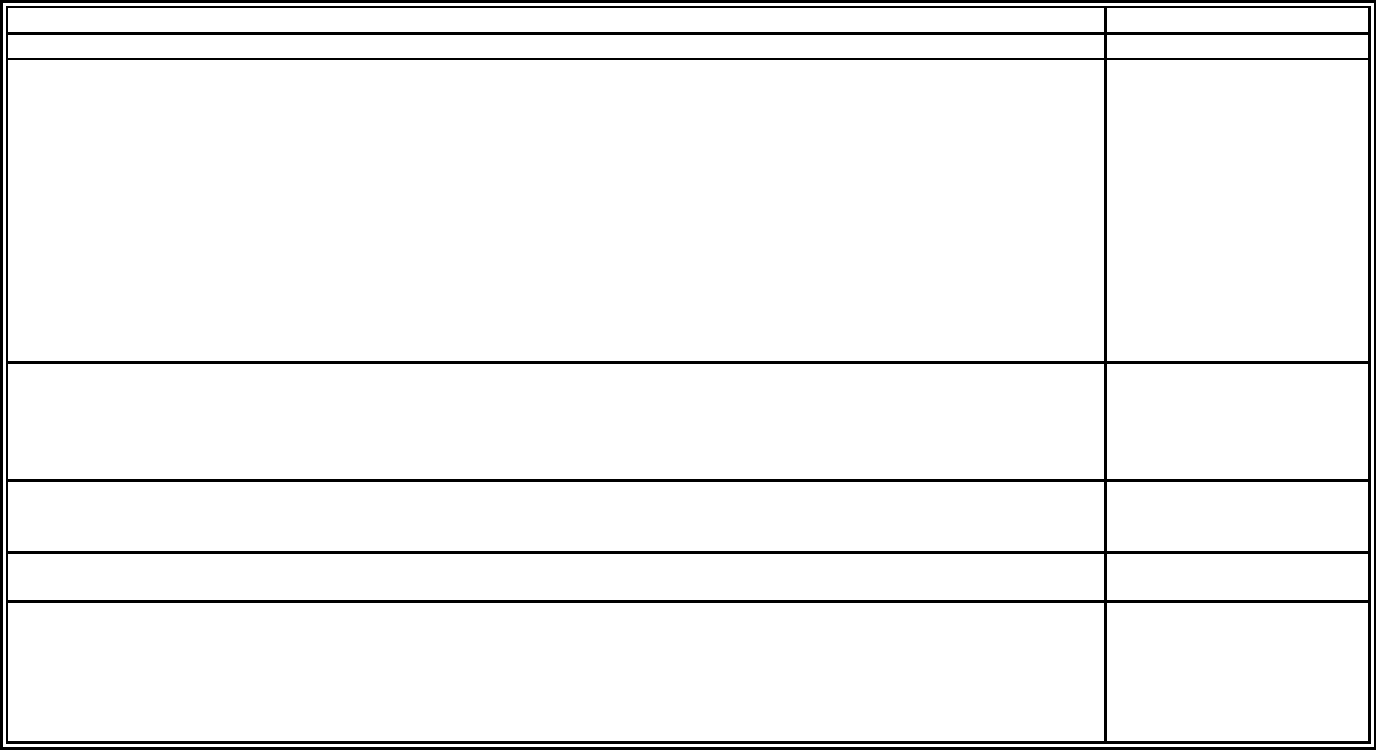

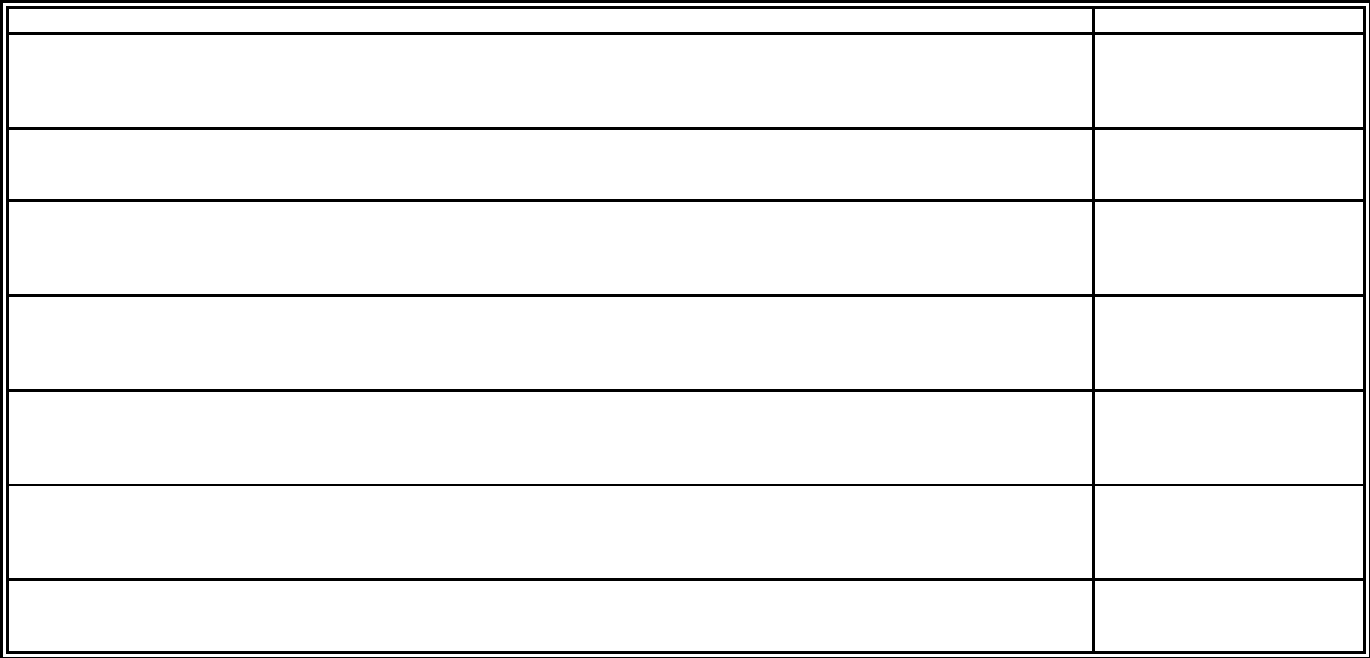

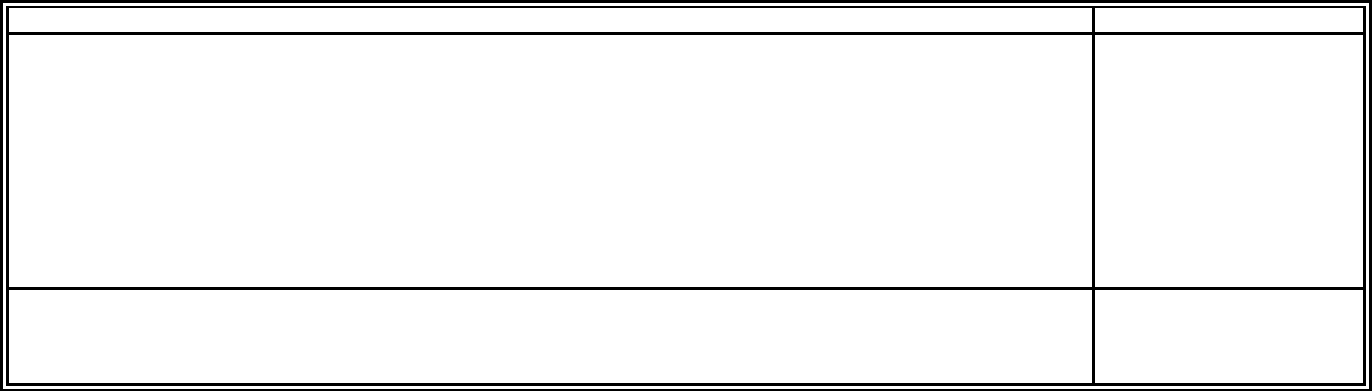

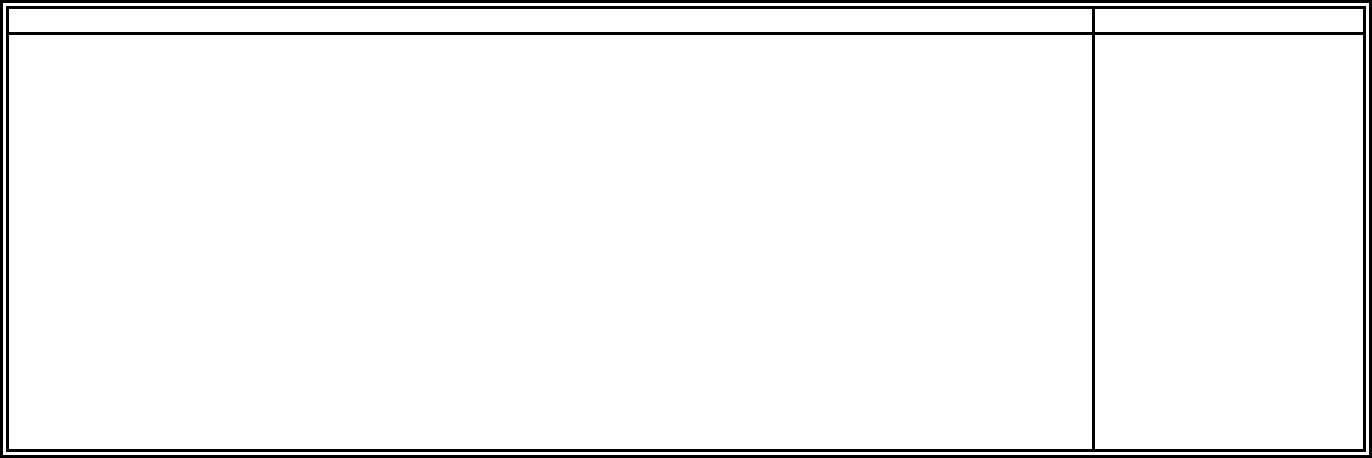

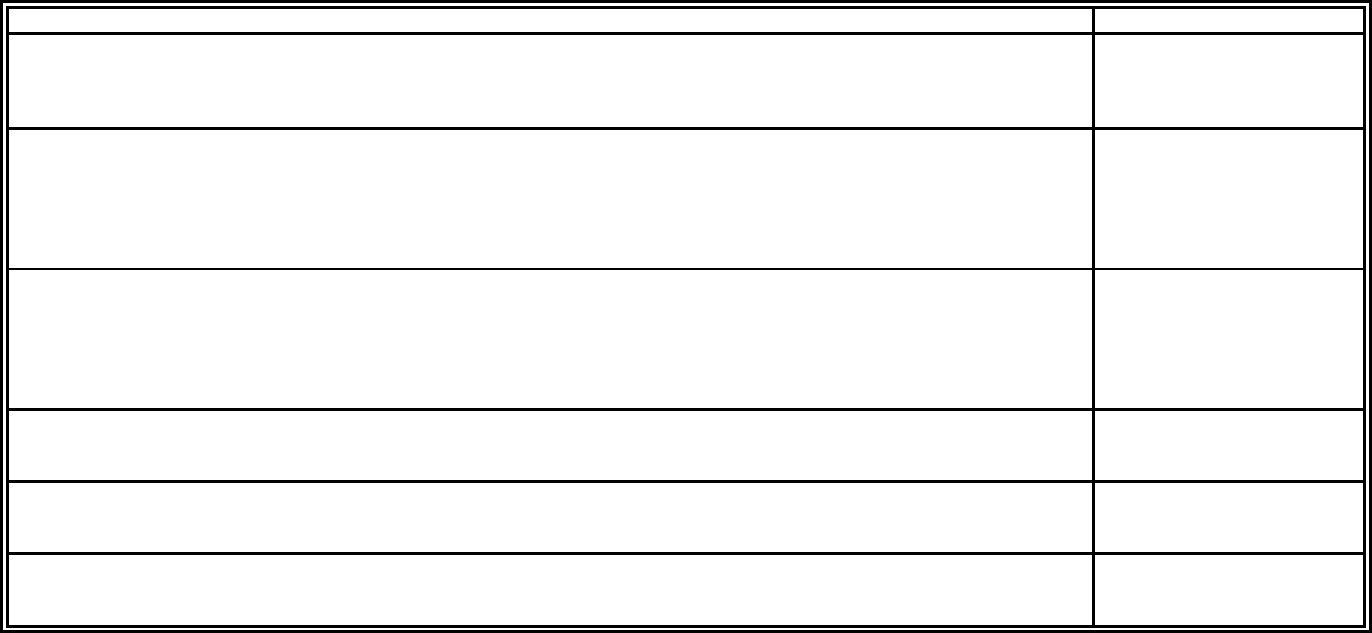

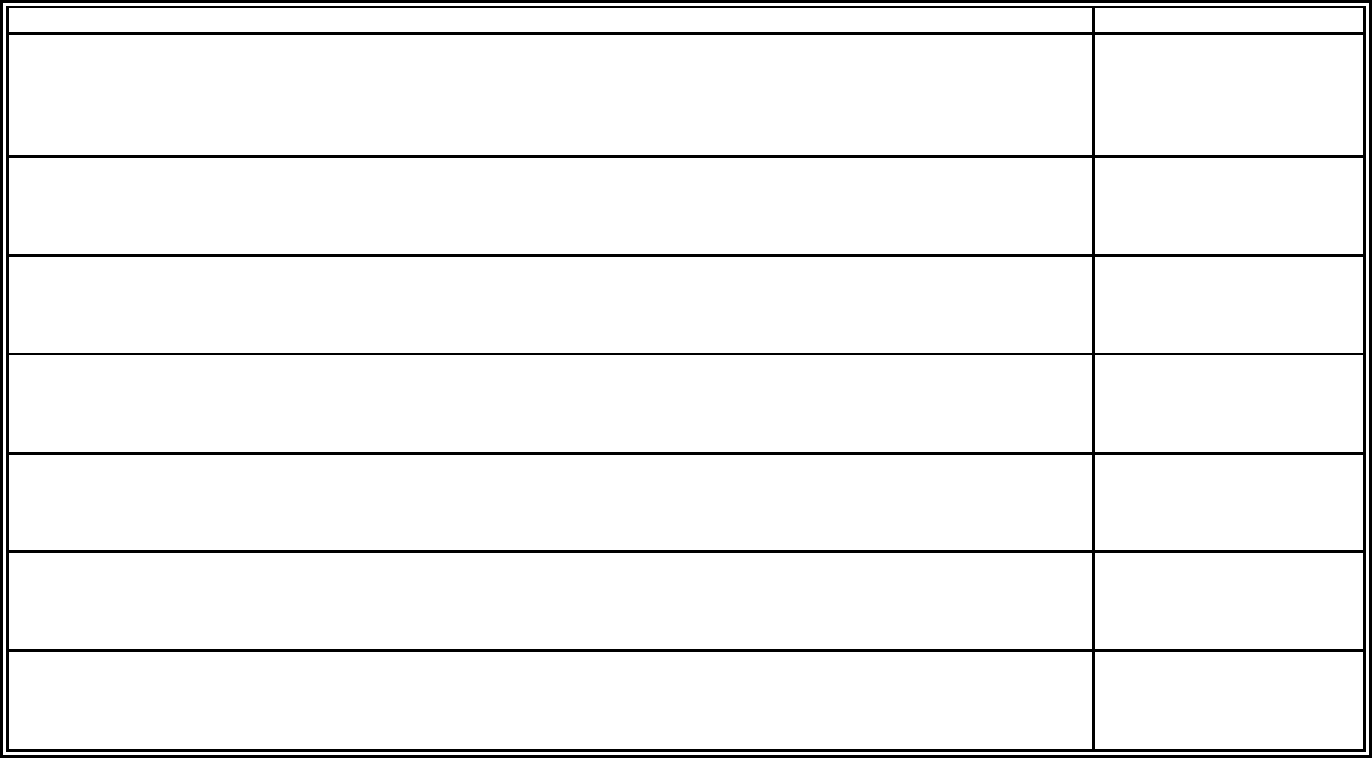

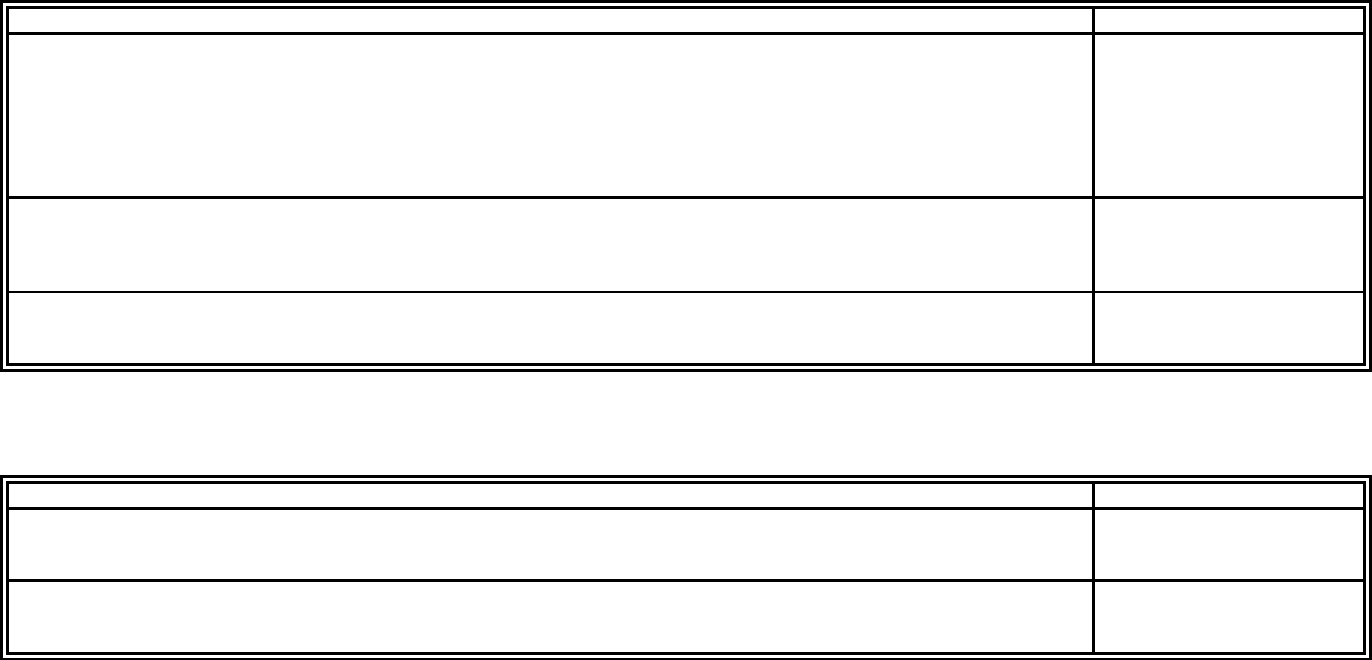

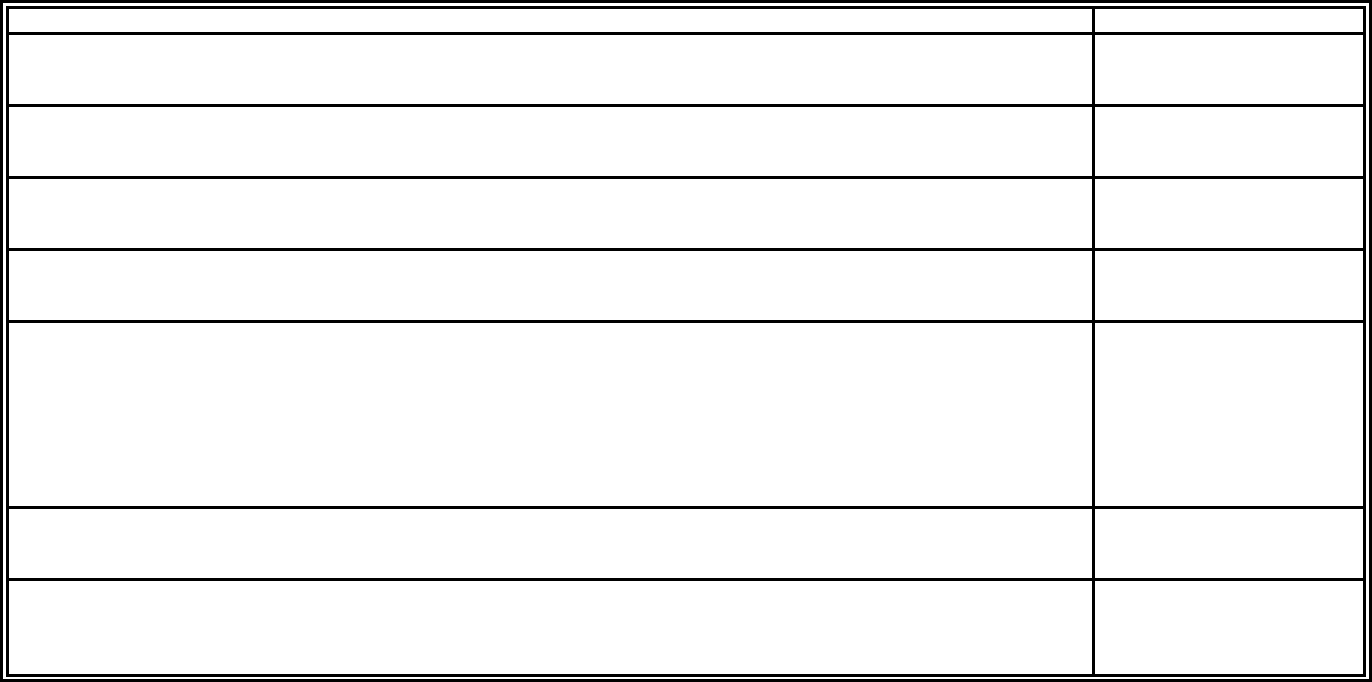

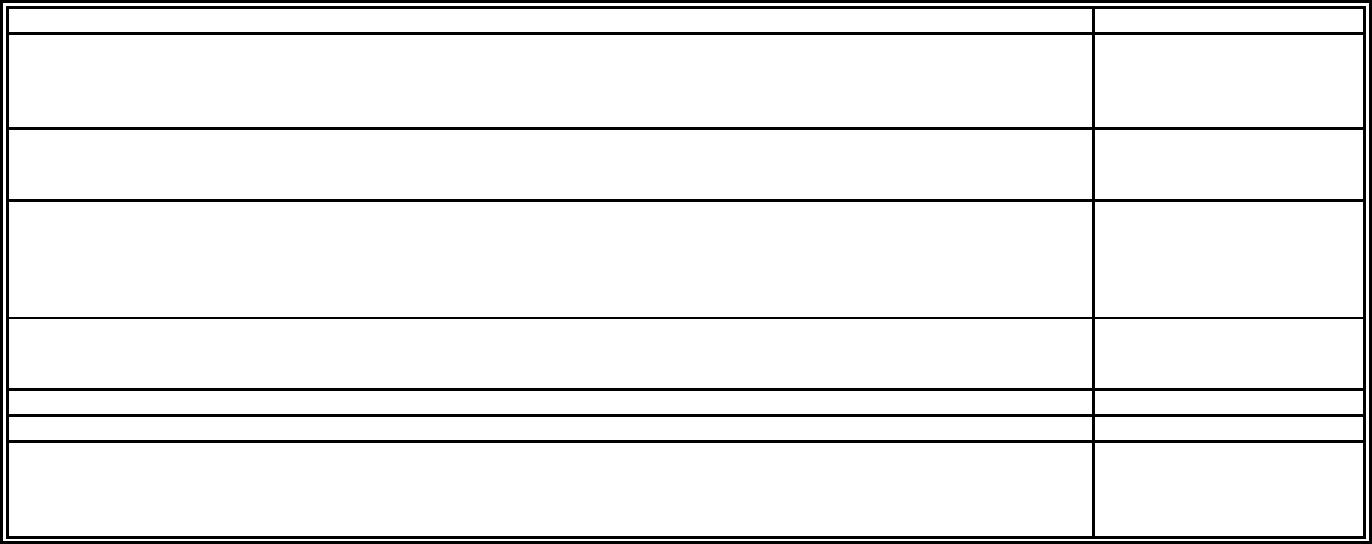

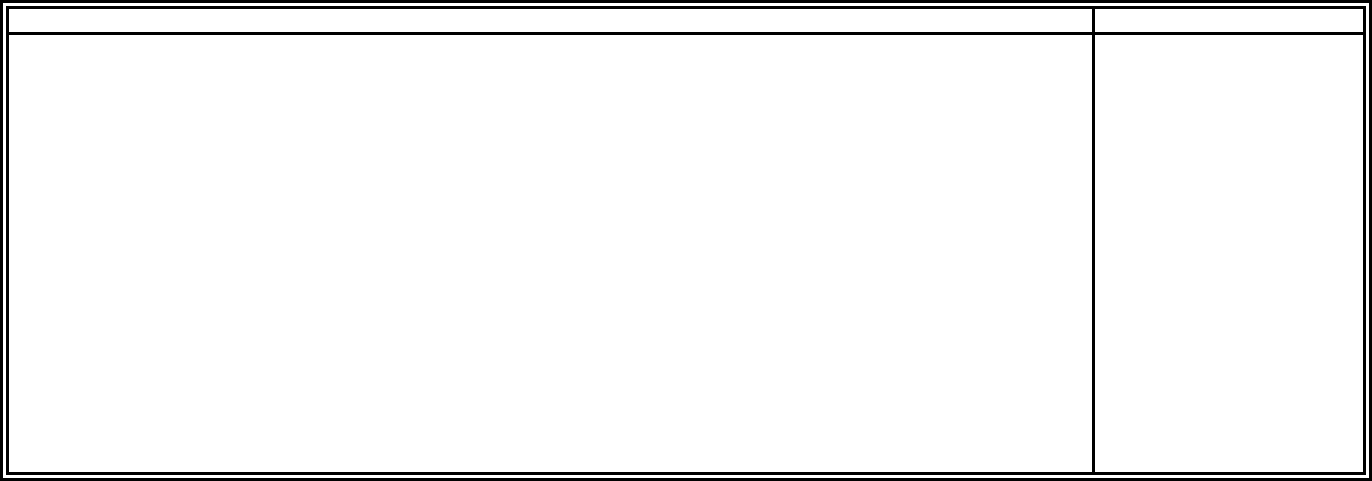

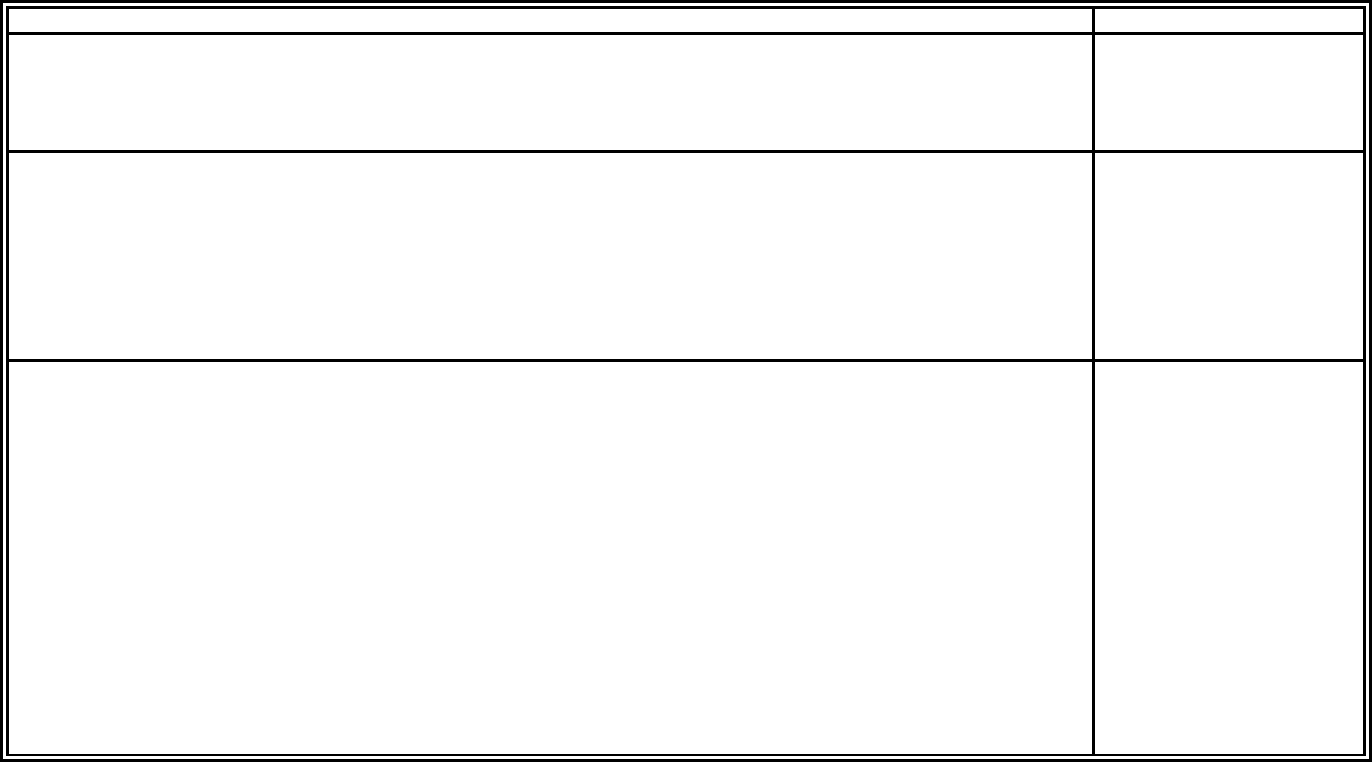

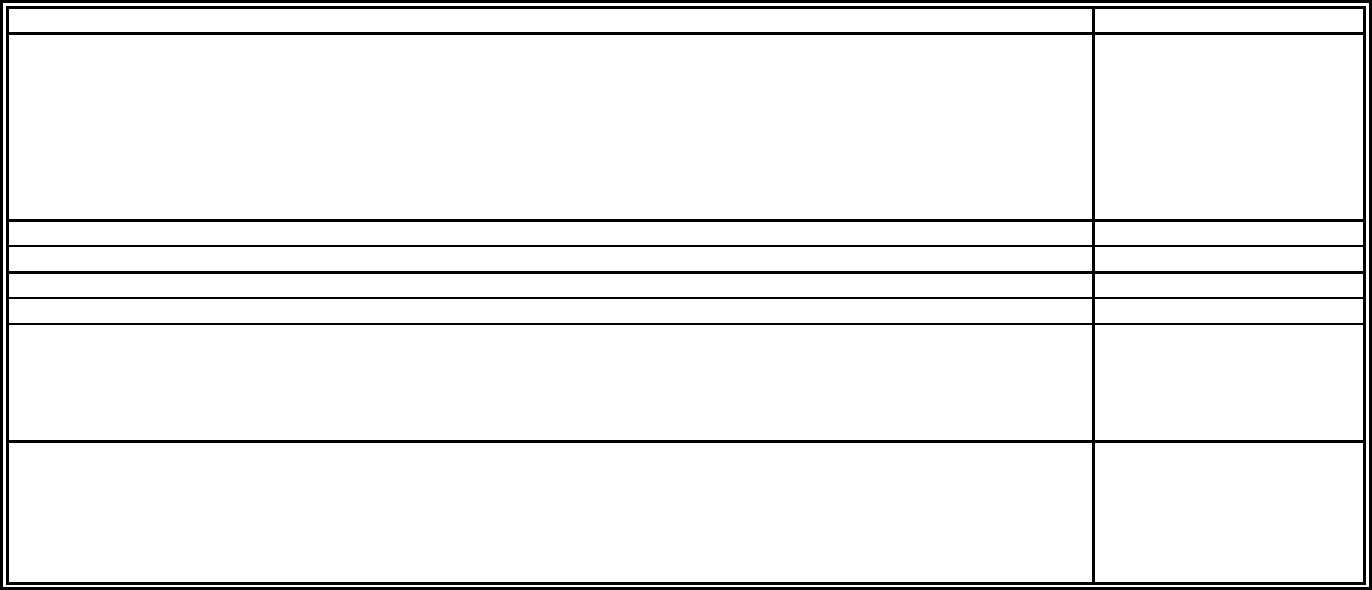

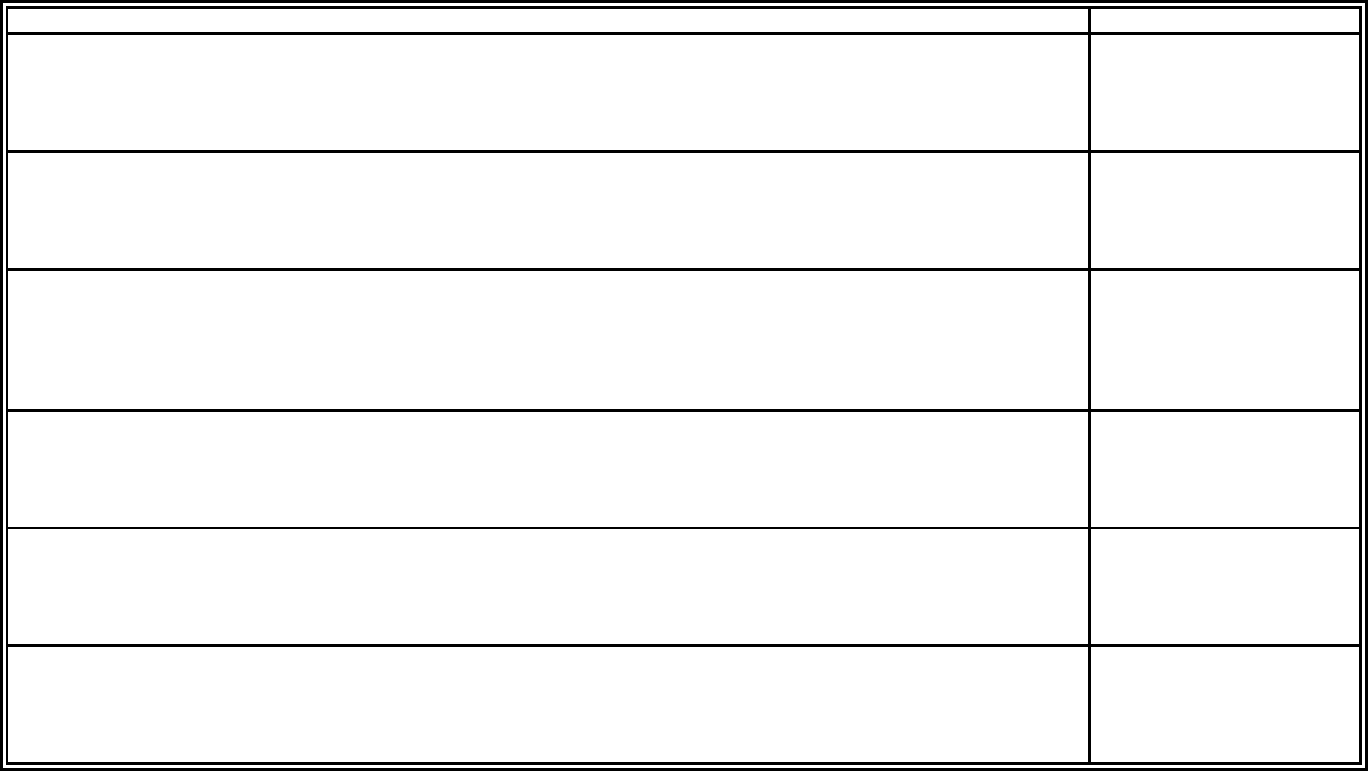

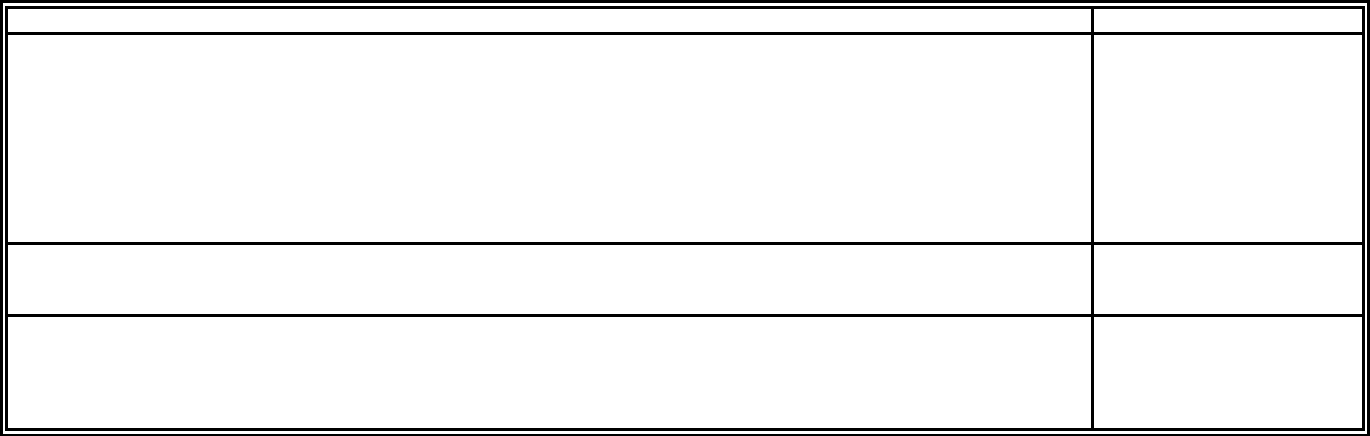

Producer Licensing Fees (cont.)

§§ 21.27.010; 21.27.025; 21.27.040; 21.59.140; 21.59.160; 3 Alaska Admin. Code 31.020 to 31.060

(cont.)

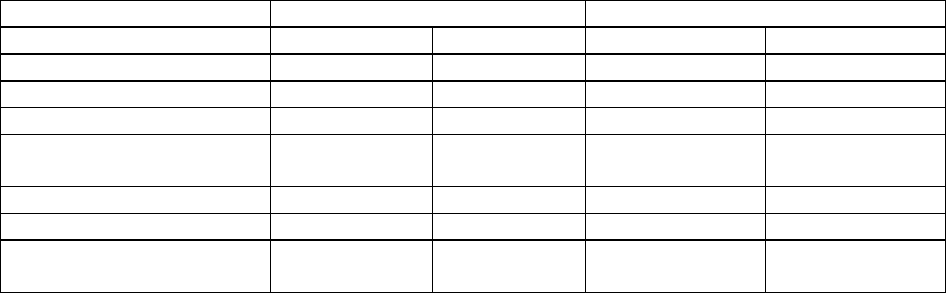

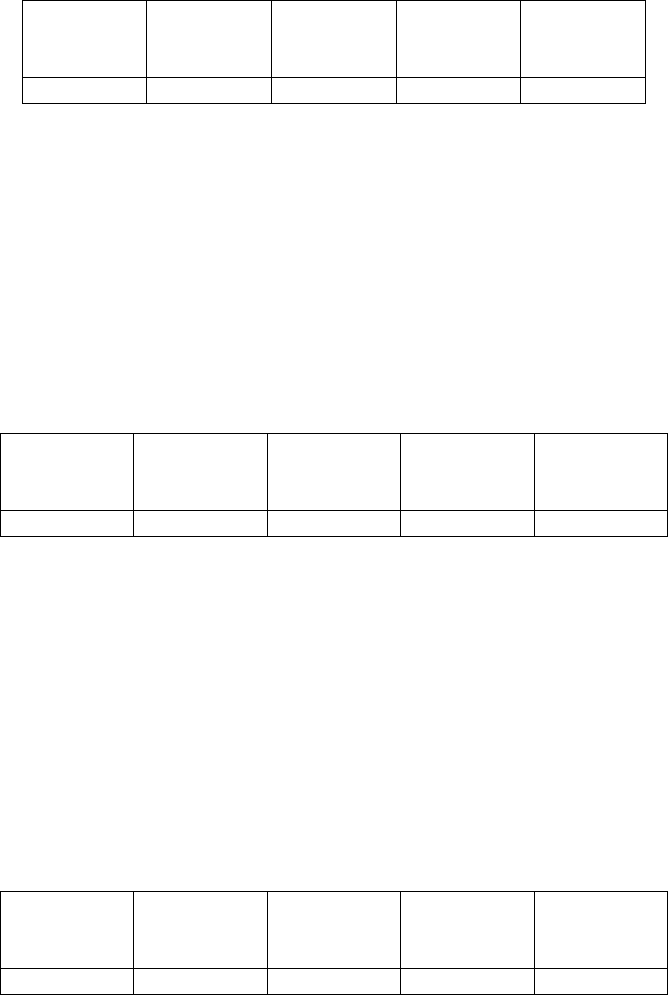

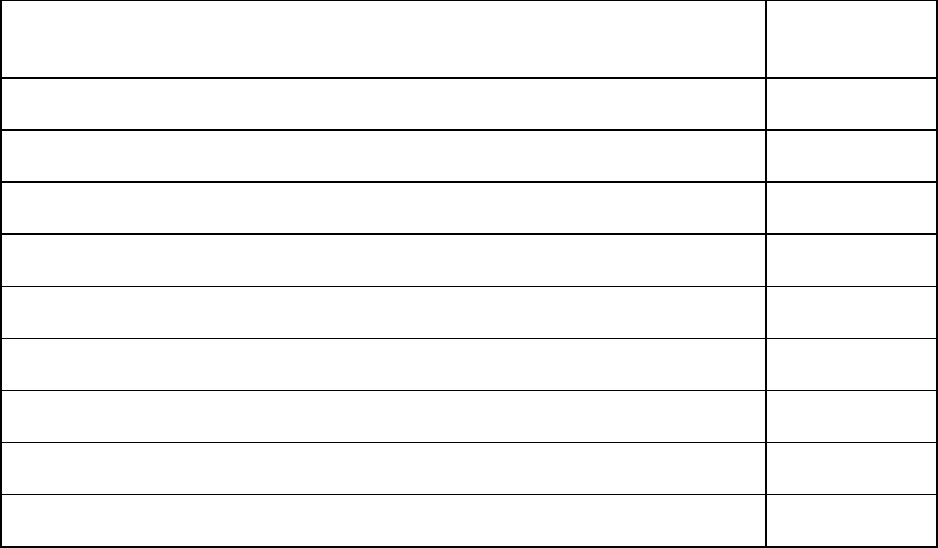

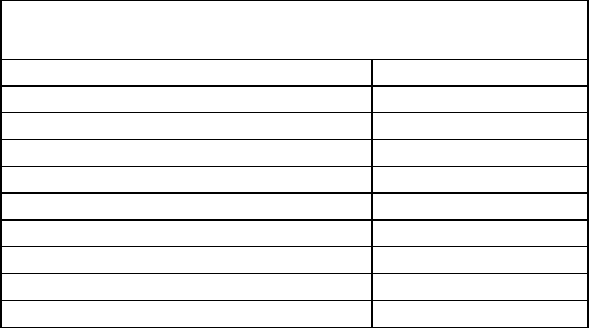

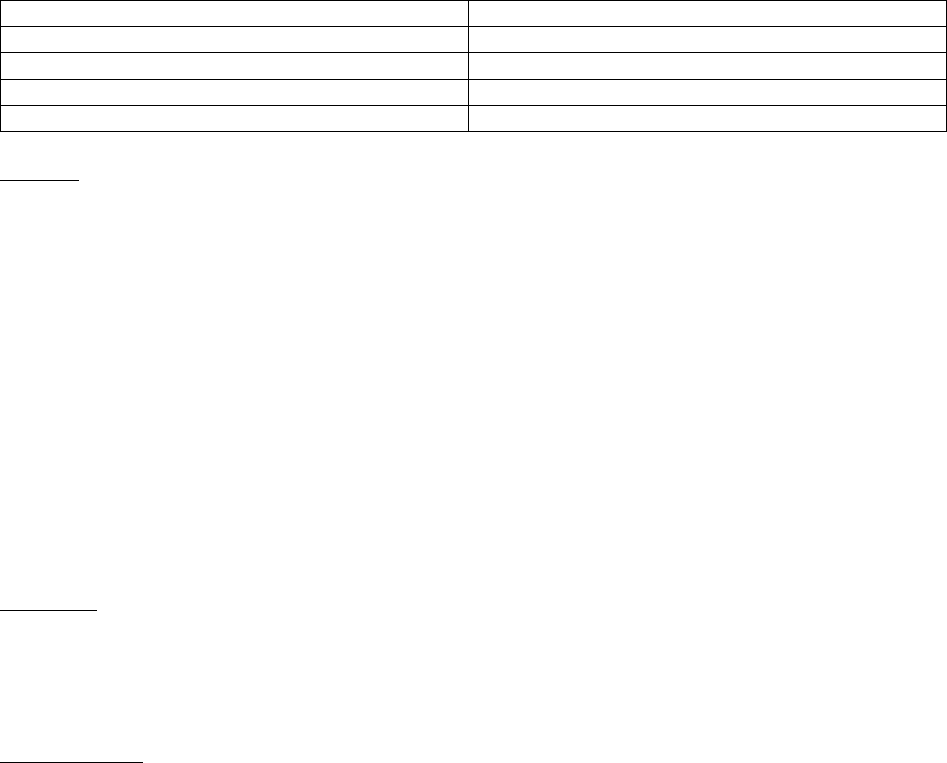

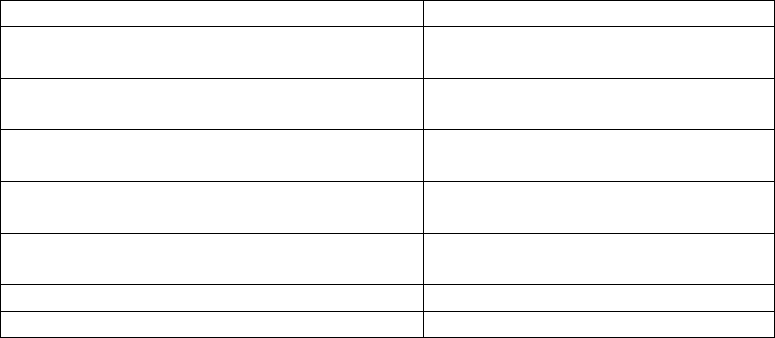

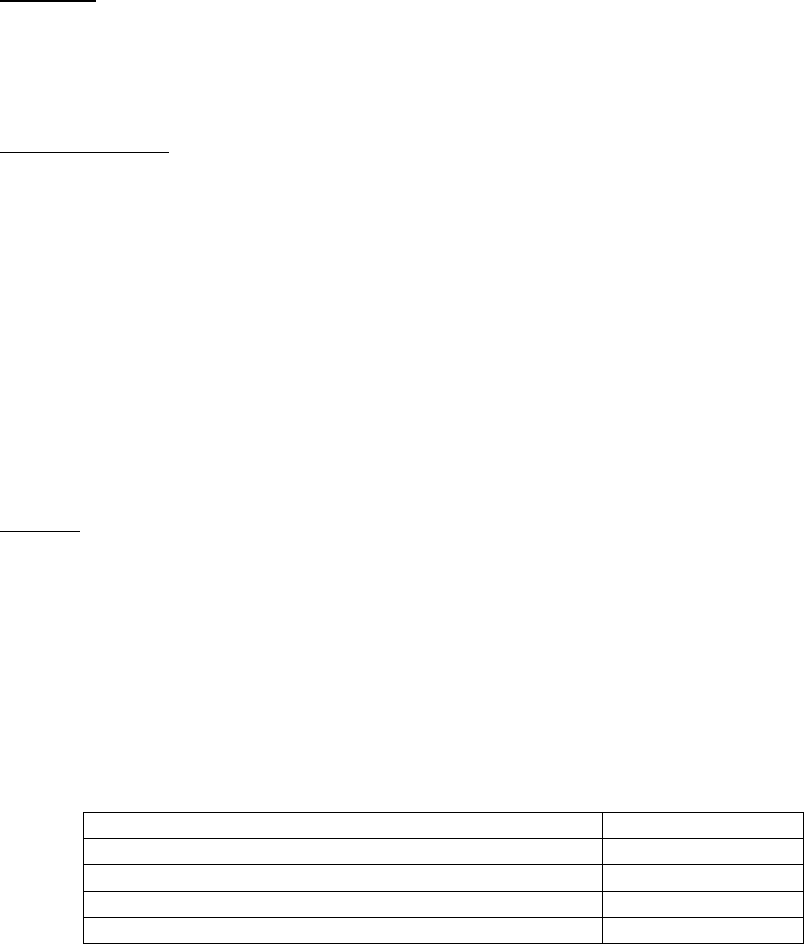

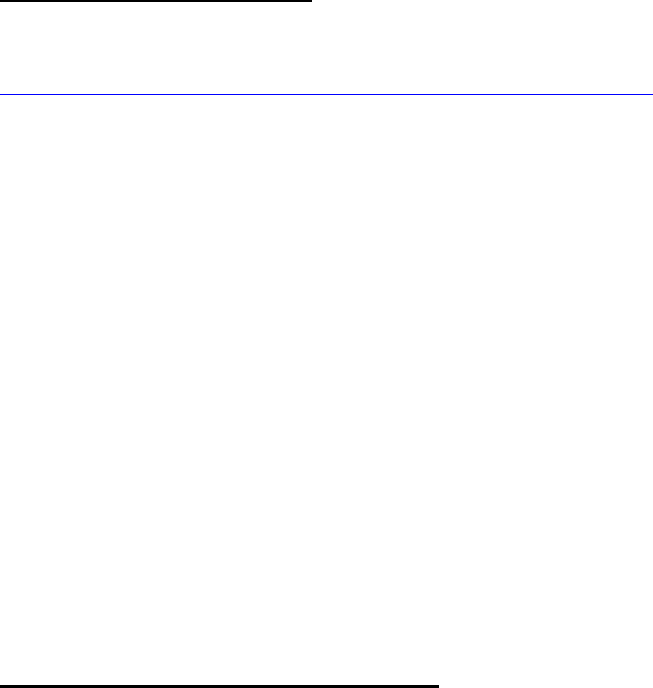

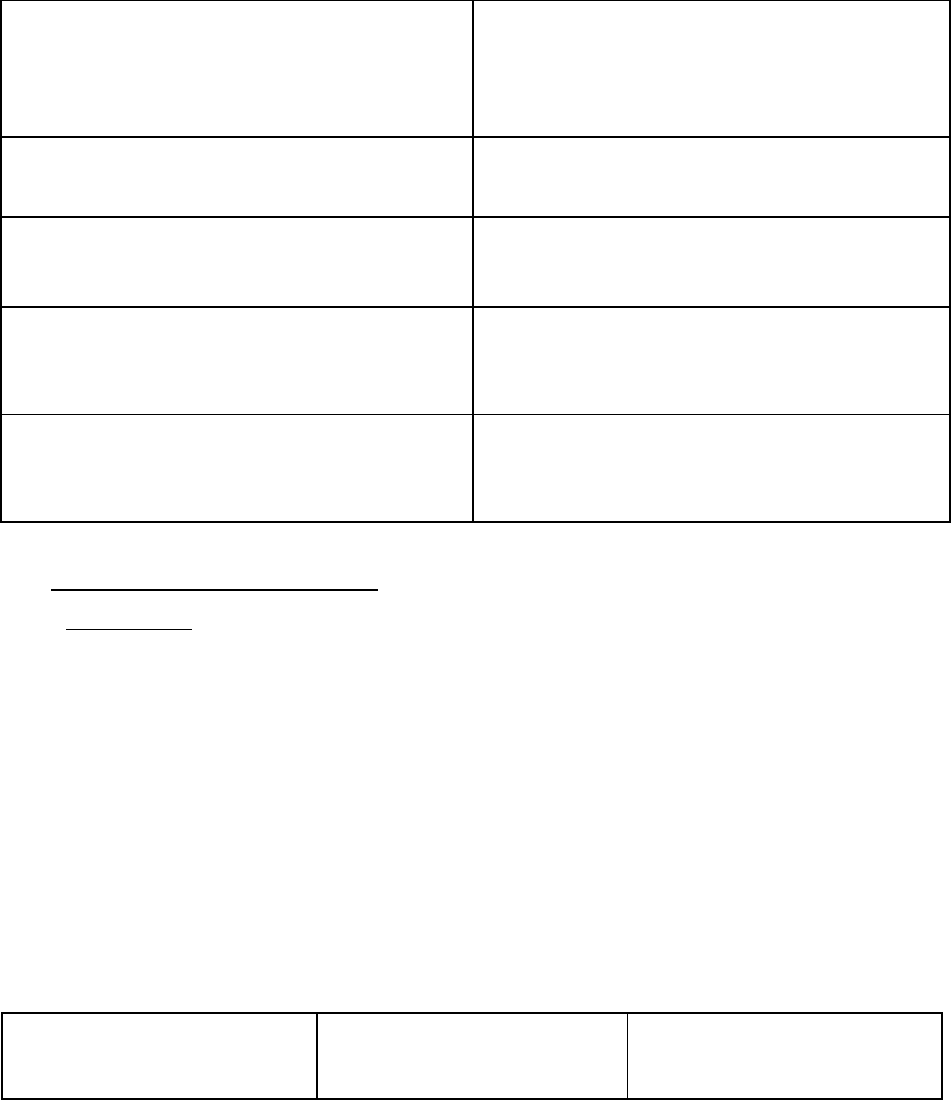

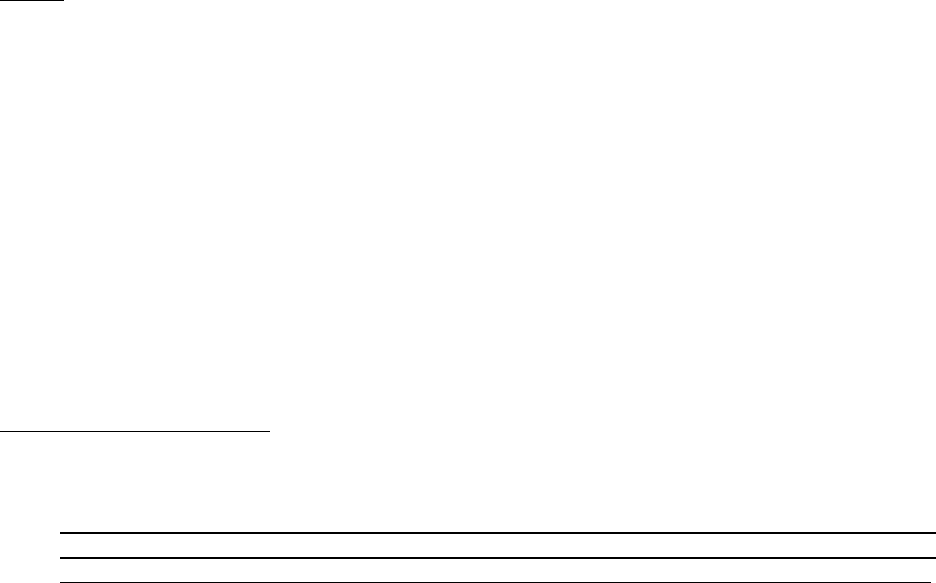

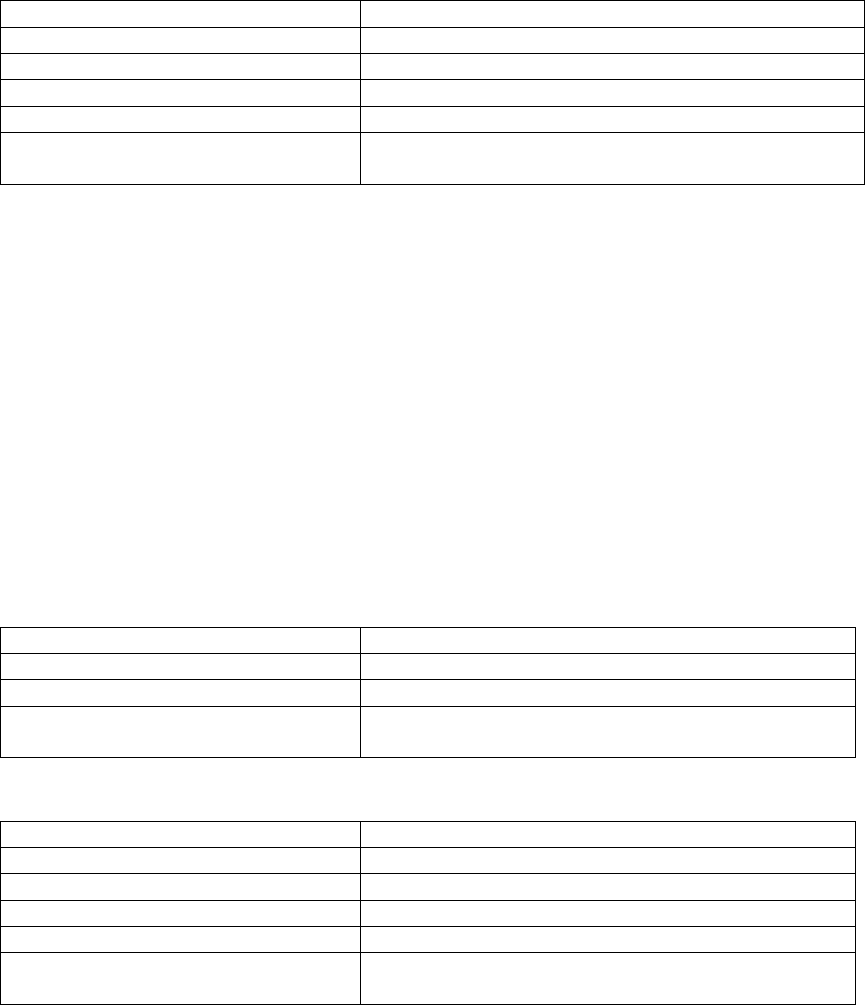

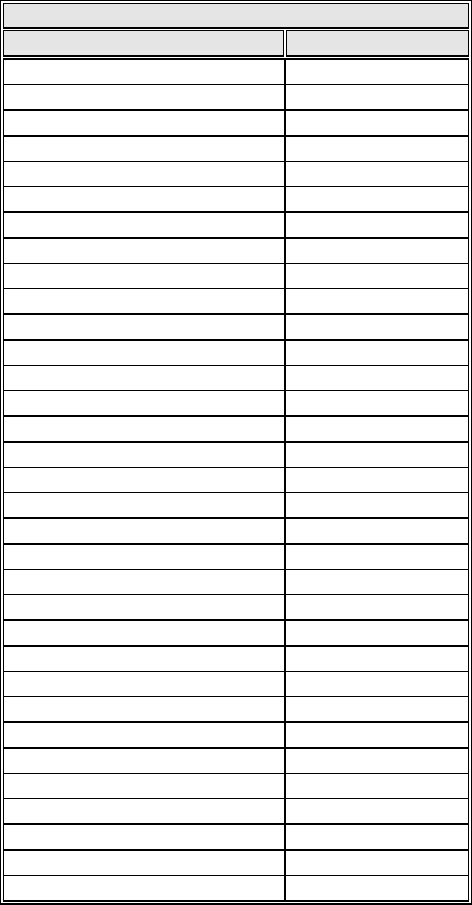

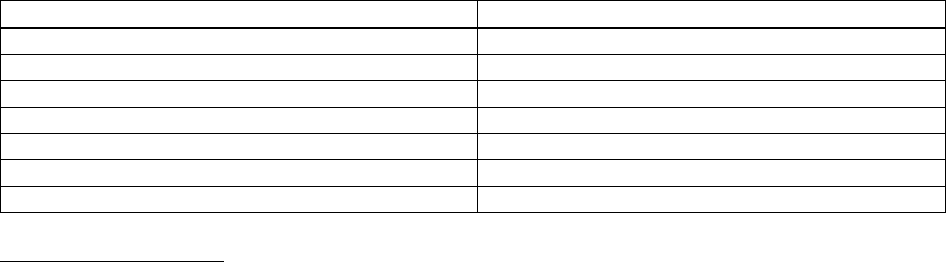

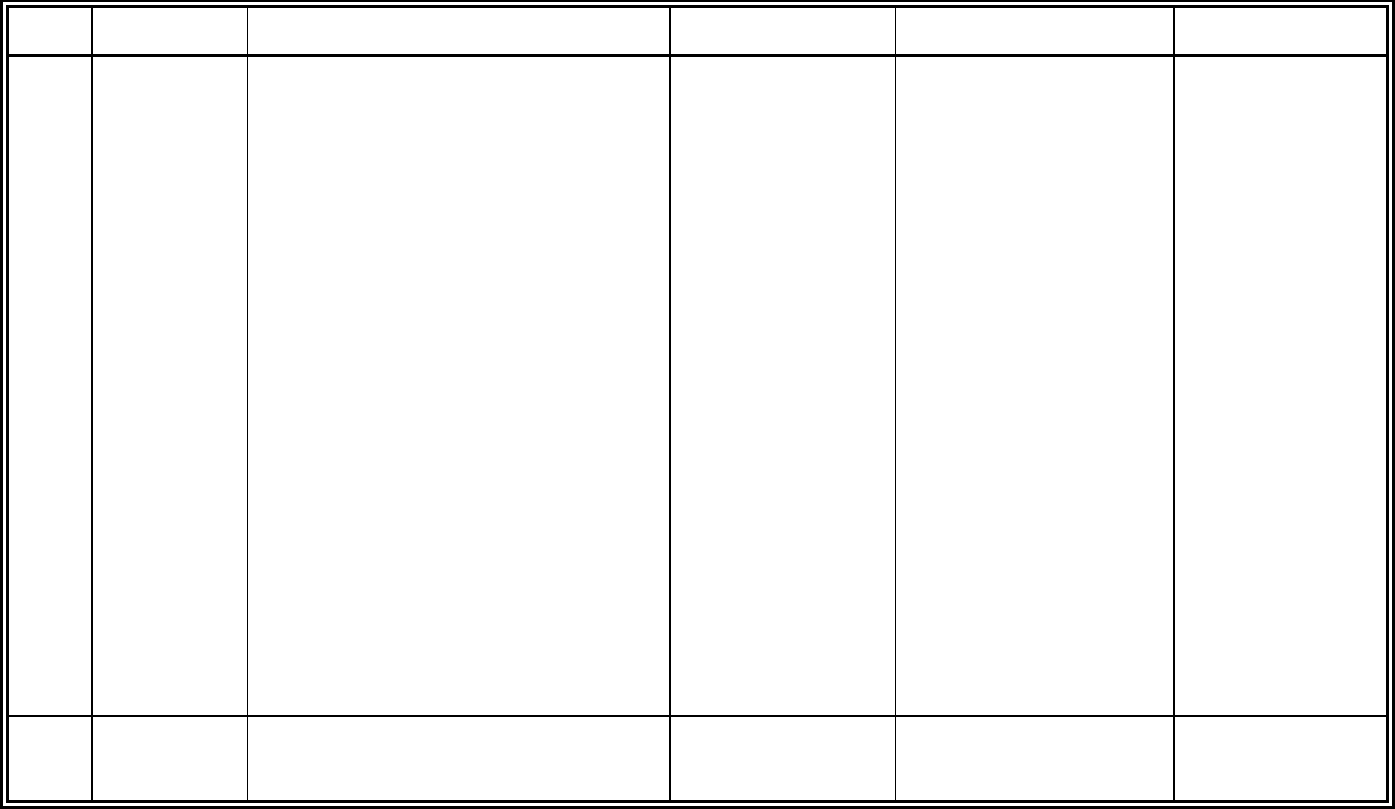

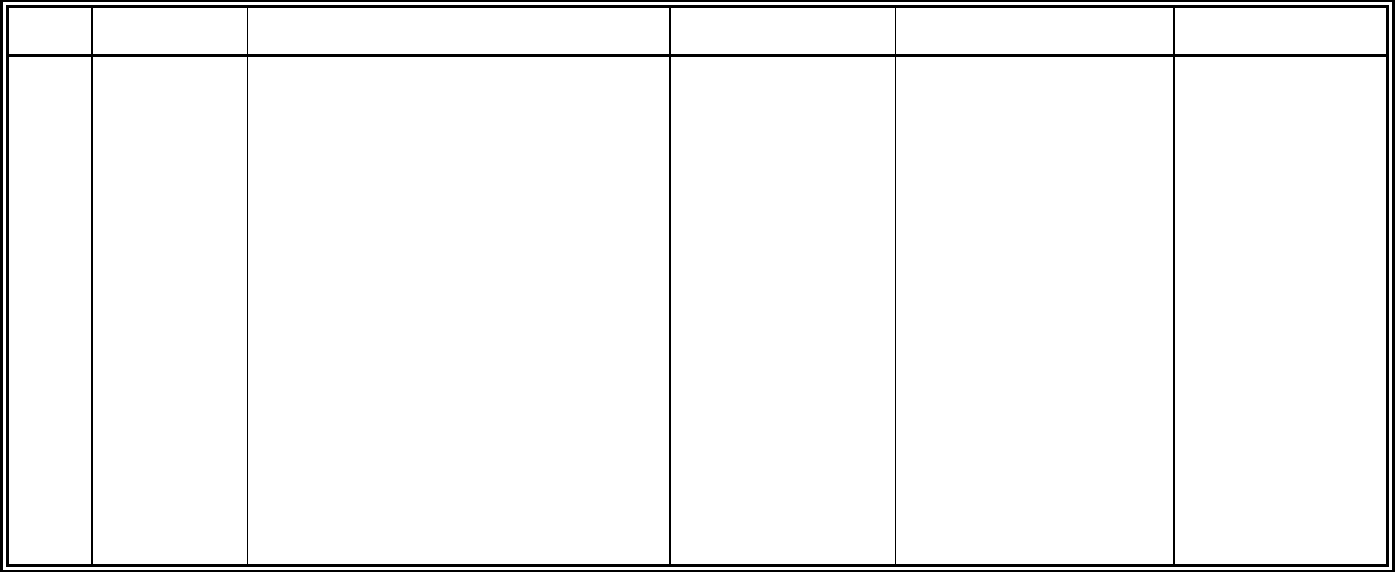

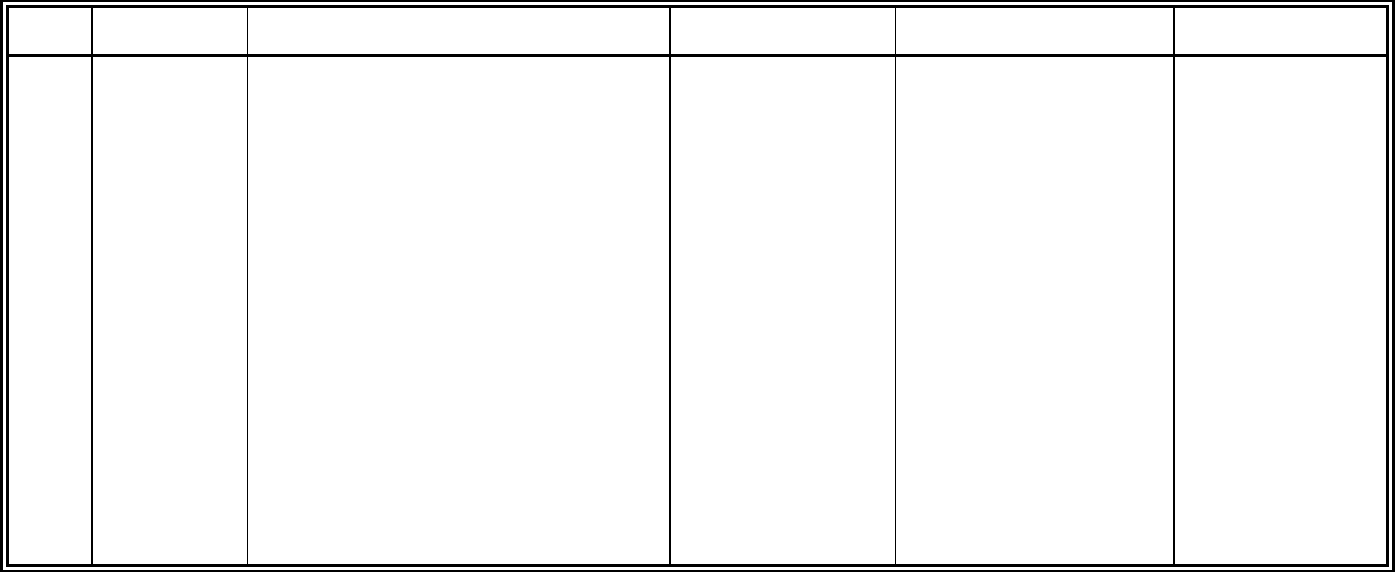

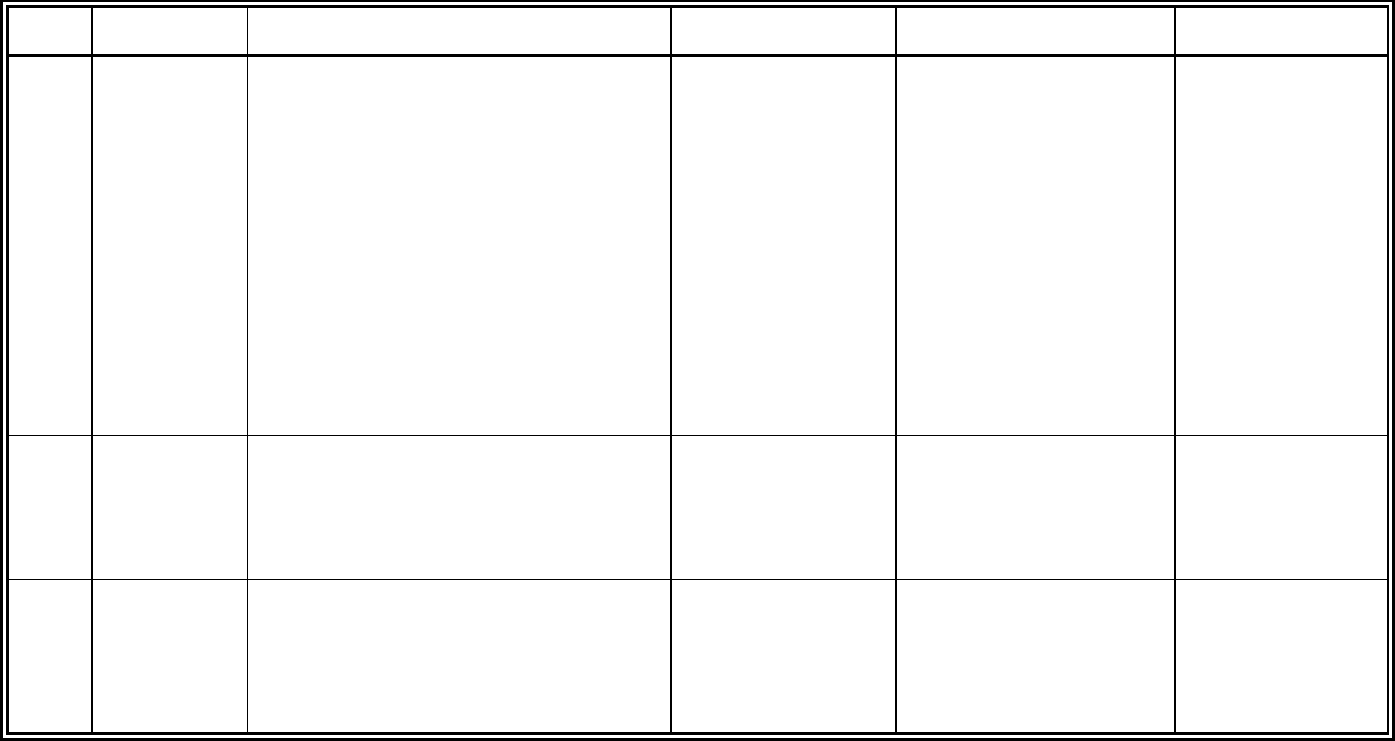

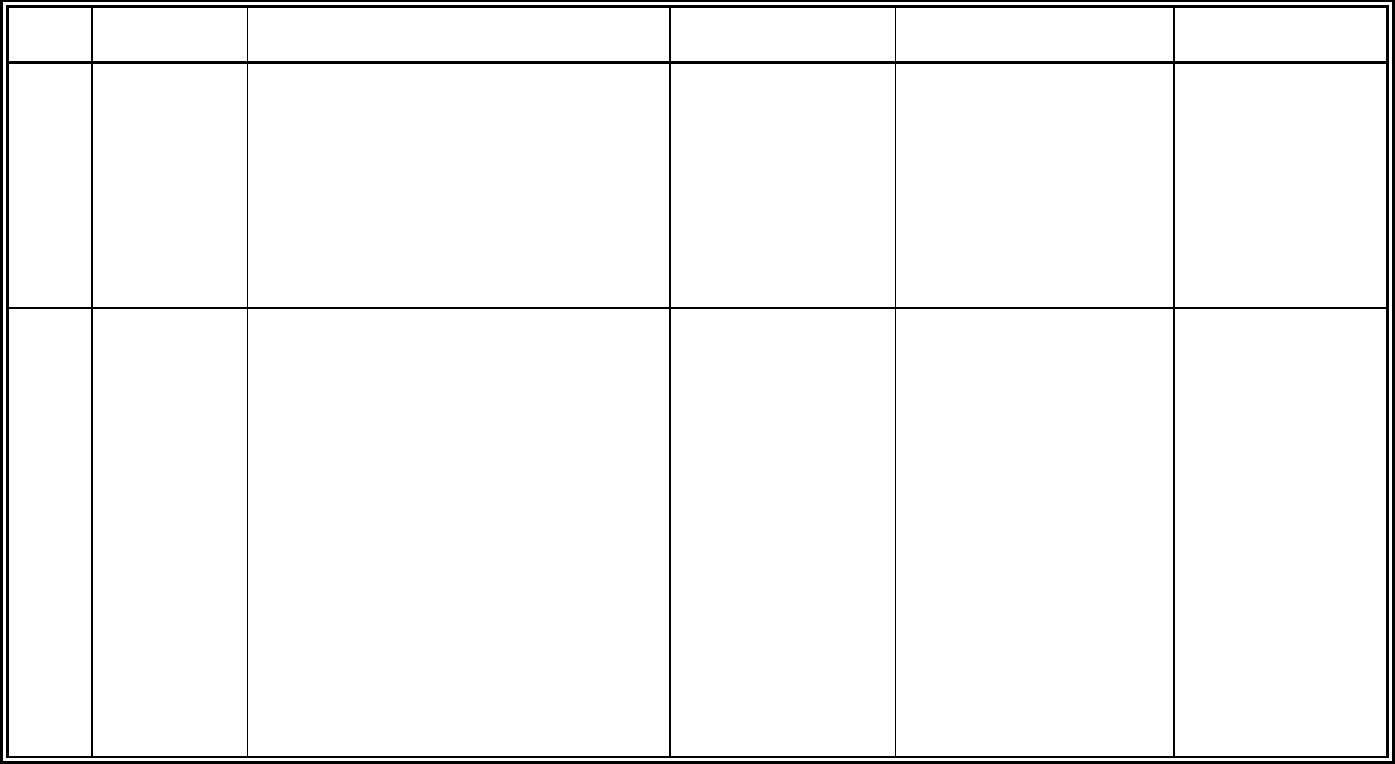

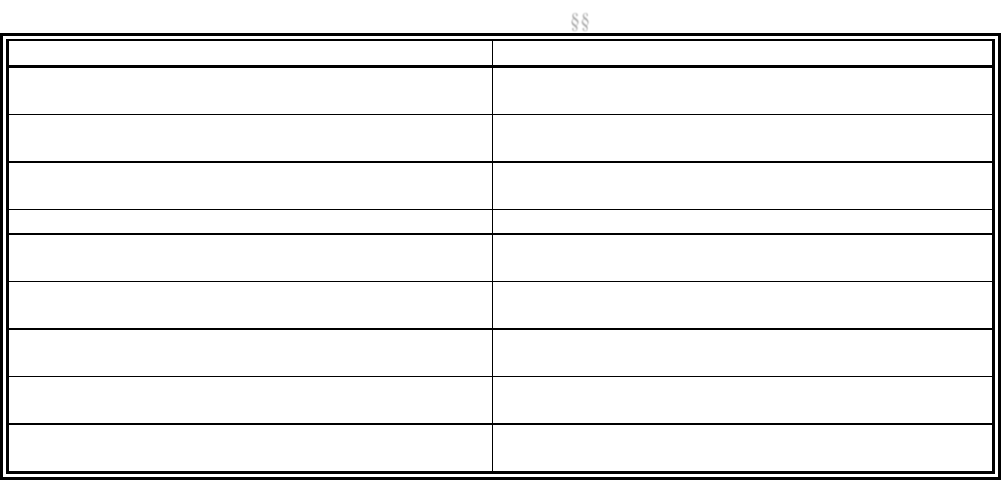

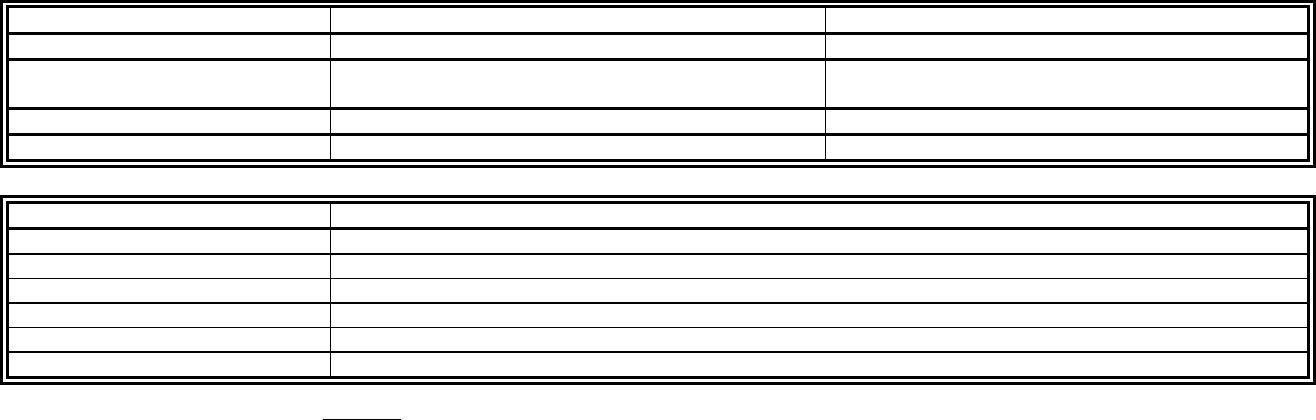

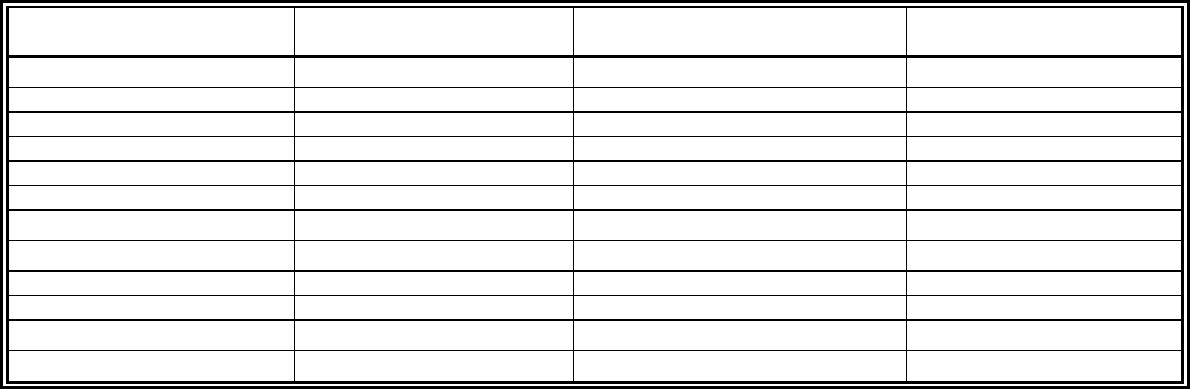

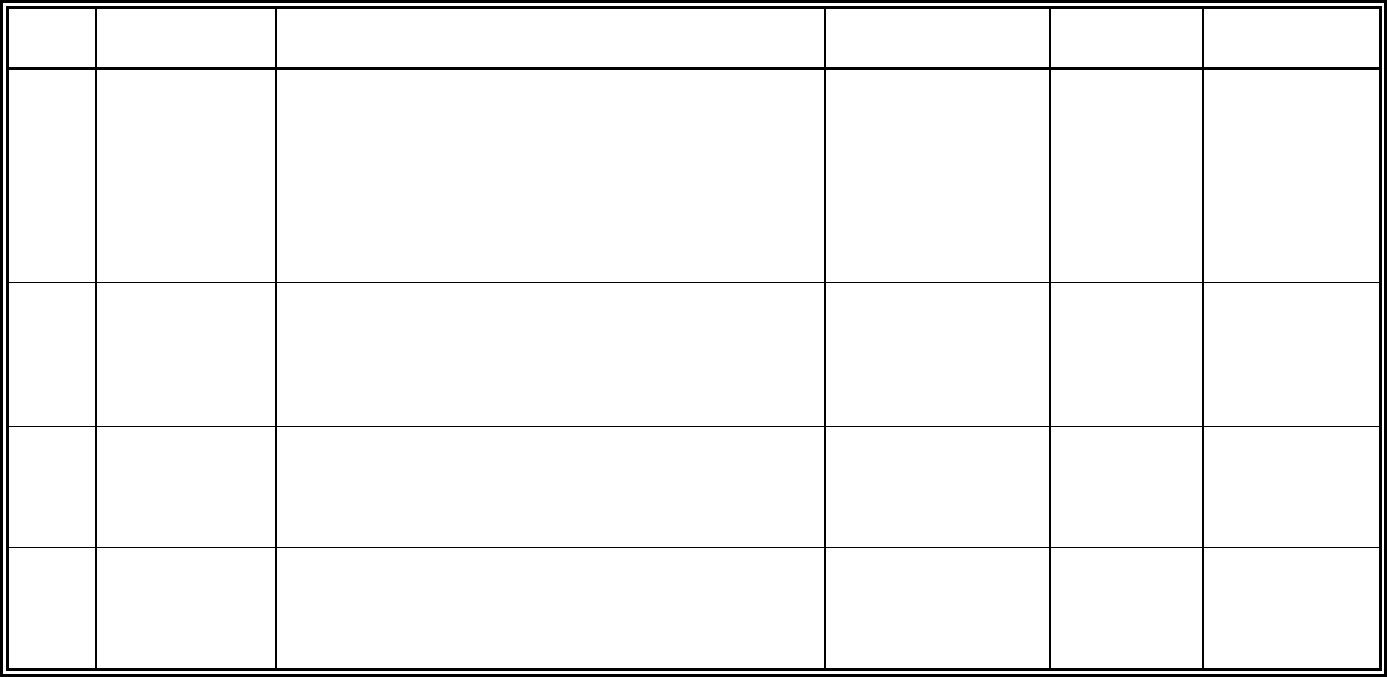

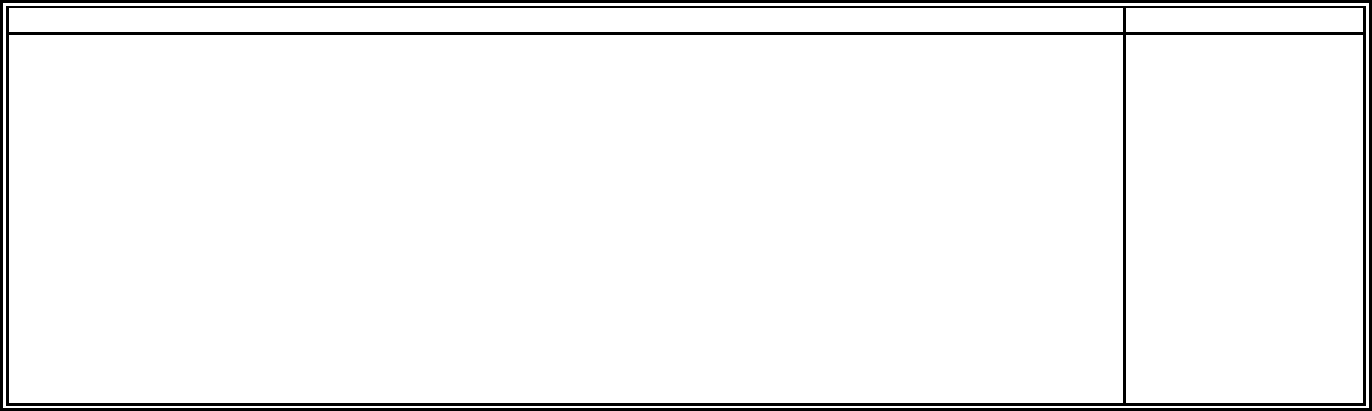

Limited Licenses (Biennial fee)

Individual

Firm

Resident

Nonresident

Resident

Nonresident

Bail Bond

$75

$75

$75

$75

Travel

75

75

75

75

Title

75

N/A

75

N/A

Motor Vehicle Rental

Agency

75

75

75

75

Credit

75

75

75

75

Crop

75

75

75

75

Portable Electronics

Limited Producer

75

75

75

75

Late fee for failure to timely notify director in writing within 30 days after a change in residence,

place of business, legal name, fictitious name or alias, mailing address, electronic mailing

address, telephone number, compliance office, any administrative action taken against the

licensee by a governmental agency of another state or by a governmental agency of another

jurisdiction, including FINRA sanction or arbitration proceedings (effective Oct. 16, 2016),

within 30 days after the final disposition of the action, and any criminal prosecution of the

licensee in this or another state or jurisdiction within 30 days after the date of filing of the

criminal complaint, indictment, information, or citation in the prosecution:

1—60 days late ............................................................................................................................ $50

61—120 days late ........................................................................................................................ 100

More than 120 days late ............................................................................................................... 200

Delayed renewal penalty to reinstate a license that has expired:

1—60 days overdue ..................................................................................................................... 100

More than 60 days overdue .......................................................................................................... 200

Reinstatement:

Of revoked license, if received within 6 months of revocation, application fee plus .................. 500

Miscellaneous licensing fees:

License amendment ......................................................................................................................... 0

Certification of license status ......................................................................................................... 25

Letter of clearance.......................................................................................................................... 25

Fingerprint processing fee ......................................................................................................... 48.25

(made payable to Alaska Division of Insurance when not paid through NIPR)

Retaliation—December 2023

AK-10 © 1991-2023 National Association of Insurance Commissioners

Producer Licensing Fees (cont.)

§§ 21.27.010; 21.27.025; 21.27.040; 21.59.140; 21.59.160; 3 Alaska Admin. Code 31.020 to 31.060

(cont.)

Application filing fee:

For third party administrators, reinsurance intermediary managers or brokers,

or managing general agents seeking exemption from the registration

or license requirement ......................................................................................................... $100

Additional filing fee if paper application received when filing can be

submitted electronically .......................................................................................................... 50

Continuing Education Fees:

Provider application fee ............................................................................................................... 200

Course application fee.................................................................................................................... 50

Provider renewal fee .................................................................................................................... 100

Course renewal fee ......................................................................................................................... 50

Course late roster filing fee .......................................................................................................... 250

Late issuance of certificate of course completion .......................................................................... 20

Course late renewal fee .................................................................................................................. 50

(in addition to the $50 renewal fee)

Provider late renewal fee ............................................................................................................... 50

(in addition to the $100 renewal fee)

Manual course review fee .............................................................................................................. 50

DEPOSITS

§§ 21.09.090; 21.66.010; 21.66.020; 21.85.030; 21.87.210

Most admitted insurers must have a deposit at least $300,000 with the director. Foreign insurers may

instead provide a certificate from the public official having supervision over them in any other state

with at least a $300,000 deposit. A title insurance company must have $300,000 plus $50,000 for

each state or territorial subdivision in which it becomes qualified to sell title insurance up to

$750,000. In addition, within 30 days after filing each annual statement, title companies shall deposit

10% of preceding year written premiums up to $50,000 in one year until the aggregate deposits of

$750,000 is reached at which point no further deposit will be required. Multiple Employer Welfare

Arrangements (MEWA) are required to deposit at least $200,000 with the director. Hospital/Medical

Service Corporations are required to have a minimum $100,000 surplus fund.

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AK-11

CONTACT PERSON

Premium Tax and Producer Licensing

Rebecca Nesheim: (907) 465-2584; rebecca.nesheim@alaska.gov

Company Licensing

Jeffery Bethel: (907) 269-7919; jeffery.bethel@alaska.gov

Producer Licensing

Kayla Erickson: (907) 465-2545; kayla.eric[email protected]

Every effort has been made to make this information as correct and complete as possible, but for

specific issues the reader should check the statutes cited. This summary has been prepared by the

NAIC and reviewed by the state’s insurance department and/or tax department for accuracy. All

decisions on legal interpretation are made by state officials, so the reader should contact the above

for further information.

Retaliation—December 2023

AK-12 © 1991-2023 National Association of Insurance Commissioners

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AZ-1

ARIZONA

→ Arrow indicates an update for 2023

EDITOR’S NOTE

Arizona Revised Statutes (“ARS”) are accessible from the “Legislative Council” menu on the Arizona

State Legislature website (www.azleg.gov). Most insurance laws are contained within Title 20.

Arizona Administrative Code (“AAC”) is accessible from the “Rules” menu on the Arizona Secretary of

State website (www.azsos.gov). Most insurance-related rules are contained within Title 20, Chapter 6.

PREMIUM TAX

Tax forms and instructions are available from the Department of Insurance “Taxes” web page

(https://insurance.az.gov/insurers/taxes).

Premium Tax Base:

ARS § 20-206(B) Previously Authorized Insurers

An insurer no longer transacting new business in Arizona is subject to premium tax requirements

but does not need a certificate of authority to collect premiums for, or to service, policies

remaining in force for residents or risks residing in Arizona.

§ 20-224 Authorized Insurers

Total direct premium income including policy membership and other fees and all other

considerations for insurance from all classes of business whether designated as a premium or

otherwise received by the insurer during the preceding calendar year on account of policies and

contracts covering property, subjects or risks located, resident or to be performed in Arizona,

after deducting applicable cancellations, returned premiums, the amount of reduction in or refund

of premiums allowed to industrial life policyholders for payment of premiums direct to an office

of the insurer and all policy dividends, refunds, savings coupons and other similar returns paid or

credited to policyholders within Arizona and not reapplied as premiums for new, additional or

extended insurance. No deduction shall be made of the cash surrender values of policies or

contracts.

§ 20-837 Hospital, Medical, Dental and Optometric Service Corporations

Net premiums received to effect or maintain subscription contracts.

§ 20-1010 Prepaid Dental Plan Organizations

Prepaid net charges received from members.

Retaliation—December 2023

AZ-2 © 1991-2023 National Association of Insurance Commissioners

Premium Tax Base (cont.)

§ 20-1060; AAC R20-6-405(E)(14) and (L) Health Care Services Organizations

Net charges received from enrollees. Net charges are the total of all sums prepaid by or for all

enrollees, less approved refunds, adjustments and deductions, as consideration for health care

services of a health care plan under an evidence of coverage.

§ 20-1097.07 Prepaid Legal Insurance Corporations

Taxes as prescribed by § 20-224.

§ 20-2403(C) Foreign Risk Retention Groups

Premiums of direct business for risks resident or located in Arizona on the same basis as a foreign

admitted insurer.

§ 23-961(G) Workers’ Compensation Insurance

Premiums collected or contracted for during the preceding year ending Dec. 31 less deductions

for cancellations, returned premiums, policy dividends, or refunds paid or credited to

policyholders that are not reapplied for new, additional or extended insurance. Paid to the Arizona

Industrial Commission in lieu of insurance premium tax.

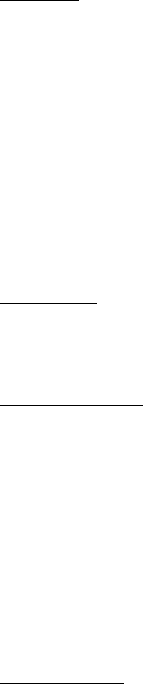

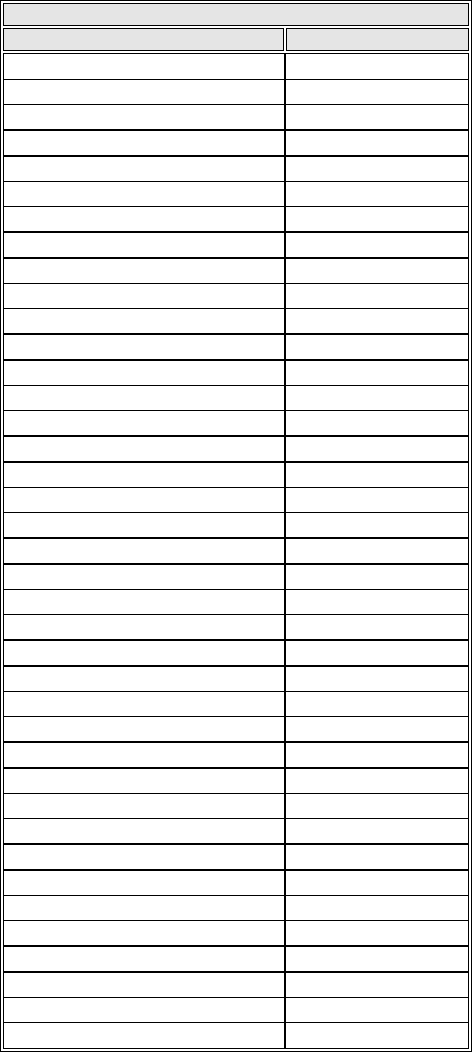

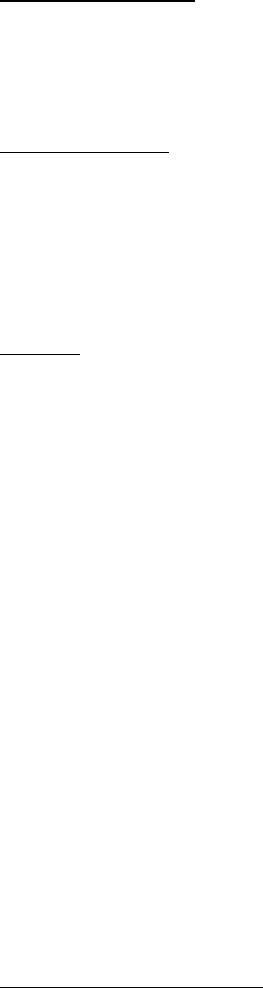

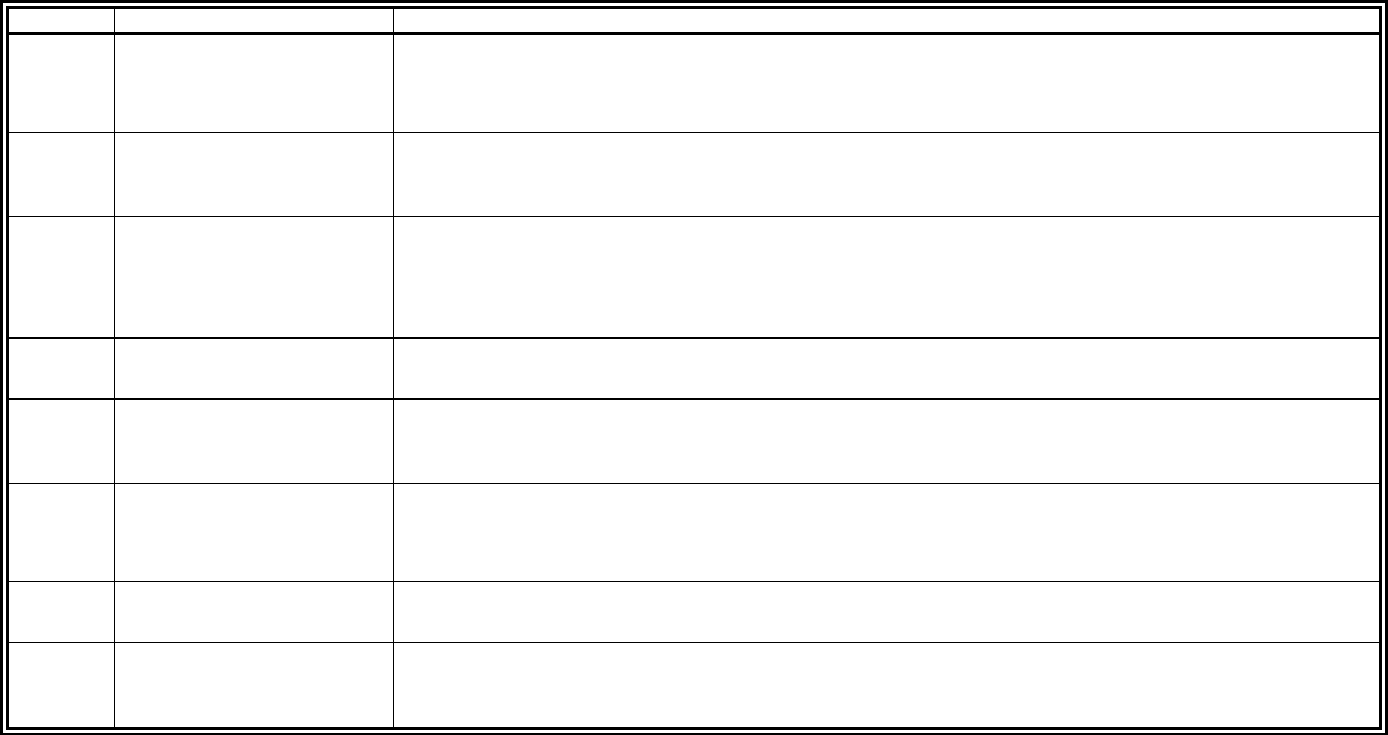

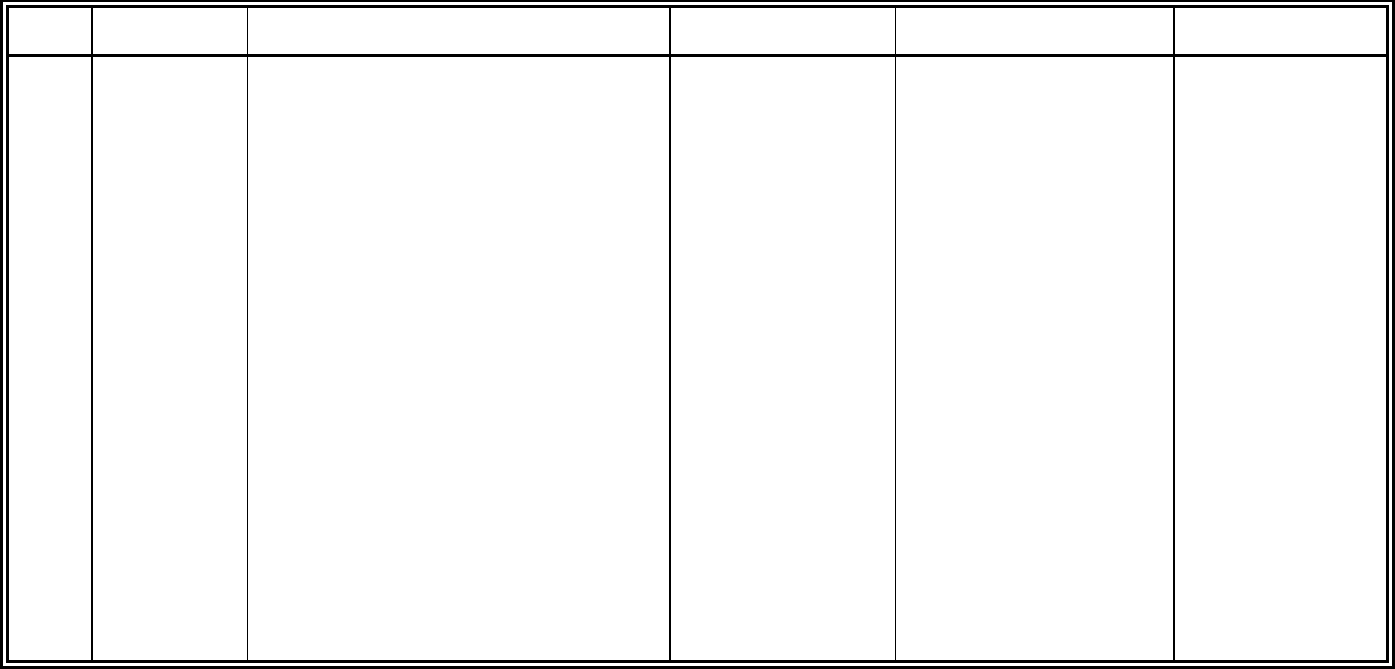

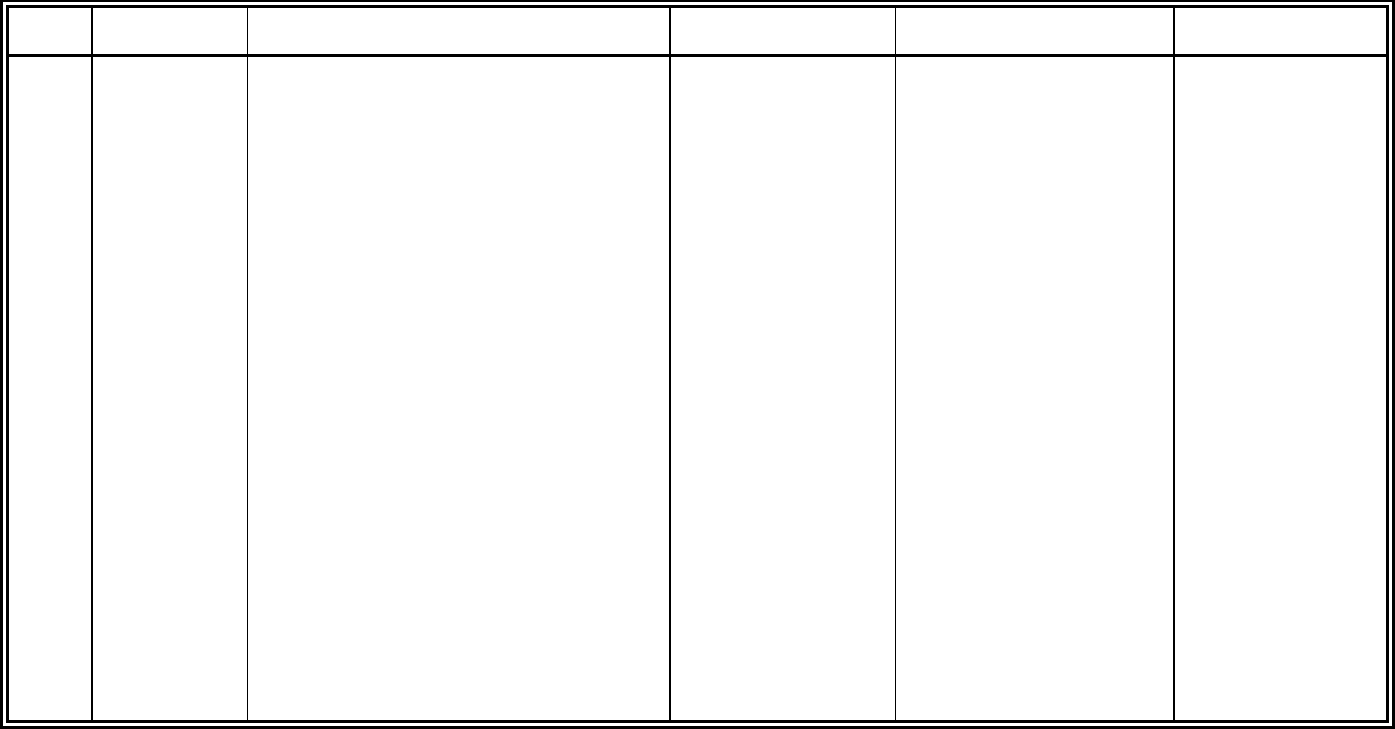

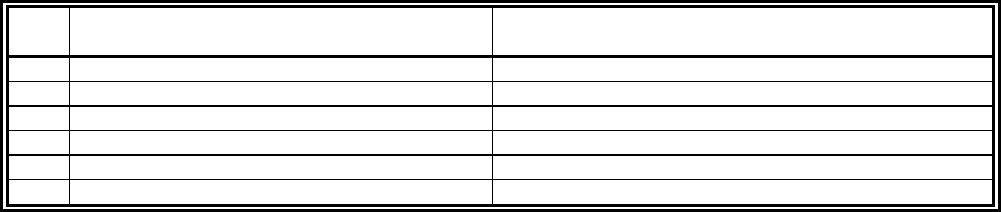

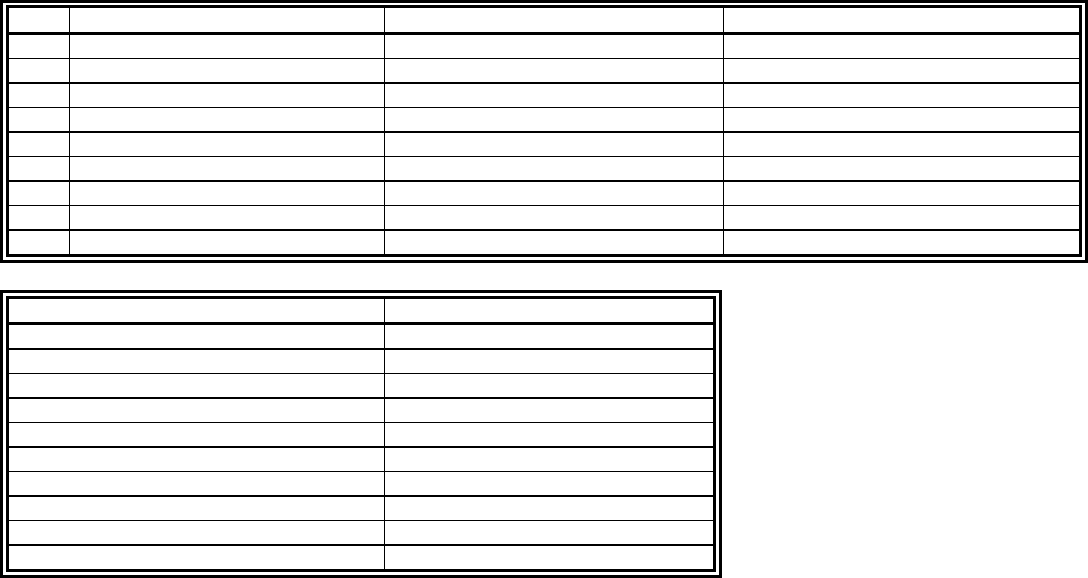

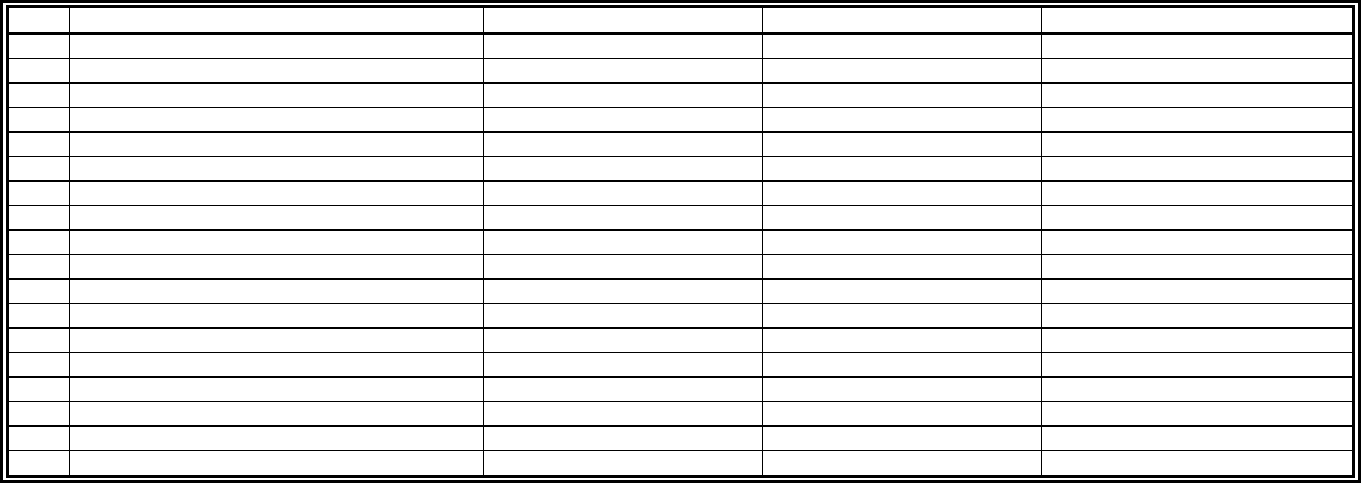

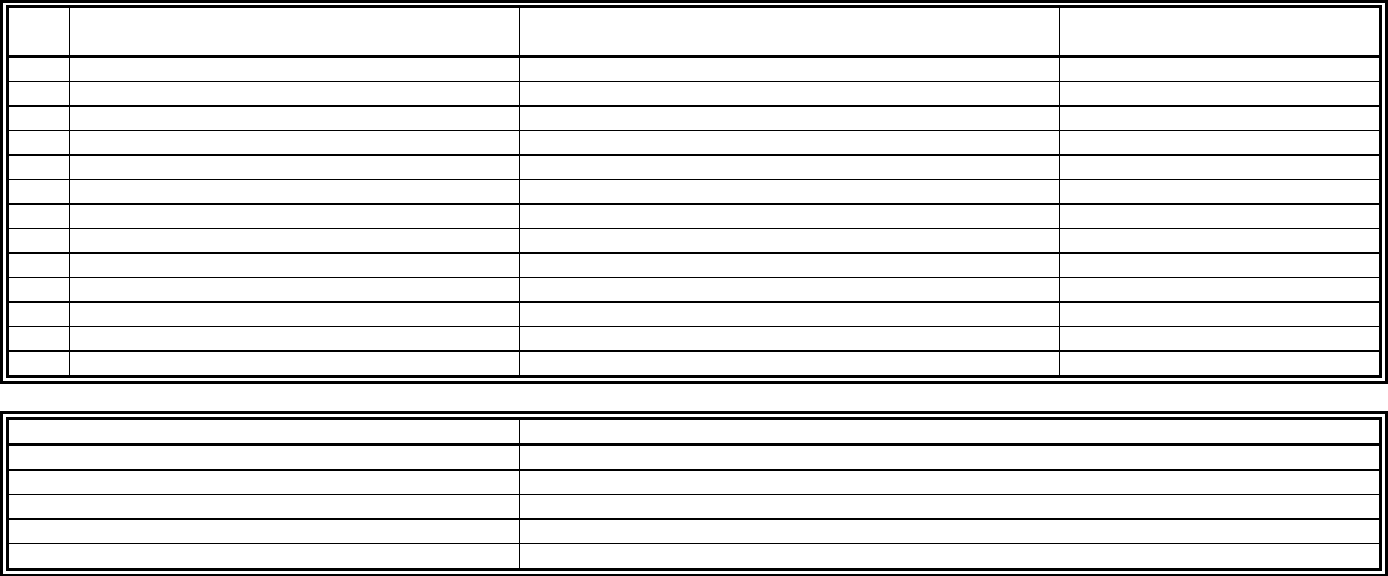

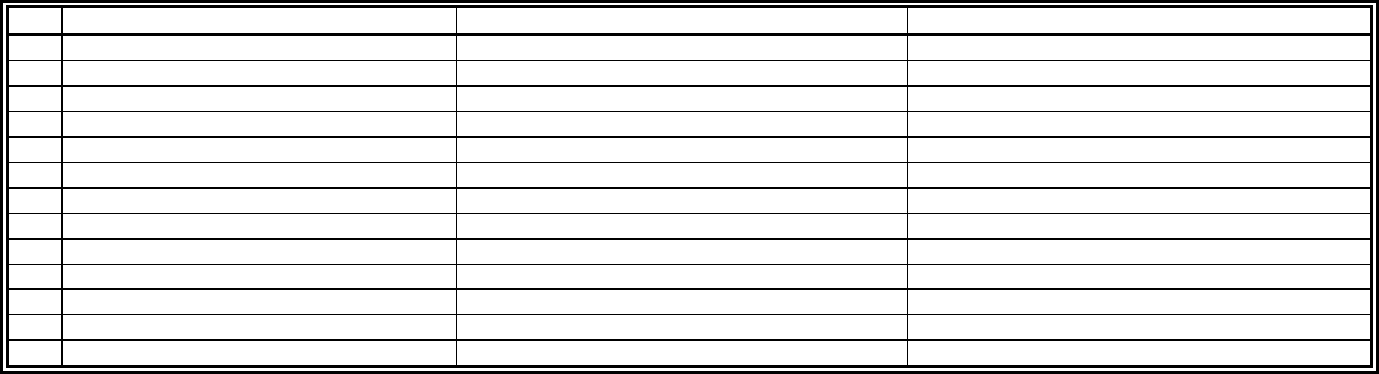

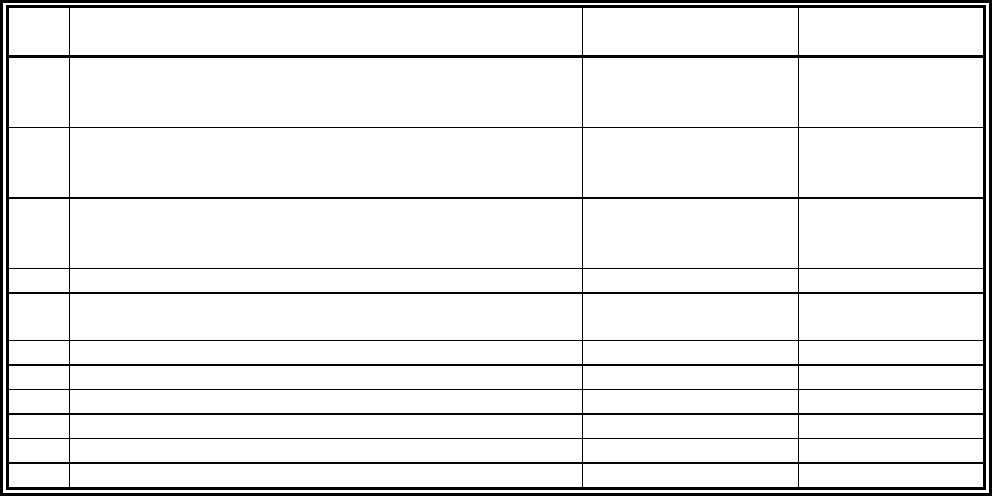

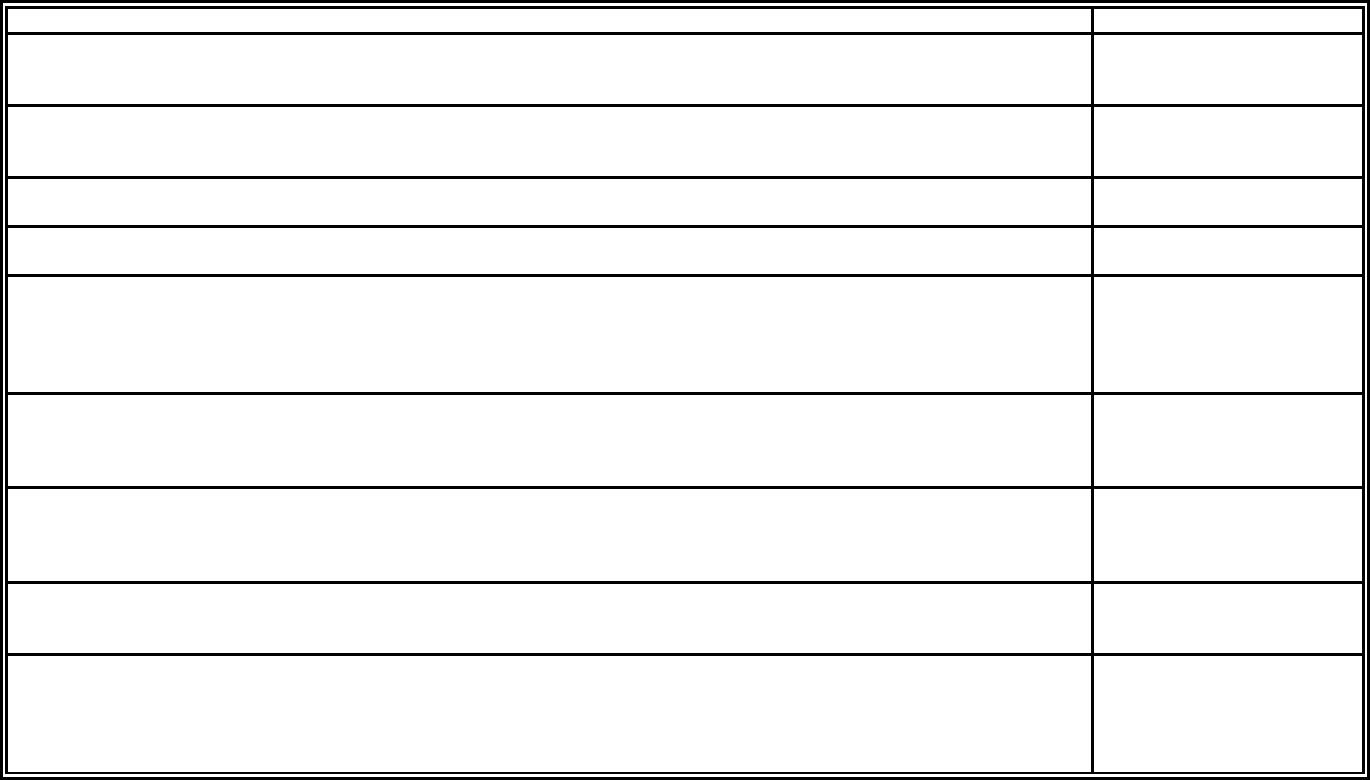

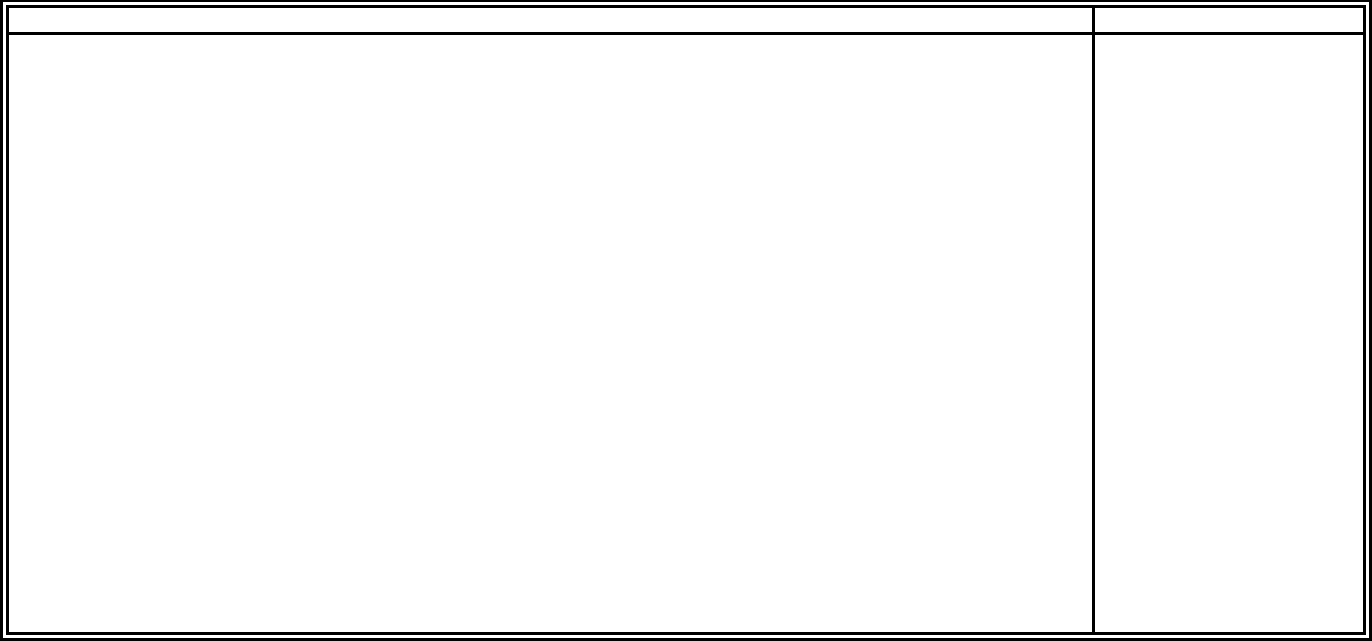

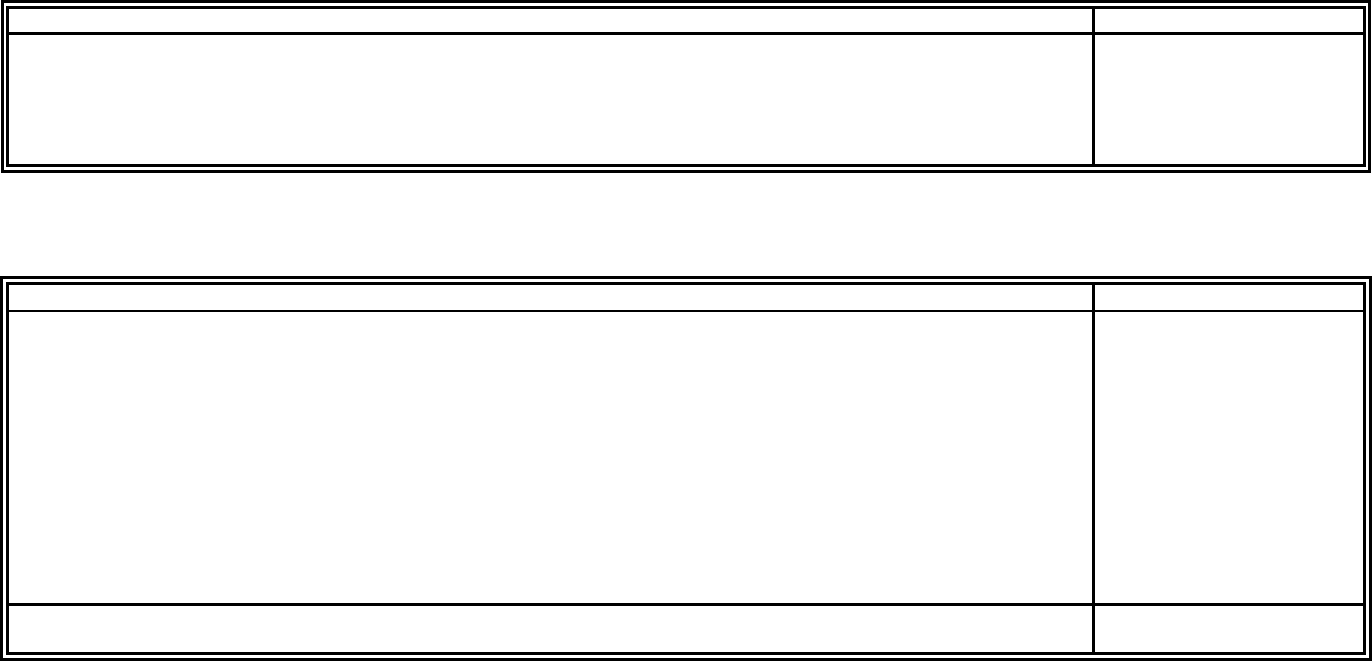

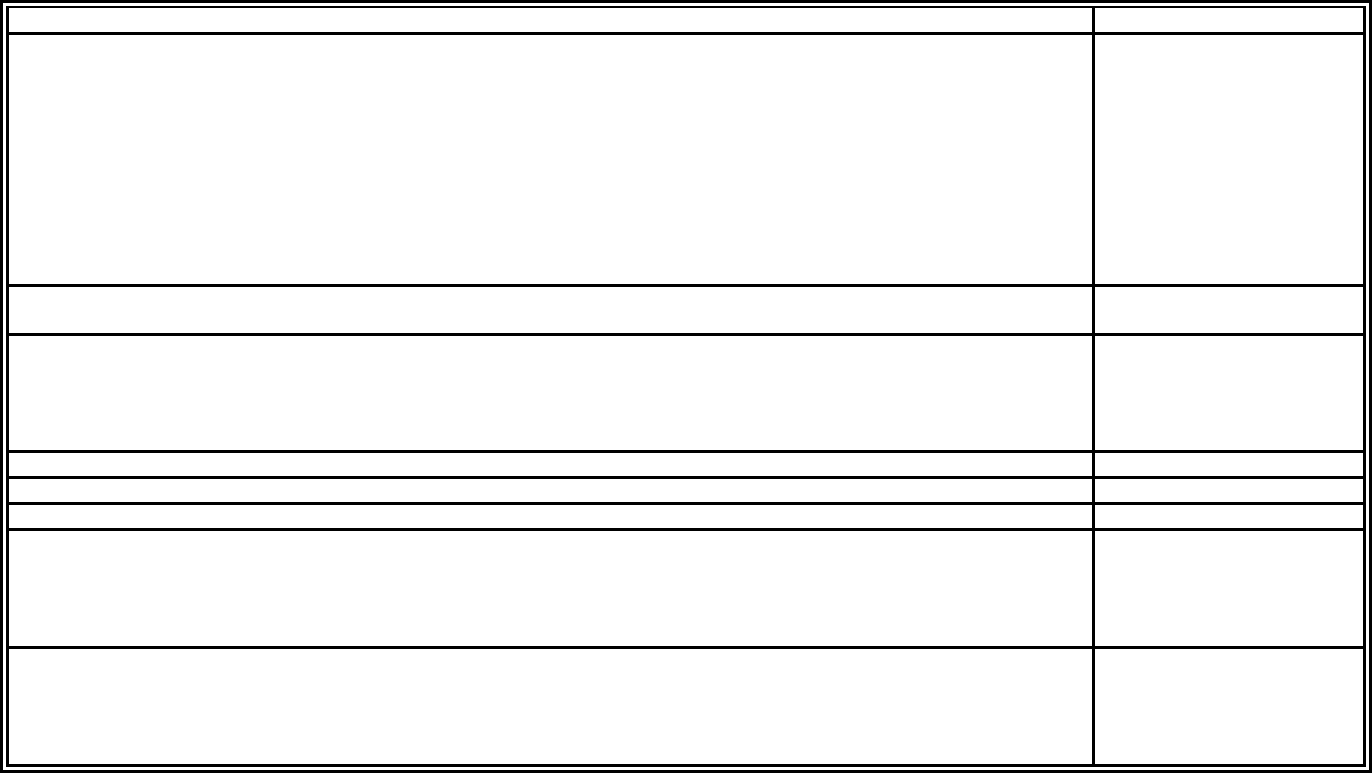

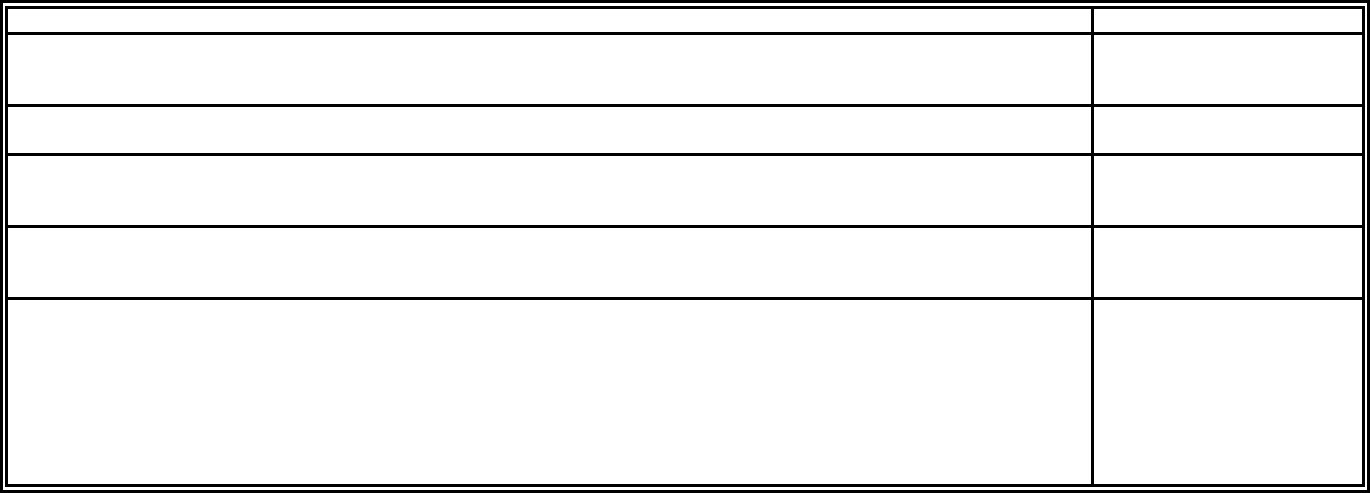

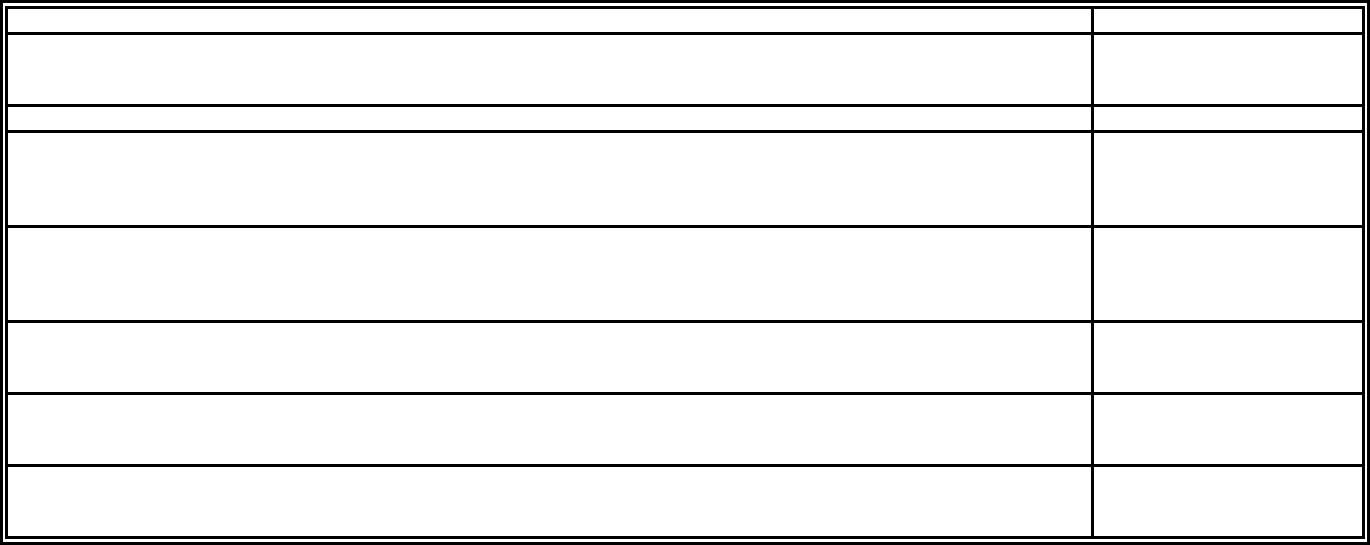

Tax Rate:

§ 20-224

“Base rate” applicable to authorized insurers and formerly authorized insurers subject to

§ 20-206(B), except as otherwise specified.

CY 2015

and before

CY 2016

CY 2017

CY 2018

CY 2019

CY 2020

CY 2021

& after

2.00%

1.95%

1.90%

1.85%

1.80%

1.75%

1.70%

In lieu of base rate, 2.2% for fire insurance premiums, except 0.66% for fire insurance premiums

on property located in an incorporated town or city certified by the state fire marshal pursuant to

§ 9-951, subsection B, as procuring the services of a private fire company. Since Jan. 1, 2007,

Carefree and Fountain Hills have been the only incorporated cities or towns procuring services of

a private fire company.

“Fire insurance” consists of 100% of fire, 40% of commercial multiple peril non-liability

(property), 35% of homeowners’ multiple peril, 25% of farm owners’ multiple peril and 20% of

allied lines.

0% of annuity considerations

2.00% disability

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AZ-3

Tax Rate (cont.)

§ 20-224.01

0.4312% additional premium tax on insurance covering vehicles (in addition to “base rate”)

“Vehicles” means a device in, on or by which a person or property is or may be transported or

drawn on a public highway, excluding electric bicycles, electric miniature scooters, electric

standup scooters, devices moved by human power; devices used exclusively on stationary rails or

tracks; personal delivery devices; scrap vehicles; or personal mobile cargo carrying devices. See

§ 28-101.

§ 20-837

2% hospital, medical, dental & optometric service corporation

§ 20-883

0% fraternal benefit societies

§ 20-1010

2% prepaid dental plan organization

§ 20-1060

2% health care services organization

§ 20-1097.07

Base rate prescribed under § 20-224 for prepaid legal insurance corporation

§ 20-1566

0% title insurer premium tax. Title insurers pay corporate income tax to Arizona Department of

Revenue (www.azdor.gov) in lieu of insurance premium tax, but are subject to retaliation

(payable to the Arizona Department of Insurance) to the extent the domicile’s premium tax rate

multiplied times the insurer’s Arizona risk premiums is greater than the net income tax the insurer

paid to the Arizona Department of Revenue.

§ 20-2304(J)

0% for accountable health plan net premiums received for health benefit plans issued to small

employers. See definitions for “accountable health plan,” “health benefits plan” and “small

employer” in § 20-2301(A).

§ 20-2403(C)

Risk retention group same as for a foreign admitted insurer.

Retaliation—December 2023

AZ-4 © 1991-2023 National Association of Insurance Commissioners

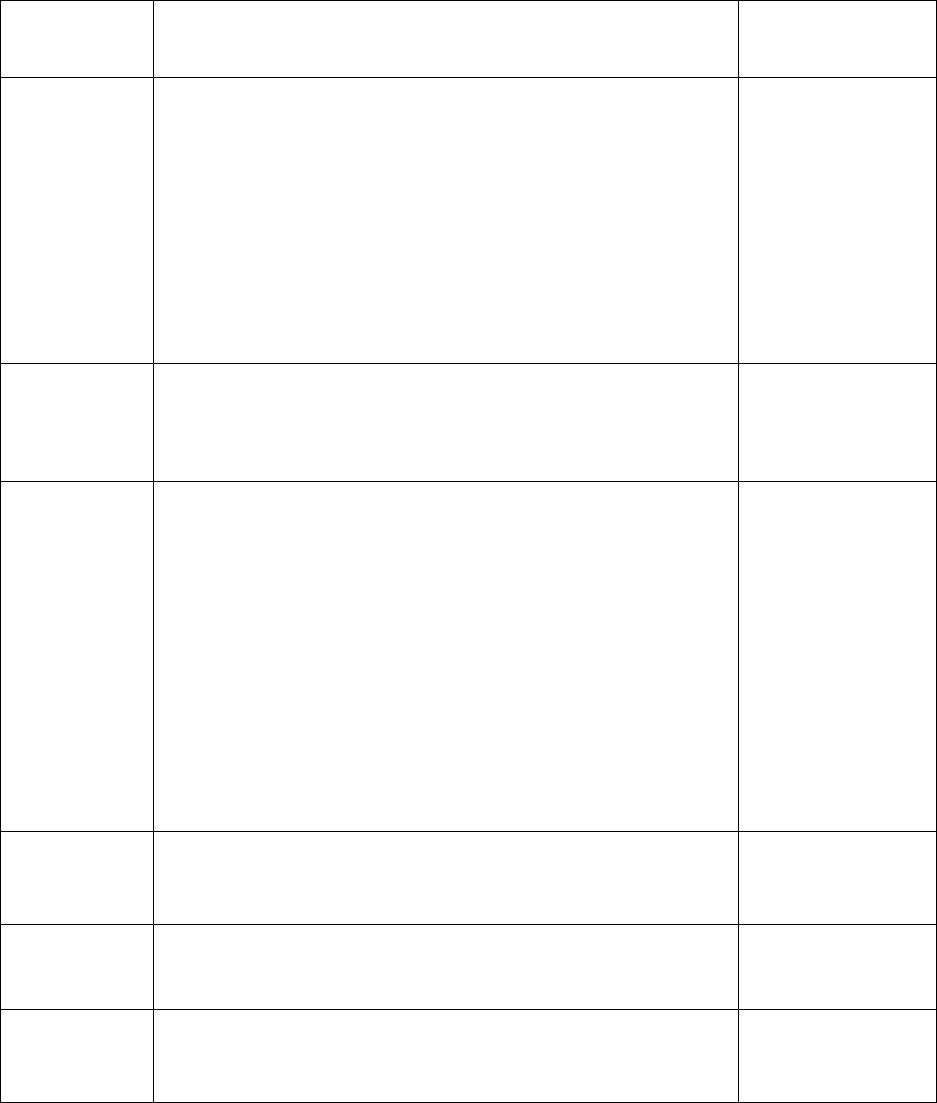

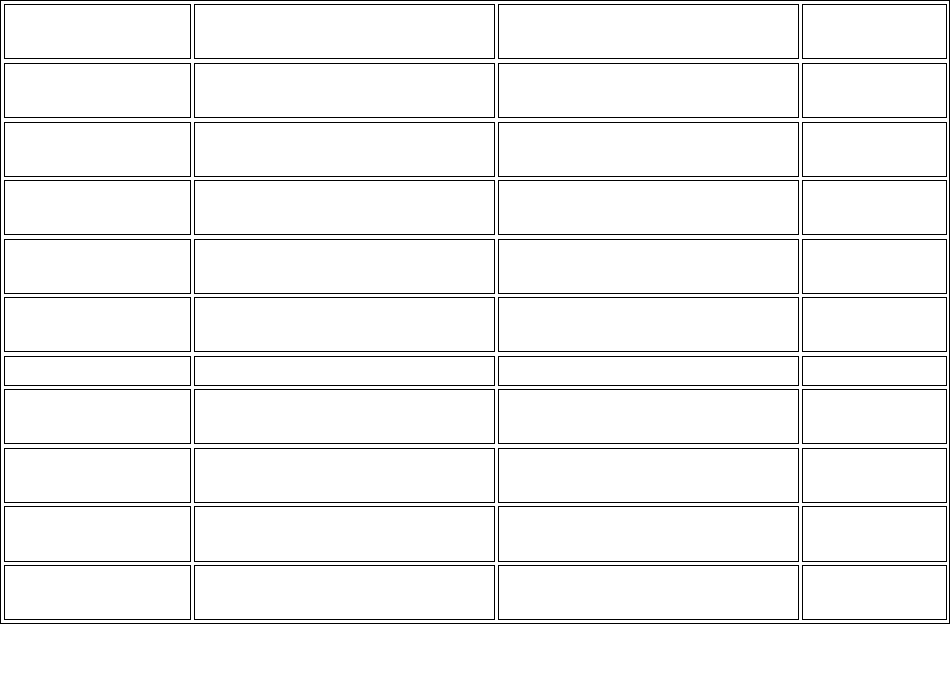

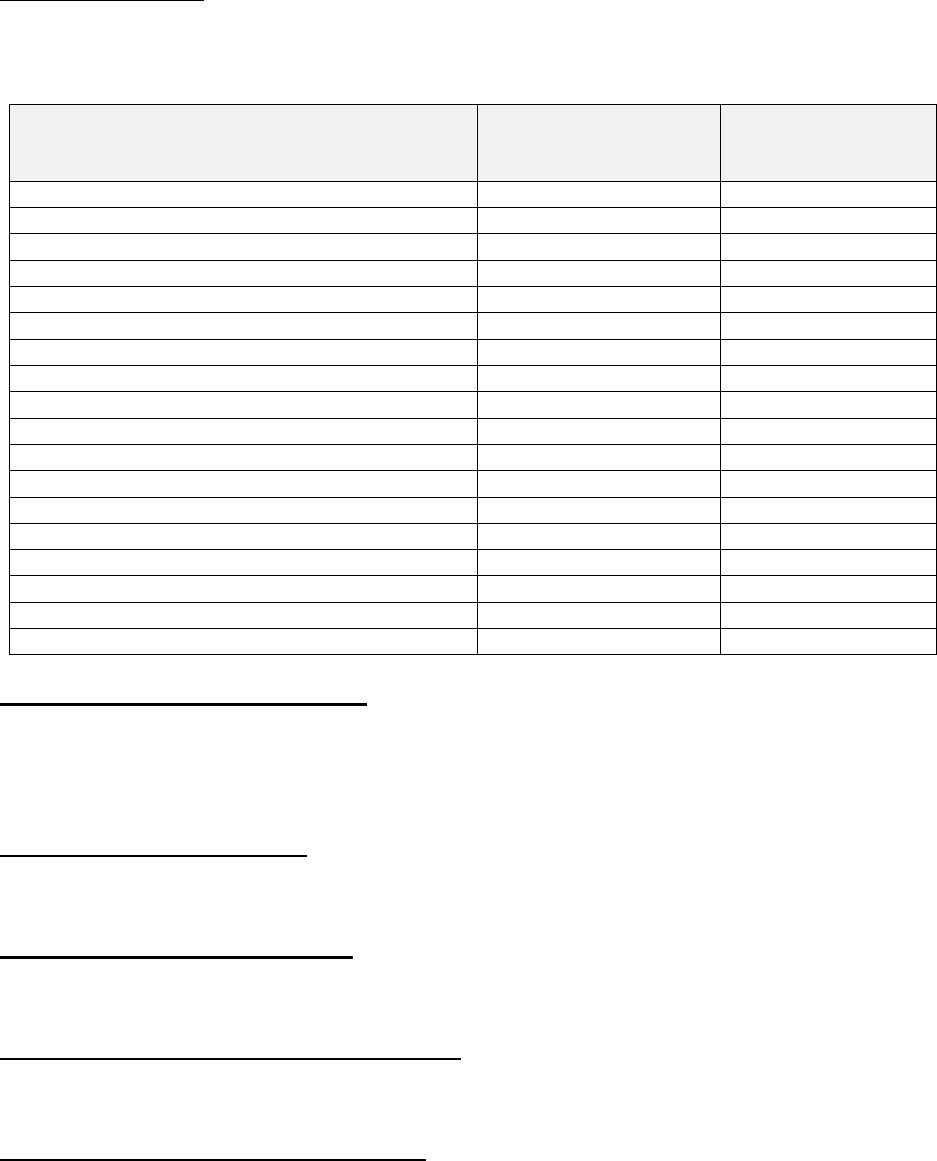

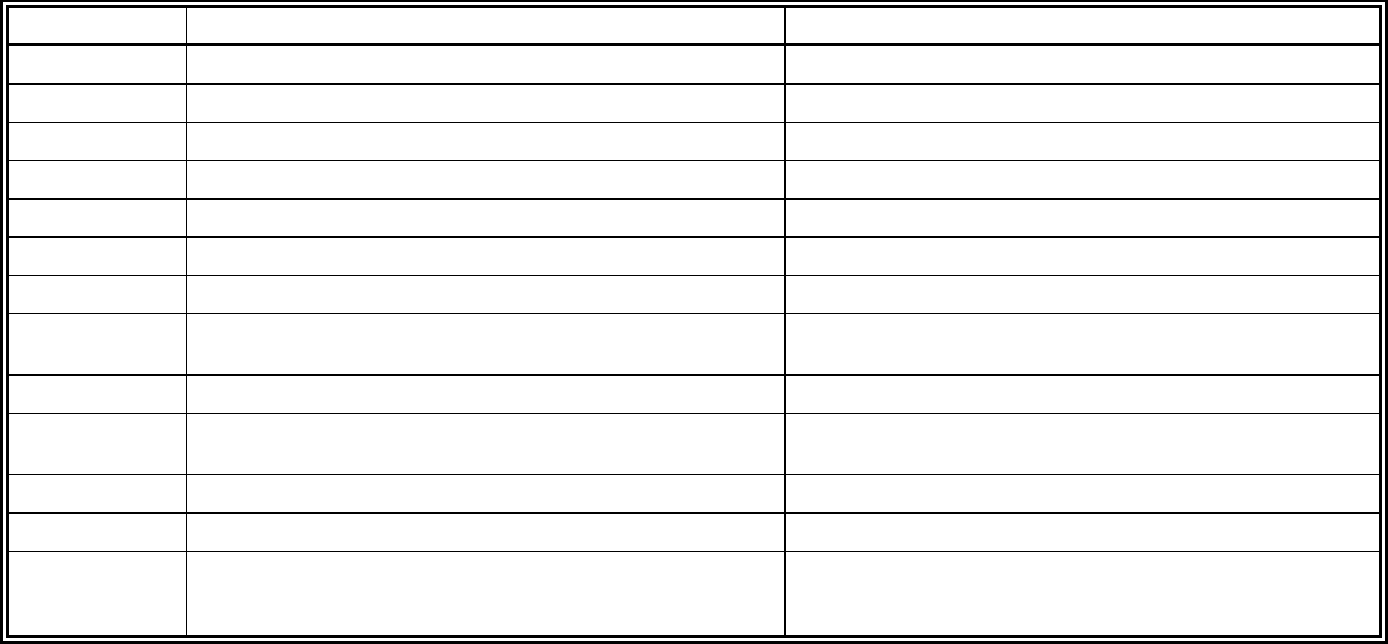

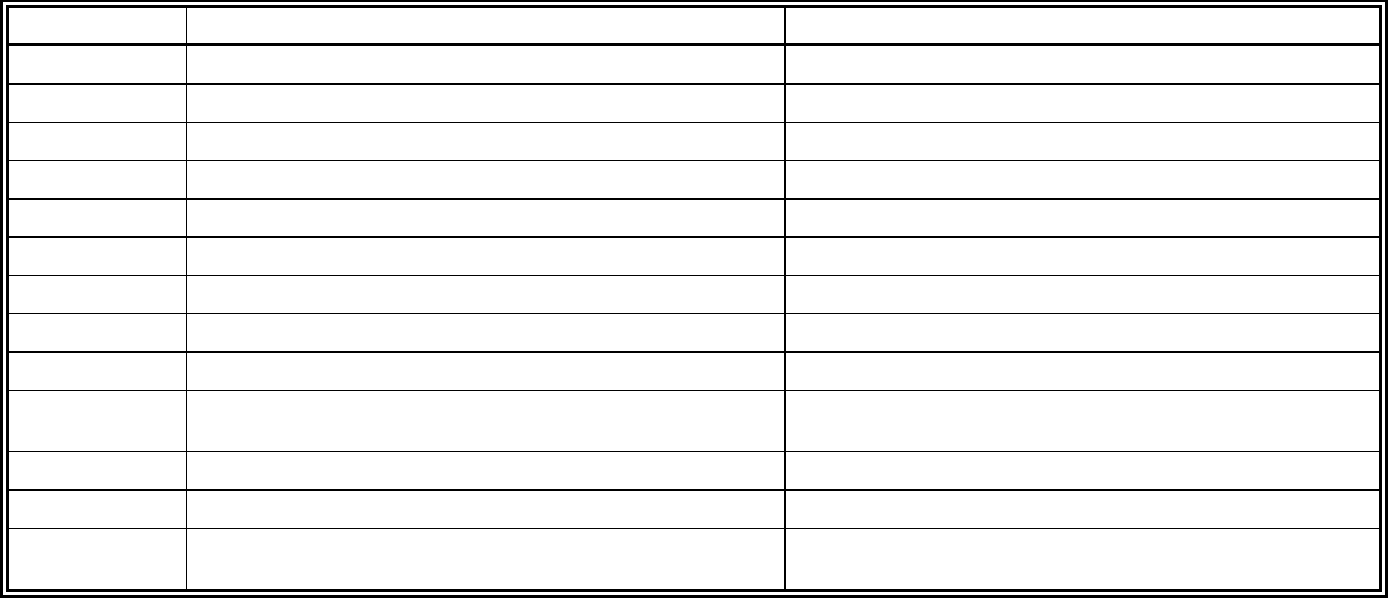

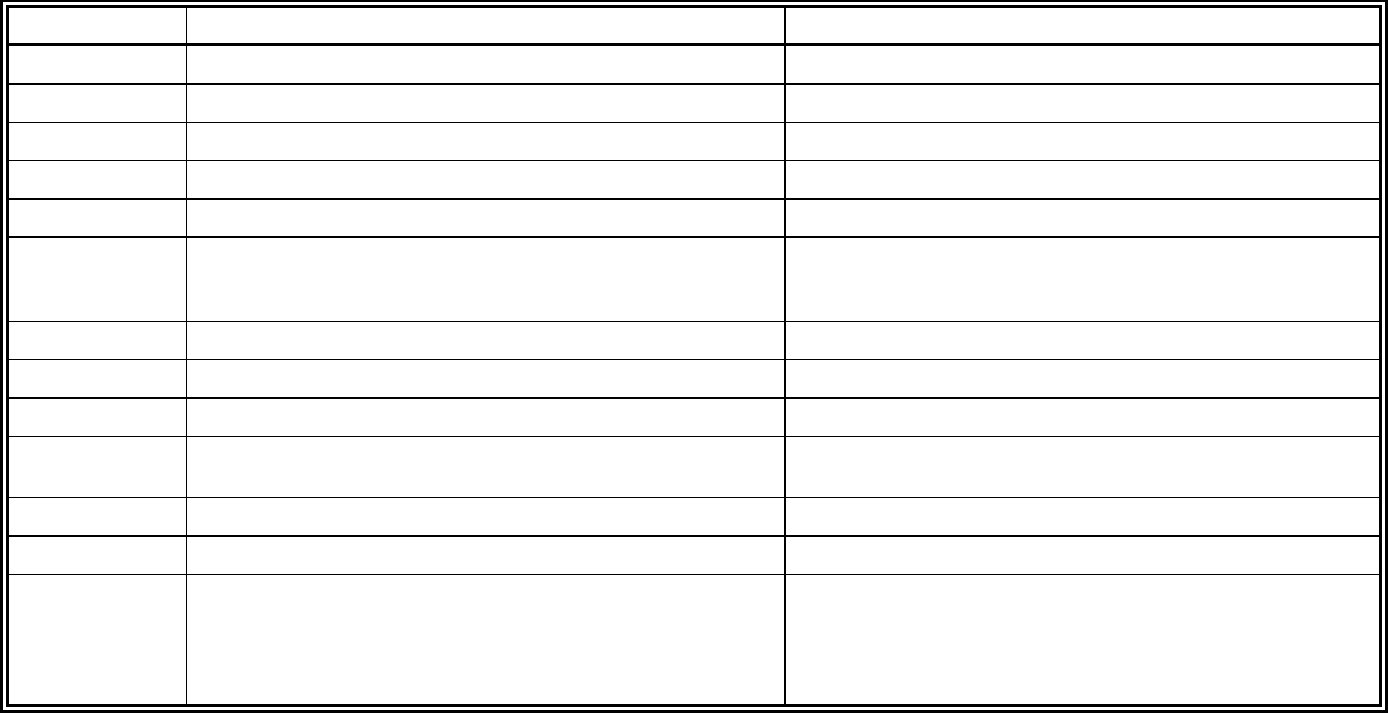

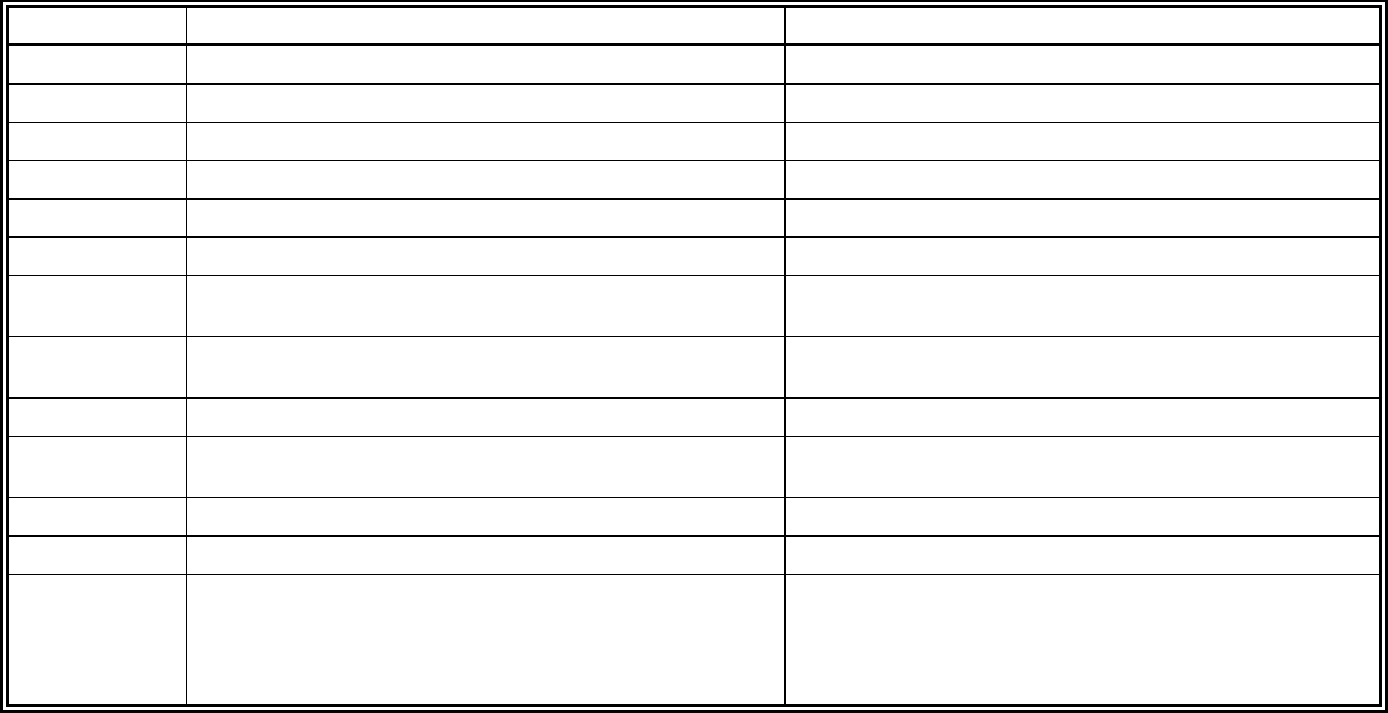

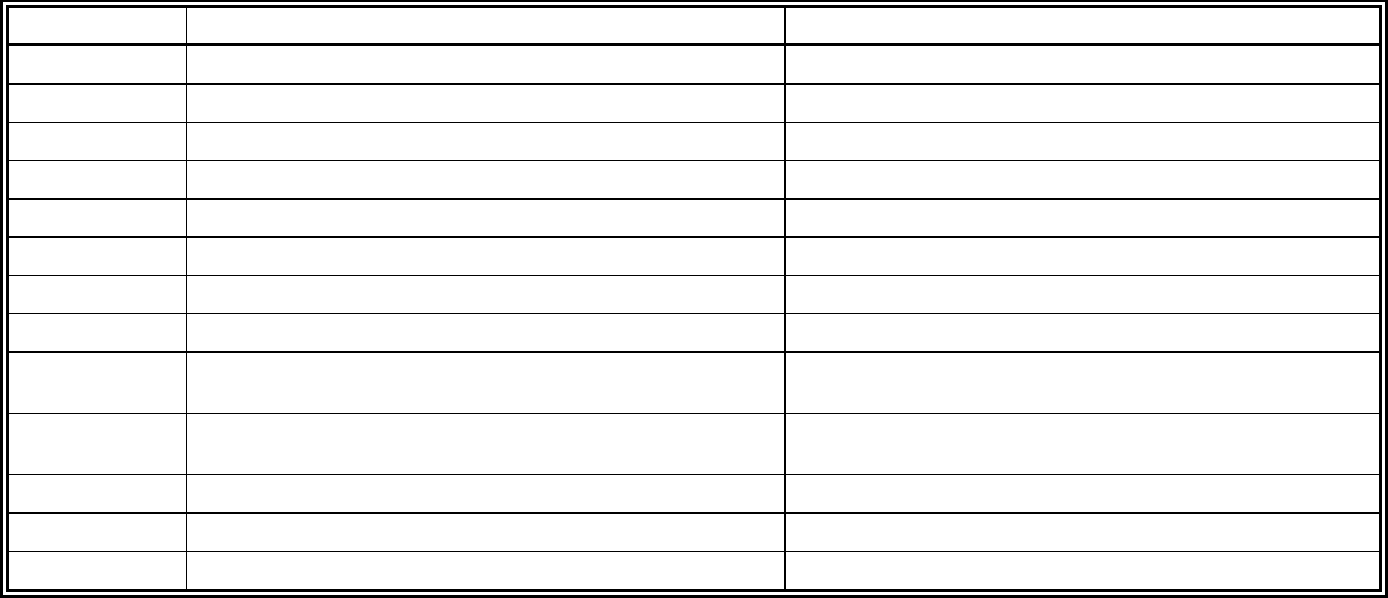

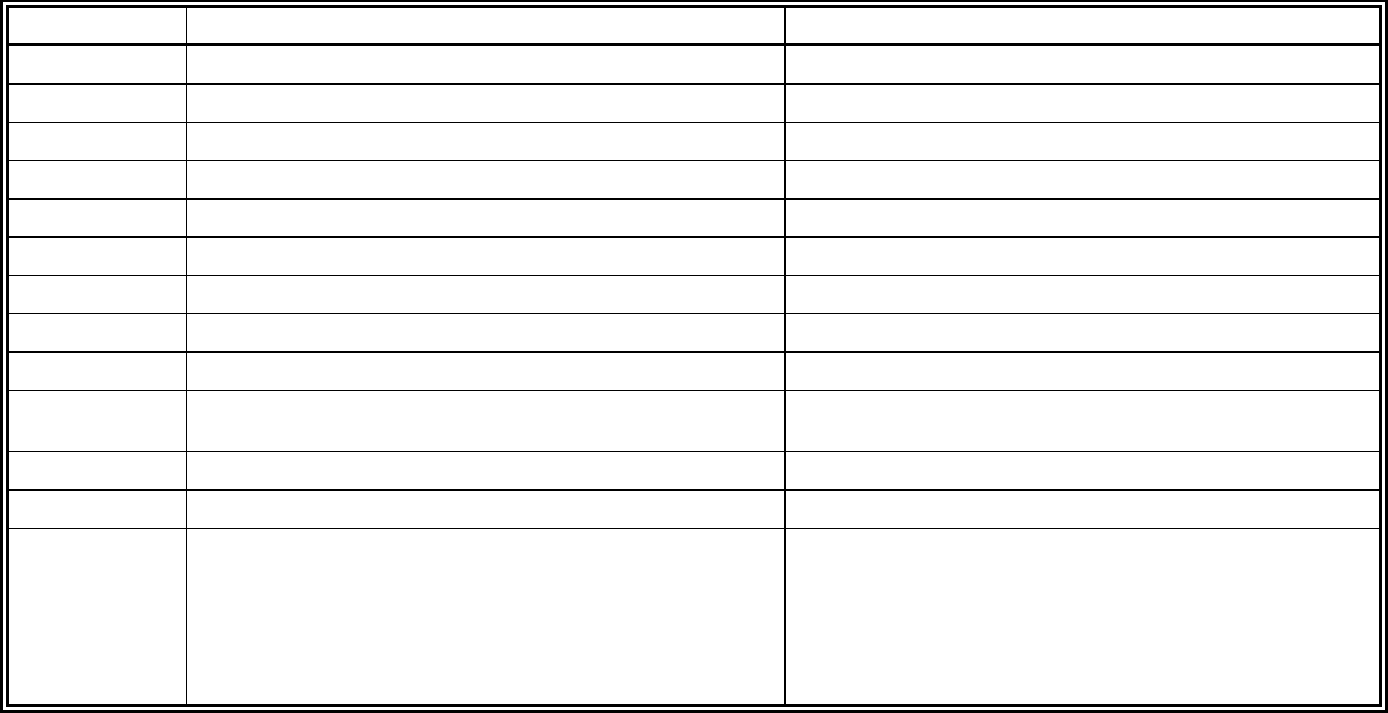

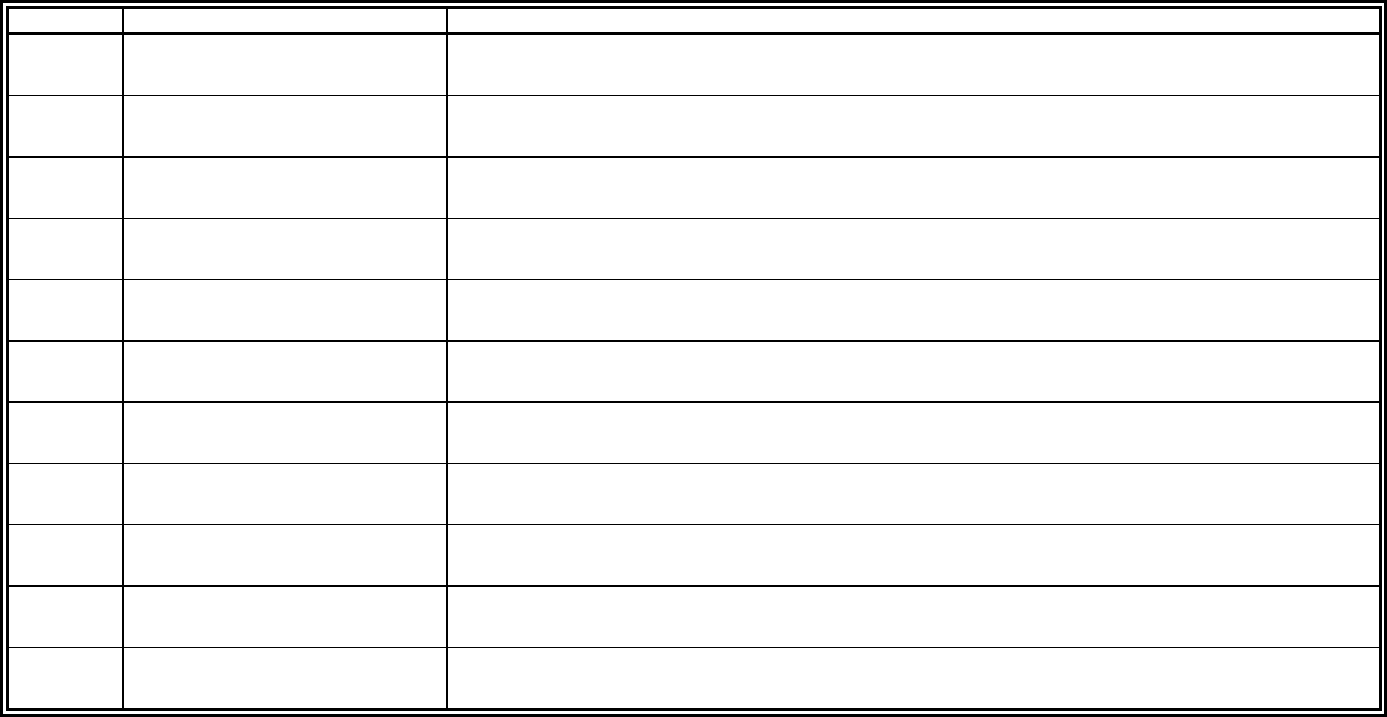

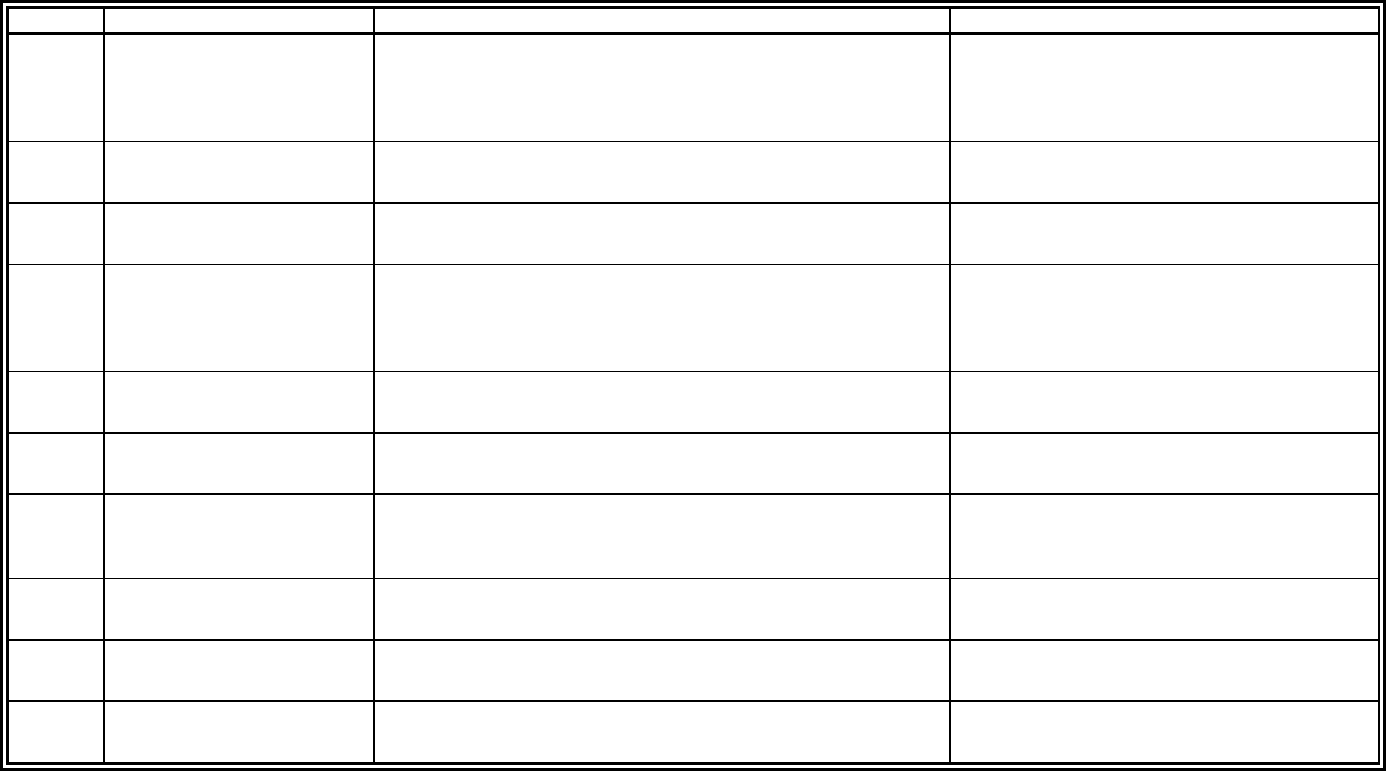

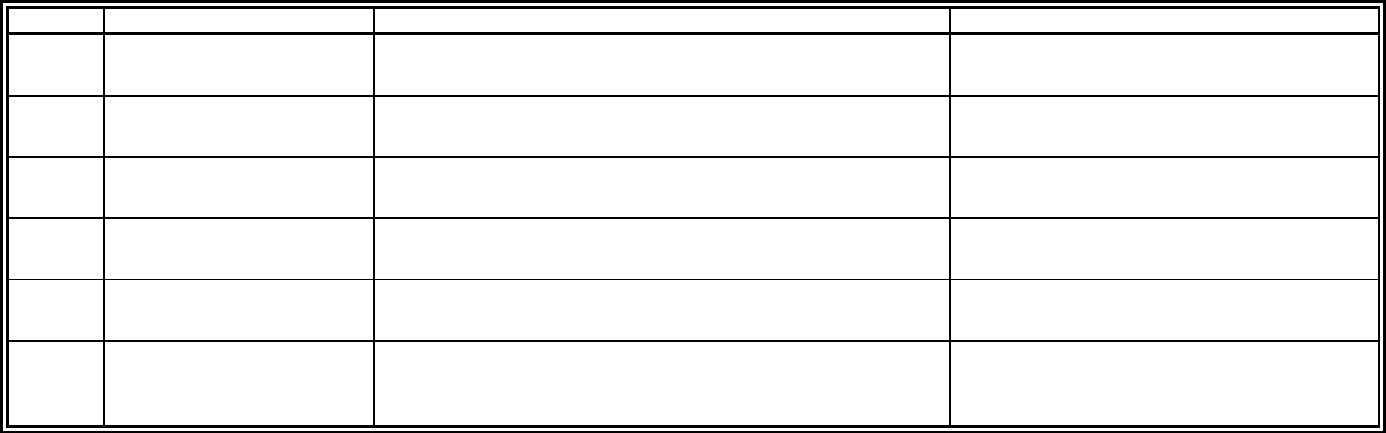

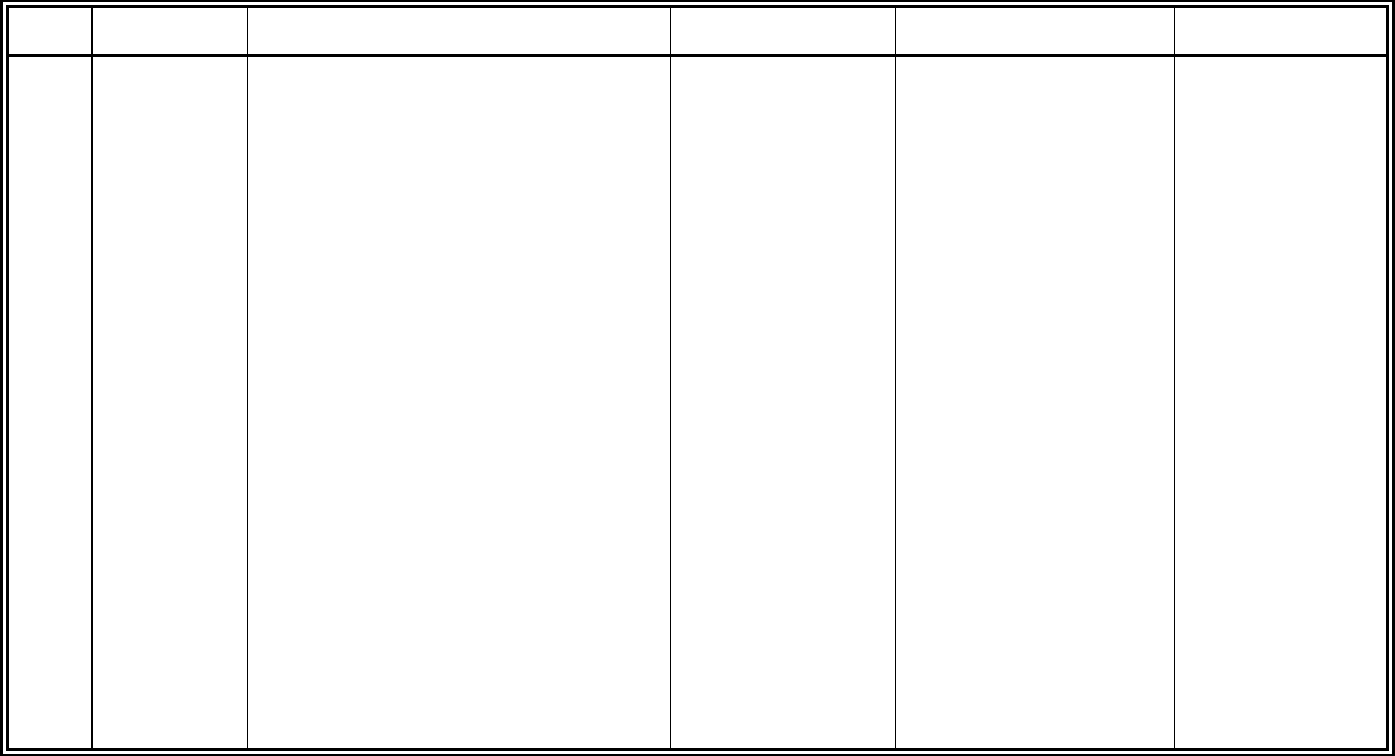

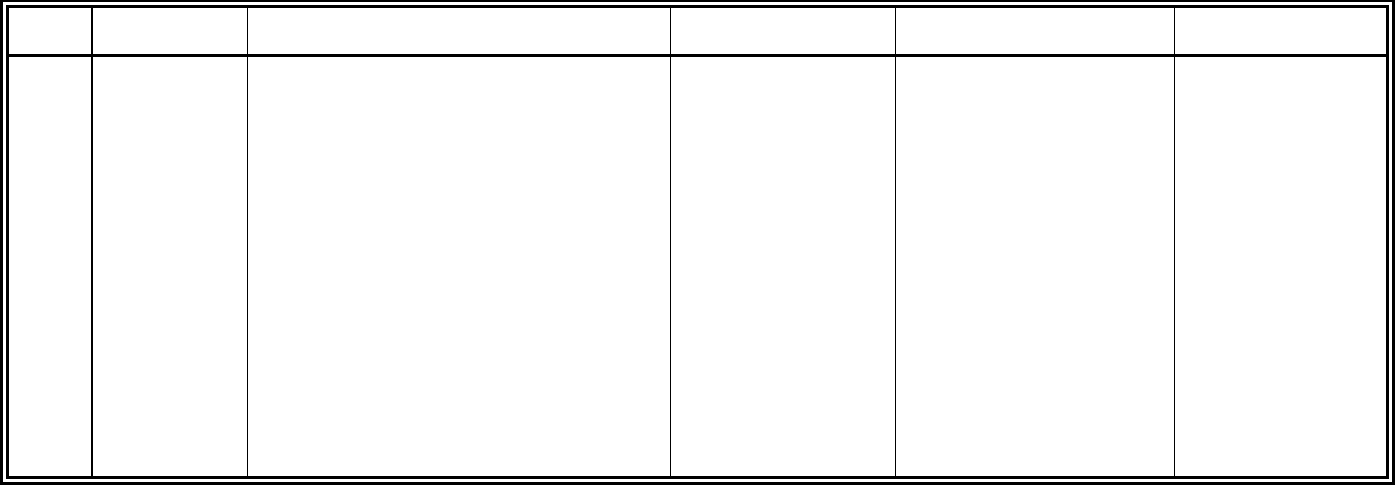

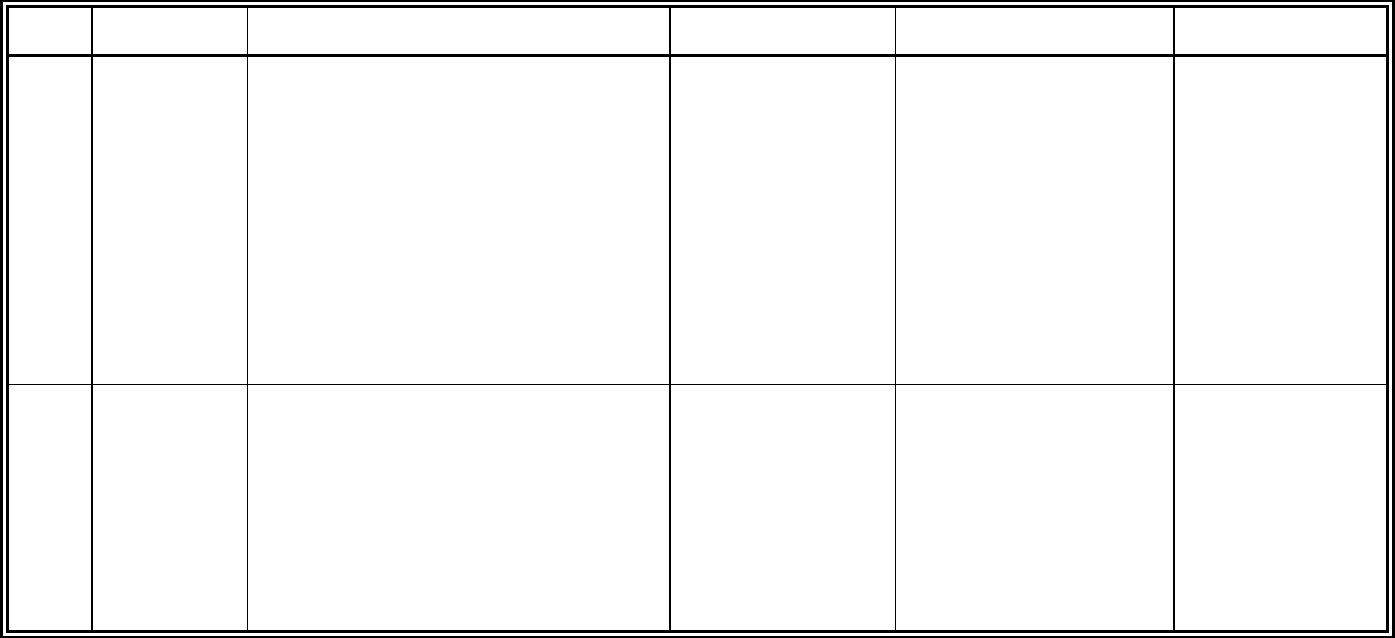

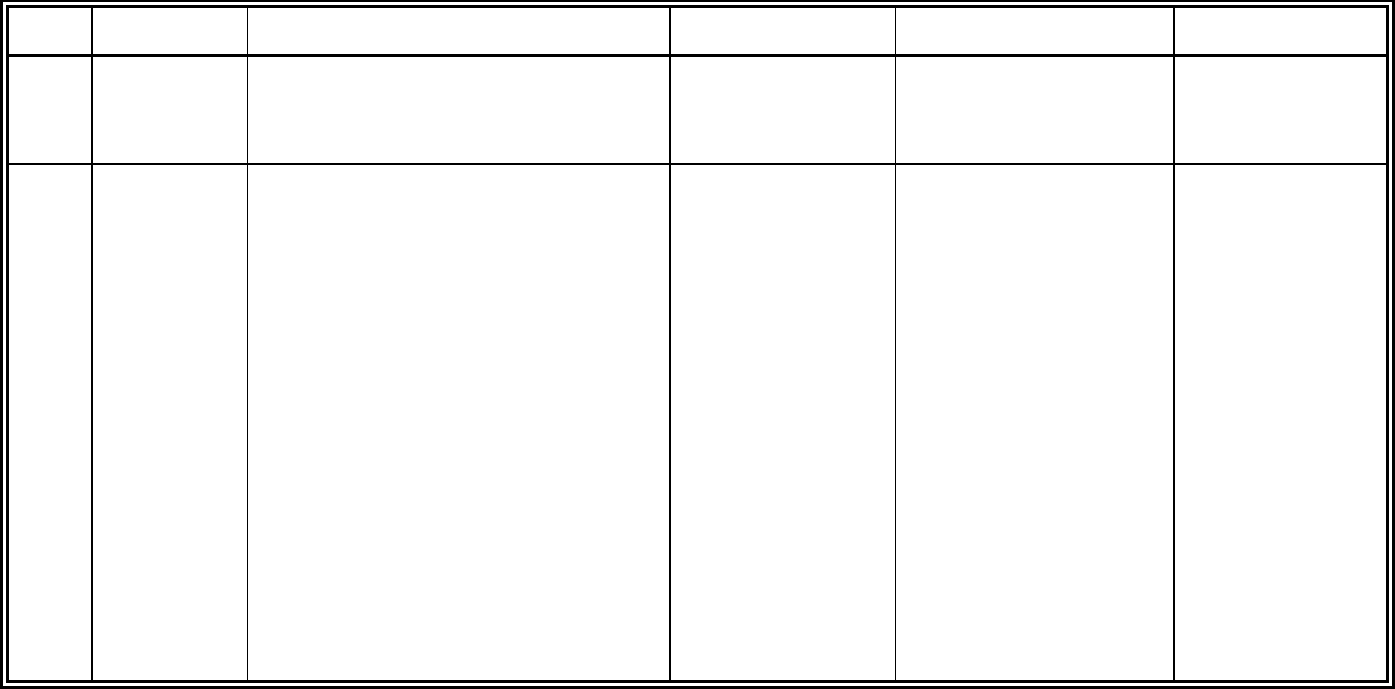

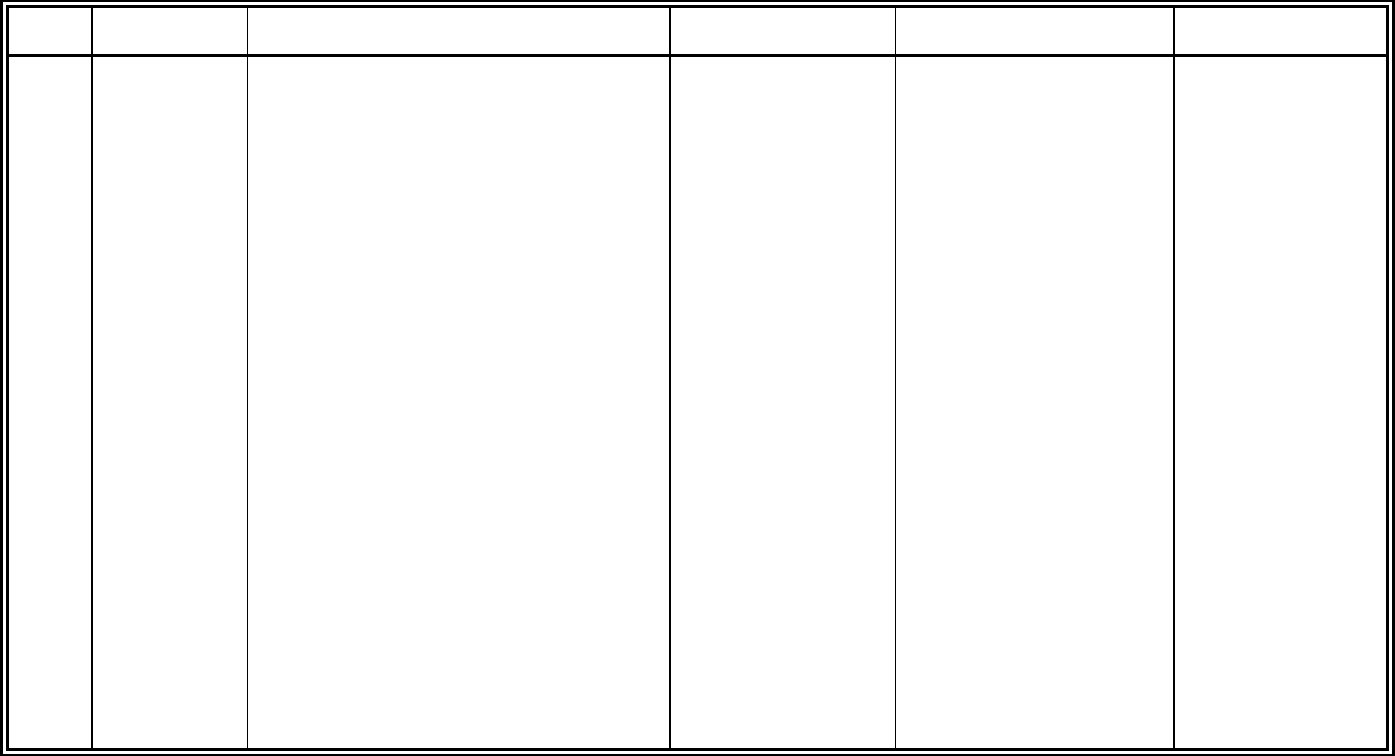

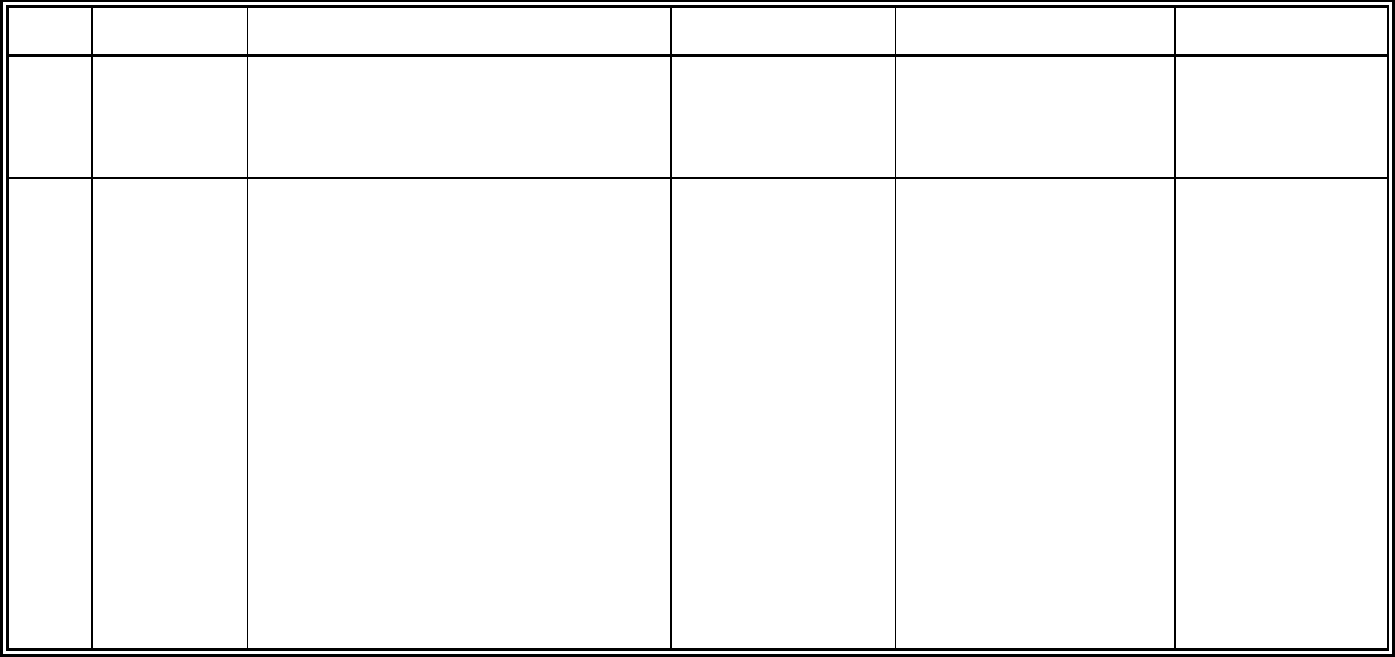

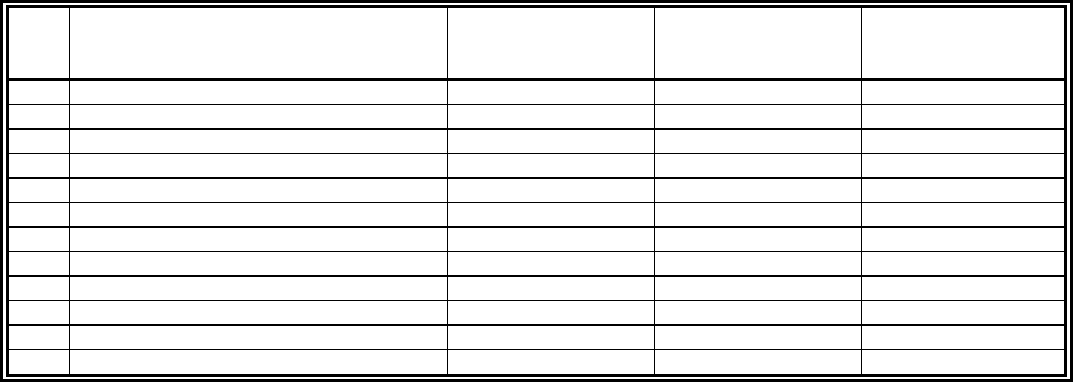

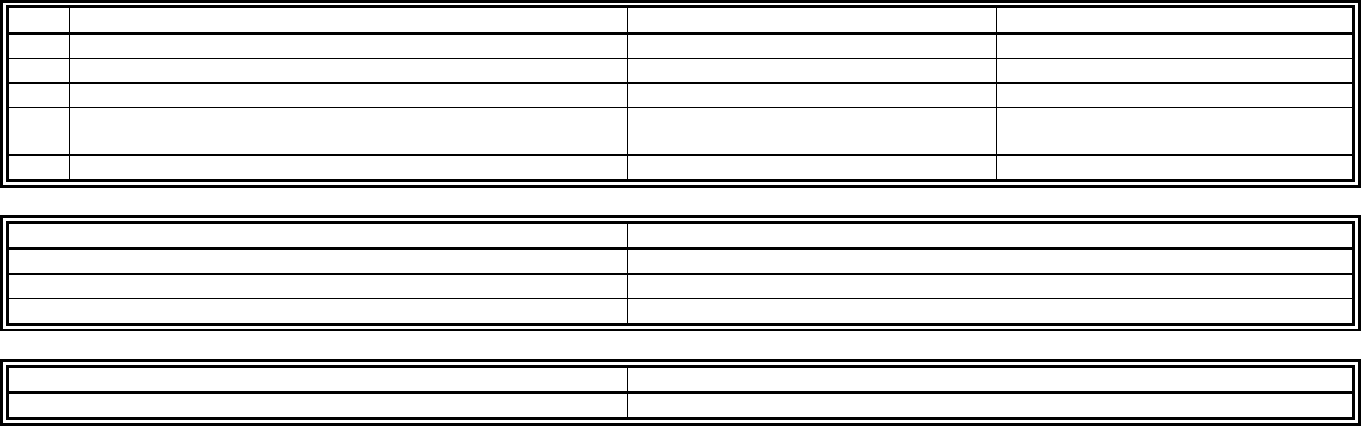

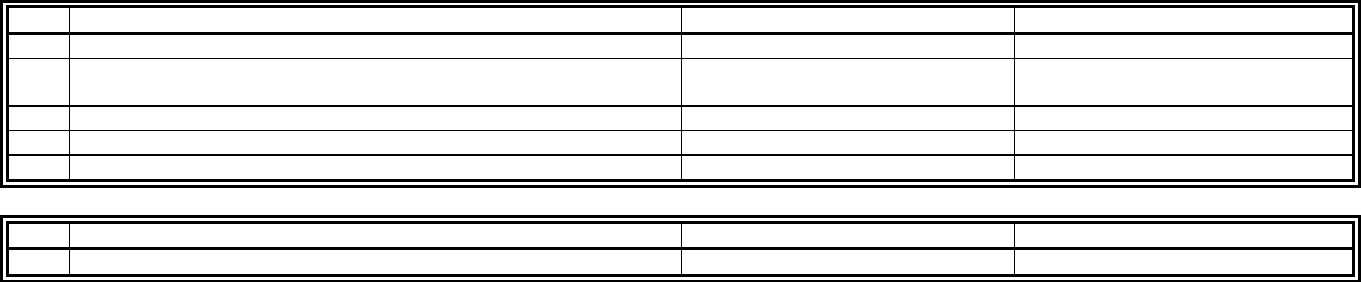

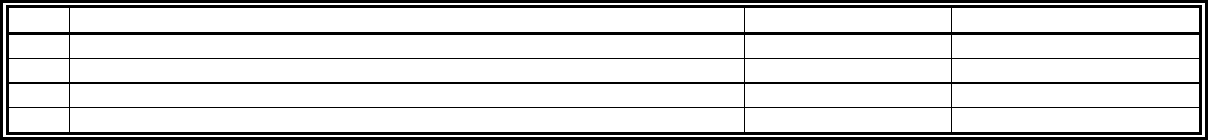

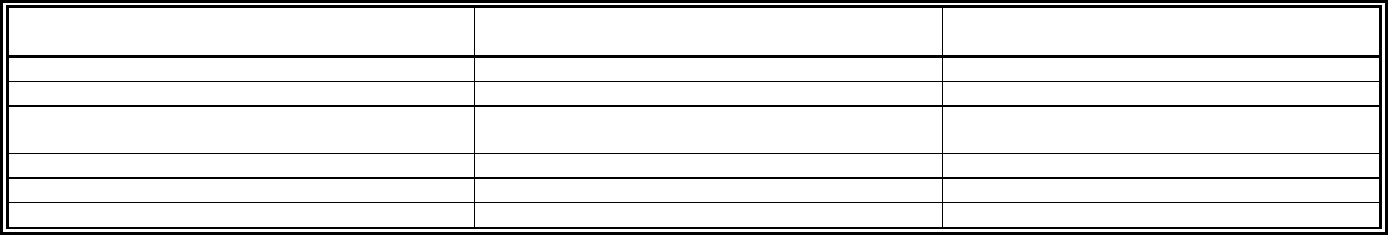

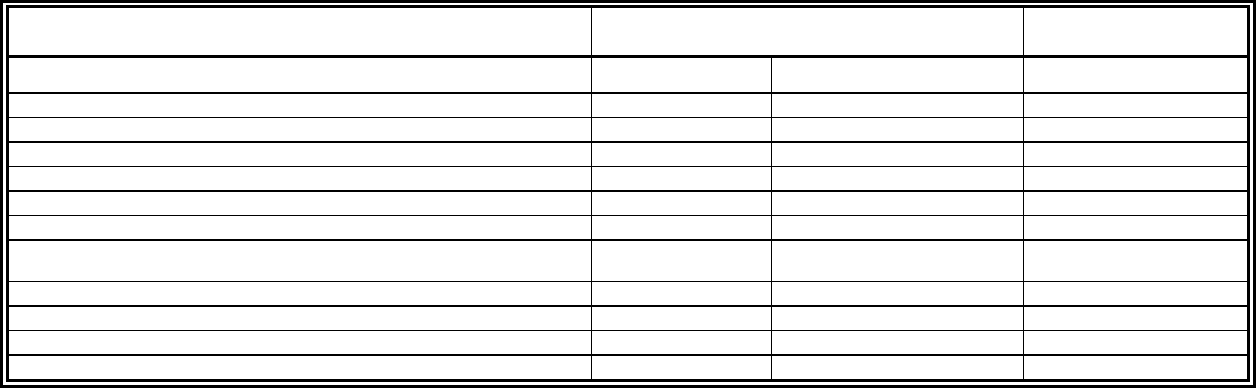

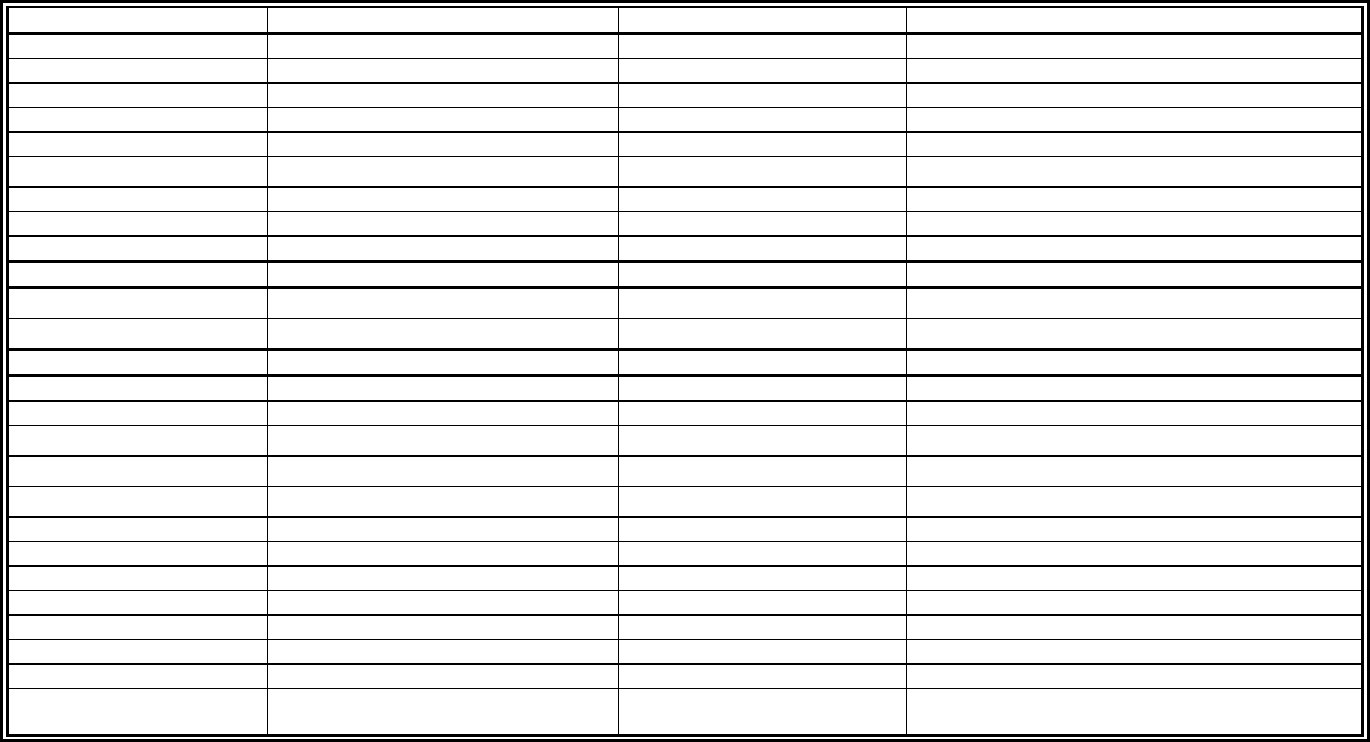

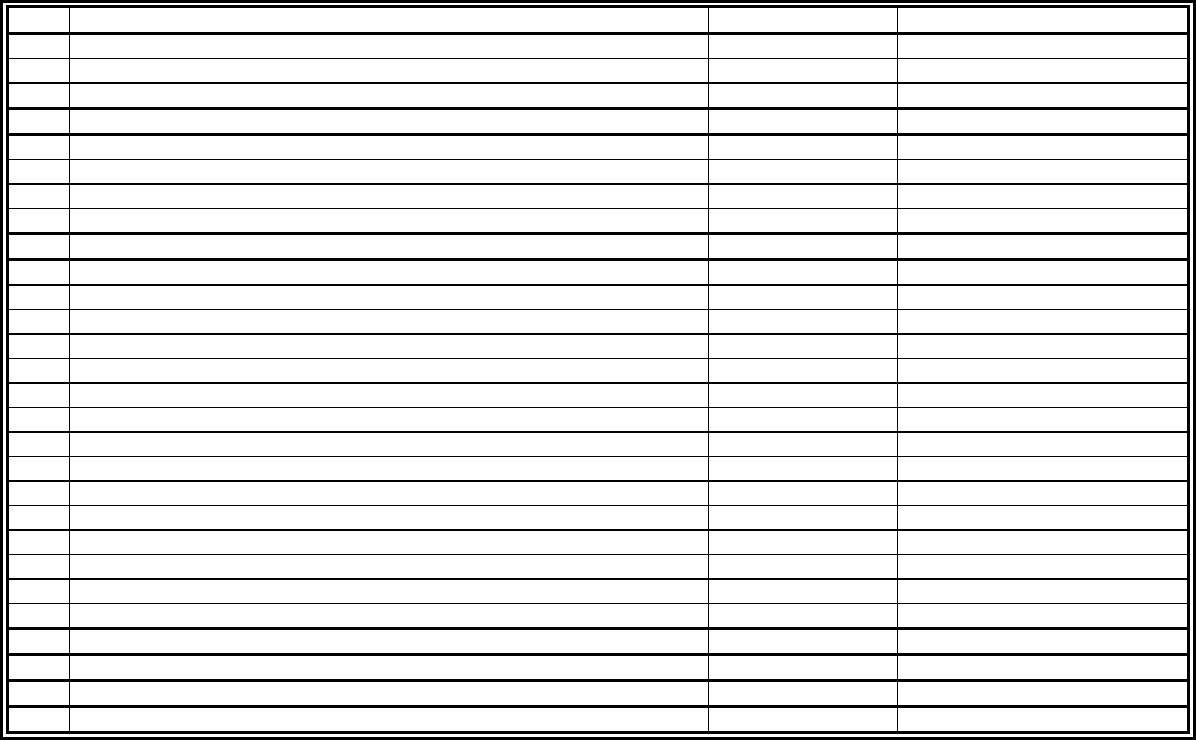

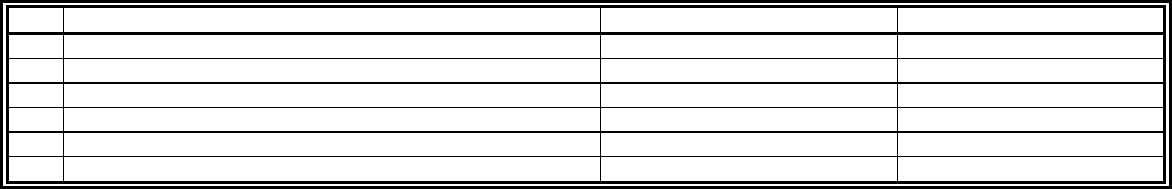

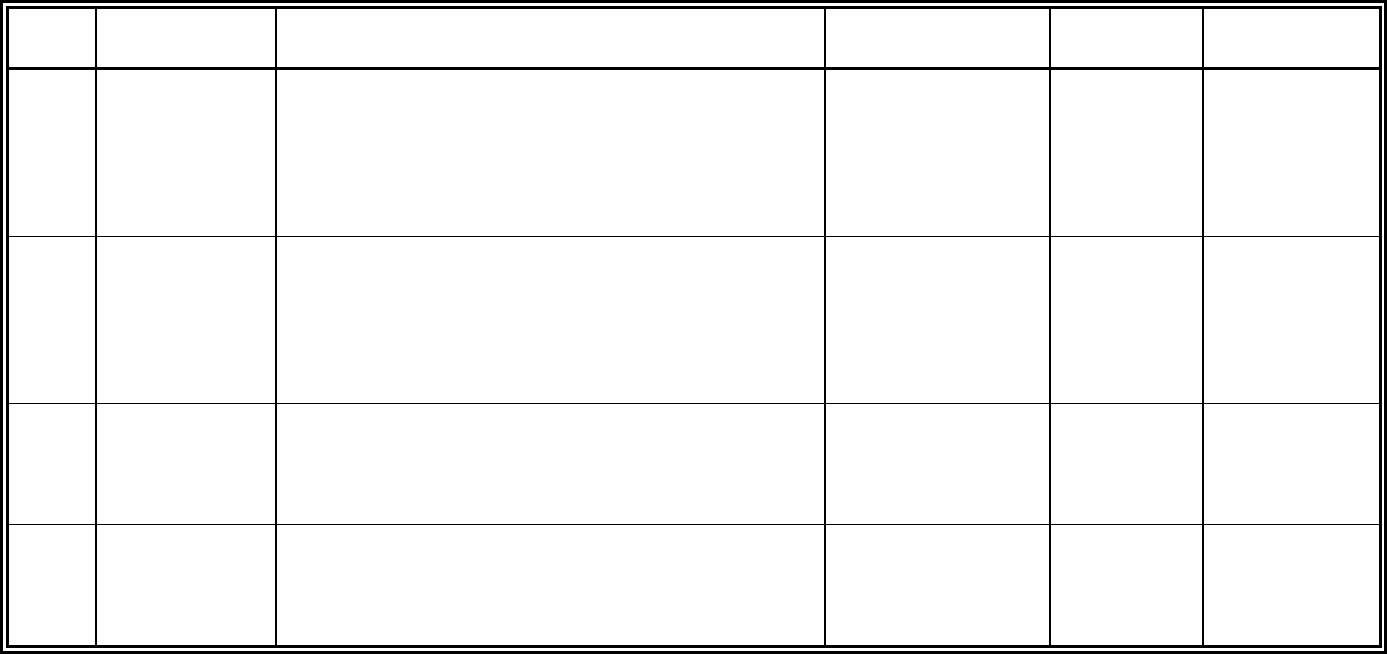

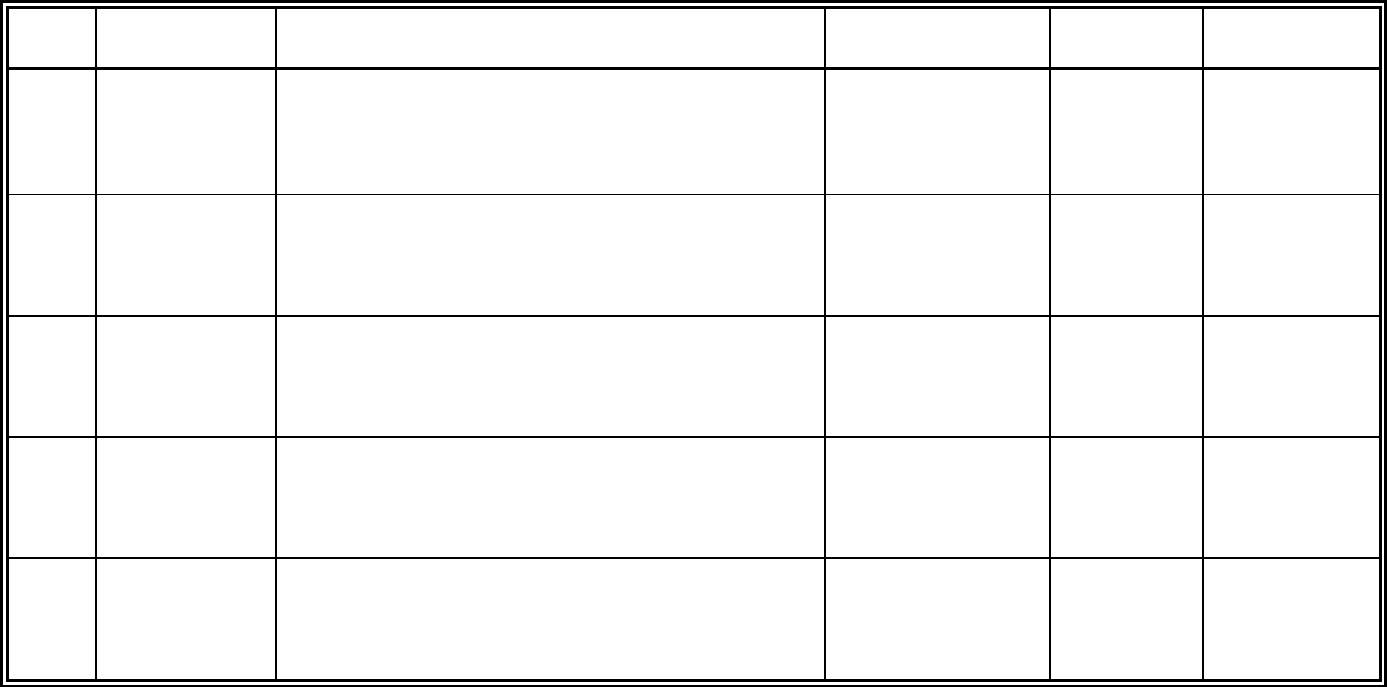

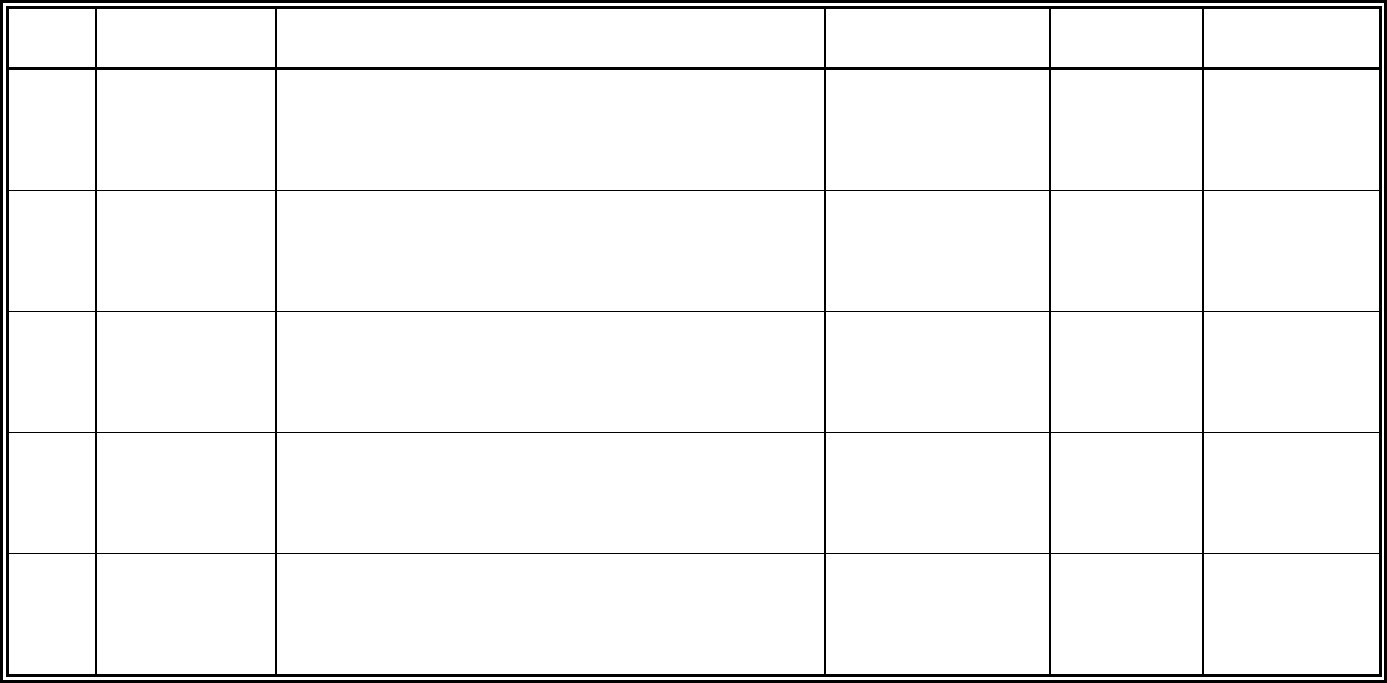

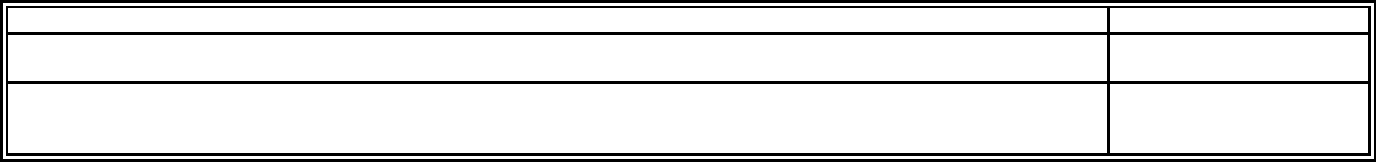

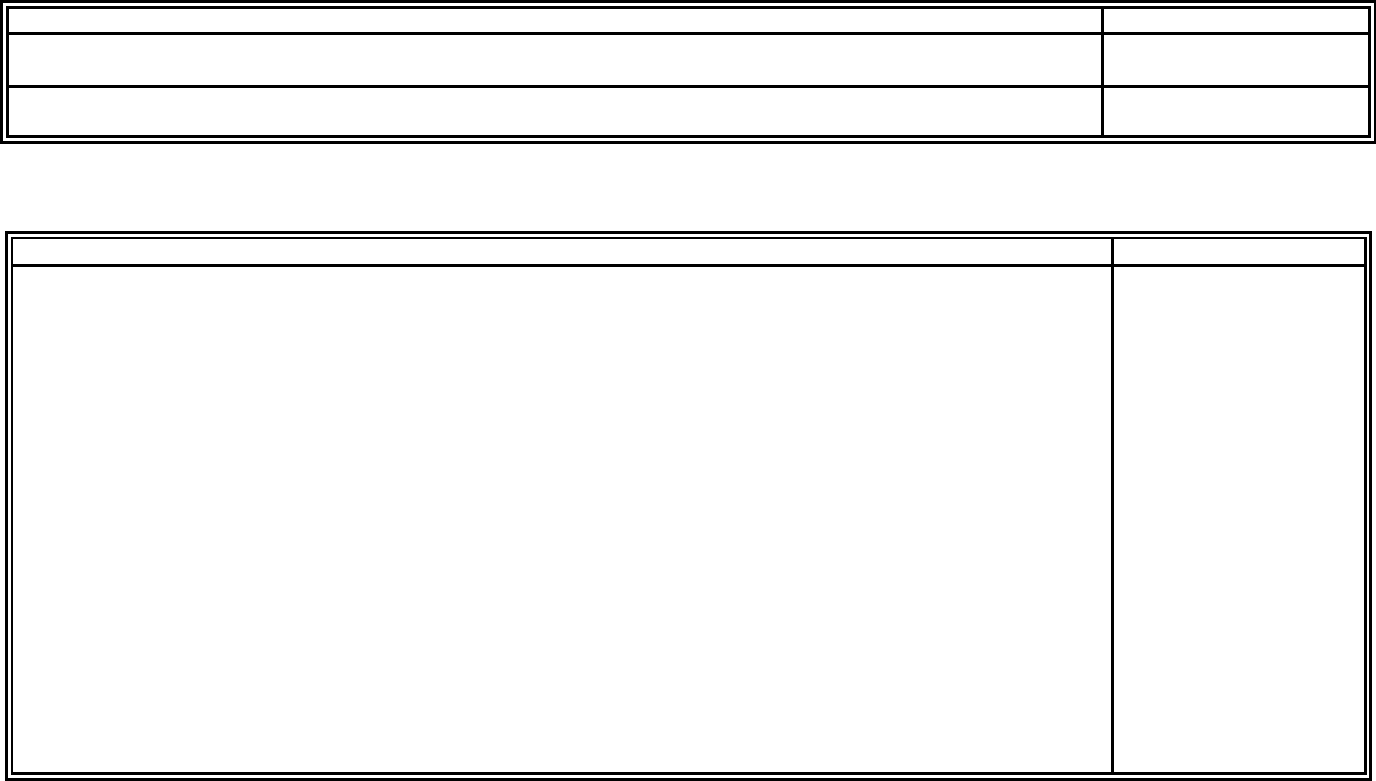

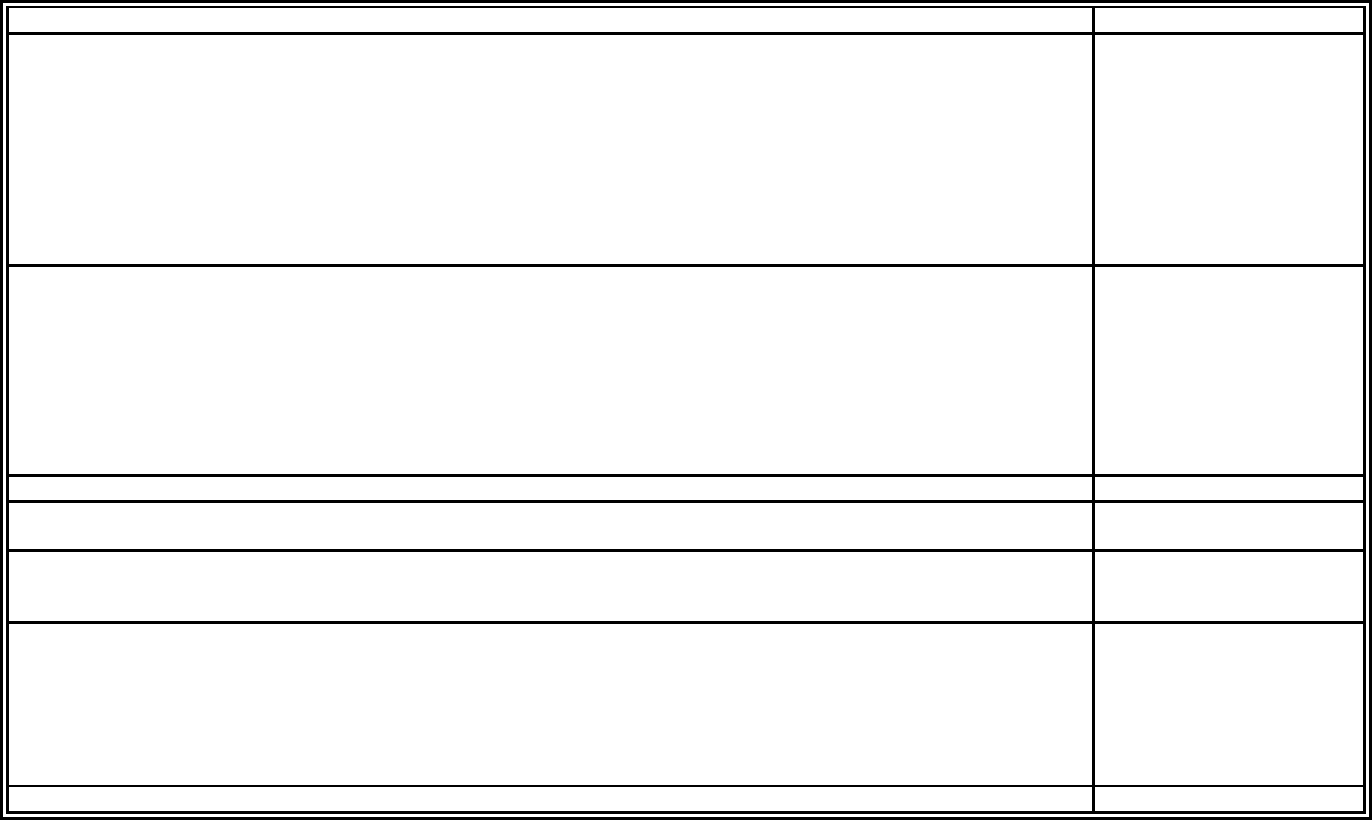

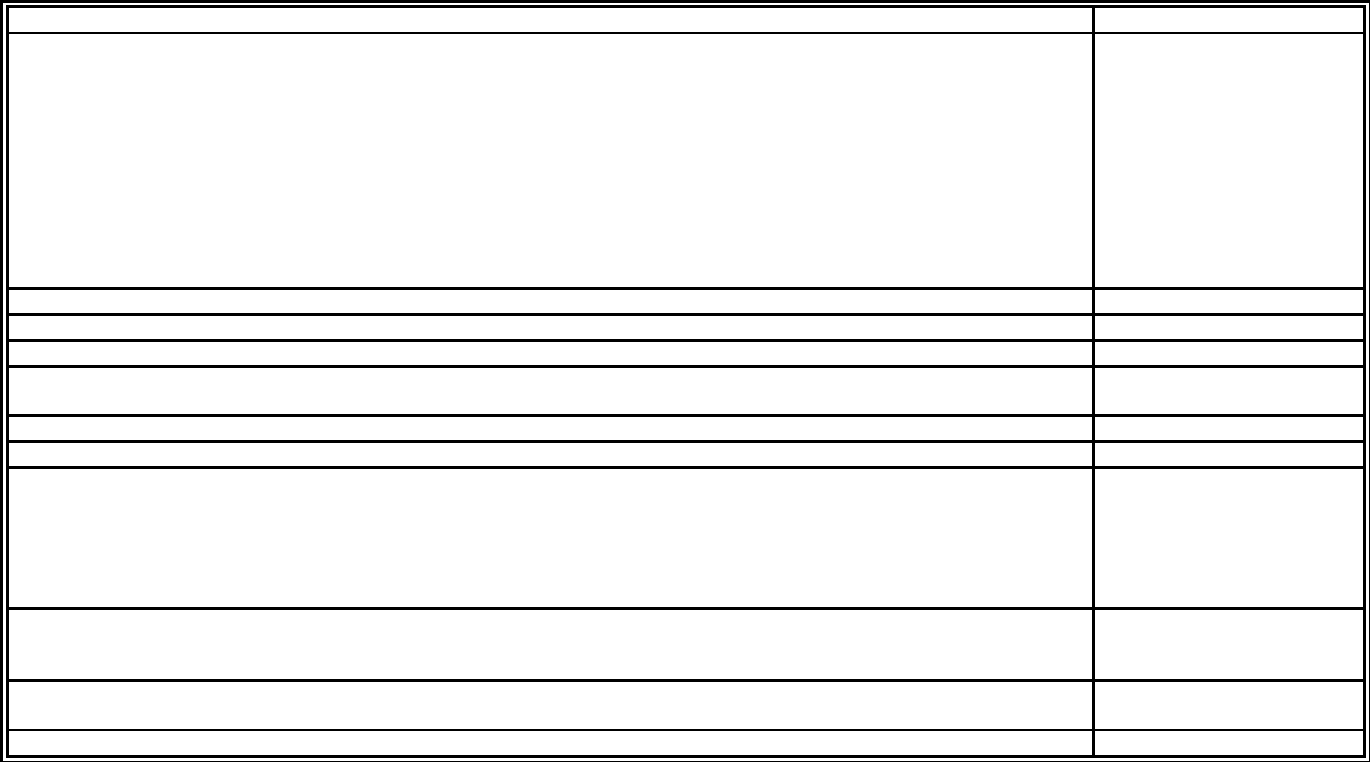

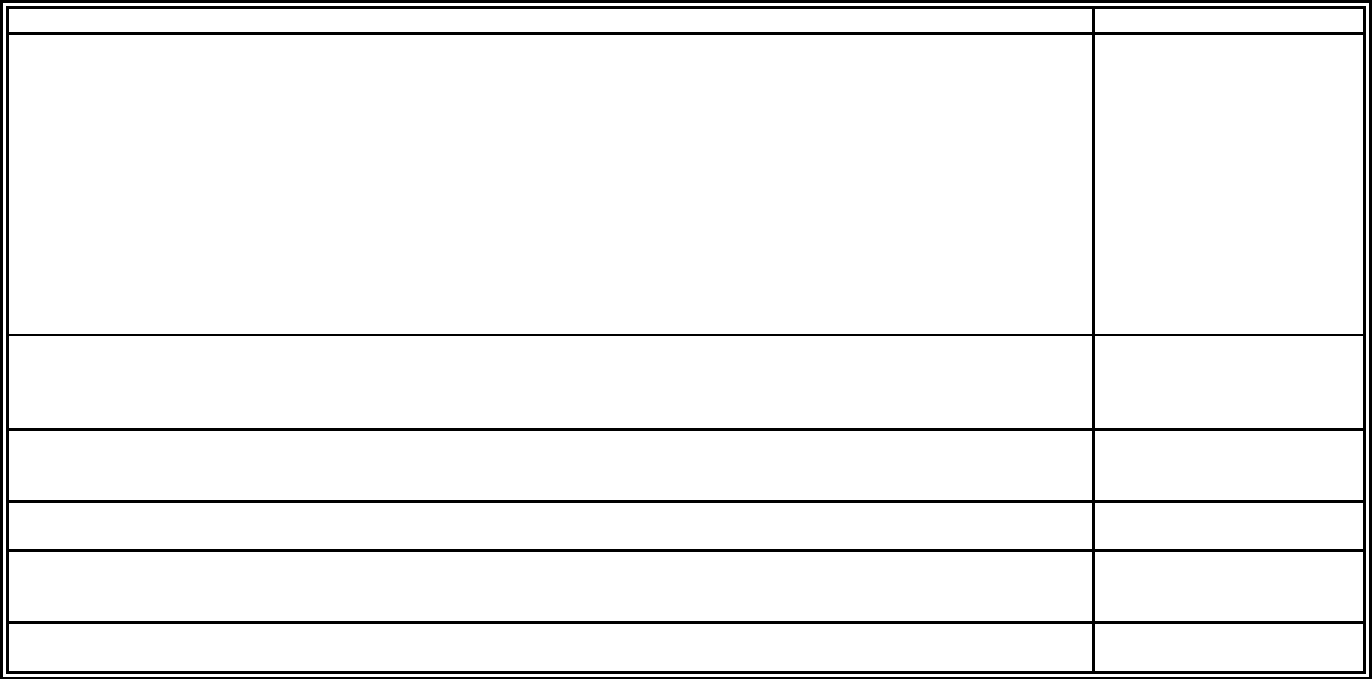

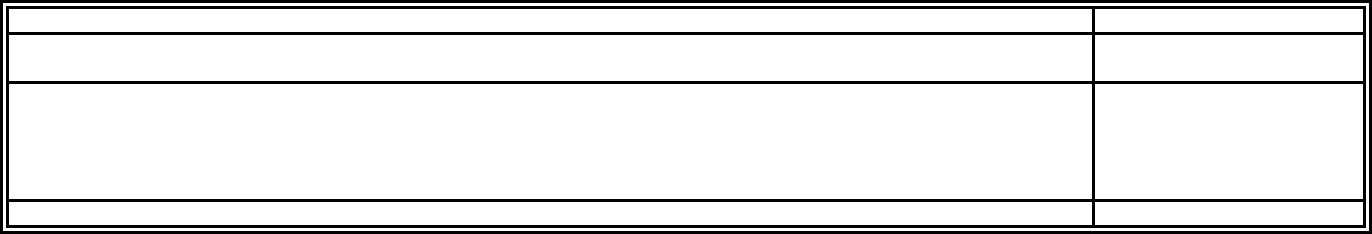

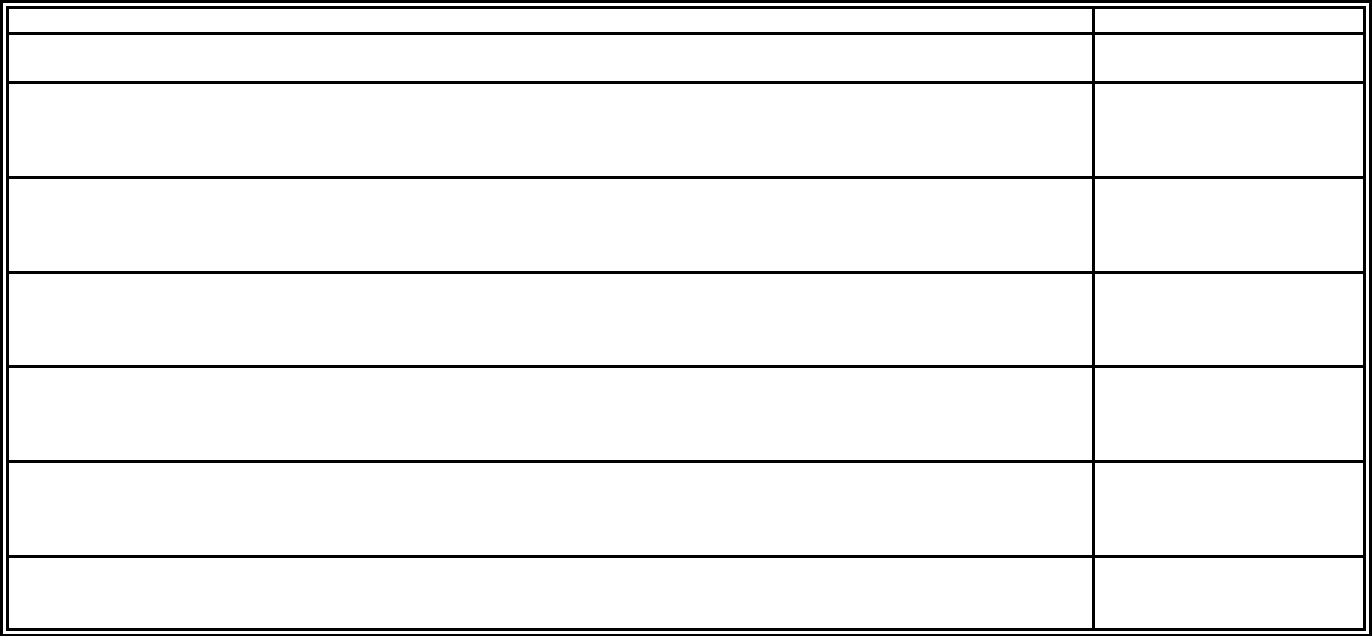

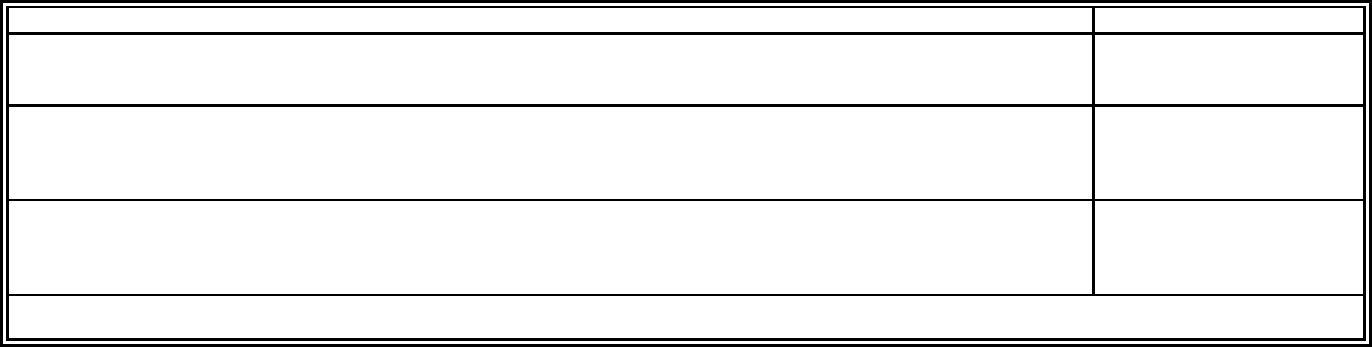

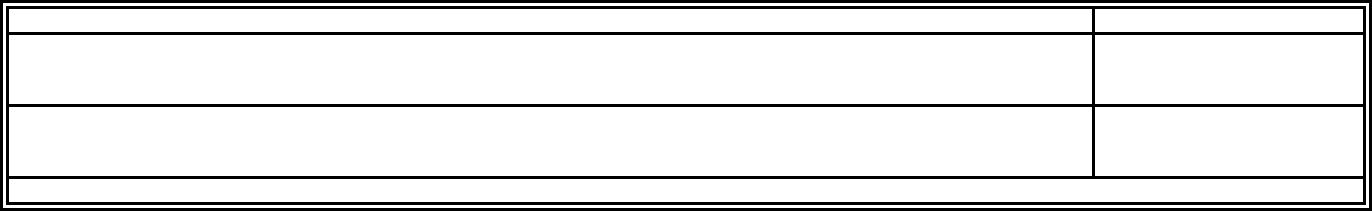

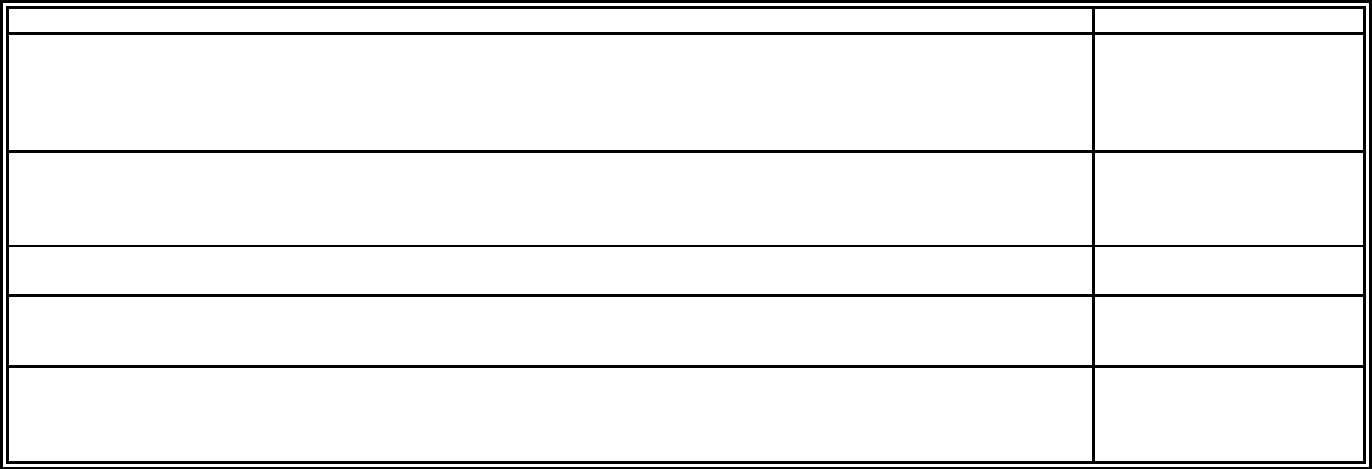

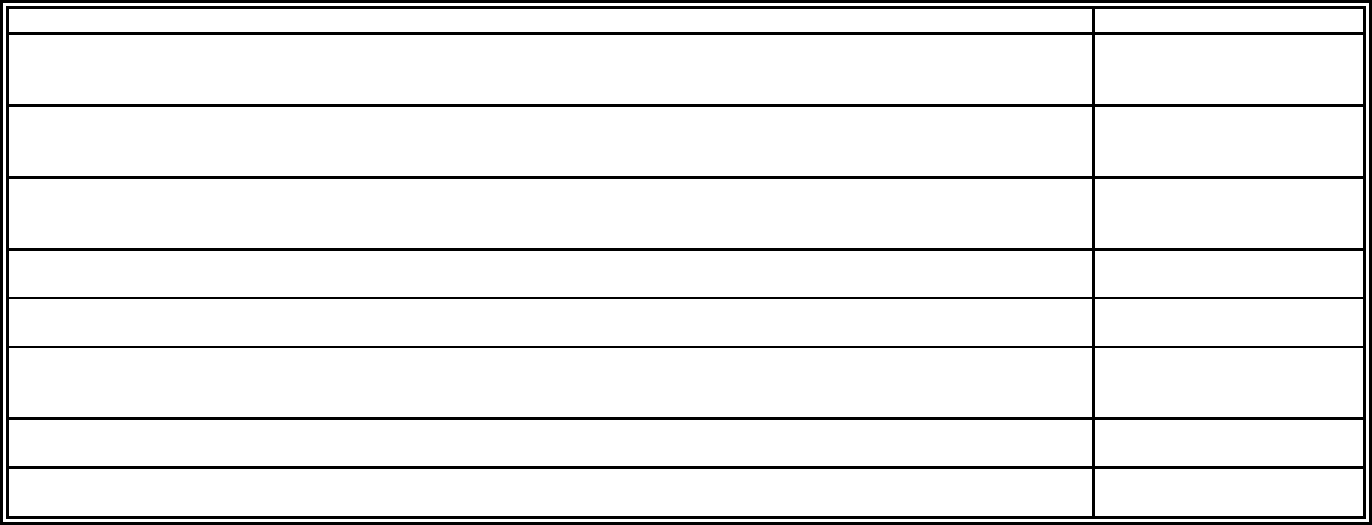

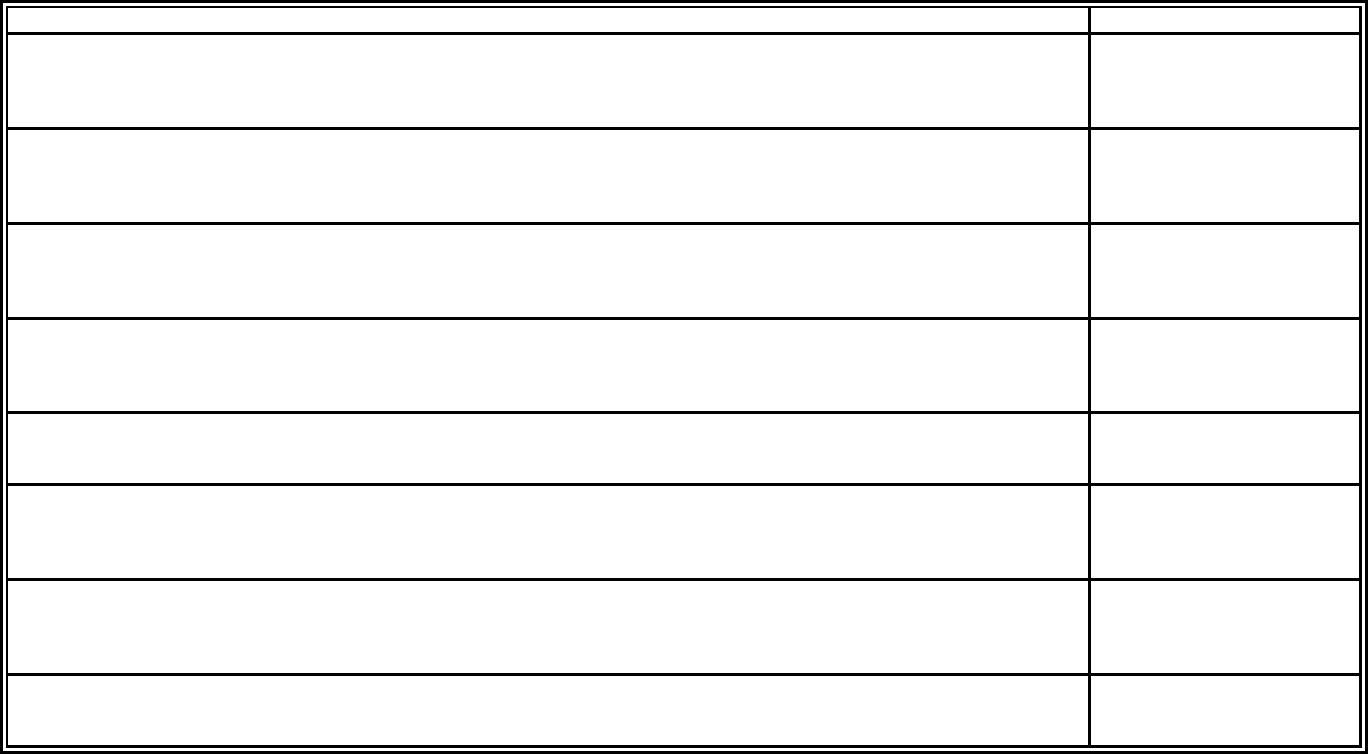

Tax Rate (cont.)

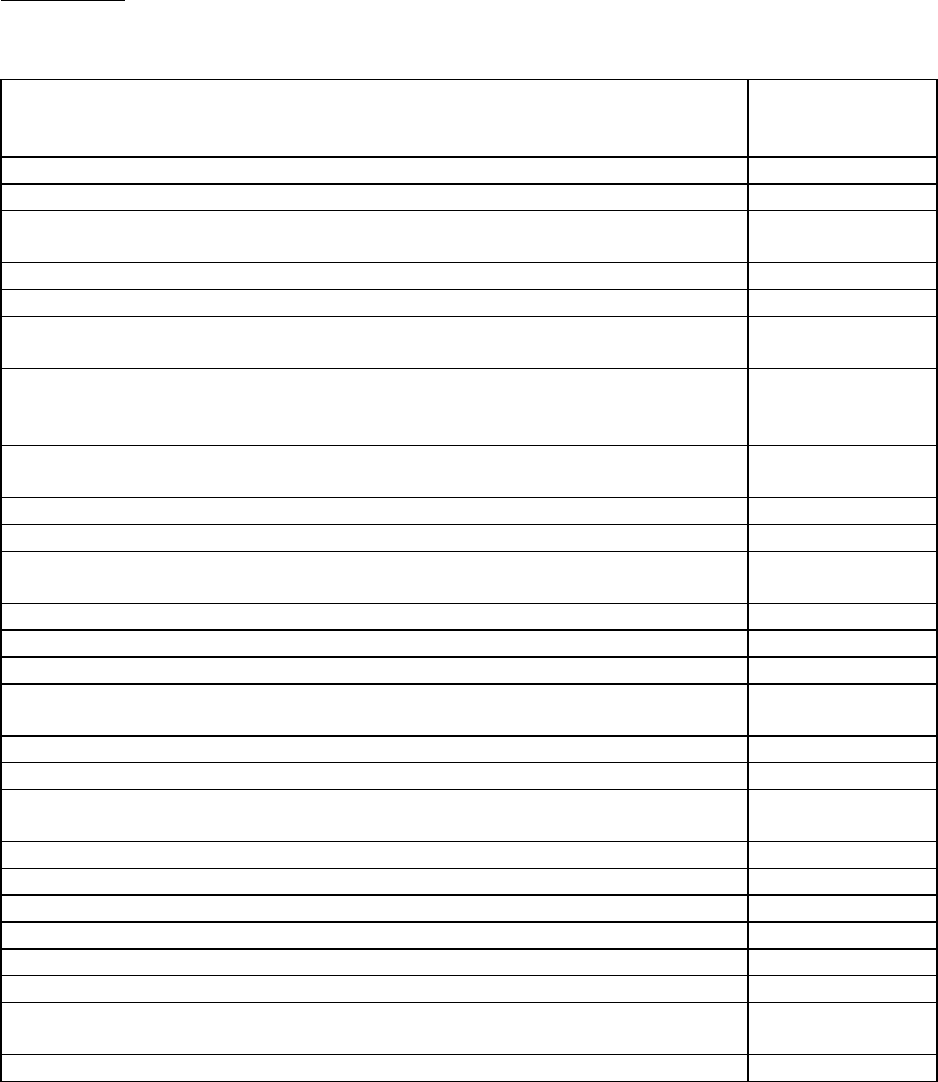

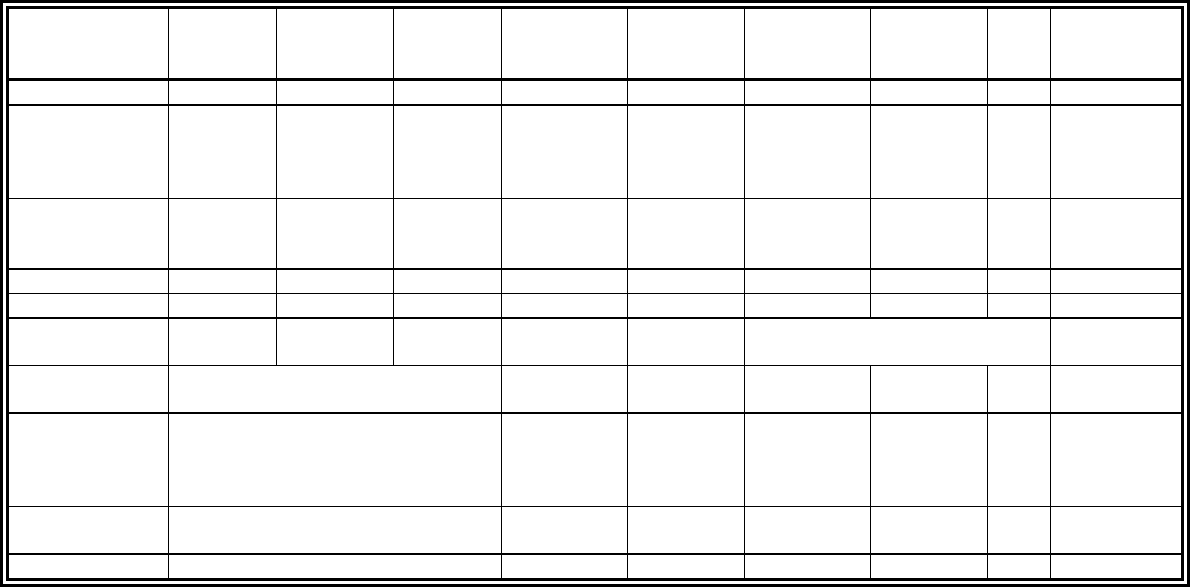

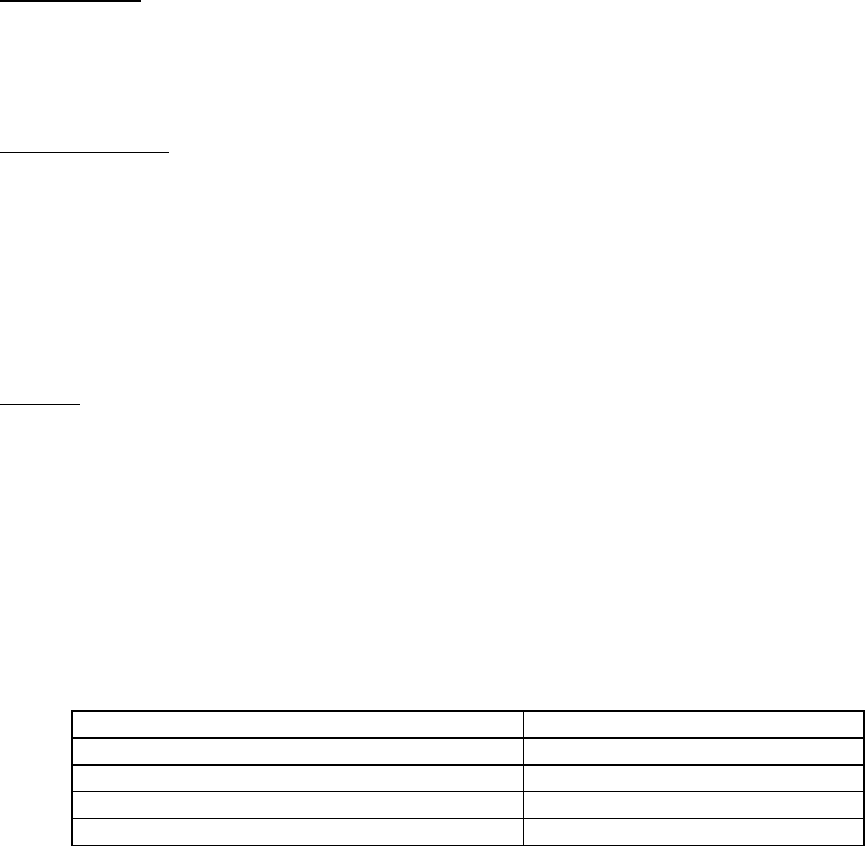

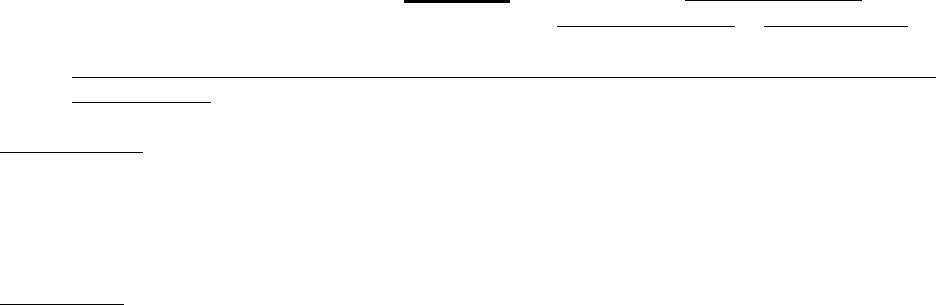

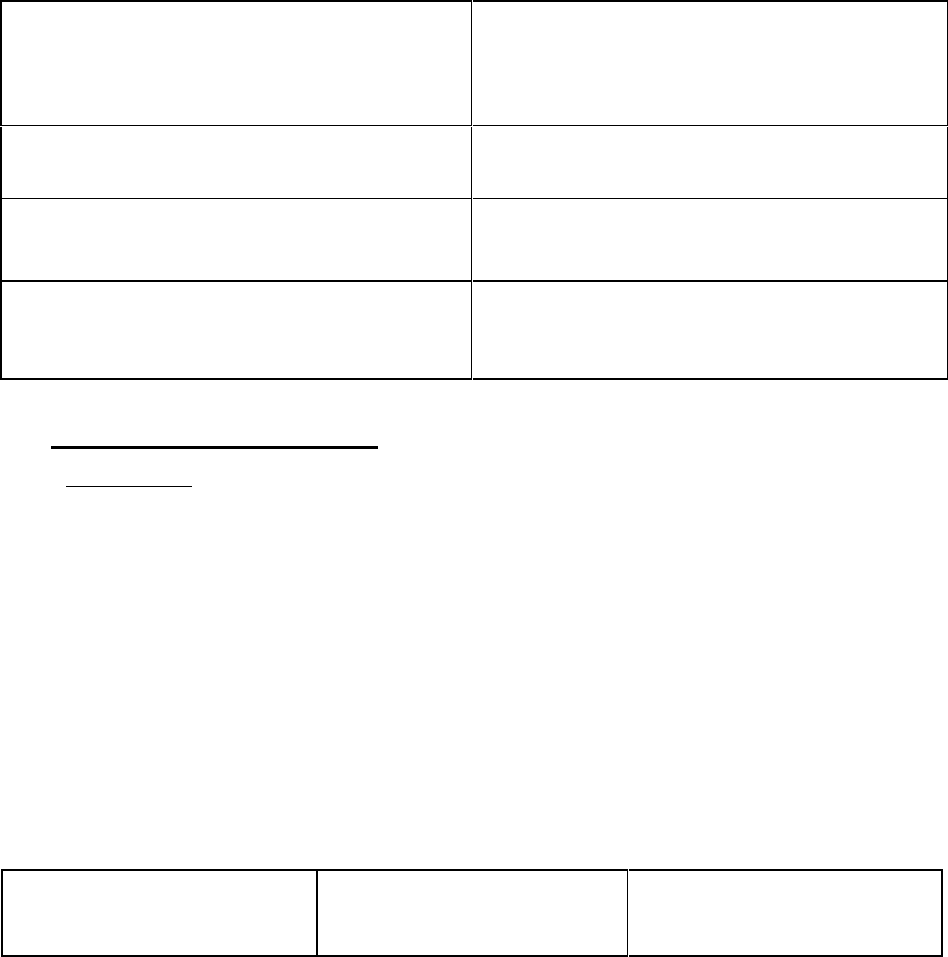

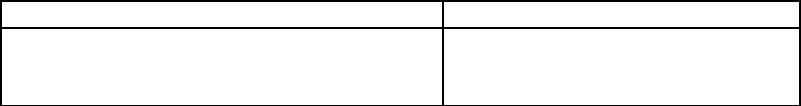

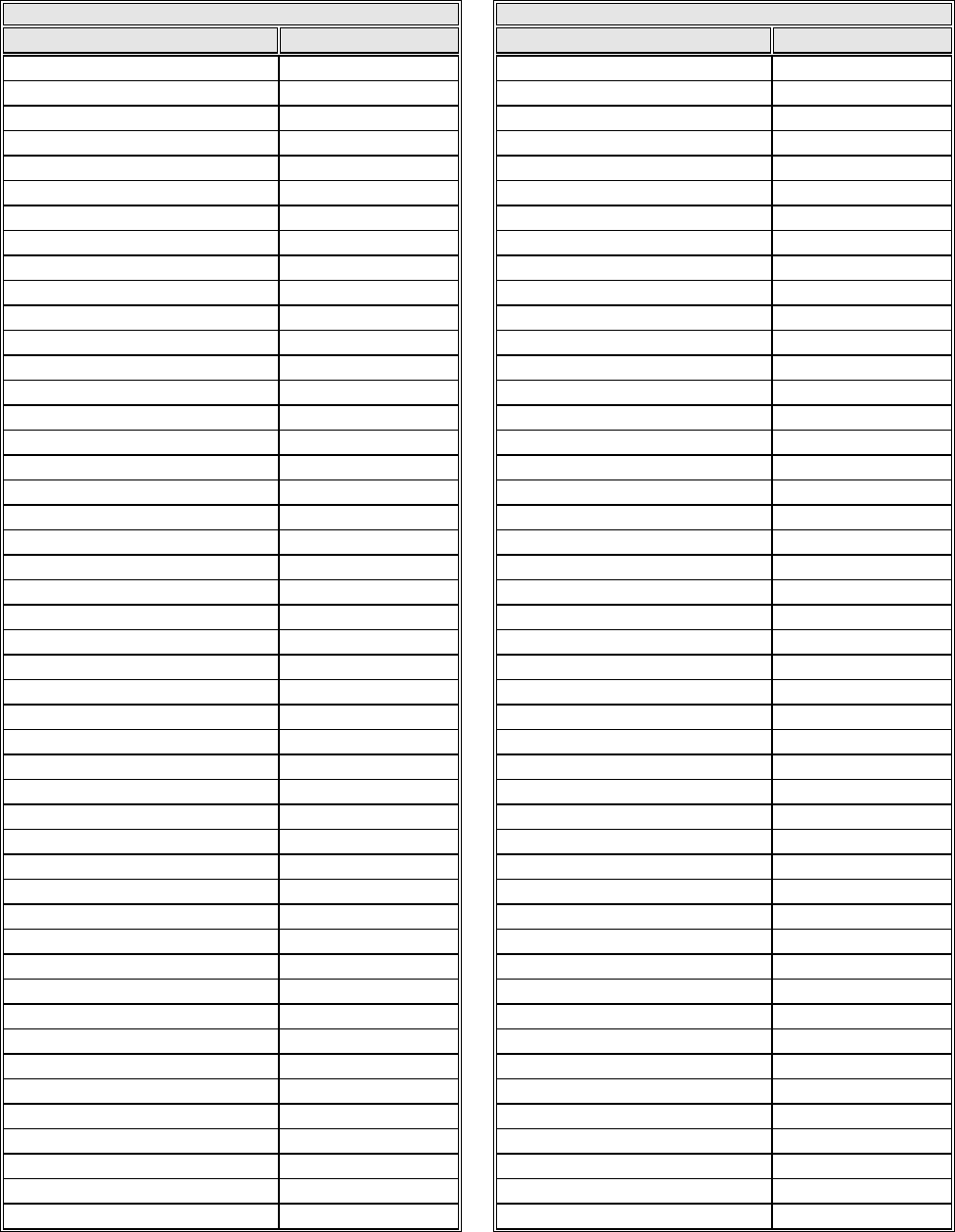

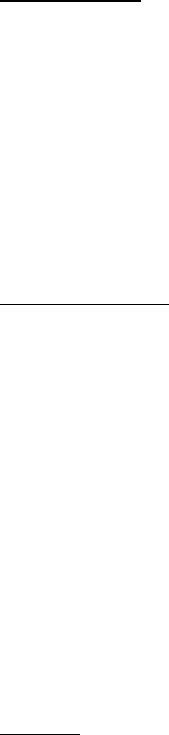

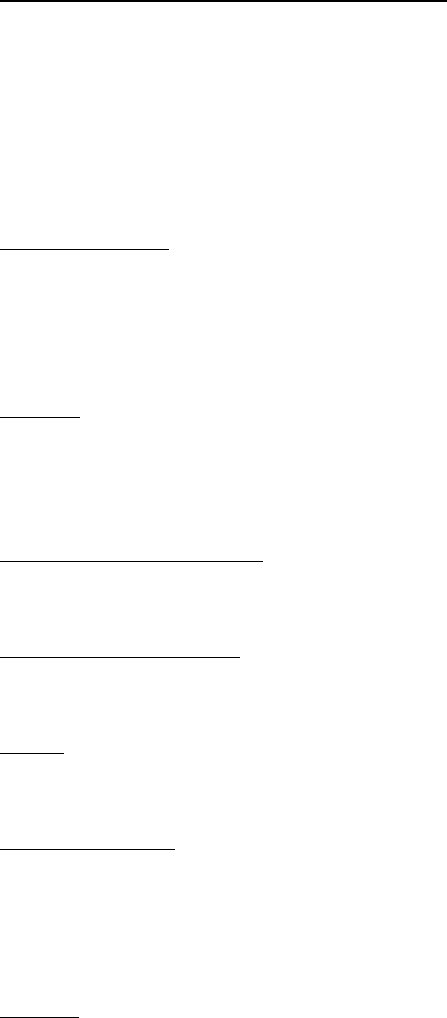

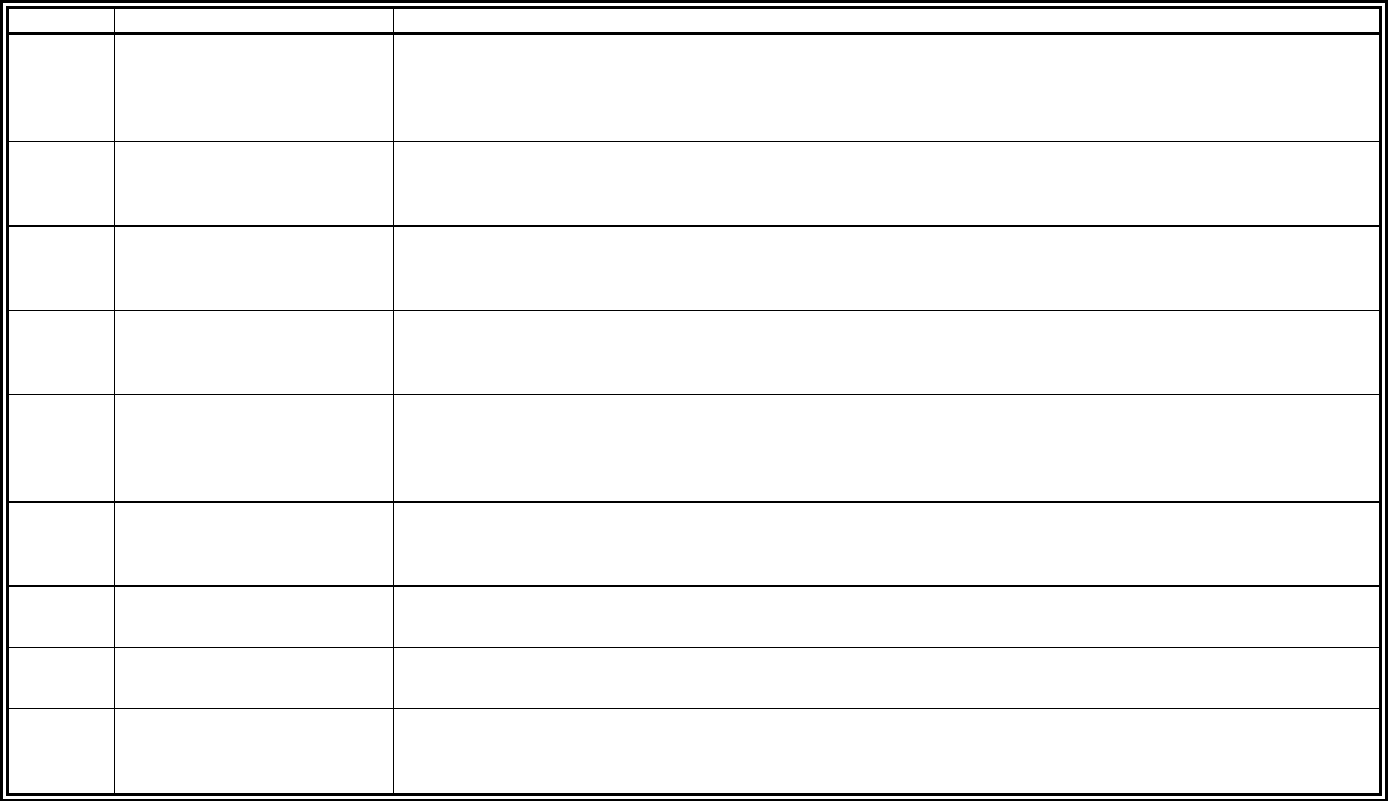

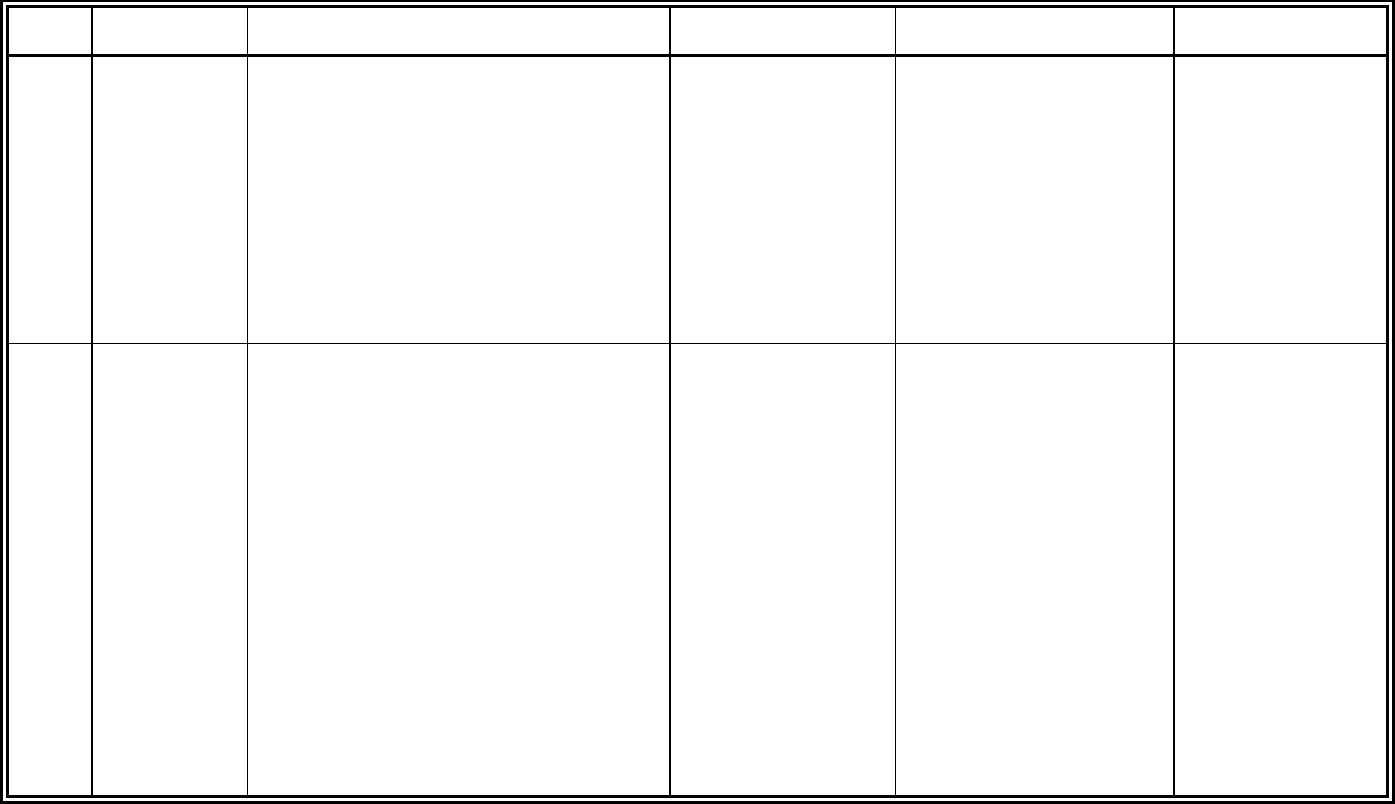

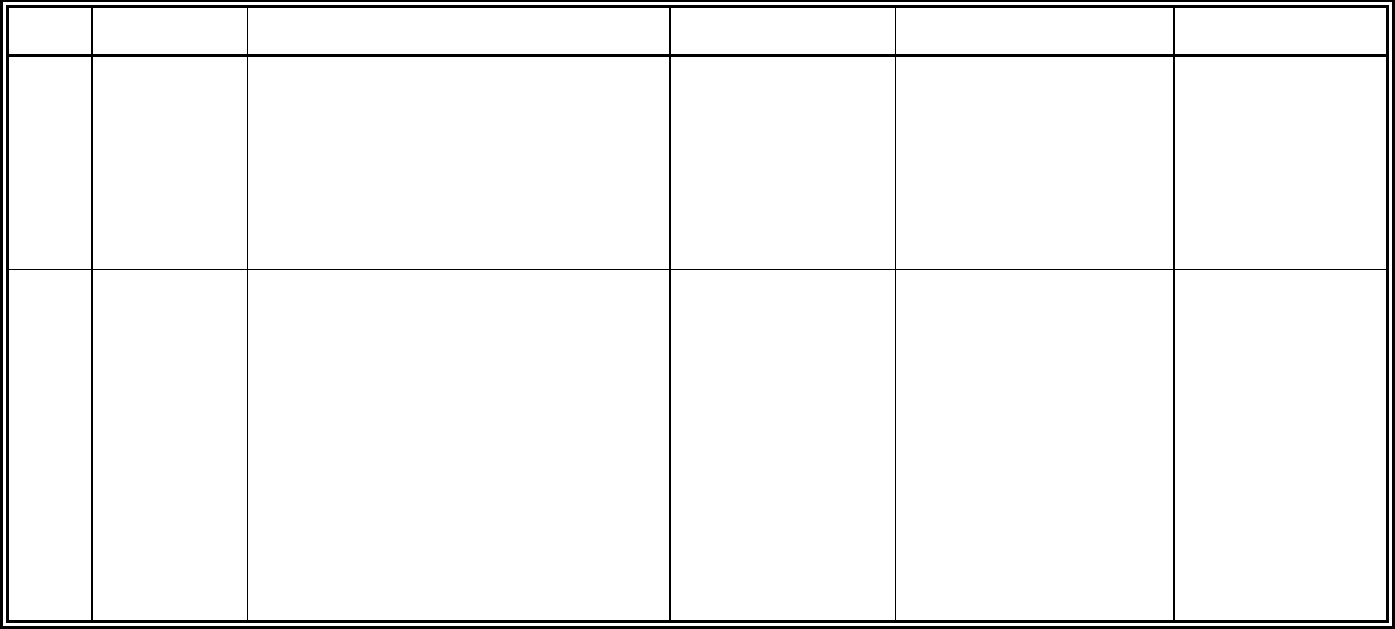

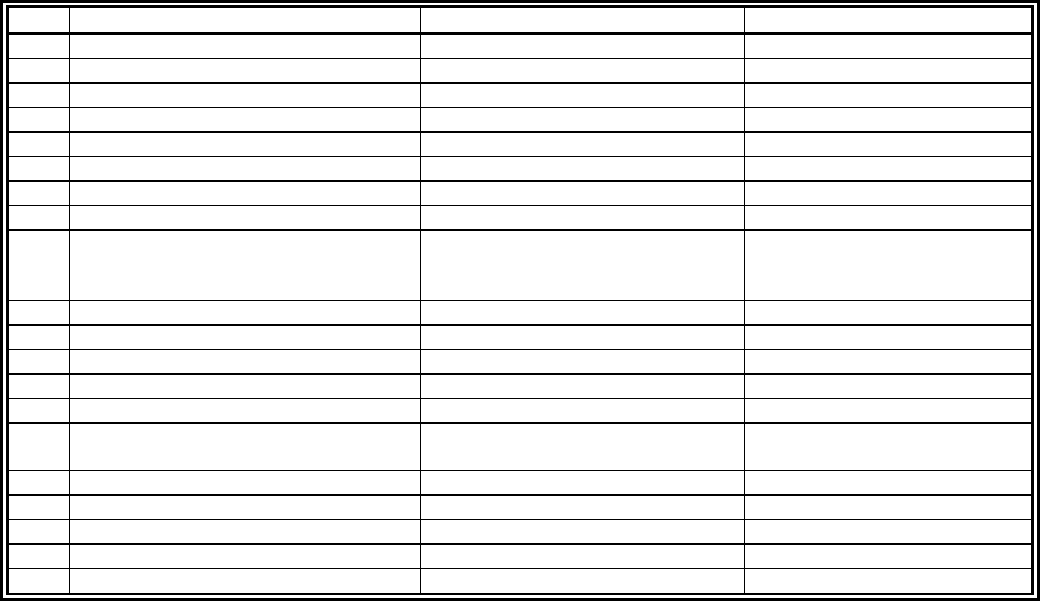

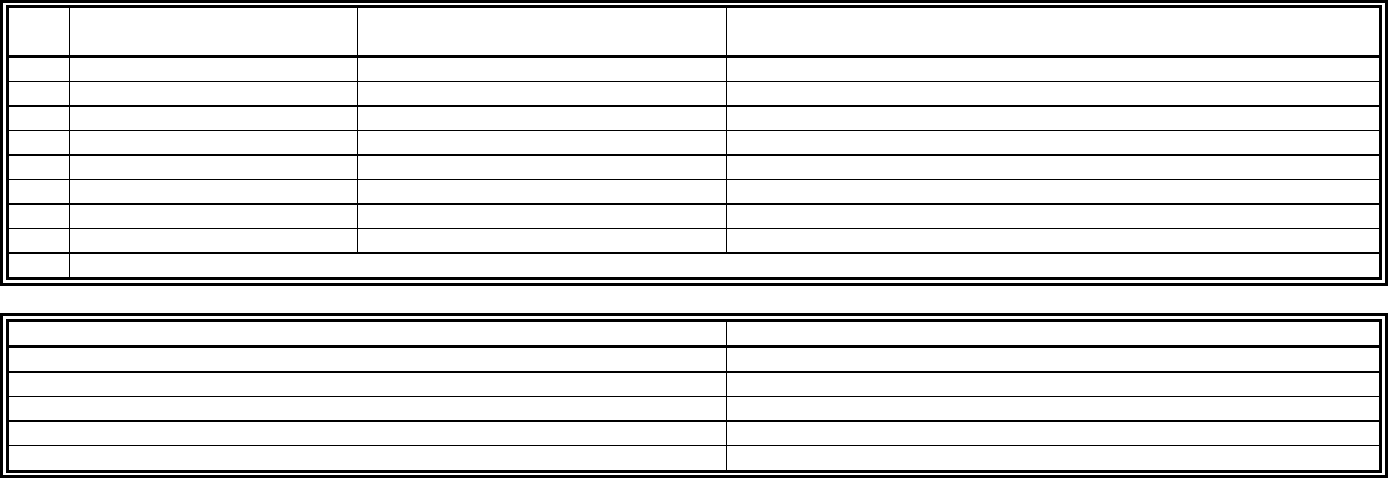

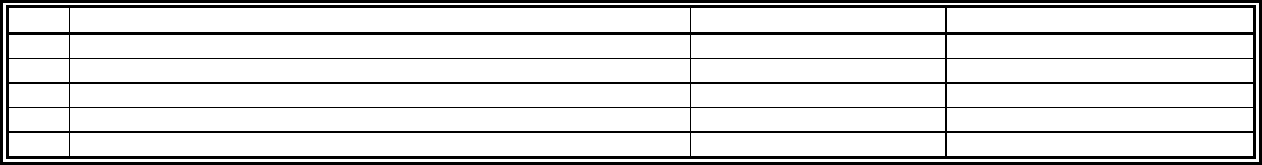

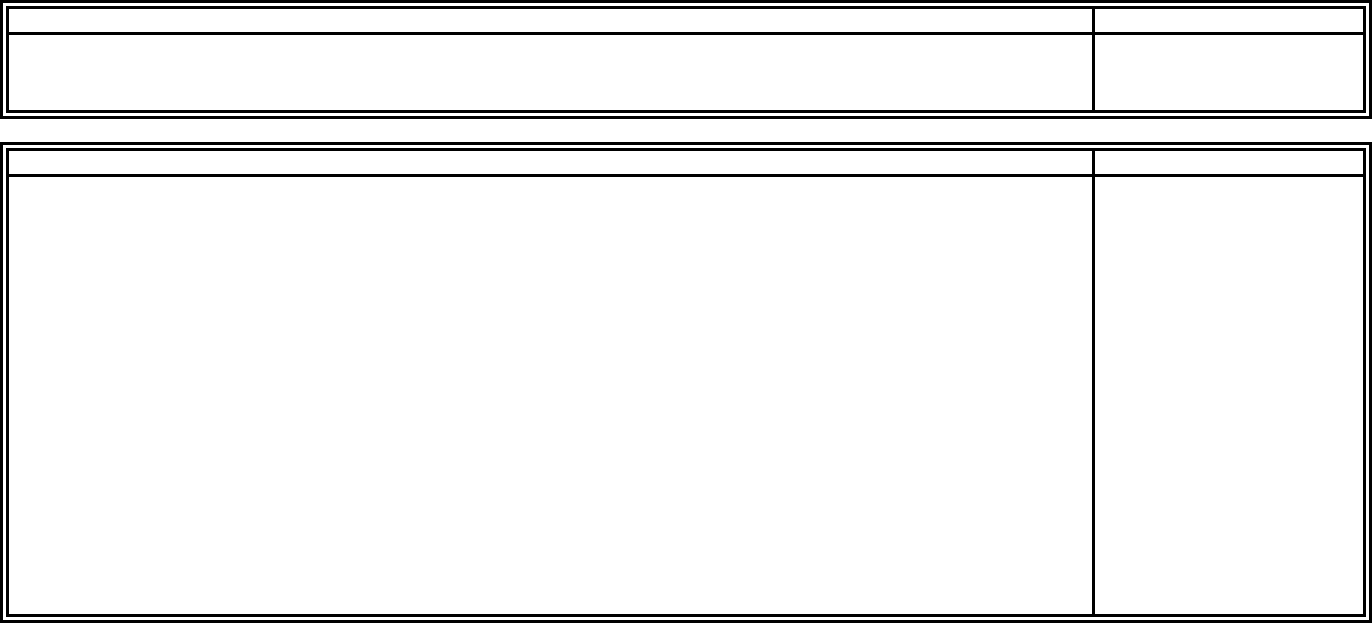

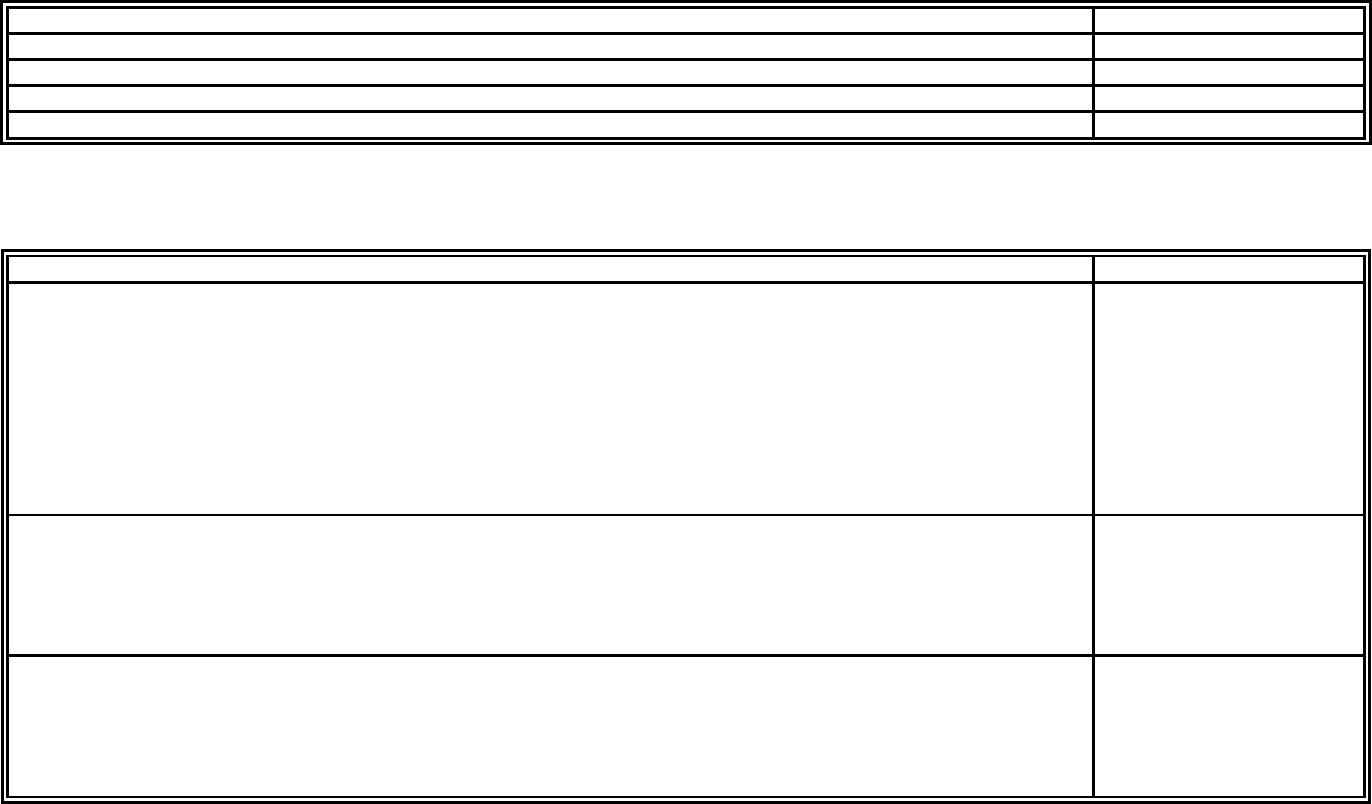

→ §§ 23-961(G); 23-1065(A) and (F)

Workers’ compensation insurance premium tax assessments, payable to the Industrial

Commission of Arizona (https://www.azica.gov) consisting of the following components:

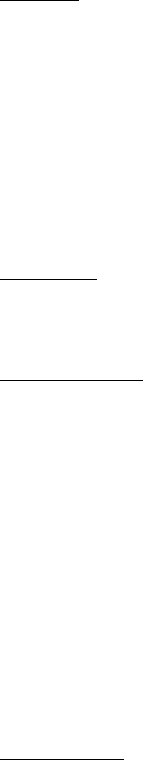

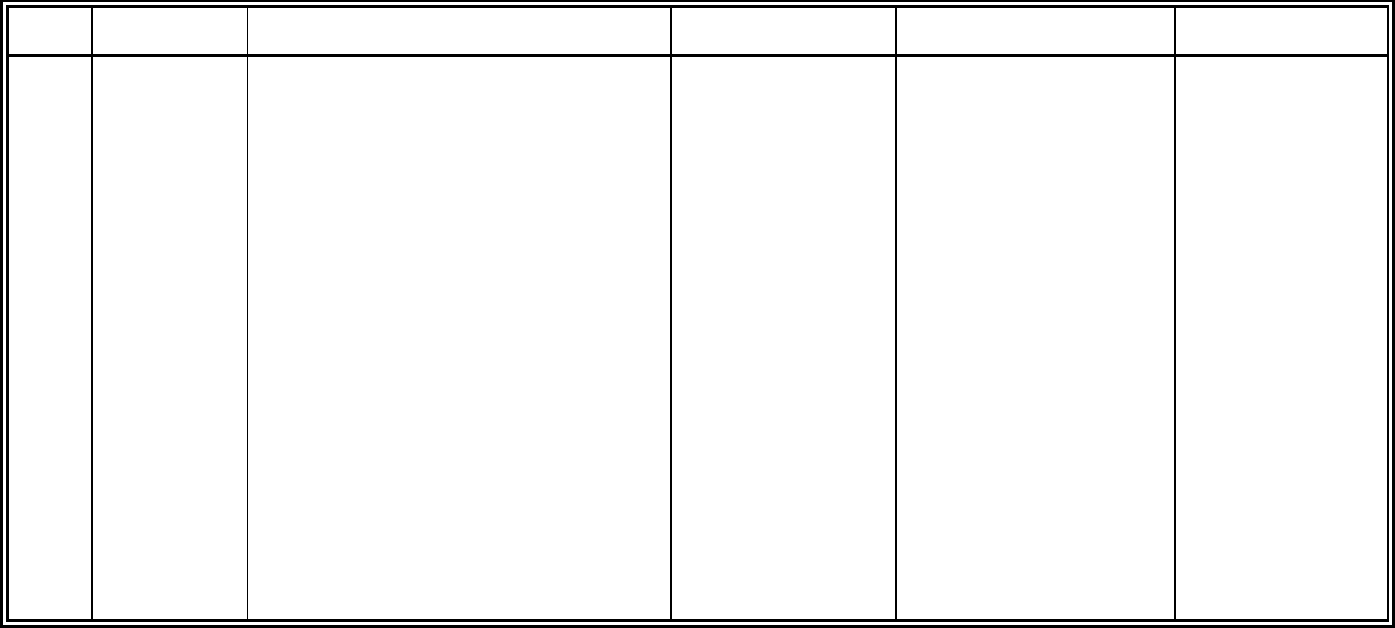

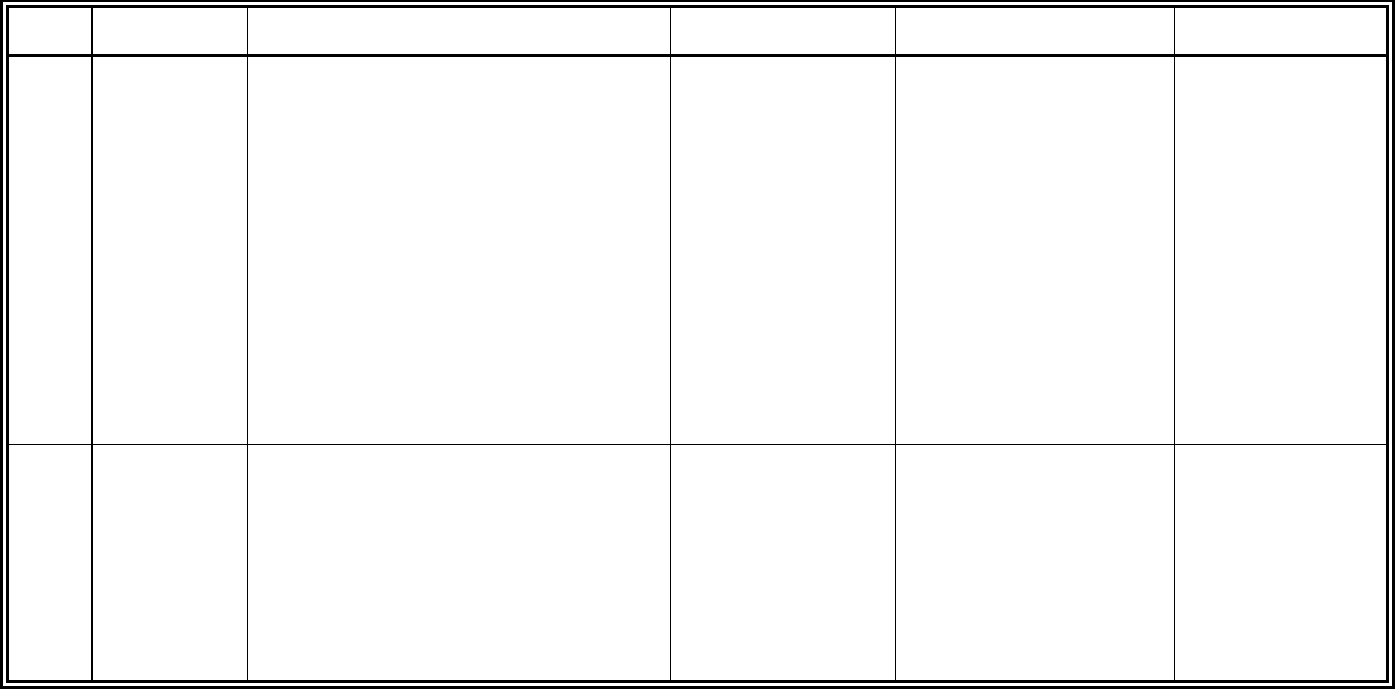

Description

CY 2023

Rate

CY 2022

Rate

CY 2021

Rate

CY 2020

Rate

CY 2019

Rate

Administrative Fund tax § 23-961(G)

2.00%

1.75%

1.75%

1.75%

1.75%

“Special Fund tax” to pay for

vocational rehabilitation for persons

sustaining industrial injuries

§ 23-1065(A)

0.00%

0.00%

0.00%

0.00%

0.00%

“Apportionment tax” to pay for

vocational rehabilitation for persons

sustaining industrial injuries

§ 23-1065(F)

0.00%

0.00%

0.00%

0.00%

0.00%

TOTAL

2.00%

1.75%

1.75%

1.75%

1.75%

Other Taxes and Assessments:

§ 20-226 Insurers

Taxes paid pursuant to § 20-224 are in lieu of all other demands for state, county, district,

municipal and school taxes, licenses and excises except for fees prescribed in ARS Title 20; taxes

on real and tangible personal property located in Arizona; and state, county, city or town

transaction privilege and use taxes.

§ 20-1566 Title Insurers

Income tax paid by title insurers pursuant to § 20-1566(A) in lieu of all other demands for state,

county, district, municipal and school taxes, licenses and excises except for fees prescribed in

ARS Title 20, Chapter 1, Article 2; and taxes on real and tangible personal property located in

Arizona. Title insurers are subject to retaliation per § 20-230.

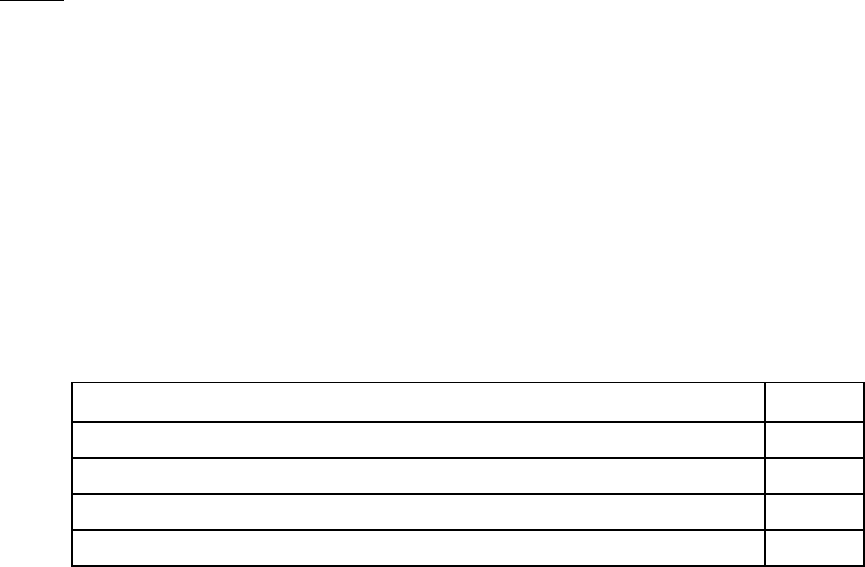

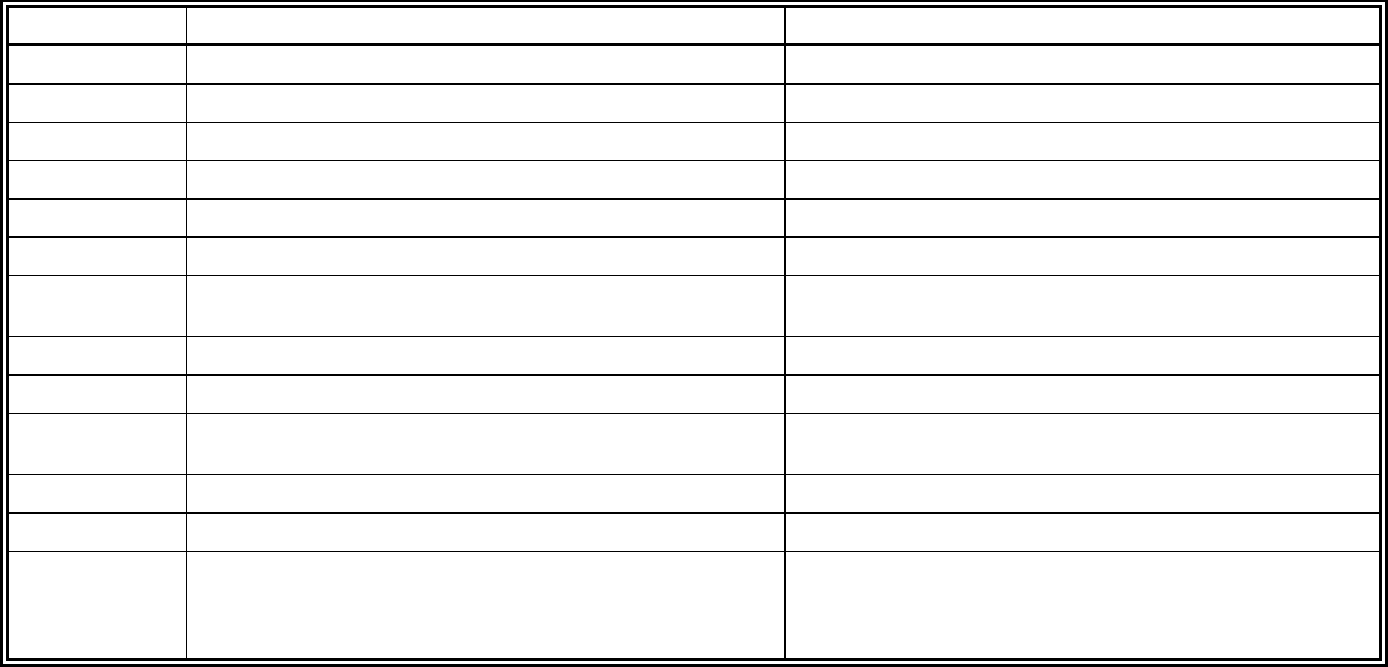

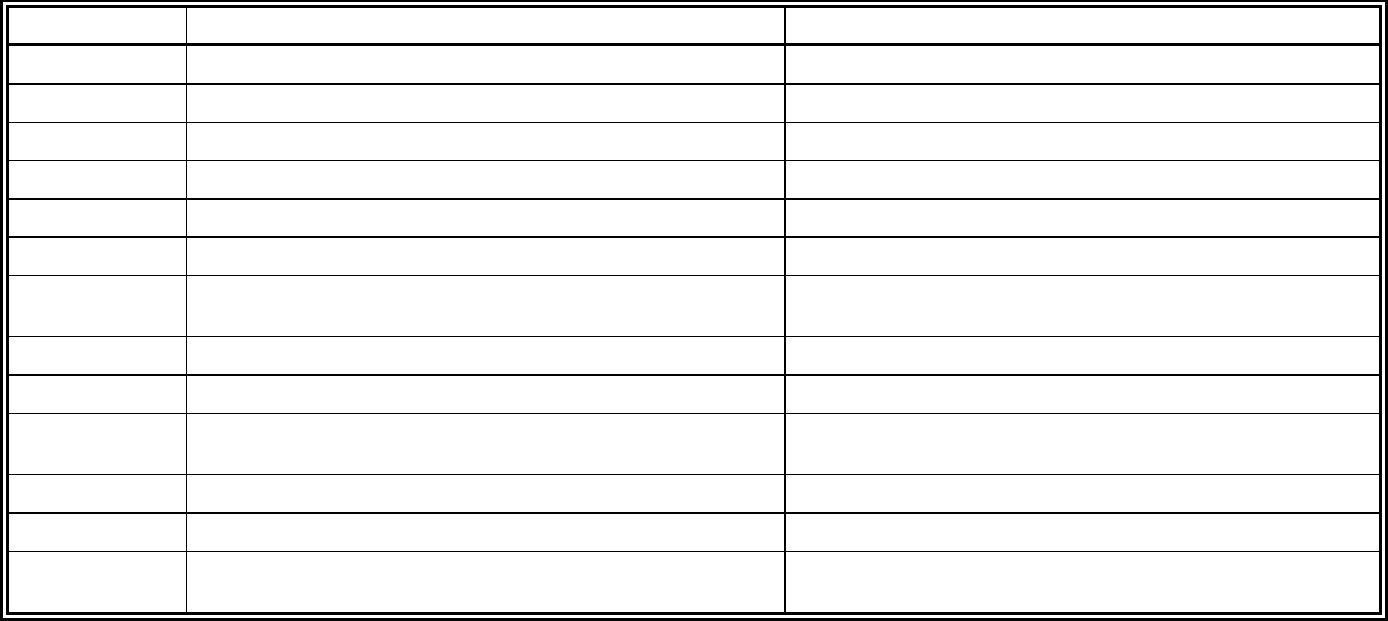

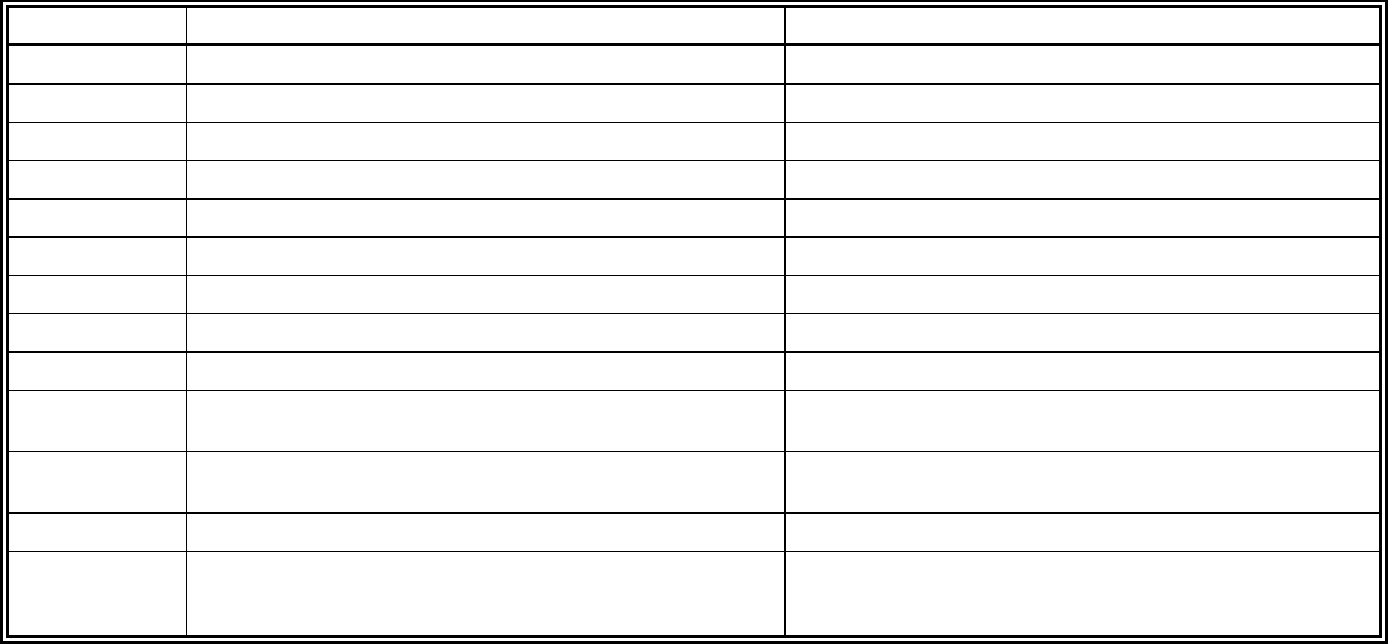

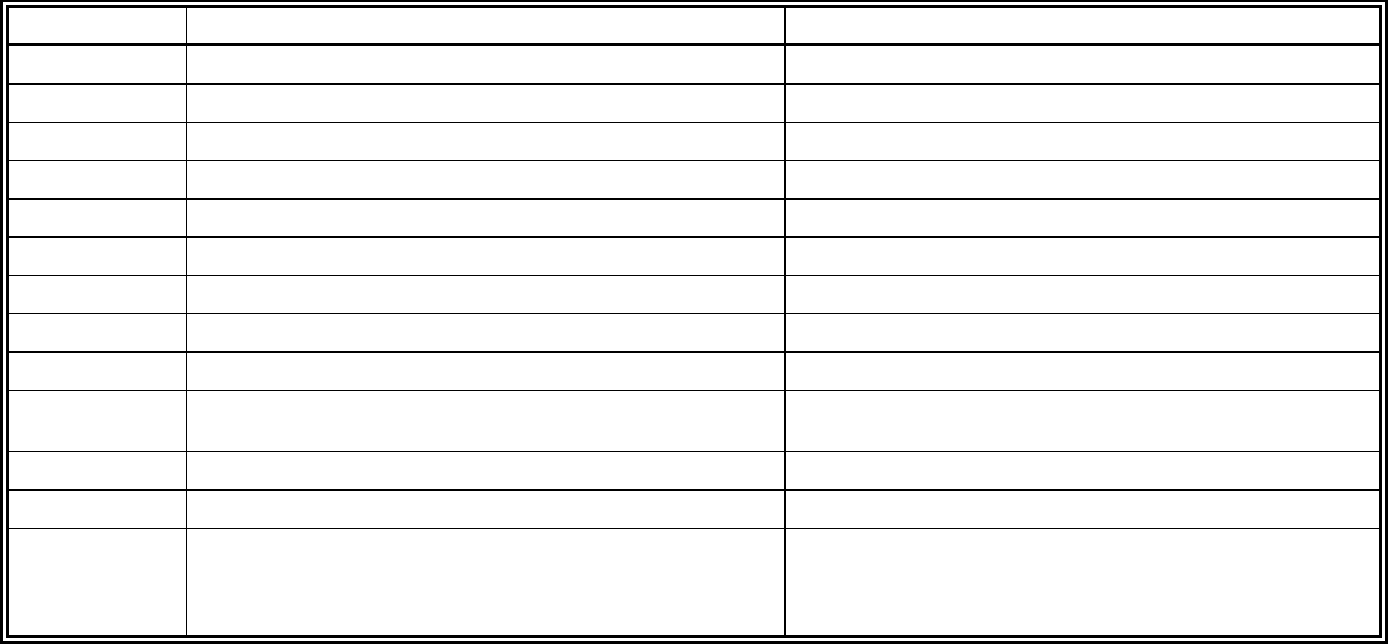

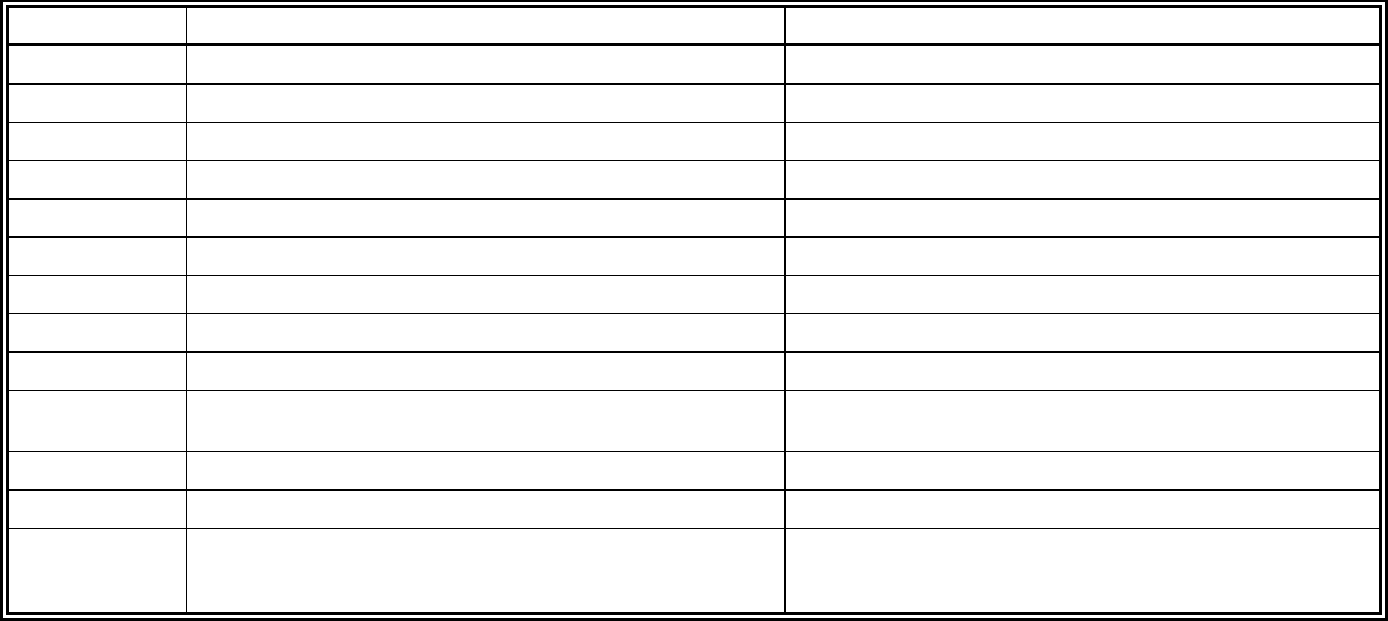

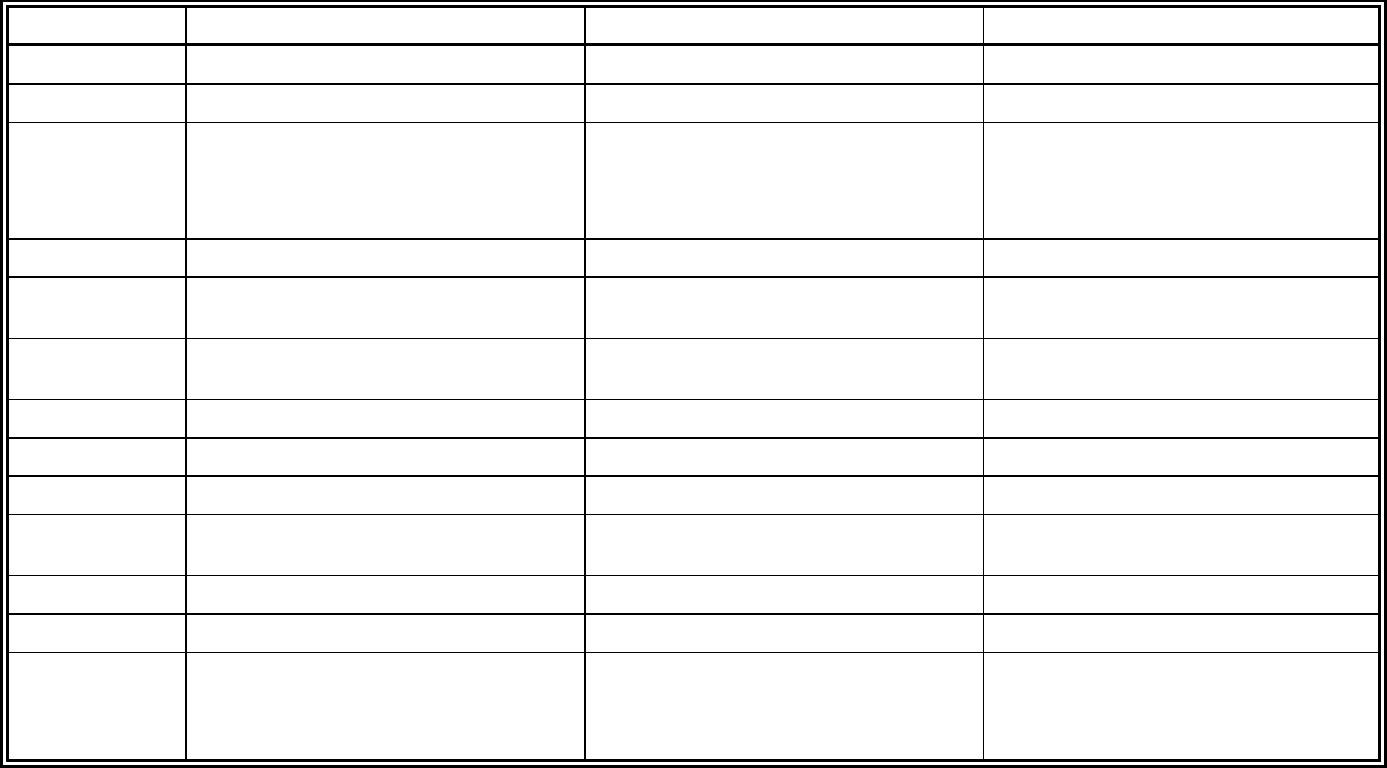

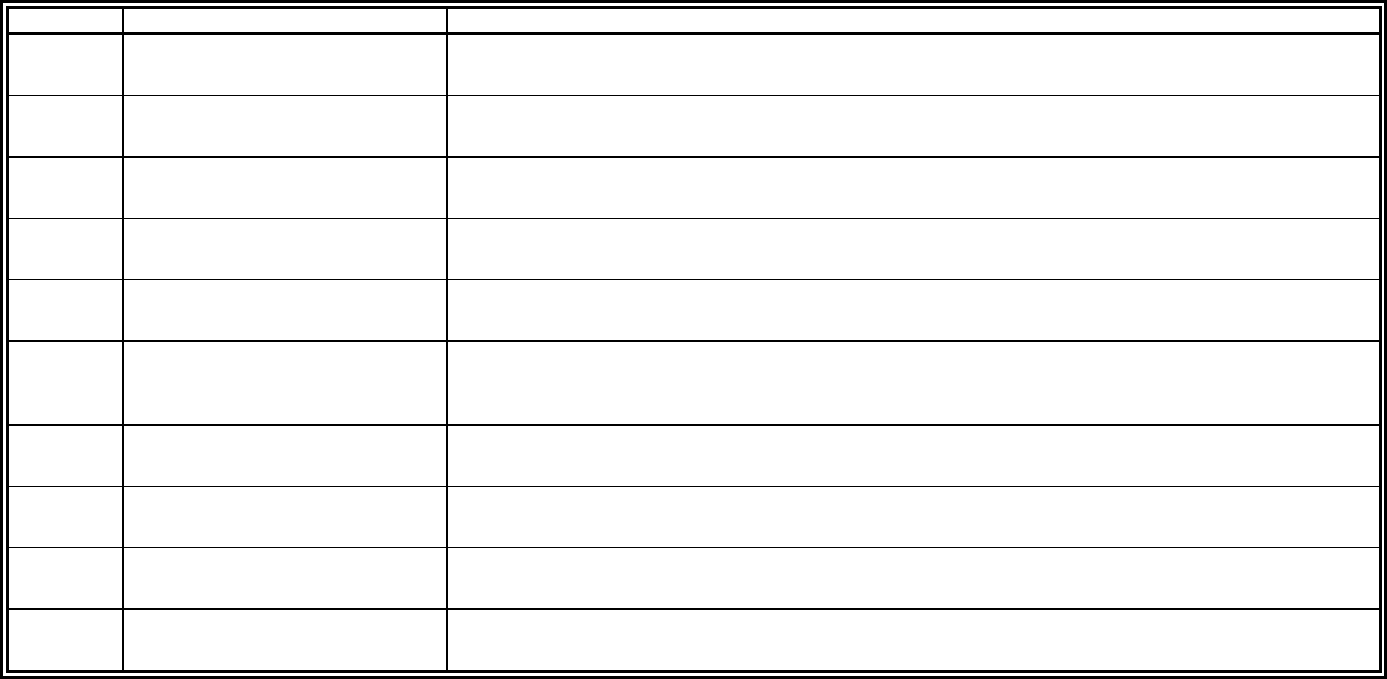

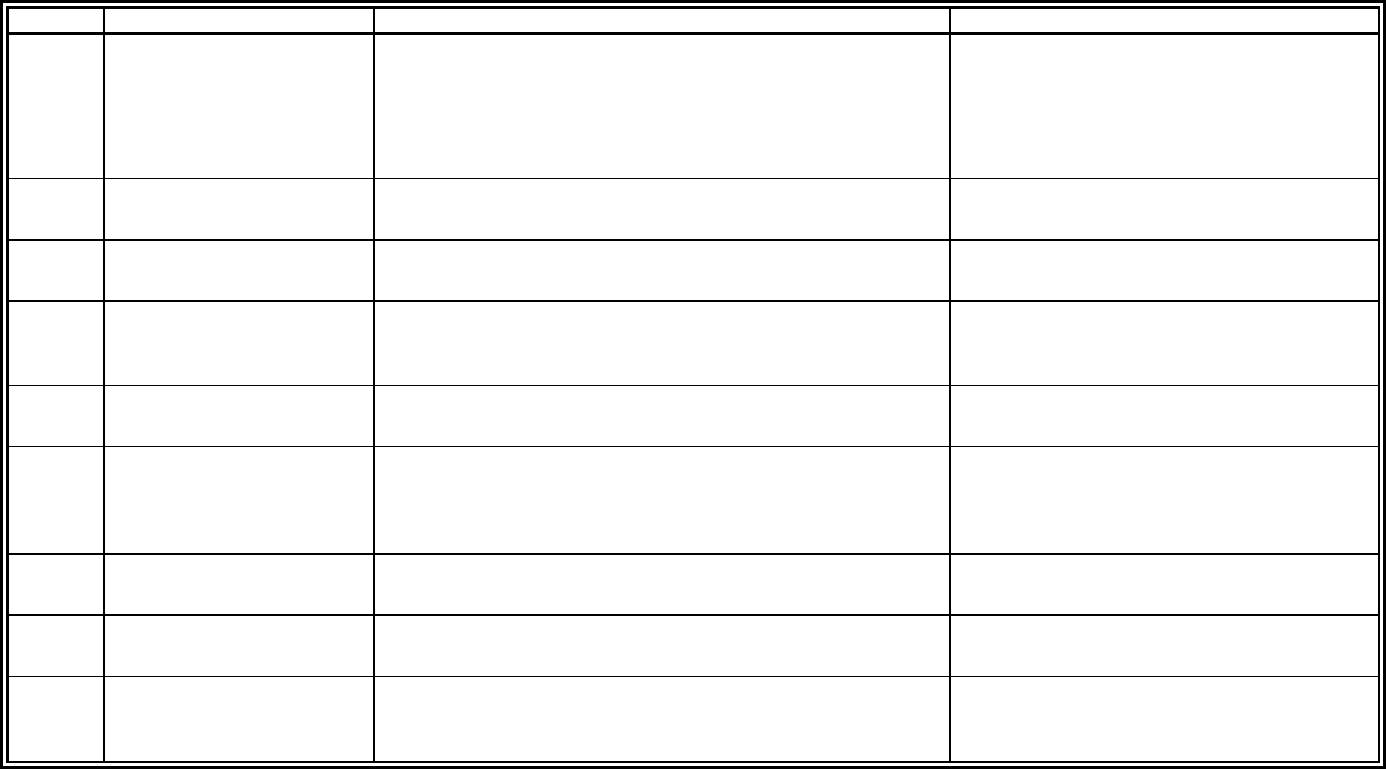

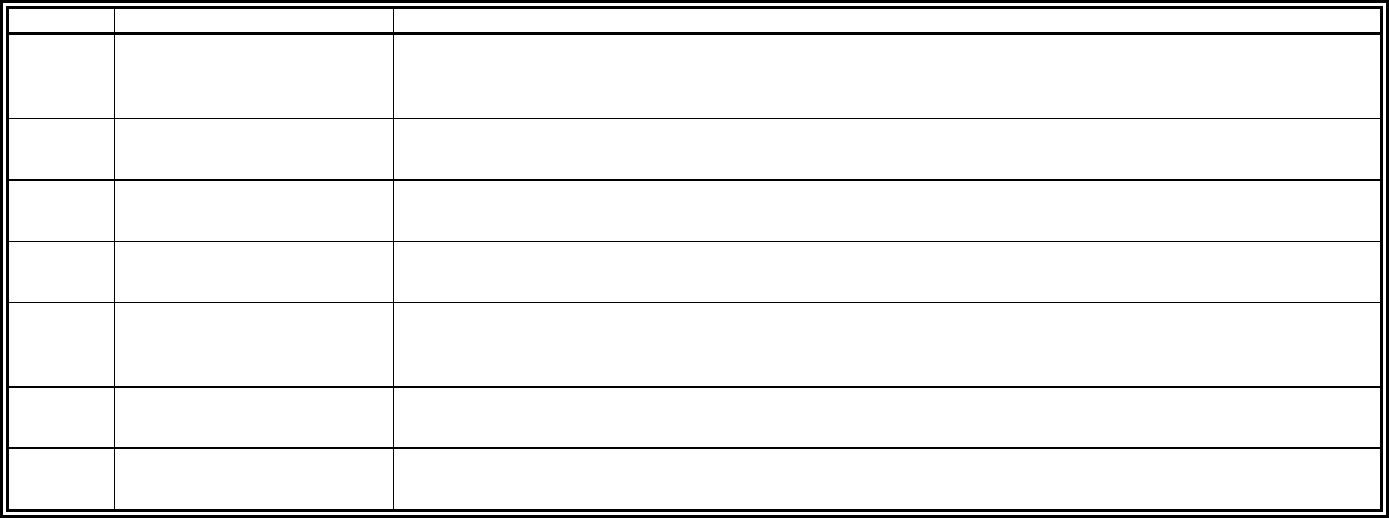

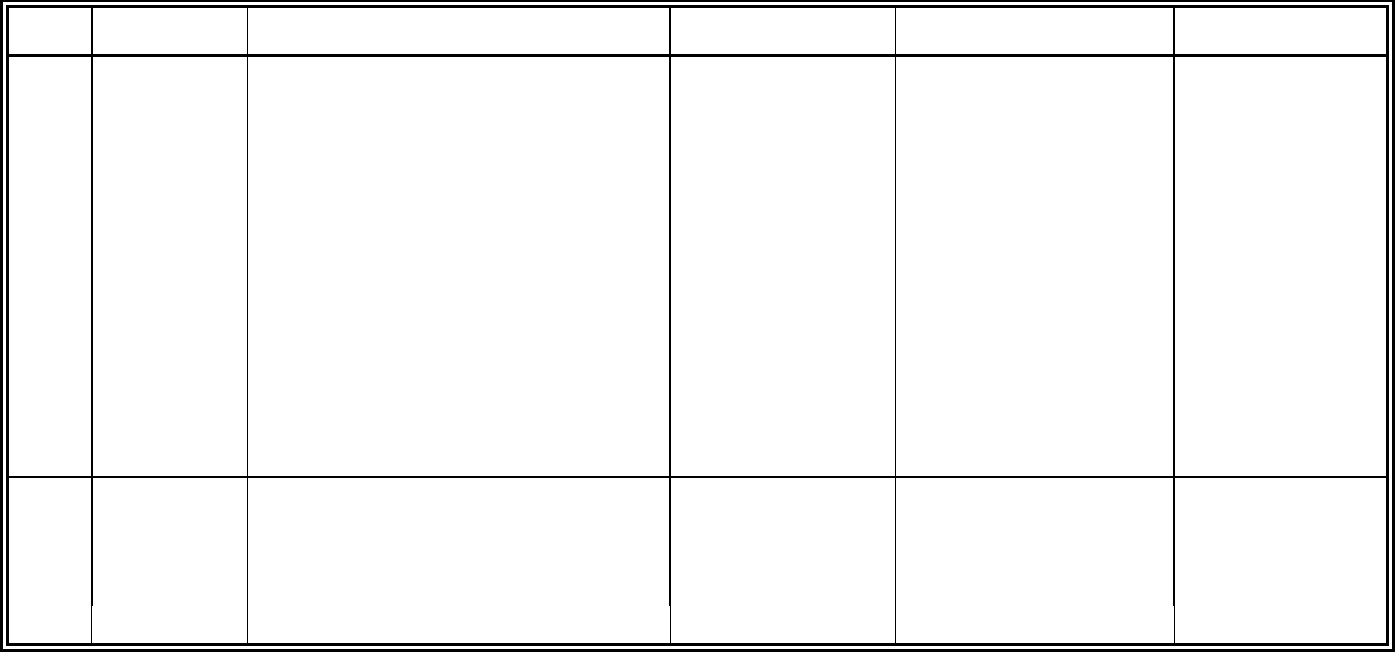

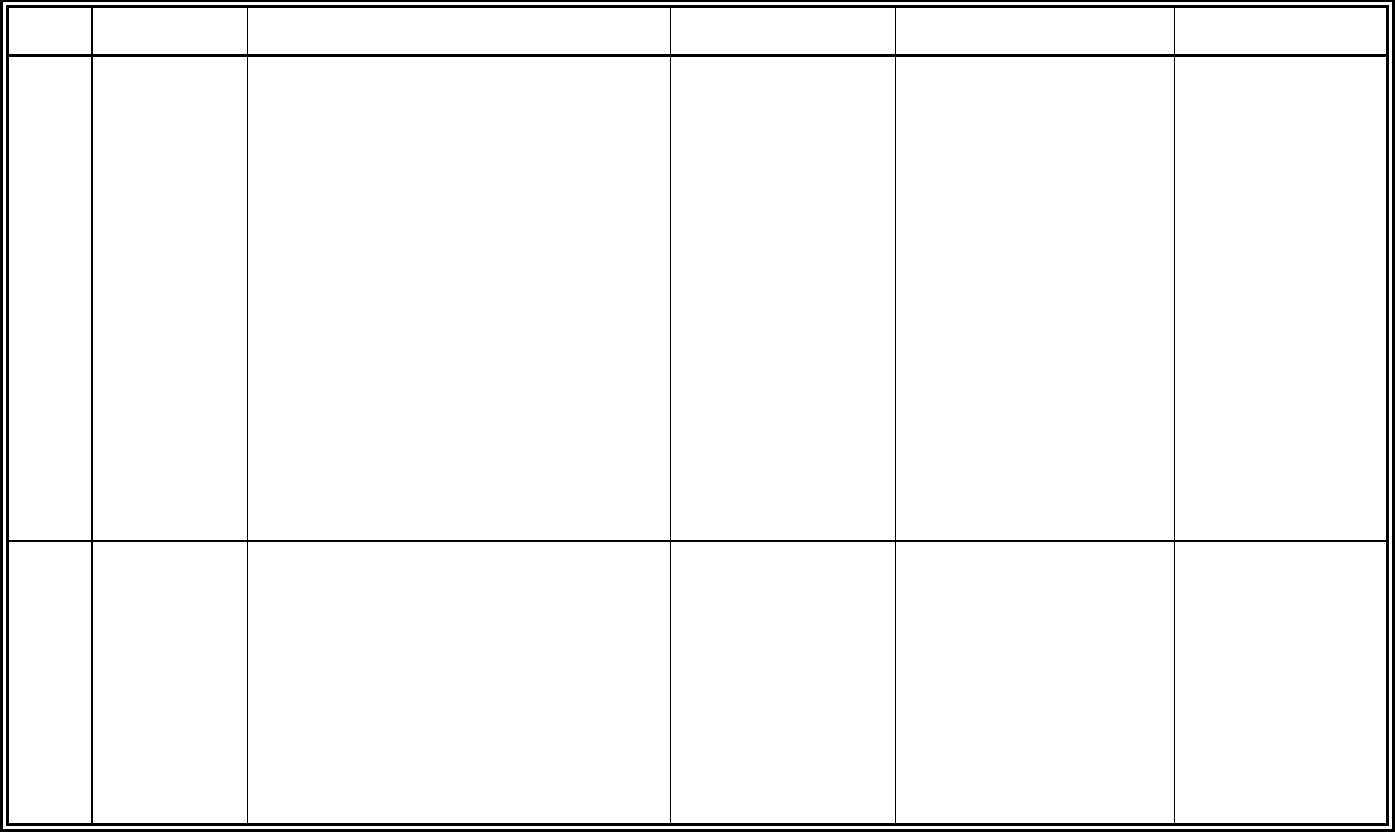

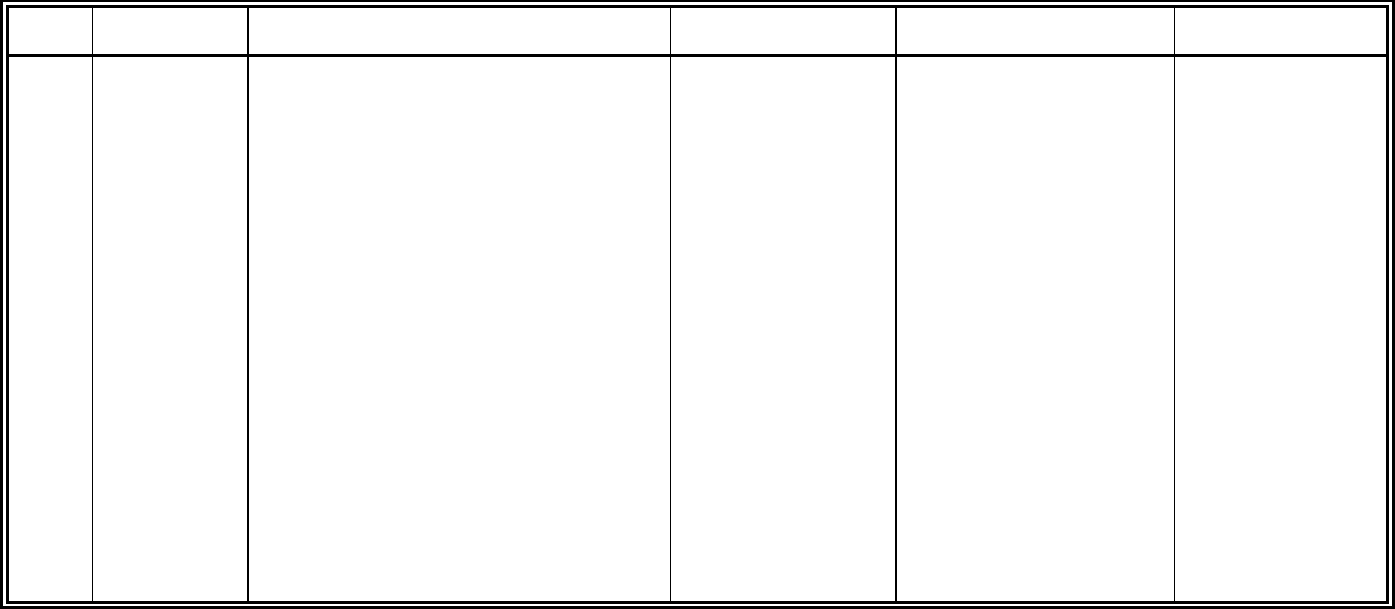

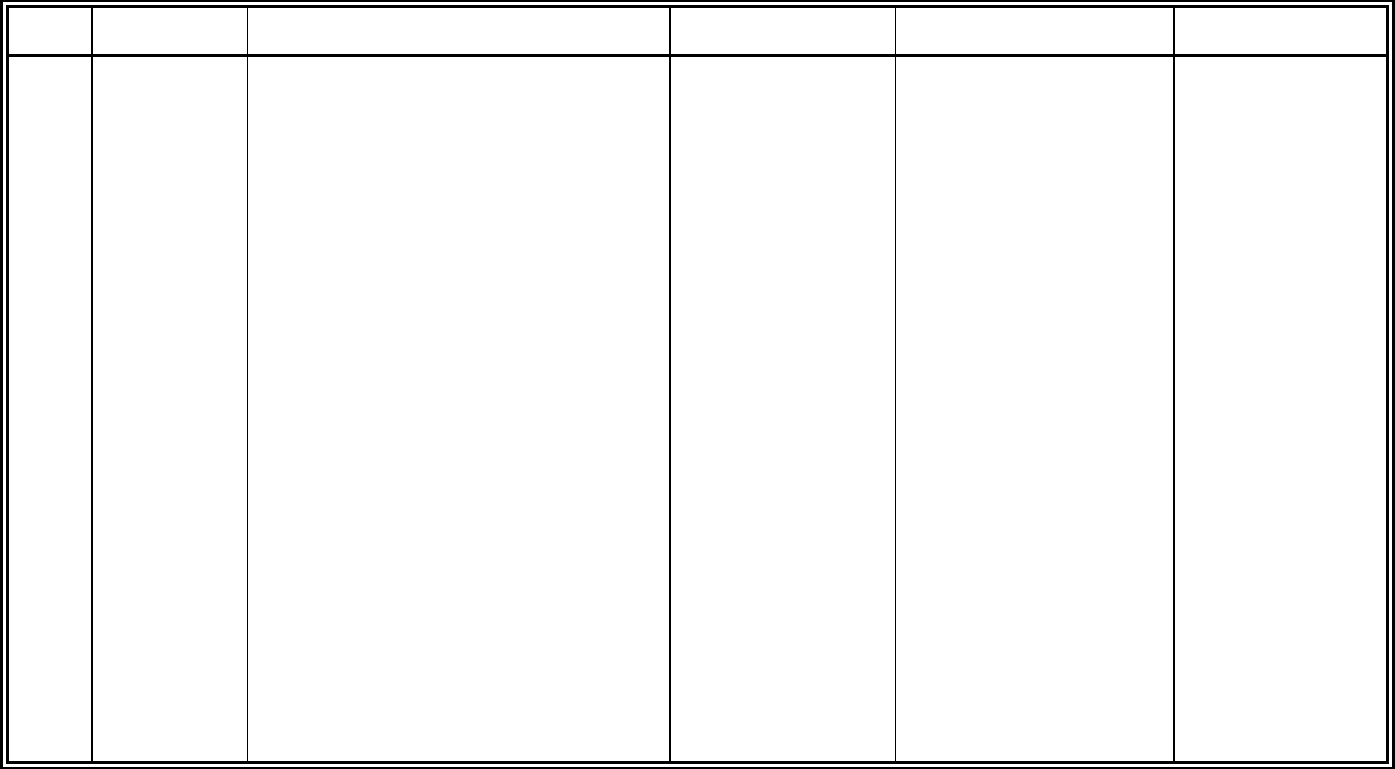

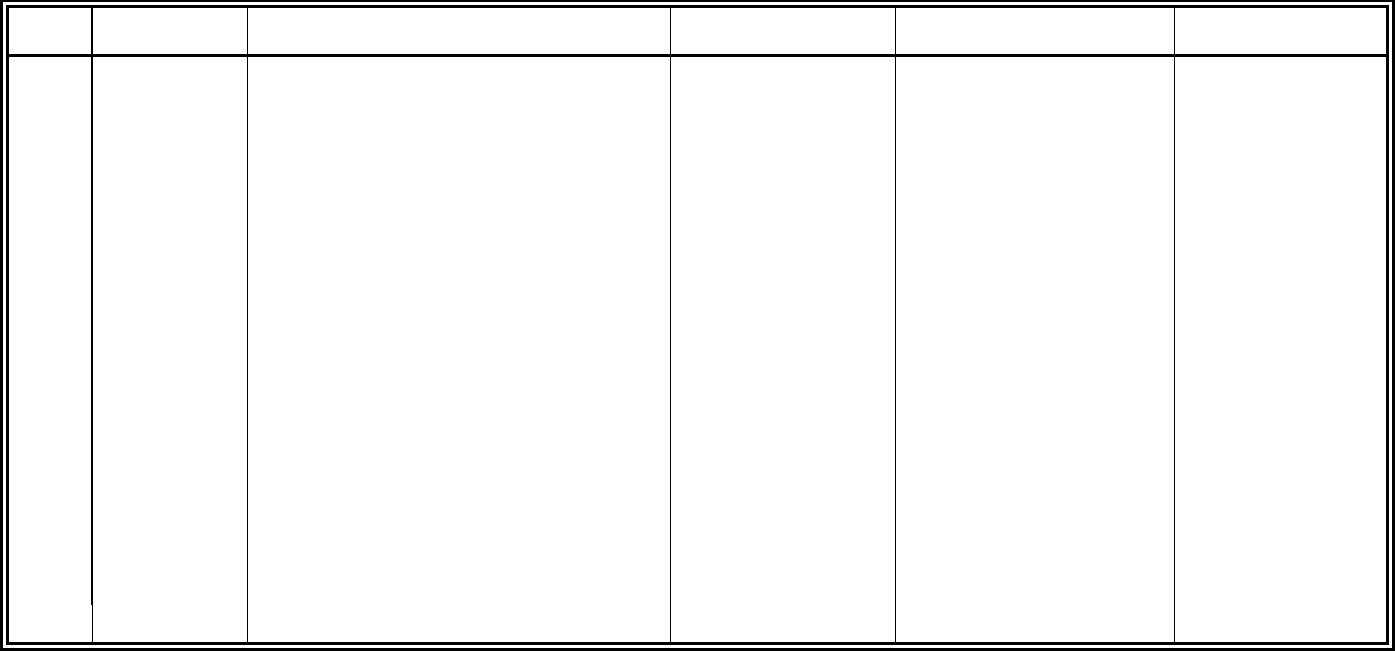

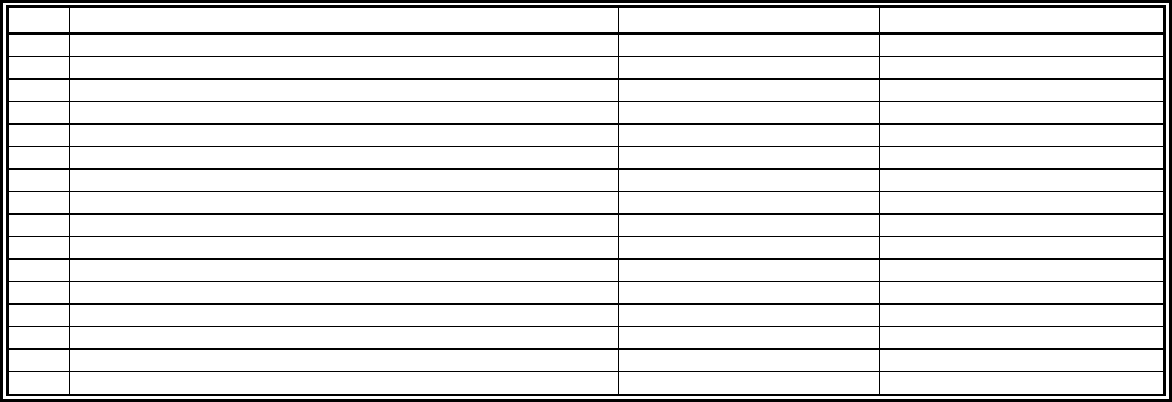

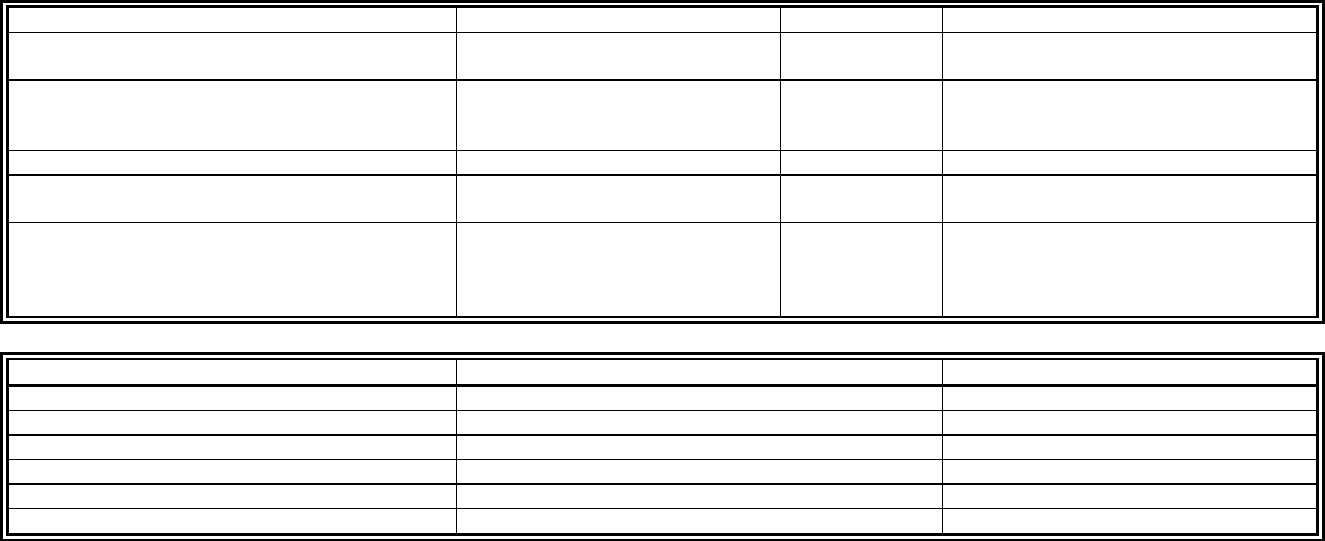

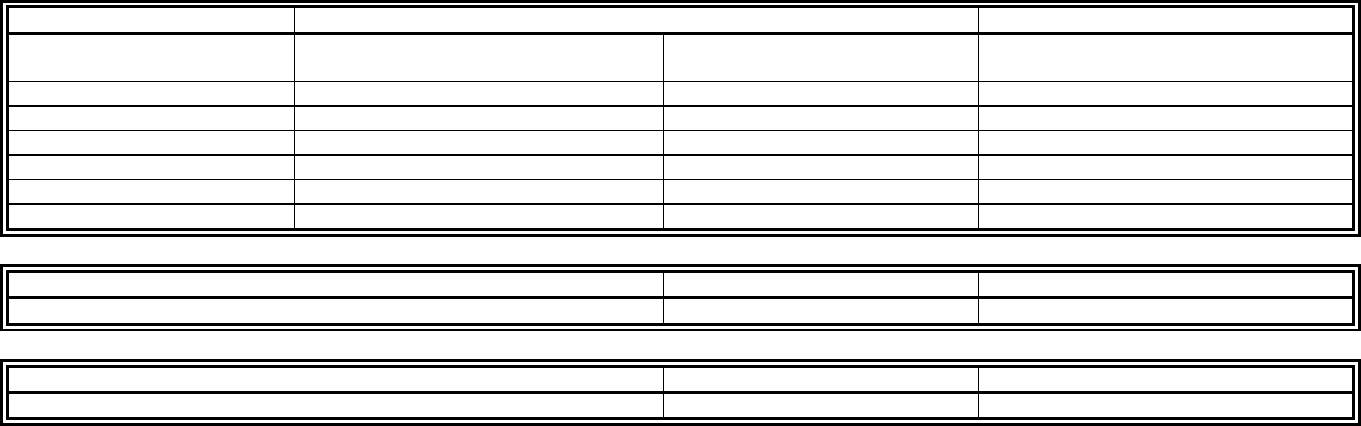

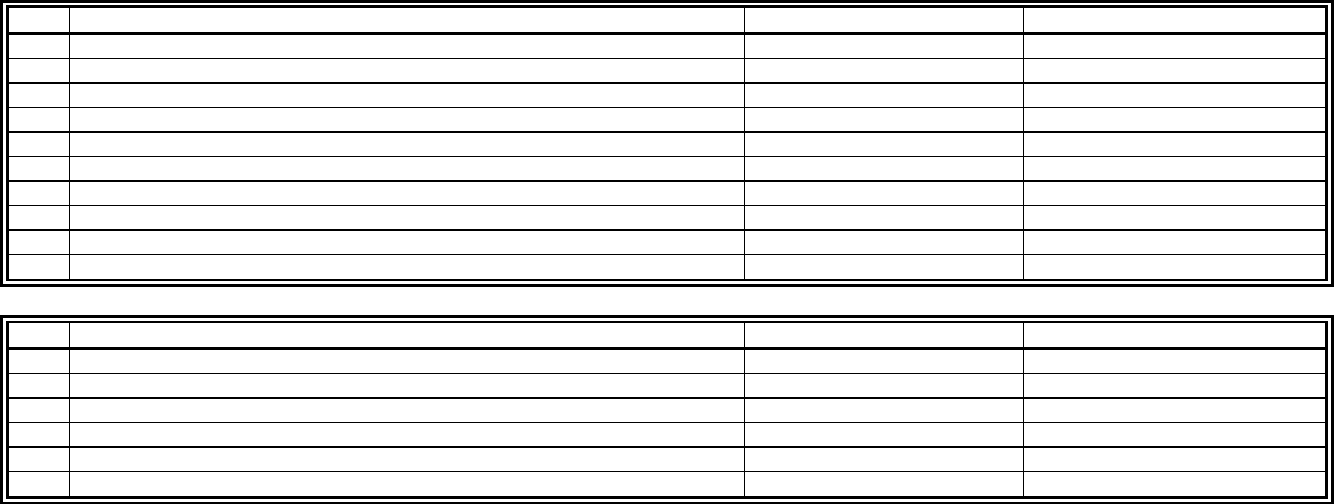

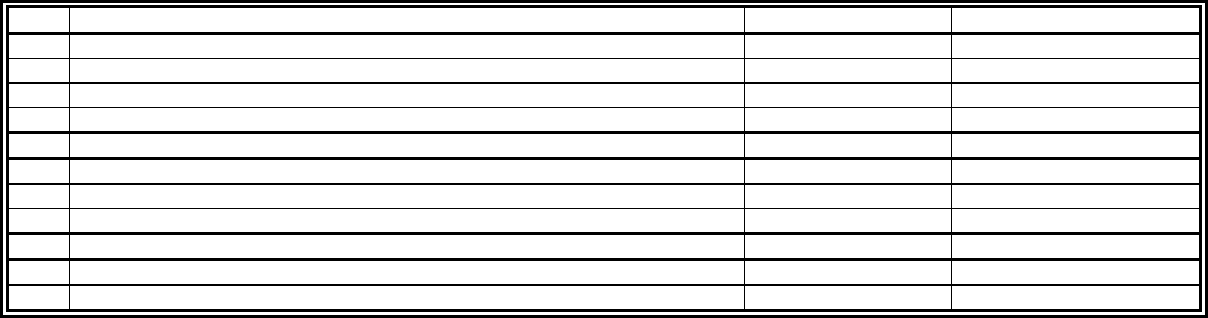

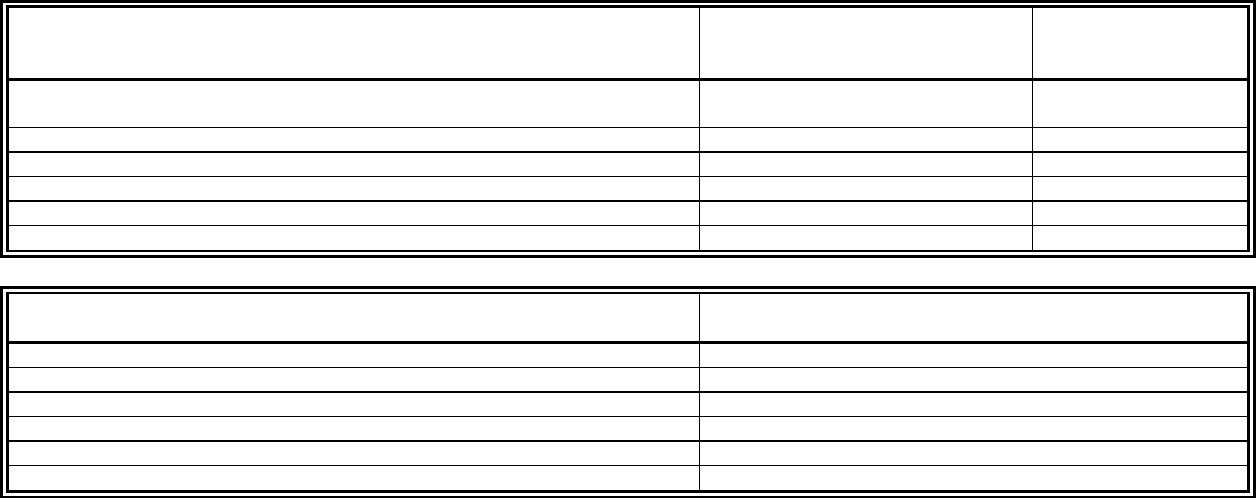

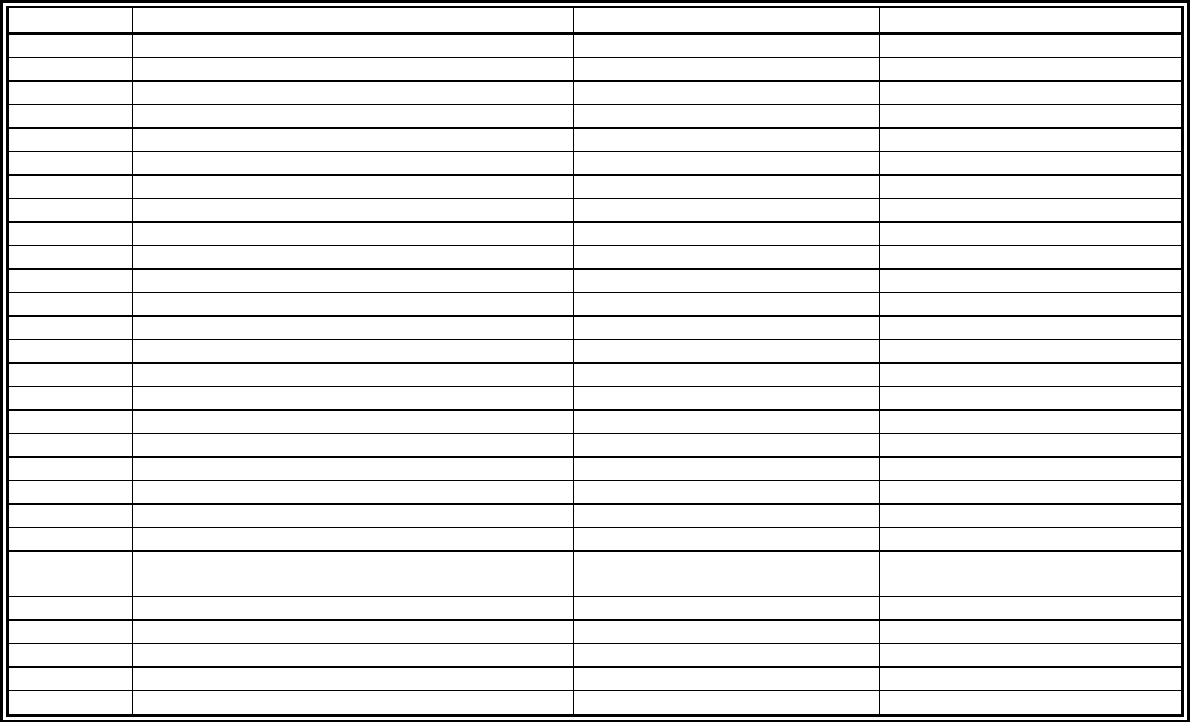

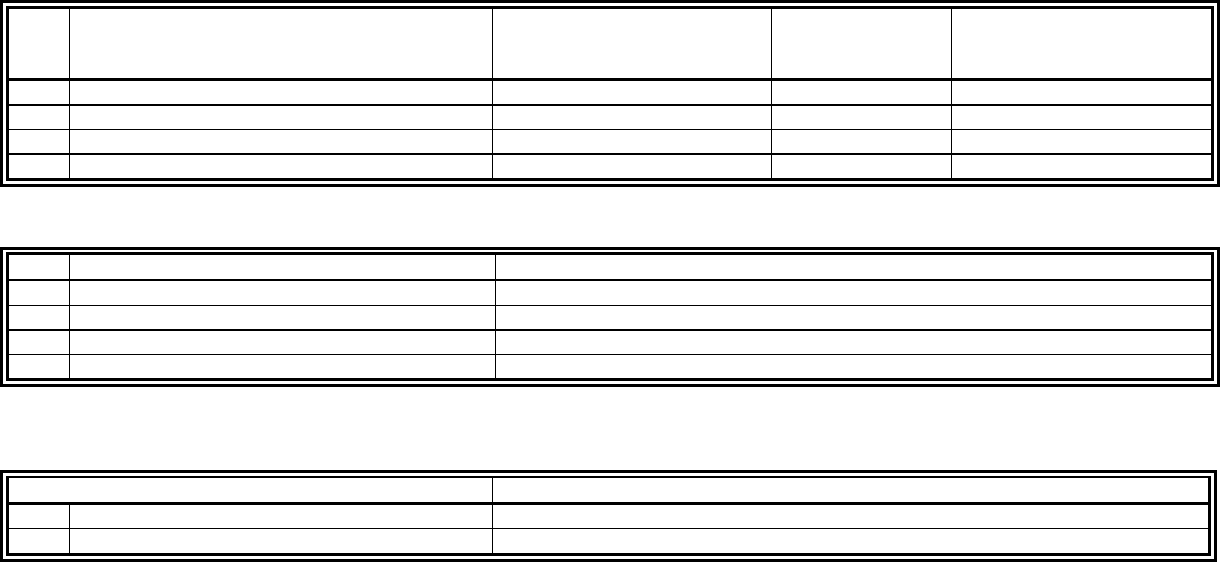

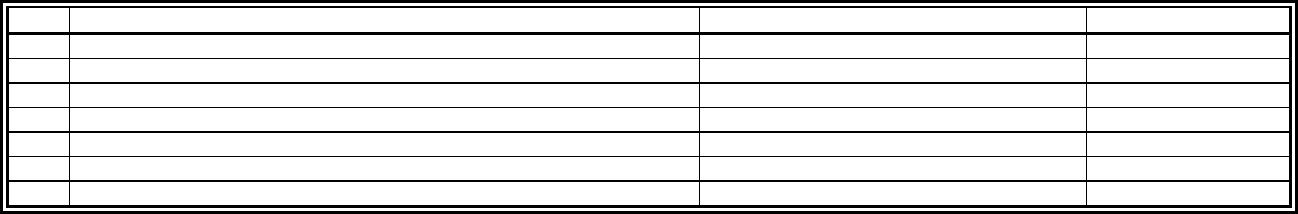

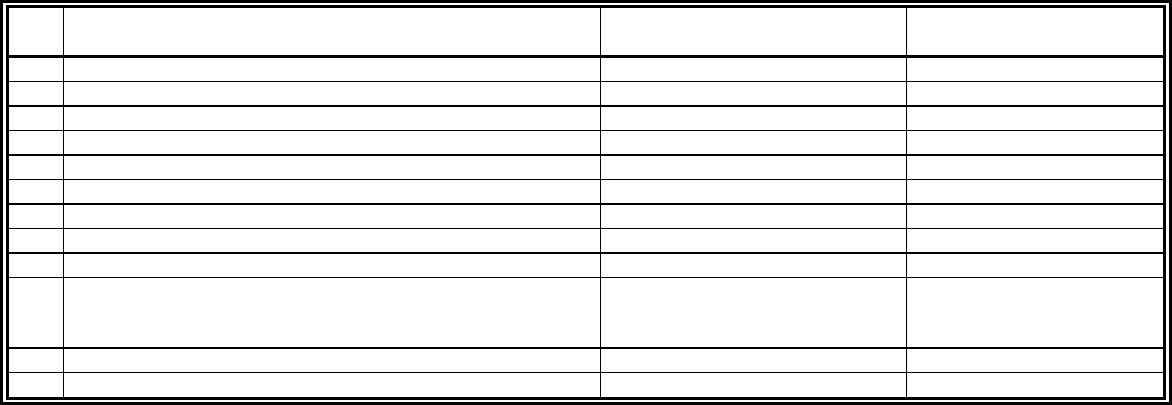

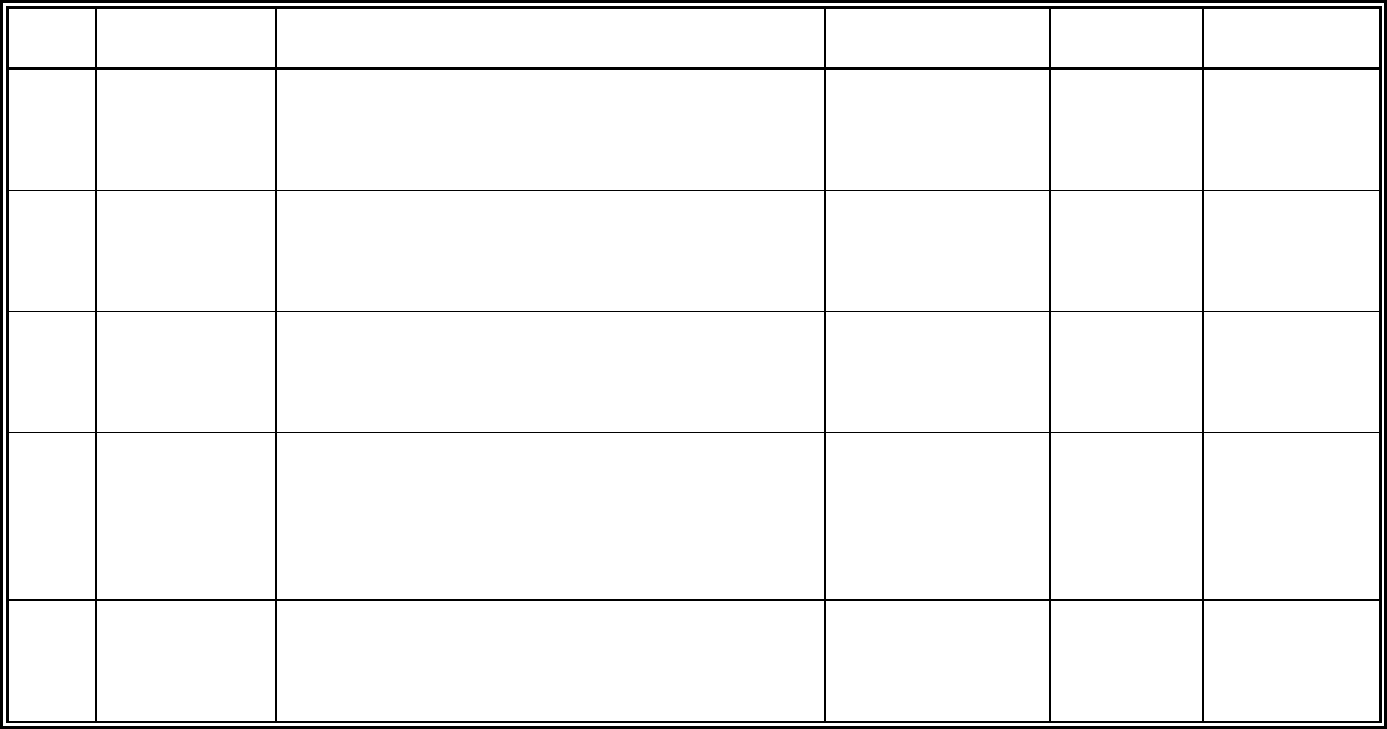

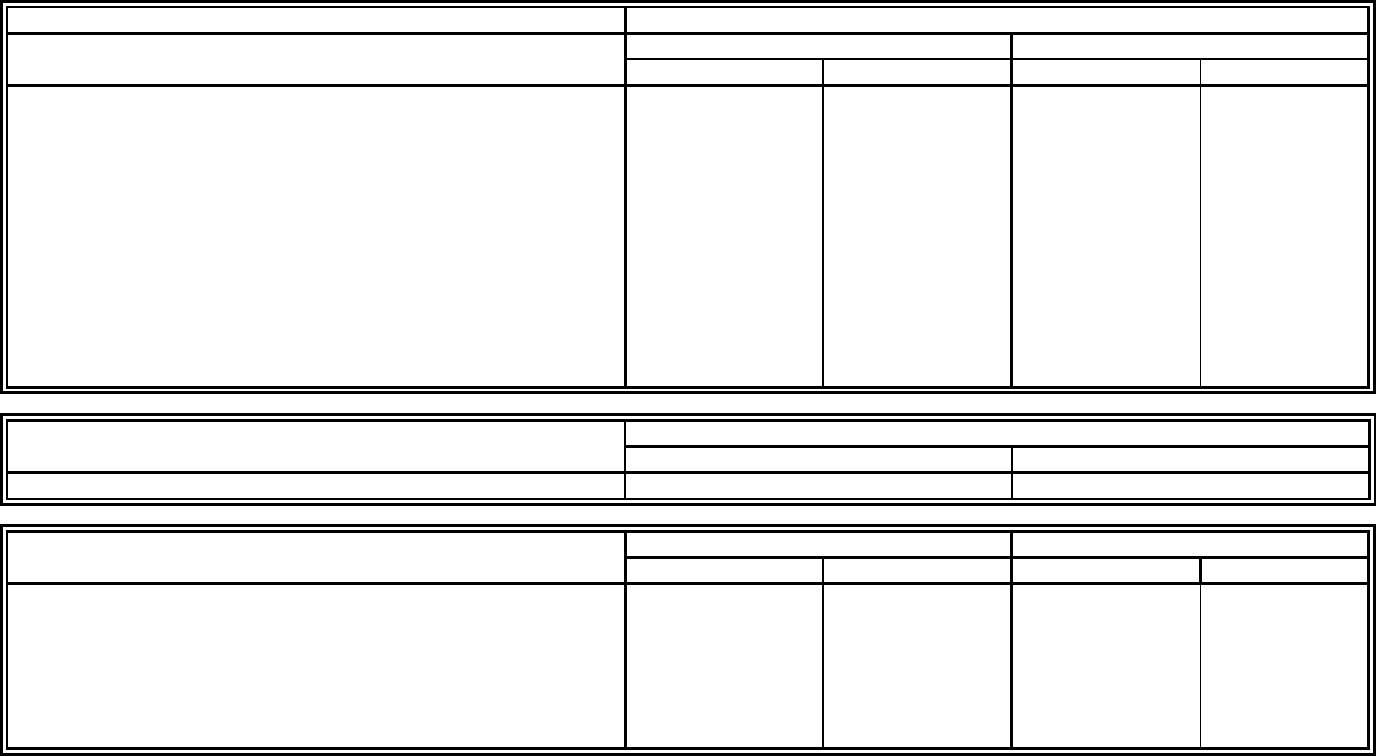

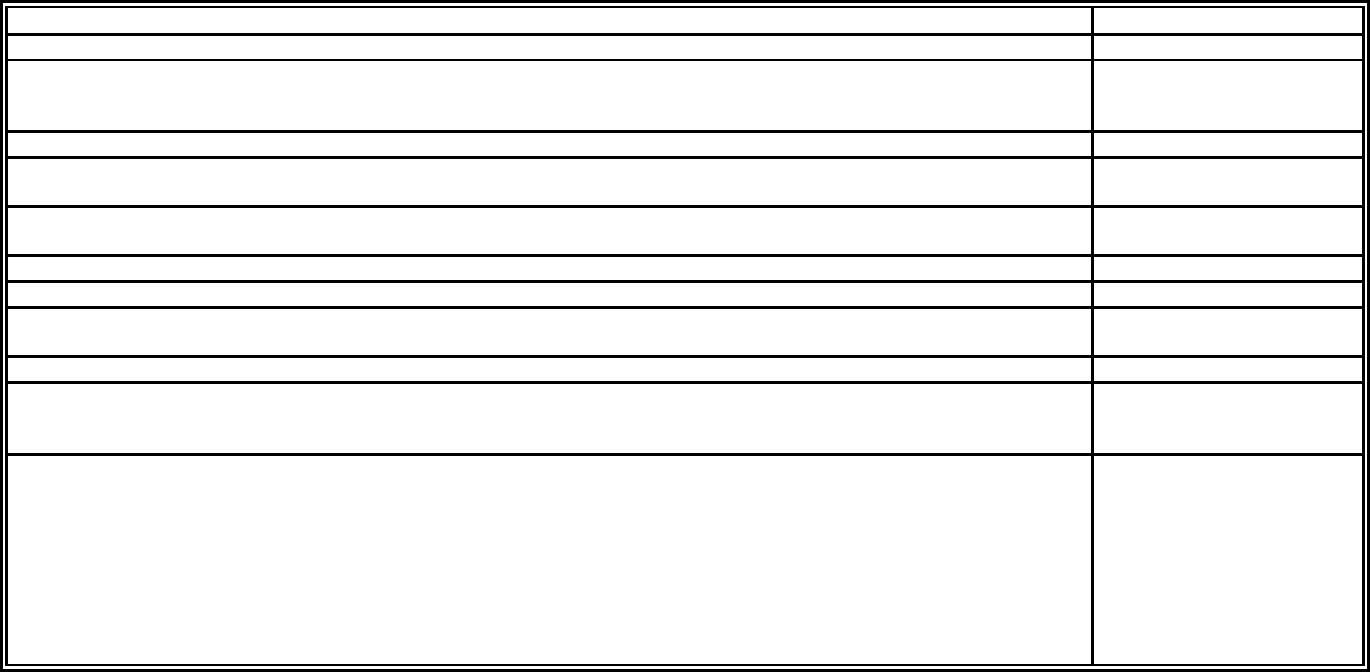

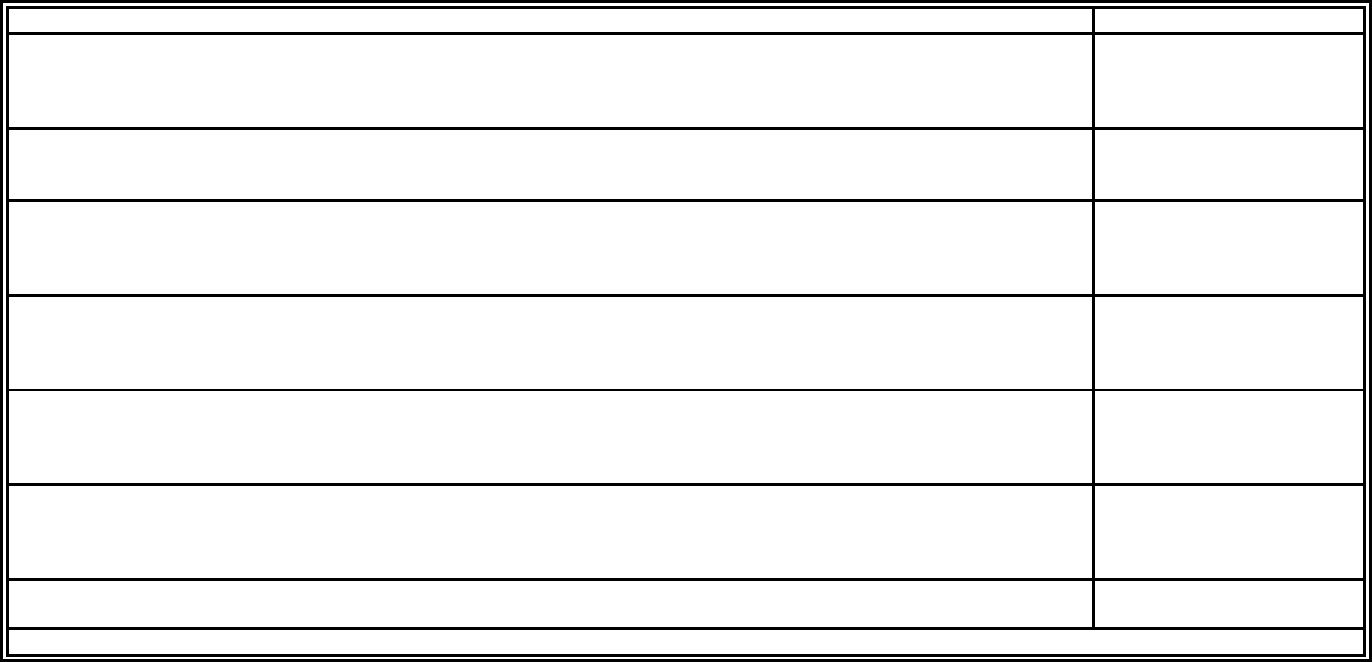

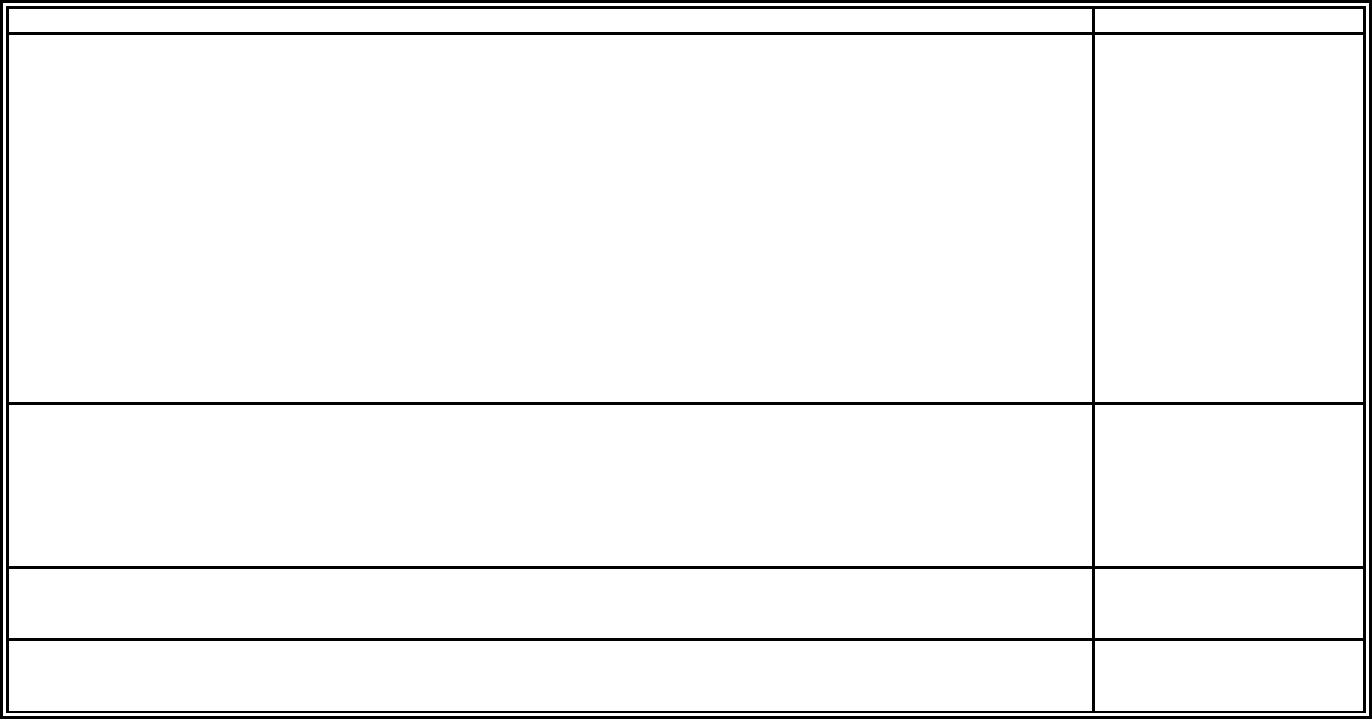

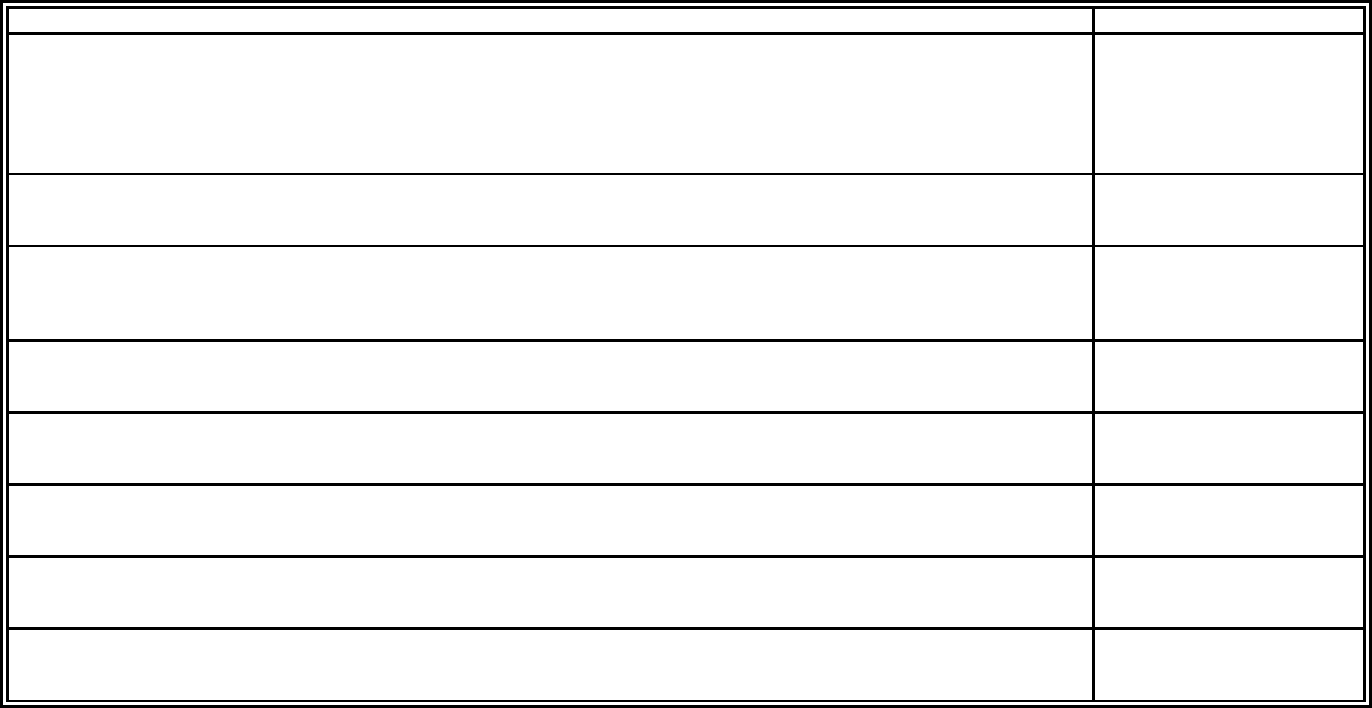

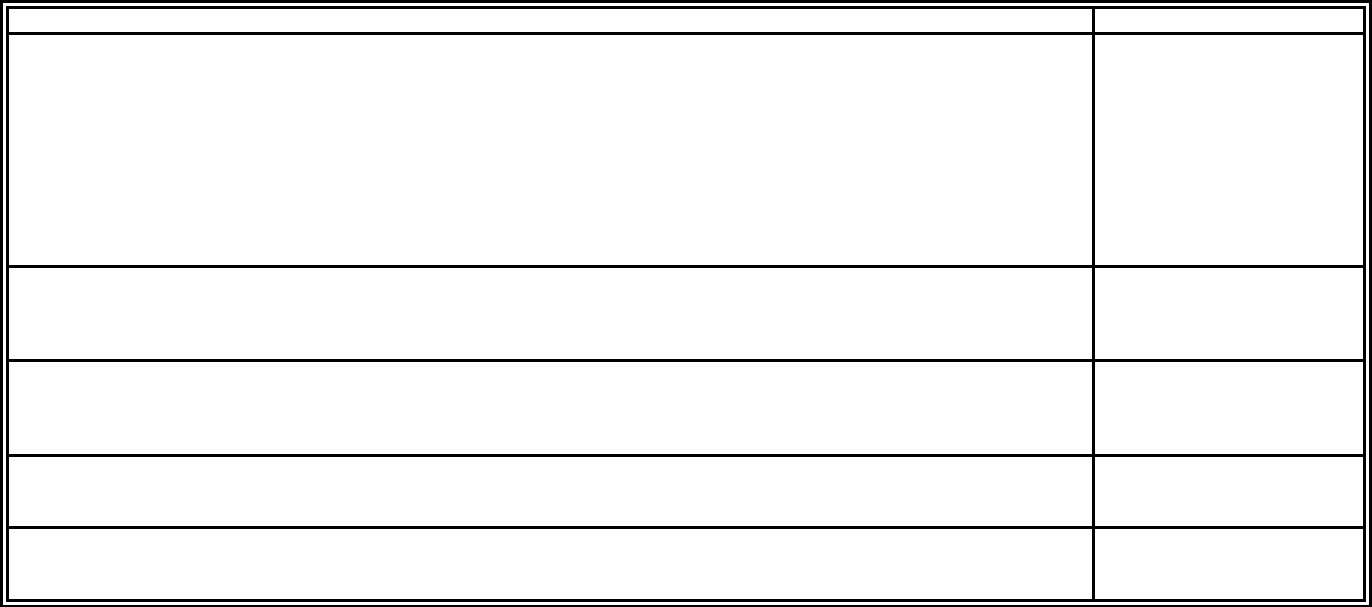

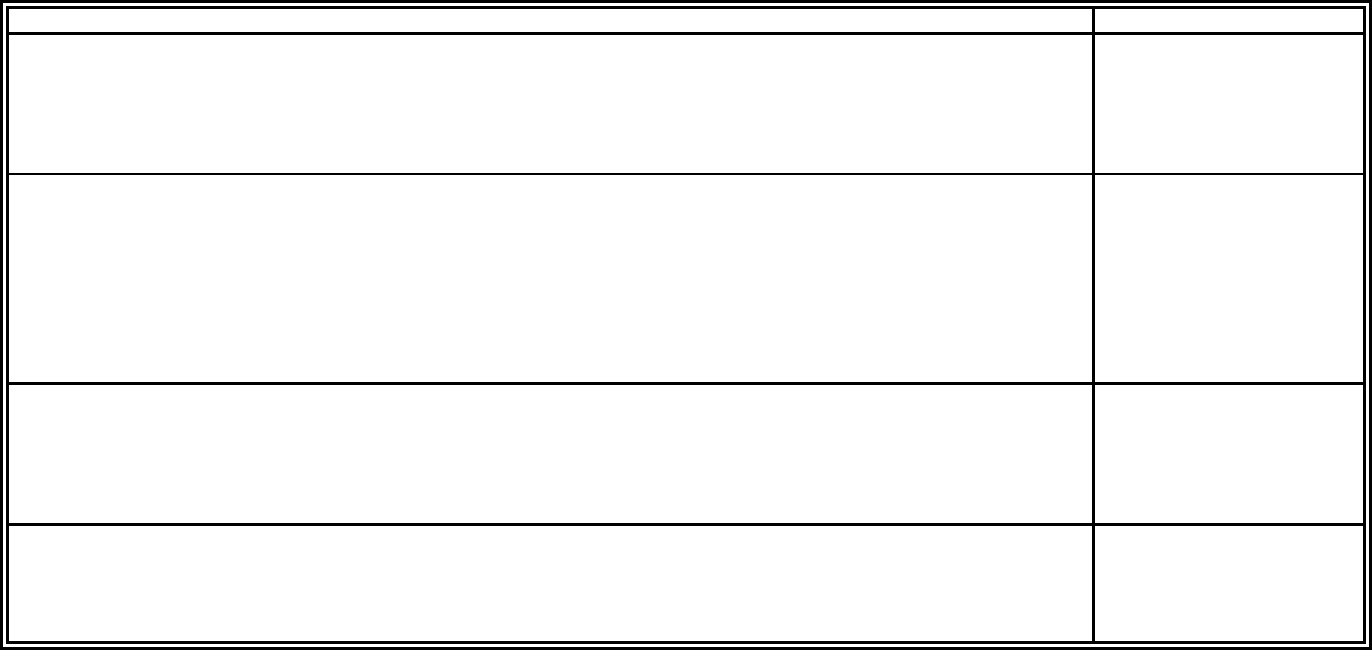

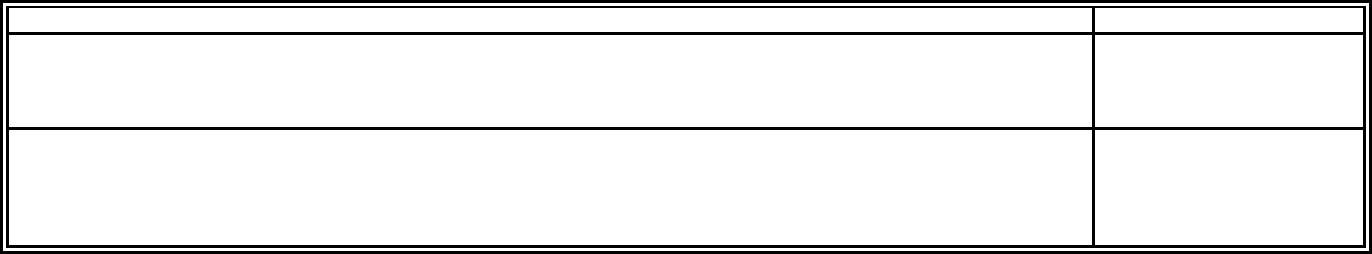

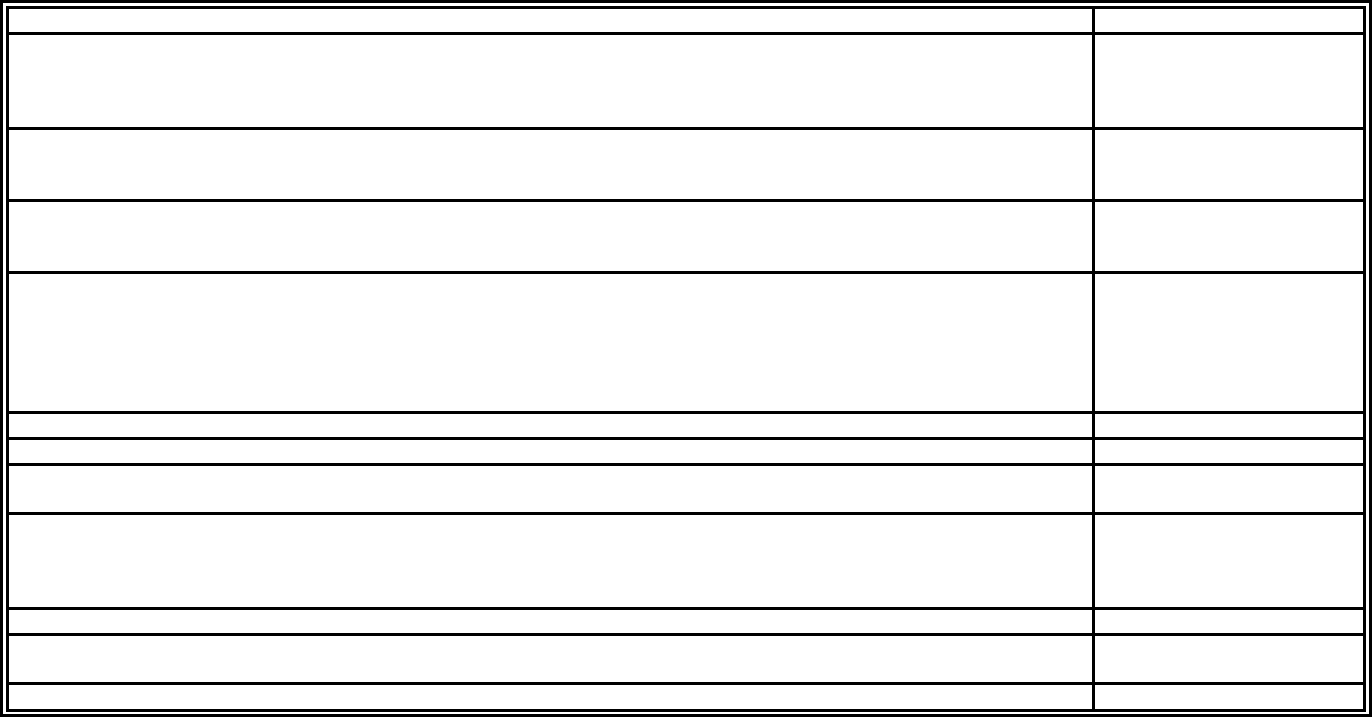

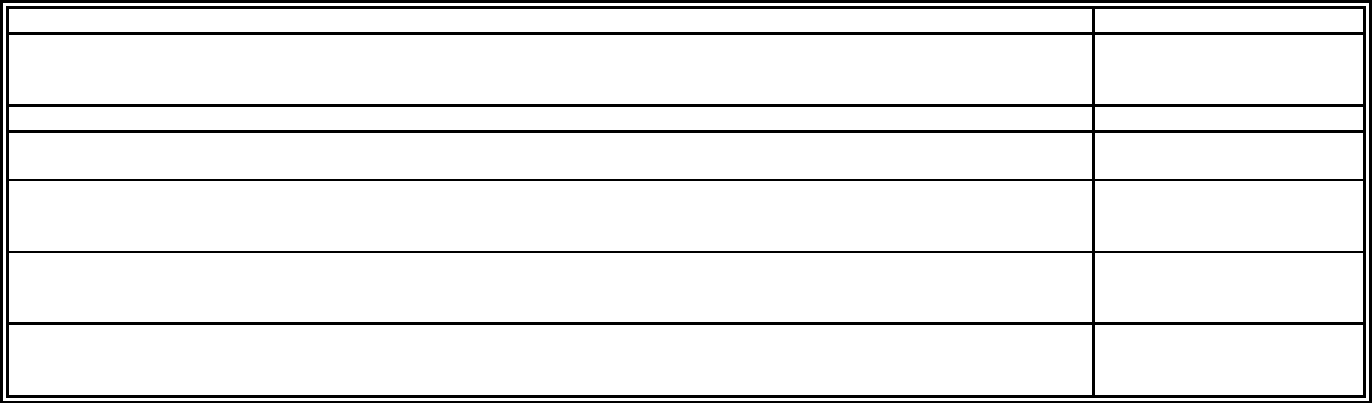

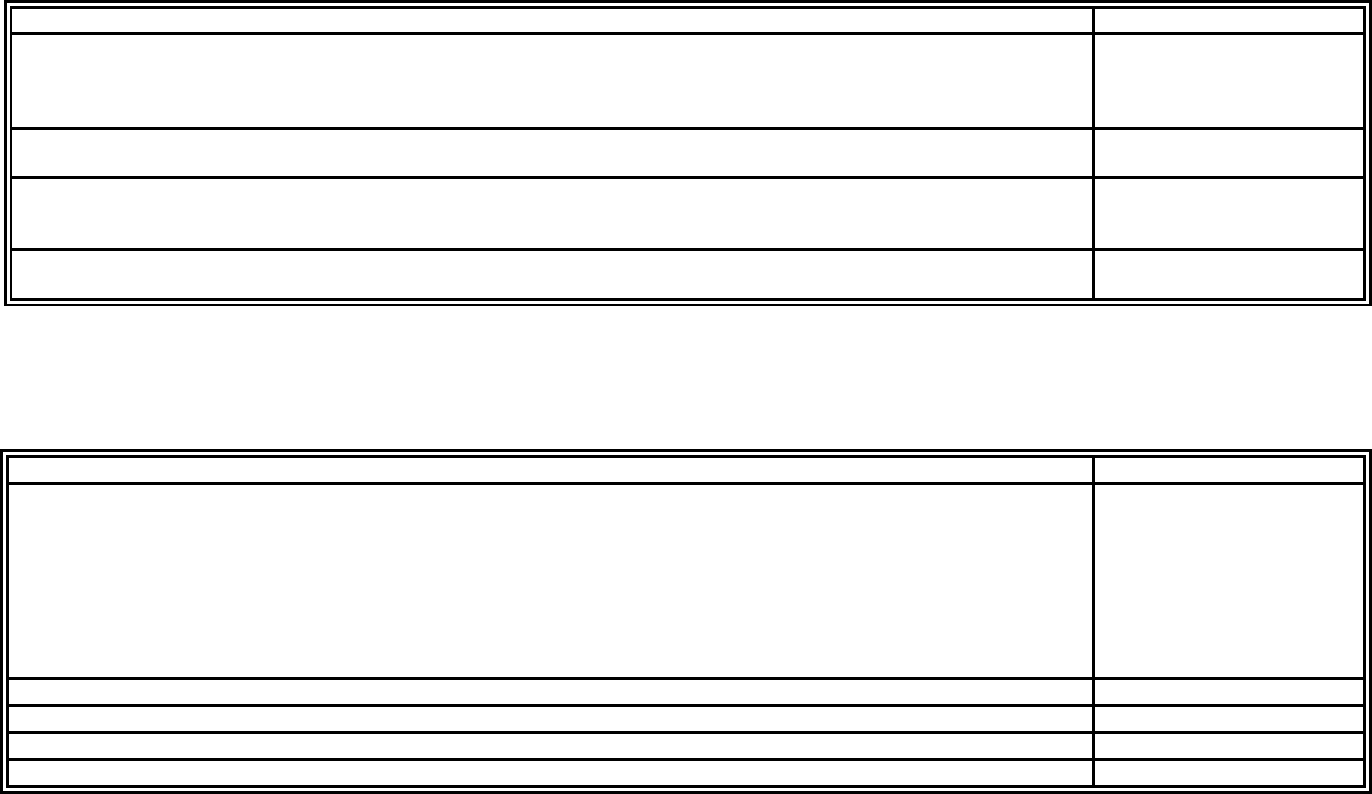

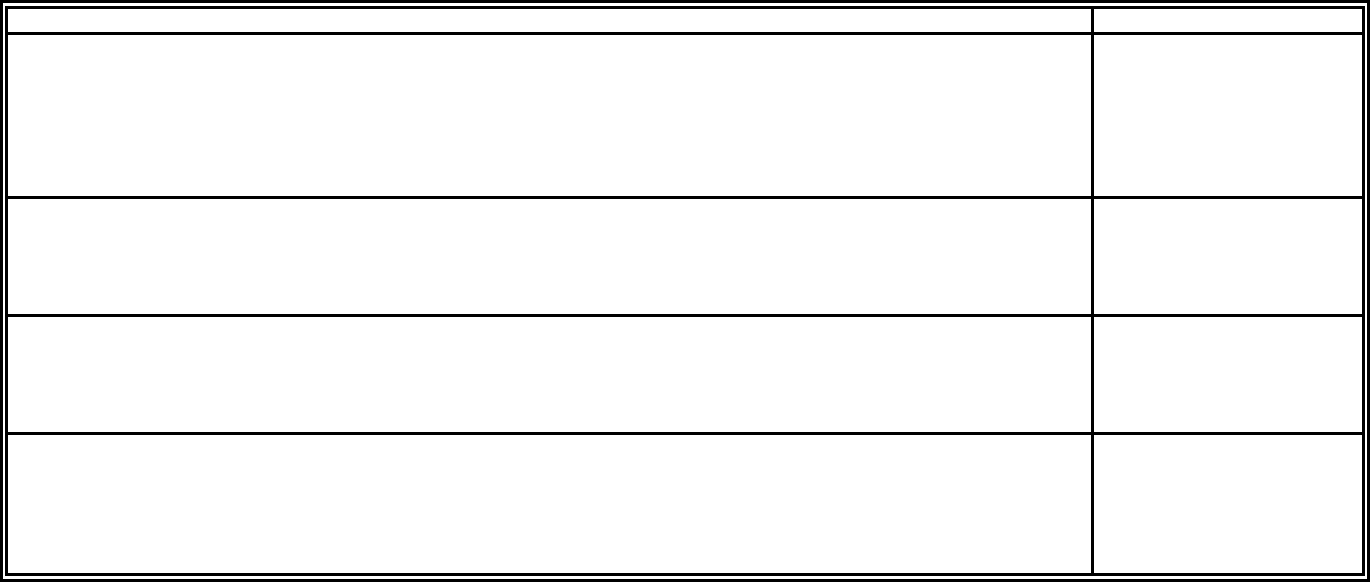

→ § 20-466(J) Fraud Unit Assessment

The director shall annually assess each insurer, hospital service corporation, health care services

organization, prepaid dental plan organization and service company authorized to transact

business up to $1,050 for the administration and operation of the fraud unit, which may be

adjusted annually. Assessments are levied July of each year.

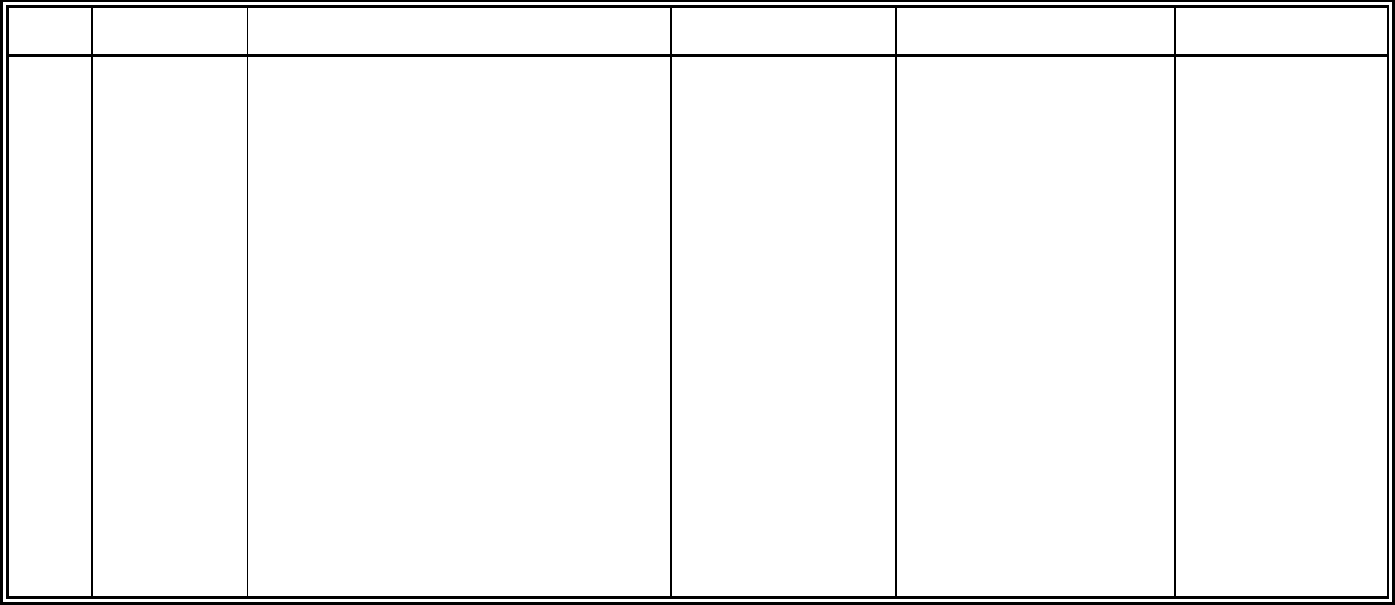

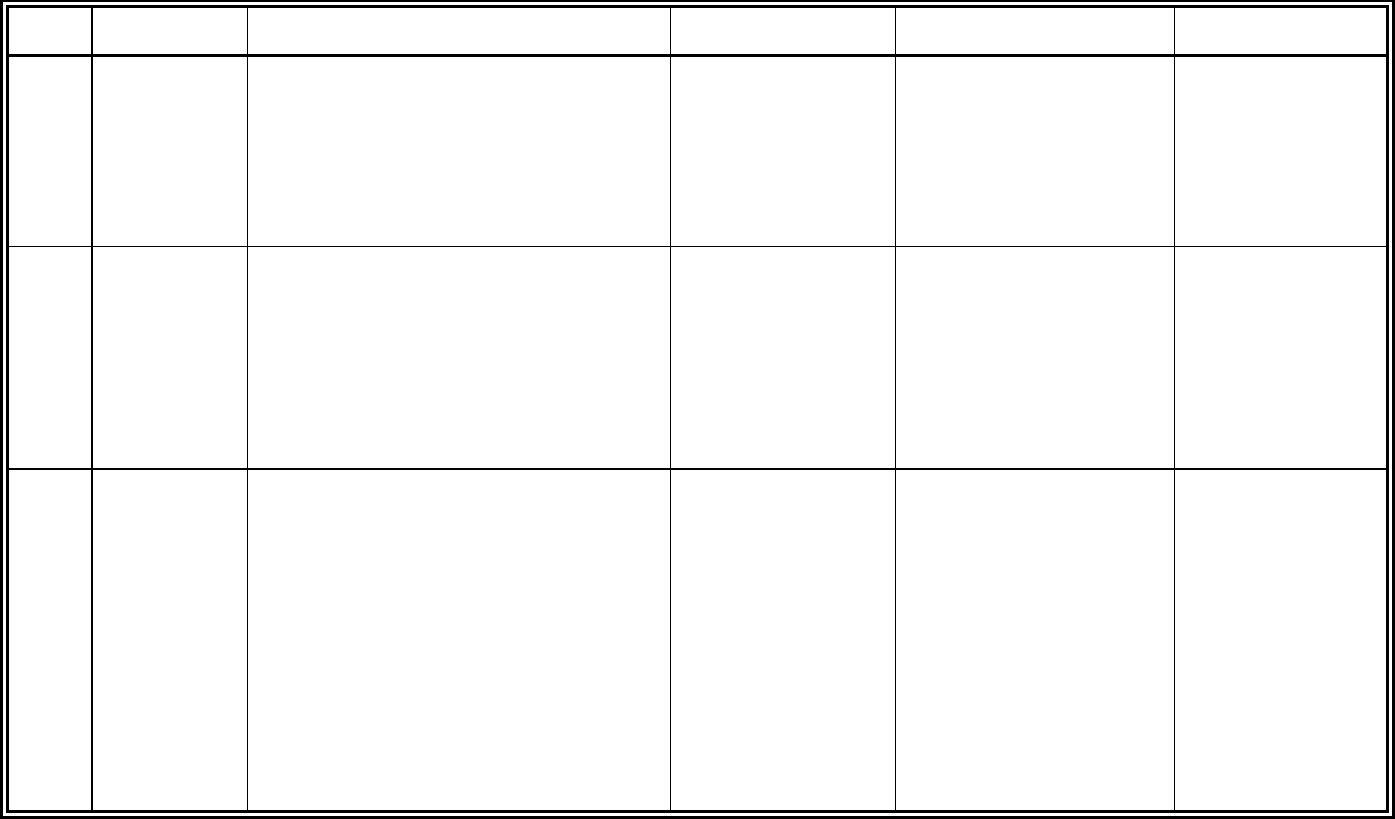

2023

Per-Insurer

Amount

2022

Per-Insurer

Amount

2021

Per-Insurer

Amount

2020

Per-Insurer

Amount

2019

Per-Insurer

Amount

$1,050.00

$1,050.00

$1,050.00

$1,050.00

$1,050.00

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AZ-5

Other Taxes and Assessments (cont.)

→ § 20-666 Property and Casualty Insurance Guaranty Fund

The Fund board may assess each member insurer up to 1% of direct written premiums for kinds

of insurance in account with insolvency and not more than $200 per year for operating expenses

of the board. The retaliation provisions of § 20-230 do not apply to assessments on or credits to

insurers for the payment of claims of policyholders of insolvent insurers.

2023

Aggregate

Amount

2022

Aggregate

Amount

2021

Aggregate

Amount

2020

Aggregate

Amount

2019

Aggregate

Amount

$0.00

$0.00

$0.00

$0.00

$0.00

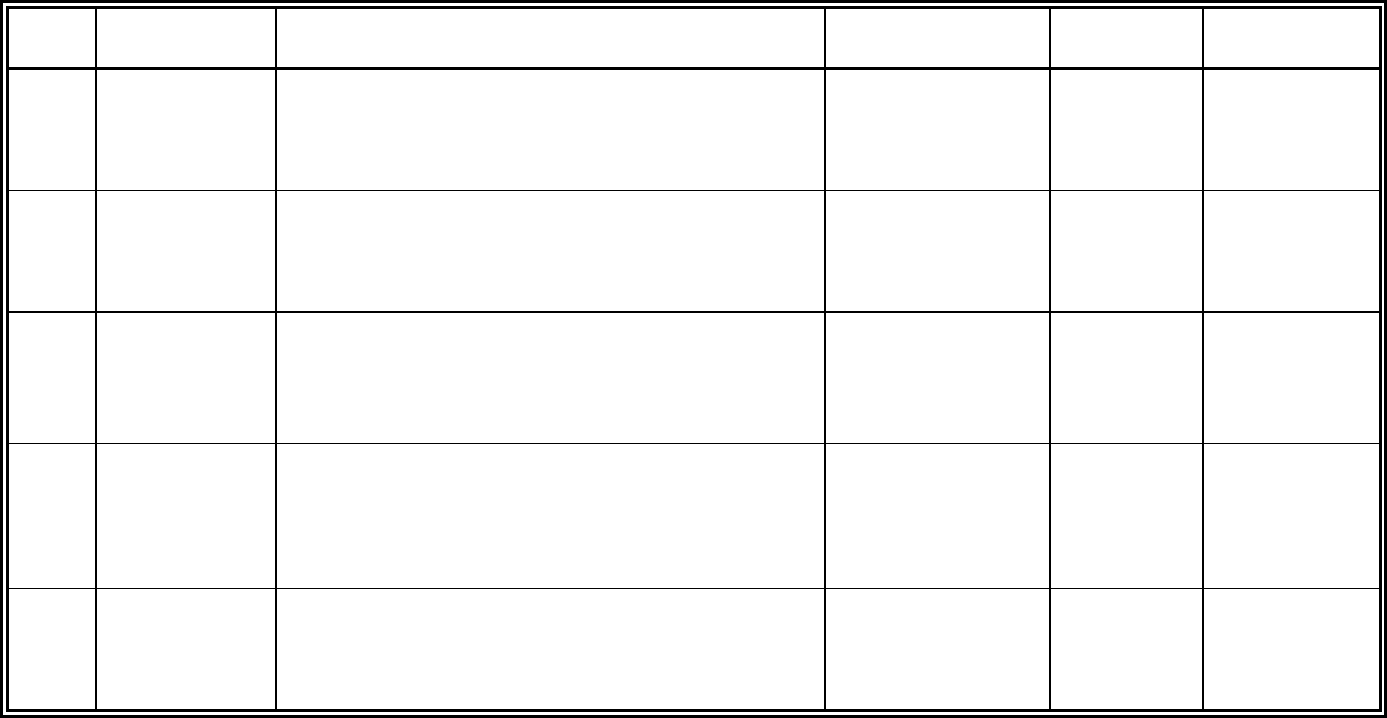

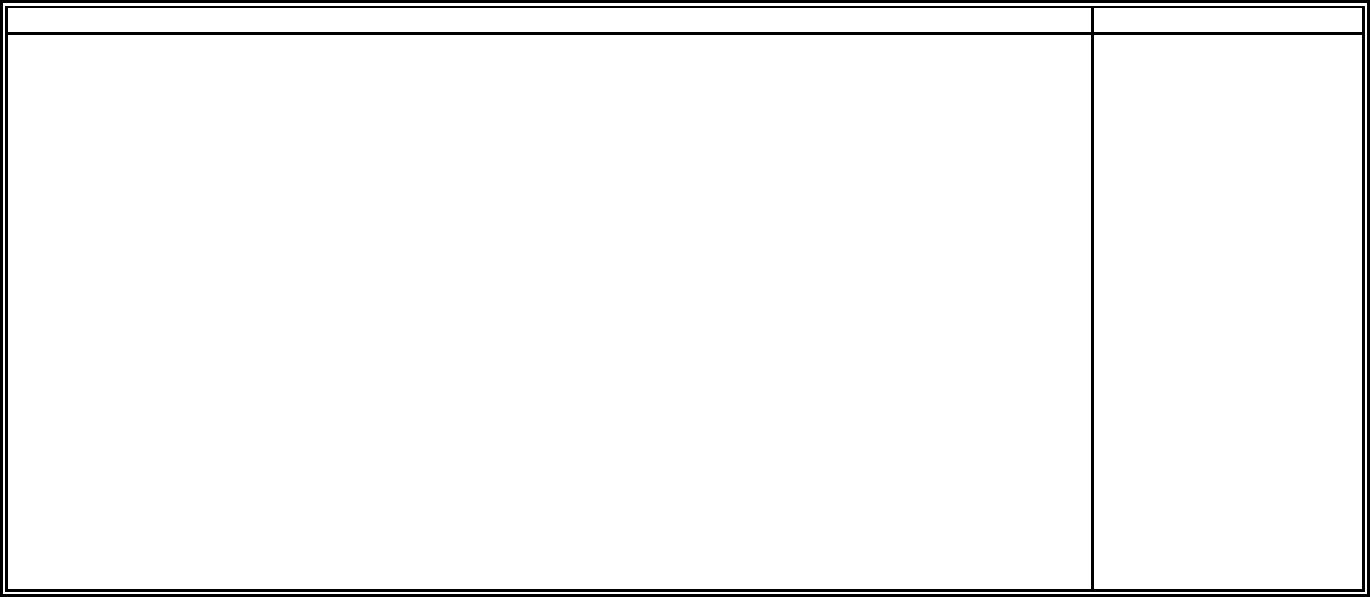

→ § 20-686 Life and Health Insurance Guaranty Fund

The fund board may assess each member insurer, separately for each account, a Class A

assessment for the purpose of meeting administrative costs and other general expenses not related

to a particular impaired insurer and a Class B assessment to carry out the powers and duties of the

fund with regard to an impaired insurer. The total of all assessments upon a member insurer for

each account shall not in any one calendar year exceed 2% of premiums in Arizona on the

policies covered by the account. The retaliation provisions of § 20-230 do not apply to

assessments on or credits to insurers for the payment of claims of policyholders of insolvent

insurers.

2023

Aggregate

Amount

2022

Aggregate

Amount

2021

Aggregate

Amount

2020

Aggregate

Amount

2019

Aggregate

Amount

$0.00

$6,389,000

$5,435,000

$7,500,000

$16,000,000

→ § 20-2201(D) Liability Insurance Voluntary Plan Administration Assessment

The director may annually assess insurers authorized to transact liability insurance up to $200 for

the costs of administering the voluntary plan.

2023

Per-Insurer

Amount

2022

Per-Insurer

Amount

2021

Per-Insurer

Amount

2020

Per-Insurer

Amount

2019

Per-Insurer

Amount

$0.00

$0.00

$0.00

$0.00

$0.00

→ § 20-2212(B) Liability Insurance Joint Underwriting Association; Deficit Assessment

The JUA may assess each member up to 1% of its net direct premium in Arizona attributable to

the line of insurance for which the deficit assessment is made.

2023

Aggregate

Amount

2022

Aggregate

Amount

2021

Aggregate

Amount

2020

Aggregate

Amount

2019

Aggregate

Amount

$0.00

$0.00

$0.00

$0.00

$0.00

Retaliation—December 2023

AZ-6 © 1991-2023 National Association of Insurance Commissioners

Other Taxes and Assessments (cont.)

→ § 20-2213(A) Liability Insurance Joint Underwriting Association; Initial Assessment

An initial assessment of up to $500 may be imposed upon each member to defray the initial

operating expenses. The initial assessment may be refunded by the association.

2023

Aggregate

Amount

2022

Aggregate

Amount

2021

Aggregate

Amount

2020

Aggregate

Amount

2019

Aggregate

Amount

$0.00

$0.00

$0.00

$0.00

$0.00

§ 20-2541(1) Health Care Appeals Fund; Single Fee

The director may assess each authorized health care insurer a single fee of not more than $200 per

insurer. This assessment was only levied at the outset of the department’s health care appeals

program in Calendar Year 2000.

→ § 20-2541(2) Health Care Appeals Fund Annual Assessment

The director may assess up to $200 each year for administrative costs associated with

implementing and maintaining the external independent review process, including processing and

payment of claims through the health care appeals fund.

2023

Per-Insurer

Amount

2022

Per-Insurer

Amount

2021

Per-Insurer

Amount

2020

Per-Insurer

Amount

2019

Per-Insurer

Amount

$200.00

$200.00

$200.00

$200.00

$200.00

→ § 41-3451(J) Automobile Theft Authority Fund; Semiannual Fees

Each insurer issuing motor vehicle liability insurance policies shall pay to the Arizona

Automobile Theft Authority a semiannual fee of 50 cents per vehicle insured under a motor

vehicle liability insurance policy issued by the insurer. The fee shall be fully earned and

nonrefundable at the time the insurer collects the premium for the motor vehicle liability

insurance policy.

Insurers must transmit fees to the Arizona Automobile Theft Authority by Jan. 31 for vehicles

insured under policies issued during the immediately preceding July 1 through Dec. 31, and by

July 31 for vehicles insured under policies issued during the immediately preceding Jan. 1

through June 30.

2023

Per-Vehicle

Amount

2022

Per-Vehicle

Amount

2021

Per-Vehicle

Amount

2020

Per-Vehicle

Amount

2019

Per-Vehicle

Amount

$0.50

$0.50

$0.50

$0.50

$0.50

Retaliation—December 2023

© 1991-2023 National Association of Insurance Commissioners AZ-7

Exclusions and Deductions:

§ 20-224 Annuities and Unabsorbed Premium Deposit

Considerations received on annuity contracts, as well as the unabsorbed portion of any premium