CONSOLIDATED FINANCIAL STATEMENTS

May 10, 2022

Nintendo Co., Ltd.

1

1-1 Hokotate-cho, Kamitoba,

Minami-ku, Kyoto 601-8501

Japan

(Amounts below one million yen are rounded down)

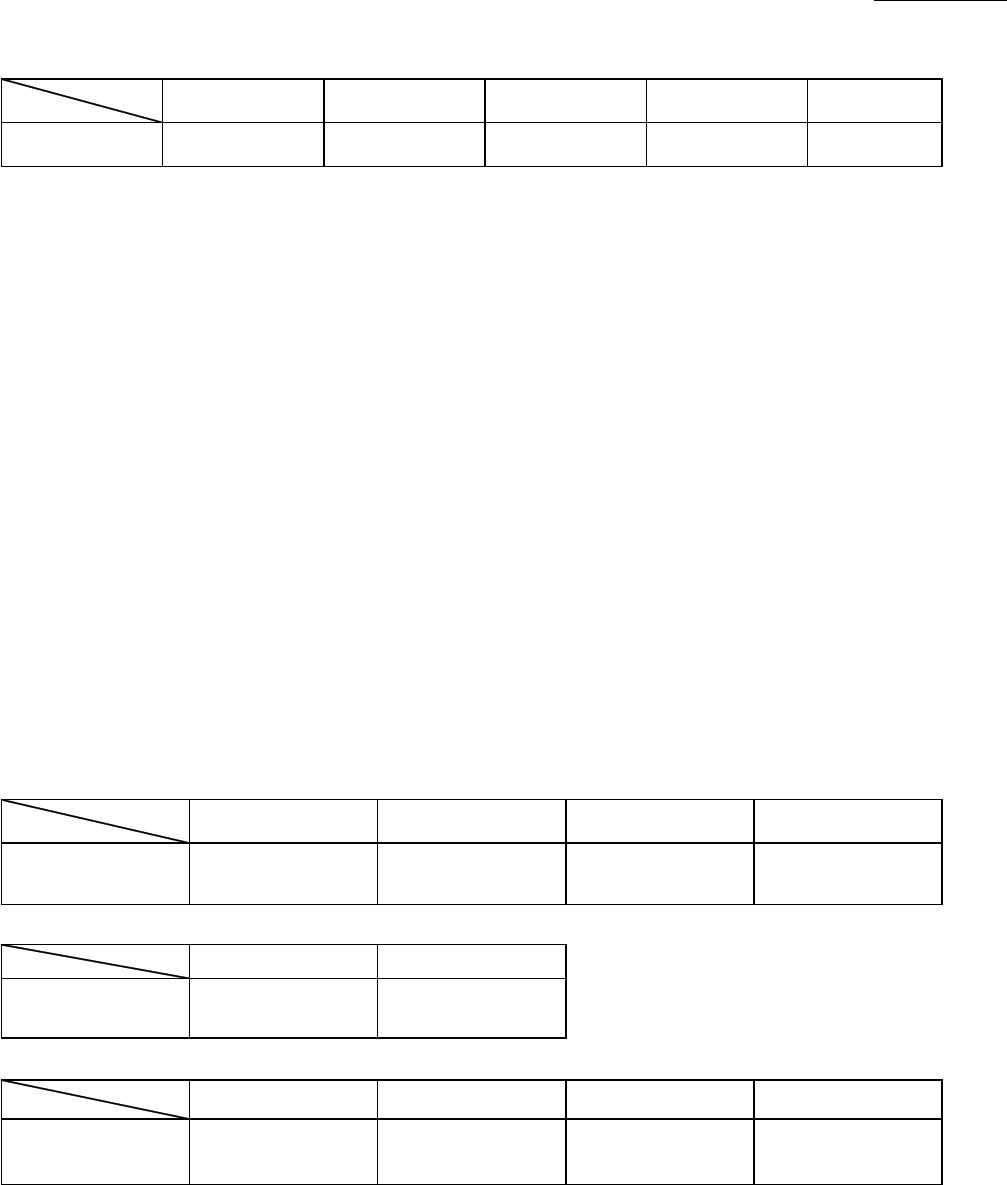

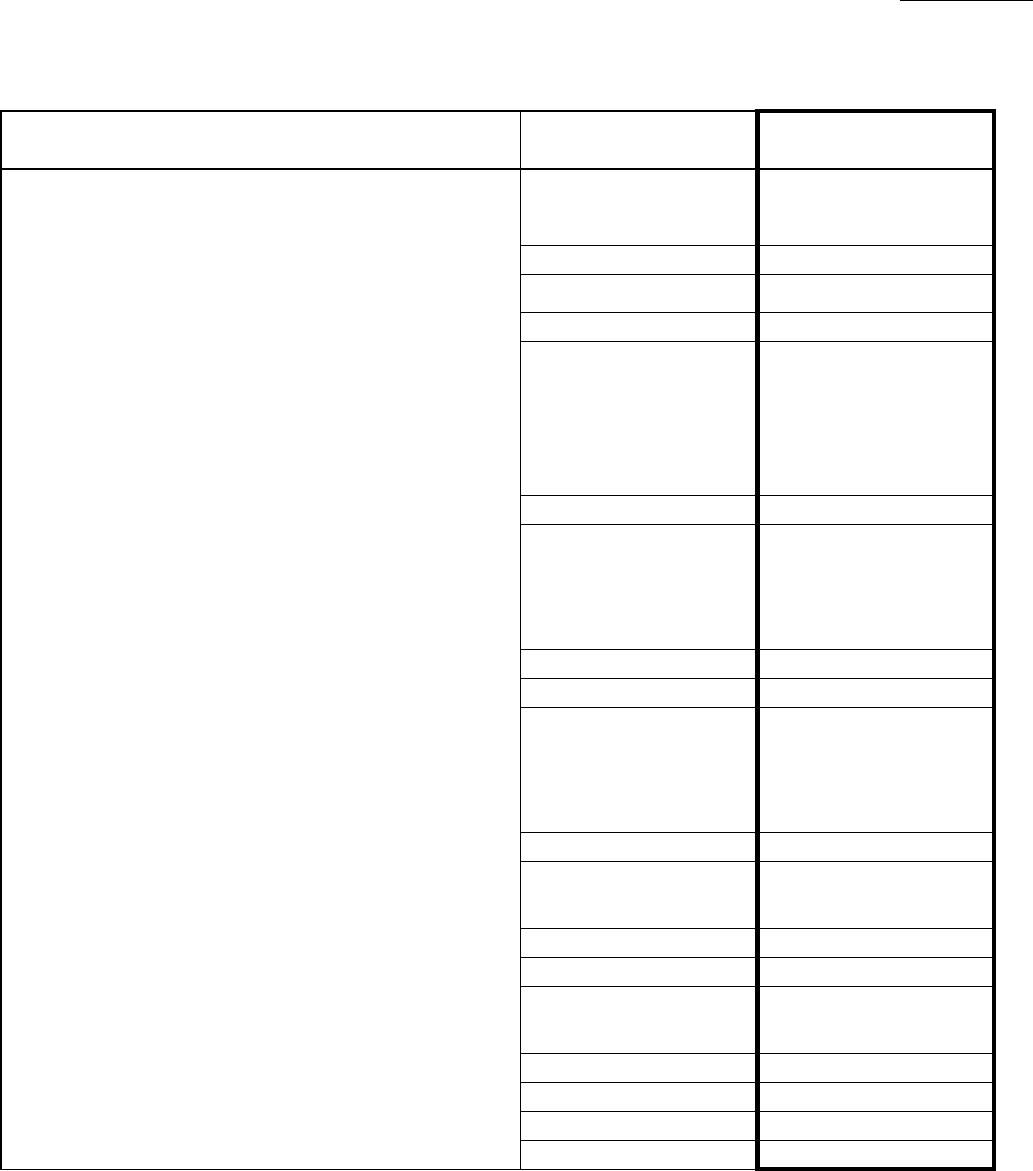

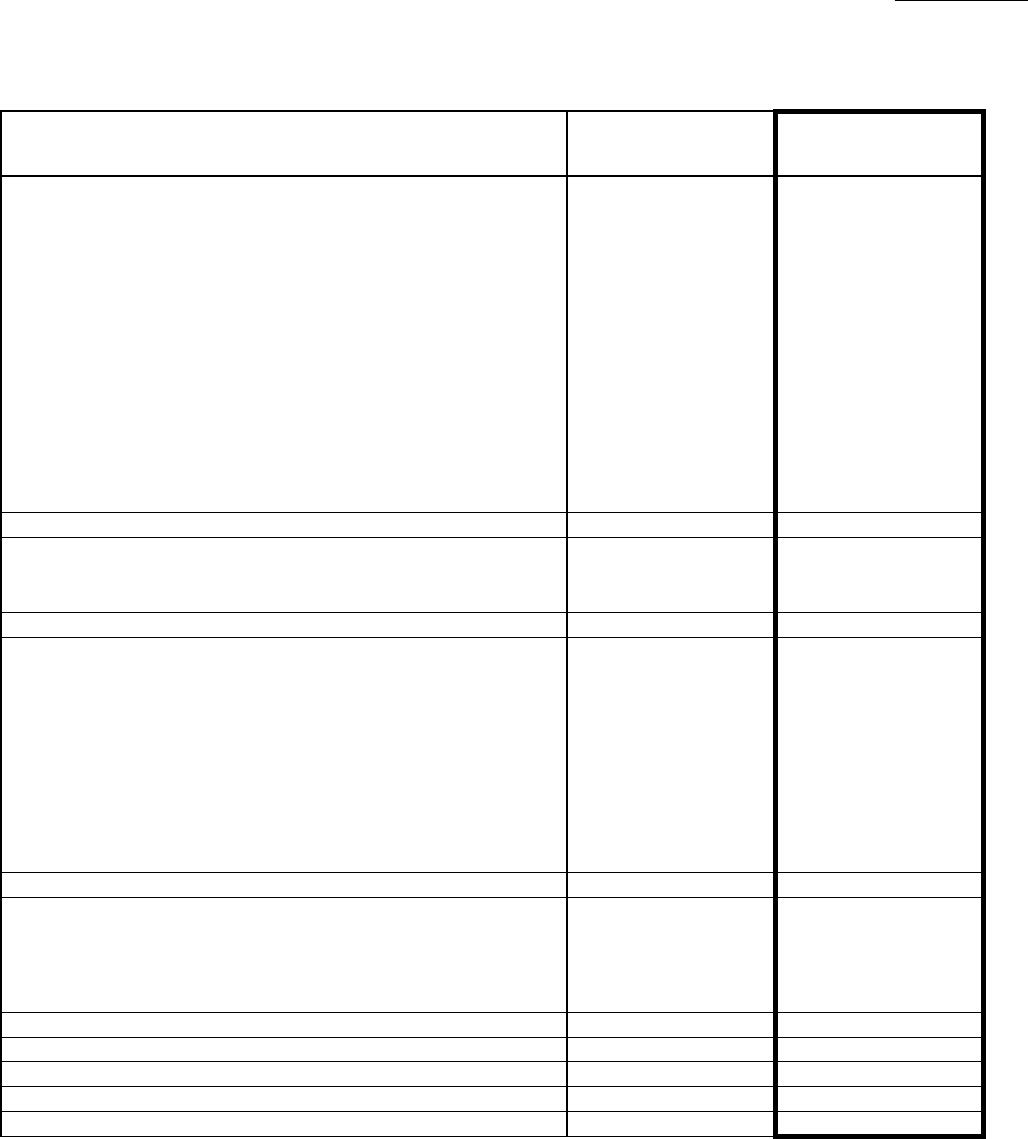

Consolidated Results for the Years Ended March 31

,

2021 and 2022

(1) Consolidated operating results

Net sales Operating profit Ordinary profit

million yen % million yen % million yen % million yen %

Year ended March 31, 2022

Year ended March 31, 2021

[Notes]

Percentages for net sales, operating profit etc. show increase (decrease) from the previous fiscal year.

Comprehensive income: Year ended March 31, 2022: 530,498 million yen [0.5%] Year ended March 31, 2021: 527,951 million yen [123.2%]

Profit per share

Diluted profit

per share

Return on equity

yen yen % % %

Year ended March 31, 2022

Year ended March 31, 2021

[Reference]

Share of profit of entities accounted for using equity method: Year ended March 31, 2022: 26,672 million yen Year ended March 31, 2021: 6,564 million yen

(2) Consolidated financial positions

Total assets Net assets

% y

e

n

As of March 31, 2022

As of March 31, 2021

[Reference]

Shareholders equity: As of March 31, 2022: 2,069,043 million yen As of March 31, 2021: 1,874,371 million yen

(3) Consolidated cash flows

Cash and cash

e

q

uivalents - endin

g

Year ended March 31, 2022

Year ended March 31, 2021

Dividends

yen yen yen % %

[Notes]

4,032.60 - 28.1 31.0 36.4

Capital adequacy ratio

Net assets per share

480,376 85.7

Ordinary profit

on total assets

Operating profit

to net sales

4,046.69 - 24.2 26.3 35.0

1,758,910 34.4 640,634 81.8 678,996 88.4

Profit attributable

to owners of parent

1,695,344 (3.6) 592,760 (7.5) 670,813 (1.2) 477,691 (0.6)

2,446,918 1,874,614 76.6 15,734.79

Cash flows from

operating activities

Cash flows from

investing activities

Cash flows from

financing activities

million yen million yen

2,662,384 2,069,310 77.7 17,635.60

932,079

Dividend per share

Dividends in total

(annual)

Dividend payout ratio

(consolidated basis)

Dividends on net assets

(consolidated basis)

End of 2nd quarter

Year-end

million yen million yen million yen million yen

289,661 93,699 (337,010) 1,022,718

Annual

million yen

Year ended March 31, 2021

810.00 1,410.00 2,220.00 264,453

612,106 (136,533) (194,938)

55.1 15.5

Year ended March 31, 2022

620.00 1,410.00 2,030.00 238,163 50.2 12.2

Year ending March 31, 2023

(forecast)*

--- -

*A 10-for-1 split of the Company’s common stock is scheduled to take effect on October 1, 2022. Dividends are paid twice per year, following the end of the second quarter and

at the fiscal year-end based on profit levels achieved in each fiscal year, in accordance with our basic policy of profit distribution and dividends described on page 4. The

dividend forecast for the fiscal year ending March 31, 2023 is undecided at this point in time, and will be announced at the timing of the 2023 fiscal year second quarter earnings

release. For details, please refer to “Notification of Common Stock Split and Partial Amendment to the Articles of Incorporation and Change in the Dividend Policy due to Stock

Split” released today.

Nintendo Co., Ltd.

Consolidated Financial Forecast for the Fiscal Year Ending March 31, 2023

% % % % yen

Year ending March 31, 2023

[Notes]

Percentages for net sales, operating profit etc. show increase (decrease) from the previous fiscal year.

With respect to the impact of COVID-19, please refer to "2. Outlook for the Fiscal Year Ending March 31, 2023" on page 4.

Profit per share takes into account the effect of the stock split described in the notes of "Dividends".

Others

(1) Changes for important subsidiaries during the fiscal year ended March 31, 2022

: Not applicable

(2) Changes in accounting procedures:

1) Related to accounting standard revisions etc.

: Applicable

2) Other changes

: Not applicable

3) Changes in accounting estimates

: Not applicable

4) Modified restatements

: Not applicable

(3) Outstanding shares (common shares)

1) Number of shares outstanding (including treasury shares)

As of Mar. 31, 2022 : 129,869,000 shares As of Mar. 31, 2021 : 131,669,000 shares

2) Number of treasury shares

As of Mar. 31, 2022 : 12,547,022 shares As of Mar. 31, 2021 : 12,546,233 shares

3) Average number of shares

Year ended Mar. 31, 2022 : 118,044,880 shares Year ended Mar. 31, 2021 : 119,123,333 shares

(

Reference

)

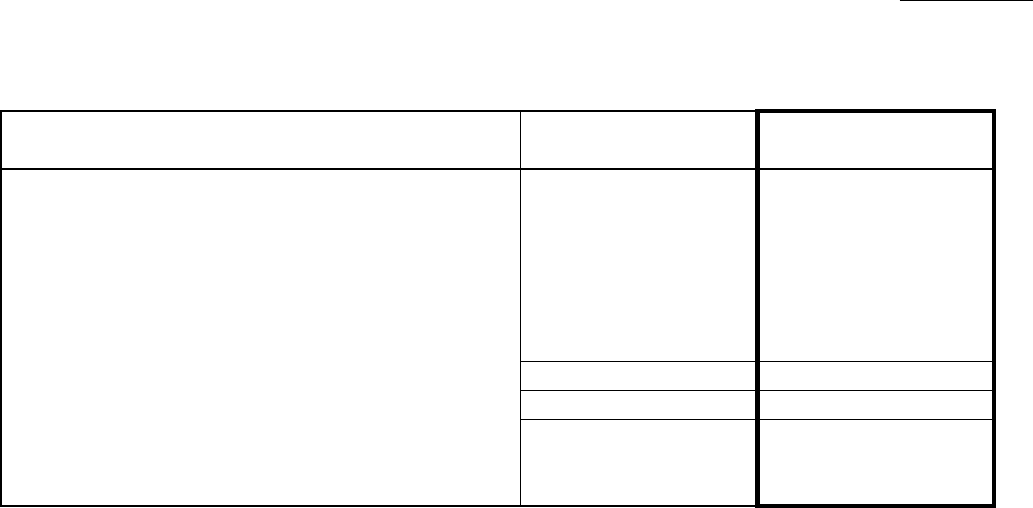

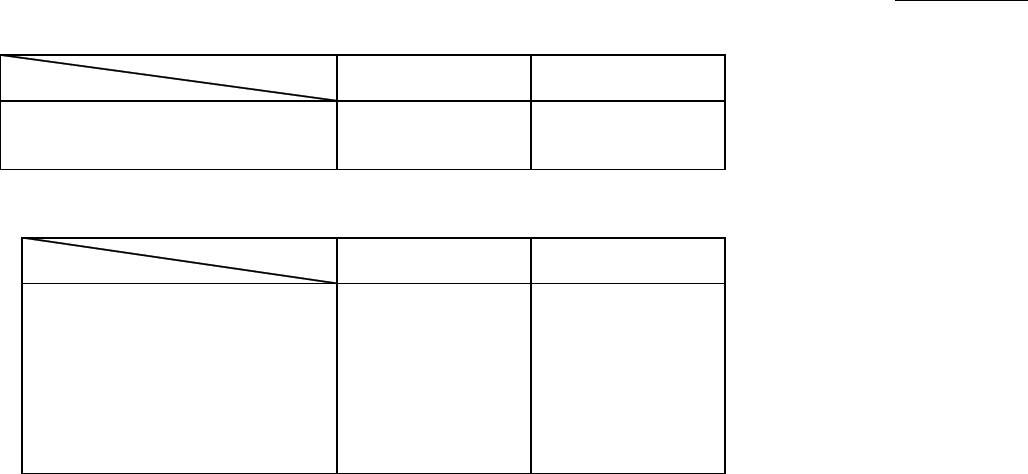

Non-consolidated Results

Non-consolidated Results for the Years Ended March 31, 2021 and 2022

(1) Non-consolidated operating results

Net sales Operating profit Ordinary profit Profit

million yen % million yen % million yen % million yen %

Year ended March 31, 2022

Year ended March 31, 2021

[Note] Percentages for net sales, operating profit etc. show increase (decrease) from the last fiscal year.

Profit per share Diluted Profit per share

yen yen

Year ended March 31, 2022

Year ended March 31, 2021

(2) Non-consolidated financial positions

Total assets Net assets

Capital adequacy

ratio

Net assets per share

% yen

As of March 31, 2022

As of March 31, 2021

[Reference]

Shareholders equity: As of March 31, 2022: 1,410,447 million yen As of March 31, 2021: 1,281,948 million yen

[Note]

1. This earnings release report is not subject to audit by certified public accountant or audit firm.

Net sales Operating profit Ordinary profit

(28.4) 340,000 289.80

Profit attributable to

owners of parent

million yen million yen million yen million yen

Profit per share

1,600,000 (5.6) 500,000 (15.6) 480,000

93.5 403,339 91.3

1,437,831 (2.1) 499,525 (7.5) 629,958 9.9 462,509

3,918.08 -

3,385.90 -

(28.8)

2. Forecasts announced by the Company (Nintendo Co., Ltd.) referred to above were prepared based on management's assumptions with information available at this time and

therefore involve known and unknown risks and uncertainties. Please note such risks and uncertainties may cause the actual results to be materially different from the forecasts

(earnings forecast, dividend forecast, and other forecasts). For details, please refer to "2. Outlook for the Fiscal Year Ending March 31, 2023" on page 4.

1,765,683 1,281,948 72.6 10,761.57

million yen million yen

1,857,584 1,410,447 75.9 12,022.02

14.7

1,468,563 36.4 540,217 80.0 573,057

Nintendo Co., Ltd.

Description of Operating Results

1. Operating Results and Financial Positions for the Fiscal Year Ended March 31, 2022

(1) Operating Results and Financial State for the Fiscal Year Ended March 31, 2022

The Nintendo Switch business this fiscal year (April 2021 to March 2022) saw the October 2021 launch of Nintendo Switch –

OLED Model and strong hardware sales in each region. Growth in sales of Nintendo Switch, Nintendo Switch – OLED Model and

Nintendo Switch Lite demonstrated a good balance between each of the three individual models, and as a result of stable

performance among the overall hardware lineup, final sales totaled 23.06 million units. Whereas the March 2020 release of Animal

Crossing: New Horizons was a major driver of hardware sales last fiscal year, sales this fiscal year were affected by shortages of

semiconductor components and other parts, resulting in a 20.0% decrease year-on-year.

Looking at software, among titles released this period, Pokémon Brilliant Diamond and Pokémon Shining Pearl sold a combined

14.65 million units and Pokémon Legends: Arceus sold 12.64 million units, marking sales of more than 10 million units for each.

In addition, Mario Party Superstars sold 6.88 million units, and The Legend of Zelda: Skyward Sword HD sold 3.91 million units.

Titles released in previous fiscal years also continued to perform well, with Mario Kart 8 Deluxe selling 9.94 million units (for

cumulative sales of 45.33 million units) and Animal Crossing: New Horizons selling 6.01 million units (for cumulative sales of

38.64 million units). Sales of titles from other software publishers grew as well, and when combined with those published by

Nintendo, a total of 39 titles sold over one million units during this period. As a result, software sales grew 1.8% year-on-year to

235.07 million units, making it the highest annual software sales figure ever posted for a Nintendo platform to date.

Turning to the dedicated video game platform digital business, sales were strong for Nintendo Switch downloadable versions of

packaged software. Sales also grew for add-on content, including Animal Crossing: New Horizons – Happy Home Paradise and

Mario Kart 8 Deluxe – Booster Course Pack. In addition, sales of download-only titles and sales related to Nintendo Switch Online

also performed well, contributing to digital sales of 359.6 billion yen (an increase of 4.5% year-on-year).

For the mobile business, many consumers continued to enjoy our applications, and combined with a steady stream of royalty

income, the resulting mobile and IP related income totaled 53.3 billion yen (a decrease of 6.5% year-on-year).

As a result, net sales reached 1,695.3 billion yen, with overseas sales of 1,336.4 billion yen accounting for 78.8% of the total.

Operating profit came to 592.7 billion yen, ordinary profit was 670.8 billion yen, and profit attributable to owners of parent totaled

477.6 billion yen.

(2) F

inancial positions as of March 31, 2022

Total assets increased by 215.4 billion yen compared to the prior fiscal year-end to 2,662.3 billion yen mainly due to an increase

in inventories and investment securities. Total liabilities increased by 20.7 billion yen compared to the prior fiscal year-end to

593.0 billion yen mainly due to an increase in notes and accounts payable-trade despite a decrease in taxes payable. Net assets

increased by 194.6 billion yen compared to the prior fiscal year-end to 2,069.3 billion yen.

(3) Cash f

lows for the fiscal year ended March 31, 2022

The ending balance of “Cash and cash equivalents” (collectively, “Cash”) as of March 31, 2022 was 1,022.7 billion yen, with

an

increase of 90.6 billion yen during the fiscal year. During the prior fiscal year, there was an increase of 310.6 billion yen. Net

increase (decrease) of Cash and contributing factors during the fiscal year ended March 31, 2022 are as follows:

Net cash provided by (used in) operating activities:

There were decreasing factors contributing to 674.3 billion yen of profit before income taxes such as payment of income taxes

and an increase in inventories. However, due to increasing factors such as an increase in trade payables, net cash resulted in an

increase of 289.6 billion yen compared to an increase of 612.1 billion yen during the prior year.

Net cash provided by (used in) investing activities:

Net cash from investing activities increased by 93.6 billion yen compared to a decrease of 136.5 billion during the prior year

mainly due to proceeds from withdrawal of time deposits and sales and redemption of short-term and long-term investment

securities being higher than payments into time deposits and purchase of short-term and long-term investment securities.

Net cash provided by (used in) financing activities:

Net cash from financing activities decreased by 337.0 billion yen compared to a decrease of 194.9 billion yen during the prior

year mainly due to payments of cash dividends.

Nintendo Co., Ltd.

2. Outlook for the Fiscal Year Ending March 31, 2023

3. Basic Policy of Profit Distribution and Dividends

Basic Policy on the Selection of Accounting Standards

It is the Company’s basic policy to internally provide the capital necessary to fund future growth, including capital investments,

and to maintain a strong and liquid financial position in preparation for changes in the business environment and intensified

competition. As for direct profit returns to our shareholders, dividends are paid based on profit levels achieved in each fiscalperiod.

The annual dividend per share will be established at the higher of the amount calculated by dividing 33% of consolidated

operating profit by the total number of outstanding shares, excluding treasury shares, as of the end of the fiscal year rounded up to

the 10 yen digit, and the amount calculated based on the 50% consolidated profit standard rounded up to the 10 yen digit.

The end of 2nd quarter (interim) dividend per share is calculated by dividing 33% of consolidated operating profit by the total

number of outstanding shares, excluding treasury shares, as of the end of the six-month period rounded up to the 10 yen digit.

As a result, the dividend for the fiscal year ended March 31, 2022 has been established at 2,030 yen (interim: 620 yen, year-end:

1,410 yen).

A 10-for-1 split of the Company’s common stock is scheduled to take effect on October 1, 2022. The Company has not

announced a dividend forecast for the next fiscal year. The dividend policy will be changed in accordance with the stock split.

However, this change is an adjustment due to the stock split, and there will be no substantive change in comparison with the

existing policy. The revised policy will be applied starting with the year-end dividend for the fiscal year ending March 31, 2023, as

it is the first dividend to which the shares are subject to after the stock split. For details, please refer to “Notification of Common

Stock Split and Partial Amendment to the Articles of Incorporation and Change in the Dividend Policy due to Stock Split” released

today.

Retained earnings are maintained for effective use in research of new technology and development of new products and services,

capital investments and securing materials, enhancement of selling power including advertisements, strengthening of network

infrastructure, and treasury share buyback whenever deemed appropriate

.

Regarding Nintendo Switch, we will continue to convey the appeal of all three hardware models to maintain a high level of sales

momentum and expand the install base. As for software, along with the release of Nintendo Switch Sports in April, we have

planned the global releases of Xenoblade 3 (July) and Splatoon 3 (September). In addition, the latest entries in the Pokémon series,

Pokémon Scarlet and Pokémon Violet, are slated for release in late 2022. Other software publishers also plan to release a wide

variety of titles, and we will work to strengthen sales through the combination of existing popular titles and a continuous stream of

new titles.

Through these initiatives, we expect to see results of 1,600.0 billion yen in net sales, 500.0 billion yen in operating profit, 480.0

billion yen in ordinary profit, and 340.0 billion yen in profit attributable to owners of parent during the next fiscal year.

The unit sales forecasts for key products on which these calculations are based can be found on page 15 under the heading

“Others (4) Consolidated sales units, number of new titles, and sales units forecast” Assumed exchange rates for the major

currencies are 115 yen per U.S. dollar, and 125 yen per euro.

If COVID-19 interferes with production or transportation in the future, this might impact the supply of products. Other

unpredictable risks to the development and marketing of products and services also continue to exist.

In addition, the production of products might be affected by obstacles to the procurement of parts, such as the increase in global

demand for semiconductor components. The consolidated earnings forecast is based on the premise that we will be able to secure

the parts needed for the manufacture of products in line with our sales plans.

The Nintendo group will take the necessary measures and continue business operations to provide an environment in which

consumers can continue to enjoy Nintendo products and services.

In light of the comparability of consolidated financial statements over different fiscal years, Nintendo has a policy of preparing

its consolidated financial statements in accordance with accounting principles generally accepted in Japan, which has been

designed for convergence with International Financial Reporting Standards (IFRS), for the time being. Taking into account the

possible adoption of IFRS in the future, Nintendo continues to collect information and conduct various studies, participating in

seminars hosted by external organizations.

[Note] Appropriate Use of Earnings Forecasts

Statements relating to future projections represent the judgments made by Nintendo management based on information that was available at the time it is

written, and for that reason include certain potential risks and uncertainties. Please note that such risks and uncertainties may cause actual results to be

materially different from these forecasts (earnings forecasts, dividend forecasts, or other such forecasts).

Nintendo Co., Ltd.

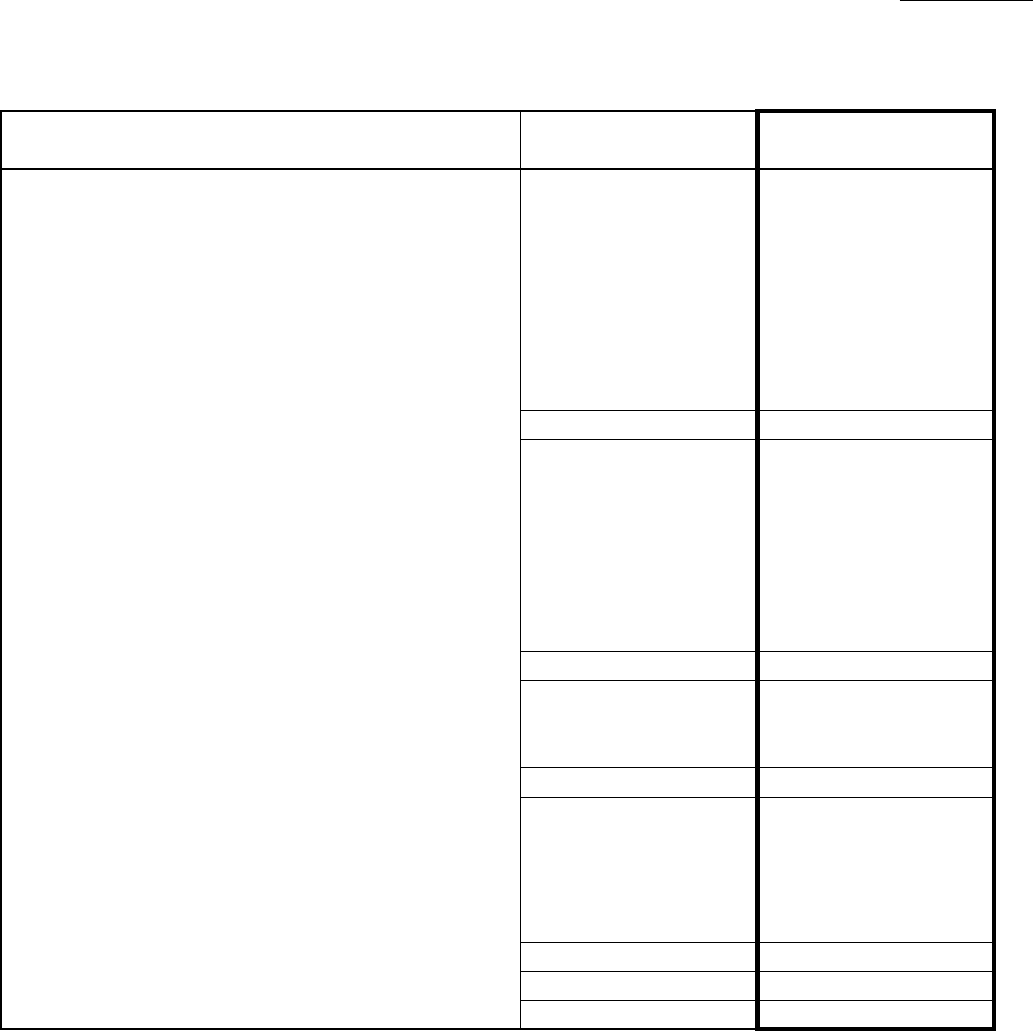

Consolidated Balance Sheets

million yen

(Assets)

Current assets

Cash and deposits 1,185,151 1,206,506

Notes and accounts receivable-trade 140,570 141,087

Securities 557,238 504,385

Inventories 86,817 204,183

Other 50,692 70,147

Allowance for doubtful accounts (94) (98)

Total current assets 2,020,375 2,126,212

Non-current assets

Property, plant and equipment

Buildings and structures, net 42,230 42,571

Tools, furniture and fixtures, net 4,783 4,498

Machinery, equipment and vehicles, net 1,591 1,477

Land 34,785 35,337

Construction in progress 178 1,280

Total property, plant and equipment 83,569 85,164

Intangible assets

Software

11,106 10,241

Other 3,815 7,073

14,922 17,315

Investments and other assets

Investment securities 214,832 312,663

Retirement benefit asset 8,205 8,597

Deferred tax assets 82,819 87,996

Other 22,194 24,434

Total investments and other assets 328,051 433,692

Total non-current assets 426,543 536,172

Total assets 2,446,918 2,662,384

Total intangible assets

Description

As of March 31, 2021 As of March 31, 2022

Nintendo Co., Ltd.

million yen

(Liabilities)

Current liabilities

Notes and accounts payable-trade 114,677 150,910

Provision for bonuses 5,227 5,459

Income taxes payable 157,307 99,520

Other 249,119 284,836

Total current liabilities 526,331 540,726

Non-current liabilities

Retirement benefit liability 21,001 25,063

Other 24,970 27,284

Total non-current liabilities 45,972 52,347

Total liabilities 572,304 593,074

(Net assets)

Shareholders' equity

Share capital 10,065 10,065

Capital surplus 15,043 15,041

Retained earnings 1,993,325 2,198,706

Treasury shares (156,851) (220,343)

Total shareholders' equity 1,861,582 2,003,469

Accumulated other comprehensive income

Valuation difference on available-for-sale securities 33,571 33,199

Foreign currency translation adjustment (20,782) 32,373

Total accumulated other comprehensive income 12,788 65,573

Non-controlling interests 243 266

Total net assets 1,874,614 2,069,310

Total liabilities and net assets 2,446,918 2,662,384

Description

As of March 31, 2021 As of March 31, 2022

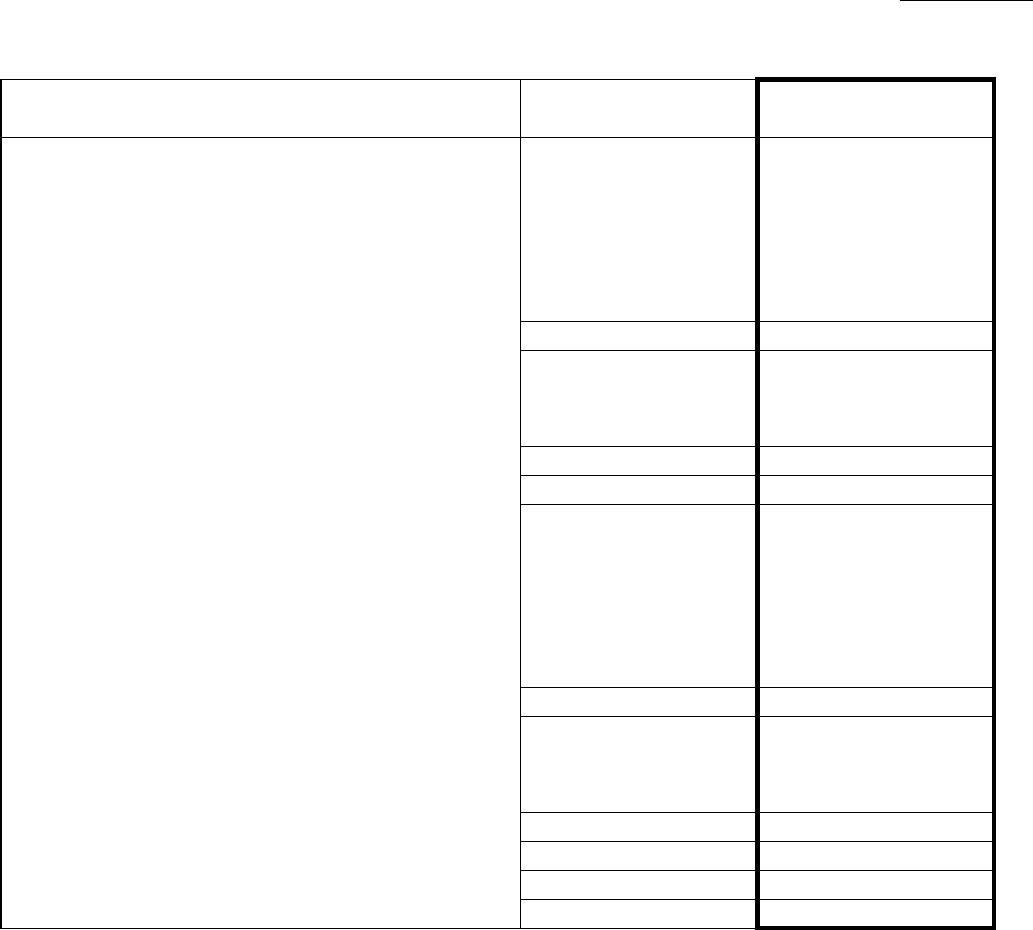

Nintendo Co., Ltd.

Consolidated Statements of Income

million yen

Net sales 1,758,910 1,695,344

Cost of sales 788,437 749,299

Gross profit 970,472 946,044

329,838 353,283

Operating profit 640,634 592,760

Non-operating income

Interest income 5,723 3,317

Share of profit of entities accounted for using equity method 6,564 26,672

Foreign exchange gains 24,039 45,626

Other 3,385 3,169

Total non-operating income 39,713 78,786

Non-operating expenses

Interest expenses 177 281

Commission for purchase of treasury shares 0 250

Other 1,174 201

Total non-operating expenses 1,351 733

678,996 670,813

Extraordinary income

Gain on sale of non-current assets 2,516 1

Gain on sale of investment securities 40 347

Settlement income - 3,300

Total extraordinary income 2,556 3,648

Extraordinary losses

Loss on disposal of non-current assets 247 73

Total extraordinary losses 247 73

Profit before income taxes 681,305 674,389

220,348 200,469

(19,463) (3,794)

Total income taxes 200,884 196,674

480,420 477,714

44 22

480,376 477,691

Profit attributable to non-controlling interests

Profit attributable to owners of parent

Profit

Income taxes-current

Income taxes-deferred

Ordinary profit

Description

Selling, general and administrative expenses

Year ended March 31, 2021 Year ended March 31, 2022

Nintendo Co., Ltd.

Consolidated Statements of Comprehensive Income

million yen

480,420 477,714

Other comprehensive income

Valuation difference on available-for-sale securities 23,137 (417)

Foreign currency translation adjustment 25,405 49,777

(1,013) 3,424

Total other comprehensive income 47,530 52,784

Comprehensive income 527,951 530,498

(Comprehensive income attributable to)

Comprehensive income attributable to owners of parent 527,907 530,476

Comprehensive income attributable to non-controlling interests 44 22

Year ended March 31, 2022

Description

Profit

Year ended March 31, 2021

Share of other comprehensive income of entities

accounted for using equity method

Nintendo Co., Ltd.

Consolidated Statements of Changes in Equity

Year ended March 31, 2021 (April 1, 2020 - March 31, 2021)

million yen

Balance as of April 1, 2020

10,065 15,041 1,707,119 (156,798) 1,575,428

Changes during period

Dividends of surplus

- - (194,171) - (194,171)

Profit attributable to owners of parent

- - 480,376 - 480,376

Purchase of treasury shares

- - - (53) (53)

Disposal of treasury shares

- 1 - 0 1

Cancellation of treasury shares

- - - - -

- - - - -

Total changes during period

- 1 286,205 (52) 286,153

Balance as of March 31, 2021

10,065 15,043 1,993,325 (156,851) 1,861,582

Balance as of April 1, 2020

10,637 (45,378) (34,741) 213 1,540,900

Changes during period

Dividends of surplus

- - - - (194,171)

Profit attributable to owners of parent

- - - - 480,376

Purchase of treasury shares

- - - - (53)

Disposal of treasury shares

- - - - 1

Cancellation of treasury shares

- - - - -

22,933 24,596 47,530 29 47,560

Total changes during period

22,933 24,596 47,530 29 333,714

Balance as of March 31, 2021

33,571 (20,782) 12,788 243 1,874,614

Non-controlling

interests

Total

net assets

Capital surplus

Retained

earnings

Treasury shares

Net changes in items

other than shareholders' equity

Accumulated other comprehensive income

Total

accumulated

other

comprehensive

income

Foreign currency

translation

adjustment

Valuation

difference

on available-for-

sale securities

Net changes in items

other than shareholders' equity

Share capital

Shareholders' equity

Total

shareholders'

equity

Nintendo Co., Ltd.

Consolidated Statements of Changes in Equity

Year ended March 31, 2022 (April 1, 2021 - March 31, 2022)

million yen

Balance as of April 1, 2021

10,065 15,043 1,993,325 (156,851) 1,861,582

Changes during period

Dividends of surplus

- - (240,702) - (240,702)

Profit attributable to owners of parent

- - 477,691 - 477,691

Purchase of treasury shares

- - - (95,100) (95,100)

Disposal of treasury shares

- - - - -

Cancellation of treasury shares

- (1) (31,607) 31,608 -

- - - - -

Total changes during period

- (1) 205,380 (63,492) 141,887

Balance as of March 31, 2022

10,065 15,041 2,198,706 (220,343) 2,003,469

Balance as of April 1, 2021

33,571 (20,782) 12,788 243 1,874,614

Changes during period

Dividends of surplus

- - - - (240,702)

Profit attributable to owners of parent

- - - - 477,691

Purchase of treasury shares

- - - - (95,100)

Disposal of treasury shares

- - - - -

Cancellation of treasury shares

- - - - -

(371) 53,156 52,784 22 52,807

Total changes during period

(371) 53,156 52,784 22 194,695

Balance as of March 31, 2022

33,199 32,373 65,573 266 2,069,310

Net changes in items

other than shareholders' equity

Share capital

Shareholders' equity

Total

shareholders'

equity

Net changes in items

other than shareholders' equity

Accumulated other comprehensive income

Valuation

difference

on available-for-

sale securities

Foreign currency

translation

adjustment

Total

accumulated

other

comprehensive

income

Non-controlling

interests

Total

net assets

Capital surplus

Retained

earnings

Treasury shares

Nintendo Co., Ltd.

Consolidated Statements of Cash Flows

million yen

Cash flows from operating activities

681,305 674,389

Depreciation

10,798 10,527

Increase (decrease) in allowance for doubtful accounts

(552) (37)

Interest and dividend income

(6,770) (4,525)

Foreign exchange losses (gains)

(24,625) (57,324)

Share of loss (profit) of entities accounted for using equity method

(6,564) (26,672)

Decrease (increase) in trade receivables

(527) 8,134

Decrease (increase) in inventories

7,244 (84,563)

Increase (decrease) in trade payables

22,002 25,125

254 2,575

Increase (decrease) in accrued consumption taxes

(4,613) (1,824)

Other, net

58,752 3,307

736,703 549,112

Interest and dividends received

8,702 4,862

Interest paid

(177) (281)

Income taxes paid

(133,122) (264,031)

Net cash provided by (used in) operating activities 612,106 289,661

Cash flows from investing activities

Purchase of short-term and long-term investment securities

(952,783) (943,319)

803,058 1,015,200

(7,011) (7,587)

4,853 7

Payments into time deposits

(468,817) (354,500)

Proceeds from withdrawal of time deposits

480,712 383,921

Other, net

3,454 (21)

Net cash provided by (used in) investing activities (136,533) 93,699

Cash flows from financing activities

Purchase of treasury shares

(67) (95,350)

Dividends paid

(194,021) (240,560)

Other, net

(848) (1,099)

Net cash provided by (used in) financing activities (194,938) (337,010)

30,042 44,288

Net increase (decrease) in cash and cash equivalents 310,676 90,638

Cash and cash equivalents at beginning of period 621,402 932,079

Cash and cash equivalents at end of period 932,079 1,022,718

Year Ended March 31, 2021 Year Ended March 31, 2022

Sub-total

Increase (decrease) in retirement benefit liability

Description

Profit before income taxes

Effect of exchange rate change on cash and cash equivalents

Proceeds from sale of property, plant and equipment and intangible assets

Proceeds from sale and redemption of short-term

and long-term investment securities

Purchase of property, plant and equipment and intangible assets

Nintendo Co., Ltd.

Notes Pertaining to Consolidated Financial Statements

(Changes in accounting procedures)

(Consolidated balance sheets information) million yen million yen

As of March 31, 2021 As of March 31, 2022

(

Consolidated statements of cash flows information

)

million yen million yen

Cash and deposits

Cash and cash e

q

uivalents

(Segment information)

Accumulated depreciation 72,872 78,988

(Application of the Accounting Standard for Revenue Recognition)

Effective at the beginning of the fiscal year ended March 31, 2022, Nintendo has adopted the Accounting Standard

for Revenue Recognition (ASBJ Statement No. 29, March 31, 2020). Under this standard, revenue is recognized at

the amount expected to be received for the goods or services and at the time control of the promised goods or services

is transferred to the customer.

Under the new standard, if the seller is obligated to buy back goods included in paid-for transactions, those goods

are no longer recognized as extinguished when they are paid for. As a result, at the end of the consolidated fiscal year

ended March 31, 2022, inventories and other current liabilities increased by 36,559 million yen. These were

previously recognized as the extinguishment of paid-for services.

The application of the Accounting Standard for Revenue Recognition is subject to the transitional treatment

stipulated in paragraph 84, but because there is no cumulative impact on profit or loss, the balance of retained

earnings at the beginning of the period has not been adjusted. The impact on the consolidated financial statements is

immaterial.

(Application of the Accounting Standard for Fair Value Measurement)

Effective at the beginning of the fiscal year ended March 31, 2022, Nintendo has adopted the Accounting Standard

for Fair Value Measurement (ASBJ Statement No. 30, July 4, 2019). Requirements of this accounting standard will

be applied prospectively, subject to the transitional treatment stipulated in paragraph 19 of the standard as well as

Article 44-2 of the Accounting Standards for Financial Instruments (ASBJ Statement 10, July 4, 2019). There is no

impact on the consolidated financial statements.

“Cash and cash equivalents at end of period” were reconciled to “Cash and deposits” in the accompanying consolidated balance sheets as of

March 31, 2021 and 2022 as follows:

Year ended

March 31, 2021

Year ended

March 31, 2022

1,185,151 1,206,506

Time deposits with maturities of

more than three months

(310,315) (304,527)

Short-term investments with an original

maturity of three months or less

57,243 120,739

932,079 1,022,718

Segment information is omitted as Nintendo (the Company and its consolidated subsidiaries) operates as a single

b

usiness se

g

ment.

Nintendo Co., Ltd.

(Per share information)

yen yen

[Notes]

1. Diluted profit per share is omitted as no residual securities were outstanding as of March 31, 2021 and 2022

2. The basis of calculation of profit per share is as follows:

million yen million yen

Profit attributable to owners of parent

thousands of shares thousands of shares

Average number of shares

(Significant subsequent events)

(Ac

q

uisition of treasur

y

shares)

(Stock s

p

li

t

)

(Introduction of a restricted stock com

p

ensation

p

la

n

)

At the meeting of the Board of Directors held on May 10, 2022, the Company resolved to acquire its own shares pursuant to Article 156

and Article 165-3 of the Japanese Companies Act and decided the specific method of acquisition. For details, please refer to "Notification

of Acquisition of Treasury Shares through Off-Auction Own Share Repurchase Trading (ToSTNeT-3)" released today.

At the meeting of the Board of Directors held on May 10, 2022, the Company resolved to authorize a stock split of shares of its common

stock and a partial amendment to the Articles of Incorporation and change in the Dividend Policy due to the stock split. For details, please

refer to "Notification of Common Stock Split and Partial Amendment to the Articles of Incorporation and Change in the Dividend Policy

due to Stock Split" released today.

At the meeting of the Board of Directors held on May 10, 2022, the Company reviewed the compensation plan for Directors and Executive

Officers and resolved to introduce a restricted stock compensation plan. A proposal of the Plan will be discussed at the 82nd Annual

General Meeting of Shareholders scheduled to be held on June 29, 2022. For details, please refer to "Notification of the Introduction of a

Restricted Stock Compensation Plan" released today.

Year ended

March 31, 2022

Year ended

March 31, 2021

Year ended

March 31, 2022

N

et assets per share 15,734.79 17,635.60

Profit per share 4,032.60 4,046.69

Year ended

March 31, 2021

119,123 118,044

480,376 477,691

Amount not attributable to common

shareholders

--

Profit attributable to owners of parent

related to common shares

480,376 477,691

Nintendo Co., Ltd.

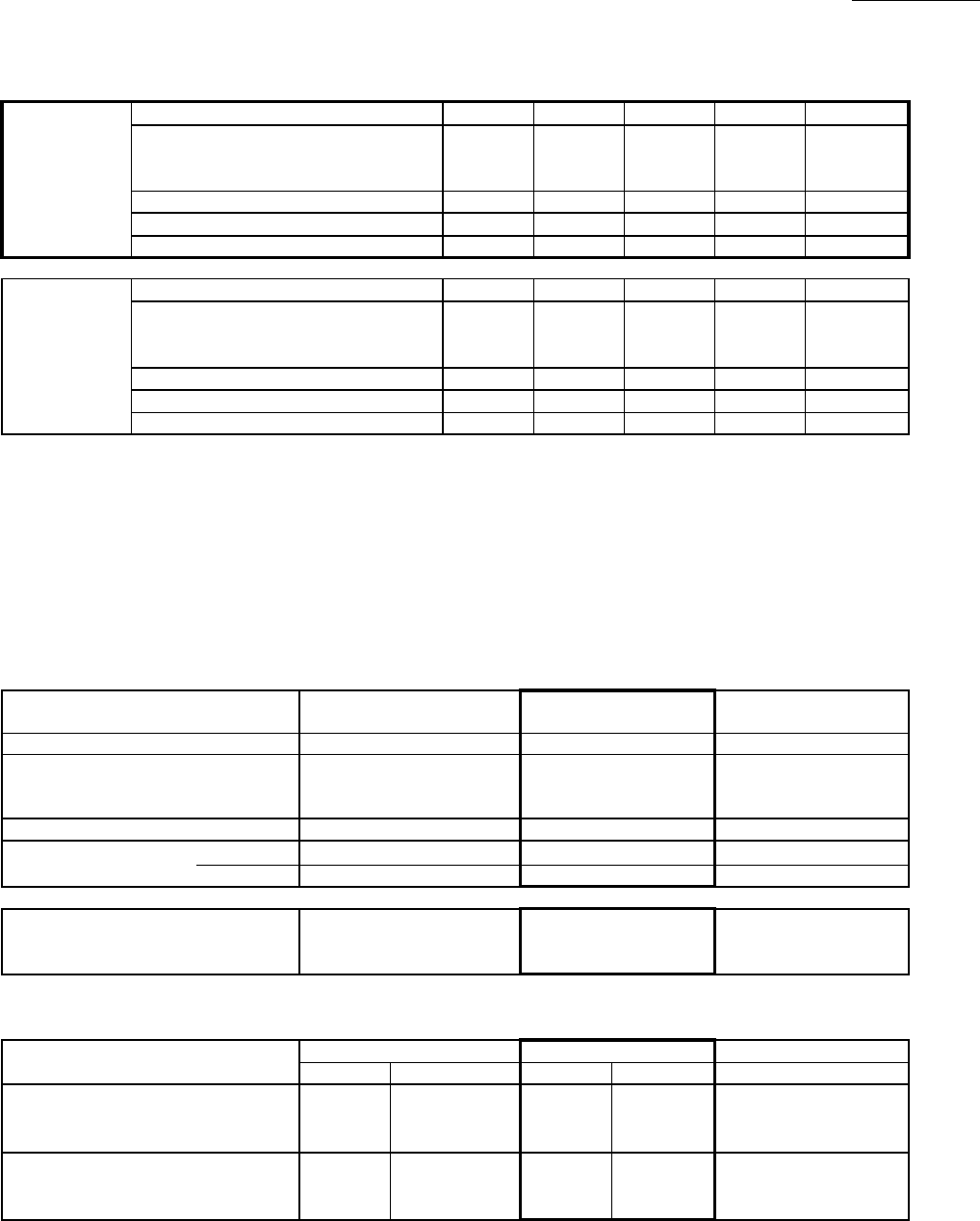

Others

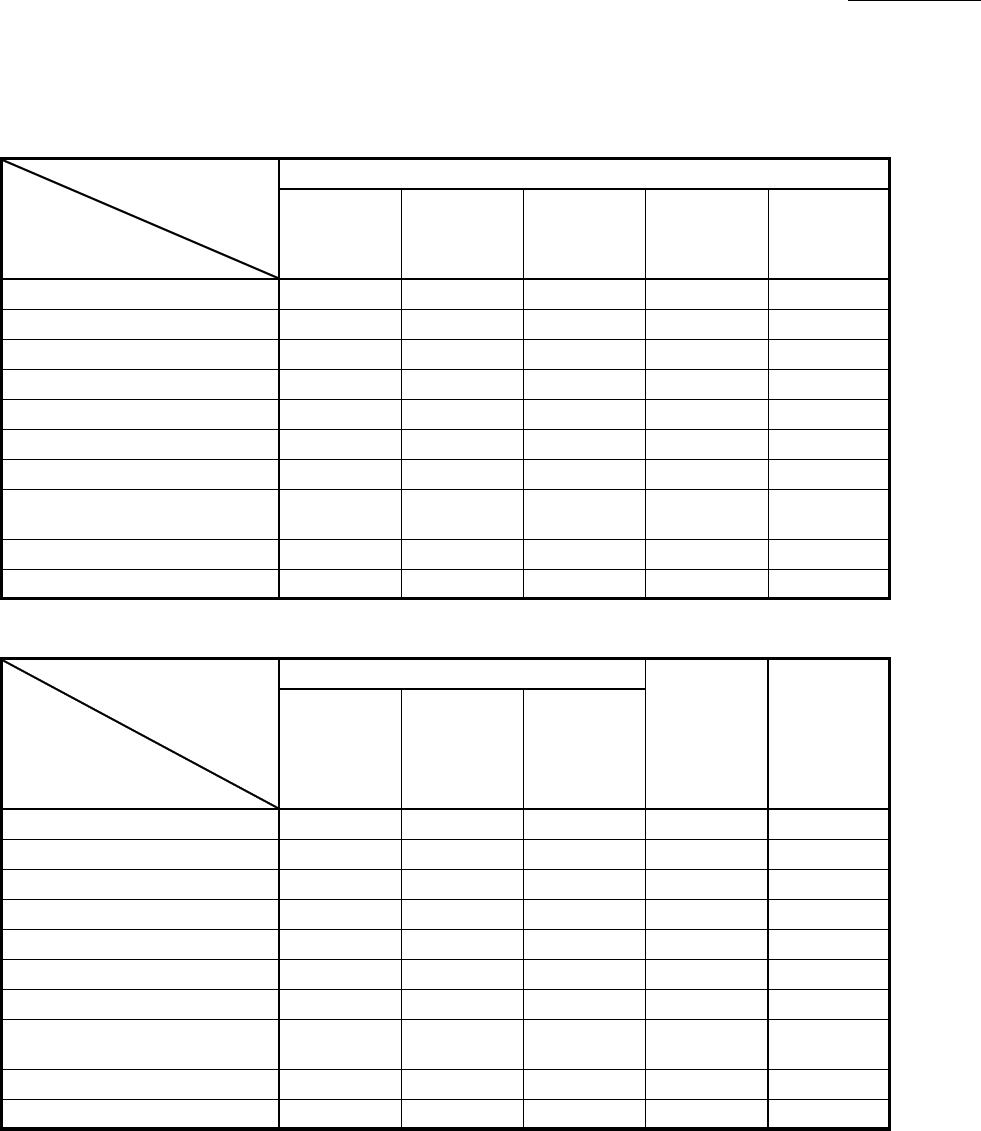

(1) Consolidated sales information

Dedicated video game platform

of which Nintendo Switch platform (*1)

of which the others (*2)

Mobile, IP related income, etc. (*3)

Playing cards, etc.

Dedicated video game platform

of which Nintendo Switch platform (*1)

of which the others (*2)

Mobile, IP related income, etc. (*3)

Playing cards, etc.

[Note] Digital sales in dedicated video game platform (*4):

Year ended March 31, 2022: 359.6 billion yen Year ended March 31, 2021: 344.1 billion yen

*1

*2 Includes platforms other than Nintendo Switch and also amiibo.

*3 Includes income from smart-device content and royalty income.

*4 Includes downloadable versions of packaged software, download-only software, add-on content and Nintendo Switch Online

.

(2) Other consolidated information

Average exchange rates 1 USD =

1 Euro =

Consolidated net sales in U.S. dollars

Consolidated net sales in Euros

Non-consolidated purchases in U.S. dollars

USD

Accounts receivable-trade

Accounts payable-trade

Euro

Accounts receivable-trade

Borrowings from subsidiaries

million U.S. dollars/Euros

(3) Balance of major assets and liabilities in foreign currencies (non-consolidated)

5.6 billion

828

Cash and deposits

Exchange rate Exchange rate Estimated exchange rate

3,575

1 USD=

115.00 yen

769

As of March 31, 2022

555

Nintendo Switch platform includes hardware, software (including downloadable versions of packaged software,

download-only software, add-on content and Nintendo Switch Online) and accessories.

6,717

Capital investments

Year ended March 31, 2022

Year ending March 31, 2023

(Forecast)

million yen

Depreciation of property, plant and equipment

16,766

7,0006,046

Cash and deposits

93,253

84,450

6,574

Balance

-

112.34 yen

Number of employees (at year-end)

Advertising expenses

Research and development expenses

125.00 yen

93,838

100,000

100,000

115.00 yen

As of March 31, 2023

-

-

130.50 yen

3.4 billion

6.3 billion

3.1 billion

-

As of March 31, 2021

million yen

17,912

Year ended March 31, 2021

38,000

Year ended

March 31, 2022

Japan The Americas Europe Other

2,773

Total

3,191

1,639,227

Total

708,382

375

5,529

3,125

123.68 yen

423

5.8 billion

106.03 yen

6.6 billion

Balance

102,199

522 575

1 Euro=

125.00 yen

1 USD=

110.70 yen

1 Euro=

129.82 yen

1 Euro=

135.41 yen

1 USD=

121.83 yen

381

325

827

419,012

694,890 412,482

13,492 6,529

Year ended

March 31, 2021

Japan The Americas Europe Other

173,666

18,907

1,783

358,857

Total

338,166

324,877

13,289

27,467 4,773 2,193

987

-

2

1,602,725

36,502

53,342

170,475

1,695,344

373,814 703,611 435,804 186,820 1,700,050

736,837 423,786 175,862

Total

1,583 190 0 5 1,779

361,824

27,366 5,293 2,373

691,498 428,258 184,823 1,666,405

397,443 731,168 441,097 189,200 1,758,910

22,046 57,080

11,989 12,112 7,545 1,997 33,645

Nintendo Co., Ltd.

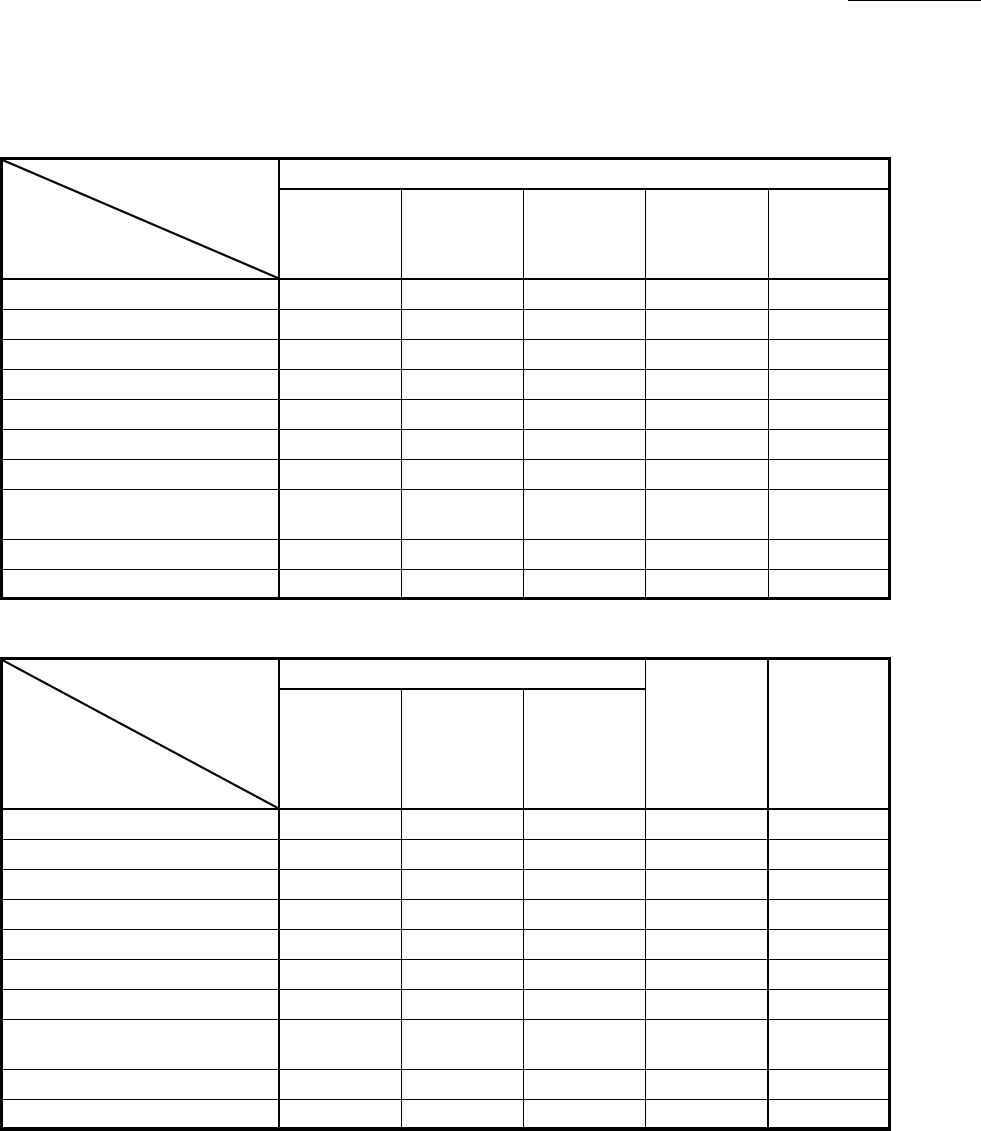

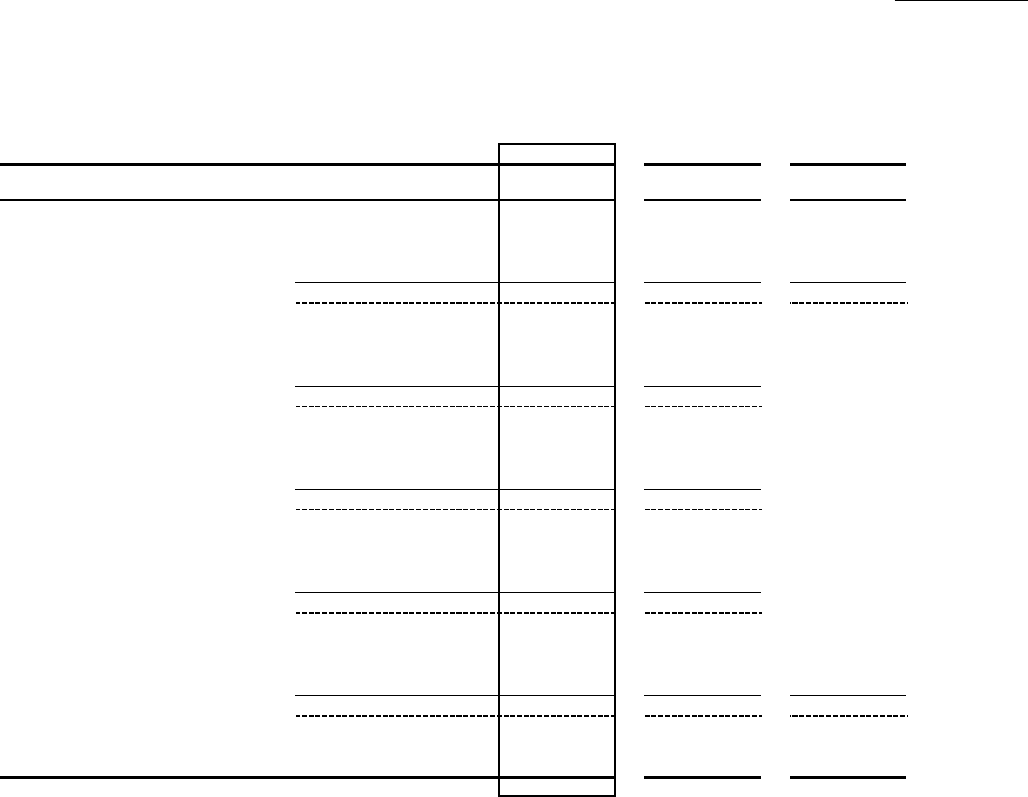

(4) Consolidated sales units, number of new titles, and sales units forecast

Sales Units in Ten Thousands

Number of New Titles Released

Actua

l

Actua

l

Life-to-dat

e

Forecas

t

Apr. '20-Mar. '21 Apr. '21-Mar. '22 Mar. '22 Apr. '22-Mar. '23

Nintendo Switch

(

Total

)

Hardware Japan

660 519 2,523

The Americas

1,115 876 4,203

Europe

715 602 2,760

Other

393 309 1,279

Total

2,883 2,306 10,765 2,100

Japan

478 256 1,878

The Americas

707 522 3,208

Europe

502 404 2,215

Other

345 174 1,044

Total

2,032 1,356 8,345

Japan

- 161 161

– OLED Model

The Americas

- 194 194

Europe

- 112 112

Other

- 113 113

Total

- 580 580

Japan

181 102 484

The Americas

409 159 801

Europe

213 86 433

Other

48 22 123

Total

851 370 1,840

Software Japan

4,502 4,214 15,436

The Americas

10,242 10,827 36,927

Europe

6,624 6,578 23,793

Other

1,720 1,888 6,062

Total

23,088 23,507 82,218 21,000

New titles Japan

291 327 1,176

The Americas

348 361 1,407

Europe

325 382 1,417

[Notes]

1.

Software sales units include both packaged and downloadable versions of software, and do not include download-only software or add-on content.

2.

The number of new titles is the number of packaged software.

3.

Actual software sales units include the quantity bundled with hardware.

4.

Forecasted software sales units do not include the quantity to be bundled with hardware.

of which Nintendo Switch

of which Nintendo Switch

of which Nintendo Switch Lite

Nintendo Co., Ltd.

(5)Changes of Directors(as of June 29, 2022)

① Anticipated new Director

Director (Audit and Supervisory

Committee Member)

Takuya Yoshimura (Current: Deputy General Manager, General Affairs

Division

General Manager, Legal Department and Tokyo

Branch Office)

② Retirement of a Director

Director (Audit and Supervisory

Committee Member)

Naoki Noguchi

(6)Changes of Executive Officers(as of June 29, 2022)

Role Change of an Executive Officer

Director,

Managing Executive Officer

*The areas of responsibility are

shown to the right.

Satoru Shibata (Current: Director,

Senior Executive Officer

General Manager, Marketing Division and Licensing

Division

In charge of Global Communications Division)

*The management changes will be effective upon approval at the 82nd Annual General Meeting of Shareholders to be held on June

29, 2022 and the subsequent Board of Directors meeting.

Nintendo Co., Ltd.