4-1

CHAPTER 4: CREDIT UNDERWRITING

Overview

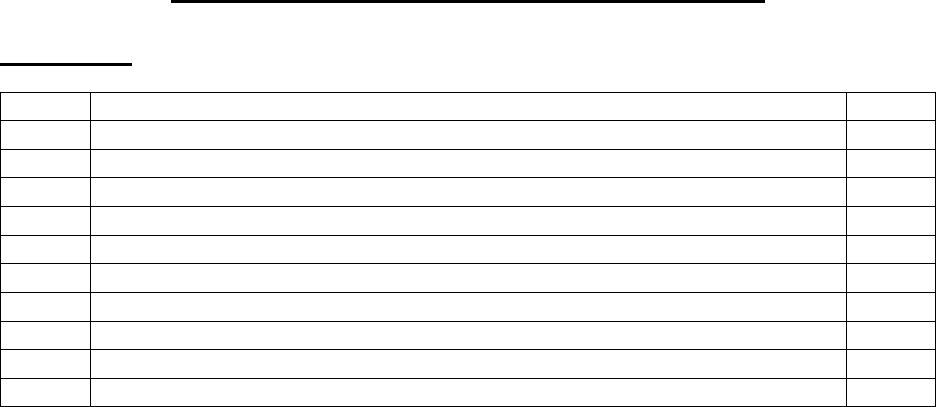

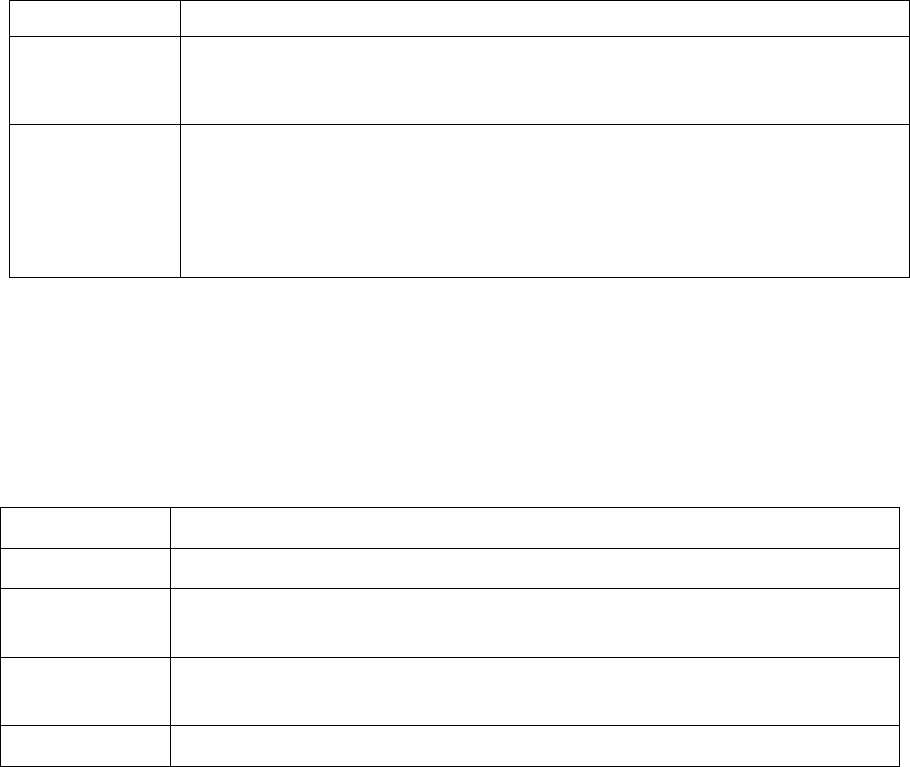

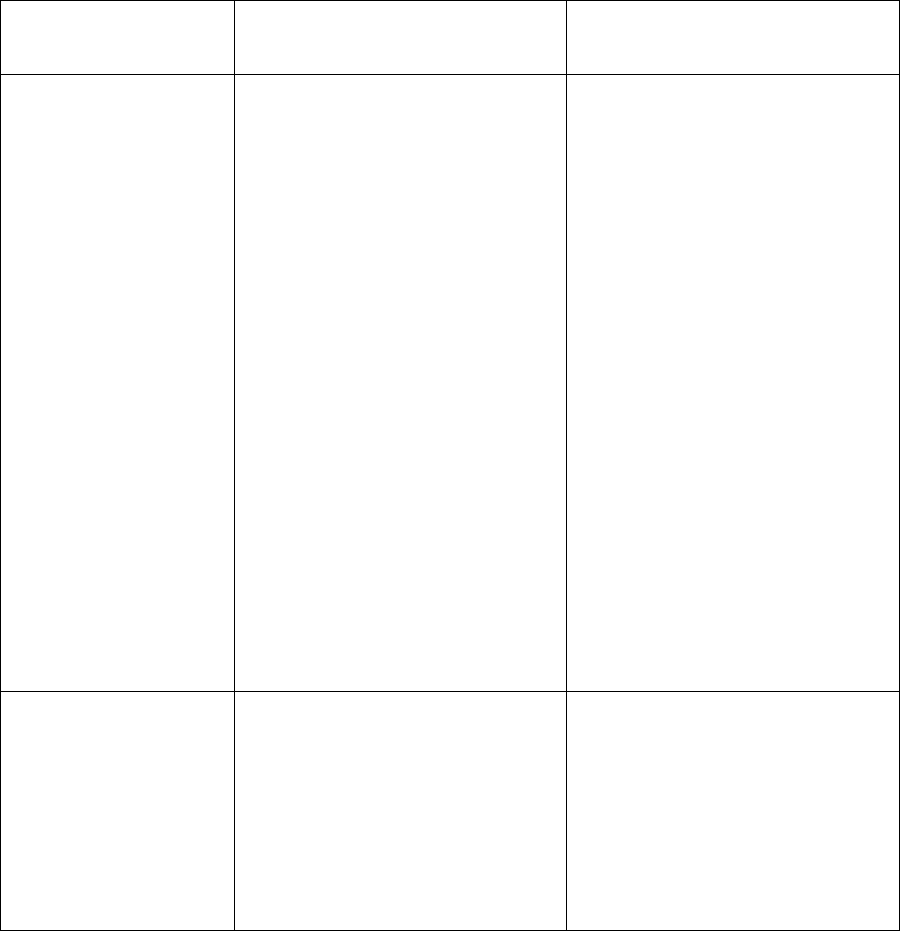

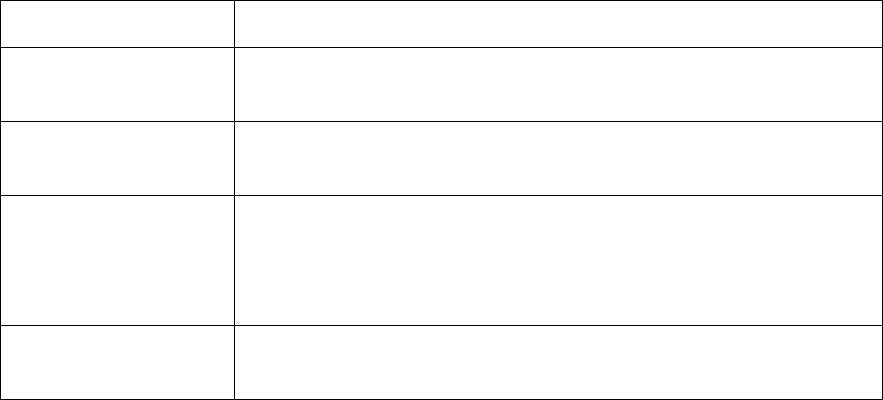

Topic

Title

Page

1

General Underwriting Information

4-2

2

Income – Required Documentation and Analysis

4-5

3

Income Taxes and Other Deductions

4-22

4

Assets and Closing Requirements

4-24

5

Debts and Obligations

4-26

6

Debts Owed to the Federal Government

4-31

7

Credit History – Required Documentation and Analysis

4-35

8

Automated Underwriting Cases (AUS)

4-41

9

How to Complete VA Form 26-6393, Loan Analysis

4-48

10

How to Analyze the Information on VA Form 26-6393, Loan Analysis

4-53

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-2

Topic 1: General Underwriting Information

Change Date: February 22, 2019

· This chapter has been revised in its entirety.

a. Underwriting Information

VA Underwriting Standards require lenders to always utilize the following guidance when

underwriting VA-guaranteed loans:

Lenders are encouraged to make VA loans to all qualified Veterans who apply. VA’s

underwriting standards are intended to provide guidelines for underwriters. Decisions must

be based on sound application of the standards, and underwriters are expected to use good

judgment and flexibility in applying underwriting guidelines. Not all possible circumstances

are addressed therefore, underwriters must apply reasonable judgment and flexibility in

administering this important Veterans’ benefit.

b. Basic Requirements

By law, VA may only guarantee a loan when it is possible to determine that the Veteran is a

satisfactory credit risk, and has present or verified anticipated income that bears a proper

relation to the anticipated terms of repayment.

VA’s underwriting standards are incorporated into VA regulations at 38 C.F.R. 36.4340 and

explained in this chapter. This chapter addresses the procedures for verifications and analysis

involved in underwriting a VA-guaranteed loan. In the event the lender fails to perform their

responsibilities, VA may take administrative actions including removal of authority to

underwrite and close VA loans.

c. Lender’s Responsibility

Lenders are responsible for:

· developing all credit information,

· properly obtaining all required verifications and the credit report,

· ensuring the accuracy of all information on which the loan decision is based,

· complying with the law and regulations governing VA’s underwriting standards, and

with VA’s underwriting policies, procedures, and guidelines, and certifying as to

compliance with all of the above.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-3

Topic 1: General Underwriting Information, continued

d. Lender’s Procedures

Digital signatures can be accepted as an original signature or wet signature as defined by the

Electronic Signatures in Global and National Commerce Act, commonly referred to as the E-

sign Act.

The procedures on the table below address only the credit underwriting of the loan. Chapter 5

of this handbook provides all procedures that must be completed when making a VA loan.

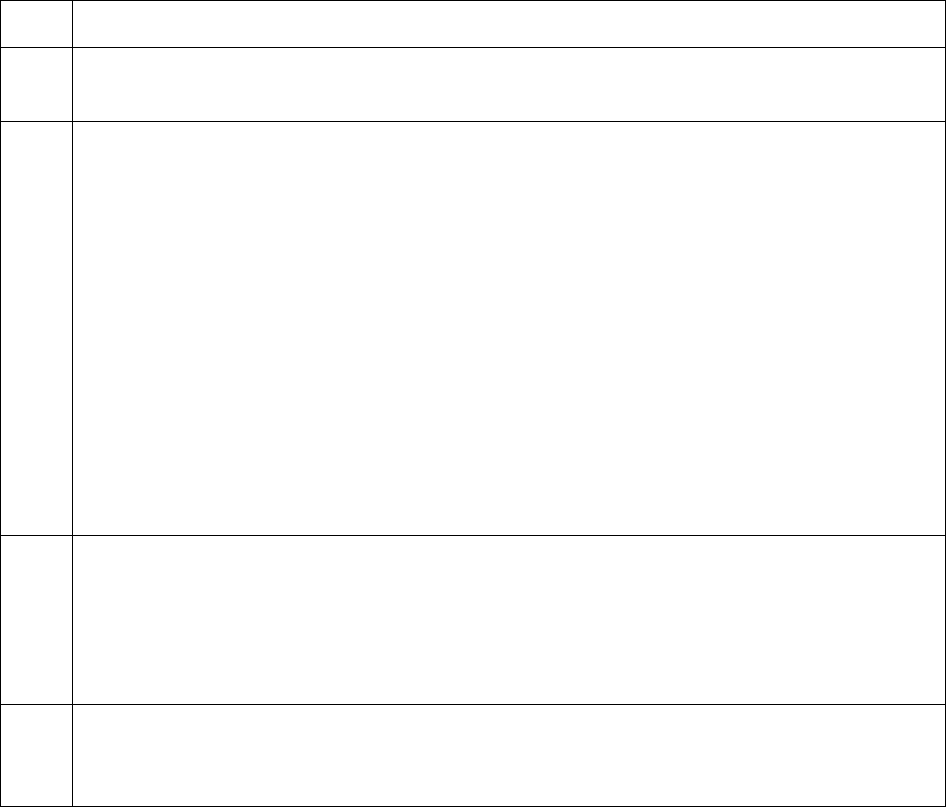

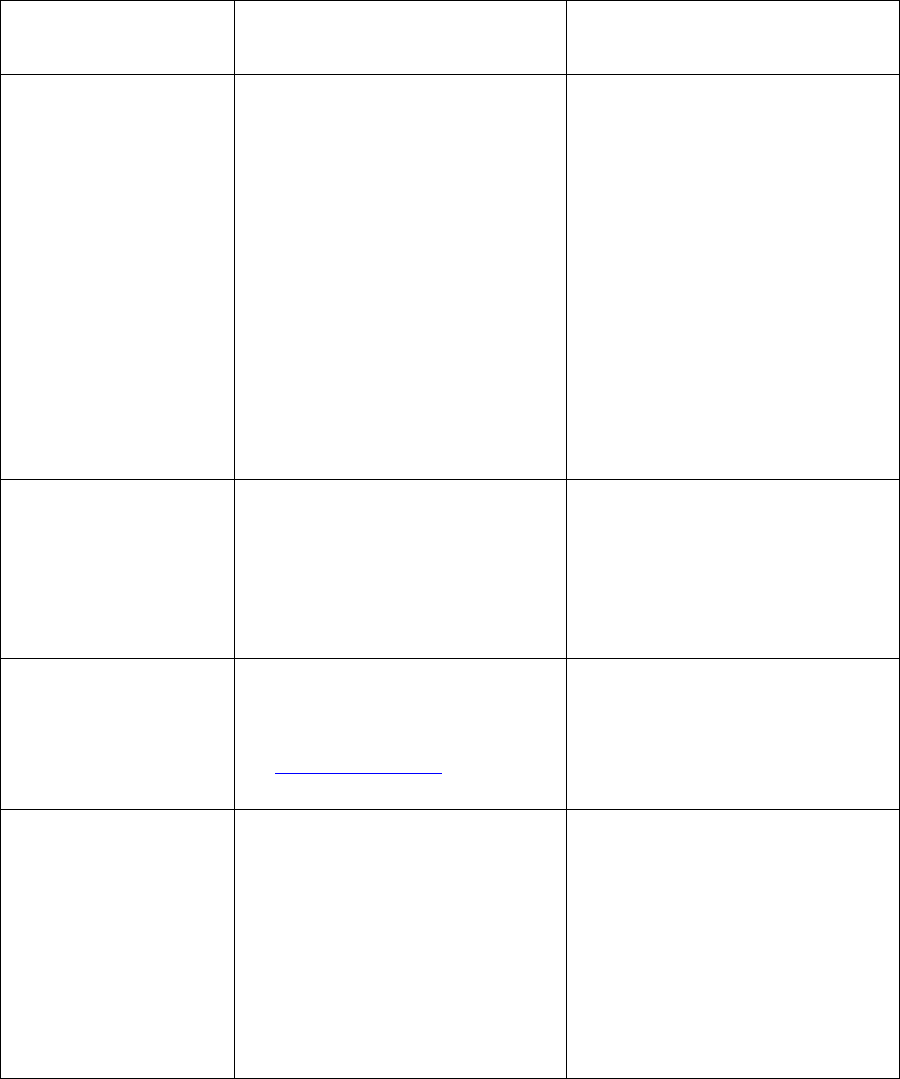

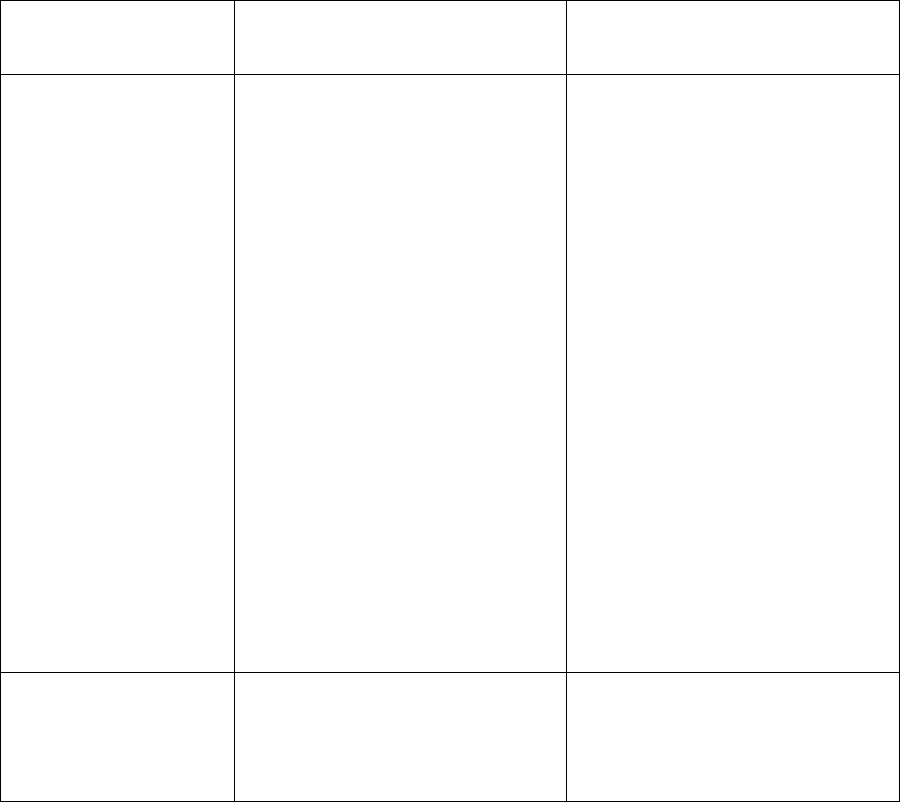

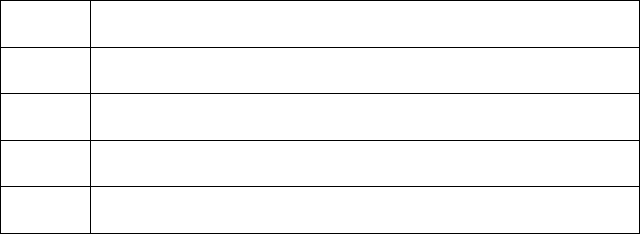

Table 1: Lender’s Credit Underwriting Procedures

Step

Action

1

Initiate the VA and Credit Alert Interactive Voice Response System (CAIVRS)

inquiries described in Topic 4, Subsection c of this chapter.

2

Obtain all necessary verifications.

The borrower’s authorization can be obtained separately for the lender’s required

verifications, or on one blanket authorization form.

The Certificate of Eligibility (COE) obtained from WebLGY provides verification of

the amount of the Veteran’s available entitlement, verification of exempt/non-exempt

from the VA Funding Fee, and the amount of VA monthly service connected disability

compensation. Order the COE before ordering the VA appraisal.

The tri-merged credit report and verifications can be ordered by the lender or its agent

or a party designated by the lender to perform that function. However, these documents

must always be delivered by the credit reporting agency or verifying party directly to

the lender or its agent, and never to another party. VA only permits the Veteran to pay

for the credit report invoiced amount, not any additional costs that the lender may incur

through other parties for obtaining the credit report.

3

Complete VA Form 26-6393, Loan Analysis, in conjunction with a careful review of the

loan application and supporting documentation. Provide any explanations in Item 47-

Remarks.

The form is not required for Interest Rate Reduction Refinancing Loans (IRRRL) except

IRRRLs to refinance delinquent VA loans.

4

Indicate the loan decision in Item 51 of the VA Form 26-6393, Loan Analysis, after

ensuring that the treatment of income, debts, and credit is compliant with VA

underwriting standards.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-4

Topic 1: General Underwriting Information, continued

e. Underwriting Special Types of Loans

The underwriting standards and procedures explained in this chapter generally apply to

purchase and regular “cash-out” refinance loans. However, some special underwriting

considerations also apply and can be found in Chapter 7 of this handbook.

f. Refinancing Loans

The underwriting standards detailed in this chapter apply to purchases and regular “cash-out”

refinances. IRRRLs generally do not require any underwriting unless the loan is delinquent.

IRRRLs made to refinance VA loans 30 days or more past due must be submitted to VA for

prior approval underwriting. The underwriter must have concluded that:

· the circumstances that caused the delinquency have been corrected, and

· the Veteran can successfully maintain the new loan.

· Refer to Chapter 6 of this handbook for details on all types of refinancing loans.

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-5

Topic 2: Income – Required Documentation and Analysis

Change Date: February 22, 2019

· This chapter has been revised in its entirety.

a. Underwriter’s Objectives

It is the underwriter’s objective to identify and verify income available to meet:

· the mortgage payment,

· other shelter expenses,

· debts and obligations, and

· family living expenses.

b. Effective Income

Income is considered effective when it is determined to be verifiable, stable and reliable, and

anticipated to continue for the foreseeable future. Income analysis is not an exact science. It

requires the lender to underwrite each loan on a case-by-case basis, using good judgement

and flexibility when warranted.

To determine whether income is stable and reliable, the probability of continued employment

must be determined through examination of the:

· borrower’s past employment record,

· borrower’s training, education, and qualifications for his or her current position, and/or

· type of employment.

· Only verified income can be considered in the repayment calculation.

c. Spousal Income

Verify and treat the income of a spouse who will be contractually obligated on the loan the

same as you would the income of a Veteran borrower that will be obligated on the loan.

However, to ensure compliance with the Equal Credit Opportunity Act (ECOA), do not ask

questions about the income of the borrower’s spouse unless the:

· spouse will be contractually liable,

· borrower is relying on the spouse’s income to qualify,

· borrower is relying on alimony, child support, or separate maintenance payments from

the spouse or former spouse, or

· borrower resides and/or the property is in a community property state.

In community property states, information concerning a spouse may be requested and

considered in the same manner as for the borrower, even if the spouse will not be

contractually obligated on the loan. See Topic 5, subsection a, of this chapter for additional

guidelines for community property states when considering a spouse’s debts and credit

history.

The non-purchasing spouse’s (NPS) credit history does not need to be considered; however,

the NPS’ liabilities must be considered to determine the extent of the household liabilities.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-6

Topic 2: Income – Required Documentation and Analysis, continued

d. ECOA Considerations

Always inform the borrower (and spouse, if applicable) that they do not have to divulge

information on the receipt of child support, alimony, or separate maintenance. However, for

this income to be considered in the loan analysis, it must be divulged and verified.

Income cannot be discounted because of sex, marital status, age, race, or other prohibited

bases under ECOA.

e. Income from Non-Military Employment

Verify a minimum of 2 years of employment. Generally, in the borrower’s current position, 2

years of employment is a positive indicator of continued employment.

If the borrower has been employed by the present employer less than 2 years:

· verify prior employment, plus present employment covering a total of 2 years, or

· provide an explanation of why 2 years of employment could not be verified,

· compare any different types of employment verifications obtained (such as Verification

of Employment (VOE), paystub(s), W2s, and tax returns) for consistency, and

· clarify any substantial differences in the data that would have a bearing on the

qualification of the borrower(s).

Use of Employment Verification Services

Lenders may use any employment verification service that provides the same information as

the “full” verification generated through the “Work Number” for all applicants. Generally,

this will include the following information:

· the current date,

· employer name and address,

· Veteran’s full legal name, social security number (complete or truncated) and job title,

· employment status (Active or Inactive),

· length of employment and start date,

· salary rate and pay frequency,

· average hours per pay period,

· summary of year to date information including base pay, overtime, commissions and

bonuses, and reference number for the verification.

A current paystub is not required with an automated employment verification service.

Additionally, any VA Form 26-8497, Request for Verification of Employment (VOE) may

be an original, faxed, or emailed copy of the original. Previously, VA required an original

VA Form 26-8497. The requirements for obtaining a paystub have not changed. Hence, the

paystub may be an original or a copy certified by the lender to be a true copy of the original.

The lender may not charge a fee to obtain the employment verification information.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-7

Topic 2: Income – Required Documentation and Analysis, continued

e. Income from Non-Military Employment, continued

Verification with VA Standard Documentation

Acceptable verification consists of VA Form 26-8497, Request for Verification of

Employment (VOE) or any format which furnishes the same information as VA Form 26-

8497, plus:

· paystub(s) covering the most recent 30-day period with year-to-date information, if the

employer normally provides a pay stub(s) to the borrower.

· if the employer does not indicate the probability of continued employment on the VOE,

the lender is not required to request anything additional on that subject.

The VOE and paystub(s) must be no more than 120 days old (180 days for new construction)

from the closing date.

· For loans closed automatically, the date of the VOE and pay stub(s) must be within 120

days of the date the note is signed (180 days for new construction) from the closing

date.

· For prior approval loans, the date of the VOE and paystub(s) must be within 120 days

of the date the application is received by VA (180 days for new construction) from the

closing date.

The VOE must be an original document or an electronic copy. The paystub(s) may be an

original, electronic, or a copy certified by the lender to be a true copy of the original

document.

Additional documentation for a borrower(s) employed in building trades or other seasonal or

climate-dependent work must provide, in addition to the standard documentation (VOE and

pay stub(s)), the following:

· Documentation of the borrower’s total earnings year-to-date,

· Signed and dated individual income tax returns for the previous 2 years, and

· If the borrower works out of a union, evidence of the union’s history with the borrower.

Alternative Verification Documentation

Alternative documentation may be submitted in place of a VOE if the lender concludes that

the borrower’s income is stable, reliable, and anticipated to continue for the foreseeable

future; that is, if the borrower’s income qualifies as effective income. Two years of

employment with the same employer is not required to reach this conclusion.

Alternative documentation consists of:

· paystub(s) covering at least the most recent 30-day period with year-to date

information,

· W-2 Forms for the most recent 2 years, and/or

· telephone verification of the borrower’s current employment.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-8

Topic 2: Income – Required Documentation and Analysis, continued

e. Income from Non-Military Employment, continued

Document the date of the verification and the name, title, and telephone number of the person

with whom employment is verified.

If the employer is not willing to give telephone verification of the borrower’s employment or

if verification is in any way questionable, use standard documentation. Alternative

documentation cannot be used.

Paystub(s) and W-2 forms may be originals, electronic, or copies certified by the lender to be

true copies of the originals.

f. Borrower Employed for Less than 12 Months

Generally, employment less than 12 months is not considered stable and reliable. However,

the lender may consider the employment stable and reliable if the facts and documentation

warrant such a conclusion.

Determine whether the borrower’s past employment, training, and/or education equipped him

or her with particular skills that relate directly to the duties of their current position.

If the probability of continued employment is high based on these factors, then the lender

may consider including the income in the total effective income.

An explanation of why income of less than 12 months duration was used must be documented

on the VA 26-6393, Loan Analysis.

If the probability of continued employment is good, but not well supported, the lender may

utilize the income if the borrower has been employed at 12 months, to partially offset debts

of 6 to 24 months duration. An explanation of why income was used to offset debts must be

documented on the VA 26-6393, Loan Analysis.

A borrower may have a valid offer of employment which will begin at or after the anticipated

date of closing which can be verified. All data pertinent to underwriting procedures should be

considered. However, a paystub(s) may not be available.

g. Recent History of Frequent Changes of Employment

Short-term employment in a present position combined with frequent changes of

employment in the recent past requires special consideration to determine stability of income.

Analyze the reasons for the changes in employment.

Give favorable consideration to changes for the purpose of career advancement in the same

or related field.

Favorable consideration may not be possible for changes with no apparent betterment to the

borrower and/or changes from one line of work to another.

If the lender includes the borrower’s income, an explanation of why income of short-term

employment was used, must be documented on VA Form 26-6393, Loan Analysis.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-9

Topic 2: Income – Required Documentation and Analysis, continued

h. Income from Overtime Work, Part Time Jobs, Second Jobs, and Bonuses

Generally, such income cannot be considered stable and reliable unless it has continued and

is verified for 2 years. To include income from these sources as income:

· the income must be consistent,

· there must be a reasonable likelihood that it will continue in the foreseeable future

based on its compatibility with the hours of duty and other work conditions of the

borrower’s primary job and,

· how long the borrower has been employed under such an arrangement.

The lender may use this income, if not eligible for inclusion in income, but verified for at

least 12 months, to offset debts of 6 to 24 months duration. An explanation of why the

income was used to offset must be documented on VA Form 26-6393, Loan Analysis.

i. Income from Commissions

Verify commission income by obtaining the VOE or other written verification which

provides the following:

· the actual amount of commissions paid year-to-date,

· the basis for payments (salary plus commission, straight commission, or draws against

commission, or other), and

· when commissions are paid bi-weekly, monthly, quarterly, semiannually, annually, or

other.

· individual income tax returns, signed and dated, plus all applicable schedules for the

previous 2 years (or additional periods if needed to demonstrate a satisfactory earnings

record).

Analyze Income Derived from Commissions

Generally, income from commissions is considered stable when the borrower has obtained

such income for at least 2 years. Employment for less than 2 years cannot usually be

considered stable unless the borrower has had previous related employment and/or

specialized training. Employment of less than 1 year can rarely qualify; however, in-depth

development is required for a conclusion of stable income on less than 1 year cases.

For a borrower who will qualify using commission income of less than 25 percent of the total

annual employment income, IRS Form 2106 expenses are not required to be deducted from

income even if they are reported on IRS Form 2106. Additionally, the expenses are not

required to be added as a monthly liability for the borrower.

For a borrower earning commission income that is 25 percent or more of annual employment

income, IRS Form 2106 expenses must be deducted from gross commission income

regardless of the length of time the borrower has filed the expenses with the IRS.

One exception is an automobile lease or loan payment. An automobile lease or loan

payments are not subtracted from the borrower’s income; they are considered part of the

borrower’s recurring monthly debts/obligations in Section D on VA Form 26-6393, Loan

Analysis.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-10

Topic 2: Income – Required Documentation and Analysis, continued

j. Self-Employment Income Analysis Guidelines

Obtain a current financial statement in an industry recognized accounting format including:

· Year-To-Date Profit and Loss statement (if the most recent year’s tax return has not yet

been prepared, provide a profit and loss statement for that year),

· current Balance Sheet, and

· individual income tax returns, signed and dated, plus all applicable schedules for the

previous 2 years (or additional periods if needed to demonstrate a satisfactory earnings

record).

· If the business is a corporation or partnership, include copies of the signed federal

business income tax returns for the previous 2 years with all applicable schedules, and a

list of all stockholders or partners showing the interest each holds in the business.

The financial statements must be sufficient for an underwriter to determine the necessary

information for loan approval.

Financial Statements, including a year-to-date Profit and Loss Statement and Balance Sheet

must be completed after one-half of the tax-year has passed to verify current income and

stability of the income.

The lender may require an accountant or Certified Public Accountant-prepared financial

statements if needed to make such a determination due to the nature of the business or the

content of the financial statements

Analyze Income Derived from Self-Employment

Generally, income from self-employment is considered stable when the borrower has

obtained such income for at least 2 years. Less-than-2-years cannot usually be considered

stable unless the borrower has had previous related employment and/or specialized training.

Less-than-1-year can rarely qualify; however, in-depth development is required for a

conclusion of stable income on less-than-1-year cases.

Determine whether the business can be expected to generate sufficient income for the

borrower’s future needs.

If the business shows a steady or significant decline in earnings over the period analyzed, the

reasons for such decline must be analyzed to determine whether the trend is likely to

continue or be reversed.

If it is difficult to determine the probability of continued operation, obtain documentation on

the viability and potential future earnings, and an explanation of the function and financial

operations of the business from a qualified party.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-11

Topic 2: Income – Required Documentation and Analysis, continued

j. Self-Employment Income Analysis Guidelines, continued

Deductions and Expenses Claimed on Tax Returns

Depreciation claimed as a deduction on the tax returns and financial statements of the

business may be included in effective income.

Business or roll over losses must be considered from all tax returns.

What is reported to the IRS on a joint return must be used when applying for a federally

guaranteed loan.

On a joint tax return, the loss must be deducted from the borrower’s income in both

community and non-community property states.

On a joint tax return, when a borrower and co-borrower have been faced with business

losses, the Veteran/borrower and his/her spouse may want to consider both being on the loan

in order to potentially qualify. The credit of both borrowers will be considered.

k. Active Military Borrower’s Income

For active-duty military borrowers, a Leave and Earnings Statement (LES) is required

instead of a VOE. The LES must be an original, electronic, or a copy certified by the lender

to be a true copy of the original.

The LES must furnish the same information as a VOE and must be no more than 120 days

old (180 days for new construction), from the date of closing.

For loans closed automatically, the date of the LES must be within 120 days of the date the

note is signed (180 days for new construction).

For prior approval loans, the date of the LES must be within 120 days of the date the

application is received by VA (180 days for new construction).

In addition, identify servicemembers who are within 12 months of release from active duty or

the end of their contract term. For an enlisted servicemember, find the date of expiration

(ETS) of the borrower’s current contract for active service on the LES. For National Guard or

Reserve members, find the ETS of the borrower’s current contract on the LES. Also, if a

National Guard or Reserve member is currently serving on active duty, also identify the

expiration date of the current active-duty tour. If the date is within 12 months of the projected

date that the loan will close, the loan package must also include one of the following items,

or combinations of items, to be acceptable:

· documentation that the servicemember has already re-enlisted or extended his/her

period of active duty to a date beyond the 12-month period following the projected

closing of the loan, or

· documentation that the servicemember has already re-enlisted or extended his/her

period of active-duty service to a date beyond the 12-month period following the

projected closing of the loan, or

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-12

Topic 2: Income – Required Documentation and Analysis, continued

k. Active Military Borrower’s Income, continued

· verification of a valid offer of local civilian employment and/or verification of military

retirement income following the release from active-duty service, or

· verification of a valid offer of local civilian employment and/or verification of military

retirement income following the release from active-duty service, or

· a statement from the servicemember that he/she intends to re-enlist or extend his/her

period of active-duty service to a date beyond the 12- month period, plus (1) a

statement from the servicemember’s commanding officer confirming that the

servicemember is eligible to re-enlist or extend his/her active-duty service as indicated,

and (2) the commanding officer has no reason to believe that such re-enlistment or

extension of active-duty service will not be granted, or

· documentation of other unusual strong positive underwriting factors, such as a

downpayment of at least 10 percent from the borrower’s own assets (not a gift), a

minimum of 6 months PITI, in cash, after the downpayment from the borrower’s own

assets (not a gift) or clear evidence of strong ties to the community coupled with a non-

military spouse’s income so high that only minimal income from the active-duty

servicemember is needed to qualify.

If an Officer has an ETS date listed as 888888 or 000000 on his or her LES, the above

documentation is not required unless there is evidence that the Officer has resigned his or her

commission.

Example: An Active Duty Veteran’s LES indicates her ETS date listed on her LES is

171031 (October 31, 2017) and the projected date of closing is October 1, 2017. Therefore,

one of the above items is needed to verify future income since her ETS date is less than 12

months from the projected date of closing.

Example: A member of the Reserves has been called to Active Duty. The ETS date on his

LES indicates 181031 (October 31, 2018); however, his active duty orders indicate his active

duty tour will not exceed the next 60 days.

Therefore, since he will be leaving active duty before 12 months of the projected closing

date, the active-duty income cannot be considered, and his civilian employment and drill

duty will need to be considered.

Example: An Active Duty Veteran’s LES indicates his ETS date is less than 1 month from

the anticipated date of closing, and he indicates he will be receiving military retirement and

has accepted civilian employment. Verify his future retirement income from the Department

of Defense and verify future civilian employment with the Veteran’s new employer.

Analysis of Base Pay

Consider the borrower’s base pay as stable and reliable unless the borrower is within 12

months of release from active-duty service. Analyze the additional documentation submitted.

If the borrower will not be re-enlisting, determine whether the borrower’s anticipated source

of income is stable and reliable, and/or unusually strong underwriting factors compensate for

any unknowns regarding future sources of income.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-13

Topic 2: Income – Required Documentation and Analysis, continued

k. Active Military Borrower’s Income, continued

If an Officer has an ETS date listed as 888888 or 000000 on his or her LES, the above

documentation is not required unless there is evidence that the Officer has resigned his or her

commission.

Analysis of Military Quarters Allowance/ Basic Allowance for Housing (BAH)

Include a military quarters allowance in effective income if properly verified. In most areas,

there will be an additional variable housing allowance, which can also be included. The

military quarters and variable housing allowances are not taxable income. The lender must

verify the amount of BAH the Veteran will receive. The BAH amount will change from one

duty station to another.

Ensure that the borrower meets the occupancy requirements set forth in Chapter 3 of this

handbook.

Verification and Analysis of Basic Allowance for Subsistence (BAS) and Clothing

Allowances

Any subsistence (rations) and clothing allowances are indicated on the LES. The lender may

include verified allowances in effective income. These allowances are not taxable income.

The clothing allowance generally appears on the LES as an annual amount. Convert the

annual amount to a monthly amount for the Loan Analysis.

Verification and Analysis of Other Military Allowances

To consider a military allowance in the underwriting analysis, obtain verification of the type

and amount of the military allowance, how long the borrower has received it and the

continuance into the foreseeable future.

Military allowances may be included in effective income only if such income can be

expected to continue because of the nature of the borrower’s assigned duties. Such

allowances include, but are not limited to:

· proficiency pay, such as linguistic, parachute, scuba, flight or hazard pay, and

· overseas or combat pay (sea pay, submarine, etc.)

All types of allowances above are subject to periodic review and/or testing of the recipient to

ascertain whether eligibility for such pay will continue. Only if it can be shown that such pay

has continued for a prolonged period and can be expected to continue because of the nature

of the recipient's assigned duties, should the income be added to base pay. Contact the

borrower’s chain of command if there are questions regarding the continuance of the income.

If the duration of the military allowance cannot be determined, this source of income may

still be used to offset short term obligations of 6 to 24 months duration.

Consult the IRS to determine if any allowances for pay are considered taxable income by the

IRS, unlike housing, clothing, and subsistence allowances.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-14

Topic 2: Income – Required Documentation and Analysis, continued

l. Income and Analysis of Income from Service in the Reserves or National Guard

Income derived from service in the Reserves or National Guard may be used if the borrower

has served in such capacity for a period of time sufficient to indicate a good probability that

such income will continue beyond 12 months. The total period of active-duty and reserve

service may be helpful in this regard. Otherwise, this income may be used to offset

obligations of 6 to 24 months duration.

Income from Recently Activated Members of the Reserve or National Guard

Lenders must consider if a borrower, whose income is being used to qualify for a loan, may

have a change in income due to participation in a Reserves/National Guard unit subject to

activation.

If an activated Reserves/National Guard member applies for a loan, they must present orders

indicating their current active duty tour is not to exceed 12 months.

Example: The borrower’s full-time civilian employment is $3,000 per month. The

borrower’s current income from the Reserves due to activation is $3,500 per month and

orders are for 12 months. Since the borrower’s full-time civilian employment is only $3,000

per month, the $3,000 should be used to qualify the borrower.

There are not any clear-cut procedures that can be applied to all cases. Evaluate all aspects of

each individual case, including credit history, accumulation of assets, overall employment

history, and make the best decision for each loan regarding the use of income in qualifying

for the loan.

It is very important that loan files be carefully and thoroughly documented, including any

reasons for using or not using Reserve/National Guard income in these situations.

As a lender, the goal is to provide the Veteran their benefit without placing him/her in a

financial hardship.

m. Verification and Analysis of Income of Recently Discharged Veterans or Veterans to be

Discharged from the Military

See the Income from Non-Military Employment in Topic 2, subsection e of this chapter for

verification requirements.

Obtain verification that any of the following income types apply:

· employment income,

· retirement income, and/or

· VA disability income.

VA disability income is considered a benefit and does not need to be documented for the

likelihood of continuance.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-15

Topic 2: Income – Required Documentation and Analysis, continued

m. Verification and Analysis of Income of Recently Discharged Veterans or Veterans to be

Discharged from the Military, continued

VA disability income verification will be placed on the COE. However, there are some

instances where this income is not placed on the COE which may include if the Veteran:

· will be discharging within the next 6 months from the military and has completed a

Physical Exam Board (PEB) or Medical Review Board (MEB) and will be filing for

VA disability while still on active duty,

· has recently filed for VA disability and VA’s Compensation Service has not yet made a

determination and would be entitled to receive VA disability benefits,

· would be entitled to receive VA disability benefits, but for the receipt of retired pay,

· has received VA disability benefits in the past, or

· is an unmarried surviving spouse of a Veteran who is eligible for or receiving

qualifying Disability and Indemnity Compensation (DIC), or

· is in receipt of a VA nonservice connected pension, or

· has a VA-appointed Fiduciary to handle financial matters.

If the Veteran falls under one of the above categories, perform the following:

· Submit by fax VA Form 26-8937, Verification of VA Benefits, to the VA Regional

Loan Center (RLC) where the subject property is located. VA will complete and return

the form to the lender by return fax.

· Provide any supporting documents, including the COE, if it states to send VA Form 26-

8937, Verification of Benefits to VA, to verify a Veteran’s monthly income from VA.

Please note that if VA’s Compensation Service has not yet issued a memo rating and/or

completed a claim for a Veteran, then the amount the Veteran may receive in the future

cannot be determined until the claim has been completed.

Until the Veteran begins receiving the monthly award, the amount cannot be placed on the

COE. A VA awards letter can be used to verify the amount and date a future monthly VA

compensation award will begin. However, the COE may be updated to reflect if the Veteran

is exempt from paying the VA funding fee on a future disability award. See Chapter 8 of this

handbook for funding fee exemptions.

The loan cannot be submitted for prior approval, or approved under the automatic procedure,

until the lender obtains the completed form from VA when the Veteran or surviving spouse is

under one of the above categories in subsection m of this topic. The lender must maintain the

completed form with the loan package.

If the form indicates that the borrower receives a non service-connected pension or has a VA

Fiduciary, the loan cannot be closed automatically. The loan must be uploaded in WebLGY

for prior approval. See Chapter 5 of this handbook for the necessary documentation that must

be submitted to VA.

VA must review, underwrite, and issue a Certificate of Commitment before the loan can

close. See Chapter 5 of this handbook for prior approval procedures.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-16

Topic 2: Income – Required Documentation and Analysis, continued

m. Verification and Analysis of Income of Recently Discharged Veterans or Veterans to be

Discharged from the Military, continued

VA’s Pension Service may also have to review and/or approve the application in addition to

Loan Production. The VA RLC will coordinate with the Pension Service upon receipt of the

underwriting package.

Allow for additional processing time of a prior approval loan application when

Compensation and/or Pension Service must also review.

Analysis of Prospects for Continued Employment

Cases involving recently discharged Veterans often require the underwriter to exercise a

great deal of judgment and flexibility in determining whether the employment income will

continue in the foreseeable future. This is because some Veterans may have little or no

employment experience other than their military occupation.

Continuity of employment is essential for a Veteran with no retirement income, or

insufficient retirement income, to support the loan obligation. If the duties the borrower

performed in the military are similar or directly related to the duties of the present position,

use this as one indicator that the employment is likely to continue.

Most cases fall somewhere between these extremes. Fully develop the facts of each case to

make a determination. The guidelines under Self-Employment Income in Topic 2, subsection

j of this chapter provide guidance for a recently discharged Veteran who is self-employed.

n. Rental Income

When all or a portion of the borrower’s income is derived from rental income, documentation

and verification of the income are necessary to determine the likelihood of continuance.

Verification of Rental Offset of the Property Occupied Prior to the New Home

Obtain a copy of the rental agreement for the property, if any.

Analysis using Rental Offset of the Property Occupied Prior to the New Loan

Use the prospective rental income only to offset the mortgage payment on the rental

property, and only if there is not an indication that the property will be difficult to rent. This

rental income may not be included in effective income.

Obtain a working knowledge of the local rental market. If there is not a lease on the property,

but the local rental market is very strong, the lender may still consider the prospective rental

income for offset purposes. Provide a justification on VA Form 26-6393, Loan Analysis.

Reserves are not needed to offset the mortgage payment on the property the Veteran occupies

prior to the new loan.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-17

Topic 2: Income – Required Documentation and Analysis, continued

n. Rental Income, continued

Example [Rental Offset of the Property Occupied Prior to the New Loan]: The Veteran’s

current home has a VA mortgage with a monthly PITI payment of $1,000. Bonus entitlement

is being used to purchase a new primary residence and the Veteran will rent the previous

home for $1,200 monthly upon closing of the new home. The payment of $1,200 can be used

to offset the existing mortgage payment, if all the above conditions are met. The additional

rent received in excess of the mortgage payment cannot be used as effective income.

Verification of Rental Property Income

Obtain the following:

· documentation of cash reserves totaling at least 3 months mortgage payments (PITI),

and

· individual income tax returns, signed and dated or lender obtained tax transcripts, plus

all applicable schedules for the previous 2 years, which show rental income generated

by the property.

If the borrower has multiple properties, the borrower must have 3 months PITI documented

for each property to consider the rental income.

If there is not a lien on the property, 3 months reserves to cover expenses such as taxes,

hazard insurance, flood insurance, homeowner’s association fees, and any other recurring

fees should be documented for the property(ies).

Equity in the property cannot be used as reserves.

Cash proceeds from a VA refinance cannot be counted as the required PITI on a rental

property. The reserve funds must be in the borrower’s account before the new VA loan

closes.

Gift funds cannot be used to meet reserve requirements.

Analysis of Rental Property Income

Each property(ies) must have a 2-year rental history itemized on the borrower’s tax return.

Property depreciation claimed as a deduction on the tax returns may be included in effective

income.

If after adding depreciation to the negative rental income, the borrower still has rental loss,

the negative income should be deducted from the overall income as it reduces the borrower’s

income.

If rental income will not, or cannot be used, then the full mortgage payment should be

considered and reserves do not need to be considered.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-18

Topic 2: Income – Required Documentation and Analysis, continued

n. Rental Income, continued

Verification of Multi-Unit Property Securing the VA loan

The Veteran/borrower must occupy one unit as his/her residence.

For purposes of determining the VA guaranty, lenders are instructed to reference only the

One-Unit Limit column in the FHFA Table “Fannie Mae and Freddie Mac Maximum Loan

Limits for Mortgages, located at https://www.fhfa.gov/DataTools/Downloads.

Verify cash reserves totaling at least 6 months mortgage payments (PITI), and documentation

of the borrower’s prior experience managing rental units and/or use of a property

management company to oversee the property.

Analysis of Multi-Unit Property Securing the VA loan (Veteran will occupy one unit as

his/her residence)

Include the prospective rental income in effective income only if:

· the borrower has a reasonable likelihood of success as a landlord, and

· cash reserves totaling at least 6 months mortgage payments (PITI).

If each unit is separate and not under one mortgage, 6 months PITI must be verified for each

separate unit.

Equity in the property cannot be used as reserves to meet PITI requirements. This must be

the borrower’s own funds, not a gift.

Cash proceeds from a VA regular “Cash-Out” refinance cannot be counted as the required

PITI on a rental property. The reserve funds must be in the borrower’s account before the

new VA loan closes.

The amount of rental income to include in effective income is based on 75 percent of the

amount indicated on the lease or rental agreement unless a greater percentage can be

documented (existing property).

The amount of rental income to include in effective income is based on 75 percent of the

amount indicated on the appraiser’s opinion of the property’s fair monthly rental (proposed

construction).

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-19

Topic 2: Income – Required Documentation and Analysis, continued

o. Temporary Boarder Rental Income Single Family Residence

The verification of temporary boarder rental income requires the following:

· individual income tax returns, signed and dated, plus all applicable schedules for the

previous 2 years, which show boarder income generated by the property, and

· the rental cannot impair the residential character of the property and cannot exceed 25

percent of the total floor area.

Analysis of Temporary Boarder Rental Income

Include rental income in effective income only if the borrower has a reasonable likelihood of

continued success due to the strength of the local market. Provide a justification on VA Form

26-6393, Loan Analysis.

PITI reserves are not necessary to consider the income, and all the income may be used in the

analysis.

p. Alimony, Child Support, and Maintenance Payments

Verify the income if the borrower wants it to be considered. The payments must be likely to

continue for at least 3 years from the anticipated closing date to include them in effective

income.

Factors used to determine whether the payments will continue include, but are not limited to:

· whether the payments are received pursuant to a written agreement or court decree,

· the length of time the payments have been received,

· the regularity of receipt, and

· the availability of procedures to compel payment.

See “ECOA Considerations” in Topic 2, subsection d of this chapter.

q. Automobile or Similar Allowances

Generally, automobile allowances are paid to cover specific expenses related to a borrower’s

employment, and it is appropriate to use such income to offset a corresponding car payment.

However, if the borrower reports an allowance as part of monthly qualifying income, it must

be determined if the automobile expense reported on IRS Form 2106 should be deducted

from income or treated as a liability.

If the reported expense is less than the automobile allowance, the amount can be treated as

income and added to borrower’s monthly income.

If the reported expense exceeds the automobile allowance, the amount must be deducted from

income as a net calculation in Section D on VA Form 26-6393, Loan Analysis.

Likewise, any other similar type of allowance received by the borrower should be considered

with regards to the tax returns for determination of an offset of the corresponding obligation,

as income, or as an expense.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-20

Topic 2: Income – Required Documentation and Analysis, continued

r. Other Types of Income

While not all types of income can be listed, documentation of income must support the

history of receipt and the likelihood or continuance of the income for at least 3 years from the

anticipated closing date to include in effective income. Otherwise, consider whether it is

reasonable to use the income to offsets short term obligations of 6 to 24 months duration.

“Other” types of income which may be considered as effective income include, but are not

limited to:

· pension or other retirement benefits,

· disability income,

· dividends from stocks or other,

· interest from bonds, savings accounts, or others,

· royalties,

· notes receivable, and

· trusts

VA disability income is considered a benefit and does not need to be documented for the

likelihood of continuance. A COE will generally have the amount of VA disability income

listed, however, see Topic 2, subsection m of this chapter for exceptions.

A VA award letter or bank statement may also verify the current monthly amount received.

The lender may include verified income from public assistance programs in effective income

if evidence indicates it will likely continue for 3 years or more.

The lender may include workers’ compensation income that will continue for at least 3 years

from the anticipated closing date if the borrower chooses to reveal it.

The lender may include verified income received specifically for the care of any foster

child(ren), only to balance the expenses of caring for the foster child(ren) against any

increased residual requirements.

Example: The borrower(s) receive a stipend paid by the county or State for two foster

children living in the residence. Instead of considering a family size of four, a family size of

two should be used to determine the residual income requirement.

Do not include temporary income items such as VA educational allowances (including the

Post 9/11 GI Bill benefit) and unemployment compensation in effective income.

Exception: If unemployment compensation is a regular part of a borrower’s income due to

the nature of his/her employment (for example, seasonal work), it may be included.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-21

Topic 2: Income – Required Documentation and Analysis, continued

r. Other Types of Income, continued

A borrower in receipt of VA Pension or Disability benefits with Aid and Attendance should

be discussed with the VA Pension Service, VA Compensation Service, or the VA Hospital

where the property is located, to determine if the income is likely to continue for the

foreseeable future.

If a borrower has a contract for employment in a foreign country (whether or not the

employer is a US company or corporation), the income can be used if it is verified, stable,

and reliable. While some contracts are renewed yearly, consider the borrower’s past

employment history and the likelihood of the contract being extended.

Income that is paid by a foreign employer or government in foreign currency should be

converted to US dollars.

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-22

Topic 3: Income Taxes and Other Deductions

Change Date: February 22, 2019

· This chapter has been revised in its entirety.

a. Income Tax and Social Security Deductions

Determine the appropriate deductions for Federal income tax and Social Security using the

“Employer’s Tax Guide”, Circular E, issued by the Internal Revenue Service (IRS).

Determine the appropriate deductions for state and local taxes using similar materials

provided by the states.

The income tax should be based upon the borrower’s residence and what is documented in

the guide to the IRS, and not solely the amount claimed on the paystub.

An active-duty servicemember’s LES may have a different state tax deduction than the state

where the active-duty servicemember will be purchasing a residence or refinancing. Select

the state listed on the LES for the state taxes to be considered in state tax deductions.

The lender may consider the borrower’s potential tax benefits from obtaining the loan (for

example, mortgage interest deduction) in the analysis. To do so:

· determine what the borrower’s withholding allowance will be, using the instructions

and worksheet portion of IRS Form W-4, Employee’s Withholding Allowance

Certificate, and

· apply that withholding number when calculating Federal and state income tax

deductions on VA Form 26-6393, Loan Analysis, then

· document the change in deductions in Item 47, Remarks, on VA Form 26-6393, Loan

Analysis.

b. Income Tax Credits from Mortgage Credit Certificates (MCC)

MCCs issued by state and local governments may qualify a borrower for a Federal tax credit.

The Federal tax credit is based on a certain percentage of the borrower’s mortgage interest

payment. Lenders must provide a copy of the MCC to VA with the loan package which

indicates:

· documentation verifying any expenses charged by the local government entity for the

program which is listed on the Closing Disclosure Statement, and

the percentage to be used to calculate the tax credit, and if applicable, the amount of the

indebtedness. The certified indebtedness can be comprised of a loan incurred by the borrower

to acquire a principal residence or a qualified home improvement rehabilitation loan.

There is an IRS annual limit on the tax credit equal to the lesser of the borrower’s maximum

tax liability or $2,000. Calculate the tax credit by applying the specified percentage to the

interest paid on the certified indebtedness. Then apply the annual limit.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-23

Topic 3: Income Taxes and Other Deductions, continued

b. Income Tax Credits from Mortgage Credit Certificates (MCC), continued

Example: The MCC shows a 30 percent rate and $100,000 certified indebtedness. The

borrower will pay approximately $8,000 in annual mortgage interest. The borrower’s

estimated total Federal income tax liability is $9,000. Calculate the tax credit as follows:

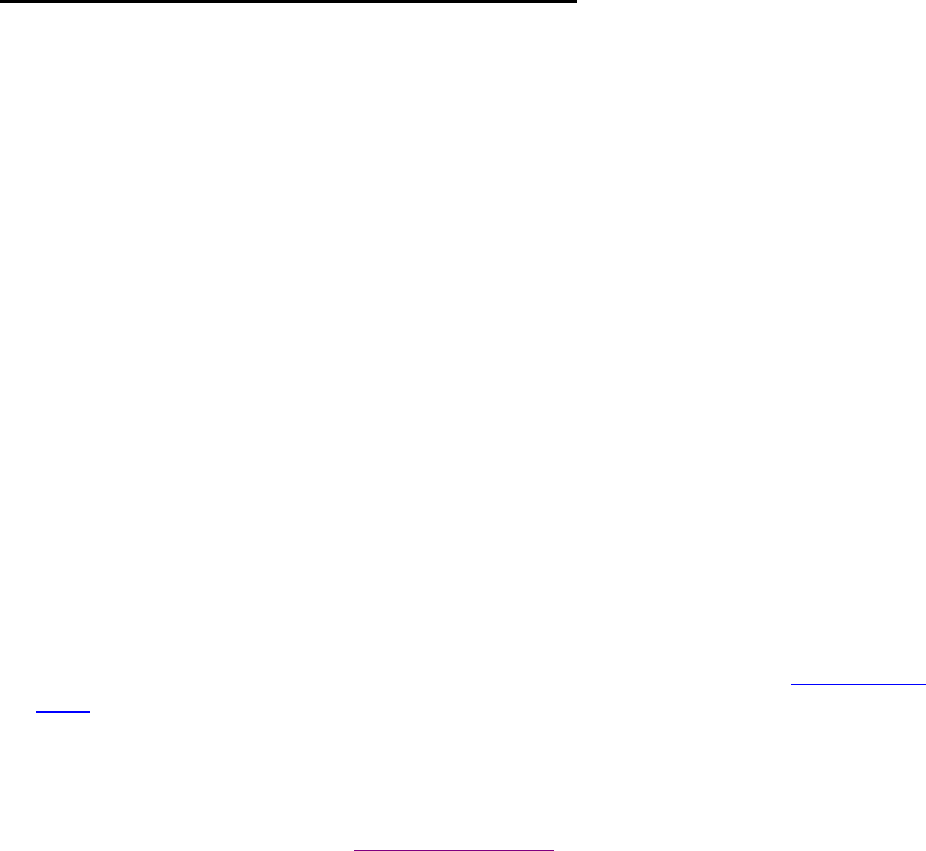

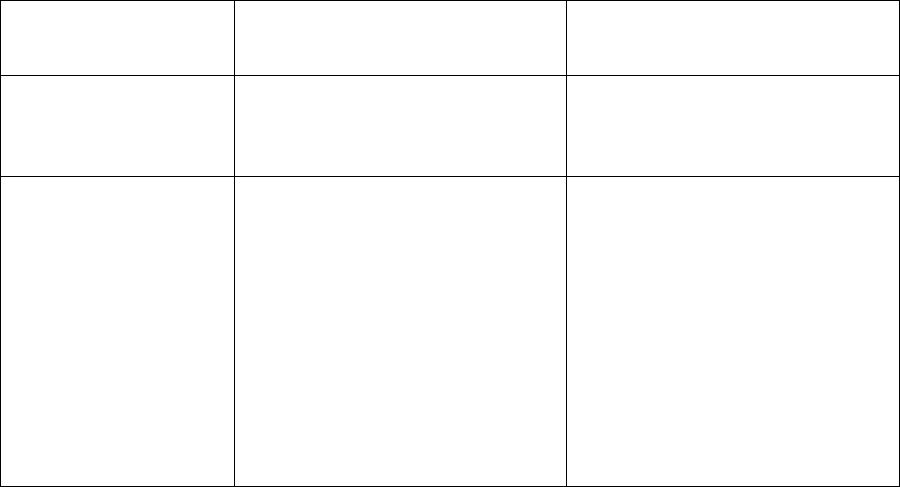

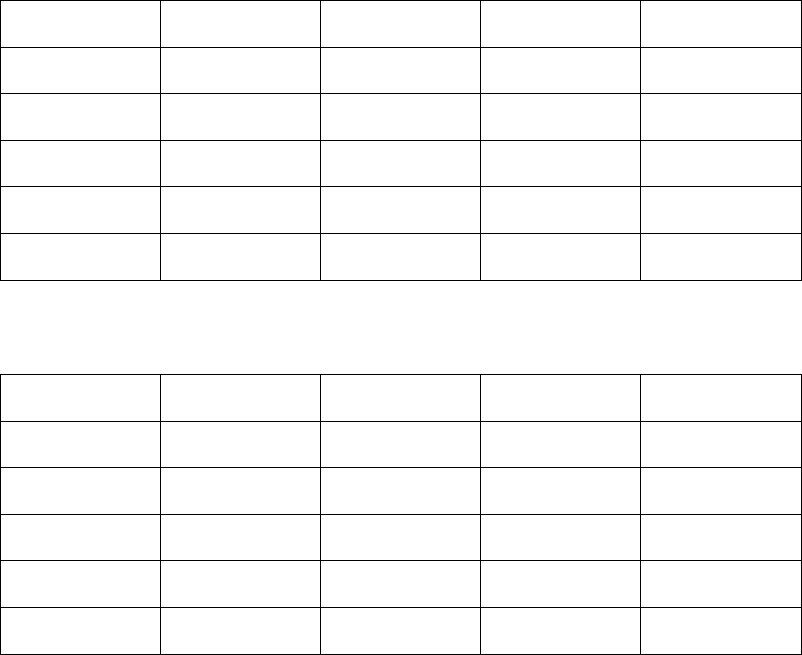

Table 2: MCC Calculation

Step

Procedure

1

30 percent of $8,000 = $2,400

2

Apply the IRS annual $2,000 limit

3

The tax credit will be $2,000

This allows use of $167 (one twelfth of $2,000) as income to qualify the borrower.

If the mortgage on which the borrower pays interest is greater than the amount of certified

indebtedness, limit the interest used in the tax credit calculation to that portion attributable to

the certified indebtedness.

Since these programs are offered by state and local government(s), pre- approval by VA is

not required for the borrower to participate in the program. The lender is responsible to

determine all eligibility requirements are met by the borrower to participate in the program.

c. Other Deductions from Income

Include any costs for job-related expenses, child care, significant commuting costs, and any

other direct or incidental costs associated with the borrower’s or spouse’s employment.

For children up to the age of 12 years, the lender is responsible for determining if there are

any child care expenses for the borrower(s).

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-24

Topic 4: Assets and Closing Requirements

Change Date: February 22, 2019

· This chapter has been revised in its entirety.

a. Assets and Amount of Cash Required for Closing

The borrower(s) must have sufficient cash assets to cover:

· any closing costs, pre-paids, or discount points which are the borrower’s responsibility

and are not financed into the loan, and

· the difference between the sales price and the loan amount, if the sales price exceeds the

reasonable value established by VA (i.e. negative equity).

VA does not require the borrower(s) to have additional cash to cover a certain number of

mortgage payments, unplanned expenses or other contingencies on the residence, or

refinance of the Veteran’s residence.

However, the borrower’s ability to accumulate liquid assets and the current availability of

liquid assets for unplanned expenses should be considered in the overall credit analysis.

Reserves are required for borrowers using rental income to qualify. See Topic 2, subsection n

of this chapter for more information.

A rental offset does not require additional assets to cover PITI. See Topic 2, subsection n of

this chapter for more information.

The assets securing a loan(s) against deposited funds (signature loans, cash value life

insurance policies, 401(k) loans, other) may not be included as an asset on the VA Form 26-

6393, Loan Analysis. See Topic 5 of this chapter for more information.

b. Verification of Assets and Cash to Close Requirements

Verify all liquid assets owned by the borrower(s) to the extent they are needed to close the

loan. In addition, verify any liquid assets that may have a bearing on the overall credit

analysis (significant assets). Use VA Form 26-8497a, Request for Verification of Deposit, or

electronic, or certified copies of the borrower’s last two bank statements.

Verifications must be no more 120 days old (180 days for new construction).

For automatically closed loans, this means the date of the deposit verification is within 120

days of the date the note is signed (180 days for new construction).

For prior approval loans, this means the date of the deposit verification is within 120 days of

the date the application is received by VA (180 days for new construction).

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-25

Topic 4: Assets and Closing Requirements, continued

c. Pending Sale of Real Estate

In some cases, the determination that the income and/or assets of borrowers are needed to

qualify for the loan depends upon the sale of presently the borrower’s owned real property.

The sale proceeds may be necessary to:

· clear the outstanding mortgage(s) against the property,

· pay outstanding consumer obligations,

· make a downpayment or pay closing costs on the VA loan, and/or

· restore previously used VA entitlement.

Evidence the sale has been completed should be included in the closing package to verify

proceeds from the sale.

As an alternative, the Veteran may sell the property with the buyer assuming the outstanding

mortgage obligation. See Chapter 6 of this handbook for assumptions (Release of Liability)

with a Substitution of Entitlement to restore previously used entitlement.

See Chapter 5 of this handbook for prior approval loans, which depend upon the sale of

property for the borrower to qualify.

See Chapter 5 of this handbook for all required loan closing documents.

d. Gift Funds

A gift can be provided by a donor that does not have any affiliation with the builder,

developer, real estate agent, or any other interested party to the transaction. A gift letter must:

· specify the dollar amount of the gift,

· include the donor’s statement that no repayment is expected, and

· indicate the donor’s name, address, telephone number, and relationship to the borrower.

The lender must verify that sufficient funds to cover the gift have been transferred to the

borrower’s account, or will be documented as received by the closing agent at the time of

closing.

Acceptable documentation includes the following:

· evidence of the borrower’s deposit,

· a copy of the donor’s funds by check/electronic transfer to the closing agent, or

· the CD showing receipt of the donor’s funds.

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-26

Topic 5: Debts and Obligations

Change Date: February 22, 2019

· This chapter has been revised in its entirety.

a. Verification Requirements for Debts and Obligations

All debts and obligations of the borrowers’ must be verified and rated. Obtain a credit report

with all information for all credit bureaus. See Topic 7, subsection a of this chapter for details

on the type of credit report required.

For obligations not included on the credit report which are revealed on the application or

through other means, the lender must obtain a verification of payment history showing the

obligation or other written verification directly from the creditor, including the payment

amount and outstanding balance.

The lender must also separately verify accounts listed as “will rate by mail only” or “need

written authorization.”

When a pay stub(s) or LES indicates an allotment, the lender must investigate the nature of

the allotment to determine whether the allotment is related to a debt or other obligation(s).

Examples may include 401K obligation or repayment, child care, child support, or other.

For obligations that have not been rated on the credit report or elsewhere, obtain the

verification and rating directly from the creditor. Include a written explanation for any

obligation that is not rated.

Resolve all discrepancies prior to closing. If the credit report, deposit verification, bank

statement, or pay stub(s) reveals any debts or obligations which were not divulged by the

borrowers):

· obtain clarification as to the status of such debts from the borrower(s), then

· verify any remaining discrepancies with the creditor.

Credit reports and verifications must be no more than 120 days old (180 days for new

construction).

For automatically closed loans, this means the date of the credit report or verification is

within 120 days of the date the note is signed (180 days for new construction).

For prior approval loans, this means the date of the credit report or verification is within 120

days of the date the application is received by VA (180 days for new construction).

ECOA prohibits requests for, or consideration of, credit history and liability information of a

spouse who will not be contractually obligated on the loan, except:

· if the borrower(s) is relying on alimony, child support, or maintenance payments from

the spouse (or former spouse), or

· in community property states.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-27

Topic 5: Debts and Obligations, continued

a. Verification Requirements for Debts and Obligations, continued

If either of these situations is applicable, the lender must:

· Obtain a credit report on the non-purchasing spouse in addition to the Veteran’s credit

report.

· Consider the spouse’s credit history in reaching a determination. A Veteran borrower

with a satisfactory credit history may be considered a satisfactory risk even though the

non-purchasing spouse’s credit may be unsatisfactory.

· Include the monthly payment of the non-purchasing spouse’s debts on the VA Form 26-

6393, Loan Analysis. For debts such as judgments and unpaid collection accounts,

lenders should consider the Veteran’s capacity to address the debt(s).

· Develop the facts surrounding any unsatisfied judgments on the spouse’s credit report,

such as where the judgment was filed and whether the parties were married to one

another at the time, and secure a competent legal opinion whether the judgment may

become a lien against the property.

· Exclude the monthly payment on the spouse’s debts from the loan analysis when a

reliable source of income for the spouse is verified to reach such a conclusion which is

voluntarily provided.

· Document VA Form 26-6393, Loan Analysis, with an explanation of facts and determination

when concluding credit worthiness of the Veteran or excluding obligations of the non-

purchasing spouse.

b. Verification of Alimony and Child Support Obligations

The payment amount of any alimony and/or child support obligation of the borrower must be

verified.

Do not request documentation of a borrower’s divorce unless it is necessary to verify the

amount of any alimony or child support liability indicated by the borrower. If, however, in

the routine course of processing the loan, the lender encounters direct evidence (such as, in

the credit report) that a child support or alimony obligation exists, they should make any

inquiries necessary to resolve discrepancies and obtain the appropriate verification.

Spousal support may be treated as a reduction in income on VA Form 26-6393, Loan

Analysis.

Child support payment is treated as a liability on VA Form 26-6393, Loan Analysis.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-28

Topic 5: Debts and Obligations, continued

c. Analysis of Debts and Obligations

Significant debts and obligations include:

· debts and obligations with a remaining term of 10 months or more; that is, long-term

obligations, and

· accounts with a term of less than 10 months that require payments so large as to cause a

severe impact on the family’s resources for any period of time.

Example: Monthly payments of $300 on an auto loan or lease with a remaining balance of

$1,500, even though it should be paid out in 5 months, would be considered significant. The

payment amount is so large as to cause a severe impact on the family’s resources during the

first, most critical, months of the home loan.

Determine whether debts and obligations which do not fit the description of “significant”

should be given any weight in the analysis. They may have an impact on the borrower’s

ability to provide for family living expenses.

If a married Veteran wants to obtain the loan in his or her name only, the Veteran may do so

without regard to the spouse’s debts and obligations in a non-community property state.

However, in community property states, the spouse’s debts and obligations must be

considered even if the Veteran wishes to obtain the loan in his or her name only. See Topic 2,

subsection c of this chapter.

Debts assigned to an ex-spouse by a divorce decree will not generally be charged against a

borrower. This includes debts that are now delinquent.

d. Borrower as Co-obligor/Co-Signor on a Loan or Obligation

The borrower(s) may have a contingent liability based on co-signing a loan. The lender may

exclude the loan payments from the monthly obligations factored into the net effective

income calculation in the loan analysis if:

· there is evidence that the loan payments are being made by someone else and the

obligation is current, and

· there is not a reason to believe that the borrower will have to participate in repayment

of the loan.

e. Pending Sale of Real Estate

A borrower(s) may have a current home and the sale of the real property is needed to

complete the transaction. The lender may disregard the payments on the outstanding

mortgage(s) and any consumer obligations which the Veteran intends to clear if available

information provides a reasonable basis for concluding the equity to be realized from the sale

will be sufficient for this purpose. See Topic 4, subsection c of this chapter for necessary

documents.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-29

Topic 5: Debts and Obligations, continued

f. Secondary Borrowing

If the borrower(s) plans to obtain a second mortgage simultaneously with the VA-guaranteed

loan, include the second mortgage payment as a significant debt. From an underwriting

standpoint, the Veteran must not be placed in a substantially worse position than if the entire

amount borrowed had been guaranteed by VA. See Chapter 9 of this handbook for VA

limitations on secondary borrowing.

If the borrower(s) provides written evidence that the student loan debt will be deferred at

least 12 months beyond the date of closing, a monthly payment does not need to be

considered.

If a student loan is in repayment, or scheduled to begin within 12 months from the date of

VA loan closing, the lender must consider the anticipated monthly obligation in the loan

analysis and utilize the payment established by calculating each loan at a rate of five percent

of the outstanding balance divided by 12 months.

Example: A borrower has a $25,000 student loan balance and you multiple it by 5%, which

equals $1,250. This amount ($1,250) is divided by 12 months to equal a monthly payment of

$104.17.

If the payment(s) reported on the credit report for each student loan(s) is greater than the

threshold payment calculation above in a above, the lender must use the payment recorded

on the credit report.

If the payment(s) reported on the credit report is less than the threshold payment calculation

above, in order to count the lower payment, the loan file must contain a statement from the

student loan servicer that reflects the actual loan terms and payment information for each

student loan(s).

The statement(s) must be dated within 60 days of VA loan closing, and may be an electronic

copy from the student loan servicer’s website or a printed statement provided by the student

loan servicer.

It is the lender’s discretion as to whether the credit report should be supplemented with this

information.

g. Loans Secured by Deposited Funds

Certain types of loans secured against deposited funds (signature loans, cash value life

insurance policies, 401(k) loans, or other) in which repayment may be obtained through

extinguishing the asset, do not require repayment consideration for loan qualification.

The assets required to secure a loan(s) may not be included as an asset on the VA Form 26-

6393, Loan Analysis.

Use the current balance times 60 percent minus the loan balance to equal the usable amount

to consider as an asset.

A statement would only be necessary to verify the amount used as an asset.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-30

Topic 5: Debts and Obligations, continued

h. Open 30-Day Charge Accounts

An open 30-day charge account is defined as an account in which the borrower(s) must pay

off the outstanding balance on the account every month.

For open 30-day charge accounts, determine if the borrower(s) pays the balance in full each

month, and has verified funds to cover the account balance in addition to any funds required

for closing costs.

· If there are sufficient funds, the payment does not need to be included in Section D of

the VA Form 26-6393, Loan Analysis, but the obligation should continue to be listed.

· If there are not sufficient funds, a minimum payment of 5 percent of the balance should

be considered included in Section D of the VA Form 26-6393, Loan Analysis.

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-31

Topic 6: Debts Owed to the Federal Government

Change Date: February 22, 2019

· This chapter has been revised in its entirety.

a. Title Search Requirements

The lender is responsible for obtaining the necessary title search to ensure there are no

encumbrances that would preclude the borrower from obtaining a loan.

b. VA Form 26-8937, Verification of Benefits

The lender is responsible for obtaining the necessary title search to ensure there are no

encumbrances that would preclude the borrower from obtaining a loan.

Generally, VA Form 26-8937, Verification of VA Benefits, is not needed unless the COE or

new IRRRL case number indicates to submit the form to VA before closing. However, ask

the Veteran and any Veteran co-obligors (including spouse if a Veteran) if he or she:

· will be discharging within the next 6 months from the military and has completed a

PEB or MEB and will be filing for VA disability while still on active duty,

· has recently filed for VA disability and compensation, or VA pension, and VA has not

yet made a determination,

· would be entitled to receive VA disability benefits, but in receipt of retirement pay,

· has received VA disability benefits in the past, or

· is an unmarried surviving spouse of a Veteran (has applied and/or in receipt of DIC

who died on active duty or as a result of a

· service-connected disability.

If the Veteran falls under one of the above categories, follow the procedures discussed in

Topic 2, subsection m of this chapter.

When VA returns the form to the lender and the form indicates that the borrower has any of

the following:

· an outstanding indebtedness of VA overpaid education, compensation, or pension

benefits,

· an education or direct home loan in default,

· an outstanding indebtedness resulting from payment of a claim on a prior VA home

loan, or

· a repayment plan for any of these debts that is current,

Then one of the following must accompany the loan package:

· evidence of payment in full of the debt, or

· evidence of a current payment plan acceptable to VA and evidence that the Veteran

executed a promissory note for the entire debt balance.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-32

Topic 6: Debts Owed to the Federal Government, continued

b. VA Form 26-8937, Verification of Benefits, continued

VA may find a repayment plan acceptable if:

· the Veteran has been satisfactorily making payments on a repayment plan in effect prior

to the lender’s inquiry,

· the Veteran’s overall credit history and anticipated financial capacity after the proposed

loan is made indicate a reasonable likelihood that the repayment plan will be honored

and the outstanding amount of indebtedness is not so large that it would prevent

payment in full, within a reasonable period (approximately 1 year), or

· the case involves unusually meritorious circumstances.

Examples

Consideration would be given to a Veteran with an outstanding/excellent credit history and

adequate income whose debt balance is too large to be reasonably paid out in less than 18

months to 2 years.

VA will offer special consideration to a Veteran’s claim that he or she was not previously

aware of an overpayment of benefits.

c. What is the Credit Alert Verification Reporting System (CAIVRS)

CAIVRS is a Department of Housing and Urban Development (HUD) maintained computer

information system which enables participating lenders to learn when a borrower has

previously defaulted on a federally-assisted loan. More information can be found at:

http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/sfh/caivrs

The database includes default information from the Department of Agriculture, Department

of Education, Department of Justice, HUD, Small Business Administration, Federal Deposit

Insurance Corporation, and VA.

The VA default information included in the database relates to:

· overpayments on education cases,

· overpayments on disability benefits income, and

· claims paid due to home loan foreclosures which resulted in a debt of the government

(Generally type 2 VA loans).

CAIVRS Procedures

A CAIVRS inquiry must be performed for all borrowers and co-borrowers (Veteran or non-

Veteran) on all VA loans, including IRRRLs. The one exception to this policy is that

CAIVRS is not required for non-purchasing spouses in community property states.

VA assigns a 10-digit VA lender identification number (ID) to each new lender, then

automatically forwards the ID number to HUD with a request to grant the lender CAIVRS

access. The lender can begin accessing CAIVRS usually between 7 to 10 business days after

receiving its VA ID number assignment.

Continued on next page

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

4-33

Topic 6: Debts Owed to the Federal Government, continued

c. What is the Credit Alert Verification Reporting System (CAIVRS), continued

To register for CAIVRS access for first time users, please use the following link:

https://entp.hud.gov/idapp/html/f57register.cfm.

Please direct questions concerning problems encountered with accessing CAIVRS to

If the borrower(s) is found to have a delinquent federal debt through CAIVRS, the validity

and delinquency status of the debt should be verified by contacting the creditor agency using

the contact phone number and case number reflected on the borrower’s CAIVRS report.

The creditor agency that is owed the debt can verify that the debt has been resolved.

Documentation should be included in the loan file and an explanation must be provided on

VA Form 26-6393, Loan Analysis. It is not necessary for CAIVRS to update the number if

documentation is included in the loan file.

Once screening is complete, enter the CAIVRS confirmation code on VA Form 26-6393,

Loan Analysis, in the space to the right of the “no” block in item 46 for purchase and

refinances.

For IRRRLs, enter the code on VA Form 26-8923, IRRRL Worksheet, in the Notes section.

d. Borrower with Presently Delinquent Federal Debts

When CAIVRS or another source indicates that the borrower has a delinquent Federal debt,